Norwood Grand is set to be the first private condo launch in the Woodlands area in 12 years, generating considerable interest among prospective homebuyers and investors alike. The last launch in the area was Parc Rosewood in 2012, which was completed in 2014.

The anticipation surrounding Norwood Grand is not just about a new residential option; it represents a pivotal moment in Woodlands’ evolution as a key regional centre in Singapore’s north.

In this comprehensive review, we will explore the key features, location and pricing analysis, as well as how Norwood Grand fits into the broader context of Woodlands’ ongoing transformation and what this means for potential buyers and investors.

*This article was written in October 2024 and does not reflect data and market conditions beyond.

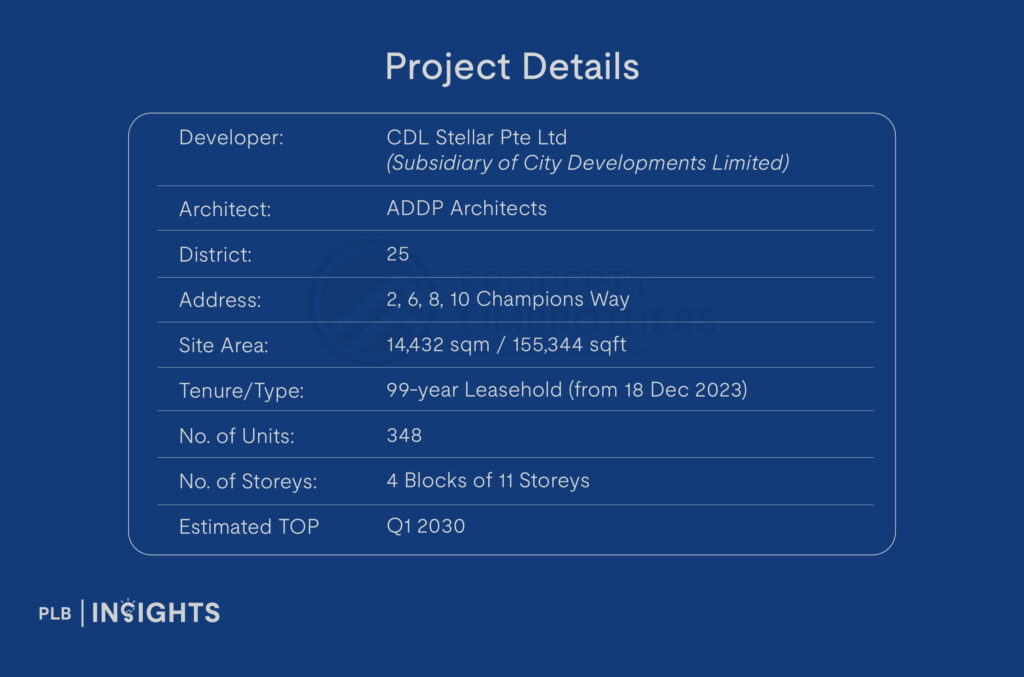

Project Details

Location Analysis

One of Norwood Grand’s most compelling features is its strategic location. Situated just 300 metres (about a 5-minute walk) from Woodlands South MRT station on the Thomson-East Coast Line (TEL), residents will enjoy unparalleled connectivity to the rest of Singapore. This proximity to public transportation is a rarity among private condominiums in Woodlands. In fact, it is the ONLY condo in Woodlands that is within a 500m radius of an MRT station, giving Norwood Grand a significant edge in terms of accessibility and future rental potential.

It is located right next to Innova Primary School, with Si Ling, Woodgrove, Woodlands Ring, and Woodlands Primary School within a 1km radius as well. This makes Norwood Grand an ideal choice for buyers planning to start a family in the near future, with 5 primary schools within the 1km radius.

The development’s location also puts it at the heart of the Woodlands Regional Centre, an area slated for major transformation in the coming years. To fully appreciate Norwood Grand’s potential, it’s crucial to understand the government’s vision for Woodlands. The Woodlands Regional Centre is set to become a vibrant commercial hub, with plans for new office spaces, retail outlets, and lifestyle amenities. This transformation is expected to create thousands of job opportunities, potentially reducing commute times for Norwood Grand residents who may find employment closer to home.

The development of Woodlands North Coast, a new waterfront precinct, will add a unique dimension to the area. This coastal development promises to bring recreational spaces and waterfront living experiences, further enhancing the appeal of living in Woodlands.

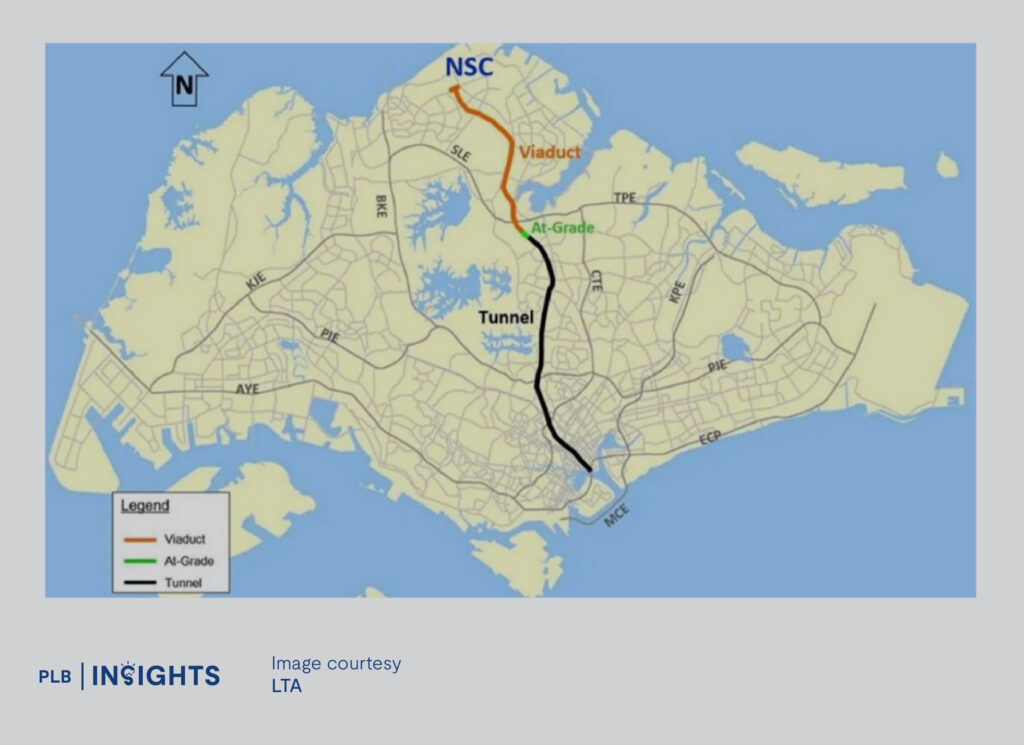

With the upcoming North-South Corridor and the future Rapid Transit System (RTS) link to Johor Bahru, Norwood Grand residents will benefit from enhanced connectivity both within Singapore and to Malaysia.

Site Plan

The site of Norwood Grand takes a triangular plot of land bordered by Woodlands Drive 17 and Champions Way. It is also right next to Innova Primary School, but the developers have accounted for this using landscaping to ensure a good setback distance and privacy.

The residential blocks are clustered in pairs – blocks 8 and 10 will have a north-south orientation with a slight tilt to the west while blocks 2 and 6 will have the same orientation but with a slight tilt to the east instead.

Most of the facilities are clustered in the middle of the development, in between the residential blocks. Take note that the tennis court will be located right next to block 8, which may generate some noise for those who prefer a quieter living environment.

One interesting facility that we noticed is the inclusion of an Early Childhood Development Centre within the development. This will be a 2-storey building located at the edge of the development near block 2 and the main entrance.

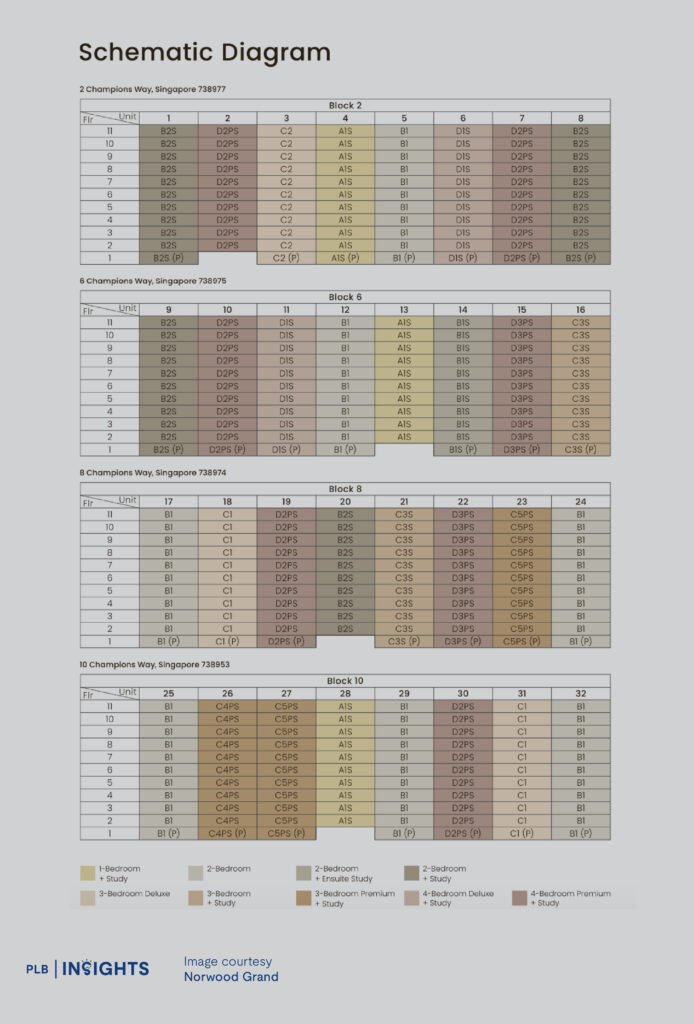

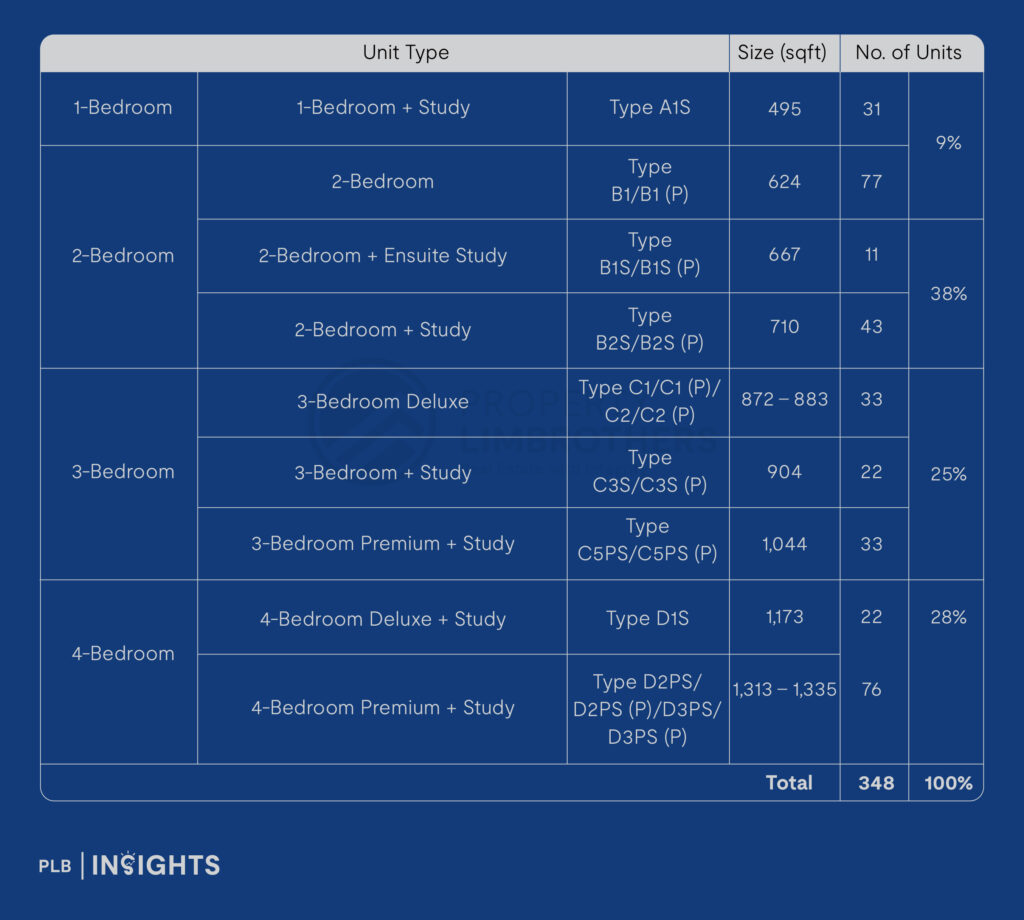

Unit Distribution

Norwood Grand will feature unit types from 1-Bedroom + Study to 4-Bedroom + Study, and looking at the site plan, the unit types are distributed rather evenly across the four residential blocks.

The premium stacks, where the largest 4-Bedroom Premium + Study layouts are located, are stack 07, 10, 15, 19, and 30. Stacks 07 and 10 will directly overlook the 50m lap pool, stack 15 will have a northeast facing diagonally towards Innova Primary, while stacks 19 and 30 will have a southeast facing towards Champions Way and the Champions Bliss HDB enclave.

There will only be two stacks of 1-Bedroom + Study, located at stacks 04 and 28. And only one stack of the unique 2-Bedroom + Ensuite Study (which we will delve deeper into in the floor plan analysis) located at stack 14.

Floor Plan Analysis

In this segment, we will highlight various types of floor plans available at Norwood Grand. Our aim is to furnish you with useful knowledge that will assist you in choosing the perfect unit tailored to your preferences and lifestyle needs.

Take note that Norwood Grand’s floor area calculations will be based on URA’s GFA harmonisation rule, which includes strata areas and excludes non-strata/void spaces.

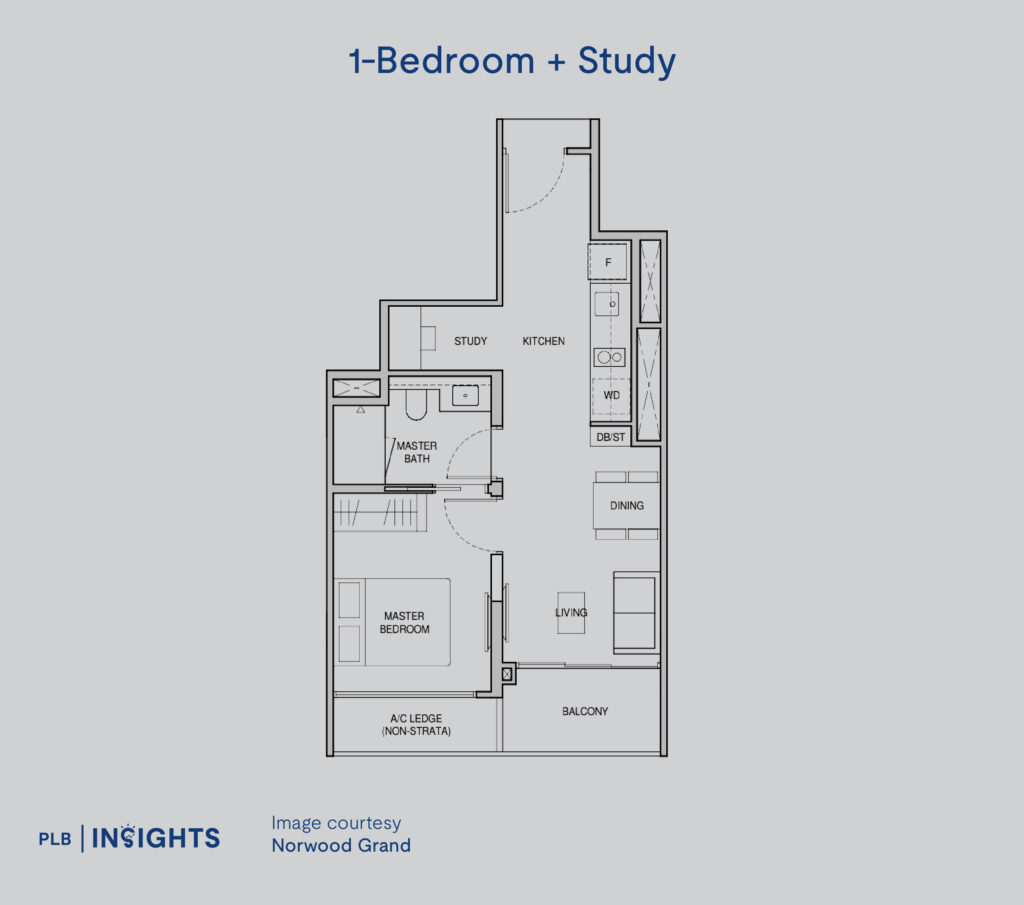

1-Bedroom + Study

There is only one variation available for the 1-Bedroom + Study layout. Entering the unit, you will find a slightly elongated foyer area. The rest of the layout is quite efficient, with the living areas and master bedroom nicely segregated.

The jack-and-jill master bathroom allows visitors to use the toilet without infringing on the privacy of the master bedroom – a feature often seen in 1-bedders.

The study area is tucked in a corner opposite the open kitchen, which can be used for storage purposes. However, if the intention is to use it as a proper study, you can also choose to enclose it with a sliding door to prevent kitchen fumes from entering.

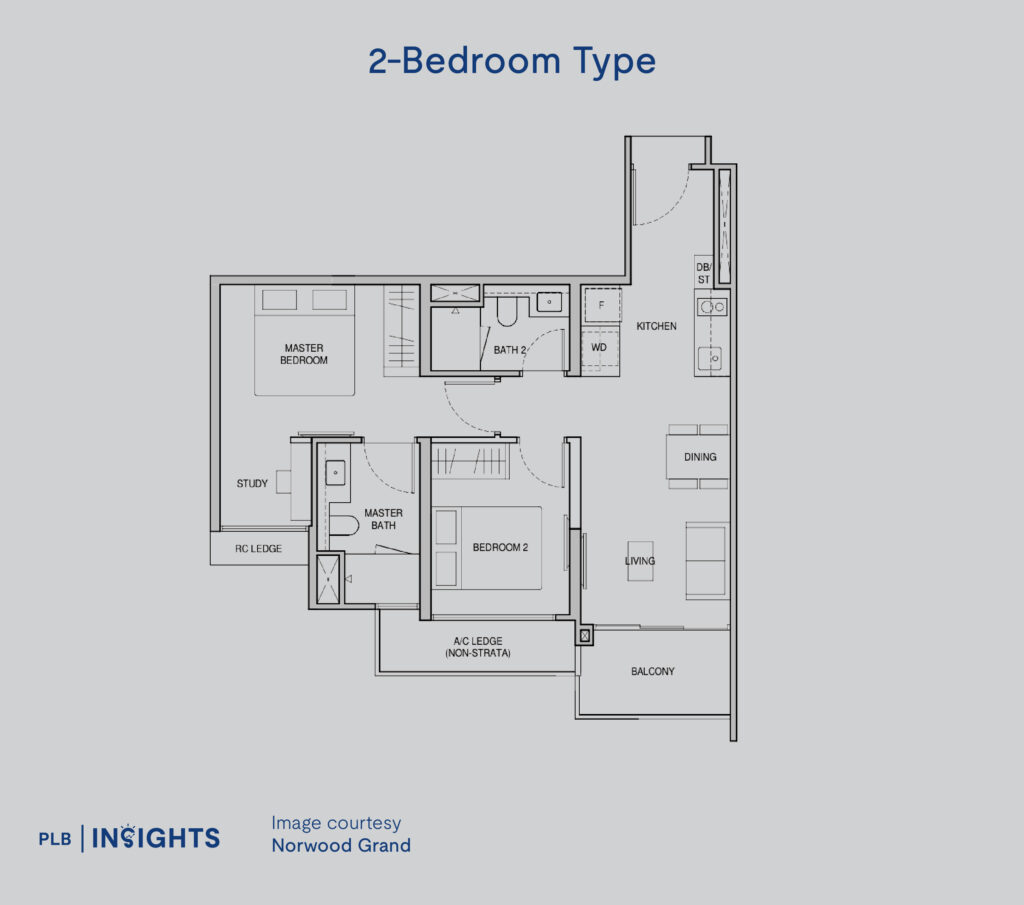

2-Bedroom Type

There are three layout variations for the 2-Bedroom type – the standard, the 2-Bedroom + Ensuite Study, and the 2-Bedroom + Study. Let’s talk about the 2-Bedroom + Ensuite Study since it’s a layout that’s unique to Norwood Grand.

Typically, developers would place the study along the corridor leading to the bedrooms or near the living room or kitchen, as we’ve seen in the 1-Bedroom + Study layout. In Norwood Grand, you will only find 11 of such units with this unique layout that has the ensuite study within the master bedroom. This gives you a lot of flexibility in terms of the usage – you can turn it into a walk-in wardrobe, a proper study or work station, or even a lounge area for movie nights.

Overall, this layout offers flexibility and a very efficient layout that minimises wasted space.

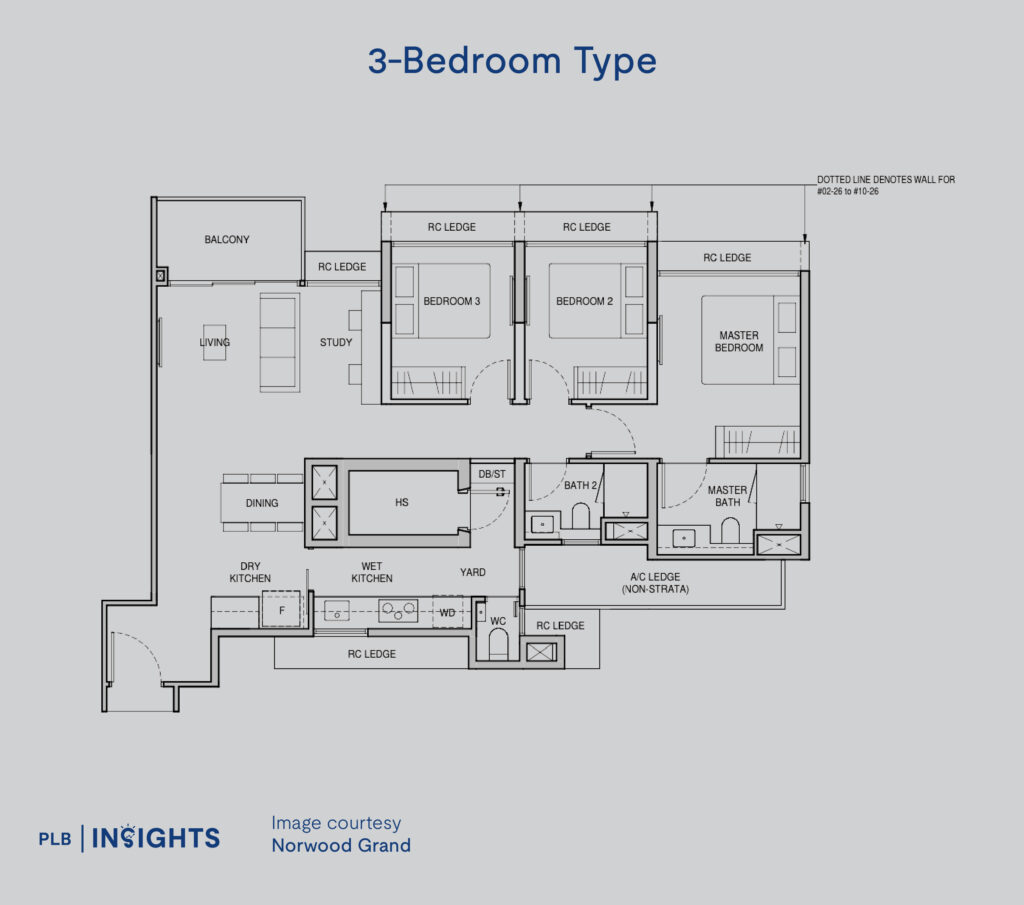

3-Bedroom Type

The 3-Bedroom type is categorised into 3-Bedroom Deluxe, 3-Bedroom + Study, and 3-Bedroom Premium + Study layouts. The featured layout is the 3-Bedroom Premium + Study (C4PS) standing at 1,044 sqft.

The unit opens up into a squarish foyer area before extending to the kitchen, dining, and living areas. Entering the unit, you will be greeted by a dry kitchen that you can use as a pantry area, and a sliding door to segregate it from the main wet kitchen. There is also a yard at the back of the kitchen for your laundry needs, and a household shelter accessible from the yard area for additional storage.

Coming to the living and dining area, the setup is similar to what you’d see in a 5-room HDB flat, with the study placed right behind the main living room. This gives flexibility in terms of usage, and allows you to expand the living room according to your needs and preferences. The rest of the bedrooms and bathrooms are pretty standard of what you’d find in a 3-bedder, and the bedrooms are all large enough to fit a queen-sized bed minimally.

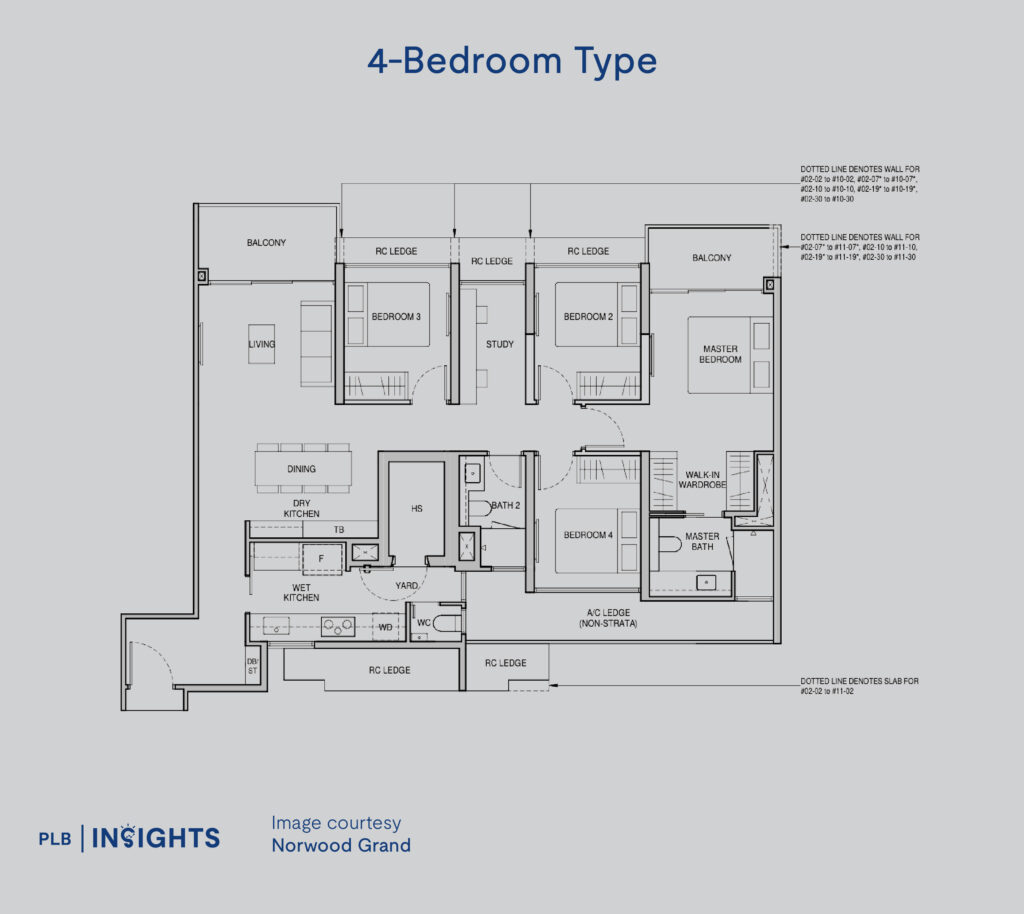

4-Bedroom Type

Last but not least, the largest 4-Bedroom type has three layout variations – a 4-Bedroom Deluxe + Study and two 4-Bedroom Premium + Study layouts. The featured floor plan is the 4-Bedroom Premium + Study layout (D2PS), standing at 1,313 sqft.

The main difference between the two 4-Bedroom Premium + Study layouts is the foyer size. The featured D2PS layout has a smaller foyer area compared to the elongated foyer found in the D3PS layout. Aside from that, the rest of the layout is completely identical.

The dry kitchen in the 4-Bedroom Premium + Study is placed next to the dining area, separated from the wet kitchen by a wall. The wet kitchen is enclosed by a sliding door, and you will find the yard and household shelter tucked towards the back of the wet kitchen.

As for the study, it is tucked in between bedrooms 2 and 3. From the floor plan, it seems possible to combine the study with bedroom 2 as part of the wall partition between the two spaces is hackable. From there, the study can be turned into a walk-in wardrobe or a workstation as necessary.

The downside for this layout is that there is no junior master with ensuite bathroom, which would be more ideal for multi-generational families. Instead, the three common bedrooms will have to share a common bathroom. However, the master bedroom is very generously sized with plenty of walking room even with a king-sized bed, and it will come with a provisioned walk-in wardrobe outside the master bathroom.

Comparative Market Analysis (CMA)

Pricing Analysis

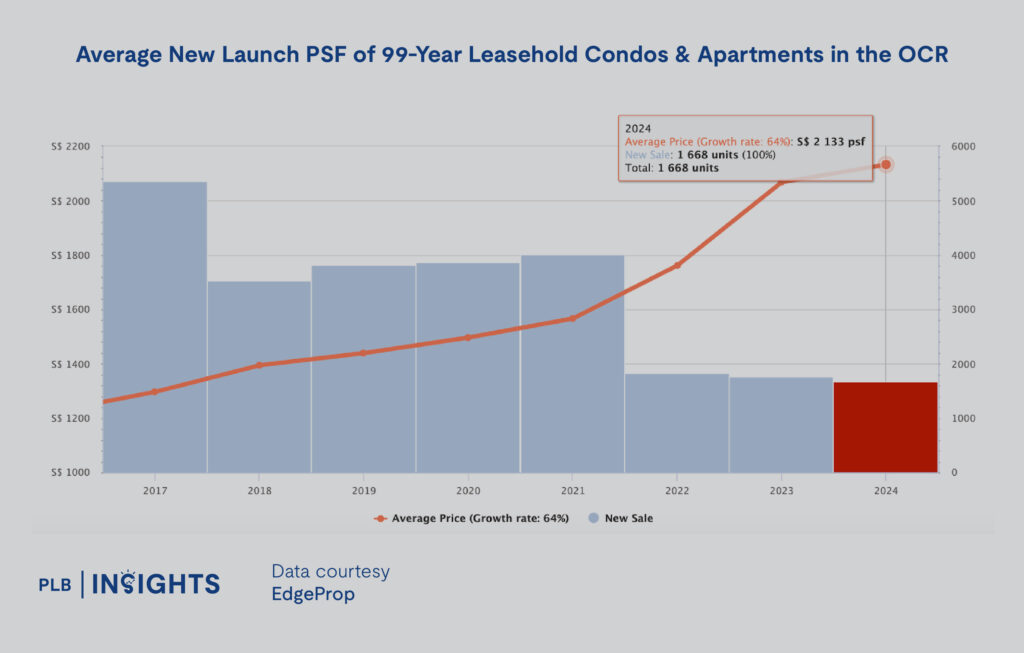

According to guide prices and after factoring in early bird discount on launch day, most of Norwood Grand’s units will have prices of under $2,000 PSF. Even for new launches in the Outside Central Region (OCR), private new launch prices at under $2,000 PSF are almost unheard of already in today’s market. The pent-up demand in the area, being the first private new launch condo in 12 years, make these prices even more attractive.

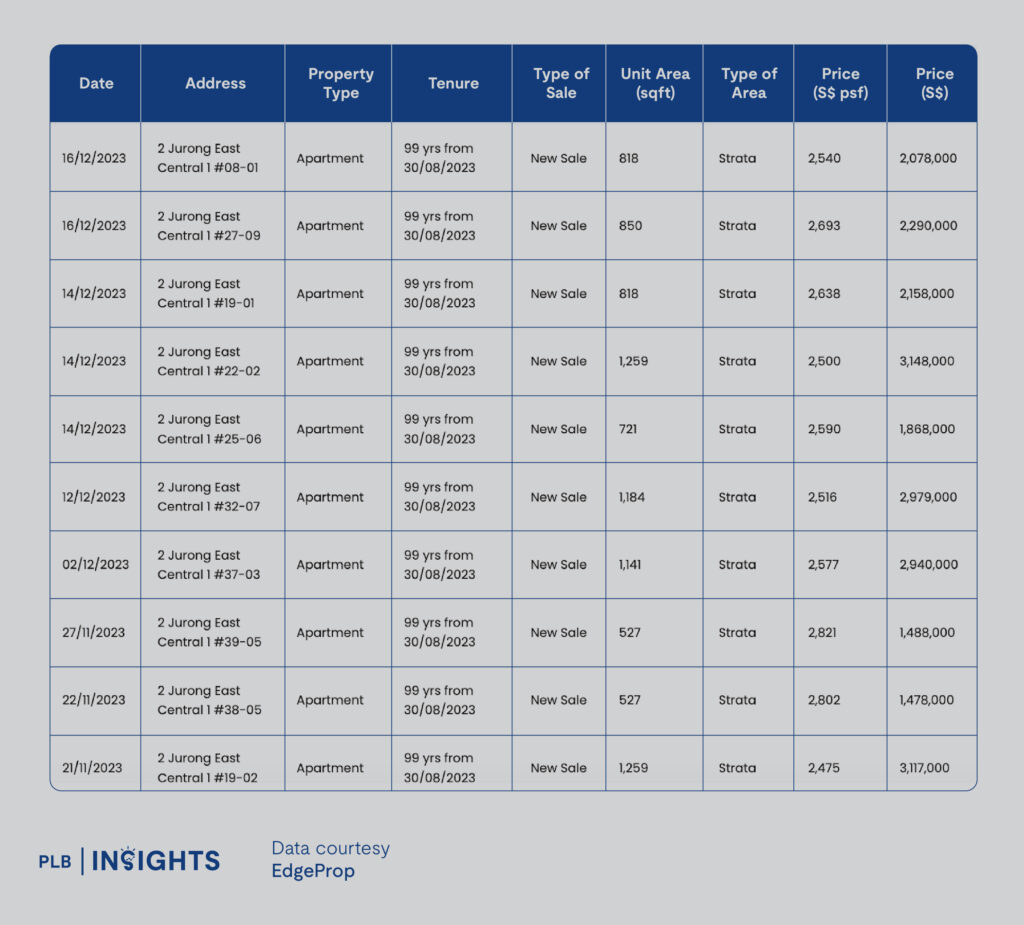

A similar launch that we can compare it to is last year’s launch of J’den. Like Norwood Grand, there hadn’t been a new launch in Jurong East for a decade before the launch of J’den. Because of pent-up demand, the launch was extremely successful, selling 88% of its units at an average price of $2,451 PSF. This is almost $500 PSF more than what Norwood Grand is launching its units for.

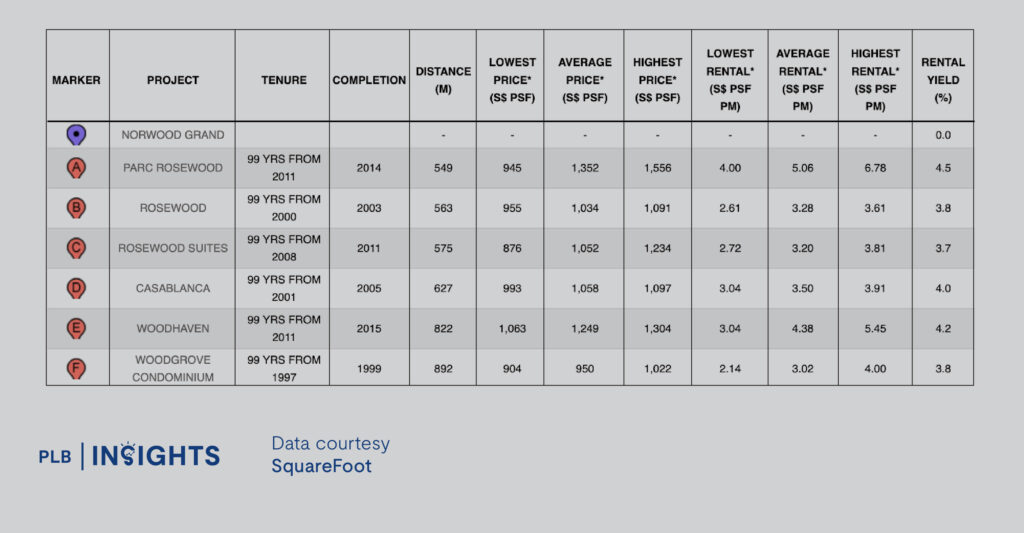

Looking at two of the most recent condos launched in the area, namely Parc Rosewood (TOP 2014) and Woodhaven (TOP 2015), we observe that the unit mix is made up of a large percentage of smaller unit types like 1 and 2-bedders. For Parc Rosewood, 1-bedders made up more than half of its offerings. At the time, this was likely due to developers trying to capitalise on the existing tenant pool in Woodlands made up of Malaysians wanting to live near the causeway for easier commutes back home. These projects will benefit from future rental demand when the Woodlands Regional Centre and RTS Link is completed, which would bring in an influx of tenants (expats working in the new employment nodes and Malaysians wanting to rent near the RTS Link).

For Norwood Grand, the developers have decided to diversify the unit types quite evenly, catering to a wider range of buyers and investors – especially families. In fact, only 9% of its units are 1-bedders. This is a rather smart move by CDL as it would inject a good supply of larger units into an area which is lacking in 4-bedroom inventory, and attract family profiles that want to live in Woodlands.

Resale condos in the vicinity are transacting at average prices of $1,0XX to $1,3XX PSF, but we’d have to take into account that most of them are at least 10 years old and located more than 500m away from the nearest MRT station. Norwood Grand would stand out a lot more if you were to compare it to today’s average PSF of $2,1XX for new launches in the OCR.

Furthermore, if you zoom in to the rental yield, all of the developments in the area have a rental yield of at least 3.5%, with Parc Rosewood recording an impressive 4.5%. With Norwood Grand being the closest to an MRT station, we would expect it to perform well in terms of rental demand and yield.

MOAT Analysis

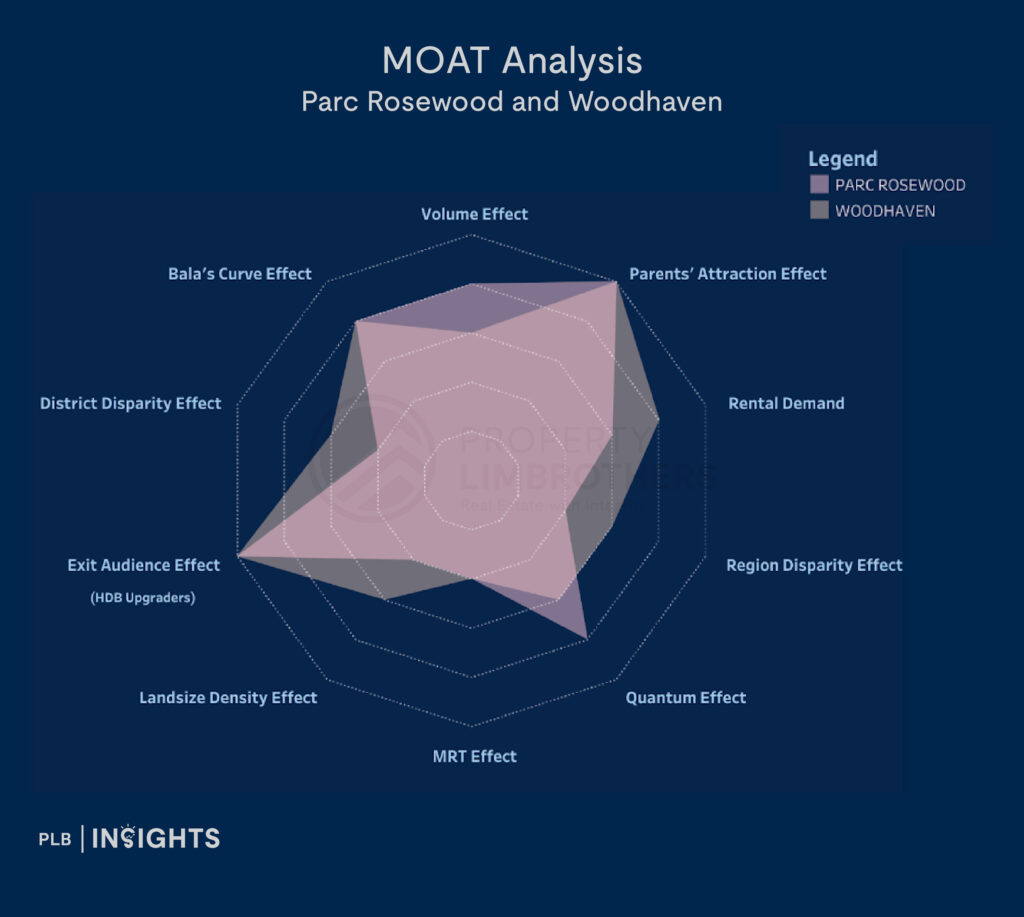

Due to insufficient information to perform a MOAT analysis on Norwood Grand, we will be comparing the two closest projects within the vicinity – Parc Rosewood and Woodhaven. We will provide insights and commentary on how Norwood Grand may compare to these developments, using the same key metrics in the MOAT analysis.

Stay tuned for our upcoming PLB New Launch MOAT Analysis Tool, which will provide key insights into a new launch project’s future potential appreciation using similar metrics used to assess existing condominiums.

Parc Rosewood achieved a MOAT score of 66% and Woodhaven scored a 70%, which are very high scores. Typically, we would classify projects that score above 60% as having high appreciation potential.

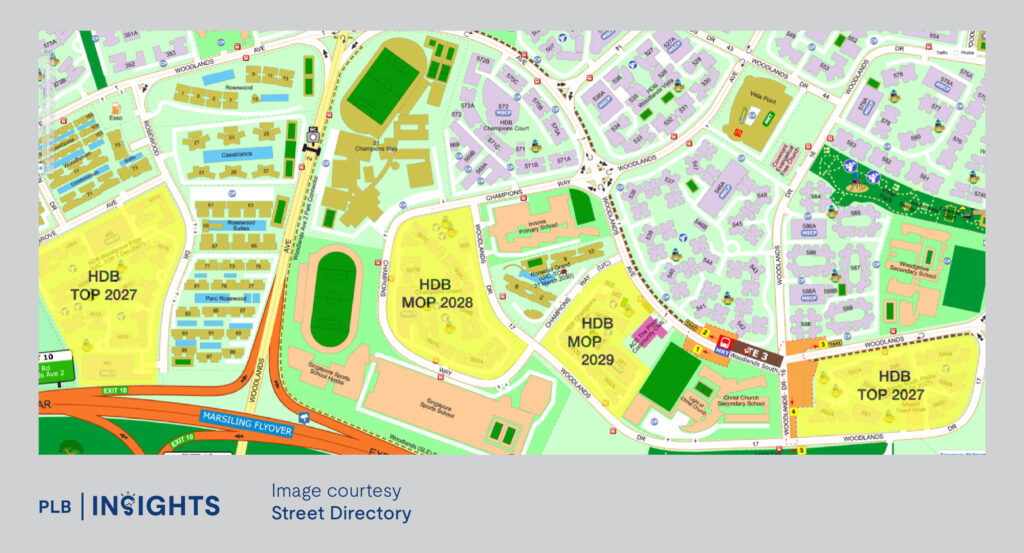

Looking at the metrics that Parc Rosewood and Woodhaven scored well in, they stood out in the Exit Audience and Parents’ Attraction Effect metrics, scoring a perfect 5 out of 5. This is not surprising given the number of HDB enclaves in the area, with more BTO flats achieving MOP and TOP in the next few years. This forms a pool of potential HDB upgraders for condo developments in the area. The area also boasts a good number of primary and secondary schools, with multiple schools falling within the 1km radius.

On the other hand, Parc Rosewood and Woodhaven did not perform well in terms of the District and Region Disparity scores, as well as the MRT Effect score. This means that there are more affordable options within the district and region, and the low MRT Effect score highlights the two developments’ proximity from the nearest MRT station.

For Norwood Grand, we expect similar scores to Parc Rosewood and Woodhaven in the Exit Audience metrics, as it shares the abundance of surrounding HDB enclaves. Due to its convenient location near an MRT station and right next to a primary school, Norwood Grand is likely to perform better in the MRT Effect, Parents’ Attraction Effect, as well as Rental Demand. However, its higher PSF prices relative to other developments in the area could translate to lower District and Region Disparity Effect scores as well as a lower Quantum Effect score.

Overall, we estimate that Norwood Grand will achieve a MOAT score between 68% and 72%, reflecting its strong attributes.

Growth Potential

As mentioned in our MOAT Analysis, projects in the area have a high Exit Audience score because of the abundance of HDB enclaves. Furthermore, there are upcoming BTO flats that will be achieving their TOP in 2027 as well as their MOP in 2028 and 2029. Those projects that will achieve TOP in 2027 will eventually hit their MOP in 2032 as well, which is just 2 years after Norwood Grand achieves TOP. This large pool of potential HDB upgraders will form the future exit audience for Norwood Grand, which is a good exit strategy for buyers who may be looking at shorter-term investments before moving on to their next property.

The upcoming RTS Link will be constructed underground at Woodlands North station, and will connect passengers between Singapore’s Woodlands North station and Johor’s Bukit Chagar station via a 4km long train journey. With Norwood Grand being just two stations away near the Woodlands South MRT station on the TEL, future residents can get to the RTS link in under 15 minutes. This is a great convenience for Malaysians working in Singapore, cutting their travelling time significantly, which will boost the rental demand and reduce vacancy rates for projects in the area. Norwood Grand stands to benefit from this as the only development within a 500m radius from an MRT station.

Lastly, the biggest transformation in the north will be the Woodlands Regional Centre, which will bring in an influx of workers with new industrial and commercial developments. This will boost commercial activity and rental demand for the area, bringing in tenants who want to stay nearer to these employment nodes. Aside from rental demand, the transformation will also boost property valuations in the area in the coming years, deviating from Woodlands’ reputation of being ‘ulu’.

The Verdict

The transformation in the north is definitely an exciting one, with the upcoming Woodlands Regional Centre and RTS Link at the forefront of these developments. Norwood Grand, being the only condo development in the Woodlands area to be within a 500m radius of an MRT station, stands to reap the benefits of the future transformations.

With attractive prices starting from under $2,000 PSF, at a time where OCR new launches are averaging above $2,100 PSF, we expect units here to move fast.

Let’s get in touch

If you’re considering buying, selling, or renting a unit and are uncertain about its implications on your property journey and portfolio, please reach out to us here. We would be delighted to help with any market and financial assessments related to your property, or offer a second opinion.

We appreciate your readership and support for PropertyLimBrothers. Keep an eye out as we continue to provide detailed reviews of condominium projects throughout Singapore.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.