The latest property cooling measures included tightening the loan-to-value (LTV) limit for HDB loans and increasing the Enhanced CPF Housing Grant (EHG). The LTV limit for HDB housing loans was reduced from 80% to 75%, and the EHG amount for first-time flat buyers in the lower- to middle-income brackets was increased to up to $120,000 for families and $60,000 for singles.

This measure is not unexpected given the rapid rise in HDB resale flat prices. Since the second quarter of 2020, resale prices have surged by 42.5% despite several rounds of cooling measures implemented. Minister for National Development (MND) Desmond Lee mentioned that they observed buyers who took loans at higher LTV limit disproportionately bought larger flats and paid higher prices. This group generally paid approximately $20,000 to $60,000 more than other buyers with LTV limits lower than 75%. Such market dynamics have driven up the overall resale market.

Effects of Reduction in LTV Limit

Several cooling measures have been rolled out, including two rounds of reductions in LTV limit previously — from 90% to 85% in the fourth quarter of 2021 and from 85% to 80% in the third quarter of 2022.

However, resale prices continued to rise, albeit at a slower rate. Since the fourth quarter of 2021 (1st reduction) and the third quarter of 2022 (2nd reduction), resale prices have surged by 20.7% and 11.8% to-date, respectively.

According to the latest data released by HDB, resale prices rose 4.2% in the first half of 2024, just a slight dip compared to the 4.9% increase in 2023. The surge in resale prices in the first half of 2024 could be due to the demand from private downgraders who have waited out 15 months since the September 2022 cooling measure, which required private homeowners to wait 15 months between selling a private property and buying an HDB resale flat.

Million-dollar public housing transactions also made headlines more frequently in 2024. As of August, 626 HDB resale flats changed hands for more than $1 million. July 2024 also saw 120 million-dollar HDB transactions – the highest ever in a single month1. Such headlines and noise in the market could cause anxiety among buyers, and when left to market forces, resale prices may be pushed up irrationally.

This is what MND is concerned about. They sensed that Singaporeans are starting to worry about the affordability of resale flats as a whole. As the property market moves in cycles, those who took up higher loans will be the hardest hit during downturns. Therefore, this cooling measure is targeted to encourage prudent borrowing, especially for buyers purchasing high-priced resale flats.

This cooling measure also came in timely to calm the anxiety among Singaporeans and perhaps acts as a signal that public housing in Singapore cannot be left solely to market forces and more cooling measures may come in. Government intervention is required to prevent a potential housing bubble from forming.

The tightening of loan limits will likely curb short-term demand, and resale prices may taper off slightly. However, the long-term effect remains unknown. Based on historical trends as seen in Figure 1, where resale prices continued to increase following the two rounds of reductions in LTV limit, it would not be surprising to see a continued rise in resale prices in the future.

Resale price movements are also affected by supply in the market. Approximately 7,000 flats will reach their Minimum Occupation Period (MOP) in 2025. Once these flats enter the market, we will have more visibility on the resale price trend.

Higher EHG increases the affordability for lower-income families

Unlike the previous increase in CPF Housing Grants, which applied to all first-time families buying resale flats, the higher EHG targets the lower- to medium-income groups, providing them with further financial support against the impact of tightening loan limits.

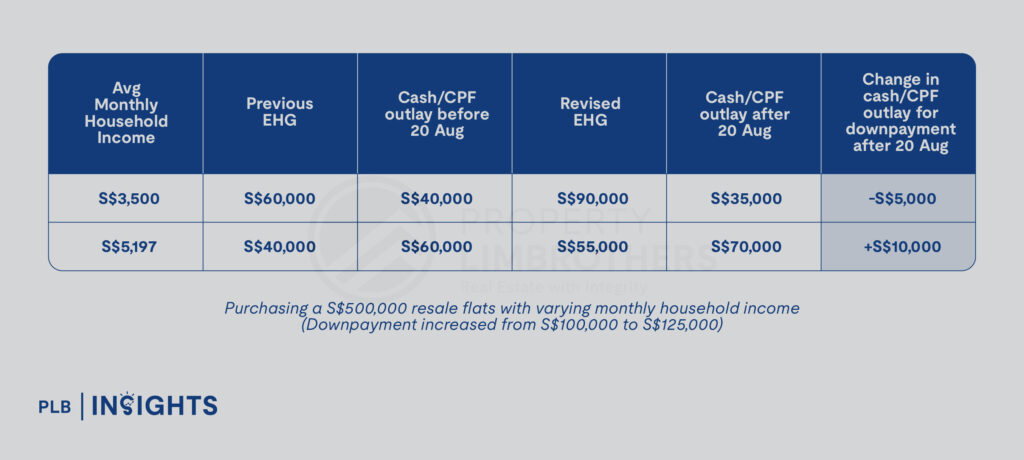

Lower-income households stand to benefit the most from the increased EHG. For example, consider a family with a household income of S$3,500 purchasing a S$500,000 resale flat. The tightening of HDB LTV limit from 80% to 75% would mean they have to fork out an additional $25,000 in downpayment, increasing from $100,000 to $125,000. Under the new EHG, they would receive S$90,000 in grants — an increase of S$30,000 from the previous grant amount. This additional S$30,000 in EHG would reduce their required cash or CPF outlay to S$35,000, compared to S$40,000 under the previous EHG. This results in a S$5,000 saving in cash or CPF for the downpayment.

Now, consider another case for a medium-income household with an income of S$5,197 (Singapore’s median household income in 2023) purchasing the same $500,000 resale flat. With the tightening of the HDB Loan-to-Value (LTV) limit, their downpayment would also increase by S$25,000, from S$100,000 to S$125,000. Under the new EHG, they would receive S$55,000 in grants, an increase of S$15,000 from the previous EHG of S$40,000. However, this additional grant is not enough to fully offset the S$25,000 increase in the required cash or CPF outlay for the downpayment. Consequently, the middle-income household would still need to pay an extra S$10,000 in cash or CPF to purchase the flat.

While the increase in the EHG appears to benefit households with incomes up to S$8,000, the tightening of loan limits means that medium-income households will need to provide more cash or CPF for their downpayment. Our calculations show that only households with an income below S$4,000 will see a reduction in the cash or CPF needed for their downpayment after August 20. This indicates that the increase in the EHG primarily benefits lower-income households, making public housing more affordable for this group of buyers.

The increased EHG is also aimed at helping lower- to middle-income households buying new flats, including those in Prime and Plus locations. This is timely as Plus flats will be making its debut in the upcoming October 2024 BTO exercise.

In a Nutshell

The August 20 cooling measures are targeted to make public housing more affordable for lower- to medium-income households, prevent overheating in the resale market driven by recent million-dollar transactions and pent-up demand, and encourage prudent borrowing for buyers purchasing more expensive flats. All these measures are calibrated and targeted to make public housing prices more sustainable in the long term.

While the long-term movement of resale prices remains unknown, the latest cooling measures certainly have a signalling effect on short-term demand and provide comfort to anxious Singaporeans concerned about the affordability of our public housing market.

We recognise that the ever-changing property market and new cooling measures can make navigating real estate complex. Our goal is to provide you with up-to-date information to support informed decision-making. Whether you are a first-time homebuyer, an experienced investor, or just considering your options, our team of experienced consultants is ready to assist you at every stage.