Singapore’s housing policy has long been lauded for its inclusivity, offering a wide array of public housing options designed to cater to different income levels. The government’s housing framework, particularly through the Housing Development Board (HDB), ensures that the majority of Singaporeans can afford homes, with significant support in the form of grants and subsidies. For lower-income households, this support is even more robust, helping them access affordable housing solutions. Middle-income groups, too, enjoy substantial assistance with schemes for Build-To-Order (BTO) flats, resale HDB flats, and Executive Condominiums (ECs), providing various pathways to homeownership.

However, a distinct challenge arises for the upper-middle class—those whose combined household income exceeds the $16,000 monthly ceiling. For this group, the options become more constrained. Couples and singles earning beyond this threshold find themselves excluded from purchasing ECs directly from developers. The issue intensifies for those earning more than $14,000 a month, as they lose eligibility for BTO flats and the majority of grants available for resale HDB flats, further limiting their access to affordable housing options.

Faced with these constraints, upper-middle-class households are left with tough choices. Should they stretch their budgets to purchase smaller private condominium units, where costs are higher but so are the amenities? Or should they consider a resale HDB flat, forgoing the substantial grants and subsidies available to those in lower income brackets? These decisions are far from straightforward, and many in this group find themselves in a financial and strategic dilemma, where affordability and long-term investment potential must be weighed carefully.

Who’s the Upper Middle Class?

In discussions about housing affordability, much of the focus tends to be on policies that impact the middle and lower-income groups in Singapore. New government measures, such as housing grants and subsidies, have significantly shaped the landscape for these demographics. However, less attention has been given to the upper-middle class—a segment that finds itself in a unique and often challenging position when navigating the housing market.

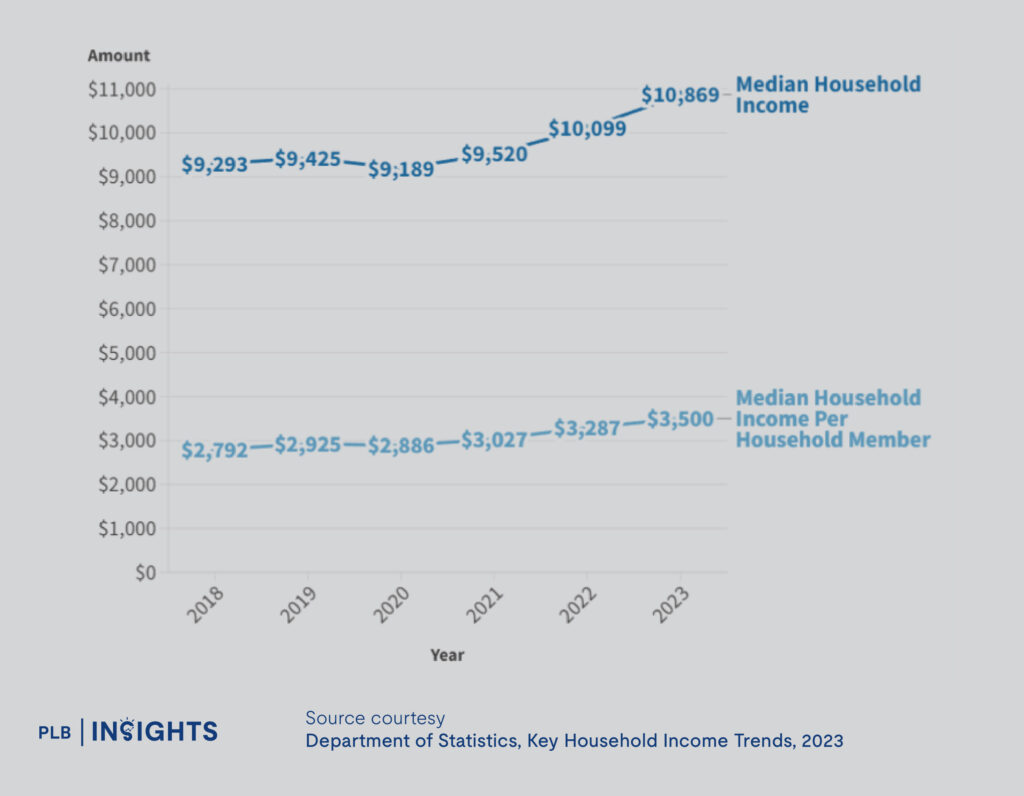

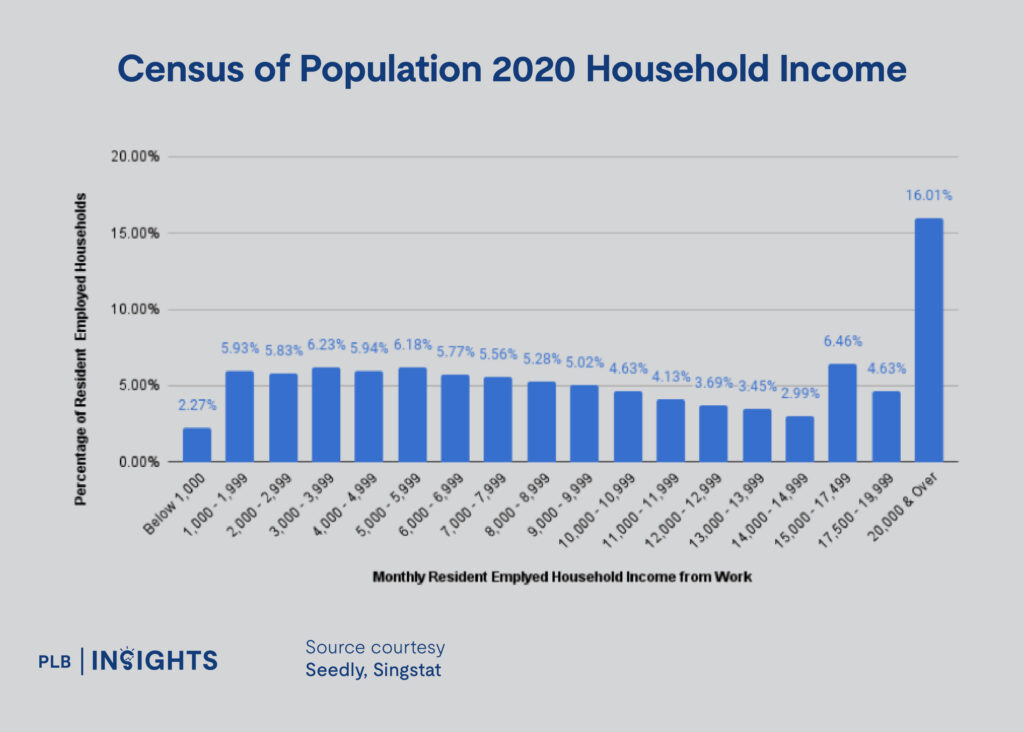

According to Singapore’s Department of Statistics, the median monthly household income in 2023 stood at $10,869. This figure serves as a key reference point for understanding income distribution across the nation. In fact, approximately 30% of Singaporean households earn more than $14,000 per month. A smaller but still significant proportion, around 20-25%, surpasses the $16,000 monthly household income mark.

The upper-middle class, typically defined as households earning between $14,000 and $25,000 per month, occupies a critical space in Singapore’s socio-economic hierarchy. While they earn substantially more than the median household, their income level often places them just beyond the reach of key housing subsidies and grants that benefit lower-income and middle-income groups. This group, though financially comfortable, faces limitations in their access to subsidised housing options such as BTO flats or Executive Condominiums (ECs), which have strict income ceilings. As a result, many upper-middle-class households find themselves exploring the private housing market, where costs are substantially higher and government assistance is minimal.

This income bracket is also heterogeneous, comprising dual-income professionals, business owners, and skilled workers who may prioritise different housing considerations based on family size, lifestyle preferences, and long-term investment goals. Despite their higher earning power, they are not immune to the escalating costs of private housing, and many face the dilemma of how to balance quality of life with financial sustainability in the face of rising property prices.

As we dive deeper into this article, we will explore the specific challenges faced by couples or singles earning more than $16,000 a month, and the tough choices they must make when deciding on housing in Singapore’s competitive property market. This income group has two primary options: resale HDB flats and private condominiums. We will focus on these, excluding Executive Condominiums (ECs), as they are no longer accessible to households with incomes exceeding the EC income ceiling.

Resale HDB or Condominium? Which is the Better Decision?

Within the upper-middle-class segment, home preferences and investment strategies can vary significantly. As a result, there is no one-size-fits-all answer to the question of whether resale HDB flats or private condominiums are the better choice. Different individuals and families have unique priorities, financial situations, and lifestyle needs that influence their housing decisions.

To navigate this dilemma effectively, it’s crucial to identify which option may be more suitable for whom. We can categorise prospective homeowners into three distinct archetypes based on their circumstances and preferences, each representing a different perspective on the resale HDB versus condominium debate.

First Archetype: The Cautious First-Timers

Individuals or couples who have recently entered the upper-middle-income bracket often find themselves feeling the most “stuck” in their decision-making process. These first-time buyers, earning above $16,000 a month, may be new to the responsibilities that come with higher income levels and are likely to adopt a frugal approach to homeownership. They tend to prioritise minimising costs, which can lead them to seek out more economical resale HDB options.

As of 2023, the average price for a resale HDB flat is around $500,000 to $800,000, depending on the size and location. For example, a 4-room resale HDB flat in the Outside Central Region (OCR) can typically be found for about $600,000 to $750,000, translating to a PSF range of approximately $500 to $600. The broad selection of locations within the OCR, such as Punggol, Sengkang, and Woodlands, offers these buyers opportunities for both affordability and growth potential.

Affordability: Assuming a typical mortgage interest rate of 3.5% for a 30-year loan, monthly payments on a $450,000 loan (after a 25% down payment) would be approximately $2,021. The down payment on a $600,000 flat would be $150,000, leading to a loan amount of $450,000. This level of affordability allows them to enter the property market without overextending their finances, providing peace of mind as they navigate homeownership.

Second Archetype: The Strategic Investors

The upper-middle-income bracket is also home to many professionals and dual-income families who view their residence as part of their broader investment portfolio. For this group, homeownership is not just about finding a place to live; it’s a strategic financial decision aimed at maximising returns over time. They are typically more knowledgeable about the real estate market and may have a clearer vision of their long-term financial goals.

When considering their options, this second group is likely to adopt a more strategic approach, carefully evaluating factors such as location, property type, and potential for appreciation. Private condominiums in the central and prime districts have historically provided better capital appreciation. For instance, condominiums in areas like Bukit Timah, Orchard, and River Valley can command prices ranging from $1,800 to $3,000 PSF, with total quantum prices for smaller units starting around $1.5 million to $2 million.

Affordability: For a $1.5 million condominium with a 25% down payment, the down payment would be $375,000, leading to a loan amount of $1,125,000. With the same interest rate of 3.5% over 30 years, the monthly mortgage payment would be about $5,052. Although this is a significant commitment, strategic investors often view such properties as valuable assets, anticipating appreciation and rental income that could offset their mortgage costs.

Third Archetype: The Family-Oriented Buyers

Lastly, we have families who prioritise lifestyle and community over pure investment potential. For these buyers, factors such as space, environment, and a sense of community play a significant role in their housing decision. They may lean towards resale HDB flats because these properties often offer larger living spaces suitable for families, along with a more established community atmosphere.

A typical 5-room resale HDB flat in family-friendly neighbourhoods like Tampines or Jurong East may range from $700,000 to $900,000, with a PSF of approximately $550 to $700. These areas provide essential amenities, including reputable schools, parks, and recreational facilities, making them attractive for families looking to settle down.

Affordability: With the same mortgage conditions, a $800,000 loan for a 5-room HDB flat would result in a down payment of $200,000 (25%). This results in a loan amount of $600,000. With a mortgage interest rate of 3.5% over 30 years, the monthly payment would be around $2,694. This price point allows families to maintain a balance between housing costs and other financial obligations, ensuring they can provide for their children’s education and other essential needs.

By breaking down the decision-making process into these three archetypes, we can better understand the diverse considerations that influence the choice between resale HDB flats and private condominiums. Each group has its own priorities and challenges, making it essential for prospective homeowners to reflect on their unique circumstances before making a final decision. Additionally, understanding the financial implications and mortgage affordability based on prevailing interest rates will empower buyers to make informed choices that align with their financial capabilities and lifestyle goals.

Tying Things Up: What is Personally the Most Important to You as a Homeowner?

The “best” decision in the realm of homeownership ultimately hinges on what is most important to you as an individual or family. This emphasises the need for introspection and a clear understanding of your values, priorities, and future aspirations. As you navigate the housing market, it’s vital to consider the factors that resonate most with your unique circumstances.

Life Stage and Family Planning

One of the most significant determinants in your decision-making process is your life stage. Are you a young professional starting your career, a couple planning for children, or a family with established roots looking to upgrade your living situation? Each of these scenarios presents distinct housing needs. Young professionals might prioritise location, seeking vibrant neighbourhoods with easy access to work and social amenities. They may be inclined to opt for a condominium that allows for a more active lifestyle, complete with modern conveniences and a sense of community.

In contrast, families might focus on the availability of schools, parks, and safe neighbourhoods. For those planning to expand their family, it becomes crucial to consider future needs, such as additional bedrooms or proximity to good schools. It’s important to take the time to envision your life in the coming years and to choose a home that can adapt to your evolving needs. Additionally, as you age and your circumstances change, your priorities may shift. A home that meets your needs now may not be suitable in ten years. This foresight is essential in future-proofing your investment and ensuring it remains aligned with your family’s growth.

Building Financial Stability

While life stage and family planning are critical, financial considerations cannot be overlooked. Understanding your financial health and capabilities is paramount. Property prices in Singapore have historically appreciated at a rate that often outpaces income growth. Property values have consistently increased, making real estate a potentially lucrative investment. This reality underscores the importance of staying invested in property or other assets to build wealth and maintain a competitive edge against inflation.

Homeownership is not merely a living arrangement; it is also an investment. Thus, having a clear picture of your financial situation—including your savings, income, debt-to-income ratio, and credit score—is vital when considering your options. A higher income bracket can provide you with more flexibility, but it is essential to ensure that your home purchase does not compromise your overall financial stability.

Moreover, the decision to invest in property should align with your long-term financial goals. Are you aiming for capital appreciation, rental income, or both? Understanding the real estate market dynamics, such as demand, supply, and neighbourhood trends, will help you make informed decisions that align with your financial objectives.

The Trade-off Between Preparation and Decision-Making

Balancing preparation for homeownership with the need to make timely decisions is another challenging aspect. While it’s crucial to gather knowledge and assess your options, there is a fine line between being adequately prepared and becoming paralyzed by analysis. The real estate market is constantly evolving, and waiting too long can lead to missed opportunities or increased prices. Therefore, it’s vital to strike a balance between thorough research and decisive action.

To assist in this process, consider developing a checklist of your needs and priorities. What are the non-negotiable features you require in a home? Perhaps it’s a minimum number of bedrooms, a specific school district, or access to public transport. Establishing these priorities will streamline your search and help you avoid distractions from properties that do not meet your essential criteria.

Personal Reflection and Future Aspirations

Finally, take the time to reflect on your values and aspirations. What does home mean to you? Is it a sanctuary for your family, a smart investment for your future, or a blend of both? Your answers to these questions will guide your decision-making process, ensuring that your choice in property aligns with your life goals.

Ultimately, your home should reflect your identity and lifestyle. It is a place where memories are made, where you build relationships, and where you can express your individuality. Taking the time to understand what matters most to you as a homeowner will empower you to make a decision that not only meets your current needs but also provides for a fulfilling future.

Closing Thoughts

In conclusion, navigating the housing market is a multifaceted journey that requires careful consideration of various factors, including life stage, family planning, financial stability, and personal values. By identifying what is most important to you, you can make informed decisions that will serve you and your family well for years to come. Whether you ultimately choose a resale HDB or a private condominium, remember that the most significant factor in your homeownership journey is ensuring that your choice aligns with your unique lifestyle and long-term aspirations.

Facing analysis paralysis? Feeling stuck and unsure of what to do? If you need guidance in your property journey, feel free to reach out to us here and our experienced consultants will gladly help you navigate your options in the market. Till next time!