Following a recent 40% price reduction for units at The Residences at W Singapore Sentosa Cove, 65 units were promptly snapped up – a successful fire sale by the developers. Such fire sales are not a common occurrence in Singapore’s real estate market, although it is a go-to move by developers during economic downturns, where macro factors influence the demand and affordability of homebuyers.

In this article, we dive into the origins, evolution, and implications of fire sales on Singapore’s real estate market. How do such sales impact buyers and sellers, and how do they affect the market at large? Read on to find out more.

What is a Fire Sale?

A fire sale refers to a transaction that occurs wherein goods or assets are sold at a significantly discounted price in order to promptly generate sales or clear out inventory. The term originates from the idea of selling something in a hurry, typically under urgent circumstances, in order to free up capital urgently.

In the real estate market, a fire sale usually involves a substantial price reduction on the property to attract buyers and expedite the buying and selling process. These sales occur when property just be sold due to unfavourable market conditions, financial distress and other factors that may bring forth a need for capital urgently. Although buyers may benefit from purchasing property at below-market prices, this is not the case for sellers as they incur losses due to the reduced pricing.

How Did They Start?

The start of fire sales in Singapore’s property market can be attributed to the cyclical nature of the real estate industry, which results from several economic shifts and the responses of both buyers and sellers to these shifts.

Macro factors such as economic crises and cooling measures can also influence developers to put up fire sales in order to clear out their inventory. As a result of these challenges, developers may experience reduced demand for property and lower consumer purchasing power. This then leads to the accumulation of unsold inventory, prompting fire sales.

Although the concept of fire sales gained traction, it has not been a common occurrence in Singapore’s housing market. Rather, it has become a prevalent phenomenon that reemerges during times of economic downturn, enabling sellers to deal with financial challenges by selling their property at discounted prices. The catalyst for the emergence of fire sales in Singapore’s real estate sector was the 1990s Asian Financial Crisis that led to a sharp downturn in the property market.

Singapore’s Fire Sales: A Timeline

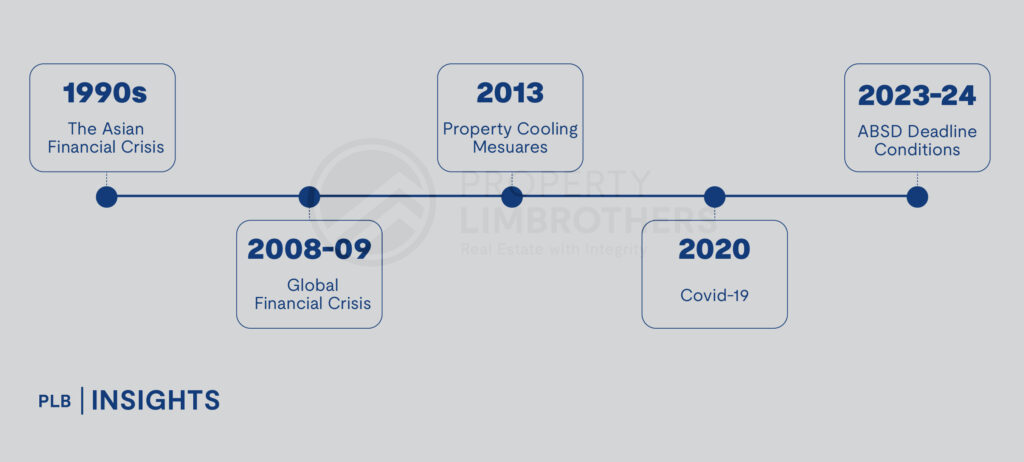

Over the last few decades, economic events and market conditions have heavily impacted the timeline and the potential of fire sales occurring in Singapore’s housing market. Let’s delve into some of the key economic events and periods in the city state’s history that may have influenced the occurrence of fire sales.

Late 1990’s: Asian Financial Crisis

The Asian Financial Crisis (AFC) of the late 1990s created a wave of financial uncertainty over property owners, buyers, and developers in Singapore. As the crisis unfolded, one of its notable implications on the property market was the downward trajectory of property prices by 40% over 18 months.

In addition to the increased financial distress financial institutions, investors, buyers and property owners grappled with rising debt, a surplus of unsold inventory and constraints with liquidity. This created a conducive environment for fire sales to assist all parties involved in relieving their financial burdens.

2008-2009: Global Financial Crisis

During the Global Financial Crisis (GFC) of 2008, Singapore’s property market experienced a significant downturn once again, with prices going down by 25%. Along with reduced demand for property and increased financial constraints, developers and property owners were facing heightened financial pressure as their inventory remained unsold and financing became tougher to secure.

Echoing the crisis occurring just a little over a decade prior, the GFC’s adverse implications created a sense of urgency to address mounting debts and improve cash flow. This made the use of fire sales more likely to strategically respond to distressing market conditions much like during the AFC.

2013: Property Cooling Measures

Developers and sellers had to navigate regulatory changes and market uncertainties as the Singapore government implemented a new set of cooling measures in 2013. This was done with the aim of curbing property demand and stabilising the property prices for both private and public housing.

2013 saw Additional Buyer’s Stamp Duty (ABSD) rates raised between 5% to 10% across the board for permanent residents purchasing their first property and Singapore citizens purchasing their second property. Additionally, Loan-To-Value (LTV) rates were tightened, and the minimum cash down payment for individuals applying for a second housing loan was raised to 25%, from 10%. The Total Debt Servicing Ratio (TDSR) was also introduced, putting a restriction on the maximum loan amount homebuyers can be granted by financial institutions.

Higher ABSD rates imposed on buyers and the introduction of TDSR affected homebuyers’ affordability and tapered demand for property, therefore decreasing the pool of eligible buyers. Sellers and developers also incurred higher holding costs associated with holding unsold properties as a result of the ABSD rates. This further incentivised sellers and developers to reduce their property prices due to the pressure of attracting more buyers. Fire sales became a viable option for sellers and developers to stand out in a market competing for the lowest prices to clear out inventory.

2020: Covid-19

The onset of the global pandemic the world faced in recent years introduced a new set of challenges to Singapore’s property market. With travel restrictions and economic disruptions, consumer confidence in the property market was dampened, and property prices declined in the first quarter of 2020. However, soon after prices went up 2.2% by the fourth quarter.

When the pandemic first started, many property owners were willing to put up their properties for sale at discounted prices to liquidate assets for cash to salvage their businesses.

Despite the overall increase in property prices after the first quarter, the volume of transactions did not mirror the rise in prices. The discrepancy between prices and transactions may also lead to fire sales as buyers might be able to find opportunities to bargain in an already constrained market. Sellers facing financial pressures in the midst of a pandemic may have also been willing to accept lower offers or engage in fire sales to mitigate financial risks they faced.

2023-2024: ABSD Deadline Conditions

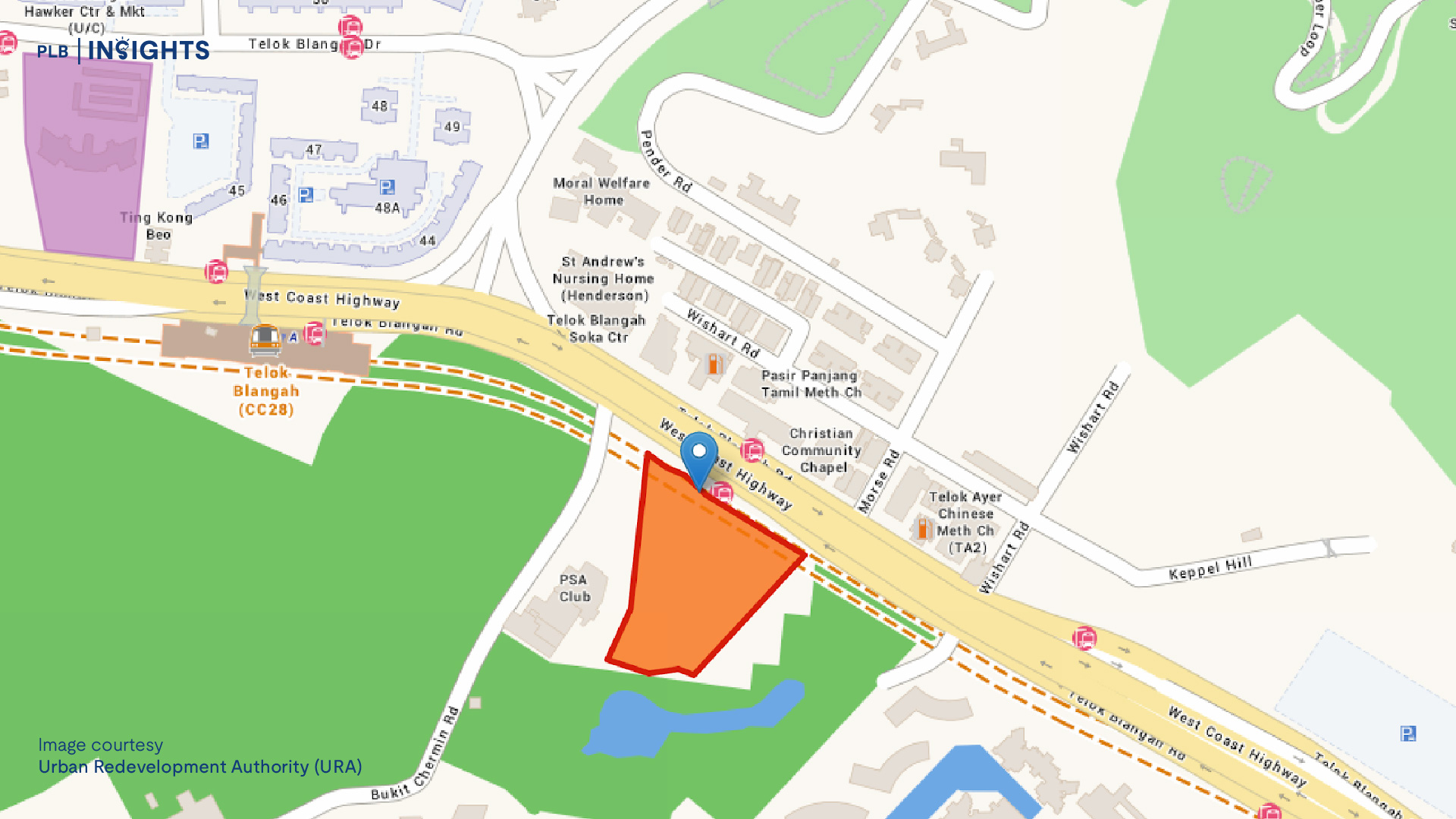

Developers in Singapore typically face deadlines and conditions imposed by regulatory authorities which mandate the sale of a proportion of units in a development within a specific timeframe. In the instance where developers fail to do so, they are penalised with the imposition of the Additional Buyer’s Stamp Duty (ABSD) on the unsold units as well as extension charges.

Recently, a number of property developments with unsold units were granted an extension of their ABSD deadlines. The extensions offered a temporary reprieve, relieving some of the pressure to clear out unsold units urgently. However, in instances where such extensions are not granted, fire sales are a likely solution to avoid issues arising with the failure to meet deadlines.

Implications of Fire Sales

Fire sales in Singapore’s property market can have a significant effect on both buyers and sellers. Moreover, they shape market dynamics and perceptions within the industry as a result. Let’s go over some of the implications of fire sales on buyers and sellers.

For Buyers:

Increased Affordability

An implication of fire sales for buyers is that they get the benefit of purchasing property at a much lower rate during the sale. Buyers can secure real estate assets that are priced significantly below market value during these rare occurrences.

Fire sales may enable a wider range of buyers to access homeownership and attract investors looking at capital appreciation potential.

Financing Considerations

Funding the purchase of a distressed property put up for a fire sale may come with additional requirements and complexities absent in traditional property purchases that will need to be taken into consideration. For instance, fire sales are often characterised by a sense of urgency and time constraints that require expedited decision making and transaction processing. Despite potential time constraints, both parties should ensure compliance with contractual obligations and practise thorough due diligence before completing the transaction of a fire sale.

As each transaction will be unique to circumstances, there may be instances where securing financing in such a short window of time may be more challenging than for a traditional property purchase due to the nature of the sale.

For Developers:

Financial Losses

Developers putting up a fire sale typically do so as a result of financial issues they are facing. As a result, they have to accept lower prices for their properties, leading to potential financial loss if they sell below market value prices.

Reputation

Participating in a fire sale may impact a developer’s reputation in the market. Potential buyers and investors may perceive the developer in a negative light and have lasting effects on the developer’s credibility, future business opportunities within the real estate sector and future property purchases.

Closing Thoughts

The evolution of fire sales in Singapore’s real estate market highlights the adaptability and resilience of the market as a whole in the face of various challenging circumstances resulting from the economic downturn.

As we trace the origins of fire sales in the city-state and explore the timeline of events influencing their emergence, it becomes evident that beyond significantly discounted deals, fire sales are a direct reflection of market volatility and financial pressures. By understanding the implications of fire sales for all parties involved as well as the history of these transactions, the property market can navigate these deals with greater insight and foresight, ensuring that there are opportunities found within what can otherwise be seen as a distressing occurrence.

Are you currently in search of your dream home? Not sure how to manage your sale and purchase timeline? Feel free to contact us here. Our team of seasoned consultants are happy to assist you in navigating the intricacies of your transition.

As always, see you in the next one.