If you are buying a flat, there is a high chance that the flat will be leasehold. After all, all HDB flats have a 99-year leasehold tenure. As early built flats inch towards the end of their tenure, it begs the question: What will happen to these ageing flats?

In this article, we will be looking back at the historical context of leasehold properties, analyse market sentiments on flats with short remaining lease, and answer a question that may become reality as old flats become the majority in the resale market – Should I buy a flat with a short lease?

What is Leasehold?

With the establishment of public housing in 1964, the government declared that the flats will be sold on a leasehold basis meaning that once the tenure expires, the land returns to the state, or more specifically, the Singapore Land Authority (SLA). The rationale behind the lease is said to be able to ensure land is able to be redeveloped in land-scarce Singapore to meet future needs.

Typically, HDB units have the full range of a 99-year leasehold tenure while private properties have a range of tenures from 99-years leasehold from the point of construction to freehold status. Properties with the elusive freehold title mean that owners can hold onto their property in perpetuity.

With many guidelines and regulations to follow, many have questioned whether we truly own our flats or are in a way ‘renting’ from HDB. HDB affirms owners that we really do since there is autonomy behind renovation and rent, till the lease is up.

What happens when the lease ends?

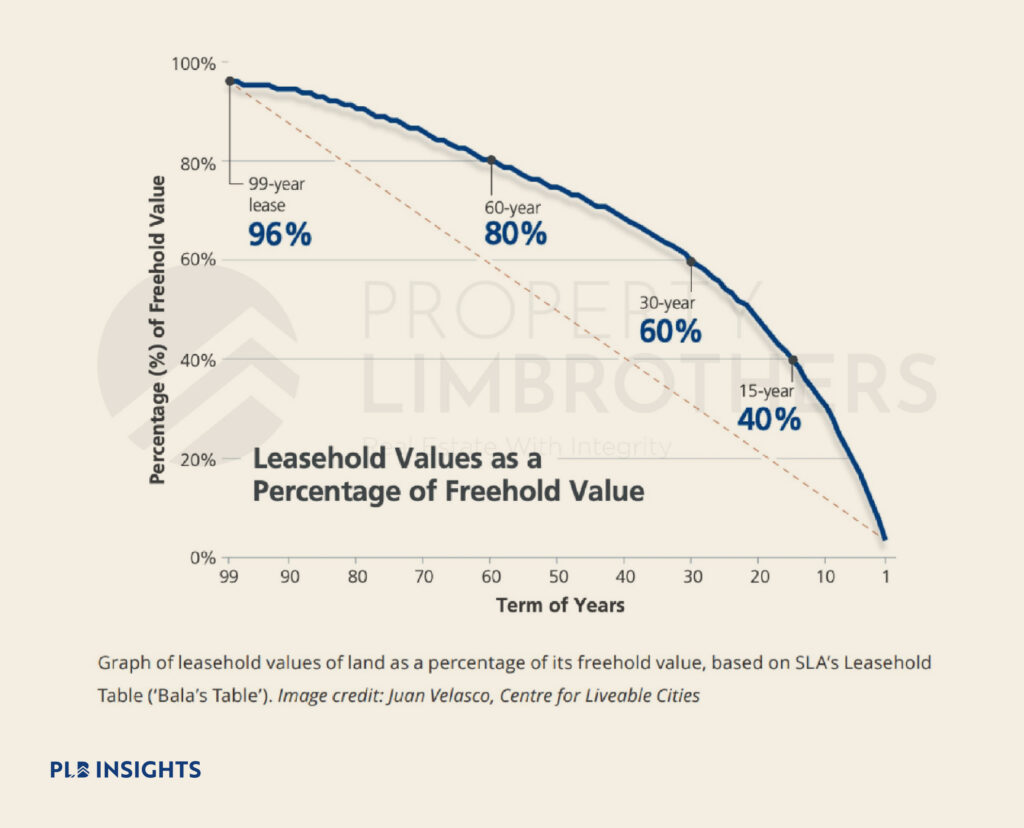

In comparison to freehold properties, leasehold properties are expected to depreciate along a Bala’s curve, with older properties depreciating at a faster rate. Upon lease termination, no extension or compensation is provided, effectively rendering the property’s value to zero.

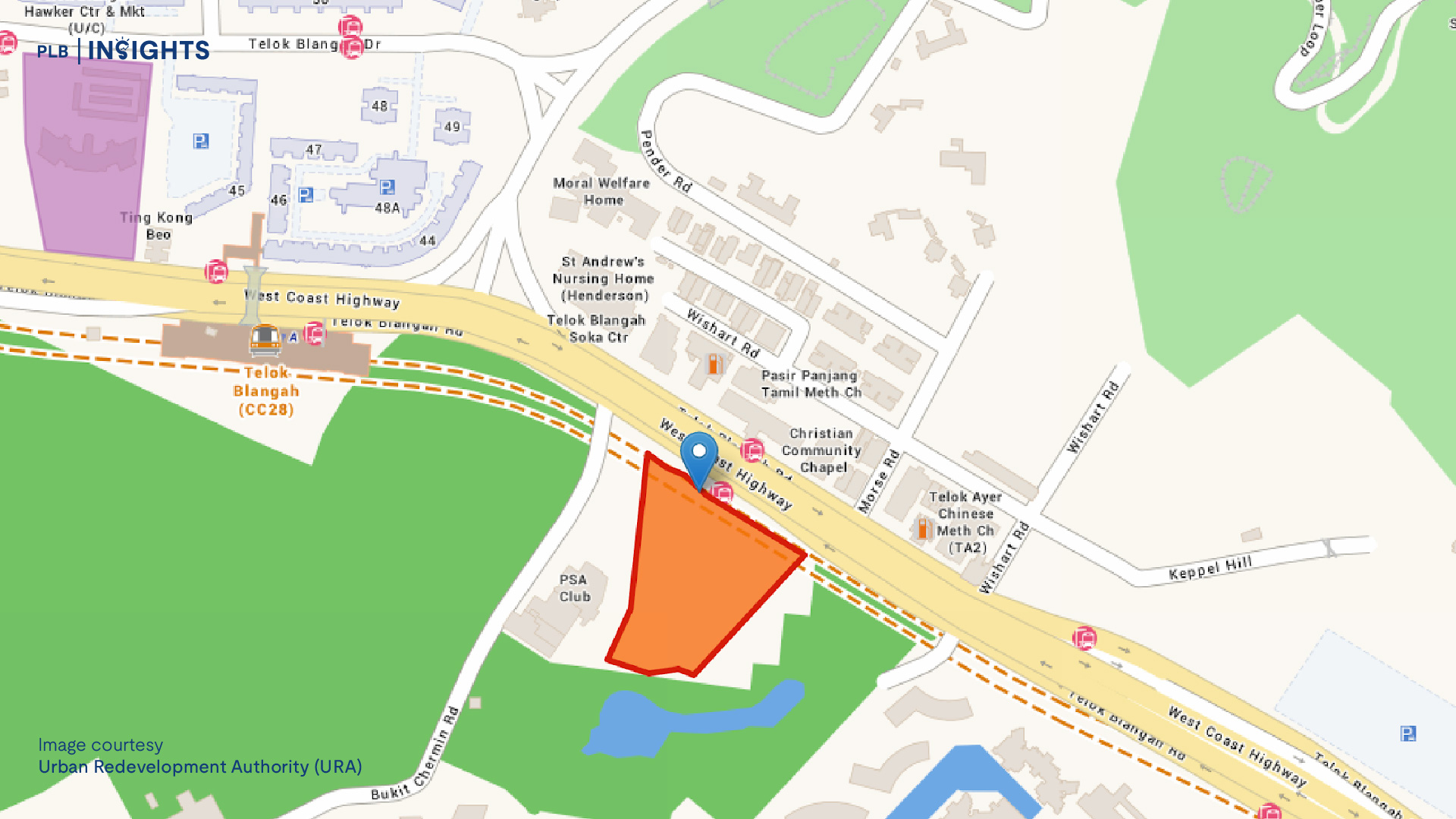

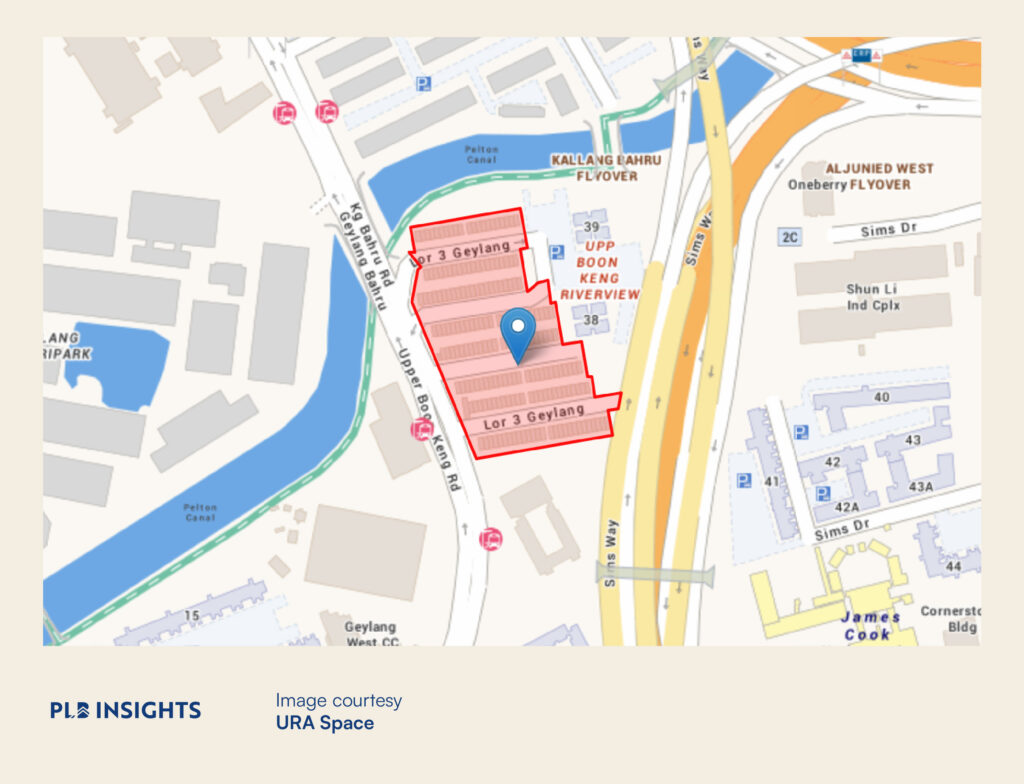

The uncommon 60-year lease expiry of the 191 terrace houses along Geylang Lorong 3 marked the first of residential buildings to reach the end of its lease. Leading up to its expiry in December 2020, several government agencies worked together with existing owners and occupiers to relocate elsewhere. Since then, these flats are undergoing demolition to make way for redevelopment. The next residential takeback is expected to be private houses in the Tanah Merah area whose 70-year lease is ending in 2034.

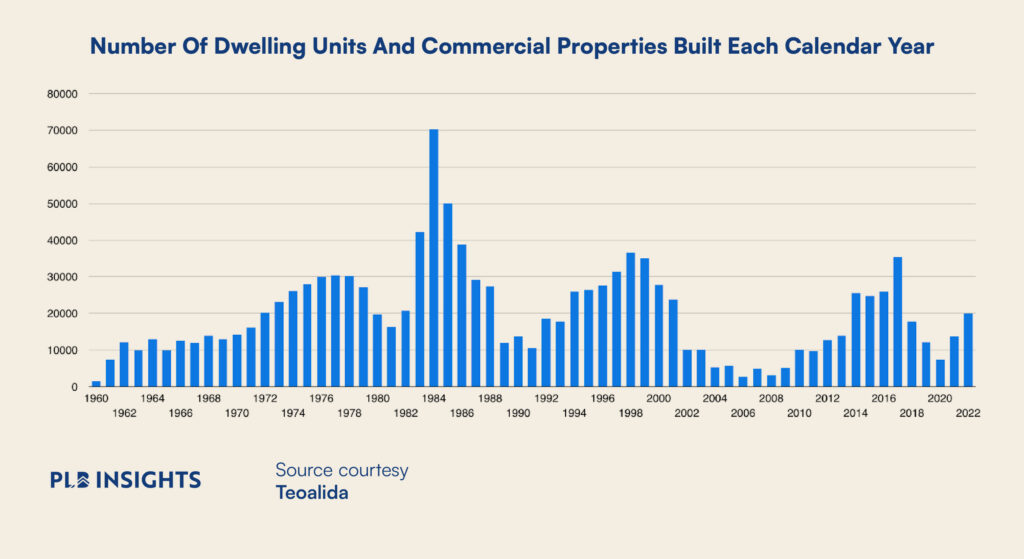

Singapore’s oldest flats are currently up to 64 years old, meaning two-thirds of their 99-year leases have elapsed. By 2034, approximately 500,000 flats will have reached the 50-year milestone, highlighting the impending lease expiry.

Although we have not seen a lease expiry of a HDB flat yet, you may have seen news regarding the redevelopment of certain developments such as the ‘OG’ HDB developments in Tanglin Halt. How is this happening?

Government Efforts Towards Ageing Estates

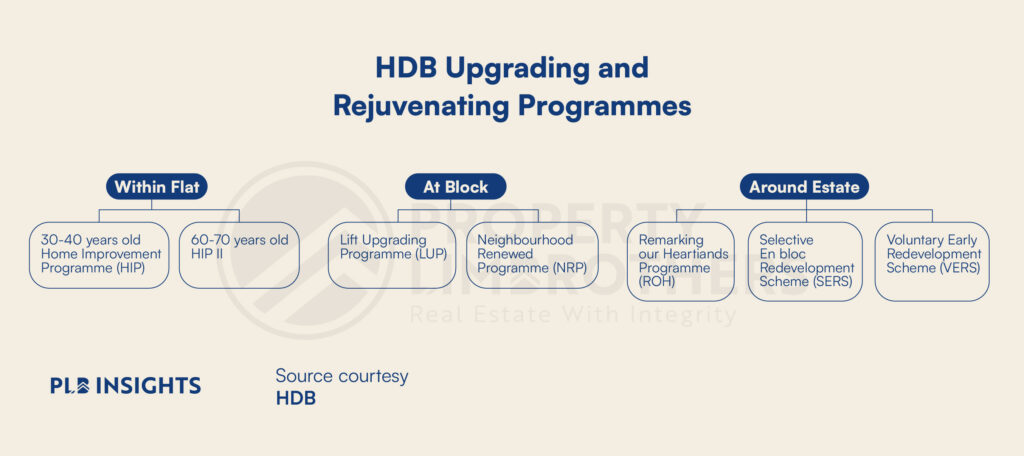

In addition to extensive policies for our ageing population, Singapore has implemented schemes aimed at improving older HDB estates. What impact does each scheme have on residents and potential buyers?

Generally, each policy enhances the experience and value of the property from ensuring lift access to every floor to repairing common maintenance problems. In regards to lease expiry, the two relevant schemes are the Selective En bloc Redevelopment Scheme (SERS) and Voluntary Early Redevelopment Scheme (VERS) respectively.

1. Selective En bloc Redevelopment Scheme (SERS)

SERS entails the government selecting specific, older developments with redevelopment potential, offering compensation benefits and rehousing owners to a brand new development. When rehousing owners, everyone will be kept together in the new designated replacement site not far from the original site.

Since 1995, numerous developments have been selected and completed the process. Seemingly a win-win situation for every stakeholder, SERS is a sought after programme for those living in older flats. However, the Ministry of National Development announced that only 5% of flats are deemed suitable for the scheme and they do not expect many more sites to be eligible for SERS. This leaves the majority of ageing HDB estates without a clear path forward as they near the end of their lease.

2. Voluntary Early Redevelopment Scheme (VERS)

Although HDB announced VERS in 2018, many details have yet to be finalised since it will only be offered to selected flats aged 70 years and above, which we are not there yet. The biggest difference between the two schemes is the mode of redevelopment. While owners of selected SERS projects must participate in the scheme, estates offered VERS must attain 80% approval from owners before proceeding. This poses a significant challenge, as not all residents may agree to participate, leaving the future of these estates uncertain. Owners are also expected to have a lower compensation since their lease will be close to expiry compared to SERS.

The process of obtaining approval of owners seems inspired by a typical en bloc sale where older private developments and its land are collectively sold to a property developer or the government. When the threshold is met, owners can expect a premium compensation in exchange for their evacuation. Private property owners may request a lease top-up to extend the tenure but there are many considerations and costs involved. Homeowners do not usually go for this option due to the high top-up cost.

For instance, the Pearl Bank Apartments was sold to CapitaLand in a $728 million collective sale. Owners who stayed in the apartments were compensated up to $5 million. CapitaLand also paid over $200 million to refresh the 99-year lease. Expected to TOP in late 2024, the new One Pearl Bank Condominium will welcome new owners onto its premises then. Check out our review of One Pearl Bank here!

The case of One Pearl Bank stands out as a unique example, given its developers’ willingness to invest in both tenure extension and redevelopment. However, it is important to note that such favourable outcomes may not be replicated for other ageing private properties, since each case presents its own set of challenges and circumstances.

Having discussed potential scenarios for both HDB and private properties, it becomes evident that holding onto an older flat can lead to either receiving decent compensation or facing the prospect of zero value upon lease expiry. Despite these risks, why is there still a demand for short lease properties, and what are the additional concerns associated with them?

Why Buyers are Still Interested in Short Lease Properties

Beyond the potential for redevelopment outlined, short lease properties remain popular primarily due to their affordability. With reduced demand for properties with short leases, prices tend to decrease, making them more accessible to buyers with budget constraints.

Private properties, especially those with shorter tenures, are often situated in prime locations such as Orchard or Novena. Despite the limited lease remaining, these properties offer buyers the opportunity to experience living in prestigious areas at a lower price point.

Additionally, investors may find short lease properties attractive despite the lease term. Renters are typically less concerned about the lease duration if the property is well-maintained. For instance, in the Geylang Lorong 3 landed enclave mentioned earlier, over 80% of properties were rented out at lease expiry. While there may be no returns after the lease expires, landlords can still enjoy decent returns during the lease period.

For HDB owners, certain HDB flat types, such as maisonettes and jumbo flats, are no longer in production, making them increasingly rare in the market. Consequently, purchasing a short lease flat may be the only viable alternative for those seeking to reside in these unique homes before they become unavailable altogether.

While the affordability and unique housing options of short lease properties may attract buyers and investors, there are other significant concerns and risks associated with such investments.

The Biggest Concern

One of the biggest concerns when considering properties with short leases is how the remaining lease duration impacts various aspects of homeownership. The number of years left on the lease affects crucial factors such as borrowing limits, the amount of CPF that can be utilised, and the eligibility for housing grants (applicable to HDB flats only). This can lead to the need for more cash on hand to meet financing requirements, potentially affecting affordability for buyers.

Furthermore, short lease properties present challenges in terms of exit strategy. As the lease approaches expiry, there is a looming uncertainty about the property’s future value. This “time bomb” scenario, where the property could depreciate to zero value upon lease expiration, adds a layer of risk for homeowners.

Moreover, ageing properties may require more extensive maintenance and renovation efforts, leading to higher upkeep costs for homeowners. This becomes particularly challenging if owners are divided on en bloc sales or redevelopment initiatives, as disagreements can delay essential maintenance and renovation projects, exacerbating the deterioration of the property over time.

For a deeper understanding of the performance analysis of ageing HDB flats and condominium units, do check out our previous article which takes a different approach in analysing flats with a short remaining lease.

Closing Thoughts

The decision to purchase a flat with a short lease remains a hotly debated topic, with numerous factors to consider. Ultimately, there are no right or wrong answers, but rather, the decision depends on finding the best balance for your individual circumstances, financial capability, and risk appetite. If you are looking at the number of years remaining as the only indicator, of course the answer will be no.

While policies exist to rejuvenate properties with short leases remaining, these may not be applicable to many estates. Despite the potential advantages that short lease properties can offer, they are not suitable for everyone.

If you require further assistance in creating your property portfolio or navigating the complexities of short lease properties, our experienced consultants are here to help. Do reach out to us here and we will get in touch shortly.

Till next time!