In the pursuit of building financial wealth and achieving financial freedom, many investors grapple with the decision of whether to invest in stocks or real estate. These two types of investments are fundamentally different and require distinct considerations.

For those with limited budgets, real estate might seem intimidating due to the perception of high initial costs. Conversely, the volatility of the stock market can be a deterrent for more risk-averse investors. Does real estate really offer lower risk? Which investment provides better returns over time? The answers to these questions are not straightforward and depend on factors such as an investor’s risk tolerance, financial capacity, age, and long-term goals.

This article explores the pros and cons of investing in both stocks and real estate, with a focus on the local Singaporean context.

Capital Gains Tax Exemption in Singapore

Before diving into the details of real estate versus stock investing, it’s important to note that Singapore does not impose a capital gains tax. This means that any profits from the sale of shares, properties, and intangible assets are tax-free, making Singapore an attractive place for both types of investments.

With this knowledge on hand, let’s delve deeper into these two asset classes, beginning with stock investing.

Stock Investing

When you invest in stocks, you essentially become a partial owner of the company whose stocks you have purchased. You would make money either through the periodic dividend payments or when the value of the share increases. Stock investing does not require a large amount of initial capital outlay, and can easily be traded through brokerage accounts with minimal to no fee. Besides that, investors will be able to easily access a wide range of index funds, mutual funds and exchange-traded funds (ETF) with minimal to no fees through these brokerage accounts.

Pros of Stock Investing

Stocks are highly liquid and easily accessible

Real estate investments can lock up your funds for years, but you can buy or sell public company shares immediately whenever you choose. Additionally, unlike real estate, it’s easy to check the current value of your stock investments at any time.

Ease of diversification

Most people don’t have the time or funds to achieve broad diversification in real estate. Stocks offer a faster and more affordable way to diversify. By investing in mutual funds, index funds, or ETFs, you can instantly diversify across numerous companies and industries.

Minimal to no transaction fees

You need a brokerage account to trade stocks. However, due to competition among discount brokers, trading costs are now typically $0. Additionally, many brokers provide mutual funds, index funds, and ETFs without transaction fees.

Cons of Stock Investing

Stocks are highly volatile

Stock prices can fluctuate much more quickly than real estate prices. This volatility can be unsettling unless you adopt a long-term strategy, planning to buy and hold stocks and funds despite short-term swings.

Stocks can lead to impulsive decisions

Although stocks are easier to buy and sell than real estate, frequent trading isn’t advisable. Market fluctuations can prompt investors to sell prematurely, while a buy-and-hold strategy usually yields better returns. It’s important to maintain a long-term perspective with all investments, including stocks.

Now that we’ve explored the advantages and disadvantages of stock investing, let’s compare them to those of real estate investing, emphasising the clear distinctions between these two assets.

Real Estate Investing

One key benefit of real estate investment is its tangible nature, offering investors a sense of security with physical assets. To keep things simple, we will be using residential properties as our means of comparison. In real estate, income can be generated through rental properties or by capitalising on property appreciation upon sale.

Pros of Real Estate Investing

Understanding the real estate market is relatively easy

While the process of buying a home can be intricate, the fundamentals are straightforward: Acquire a property, handle maintenance (and tenants, if you have other properties besides your own residence), and aim to sell for a profit. Additionally, owning a physical asset may provide a greater sense of control compared to owning small portions of companies through stock shares.

You can leverage debt to invest in real estate

Your mortgage enables you to invest in a new property with a down payment of 25% or less, financing the remainder. Conversely, investing in stocks with debt, called margin trading, is highly risky and suitable only for experienced traders.

Real estate investments can protect against inflation

Owning real estate is often seen as a defence against inflation since both property values and rental income tend to rise alongside inflationary trends.

Choosing Between Real Estate and Stocks: Navigating Investment Paths for Financial Growth

Comparing real estate investment to stock investment is like comparing apples to oranges—they’re different but both beneficial. Whether you choose real estate or stocks, both can help you reach your financial goals. However, it’s crucial to grasp the complexities of both markets and stay informed about economic trends. Most importantly, approach investments with caution and discipline, avoiding emotional decisions and risky gambles.

Approach all investments with a long-term perspective, avoiding the temptation of quick gains. Whether it’s real estate or stocks, stick to a disciplined monthly financial plan, allocating funds for both savings and investments separately. Savings should be reserved for emergencies or planned expenses, while investment funds should be left untouched to grow over time. Avoid frequent withdrawals from your investment accounts to maximise growth potential.

Having said so, investing in real estate usually demands a long-term commitment. It takes time to pay off your mortgage, see your property’s value rise, and generate enough rental income to turn a profit on your investment.

Advantages of Investing In Singapore Real Estate

Based on years of experience at PropertyLimBrothers, we recommend real estate investing for those who have the means to do so. Our thorough analysis and expertise suggest that Singapore’s real estate market is strong and will remain so. This is supported by several key factors, including:

Highest homeownership rate in the world: Indicating strong demand for homes in Singapore, which drives prices upward.

Stringent housing measures: While some believe Singapore’s numerous housing regulations stifle property investment, these measures actually protect against a housing bubble, ensuring property prices and the real estate market remain stable and robust.

Property investing offers unique leverage opportunities: By financing a portion of the property’s cost through mortgage loans, investors can amplify their investment potential, maximising returns with a smaller initial capital outlay

Projected population growth: As the local resident population continues to rise, housing demand will remain high, supporting the capital appreciation of real estate properties.

Housing Measures To Consider

Loan-To-Value Ratio (LTV)

When leveraging debt to invest in real estate, it’s important to understand the Loan-To-Value (LTV) ratio. For your first private property, banks will lend up to 75% of the property’s value, with at least 5% of the remaining 25% paid in cash. For HDB homes, the maximum LTV for a HDB Concessionary Loan is 80%, with no minimum cash down payment. The LTV is crucial as it determines how much of your savings or investment funds you’ll need for the down payment, affecting your cash flow and other investments.

Additional Buyer’s Stamp Duty (ABSD)

High Additional Buyer’s Stamp Duty (ABSD) rates—20% for Singapore Citizens and 30% for Permanent Residents on a second property—complicate real estate investment planning. To avoid ABSD impacting your financial goals, careful planning is crucial. One potential strategy is “decoupling,” where one spouse buys the property alone. However, this requires substantial funds, as the loan amount financial institutions are willing to offer may be limited.

Seller’s Stamp Duty (SSD) & Minimum Occupation Period (MOP)

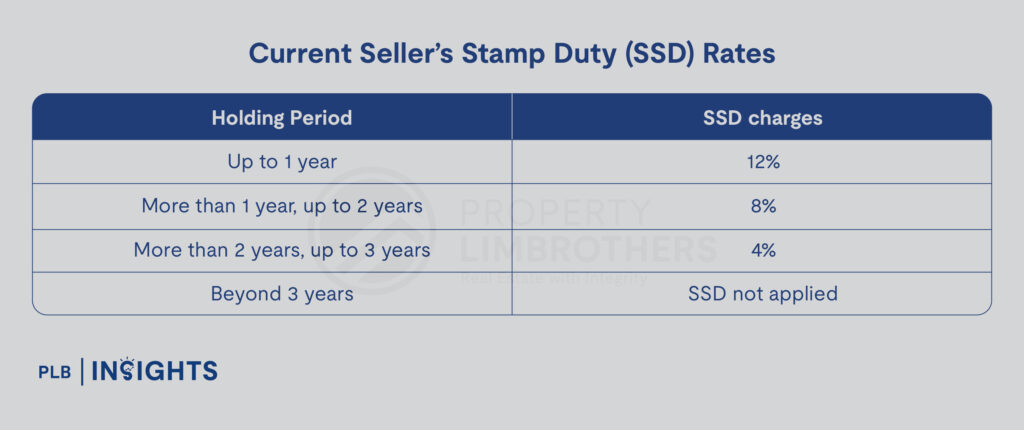

When planning long-term real estate investments, consider the Seller’s Stamp Duty (SSD) for private residences and the Minimum Occupation Period (MOP) for HDB homes. These factors must align with your investment goals. SSD applies to private homeowners selling within three years: 12% if sold within one year, 8% if sold between one and two years, and 4% if sold between two and three years. For HDB flats, the MOP is five years, increasing to ten years for Prime and Plus flats from mid-2024 onwards. Both SSD and MOP highlight the need for a solid exit strategy for your current property to ensure real estate investment success.

In Summary

Both real estate and stocks offer unique benefits and challenges for investors. In Singapore, the tax-free capital gains and strong market conditions make both attractive options.

Stocks provide liquidity, easy diversification, and low transaction costs, but come with higher volatility. Real estate offers tangible assets, safer debt leverage, and inflation protection, though it requires a longer-term commitment and careful planning due to factors like Loan-To-Value ratios, Additional Buyer’s Stamp Duty, Seller’s Stamp Duty, and Minimum Occupation Periods.

Ultimately, whether you invest in stocks, real estate, or both, a disciplined, long-term approach is key. Separate your savings from investment funds to ensure financial stability and growth. With careful planning and a prudent strategy, you can achieve your financial goals.

To ensure you achieve your financial goals, consulting with experts is crucial. What better opportunity than the Property Summit 2024? This 2-day masterclass is designed for investors like you. Gain invaluable insights from real estate experts and learn essential skills to navigate the market successfully. Don’t miss out – secure your Early Bird Tickets today!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.