Maximising rental yield is a top priority for landlords in Singapore looking to optimise their investments, where the property market offers a myriad of opportunities paired with challenges. With rising property prices, evolving tenant preferences, and a variety of property types and neighbourhoods to consider, landlords need to adapt strategies that go beyond just setting a rental price and finding the right tenant. These involve strategic planning, effective marketing, and ongoing property maintenance and management.

In this article, we are going to explore key strategies every landlord should know and implement to attract and retain tenants long-term while optimising rental income in Singapore’s competitive property market.

Understanding Rental Yield

Rental yield refers to the annual rental income generated by a property. It measures the return on investment (ROI) from rental properties. A property’s rental yield is an important metric for landlords in Singapore as it provides them with insights into the profitability of their investment. Moreover, the rental yield is further broken down into gross and net rental yields of a property.

Gross and Net Rental Yield

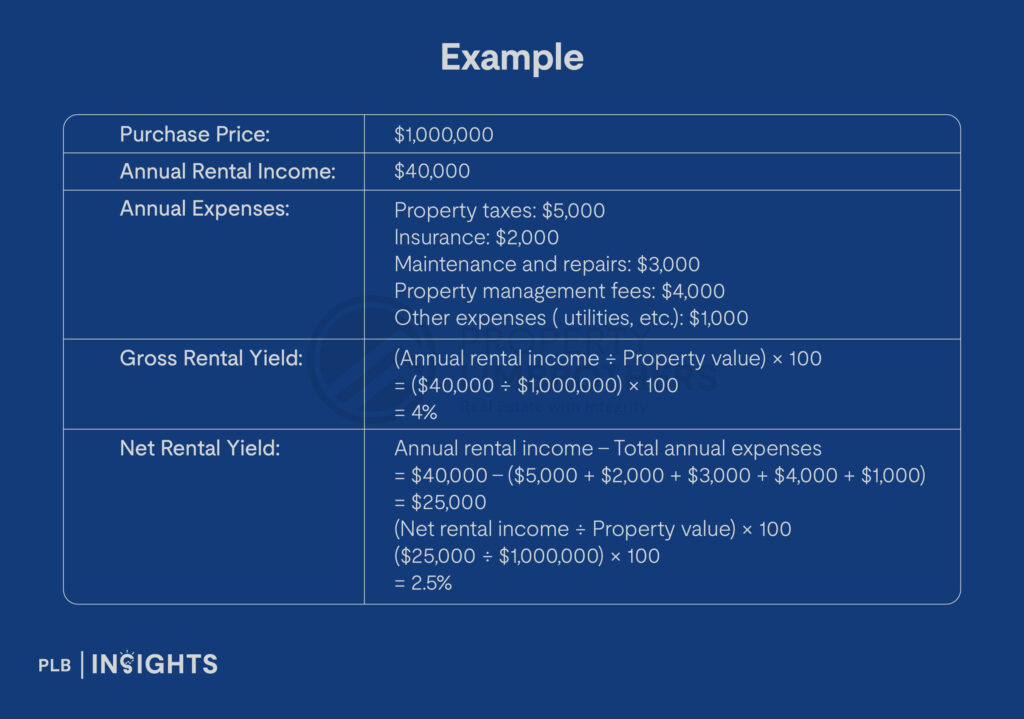

The gross rental yield measures the total annual rental income generated by a property as a percentage of its purchase price or current market value. It does not take into account any expenses related to the maintenance or management of the property.

Net rental yield, on the other hand, provides a more accurate picture of a property’s profitability as it factors in all expenses linked to the property. These include maintenance costs, insurance, taxes, and property management fees.

Calculating Rental Yield

Calculating the rental yield allows landlords to assess the financial performance of their property and gives them information on factors like pricing, property improvements, and whether to hold or sell their assets.

The formula for calculating a property’s gross rental yield is taking the annual rental income of the property and dividing it by the property price.

To calculate the net rental yield, all of the expenses need to be deducted from the annual rental income before dividing it by the property price.

Let’s go over an example of calculating the gross and net rental yields for a rental property.

Strategy 1: Market Research and Property Selection

The first strategy for landlords to maximise their rental yield is to conduct extensive market research and select properties that have a higher potential to generate a good rental income. Understanding the property market and selecting the best property as an investment for the future is crucial and can be done effectively by analysing the local rental market, tenant demographics and financial considerations.

Analysing the Local Rental Market

Landlords can start by analysing current rental market trends across various districts and regions in Singapore. Utilising resources like the Urban Redevelopment Authority (URA) can provide insights and data on rental statistics. In addition to this, landlords can also ensure they are up-to-date on real estate and any government-related news that influences the property market in Singapore. It is also essential to research and identify high-demand areas such as the Central Business District (CBD) and neighbourhoods near MRT stations or near schools, as these locations may attract higher rents.

Tenant Demographics

On top of familiarising themselves with the local rental market, another aspect that is crucial for landlords when looking for the right property is understanding their tenant demographics. Landlords must determine their target audience – whether they want to rent their property out to expats, students, young professionals, couples or families. Each demographic is going to have different preferences, needs, and lifestyles. As such, they will all be looking for specific rental options when it comes to property types, sizes, facilities, and amenities. For instance, students and expats may prefer units that are furnished, whereas families may prioritise homes that are close to schools and parks. All of these factors can have a substantial influence on rental success.

Selecting the Property Type

Choosing the right property type is another vital factor for landlords as each property type comes with its own set of pros and cons.

Renting out an HDB unit might have lower entry costs, but they also come with tighter restrictions for tenant profiles. Additionally, for other property types, it is essential for landlords to assess the size, layout, and features of potential properties they want to rent out. Properties that are in prime areas and come with attractive amenities like pools, gyms and 24-hour security may command higher rents. Areas with future development plans that enhance the livability in certain neighbourhoods may also fetch higher rental rates. For instance, properties that are in close proximity to the upcoming Cross Island Line (CRL) may command good rental rates.

Financial Considerations

Financial considerations play a significant role in the profitability of a property. Landlords need to determine their budget for purchasing a property, factoring in potential renovation and maintenance costs. Calculating an expected rental income based on thorough market research can help ensure that their budget is aligned with their investment goals.

Strategy 2: Setting the Right Rental Price

Pricing a property properly is an important step in attracting quality tenants while ensuring a return on investment that is profitable. Setting the right rental rate for your property also requires a deep understanding of the unique features of your property, the local market and seasonal trends that may influence rental properties.

Market Comparison

Landlords can scour the market and look for similar properties in the area and compare their rental rates. Utilising online platforms that provide data on comparable listings within the same neighbourhoods can also help landlords gain a better understanding of the rates in certain areas and set a competitive price for their properties.

Unique Features of Your Property

Another factor to consider when pricing a property properly is the unique features a unit has. Landlords can evaluate what features make their properties stand out in the rental market. Properties with desirable amenities like tennis and basketball courts, or amenities such as retail stores or minimart that add convenience for residents within a development. Additionally, having properties that are next to MRT stations, international schools, and shopping centres can also justify higher rental rates and more tenants.

Seasonal Trends

Rental demand typically fluctuates throughout the year and is influenced by factors such as expat relocation and school schedules. This can be more relevant for landlords with a specific tenant demographic of expats and students. Adjusting their rental prices during peak seasons for their demographic can ensure that landlords are maximising their occupancy rates and rental income.

Negotiation and Flexibility In Rates

One other factor to keep in mind is to allow for negotiation when setting rental rates. Some tenants looking for longer leases may try to negotiate prices. As such, building flexibility into the process of setting rates may lead to quicker lease agreements. Additionally, regularly reviewing and adjusting rental prices based on Singapore’s market conditions can ensure landlords keep their property rental rates competitive over time.

Strategy 3: Property Enhancement and Maintenance

A well-maintained property not only is a more attractive option for potential tenants but also a way to increase the property’s value, which can justify higher rental rates.

Maintenance and Cosmetic Upgrades

Landlords can create a schedule for regular maintenance to ensure that their properties remain in good condition. The maintenance of a property includes regular and thorough plumbing checks, electrical maintenance, pest control, and general repairs.

Along with a regular maintenance schedule, landlords must also ensure that they undertake basic cosmetic upgrades and renovations as needed to their property. This includes updates such as new paint, new flooring, and adding modern fixtures and lighting. This enhances the appeal of a rental property, making it stand out amongst options in the rental market.

Complying with Safety Regulations

It is crucial for landlords to also comply with all the required safety regulations that ensure their property meets the necessary safety standards. These safety standards include having proper ventilation, installing fire alarms, adhering to electrical safety regulations and maintaining the structural integrity of the property.

Strategy 4: Effective Marketing Techniques

The fourth strategy for landlords to implement to maximise their rental yield in Singapore is to implement effective marketing strategies, along with a strong online presence to attract quality tenants.

Online Platforms and Targeted Advertising

Leveraging social media and real estate platforms online can help landlords reach a wider audience through a set of tools that track market trends, compare prices, and analyse similar listings. Working with professionals who can guide you on using these tools and platforms can further ensure that landlords are able to benefit from all of the digital tools available to them for marketing. Moreover, working with property agents can ensure landlords and tenants find the perfect match in terms of rental rates, location, and property type.

Targeted advertising on social media platforms like Instagram and Facebook can also help landlords reach their specific tenant demographics. Setting specific parameters like location, age and preferences will help landlords increase the effectiveness of their advertisements.

Images and Descriptions

Another key factor when marketing a property for rent is to use high-quality images and descriptions for listings. This will help prospective tenants visualise themselves in the space and get a clear understanding of what they will be receiving before the viewing, thus increasing the chances of securing a viewing.

Networking

Another great way to market a property is to build good relationships with local real estate consultants, property managers, and other landlords as they may be able to provide insights and access to a wider pool of potential tenants. Landlords can also consider partnering with these professionals to expand their reach and ensure their property is competitive.

Strategy 5: Understanding Tax Implications

The final strategy we have for landlords to maximise their rental income is to gain a comprehensive understanding of any tax obligations and benefits that can help minimise liabilities and optimise their rent.

Tax Rates and Tax-Deductible Expenses

Landlords should be aware of the tax rates that apply to their rental income. In Singapore, rental income is subject to income tax and has to be declared in a landlord’s income tax return. Moreover, the rental income in this scenario refers to the monthly rent payments for the premises, the furniture, any maintenance, subletting a property and recovery from insurance.

Landlords can claim tax deductions on certain expenses related to their rental property. These include maintenance and repair costs, property management fees, property taxes and insurance during vacancy periods, and advertising and marketing expenses.

Keeping Accurate Records

To ensure compliance with all tax obligations, landlords need to maintain accurate and detailed records of their rental income and all related expenses. This can look like keeping receipts and invoices for any expenses they incur, maintaining a record of rental income and all the payment dates, and documenting any maintenance, repairs and upgrades that are done to the property during a lease agreement and vacancy periods.

Closing Thoughts

Maximising rental yield in Singapore’s competitive real estate market requires a combination of strategic planning, effective property management, and a comprehensive understanding of the ins and outs of the property market. By implementing key strategies from market research and optimal property selection, to using effective marketing techniques and screening tenants properly, landlords can optimise their rental income and ensure a sustainable return on their investment.

Get in Touch With Us

Are you currently looking to put your property up for rent in Singapore? Reach out to us here and get in touch with our experienced real estate consultants. We are more than happy to assist you on your property journey.

See you in the next one.