In Singapore, a couple’s discussion of the future and marriage is inevitably tied with homeownership due to the nature of the Build-To-Order (BTO) process. The application process involves a lot of complex considerations as well as a considerable amount of waiting time since there’s no guarantee that you will be able to secure a queue number in the BTO ballot on the first try. Not to mention the waiting time for the flats to be completed.

As such, many couples enter into this discussion at a young age, some when they are still full-time students in university. Navigating the BTO process as students can feel like a daunting task, especially when you’re juggling it alongside full-time studies and wondering how you can afford to with no income. As students, the idea of securing a home might seem far off, but understanding the BTO process early can give you a head start when the time is right.

This guide is here to help you break down the steps, highlight key considerations, and offer practical tips. Whether you’re planning ahead or just curious about your options as students, we’ve got you covered.

*Note: This article is written with the assumption that both applicants are full-time students applying for BTO and opting for an HDB loan. There will be some differences in the process if only one applicant is a full-time student while the other has been working for more than a year, and if you are taking a bank loan instead of HDB loan.

Step 1: Apply For A HDB Flat Eligibility (HFE) Letter

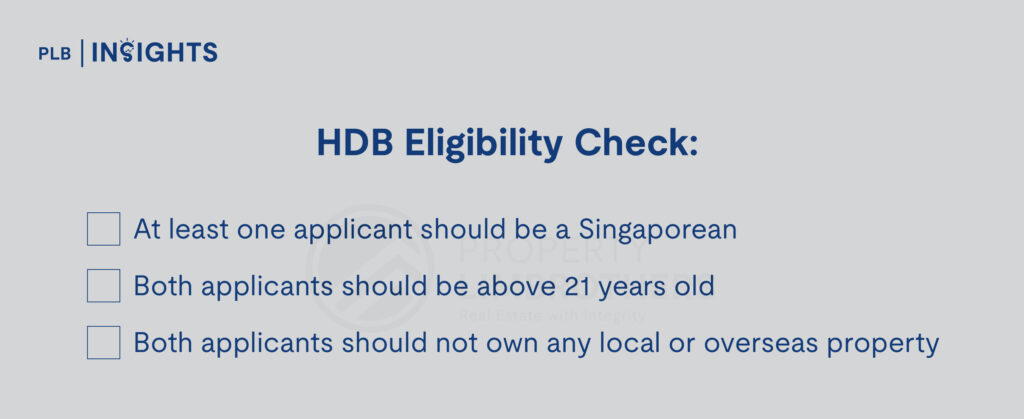

Before starting on this journey, you should ensure that both you and your partner pass HDB’s eligibility check. At least one of you should be a Singaporean, both of you should be above 21 years old, and both of you should not own any local or overseas property.

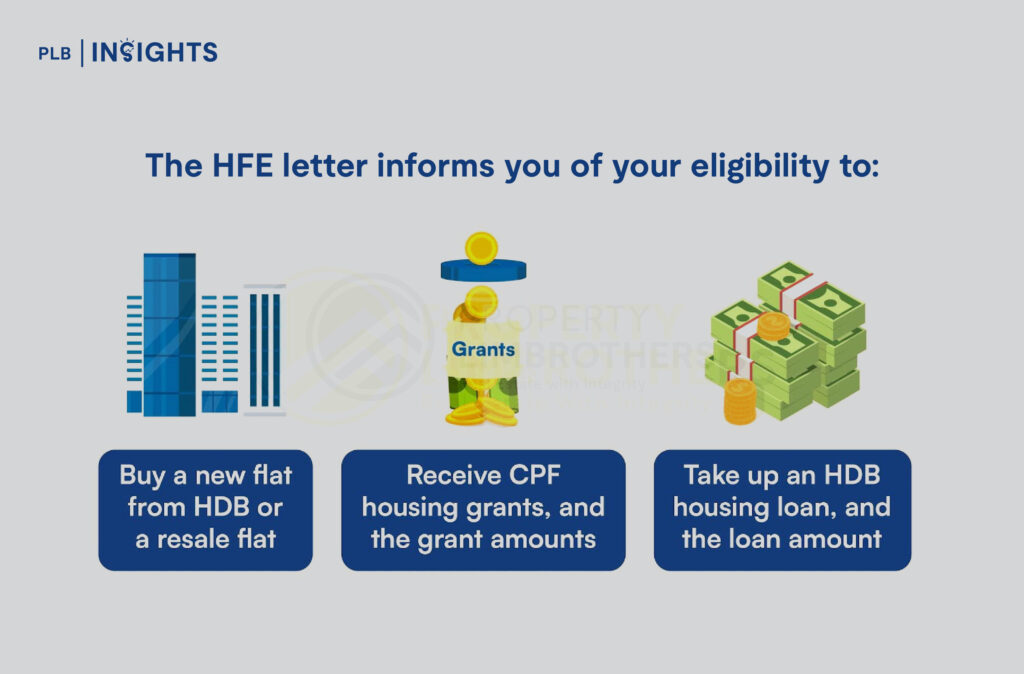

You will need a valid HDB Flat Eligibility (HFE) letter in order to apply for a BTO flat, and you can apply for it on the HDB website for free. The most important tip when starting on your BTO journey is to apply for your HFE letter early, ahead of a BTO launch, as it can take some time to get approved.

HDB recommends applying for a HFE at least a month in advance, as the processing time can take up to a month after receiving the full set of required documents. The processing time may also take longer closer to a BTO launch due to higher application volume.

For full-time student couples, you can skip the income assessment page of the HFE application as you will be under the Deferred Income Assessment scheme. The Deferred Income Assessment scheme essentially allows you to book your flat first and defer the income assessment for your HDB loan to around 3 months before the key collection of your flat.

Your eligibility to receive the Enhanced CPF Housing Grant (EHG) will also be assessed later as one of the eligibility criteria requires at least one of you to be in continuous employment for at least 12 months.

Step 2: Apply For A BTO Flat

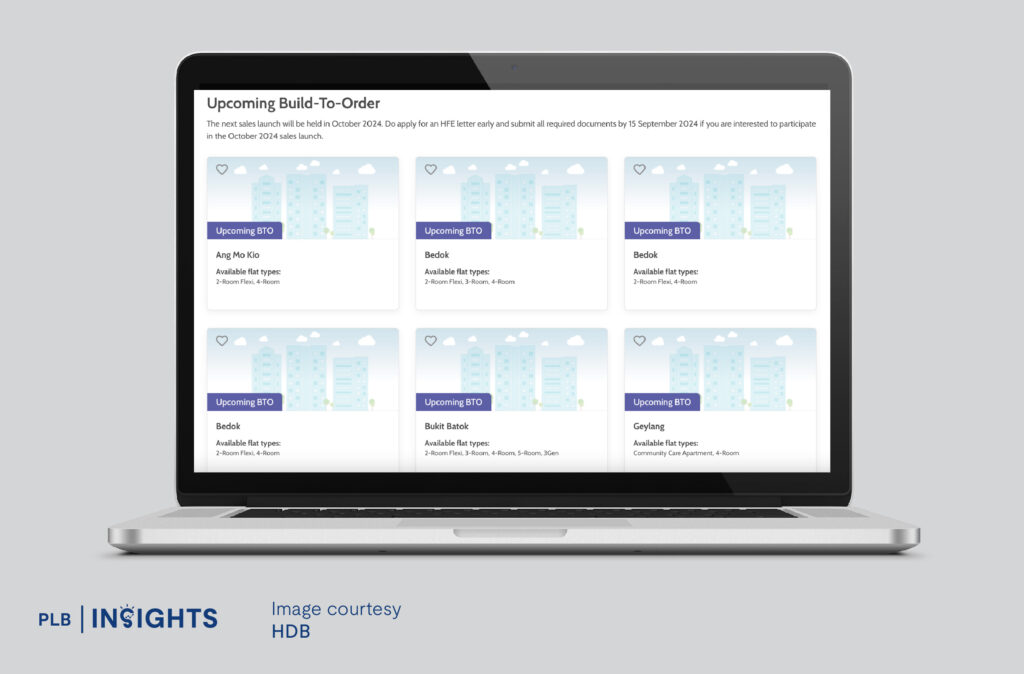

The next step is to submit an application to buy a new flat in a BTO sales exercise. Prior to the launch, you should research the projects available thoroughly. There are plenty of resources online that provide preliminary information and reviews of the various project sites. Once the application window opens, you will also have around a week to carefully review all the information provided by HDB before submitting your application.

A tip that we can offer is to wait till the last few days of the application window to observe the application rates across all the projects, and apply to a project and flat type with the lowest application rate. This gives you the best chance of getting a queue number. Since the BTO application is on a ballot and not a first-come-first-serve basis, you do not need to rush to apply or worry about fastest fingers first. But of course, if you are already set on a certain project/location and flat type, you can just go ahead and submit your application.

Do take note that when you are submitting your application, you should declare your employment as full-time students with no income. You won’t have to declare your side hustles or part-time jobs, and you won’t be required to provide documentation for this during the subsequent appointments.

After submitting your application and paying the $10 admin fee, the outcome of the application will typically take around 4-6 weeks. You will be notified of your application results and queue number via email.

Step 3: Wait For Your Flat Selection Appointment Date

If your balloted queue number is within the total number of flats available, you are guaranteed to be able to book a flat. Congratulations!

What can you do in the meantime? From personal experience, finding a community that shares periodic updates is extremely helpful and can ease a lot of anxiety during the wait. There are Telegram channels that collate BTO flat selection appointment dates across projects as well as specific project channels that you can join to get updates from your future neighbours. Within the groups, you can also ask questions and get opinions from the community.

However, do note that some of the information provided is crowdsourced based on personal experiences and you should do your due diligence when consulting in these groups.

Once you get your appointment date, there’s a few things you need to do.

1. Shortlist your ideal flats

Depending on your appointment time slot, there will likely be some applicants ahead of you. This means that the good units (high floors, corner units, units with unblocked views, units closer to certain amenities) will likely be taken up first.

In the days leading up to your first appointment, you can log into the HDB Flat Portal and go under Flat Applications to check on the flat details and availability. This way, you will be able to see which units are still available before heading down to HDB hub. Shortlist a few in the event that some of the units that you are eyeing get snapped up before your turn.

2. Discuss whether to opt in for OCS

Before your first appointment, you should have a discussion with your partner to decide whether you want to opt in for the Optional Component Scheme (OCS).

Under the OCS, the cost of necessary fixtures and fittings such as internal doors, flooring, and bathroom fixtures will be added to the final price of your BTO flat. As these finishes will be completed by HDB by the time you collect your keys, it will save you some time on renovation and you might be able to move in earlier. Additionally, since the cost of these fittings are included in the final price of your flat, you are able to pay for it using your CPF and HDB loan.

Forfeiting your queue number is not recommended as you will incur a non-selection count and your subsequent flat applications will be placed in the second-timer category for a 1-year period.

Step 4: First HDB Appointment – Flat Selection

This is the big day you’ve been waiting for – selecting your dream unit and getting into debt with your partner.

Bring along your NRICs, appointment letter, HFE letter, as well as the documents necessary to prove that you are full-time students. If you don’t have all the documents ready, not to worry, you will still be allowed to proceed with the selection and submit your documents later via MyDoc@HDB (HDB’s online e-service).

The selection of flats strictly follows the queue number, so you might be required to wait if the couple ahead of you in the queue have not selected their unit yet. While waiting, you may want to visit the My Nice Home Gallery showflats located within HDB hub to check out the latest flat designs, as well as interior design and renovation ideas.

When it is your turn, an HDB officer will walk you through the process of selecting your flat and other administrative matters involving your HDB loan and housing grants. Since you are deferring your income assessment, your officer will likely explain the timeline in greater detail.

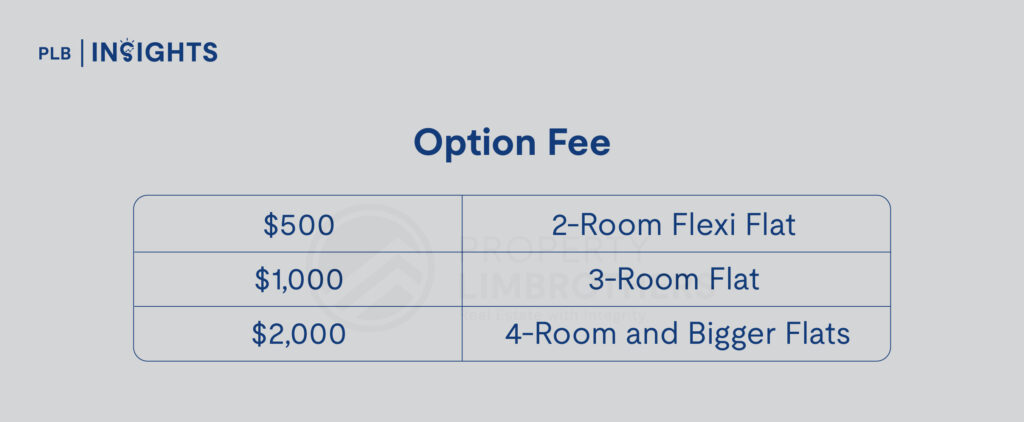

After you have selected your unit, you will be required to pay a maximum of S$2,000 in cash as the option fee. This option fee will form part of the downpayment and total cost of your flat.

Once that’s done, you’re officially homeowners! (Well, not yet but you get the gist) Congratulations on reaching this milestone, don’t forget to take a photo together at the photo wall to commemorate the moment!

Step 5: Second HDB Appointment – Signing of Lease & Downpayment

This appointment, which will be several months after the first, will be to sign the agreement of lease and to make your first downpayment, stamp duty, and legal fees. Remember to bring along your agreement of lease letter, which will specify the payment amount, when heading down to HDB hub.

During this appointment, the amount of downpayment you have to pay will depend on the type of loan you have chosen to take.

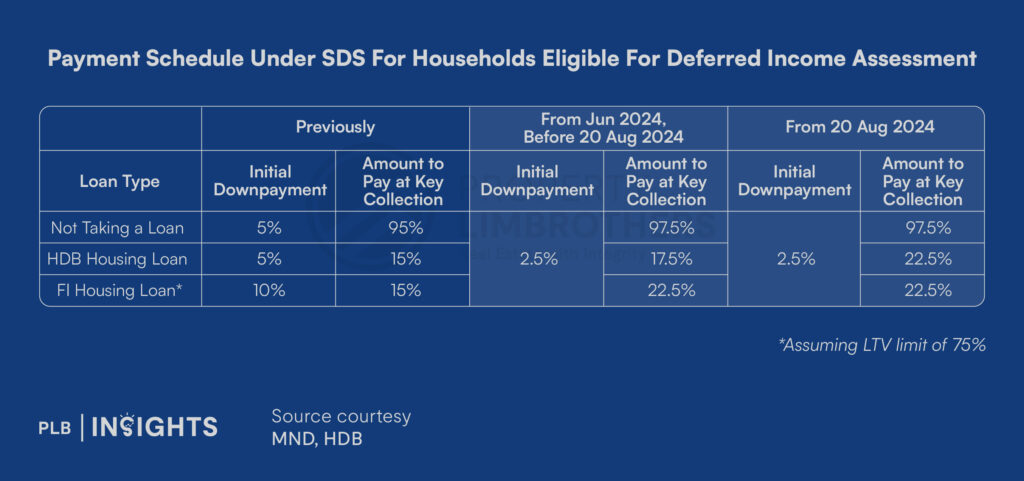

For those taking HDB Housing Loan, under the latest cooling measures, you will be required to pay a downpayment of 25% of the flat’s purchase price. However, since you will likely qualify for the Staggered Downpayment Scheme (SDS), you will be able to make the downpayment in two instalments – 2.5% of the flat’s purchase price during this appointment and the remaining 22.5% during the key collection appointment. You can use CPF OA, cash, or a combination of both to pay for your downpayment.

*Do note that if your project was launched before 20 August 2024, your HDB LTV and downpayment will still be 80% and 20% respectively.

At this stage, if you and your partner have sufficient funds in your CPF OA, you will not need to fork out any cash. However, since you have deferred your income assessment and have not received your grants, be prepared to fork out some cash.

For those opting for a bank loan, you will be required to pay a downpayment of at least 25% of the purchase price. 5% of it needs to be paid in cash while the remaining balance can be paid for using CPF OA, cash, or a combination of both.

Decide on ownership status of the flat. During this appointment, you will also be asked to choose between Joint-Tenancy or Tenancy-In-Common. The former will allow both owners to have an equal stake in the flat, no matter how much each party contributed to buy the flat. For the latter, each party will hold a separate share of the flat.

And that sums up the second appointment! Now the waiting begins.

Step 6: Final HDB Appointment – Key Collection

Congratulations once again! This important milestone is something that many aspiring homeowners are waiting for, and this marks the start of a new journey for you to create a safe space to call home!

A few months prior to this appointment, HDB will contact you to request for your income documents for the loan and grant assessment. Do remember to be thorough when submitting your income documents as this can impact your loan quantum. If you’re eligible to receive the EHG, the grant amount should be disbursed into your CPF OA accounts before your key collection appointment.

This appointment would also be the time to pay for the balance downpayment. You may use the funds and EHG (if any) in your CPF OA, cash, or a combination of both to pay for this downpayment.

After you have completed all the necessary payment and paperwork, you will be handed a bundle of keys to your new home. Once again, you may want to take a photo at the photo wall to commemorate this milestone and special occasion.

Once all that’s done, it’s time to visit your new home! Traditionally, Chinese couples would bring along a pineapple to welcome wealth and prosperity by rolling it into the house. But over the years, we’ve seen this custom being practised by other races as well.

You might also want to start looking around for defects, or choose to engage a professional to do so.

Closing Thoughts

Over the years, the government has been enhancing existing policies and frameworks to make homeownership more attainable for young couples at the start of their journey together. As the authorities have promised to continue ramping up the supply and to reduce the BTO waiting time by building ahead of demand, timeline planning is important to ensure that you are ready for the next stage of life by the time your flat is ready.

For full-time student couples considering applying for a BTO flat together, do weigh your options carefully and understand the consequences of hasty decisions in your flat application process.

If you have further questions or need help navigating your options in the market, do reach out to us here and we will be happy to offer a second opinion. Till next time, take care.