In July 2024, it was reported that HDB had taken action against 800 flat owners for violating leasing rules for a 4-year period from 2019 to 2023. HDB has taken action against these owners by way of warning, fines and revoking ownership on the flats. With the increasing concern of HDB flat prices running out of the affordability range with yet another price increment in Q2 2024, HDB is growing actively involved with regulating the market. Apart from the recent cooling measures with the LTV limit for HDB Loans reduced to 75%, HDB is taking steps to ensure that HDB flats remain available for individuals with genuine housing needs.

Recapping on the leasing rules when you purchase any HDB flat, whether it is a BTO or a resale flat, you will be required to fulfil the Minimum Occupation Period (MOP). The MOP is a time period that owners are required to physically occupy the flat. For Standard HDB flats, the MOP is 5 years from the date that the keys are collected. For the newer Plus and Prime models, they require a 10-year MOP.

The Timeout Period

During the MOP, you are not allowed to do a series of things with regards to your HDB flat in ownership or with any other property of interest.

1. You are only allowed to sell your HDB flat on the open market after you have fulfilled the MOP.

Some owners may be tempted to list their flats in advance before fulfilling the MOP, in anticipation that it may take some time for offers to come in. However, this is not allowed as you are only able to market the flat after it clears MOP.

2. You are not allowed to purchase a private property locally or overseas during your MOP. If a property was inherited during the MOP, you would be required to sell it off within 6 months upon inheritance.

One question you may have is whether you are able to buy a private new launch project, which will only be completed after your HDB flat reaches MOP. Unfortunately, you would only be able to do so after you have fulfilled the MOP. So there is the possibility of you missing out on a potential hot New Launch at an attractive price.

With regards to inheriting a private property during your MOP, you would be required to sell it off within 6 months even if you have the intention of moving into the private property. However, with acceptable reasons, HDB may grant special approvals for you to move into the private property but would require you to sell off your HDB property. This will be assessed by HDB on a case-by-case basis.

3. You can only rent out rooms and not your whole flat during the MOP. For Plus and Prime model flats, you are not allowed to rent out your whole flat even after fulfilling the MOP.

During your MOP, you are only allowed to rent out rooms but not the whole flat. For Plus and Prime model flats, you are not allowed to rent out the whole flats at all even after fulfilling the MOP. There are exceptions to this rule where you can rent out your whole flat for the Standard type flats during your MOP.

An example would be for work reasons, a long-term overseas position would require you to reallocate. In this case, HDB may grant the approval for you to rent out the whole flat with the condition that your MOP is paused during the time that you do not physically occupy the flat. We have all heard the term “lock one room”, which is the scenario of renting out a whole flat with the exception of one room being locked from the tenants. In its technicality, this does not seem like a whole flat rental, but HDB has reminded owners that it is seen as a whole flat rental which is not allowed during the MOP.

Why is MOP important?

The main objective of the MOP is to ensure that owners physically occupy their flats as the policy serves to ensure that HDB flats are for individuals and households for genuine housing needs. With the recent spotlight on photos of vacant flats that have not reached their MOP being marketed, HDB is tightening oversight to ensure that owners do not flout the rules. Through the checks, HDB discovered a case of a couple leaving their flat unoccupied from the day they collected the keys and were living with their parents in a private property. HDB has since compulsorily acquired the flat back from the couple and will put up the flat for sale in Sale of Balance Flats (SBF) exercises.

With the growing concerns on resale prices hitting new highs and rising out of the affordability range, HDB is taking a serious view of the infringement of leasing rules and would not hesitate to take action against errant flat owners.

At the same time, the MOP serves to regulate HDB prices and avoid an erratic market environment for public housing. It is similar to how the Seller Stamp Duty (SSD) restricts speculative buy and sell in a short time frame. The only class of asset in Singapore that allows for a buy and sell in any timeframe without restriction are commercial properties, where there is no SSD imposed.

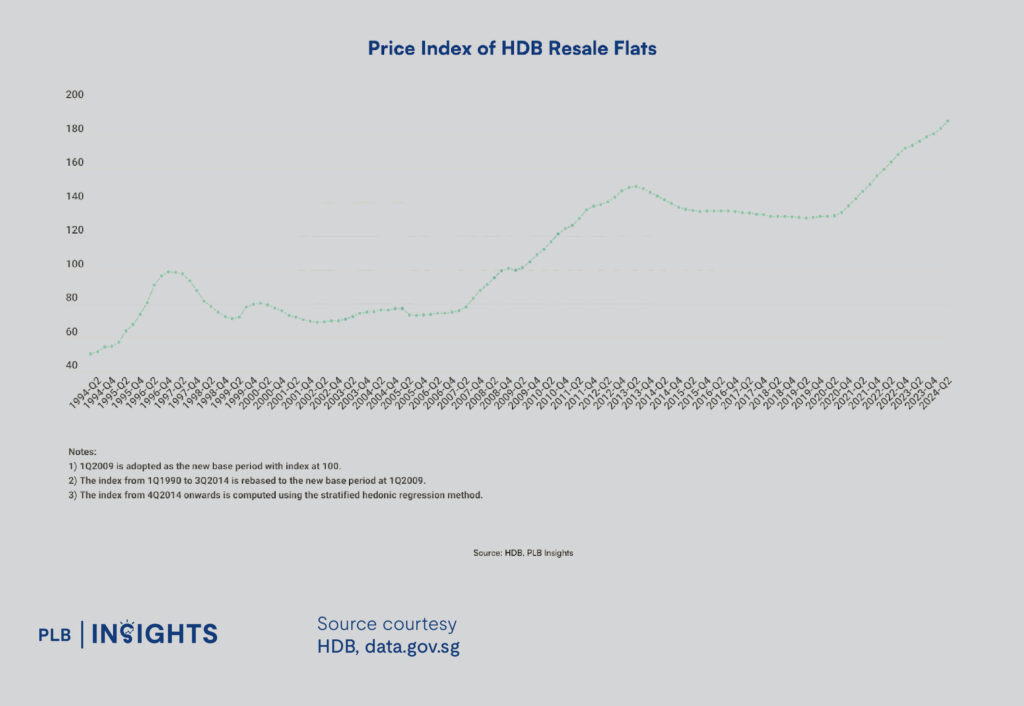

Without the MOP, an individual can potentially buy today and sell tomorrow which will create a very erratic price environment. In a positive market environment, it also serves as a damper to ensure that prices are well regulated. HDB’s new classification framework, namely the Plus and Prime model, imposes a longer 10-year MOP to further dampen price increases in more desirable locations. With the positive increase from quarter to quarter since Q1 2021, price regulation is definitely a priority for the authorities.

Amongst the 800 flat owners that have received some form of penalty from HDB, 70 flats have been compulsorily acquired by HDB. There is little impact from these flats even though the exact details of these flats are unknown. With more than 1 million flats across the 24 towns and 3 estates of Singapore, the number of flats acquired by HDB will not generate waves. But it will serve as a warning for HDB homeowners who are currently flouting the rules in any manner.

Final Thoughts

HDB prices have been on a constant rise quarter on quarter, this is likely to have caused some concern on the ownership and genuinity of HDB owners. While Singapore’s brand of public housing is uniquely different, it is still a form of public housing and is reserved for individuals with genuine housing needs. Flouting the rules on the MOP raises eyebrows and puts the authorities under a spotlight of not upholding the objective and intention of public housing.

With the growing number of HDB flats in Singapore, authorities may step up checks to ensure that the public housing system is not taken advantage of. During the MOP, while there are restrictions imposed to prevent certain things, there are still possible routes to be considered as we have mentioned in our article. But when in doubt, always check with the authorities to avoid inadvertently flouting any rules.

If you have any questions regarding your HDB flat, do not hesitate to contact any of our consultants here at PropertyLimBrothers. Or if you have any other questions pertaining to your property journey, feel free to contact us as well for a comprehensive consultation.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.