Resale HDB prices across Singapore saw a 2.9% quarter-on-quarter (q-o-q) increase in Q3 2024, following a 2.3% q-o-q rise in Q2. This quarter’s growth also represents a 1.3% year-on-year (y-o-y) increase compared to the same period in 2023, marking the fastest rise since Q3 2022, when prices jumped by 2.6%.

With the new HDB classification framework introducing more stringent requirements this month, and non-landed private residential prices (both new launch and resale) continuing to rise, albeit at a more moderate pace, could this push discerning homebuyers to turn their attention to the resale HDB market? And what ripple effects might this shift have on the broader real estate landscape?

In this article, we’ll dive into the factors driving the recent price hikes in the resale HDB market and explore how these changes could impact the local property market dynamics.

Overview Of Resale HDB Price Hike

The sharp rise in HDB resale prices during Q3 2024 was largely driven by a surge in transaction volumes. Compared to the same quarter last year, the number of resale HDB flats sold in Q3 2024 increased by 20%, with 8,035 units changing hands. This makes Q3 2024 the strongest quarter for resale HDB transactions since Q3 2021, when 8,433 units were sold.

Additionally, Q3 2024 set a record for million-dollar HDB resale transactions, with 328 flats selling for at least $1 million. This is a significant increase from the 236 such transactions in Q2 and 128 in Q1 of this year. In fact, 747 million-dollar HDB flats were sold in the first nine months of 2024, far surpassing the 463 transactions recorded for the whole of 2023. Based on this trend, analysts expect the number of million-dollar resale flats to exceed 1,000 by the end of the year.

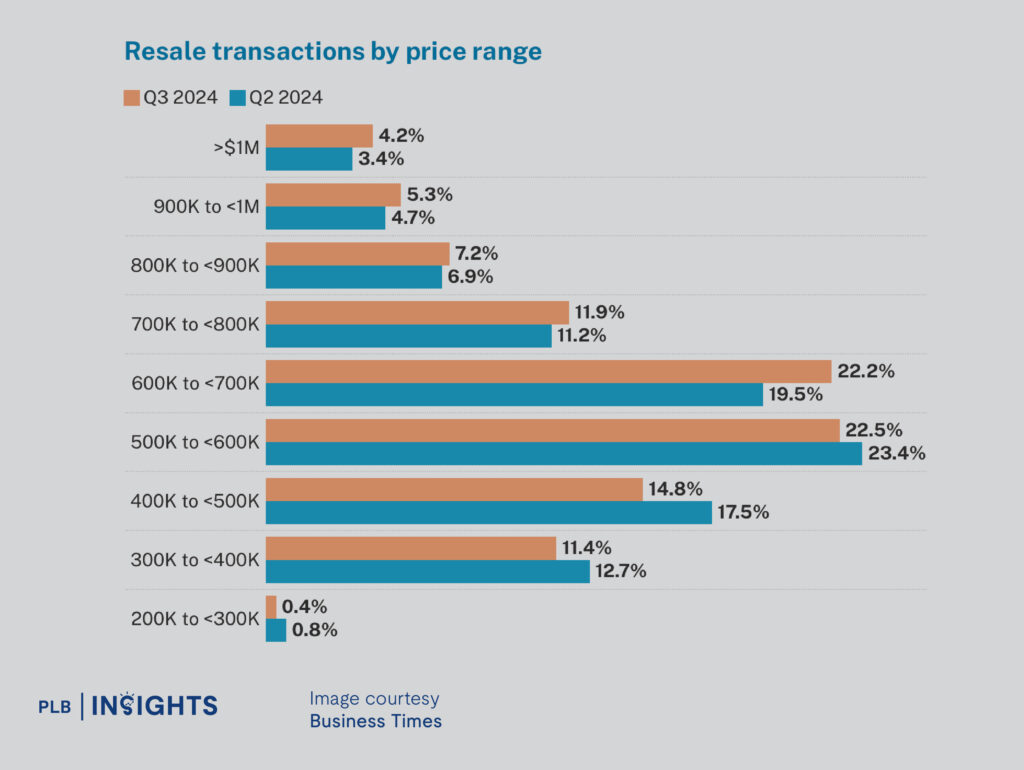

Aside from the increase in million-dollar flats, more than half of the resale transactions in Q3 2024 involved flats selling for over $600,000, up from 45.7% in the previous quarter. While prices rose across all flat types, 4-room flats saw the biggest price jump, with a 3.4% increase from the previous quarter, reaching an average price of $638,025. In contrast, 5-room flats had the smallest price growth, rising by 1.5% q-o-q to an average of $734,488.

This surge brings the year-to-date price growth for 2024 to 6.8%, outpacing the 4.9% increase seen throughout 2023. In terms of transaction volume, 22,455 flats were resold in the first nine months of 2024—an 11.2% rise compared to the 20,188 units sold during the same period last year.

According to the Housing Development Board (HDB), this uptick in resale activity and price growth can be attributed to strong demand, combined with a limited supply of new flats meeting the Minimum Occupation Period (MOP) this year. The faster price growth observed earlier in the year may have prompted a sense of urgency among buyers in Q3, especially as fewer listings were available in certain towns due to a lower number of newly MOP flats. Additionally, demand for larger flats, particularly 4- and 5-room units, as well as flats with leases starting from 2013 onwards, contributed to the overall price increase. Some experts also suggest that HDB upgraders who were priced out of the private market may have turned to the resale HDB market during this period, further fuelling demand.

Resale HDB Flats: A Growing Trend Amid New Framework and High Private Property Prices

With the introduction of the new HDB BTO classification framework, some discerning buyers may be hesitant to commit to the longer MOP of 10 years. Additionally, concerns about the $14,000 income ceiling for resale buyers limiting future demand could push more people toward choosing resale HDB flats instead. If this trend continues, resale HDB prices may continue to rise. This raises an important question: Could the surge in resale HDB prices influence the overall property market, both public and private? And is purchasing a resale HDB flat a more prudent option for capital appreciation?

While these questions don’t have straightforward answers, it’s crucial to remember that HDB flats—whether resale or BTO—are primarily designed to provide affordable housing for Singaporeans, not as a profit-making tool.

Property prices across Singapore, while still growing, are expected to moderate over time. Even though private residential property prices have recently shown signs of slowing growth, they remain out of reach for many Singaporeans, particularly those looking at new launches or resale units. This could further drive demand for resale HDB flats, especially among families seeking larger homes or those with an urgent housing need.

On the other hand, wealthier buyers are likely to continue opting for private residences that suit their lifestyle preferences, which will support private property price growth. In fact, the gap between resale and new launch prices for private non-landed homes has been closing, as buyers find more value in resale private properties due to the high cost of new launches. This trend has contributed to rising prices in the resale private market.

In summary, it wouldn’t be accurate to say that resale HDB price trends directly influence property prices across the board in Singapore. The rise in demand for resale HDB flats is a byproduct of broader real estate market dynamics and natural adjustments. Moreover, jumping on the rising demand for resale HDB flats should not be viewed as a guaranteed prudent investment. Homebuying is a complex decision that involves a range of financial and personal considerations, and most importantly, it must align with your family’s lifestyle needs and long-term goals.

Resale HDB vs BTO: Which is the Better Option?

There is no definitive answer to whether a resale or BTO flat is the better investment, and it shouldn’t be framed as a straightforward comparison. However, for discussion purposes, let’s explore the key factors to consider when choosing between the two.

If you’re not in urgent need of a home and are deciding between a resale or BTO flat in a prime area—while eligible for the maximum home loan—the biggest factor is price. A 4-room Prime BTO flat typically starts around $550,000, while resale HDB flats in prime areas are typically priced around $900,000. This creates a substantial price difference of $350,000.

With the current Loan-to-Value (LTV) ratio of 75%, the minimum downpayment for a $550,000 BTO would be $137,500, while a $900,000 resale flat would require a minimum downpayment of $225,000. The extra $87,500 can be a significant challenge, particularly for younger couples in the early stages of their careers, with limited savings and CPF funds. This is on top of the higher monthly mortgage payments they would need to manage.

When it comes to capital appreciation, there’s no clear winner. While resale flats have shown price increases, their values may eventually plateau, especially as the lease ages. Overpaying for a resale flat could mean buying at its peak price, with limited potential for further growth and the risk of lease decay.

On the other hand, concerns about the limited appreciation potential for Prime and Plus BTO flats, due to the 10-year MOP and income ceiling for resale buyers, are valid but not conclusive. These flats could still appreciate in value, though the extent remains unknown until they hit the resale market.

In this unpredictable real estate market, it’s crucial not to base your decision solely on the current trend of rising resale HDB prices. Instead, consider your financial situation, urgency, and long-term goals. Stay informed about market dynamics, develop a solid exit strategy, and choose the option that aligns with your lifestyle and future aspirations.

In Conclusion

The property market in Singapore, whether for BTO flats, resale HDB flats, or private residences, is constantly evolving, shaped by various factors such as buyer demand, government policies, and market dynamics. While the recent surge in resale HDB prices highlights a growing trend, the decision to buy a resale flat, BTO unit, or even explore private residential options requires a deeper understanding of your financial situation, long-term goals, and lifestyle needs.

Each type of property offers distinct advantages and challenges. Resale HDB flats provide immediate availability and larger spaces in mature neighbourhoods, while BTO flats offer a more affordable route but come with longer waiting periods and resale restrictions for Prime and Plus flats.

Ultimately, your choice should not be driven solely by market trends or short-term price movements but by careful consideration of what aligns with your family’s needs and aspirations. Stay informed, understand the market, and choose the property that best supports your long-term vision.

Have questions or need help with the next step in your real estate journey? Reach out to us today. Our expert consultants are ready to guide you through every step, ensuring you enjoy a smooth and fulfilling retirement.