Bank interest rates are low due to the COVID-19 pandemic, and there’s no denying how financially-savvy individuals are leveraging on this. It’s proven that last year to date, we have seen the Singapore Average Overnight Interest Rate plummet to less than 1%, though it is now making a slight recovery.

source: tradingeconomics.com

Courtesy Tradingeconomics.com | data Monetary Authority of Singapore, accurate as of 13th April 2021.

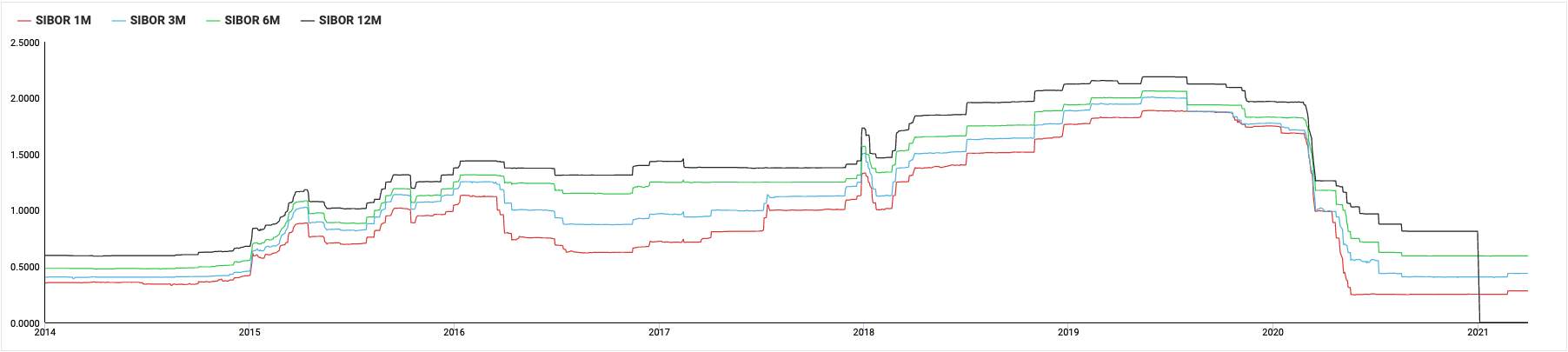

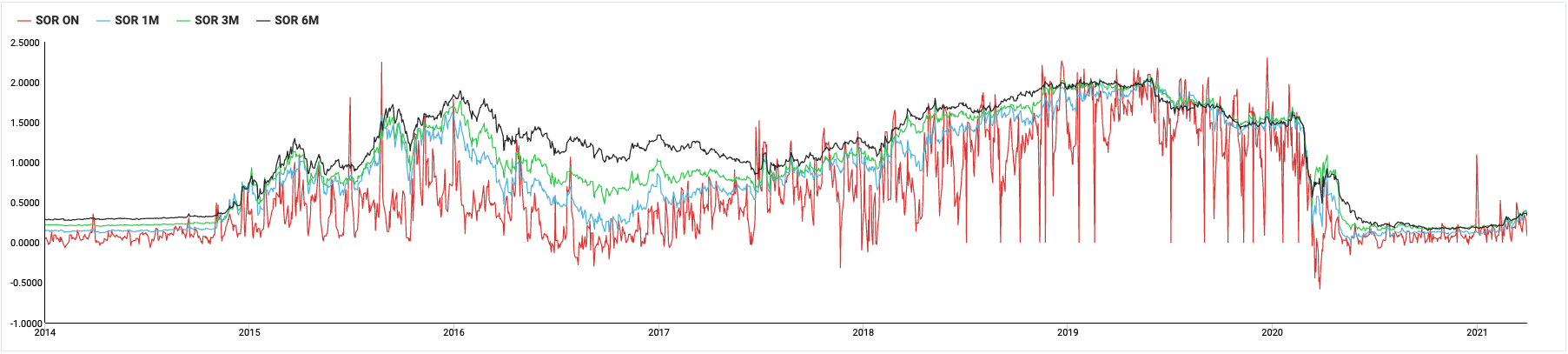

While it does seem like a prime time to invest, it is important to pay attention to the rates, the landscape for loans and which interest type will suit you better. For example, while everyone is looking at the lowest interest for this period, SIBOR rates will be undoubtedly affected by U.S’s economy recovery; hence choosing 1-month SIBOR over a flat rate environment, or a 3-month SORA rates for a long-term recovery. Your individual awareness of the market plays a role in deciding rates as well — a floating rate interest presents flexibility for people who can anticipate trends, while a more conservative mindset will opt for fixed rate packages.

Fixed Rate Packages

Stability and security are the reasons why fixed rate home loans exist. It reduces financial risk, though it returns to its floating rates after 1-5 years, depending on the package selected. This is why private property investors usually head for fixed rate packages if the market is bleak.

Floating Rates

Pegged to various rates like SIBOR, SOR, SORA and board rates (internal bank rates), it’s covered in our previous article. Board rates, while a tad higher at times, are unlikely to fluctuate as often due to the bank’s front positioning. However, it is changed at the discretion of the bank.

SIBOR rates as of 13 April 2021 courtesy ABS.

SOR Rates as of 13 April 2021 courtesy ABS.

Sibor and SOR rates courtesy ABS as of 13 April 2021

SORA is the Singapore Overnight Rate Average, and is the next benchmark to be supplanting both SIBOR and SOR due to the ceasing of LIBOR due to its fixing scandal in 2012.

It does not fluctuate as much as SIBOR. For example, in Dec 2019, it was 1.8% for the three-month SIBOR rate. However, this year in 2021, it is 0.43%, depicting a huge drop-off within slightly over a year. Thus, because of this huge swing in interest rates, it is a safer option that Singapore is inevitably moving towards.

Latest Developments

-

6-month SIBOR will be discontinued from 1 April 2022. 1-month and 3-month SIBOR by end-2024.

-

SOR was supposed be discontinued by end-April 2021 this year, but will be pushed to when LIBOR ends in mid-2023, according to Leong Sing Chiong, deputy managing director (markets & developments) at the Monetary Authority of Singapore (MAS).

-

This development of transitioning even with LIBOR being pushed further into 2023.

-

In a recent UOB poll, more than six in 10 said they are open to choosing SORA-based products due to stability. United Overseas Bank (UOB and CapitaLand entered a $200 mil term loan, based on SORA-SOFR rates in Sep 2020, last year.

-

Hoping that the transition will be smooth, you can refer to more of this in this publication.

-

OCBC’s first SORA-based loan was made to CapitaLand in 2020.

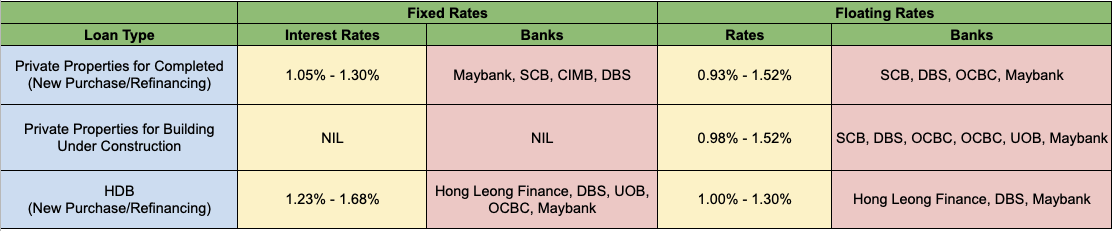

Current bank loan rates

Rates courtesy KeyQuest Mortgage. (Rates accurate as at 22 April 2021)

Disclaimer: do note that rates are subject to change by individual banks. Check with your banker or broker on latest rates)

If you are keen to learn more about SORA and what is all transpiring throughout the landscape, we recently covered it in our article, “Which is the best? SIBOR, SOR, SORA rates, and what it means for homebuyers”.

Mortgage Brokers – where they come in

Fixed Rate Bank interest rate packages are currently at an all-time low at 1.0%, the lowest in 10 years (though reaching 1.1% only briefly). For the market-conscious, this is an ideal time for loaning, but the market tends to fluctuate, and there are many factors at play, such as timely offers, a sudden drop in percentages, revision on policies (to correspond to market trends) and competitive prices.

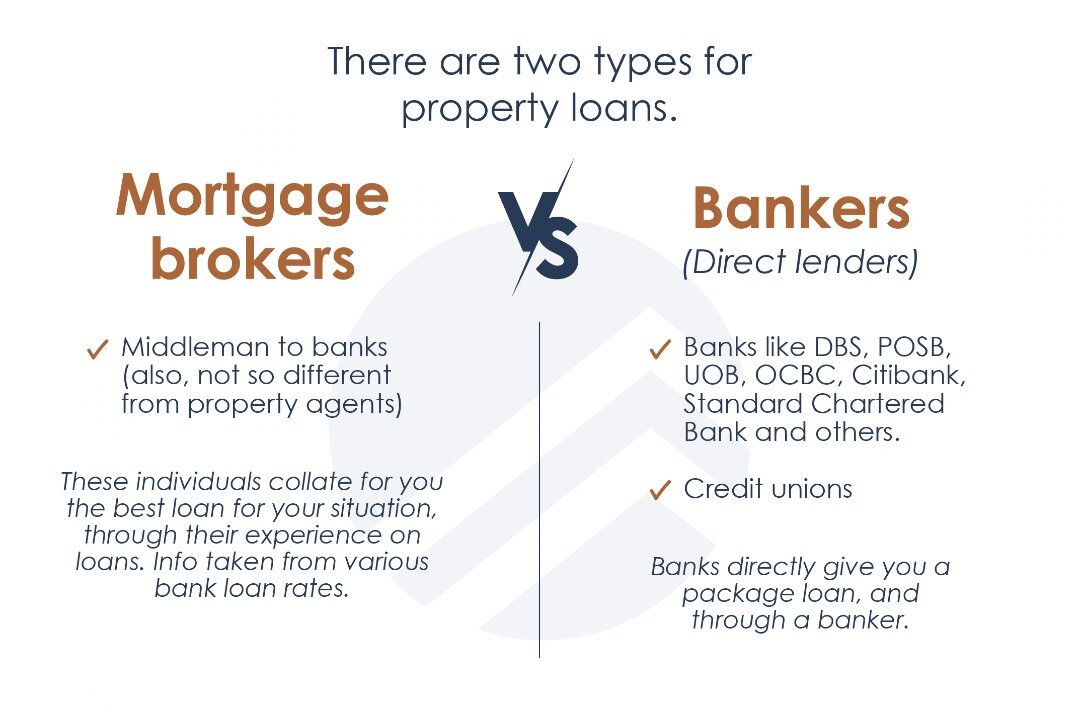

Competitive bank loans are beneficial to applicants, so long as you can draw a comparison yourself. But what’s the difference between mortgage brokers and heading to the banks yourself?

In simple terms, there are essentially two ways you can get your property loans arranged for your property purchase.

There are direct lenders, who are the usual suspects such as DBS, POSB, UOB, OCBC, Citibank and Standard Chartered Bank. Oh yes, these links are legit (and not sponsored). There are others, but in Singapore, they are the top ranking banks. But it doesn’t entirely mean that they offer the best home loan rates.

So how do Mortgage brokers earn their keep? The bank that you eventually loan from pays them a referral fee out of the bank’s own pocket and not from your bank loan rates. Thus it is a fair market practice as the banks rewards mortgage brokers to refer clients to them. Most bank referral fees are standard across banks to the middleman.

This is where mortgage brokers such as KeyQuest Mortgage initially come in to compare bank loan rates for you.

There are some property obstacles where a mortgage broker can aid a current predicament, which can be a huge help to turn tables to your favour. While PropertyLimBrothers’s bread and butter is indeed property, mortgage brokers we are not.

We hope we have shed some light on the loaning part of property. After all, you probably may have engaged a mortgage broker, or sought advice from your property agent and told you the same thing. For more enquiries, do feel free to contact PropertyLimBrothers. See you in the next article.