Navigating the real estate market in Singapore can be a daunting task to take up with its ever-changing landscape, regardless of the level of expertise you possess. Transactions within the real estate market can be complex and filled with a wide range of terminologies and jargon you may need to decipher.

So, whether you are someone looking to buy a new home for the first time, an investor brushing up on your real estate vocabulary, or a fellow reader coming from part 1 of our comprehensive guide, familiarising yourself with these important terms can equip you with the knowledge required to navigate Singapore’s real estate landscape.

In part two of this guide, we go through an extensive list of key terms and definitions that are commonly used in the industry.

Let’s jump right into some terms that will shape your understanding of Singapore’s real estate market.

Executive Condominium (EC)

An Executive Condominium (EC) is a strata-titled apartment that falls under the public-private housing hybrid scheme, where it is developed and sold by private developers, and subject to specific eligibility criteria and regulations that are set by the government.

ECs were first introduced in the 1990s to cater to citizens belonging to the “sandwich class” comprising households with higher incomes that did not qualify for public housing schemes such as the Built-to-Order (BTO) scheme. Over time, it evolved into an affordable option for those who aspired to own private housing.

As such, ECs are designed to offer similar facilities and amenities as private condominiums, but at a much more affordable range. These amenities and facilities range from swimming pools and gyms to landscaped gardens and function rooms.

There are some key points to take note of for Executive Condominiums. There is a set of eligibility criteria that applies to anyone looking to purchase. This includes any existing ownership of other properties, citizenship and permanent resident statuses, and income ceilings. Initial owners of ECs have to fulfil a Minimum Occupation Period (MOP) of 5 years. After that, they can sell it to only Singaporeans and Permanent Residents. Subsequent owners do not have to serve another MOP. Once 10 years have passed, ECs will become fully privatised and available for foreign ownership.

Strata Title

Speaking of the strata-titled housing mentioned above, you may be wondering what a strata title is.

A Strata Title refers to a form of property ownership that is commonly used in multi-unit developments and units such as townhouses, condominiums and apartments with shared areas. Within this system, each individual owner has complete and legal ownership over their specific unit, along with shared ownership of the facilities and common areas of the residence. This includes swimming pools, parking lots, gyms, gardens, lobbies, elevators and a number of other shared amenities.

Strata Title developments have regulations that govern the use and conduct of property. For instance, owners may be required to abide by rules on pet ownership, noise control, common area usage, waste management, parking and vehicle regulations, and renovations. Moreover, there are crucial legal components in place that provide a clear framework to ensure that strata title developments are well-governed and function optimally.

Two such components are the Strata Title Plan and the Strata Title Act.

The Strata Title Plan is a legal document that outlines the boundaries of ownership and the layout of the development for both individual units and shared spaces. Furthermore, it establishes the responsibilities and rights of each owner and determines the proportionate share of the common areas each unit owner is given. The Strata Title Act, on the other hand, is legislation that provides a framework for managing property, ensuring the proper functioning of these developments, and resolving any disputes that arise. In Singapore, the applicable legislation for strata title developments is known as the Building Maintenance and Strata Management Act (BMSMA).

Management Corporation Strata Title (MCST)

The Management Corporation Strata Title is the managing body that is responsible for the maintenance of the common property in condominiums and other developments with shared facilities and multiple owners. The MCST is established under the BMSMA and its primary functions include the management, maintenance, and repair of the facilities and common areas such as lobbies, gardens, swimming pools, gyms and lifts.

The process of forming an MCST starts when the developer convenes an initial general meeting (IGM) with the unit owners of the development in order to transfer the management and control of the common property to the unit owners. The unit owners then elect the members of the Management Council during the IGM, granting them the responsibility for the management and administration of the MCST. After the meeting, the MCST is formally registered with the Strata Titles Board (STB).

En bloc Sale

Coming from a French word, that means “as a block” or “as a whole”, an En bloc Sale is the collective sale of a development like a residential condominium by the majority of owners. These sales enable the redevelopment of a site into a new project – both residential and commercial.

The process of the sale typically starts when a group of owners within a development gather signatures to initiate a collective sale. At least 80% of the residents must agree and give a signature to demonstrate a collective intent to sell for an en bloc to be possible. Negotiations start if and when a developer expresses interest, and the process moves forward with a Collective Sale Agreement (CSA). The timeline of the sale, from start to finish, can range from a few months to over a year. This entire process is governed by the Land Titles (Strata) Act.

En bloc sales enable owners to sell their units or shares at a premium price, and this is especially good for individuals who own an underutilised or older property. However, these financial benefits can also come with a few downfalls. While owners can use the financial gain from this sale as a means to finance a new place, they do so at the expense of losing a home with sentimental value. And, in addition to the uncertainty and the lengthy sale process, en bloc sales also result in some owners having to involuntarily sell their homes.

We previously had a chat with an en bloc expert on our educational Youtube channel NOTG, so be sure to check that out for more insights on the processes behind successful en bloc sales.

Share Value

The share value of a property represents the proportionate share each strata unit is entitled to in the same development. It is a factor that determines the number of shares one owner has relative to the other owners. This further helps each unit owner determine their contributions to certain maintenance fees and their voting rights for things such as an en bloc sale.

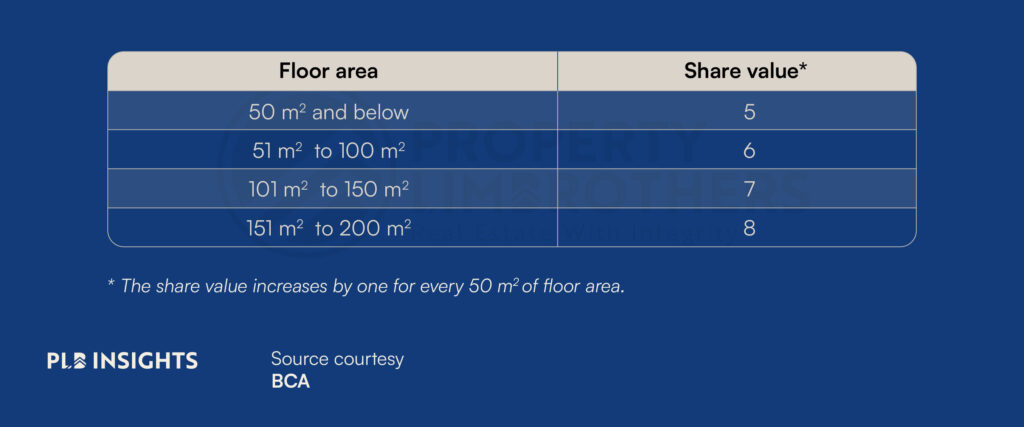

When calculating the share value, the unit size, the portion of common facilities and the number of units you own are taken into account. The table below shows the groupings of share value by floor area.

Selective En bloc Redevelopment Scheme (SERS)

The Selective En Bloc Redevelopment Scheme (SERS) is implemented by the Housing and Development Board (HDB) to rejuvenate older residences by replacing them with upgraded developments. This programme aims to improve and enhance the environment and the infrastructure of older HDBs. Through the scheme, ageing HDB estates that are suitable are selected for redevelopment. It is key to note that not all residences are eligible for redevelopment and must meet eligibility criteria to be considered. Factors in the criteria include the redevelopment potential, the age of development, and some long-term plans that must be taken into consideration.

Eligible residents whose developments are selected under SERS will be relocated and offered replacement flats that are typically newer, with more facilities and amenities. In addition to that, residents may also receive compensation for the value of the existing flats along with other incentives offered by the government.

CPF Ordinary Account (OA)

The CPF Ordinary Account is an account within the Central Provident Fund (CPF) scheme. This scheme is an all-encompassing social security savings plan that helps individuals in Singapore set aside funds for various reasons such as healthcare, retirement, and housing.

The CPF OA, in particular, is one of the three accounts within this system and is used specifically for housing-related payments such as a mortgage, mortgage insurance, down payments, monthly instalments, stamp duty and legal fees.

Homebuyers who are eligible for CPF Housing Grants will also have the funds disbursed into their CPF OA, and the grants can be used to pay the downpayment for their HDB flat.

Urban Redevelopment Authority (URA)

The Urban Redevelopment Authority is Singapore’s national urban planning authority that oversees the land use, planning and development of the urban areas of the country. The URA plays a crucial role as a key government agency to shape the physical landscape of the country while ensuring sustainable development.

URA’s key functions include planning the physical development of Singapore’s urban landscape, allocating and regulating land use for residential, commercial and recreational purposes, and preserving and conserving the country’s cultural and historical landmarks.

Progressive Payment Scheme

The Progressive Payment Scheme is a method of facilitating payments that is commonly used in the purchase of new residential properties in Singapore, specifically for new launch ECs, condominiums, and landed properties. With this, the purchase price of a property is broken down into instalments that are aligned with the stages, or progress, of the construction period of the development. The timeline or period of construction and, as a result, the number of instalments and payment percentages varies depending on the specific developer and project.

The schedule for the progressive payment scheme is generally outlined in the Sale and Purchase Agreement (S&P), and each payment is linked to a different stage such as the completion of the foundation works and the issuance of Temporary Occupation Permit (TOP). Developers are responsible for keeping buyers up-to-date with progress and providing any necessary documentation for buyers to facilitate payments on time.

These terms help ensure accountability and transparency for all parties involved in the purchase of any property.

Resale Levy

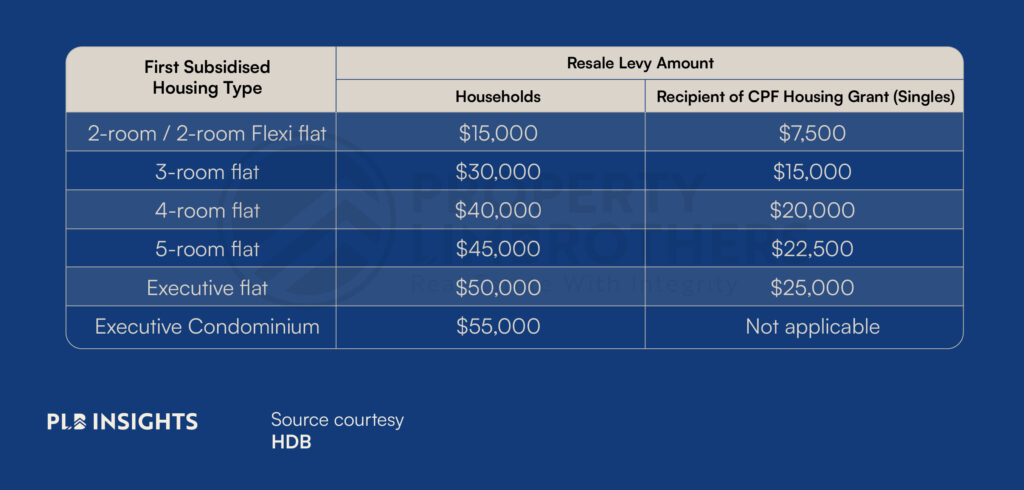

Those who wish to purchase a second subsidised flat from HDB after selling their first subsidised flat will be subjected to a resale levy. The amount of resale levy payable is based on the flat type of the first subsidised flat. The table below shows the resale levy payable for each flat type:

Gross Floor Area (GFA)

In the Singapore real estate scene, the term Gross Floor Area is used to describe the total floor area of a building measured from the exterior walls of a building. This includes the floor area of corridors, lobbies, mechanical rooms, offices, and other building facade elements. However, the GFA does not cover outdoor spaces such as car parks, balconies, terraces and rooftop gardens.

Gross Floor Area serves multiple purposes within the real estate market as it determines the maximum size and density of buildings allowed on different plots of land while complying with building codes and zoning regulations. Moreover, it allows for optimal land utilisation, efficient use of limited spaces and assistance in space and design planning while taking sustainability into consideration.

Additions & Alterations (A&A)

As the name suggests, Additions and Alterations is the process of making changes and adjustments to any existing properties. This is typically a process undertaken to enhance, upgrade, or alter the aesthetics, functionality and use of any part of a building.

Additions refer to the construction of new structures or the extension of existing ones. Examples of this include adding new rooms or floors, as well as building extra spaces for new facilities. Alterations are modifications made to existing areas on a property. This can range from an upgrade of the plumbing system in your condominium to refurbishing the master bedroom and kitchen.

Depending on the specific requirements and demands of a property owner, these works can vary. Furthermore, this process can be carried out by construction firms, developers, or property owners after all of the necessary paperwork and permits are approved by the relevant authorities.

Some typical A&A works in Singapore are extensions of floor plates, swimming pools, changes in the location or types of staircases, and additions of lifts among many other enhancements. For more information, refer to the URA guidelines for A&As here.

Income Ceiling

In order to be eligible for certain types of housing schemes and subsidies in Singapore, individuals or households must have an income that falls within a maximum gross monthly household income. This is referred to as the income ceiling.

The income ceiling in Singapore is set by the Housing Development Board (HDB) and can vary on the basis of the type of subsidy and housing scheme. Income ceilings are used by the government to ensure a fair distribution of housing resources among those who may have a greater need for affordable housing. Moreover, they also help prevent overconsumption of housing subsidies by households that bring in higher incomes.

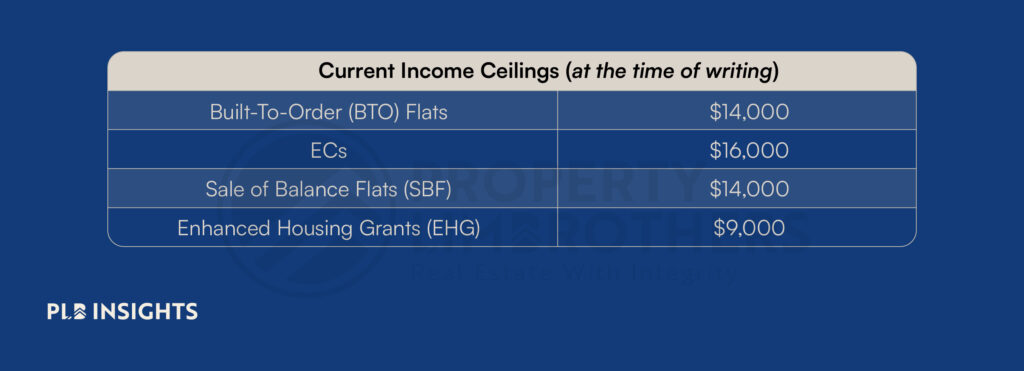

Here are some common household income ceilings in Singapore as at the time of writing:

Capital Gain/Paper Gain

A capital gain, in the context of real estate, refers to any profit that is made when properties are sold for a higher price than their original purchase price. Basically, this is the amount that represents the difference between the selling price and the original cost, which is lower. This is calculated by subtracting the original purchase price of the property from the new selling price.

A paper gain refers to an increase in valuation since the purchase, while the property is still owned by the buyer and has not been sold yet. It typically refers to unrealised profits from a property that has not been completed or is not ready to be sold.

Rental Yield

Rental Yield is the measure of the annual rental income that is generated by a property in relation to its market value. A rental yield is a return on investment (ROI) that property investors can expect to gain from a rental property. This metric, or percentage, is an important one for real estate investors to consider as it assists in gauging the potential profitability of rental properties.

Rental Yield is calculated by dividing the annual rental income by the property’s market value. This result is expressed as a percentage. A low rental yield indicates a lower return, whereas a higher rental yield suggests a higher return in relation to the property value.

The rental yield in Singapore ranges from 2% to 5% for residential properties, however, the rental yield can differ based on market conditions, location and property value.

Tenancy Agreement (TA)

A Tenancy Agreement (TA) is a legal document between a tenant and a landlord that outlines terms and conditions that gives the tenant the right to occupy a rental property for a specific period of time in exchange for a rent payment.

The TA is a document that can be referred back to should any issues or conflicts arise between the tenant and landlord as this document covers all necessary factors such as property description, lease duration, security deposit and rent payment, maintenance and repairs, and privacy and access.

Cooling-Off Period

In Singapore, a buyer of any residential property has the option to reconsider their purchase and potentially withdraw from the agreement within at least 14 days after the booking or signing of Option to Purchase (OTP). This is called the cooling-off period under the Housing Developers (Control and Licensing) Act (HDCLA). In the event that the buyer decides to withdraw from the purchase, they will forfeit their Option Fee (typically $1,000 for resale HDB and 5% of purchase price for private properties).

During the cooling-off period, the buyer can seek legal advice and review any contracts and the purchase agreement before finalising the transaction.

Defect Liability Period (DLP)

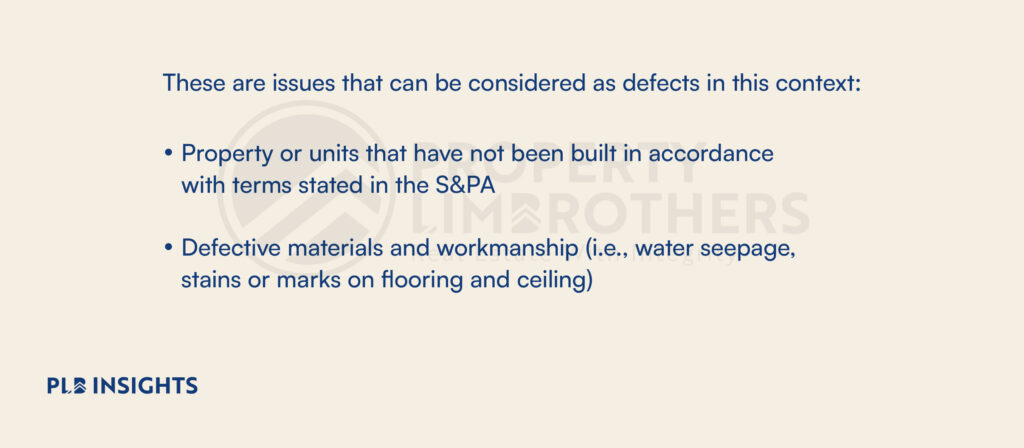

The Defect Liability Period is the duration of time in which a property developer has the responsibility to address any major or minor defects that might arise after the completion of a property. Usually, the DLP starts as soon as a Temporary Occupation Permit (TOP) is issued and all infrastructural work within the property is completed.

If a buyer discovers any defects during the Defect Liability Period, he or she must follow procedures given in the Sales and Purchase Agreement and contact developers to sort out the issues. Moreover, the duration of the DLP can vary based on the type of property being purchased. For instance, the standard DLP for private developments and HDB Flats is 1 year.

Fire Sale

A fire sale occurs in a situation where a property is sold at a steeply discounted price, often below market value. This is usually a result of an urgent financial issue on the developer’s or seller’s side that causes them to accept much lower selling prices. Other situations that can call for fire sales include instances where the investors or property developers want to sell off in a small duration of time in order to generate cash flow and reduce losses.

As always, when making decisions regarding the purchase of any property, it is strongly advised to exercise thorough research and due diligence to make the best and most well-informed decisions. One way to do so is to work with property consultants that can offer you professional guidance and assistance.

Subsidy Clawback

A subsidy clawback is a process of recovering a subsidy that has been previously provided to an individual or organisation. In terms of Singapore real estate, a subsidy clawback allows the government to recover a portion of the subsidy that is given out. This, as a result, ensures that the availability and affordability of subsidised housing is maintained.

A 6% subsidy clawback was imposed in 2021 for certain projects that fall under the Prime Location Housing (PLH) Model, which aims to keep public housing located in prime areas affordable and accessible for Singaporeans. What this means is that upon selling a flat, the property owner is obligated to pay 6% of the resale price back to HDB. Note that the 6% subsidy clawback only applies to the first resale at the time of writing.

Final Words

We hope that this article has given you some valuable insights you can use on your journey in the real estate market in Singapore. If you still find yourself with questions on different concepts, do not hesitate to reach out to us here. We will be back with more soon, see you in the next one!