District 10 (D10) is known as one of Singapore’s most prestigious addresses, home to high-end private residences and pure landed homes. Encompassing areas like Tanglin, Bukit Timah, Holland Road, and Ardmore, D10 has long been synonymous with luxury and affluence.

Residents here enjoy an extensive range of amenities, dining options, and proximity to the Orchard Shopping Belt. For families with school-going children, District 10 is also highly attractive due to its proximity to some of Singapore’s top schools, including Anglo-Chinese School, Singapore Chinese Girls’ School, Hwa Chong Institution, and Nanyang Girls’ High School.

Following our recent PLB Landed Clinic in Districts 10, we’ve discussed various insights related to pure landed homes in D10. In case you missed them, you can catch up on these in-depth articles:

In this article, we’ll focus on price trends for pure landed homes in District 10, covering all types—inter-terraced, semi-detached, and detached homes. Pure landed homes refer to properties that stand on their own land and are typically 999-year leasehold or freehold.

As previously mentioned, pure landed homes can be grouped into four categories based on their age, with Category 4 homes being the newest and in move-in-ready condition. These newer homes tend to command higher prices, both in terms of overall quantum price and price per square foot (PSF). The pricing discussed in this article reflects transacted average PSF across all categories and may not represent the price of a specific home in the district.

Singapore’s Pure Landed Homes: 5-Year Price Surge and Regional Breakdown

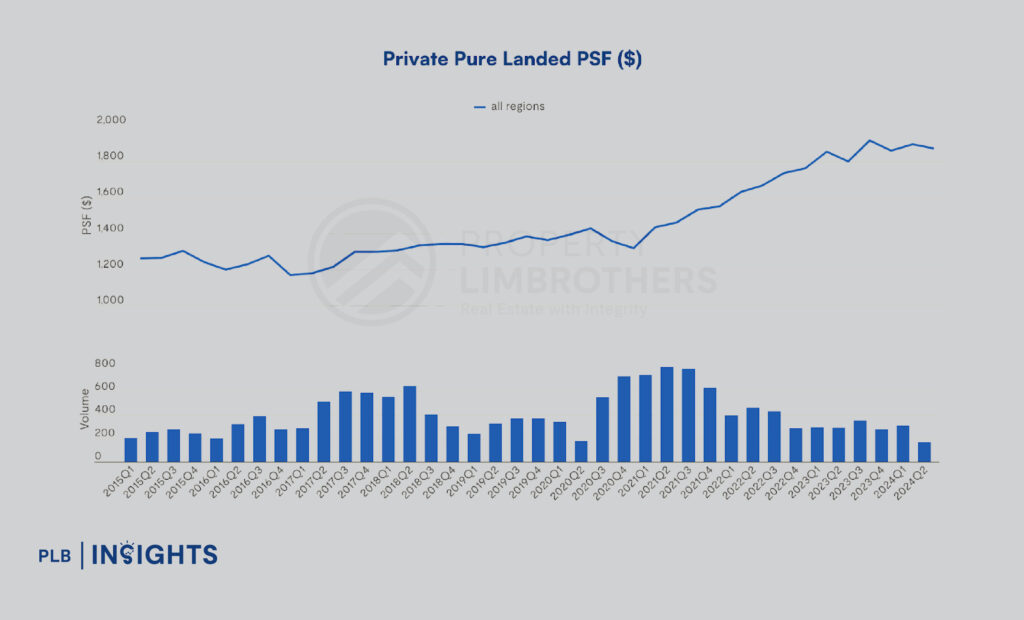

Across all property types, regions, and districts, pure landed homes have experienced a significant 39% increase in average PSF prices, rising from $1,347 in Q2 2019 to $1,873 in Q2 2024. As shown in the graph above, this average price growth is closely aligned with a sharp rise in transaction volumes between Q3 2020 and Q4 2021. Although the number of transactions has since tapered off, the average PSF prices have continued their upward trend. This highlights the inelastic nature of pure landed homes, where strong demand continues to drive prices upward, further reinforced by the inherently limited supply of such properties.

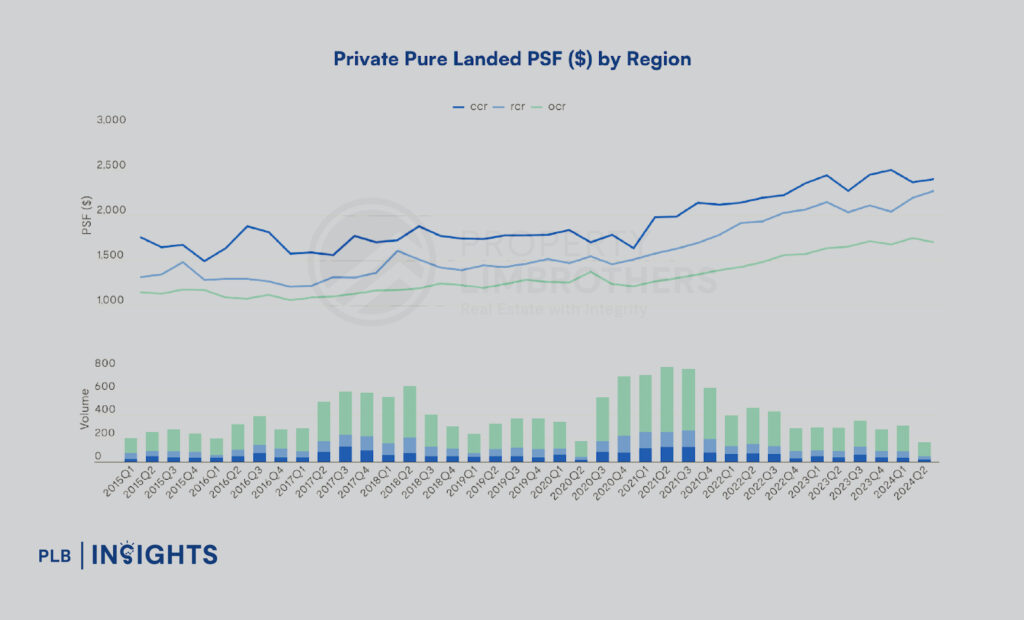

As expected, the average PSF price for pure landed homes across all types and categories in the Core Central Region (CCR) commands a premium over other regions. As of Q2 2024, the average PSF for pure landed homes in the CCR was $2,402, compared to $2,273 in the Rest of Central Region (RCR) and $1,701 in the Outside Central Region (OCR).

From Q2 2019 to Q2 2024, pure landed homes in the CCR saw a price growth of 34.9%, while the RCR experienced a significant increase of about 59%, and the OCR grew by 37.5%. As depicted in the graph, although pure landed homes in the CCR command higher average PSF prices, this doesn’t necessarily translate to a smoother capital appreciation. However, this doesn’t imply that pure landed homes in the CCR are a less viable financial investment. CCR properties, particularly pure landed homes, will consistently draw strong demand, supporting steady capital appreciation. Ultimately, capital appreciation and Return on Investment (ROI) depend on the unique attributes of each property.

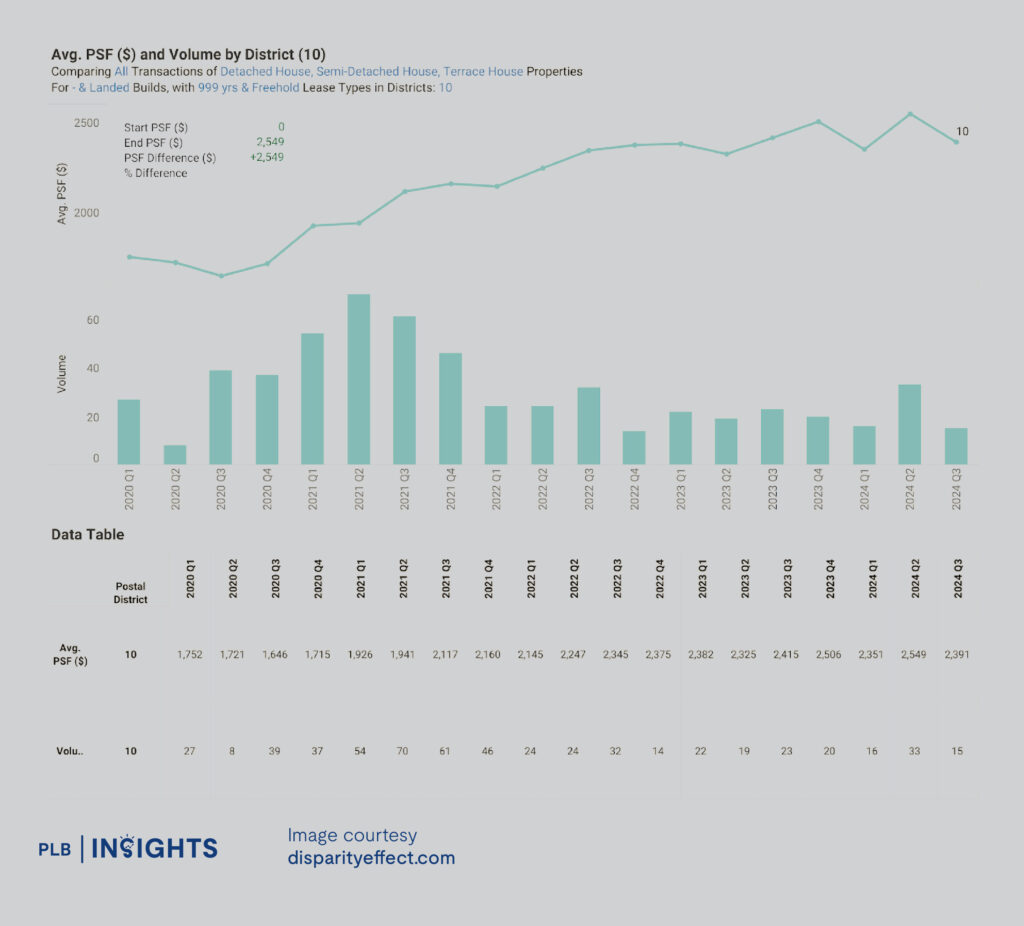

District 10 Landed Homes: Price Growth and Demand Analysis by Property Type

In District 10, the pure landed homes are predominantly semi-detached and detached homes, with only a limited supply of inter-terraced houses. As of Q3 2024, the average transacted PSF for pure landed homes across all types and categories in the district stands at $2,391. From Q3 2020 to Q3 2024, these homes saw an average PSF price growth of 45.3%. Despite signs of a slowdown in the broader real estate market since earlier this year, transaction volumes for pure landed homes in District 10 have remained relatively robust. This highlights their enduring appeal, with demand expected to stay strong in the foreseeable future.

It’s important to note that the transacted average PSF prices mentioned in this section include homes across all categories, including older properties that may require a complete teardown and rebuild. While older homes, especially those in Category 4, may have a lower PSF, they often come with significantly higher costs for rebuilding.

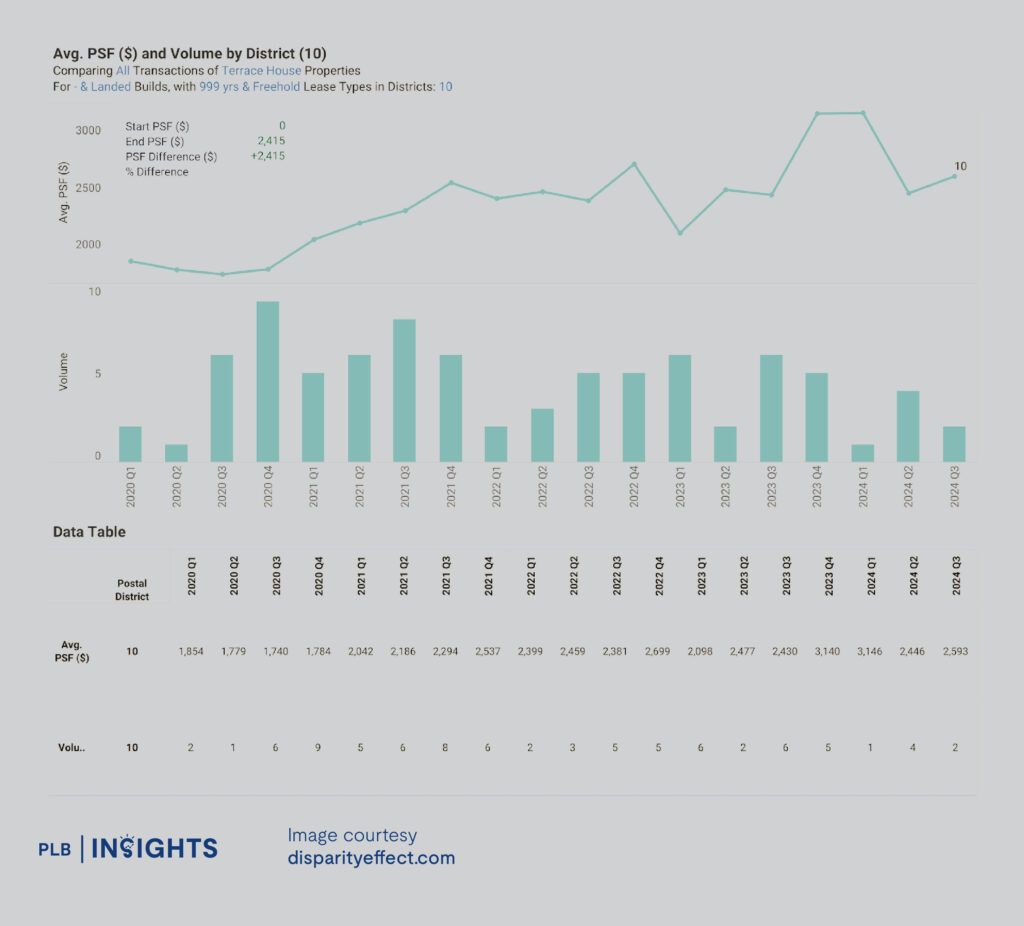

Pure Landed Inter-Terraced Homes

As previously noted, District 10 has a limited supply of inter-terraced homes, which is reflected in their low transaction volumes, as shown in the chart above. As of Q3 2024, pure landed inter-terraced homes in the district are averaging $2,593 PSF. From Q3 2020 to Q3 2024, these homes saw a 49% increase in transacted average PSF. This impressive growth demonstrates that, despite fewer transactions, pure landed inter-terraced homes hold strong potential for capital appreciation. It also highlights that discerning buyers are willing to invest significantly in inter-terraced homes within this prestigious district.

Presenting Our Listing: A Customisable Inter-Terrace in Mount Sinai

We’re excited to introduce an inter-terrace home in District 10, nestled in the peaceful Mount Sinai Landed Estate. Facing a park, this Category 3 property offers plenty of potential for those looking to personalise their space. Whether you’re considering minor updates or more extensive renovations, the 2-storey layout can be adapted to suit your needs, with the option to extend it into a 3-storey home.

With a land size of approximately 1,701 sqft and a built-up area of around 2,500 sqft, the home includes 5 bedrooms (2 ensuite) and a ground-floor granny room. The open layout, free from split levels, offers flexibility for redesign.

This 999-year leasehold home (from 1885) is ideally located within 1km of Henry Park Primary School, close to Dover MRT, and provides easy access to the PIE and AYE.

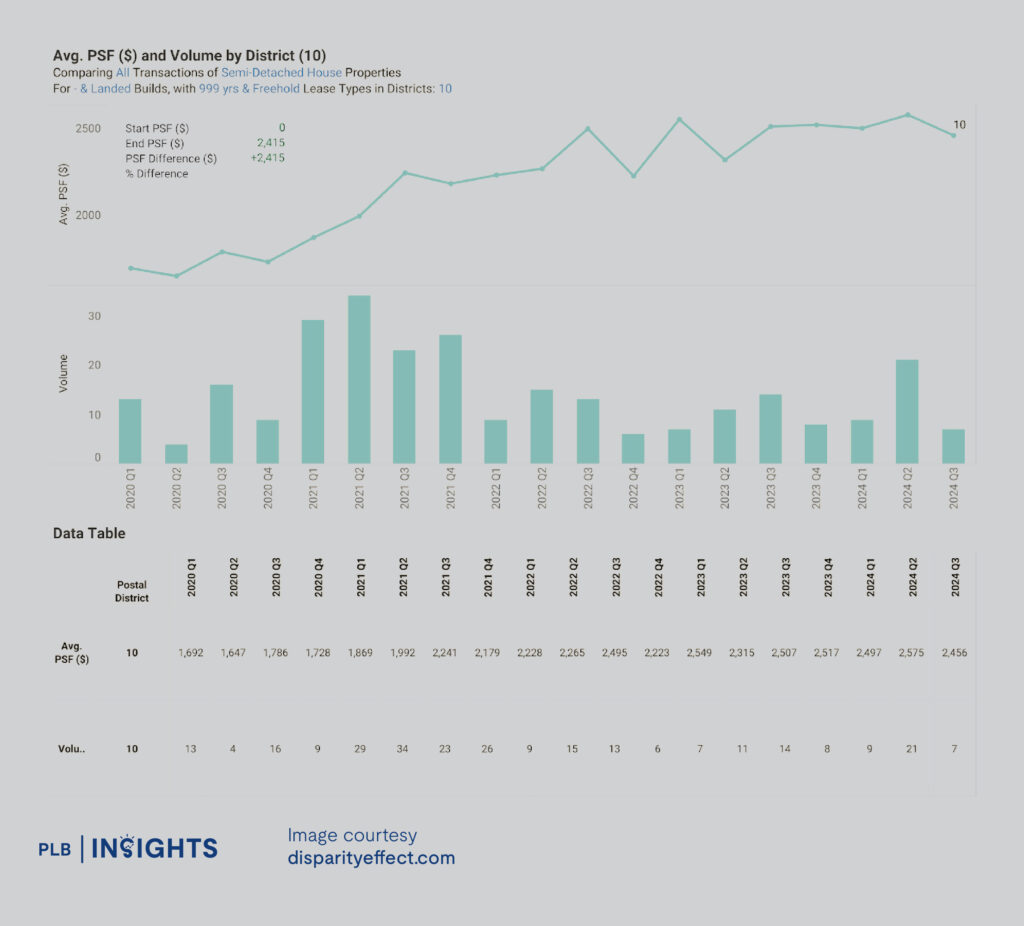

Pure Landed Semi-Detached Homes

Between Q3 2020 and Q3 2024, the average PSF price for semi-detached homes in District 10 grew by 37.5%, reaching $2,456 as of Q3 2024. Of all pure landed property types in the district, semi-detached homes have recorded the highest transaction volume, with a total of 257 sales. From an investment perspective, this is noteworthy, as higher transaction volumes suggest higher demand for such homes, which can significantly contribute to their capital appreciation potential.

Explore Our Listing: Semi-Detached Home with Expansion Potential in Namly Crescent

Tucked away in the heart of Namly Crescent, this 2.5-storey semi-detached home boasts stunning, unblocked views from its elevated position. With a built-up area of around 3,500 sqft, the home is move-in ready, offering spacious bedrooms with lofty ceilings. Whether you choose to settle in as it is or make minor alterations, the property offers flexibility for your needs.

For those looking to explore its full potential, the home presents a remarkable opportunity to expand up to 14,000 sqft—ideal for multi-generational living. Located within walking distance to Sixth Avenue MRT and surrounded by a variety of amenities, this home provides both convenience and room for growth.

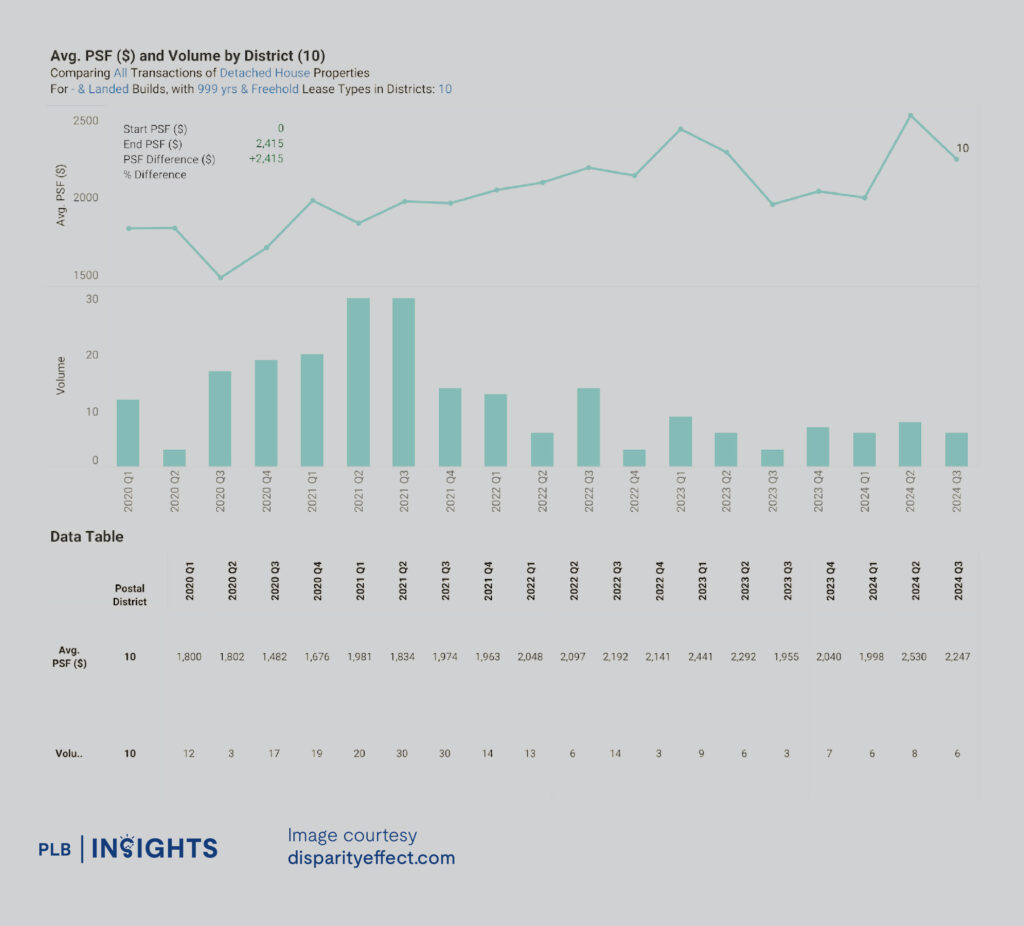

Pure Landed Detached Homes

Between Q3 2020 and Q3 2024, there were 211 sales transactions of detached homes in District 10, with the average PSF price increasing by 51.6%, reaching $2,247 PSF as of Q3 2024. Notably, detached homes in District 10 saw a sharp rise in transaction volume from Q3 2020 to Q3 2021, before moderating to single-digit transactions from Q2 2022 onwards. This surge in demand could likely be driven by affluent locals seeking larger homes to accommodate their families.

In Summary

Understanding the pricing trends of each pure landed property type—whether inter-terraced, semi-detached, or detached homes—and their respective categories (Category 1, 2, 3, or 4) is crucial for making informed property investment decisions in District 10. These trends present opportunities for discerning buyers to move up in asset class. For instance, instead of opting for a Category 4 semi-detached home, it may be financially advantageous to consider purchasing a Category 2 detached home and undertaking major renovations or additions and alterations (A&A). This approach allows you to secure a property of a higher class, potentially resulting in better long-term returns.

Equally important is the transaction volume of each property type. As we’ve seen, higher transaction volumes often signal strong demand, which can significantly influence capital appreciation. A property type with consistent and robust transaction volumes may offer more exponential growth in value, making it a key factor to consider when evaluating investment opportunities in the District 10 pure landed home market.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.

No matter where you are in your real estate journey or if you have pressing questions, we’re here to help. Reach out to us here today, our expert consultants are ready to guide you every step of the way, ensuring your goals and aspirations are met with confidence.