The Singapore real estate market has historically been viewed as a safe and stable investment option, attracting both local and foreign investors. Despite government measures to cool the market in recent years, demand for properties remains strong, particularly in prime locations. The COVID-19 pandemic has brought some uncertainty to the market, but the Singapore government has implemented measures to support the industry and maintain stability. Despite the challenges, the real estate market in Singapore is still viewed as an attractive option for investors looking to diversify their portfolios and grow their wealth over the long-term.

The real estate market in Singapore offers a range of investment opportunities, including 1-bedroom condominiums. However, investors often wonder whether these properties are easy to exit when the time comes. In this article, we will examine the pros and cons of investing in a 1-bedroom condominium in Singapore. By weighing the potential benefits, such as lower entry costs and stable demand, against the challenges, including competition and market fluctuations, investors can make an informed decision about whether a 1-bedroom condominium is the right investment for their portfolio. So, let’s explore whether 1-bedroom condominiums are easy to exit as an investor in Singapore.

Why are We Discussing 1-Bedroom Condo Units?

In recent years, developers in Singapore have been increasing the number of 1-bedroom units in their new developments. One of the primary reasons for this trend is the concept of quantum play – offering smaller units at a lower price point to attract a wider range of investors.

By including more 1-bedroom units in their developments, developers are able to offer properties at a lower price point (quantum wise), which can be more attractive to first-time buyers or investors with limited capital. Additionally, smaller units tend to have lower maintenance and upkeep costs, which can make them more profitable for developers.

Furthermore, by keeping prices palatable, developers are able to tap into a wider pool of potential buyers, including both local and foreign investors. In Singapore, there are restrictions on foreign ownership of landed properties, making condominiums a popular option for foreign investors. By offering more 1-bedroom units that are easier to enter, developers can appeal to this market, driving demand for their developments.

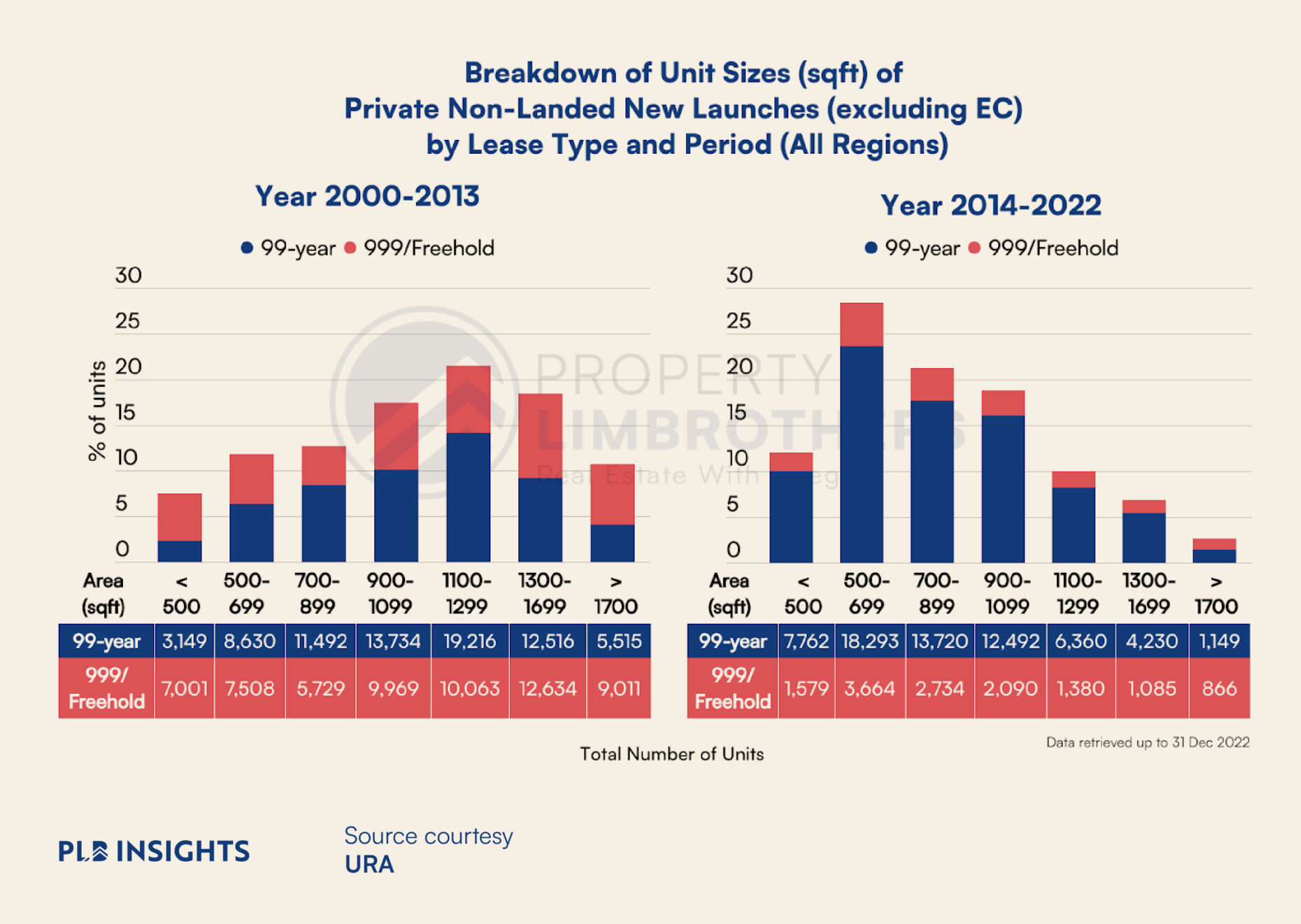

The chart above illustrates how developers have moved towards much smaller units sized between 500 to 699 sqft (typically 1-Bedroom options) from 2014 to 2022. Before that, more units had been built at a much larger size, around 1,100 to 1,299 sqft. This might be a symptom of rising PSF in our developed city. With real estate prices increasing at a faster pace than wages, the affordable unit size has gotten smaller and smaller over time.

This creates a growing trend towards smaller living spaces in Singapore. However, that is not the only reason for the demand for smaller unit sizes. Many young professionals and single adults look for affordable, convenient living options that suit their lifestyles. As the age of marriage and starting a family gets higher, more capable single professionals might get a 1-bedroom unit for their own dwelling. As such, 1-bedroom units can be an attractive choice for those who are looking for a central location and modern amenities without the high price tag of a larger property.

In conclusion, the increasing number of 1-bedroom units in newer developments in Singapore is driven by a combination of factors, including quantum play and changing lifestyle trends. By offering more affordable, smaller units, developers are able to appeal to a wider range of buyers and investors while keeping their costs down. This trend is likely to continue, with more developers looking to capitalise on the demand for smaller, more affordable properties in Singapore’s competitive real estate market.

The Challenges of Exiting a 1-Bedroom Condo Unit

Investors in a 1-bedroom condominium in Singapore often face challenges when it comes to exiting their investment. One significant obstacle is the potential difficulty of selling or renting out a 1-bedroom unit. With an increasing number of developers entering the market and constructing similar properties, competition can be fierce, making it harder to find potential buyers or tenants. This can result in a longer holding period for the property, which may be an issue for investors who need to liquidate their investment quickly.

While the issue of finding tenants may not be a problem in the current heated property market, some investors might be worried about the longer time it takes to successfully sell their 1-bedroom unit at a reasonable price. Apart from the fierce competition, a key obstacle is also creatively marketing the home. If the different 1-bedroom listings are all fighting for the same group of buyers, the ones with the best deal or most eye-catching ad will win in this attention economy. Because sellers typically want to sell at the highest price and the fastest speed, leaving money on the table often gets thrown out the window. Hence, the demand for creative real estate marketing has grown tremendously along with the 1-bedroom segment.

Additionally, fluctuations in the real estate market can pose challenges for investors looking to exit their 1-bedroom condo investment. In a downturn, the value of the property may decline, making it difficult to recoup the initial investment or to sell the property at a profit. This can be particularly problematic for investors who need to sell their property quickly due to financial constraints or changing investment priorities. This is also the same reason why the government and regulators have been implementing cooling measures. To make sure that the holding power of investors and residents is high enough such that they would not need to liquidate their property when economic conditions are unfavourable.

Furthermore, changes in the local market can impact the demand for 1-bedroom condominiums, affecting the potential resale value of the property. For example, if the government implements measures to limit the number of foreign talents coming to Singapore, this may impact the demand for rental properties, including 1-bedroom condos, as foreign talents are often a significant source of demand for rental properties in the country. This is a key component of making 1-bedroom investments sustainable. Investors in this category would need to be keenly aware of this fundamental concern.

Overall, exiting a 1-bedroom condominium investment in Singapore can be a challenging process. Investors should consider the potential for market fluctuations, competition, and changes in local market conditions before making a decision to invest. It is essential to evaluate the risks and rewards of investing in a 1-bedroom condo in Singapore and to have a solid exit strategy in place to maximise returns and minimise risks.

The Perks of Exiting a 1-Bedroom Condo Unit

While there are certainly challenges to exiting a 1-bedroom condominium investment in Singapore, there are also potential perks to consider. Here are some advantages to keep in mind when investing in a 1-bedroom condo in Singapore:

Firstly, 1-bedroom units tend to have lower entry costs than larger properties, making them an attractive investment option for investors with limited capital. This can provide investors with an opportunity to get their foot in the door of the Singapore real estate market, potentially generating a high return on investment in the long run. Most Singaporeans have grown their first and second pot of gold through the property market. Generally, Singaporeans still have a strong preference for physical assets and investments, such as residential property. As a large portion of personal wealth is locked in their residential properties (for most Singapore residents), the real estate market has relied heavily on the demand side with strong holding power for further appreciation.

Another benefit of investing in a 1-bedroom condo is that there is typically a steady demand for rental properties in Singapore. This is due to the city-state’s high population density and status as a global business hub, attracting a large number of expatriates and foreign talents who need housing. As such, investors in a 1-bedroom unit can benefit from a stable rental income stream, providing a predictable source of revenue. In the current market, 1-Bedroom units generally tend to fetch a more attractive rental yield of 3% -4% while the market average for other unit sizes is around 2% – 3%. This is due to the lower entry costs for a 1-bedroom condo, making it a popular investment choice when decoupling was still a trendy strategy.

Furthermore, the location of a 1-bedroom condo can also impact its exit potential. Properties located in prime areas with good transport links, amenities and proximity to schools and other facilities can command a premium price and generate strong demand from prospective buyers and renters alike. Therefore, investing in a well-located 1-bedroom condo may offer investors an opportunity to capitalise on future price appreciation and exit their investment at a profit. Having a healthy volume of transactions will also help. So there is a preference for larger developments as well when it comes to the ease of exit.

Finally, investors who purchase a 1-bedroom condo in a new development may be able to take advantage of early-bird discounts and other incentives offered by developers, potentially reducing their entry costs even further. Additionally, new developments are often designed with the latest technology and amenities, which can attract tenants and buyers, making it easier to exit the investment in the future. While this is a much smaller point by itself, some investors may be able to have a slight bump in gains due to discounts.

In conclusion, while there are certainly challenges to exiting a 1-bedroom condo investment in Singapore, there are also many perks to consider. Lower entry costs, steady demand for rental properties, prime location, and developer incentives are all factors that may make investing in a 1-bedroom condo an attractive option for investors looking to enter the Singapore real estate market.

Closing Thoughts

In conclusion, investing in a 1-bedroom condominium in Singapore comes with its own set of challenges and perks. While the limited exit options may be a concern for some investors, the potential for steady rental income, location-based demand, and lower entry costs can make it an attractive investment option for others. Furthermore, the increasing number of 1-bedroom units in newer developments provides an opportunity for investors to enter the market at an affordable price point.

If you are interested in learning more about real estate investment in Singapore, be sure to check out our NOTG YouTube channel and sign up for our PLB Webinar Series. We offer expert insights and analysis on the latest trends in the Singapore real estate market. Additionally, be sure to browse our other editorial pieces for more in-depth coverage of various real estate topics. Whether you’re a seasoned investor or just starting out, we’re here to help you make informed decisions and achieve your investment goals.

If you’re looking for personalised insights or advice on your property journey in Singapore, our associate consultants are here to help. With years of experience in the industry, our team can provide you with expert guidance on everything from property selection to financing and legal matters. Don’t hesitate to reach out to us for a consultation today. We’re committed to helping you make the most informed decisions and achieve your real estate investment goals.