As a person in their 20s myself, people often ask when I will apply for a BTO or what my future property plan is. It is a common thought looming on the minds of gen-z entering the workforce or younger millennials figuring out what they want. The simple answer is that it is never too early to start saving for a home, but the real question is when should we start saving and how much do we need to work towards the milestone of home ownership? If you are undecided between renting or buying, do check out our previous article!

This article aims to guide you towards answers through questions, recognising the nuanced financial and life situations we all navigate. Grab a pen and paper and jot down your thoughts!

Disclaimer: This article is a general guide to the financial mechanics in the real estate realm and is not intended to be used as legal or financial advice. Adulting is challenging, but seeking guidance from seasoned professionals can make the journey more manageable.

Let’s begin!

Where Are You At Right Now?

Welcome to the starting point of your homeownership journey—research. Evaluating your current situation can set realistic parameters for your path. Are you considering a purchase under a parent-child scheme or as an individual? What is your current financial income? Which CPF housing grant can you potentially utilise?

Property Goals

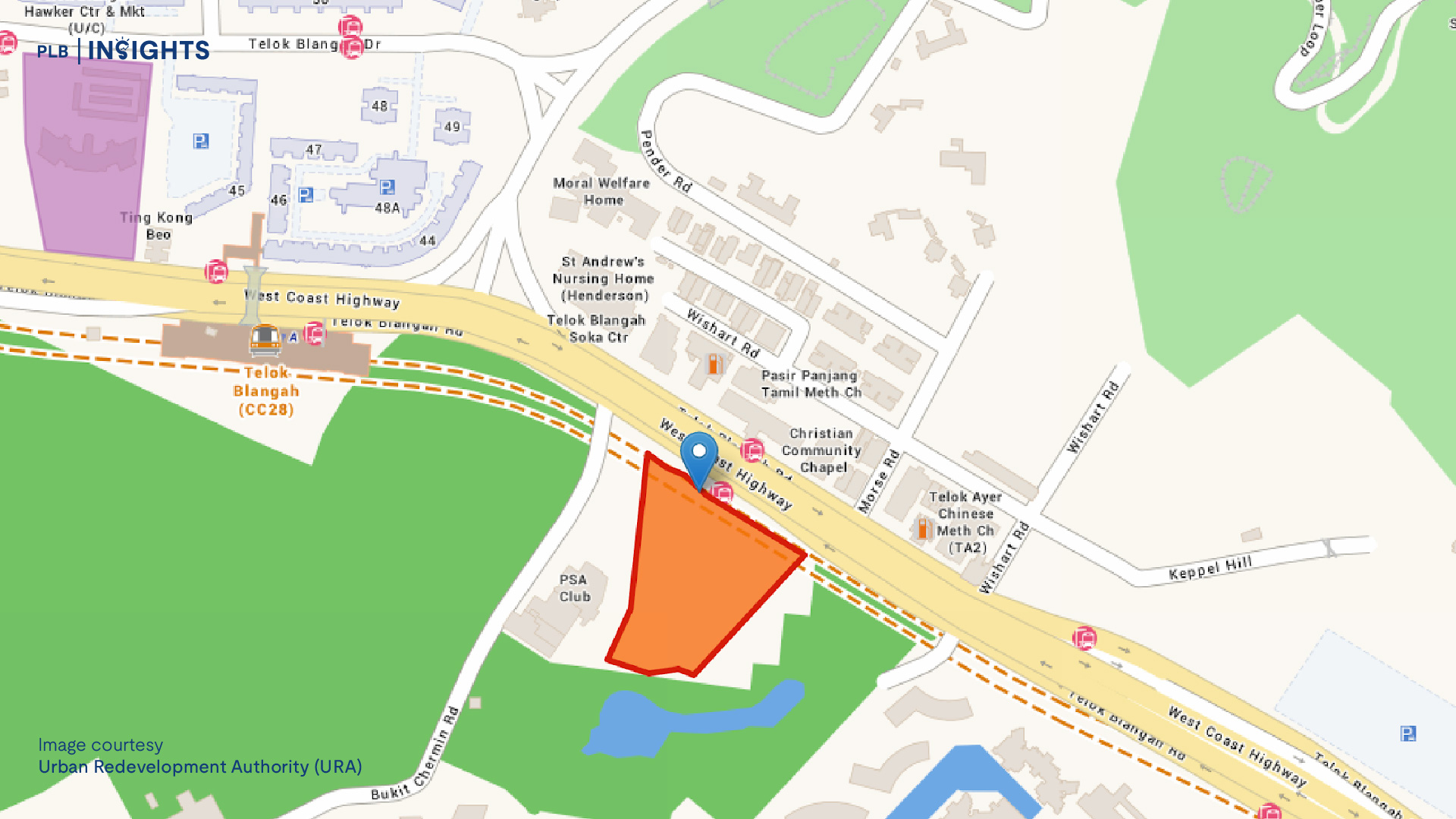

To determine how much to save, consider where you want to be in the near futurehead. Career-wise, do you anticipate increased job security and remuneration in the coming years? Your income significantly affects your loan capacity. Next, define your property goals. Which property type are you considering? Is staying near family important to you? Which part of Singapore do you want to live inare you eyeing? Your choice undoubtedly impacts your budget and grant eligibility.

Do remember that your goals extend beyond property needs to encompass various financial milestones as a young adult. What debts do you have? Jotting down these important numbers provides clarity on what you need to financially plan for. It helps you create a realistic budget that accommodates both your existing debt obligations and potential homeownership costs. Do you have the following?

Your existing debts directly influence your capacity to take on new loans. By managing and reducing outstanding balances, you not only improve your creditworthiness but also free up financial resources for homeownership goals. Managing these debts effectively ensures that your loan capacity aligns with your financial goals.

Spend Within Your Means

As everyone navigates through the adulting phase, spending within your means becomes a real challenge. This is when loan applications, Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) come into play.

Generally, there are two main categories of loans; HDB and bank loans. These ratios act as safeguards to prevent over-leveraging and ensure borrowers can manage their debt obligations responsibly. Note that HDB loans do not take into account TDSR but MSR only. There is also an income ceiling for HDB loans.

The great thing about being in your 20s is that you benefit from longer loan tenures. At the heart of responsible borrowing lies the balance between aspirations and financial prudence. Longer loan tenures provide a breathing space for your budget, preventing the strain of hefty monthly payments. This deliberate approach empowers you to meet other financial milestones, whether it’s addressing existing debts, saving for unforeseen expenses, or strategically investing in personal growth.

While loans may cover a large bulk of the housing payments, additional cash will be needed on hand to cover costs such as valuation fees, conveyance costs and option fees. The total of such amounts will be the ones you will need to save up for.

Costs Involved

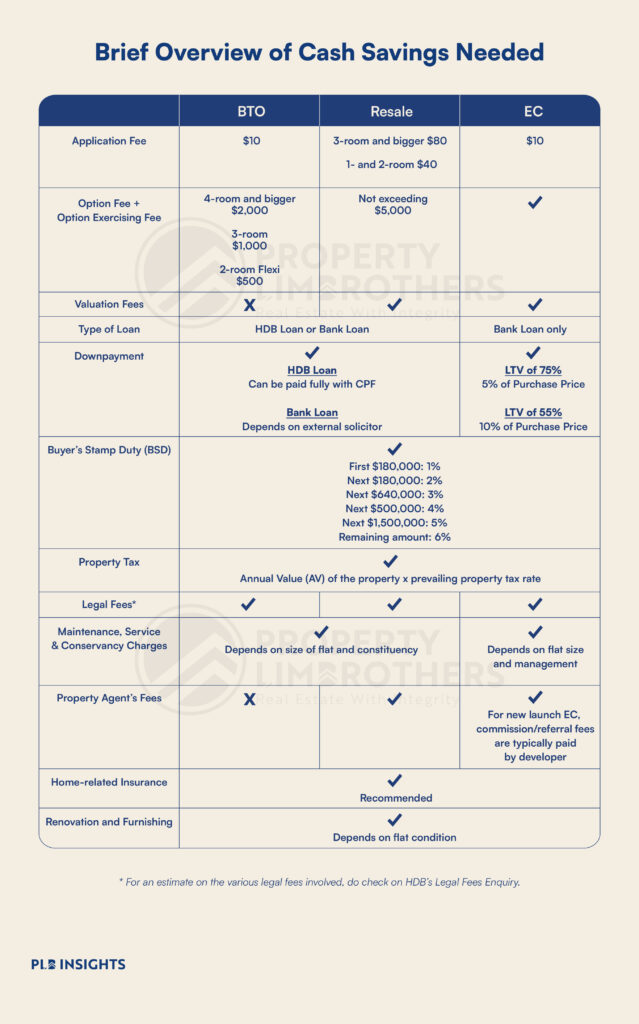

The cost of how much to save differs from property types due to the various processes involved. Here is a brief overview of cash savings needed for BTO flats, resale flats, and Executive Condominiums respectively.

* For an estimate on the various legal fees involved, do check on HDB’s Legal Fees Enquiry.

Each cost plays a unique role, collectively forming the financial mosaic of homeownership. From the application fee to potential renovation costs, they symbolise both the privileges and responsibilities that come with owning a home. While calculating the exact amount needed can be challenging, a good gauge would be to consider the dual aspects of downpayment and ongoing expenses in your financial planning.

Closing Thoughts

In the realm of real estate, the endeavour of purchasing a home in your 20s is a journey filled with both aspiration and challenge. It demands steadfast commitment, beginning with the meticulous act of saving for the downpayment and extending through the enduring commitment of servicing a mortgage for decades.

This article has delved into the intricacies of financial considerations essential for those embarking on the exciting adventure of acquiring their first home. If you have clinched an opportunity to select a unit, do check out some of the factors to take note of.

Should you seek personalised guidance or wish to discuss your future housing plan, our team of experienced consultants is at your service. Feel free to reach out, and let us navigate the path to homeownership together. Your dream home journey awaits, and we’re here to guide you every step of the way.

Till next time!