For those privileged to own a landed property, often regarded as the pinnacle of real estate in Singapore, the approach of retirement brings a significant dilemma: should they downsize or retain their home for future generations? This decision is multifaceted, involving emotional attachments, thorough financial considerations, and an in-depth understanding of Singapore’s real estate market.

In this article, we explore the pros and cons of downsizing versus holding onto a landed property for legacy planning, while highlighting the key factors homeowners must consider before making this significant decision. We also delve into the potential capital appreciation of landed properties compared to other property types.

The Advantages of Downsizing

Financial Flexibility

One of the most compelling reasons to downsize is the opportunity to free up significant capital. Selling a landed property can yield substantial proceeds that could be used to reinvest in other revenue generating assets, providing passive income for a comfortable retirement.

HDB flats, as well as certain condominiums, typically require less financial commitment for upkeep and maintenance. Downsizing to a smaller home, whether an HDB flat or a condominium, can significantly reduce these costs, allowing you to allocate more funds toward other retirement needs or lifestyle pursuits. Moreover, a smaller home often requires lower property taxes and utility bills, resulting in substantial savings over time.

Lifestyle Benefits

Downsizing into a more manageable home could be particularly appealing to retirees, as it reduces the physical and financial demands of maintaining a larger property. HDB flats in well-located areas offer convenient access to essential amenities like markets, healthcare facilities, and public transport, while fostering a strong sense of community. Condominiums, on the other hand, provide a more private living experience relative to HDB flats, with amenities such as swimming pools, gyms, and security services, contributing to a relaxed lifestyle.

Proximity to essential services is crucial for a comfortable and convenient living experience during your golden years, especially as mobility may decrease with age.

Strategic Estate Planning

If you have multiple heirs, downsizing could simplify the process of estate division. Selling a landed property and dividing the proceeds may avoid potential disputes among heirs and provide a more equitable distribution of assets.

Drawbacks of Downsizing

Loss of Sentimental Value

For many, a landed property is more than just a house, it’s a home rich with memories. Downsizing could mean leaving behind a space where cherished moments unfolded and where children were raised, making the decision not just practical but deeply emotional.

Missed Opportunity for Further Growth

Landed properties, especially freehold ones, are scarce and tend to appreciate in value over time. By selling, you might miss out on future capital gains as the property continues to increase in value.

Transaction and Moving Costs

Selling a property and purchasing a new one involves various costs, including agent fees, legal fees, stamp duties, and renovation expenses. These costs could eat into the profits gained from selling the property, making downsizing less financially beneficial than initially anticipated.

Diminished Inheritance

Selling a landed property and downsizing could reduce the value of the estate you leave behind for your heirs. While downsizing may provide more immediate financial benefits, it may result in a smaller legacy for your descendants. We’ve previously delved into the topic of property inheritance. If you missed it, click here to explore more information.

Key Considerations Before Downsizing

Before deciding to downsize, it’s essential to consider several factors unique to Singapore’s real estate market and regulatory environment.

Additional Buyer’s Stamp Duty (ABSD)

When buying a new property after selling your landed home, be aware that ABSD applies if you already own other residential properties. For Singapore citizens, the current ABSD rates are 20% for a second property and 30% for a third or more. Timing is crucial to avoid hefty ABSD charges. Selling your landed property without securing your next home can also lead to higher risks, including being priced out of the market and losing a significant portion of your sale proceeds. Interim rental costs can also add up. Engaging a real estate professional is essential to guide you through this complex process.

Wait-Out Period for HDB Flats

If you’re thinking about downsizing to an HDB flat, keep in mind that private property owners below the age of 55 must wait 15 months after selling their landed property before they can buy a non-subsidised resale HDB flat. For a subsidised flat, the wait-out period is 30 months. This policy is designed to regulate demand and promote fairness in the public housing market, but it could delay your downsizing plans. You may need to arrange interim housing, such as renting, which increases your expenses and reduces the proceeds from selling your landed property.

Lease Decay for Leasehold Properties

For those considering selling a leasehold landed property, it’s crucial to consider the impact of lease decay. As the remaining lease term shortens, the property’s value may decrease, making it harder to sell at a favourable price. If your landed property has a short lease remaining, downsizing sooner rather than later might be financially advantageous.

Market Timing and Trends

The real estate market in Singapore is cyclical, with periods of growth and contraction. Selling during a market upswing can maximise returns, but timing the market can be challenging. At PropertyLimBrothers, we believe it’s always better to stay proactive in the real estate market, rather than attempting to time it. It’s essential to stay informed about current market conditions and consult with a real estate professional in navigating the intricacies of selling your landed property.

Future Property Needs

Consider your long-term needs and lifestyle preferences. While downsizing might make sense now, think about how your needs may evolve as you age. For instance, would you prefer to move into a retirement community or continue living independently? Your choice of a downsized property should align with your future needs. Learn about the various housing options available in Singapore for your retirement. Click here to read our comprehensive guide and find the best choice for you.

Family Considerations

Engage in open discussions with your children or heirs about your plans. Some families may prefer to keep the landed property within the family, while others might support downsizing to unlock financial resources. Understanding your heirs’ expectations and preferences can help you make a decision that aligns with your family’s overall goals.

Price Trends: Landed Properties vs. Condominiums and HDB Flats

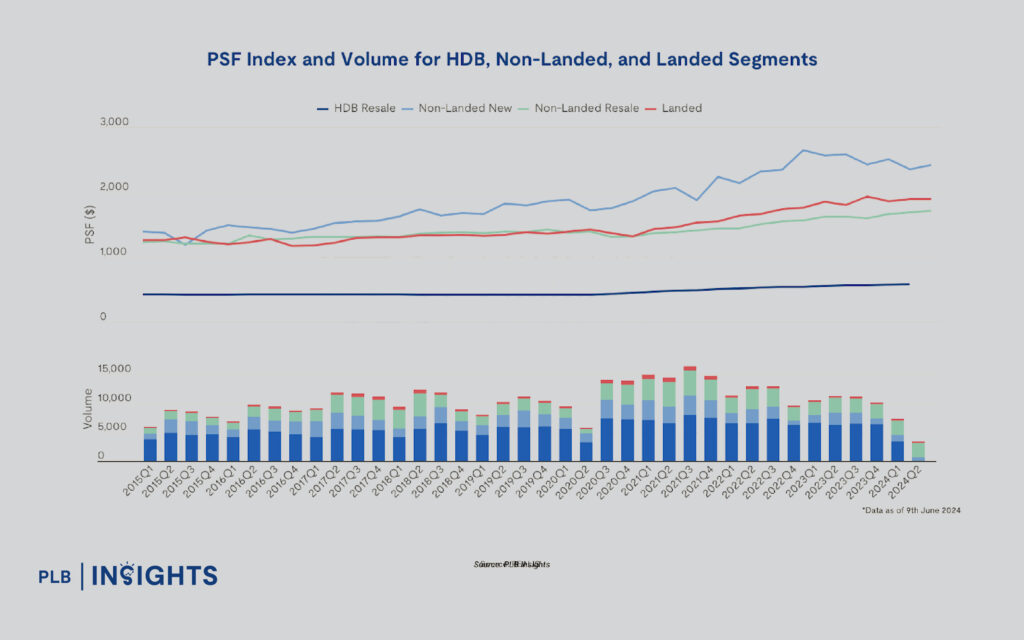

If building and preserving generational wealth is a priority, capital appreciation of your property becomes essential. Greater capital appreciation means a higher-value asset that can be passed on to your heirs. One key metric in measuring this growth is the percentage increase in price per square foot (PSF).

From Q1 2015 to Q1 2024, HDB flats across Singapore saw a 35.4% increase in average PSF, rising from $427 to $578. Resale condominiums grew by 37.4%, from $1,230 to $1,690 PSF, while landed properties, across all types and regions, appreciated by 50%, from $1,263 to $1,894 PSF.

At the same time, new launch condominium prices have been rising steeply, driven in part by increasing land prices and construction costs. Over the same period, the average PSF for new launches surged by 69.1%, from $1,392 to $2,354. This is a crucial point to consider, as prices are expected to keep climbing. It’s important to avoid purchasing a unit at an entry price that is unreasonably high, as this could eat into your funds and impact your retirement plans.

As mentioned, the average PSF price growth for landed properties has outpaced both HDB flats and resale condominiums, making landed homes one of the most promising asset classes for value appreciation. While selling your landed property to downsize may provide ample funds for retirement and asset distribution, the opportunity cost is significant. Landed property prices are expected to continue rising at a faster rate than other property types, meaning your heirs could miss out on further growth. Additionally, keeping your landed home could offer your children a place to raise their own families without the financial burden of buying a new home. This would allow them to allocate their resources towards investments in other properties or income-generating assets, helping them grow their wealth further.

In Summary

Deciding whether to downsize or retain your landed property is a significant decision that requires careful consideration of both personal and financial factors. The pros of downsizing include financial flexibility, easier living, and simplified estate planning, while the cons include potential emotional loss, missed market appreciation, and the costs associated with moving.

On the other hand, retaining your landed property offers the potential for long-term appreciation, a tangible legacy for your heirs, and emotional fulfilment. However, it also comes with the challenges of maintenance, increased responsibility, and potential estate disputes.

Before making your decision, it’s essential to consider all relevant factors, including ABSD, the wait-out period for HDB flats, lease decay for leasehold properties, and the potential impact on your legacy planning. By carefully weighing the pros and cons and consulting with real estate and financial professionals, you can make a decision that best aligns with your retirement goals and family’s future.

Ultimately, whether you choose to downsize or retain your landed property, the key is to ensure that your choice supports a comfortable and fulfilling retirement while preserving your wealth and legacy for future generations.