Chuan Park Residences, one of the most anticipated New Launches of 2024 is set to be launched in the second half of 2024. There is high interest for this development as the last addition to this area was 10 years ago with The Scala, currently the newest development along Lorong Chuan MRT Station. What remains a mystery for now is if it will be a big hit or another overpriced miss for developers. With one of the largest supply of New Launches in the pipeline for 2024, the competition is steep for every development.

Let’s dive into some considerations that you may want to note if you are considering Chuan Park Residences. After the arduous en bloc journey, the site was finally successfully sold at $890 million after the second attempt, raising eyebrows as the highest en bloc sale since Tulip Garden in Farrer Road (now known as Leedon Green). At the moment of writing, we do not have the full information of the launch but we will take a look at the surrounding factors that may make or break this highly anticipated New Launch of 2024.

The Hype

The story of Chuan Park’s en bloc will forever be etched in the minds of the property market. After several years of pushing for the redevelopment of the former Chuan Park, it was finally presented with an offer that most proprietary owners can accept. However, even then it was not without obstacles. There were several minority owners which filed a case with the Strata Titles Board to stop the redevelopment deal from going through. While the majority of the owners were waiting eagerly for the en bloc profits, a minority of the owners wanted more. The dispute seemed to have been to fight for more profits from the redevelopment of the former Chuan Park. The eventual sale price was based on the agreement that the redevelopment plot ratio would be 2.1. However, some minority owners alleged that the eventual redevelopment plot ratio would have been 2.4 instead due to a letter from the Urban Redevelopment Authority (URA) in 2017. This would have meant that the eventual redevelopment would be able to increase the GFA by an additional 11,671 sqm and also have an effect on the valuation of the land.

Fast forward to May 2023, the High Court gave the green light for the collective sale of Chuan Park at $890 million to move ahead. Thus etching it as the second highest en bloc sale of this cycle since Tulip Garden which was redeveloped for $906.9 million in January 2019. Given the stagnant en bloc environment in the current market, this was still a feat for the owners of Chuan Park. Owners of Chuan Park would have received gross proceeds from $1.16 million to $2.53 million for a 710 sqft and 2,045 sqft unit respectively.

Kingsford and MCC Group, who joined hands in this redevelopment project, also had a similar high-profile redevelopment project not too long ago – Normanton Park. It may seem that this pairing has an acquired taste for the redevelopment on more mature assets.

The Beauty of Lorong Chuan

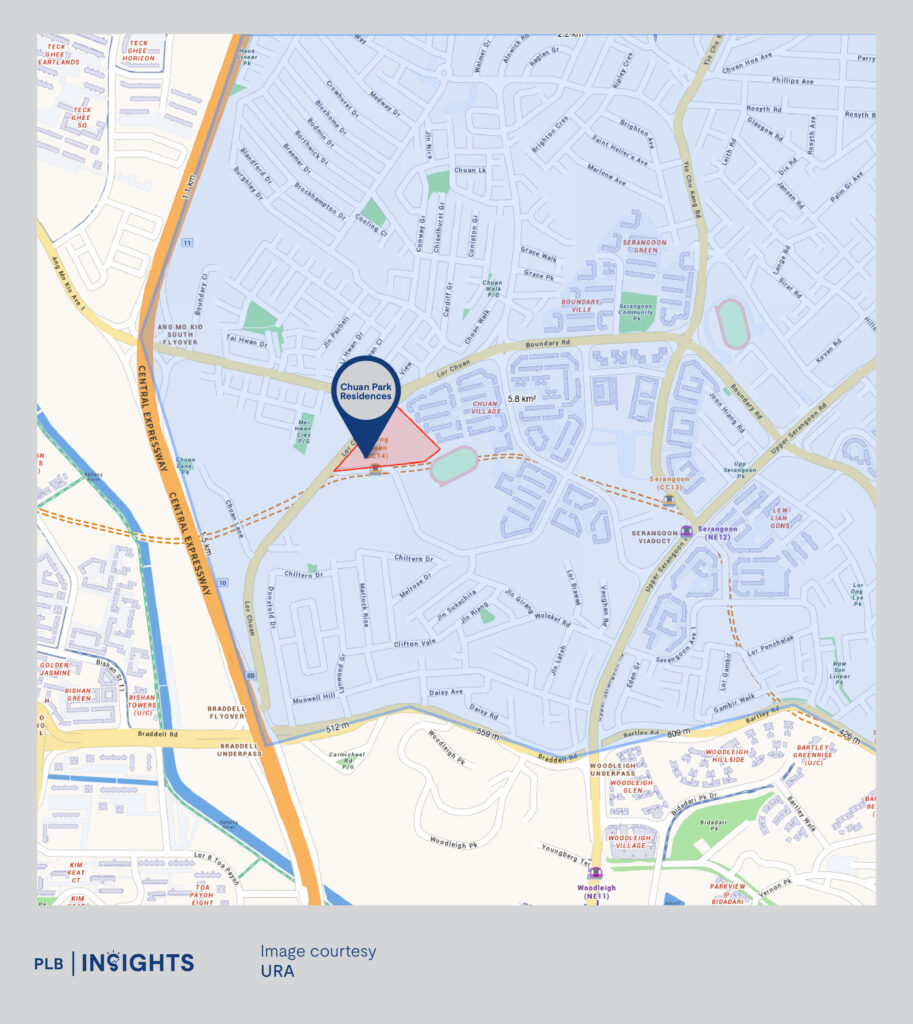

The Lorong Chuan estate area is one of the most convenient Outside Centre Region (OCR) enclaves. Located right on the edge of the OCR with the Central Expressway (CTE) and Bartley Road, serving as boundaries separating Lorong Chuan and the Rest of Central Region (RCR). Of course it is dependent on what you consider convenient. If you work at Changi Airport, perhaps Pasir Ris is your place of convenience for daily commuting. But at a location like Lorong Chuan, you are never located too far away from anywhere since you are closer to the city centre.

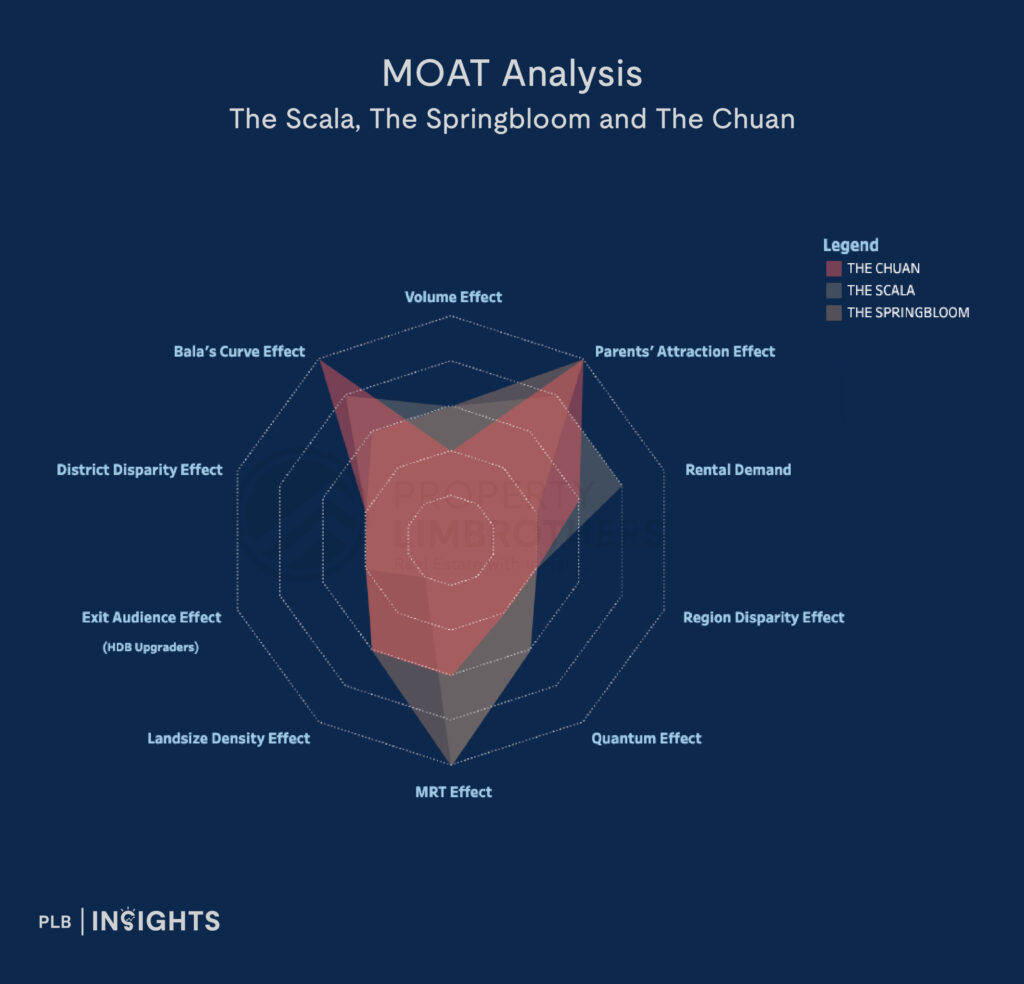

Other than the locational benefit of being nearer to the city centre, the address of Chuan Park Residences also has proximity to several reputable Primary schools within 1km. Kuo Chuan Presbyterian, CHIJ Our Lady of Good Counsel, St Gabriel’s Primary School and Yangzheng Primary School are within the 1km radius with several others falling between the 1km to 2km radius. This is one of the reasons the developments in this area of Lorong Chuan have scored exceptionally for Parent’s Attraction Effect in our PLB MOAT Analysis.

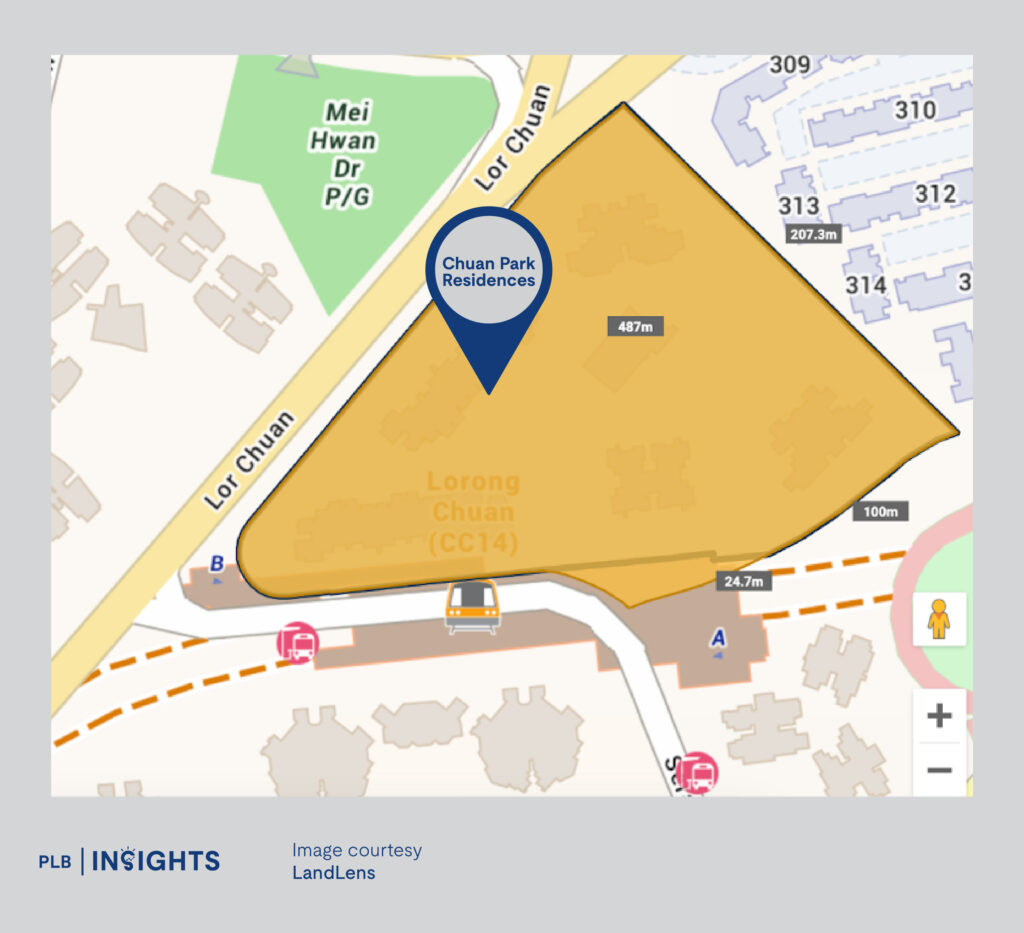

The other factor that has a high score in our PLB MOAT Analysis is the MRT Effect. While none of the developments are fully integrated with Lorong Chuan MRT Station (CC14), they are in extremely close proximity. With The Scala, The Springbloom and the upcoming Chuan Park Residences just adjacent to the station entrances. The other developments are also only a short walk across the road away. This is a highly attractive factor for those whose mode of transport for their daily commute is via public transport. This added convenience could also mean getting rid of the car and car loan for a little extra cash flow every month. Additionally, it is just 1 stop away from Serangoon MRT station, which means you will have easy access to NEX Mall, one of the largest malls in Singapore. So you have increased convenience like an integrated development while not having to bump shoulders with the larger crowds at Serangoon interchange.

Price Catalyst

At the time of writing, there is no information released on any price indications. However, based on the land sale price and accounting for the development and construction costs, the estimated breakeven price is close to around $2,3XX PSF. We expect the launch PSF prices to hit the range of $2,4XX to $2,5XX based on the information provided. At $2,500 PSF, this seems relatively high for an OCR project even though it is sitting on the border of the RCR.

Comparatively, transacted prices of RCR options like The Arcady at Boon Keng (Freehold) are hovering around $2,5XX – $2,7XX PSF. Other mega projects in the RCR like Grand Dunman (99-year leasehold) and The Continuum (Freehold), have transacted at $2,5XX – $2,8XX and $2,7XX – $2,9XX respectively. With Chuan Park Residences so closely priced against RCR options, this may lead some buyers to consider the RCR options instead given the close competitive pricing of the available options.

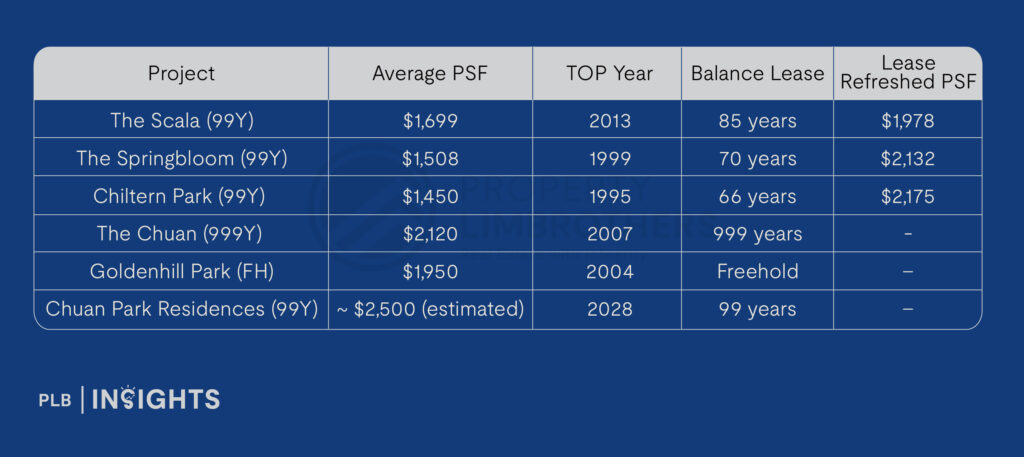

Taking a look at the direct vicinity of Chuan Park Residences, we have also done a lease refresh on the leasehold options such as The Scala, The Springbloom and Chiltern Park to further dissect the potential pricing of Chuan Park Residences.

The youngest development in the area is currently The Scala, after a lease refresh, we observe a gap of about 26% against Chuan Park Residences on the PSF differential. If the actual launch PSF of Chuan Park Residences is $2,5XX, this positions The Scala with a comfortable buffer against the New Launch project. Diving deeper into the more mature options like The Springbloom and Chiltern Park, the gap is lowered to between 14% – 17%. While this lower gap reduces the disparity of Chuan Park Residences against the mature options, it is still relatively significant for one to consider if a purchase price of $2,5XX PSF has an attractive and immediate appreciation potential.

Similarly, with the gap against the Freehold and 999-year leasehold developments like The Chuan and Goldenhill Park, is about $400 – $500 PSF based on the assumed expected PSF Price of Chuan Park Residences. This comfortably buffers these resale options against the New Launch Premium.

Of course it is not all bleak for Chuan Park Residences. Generally New Launch projects do come at a premium because of the simple fact that you will be the first to own and use the property. Nothing like the smell of the brand new home that you waited 3 to 4 years for. At the same time, the resale options in the Lorong Chuan area have larger floor plates as they were built in the early 2000s. Even though they have lower PSF prices, the larger floor plates add up and determine the price quantum. Currently, the lowest price quantum for a 3-bedroom with roughly 1,000 sqft of space is around $2 million.

What we can expect from the developers of Chuan Park Residences is to efficiently plan out the floor plans available and create attractive quantum entry prices, thus utilising a quantum play against the resale market. At the same time, Chuan Park Residences will not only be the newest within the Lorong Chuan enclave but also the largest development with over 900 units available. This will inevitably be a healthy environment for price appreciation as increase in valuation is sustained by the expected volume of transactions when it hits the resale market. With the large plot of land the developers have purchased, we are excited to see the unveiling of the project come Q4 2024 on the updated and differentiated offerings it will have against the resale market at Lorong Chuan.

Final Thoughts

There has been some delay to the launch of Chuan Park Residences where earlier in the year, it was expected to launch in August. However, it has since been delayed and the latest update was that the launch will likely be in September 2024 and this too has not been confirmed. But what we can expect is that given the high profile of Chuan Park’s en bloc success as the highest en bloc transaction since the former Tulip Garden en bloc (now known as Leedon Green), the developers are taking the extra time and effort to ensure a successful launch.

In the current market where price competition is a sensitive consideration for buyers and participants of the market, it would seem that the only factor determining the success of the launch would be the prices of Chuan Park Residences. Referencing the most recent New Launch project, Kassia, which saw this Freehold New Launch project sell off more than 50% of its available units over the launch weekend. The success was mainly attributed to a well priced development of under $2,000 PSF for a Freehold new launch development. An attractive and competitive launch price will indefinitely spur the success of Chuan Park Residences come the later part of Q3 2024.

While we await more information to be released on Chuan Park Residences, we do expect the showflat turnout rate to be one of the highest in the year of 2024. If you have any questions regarding this highly anticipated new launch project, do not hesitate to contact any of our consultants here at PropertyLimBrothers. Or if you have any other questions pertaining to your property journey, feel free to contact us as well for a comprehensive consultation.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.