In the competitive landscape of Singapore’s real estate market, freehold properties stand as the jewels in the crown. Freehold properties offer buyers an unrivalled sense of permanence and privilege, elevating them above the common fray. They’re not just homes; they’re legacies, providing unparalleled flexibility and control. With their enduring nature, freehold properties are often regarded as symbols of prestige and a savvy investment, promising a higher trajectory of capital appreciation. As discerning buyers navigate the marketplace, the allure of these properties often guides their quest for the ideal home.

Conversely, a surprising trend is unfolding within Singapore’s real estate tapestry: 99-year leasehold condominiums are beginning to outshine their freehold counterparts in performance metrics across certain enclaves. This phenomenon is sparking a paradigm shift, challenging long-held beliefs about property investment and signalling a new era of opportunity within Singapore’s vibrant housing landscape.

In one of our recent NOTG episodes, we discussed the factors such as the disparity effect, price appreciation and valuation of projects within an enclave that influence homebuyers’ decisions.

In this article, we give you a breakdown of these factors and venture into why some 99-year leasehold condos are going at higher PSF prices compared to freehold condos in the same area and becoming the preferred choice for homebuyers.

99-Year Leasehold Vs Freehold Condos Case Study: Kovan Melody and Kovan Esquire

The Kovan region is a vibrant neighbourhood located in the northeastern part of Singapore. Kovan offers residents a wide range of housing options–both public and private, with a diverse community, amenities and connectivity.

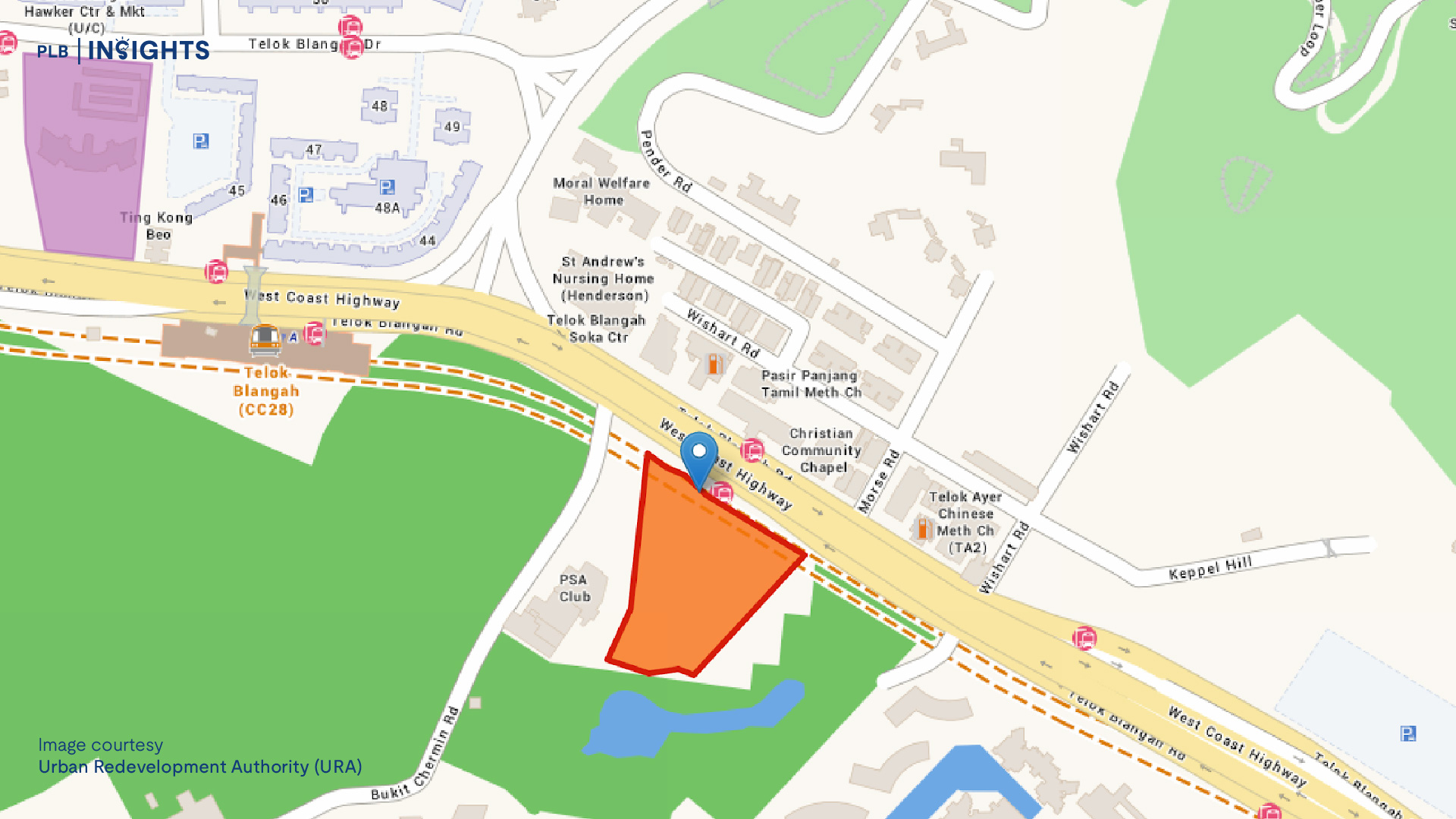

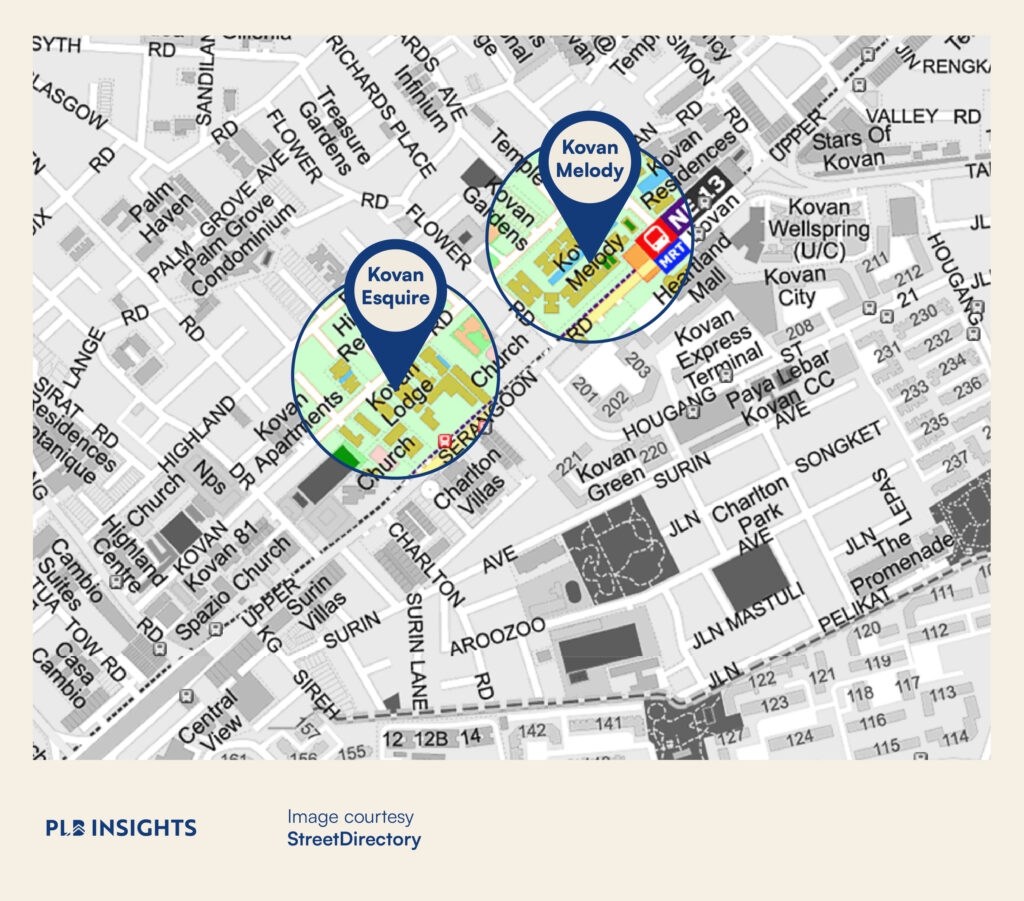

For the purpose of breaking down these factors, we will be using two condo developments in the Kovan region as examples, Kovan Melody and Kovan Esquire.

Kovan Melody is a 99-year leasehold condominium development completed in 2006 with a total of 778 units. It is located in District 19 on Kovan Road and offers residents an array of facilities and amenities. Kovan Esquire, on the other hand, is a freehold condo development that features 23 units. This is a boutique development, as it has under 100 units. Kovan Esquire is also located in District 19.

Both of these developments are in close proximity to amenities and well-reputed schools. Moreover, they offer homebuyers a comfortable and desirable long-term housing option.

Although both condo developments are in close proximity to the MRT station, amenities and other benefits that make them a great choice for homebuyers, why is it that the 99-year leasehold properties are out-performing their freehold counterparts in the Kovan region?

Let’s find out.

Valuation & Desktop Valuation

The valuation of a property is another factor that is crucial when looking for a potential home as it provides both buyers and sellers with an objective assessment of the property’s worth. It takes into account the size, location, and condition of the house as well as the current market trends that may influence value.

The valuation of a property helps determine the ideal price and ensures that both sellers and buyers are going to benefit from the transaction. Moreover, valuation is a tool that enables homebuyers to make decisions regarding the financing and mortgage, insurance, estate planning and taxation of their property.

Homebuyers typically ask their mortgage brokers or bankers for a desktop valuation once they find a home that is to their liking. A desktop valuation is a method of property valuation that is conducted remotely, without physically inspecting a property. This method of valuation is reliant on the analysis of the available data of a property, including any records, market trends, and sales of comparable properties in proximity and of a similar type.

Getting the valuation of a property before buying it is important for homebuyers as the loans they take out for their mortgage are based on a percentage pegged against the property’s valuation. However, it is also essential to note that while desktop valuations provide an estimate of a property’s value, they do not take into consideration certain physical aspects of the property. As such, these should be seen as a starting point when looking into a property’s value.

Disparity Effect

The disparity effect refers to a concept by which properties that are perceived to be priced lower or are even considered to be undervalued tend to attract a higher demand. As a result, these properties tend to experience faster price appreciation.

Typically, 99-year leasehold properties are much more affordable than freehold ones. This is because of the various advantages freehold properties have over their leasehold counterparts. The pricing disparity between the two types of leases results in 99-year leasehold developments being priced lower, thus being the more affordable option for a larger pool of buyers. Additionally, this may be a factor in the higher demand for leasehold properties which contributes to a price appreciation over time.

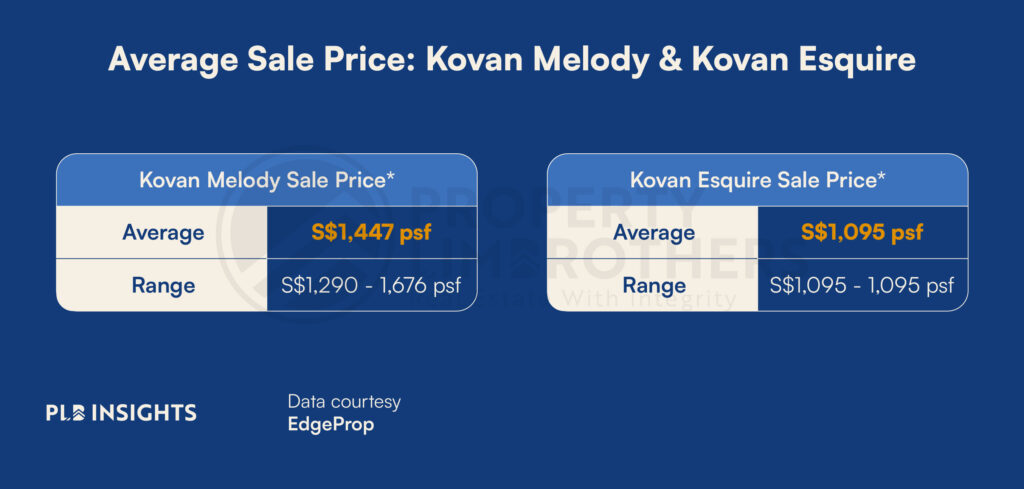

In the case of both Kovan Melody and Kovan Esquire, the disparity effect becomes evident when examining their average sale prices. One might assume that Kovan Esquire, with its freehold tenure, would command higher prices. However, data from Edgeprop reveals a surprising twist: Kovan Melody, the 99-year leasehold condo development, boasts a higher average sale price at $1,447 PSF, surpassing Kovan Esquire’s average selling price of $1,095 PSF.

Price Appreciation

The disparity effect that can be seen with the two condo developments in Kovan can also be a potential factor contributing to the price appreciation of both projects.

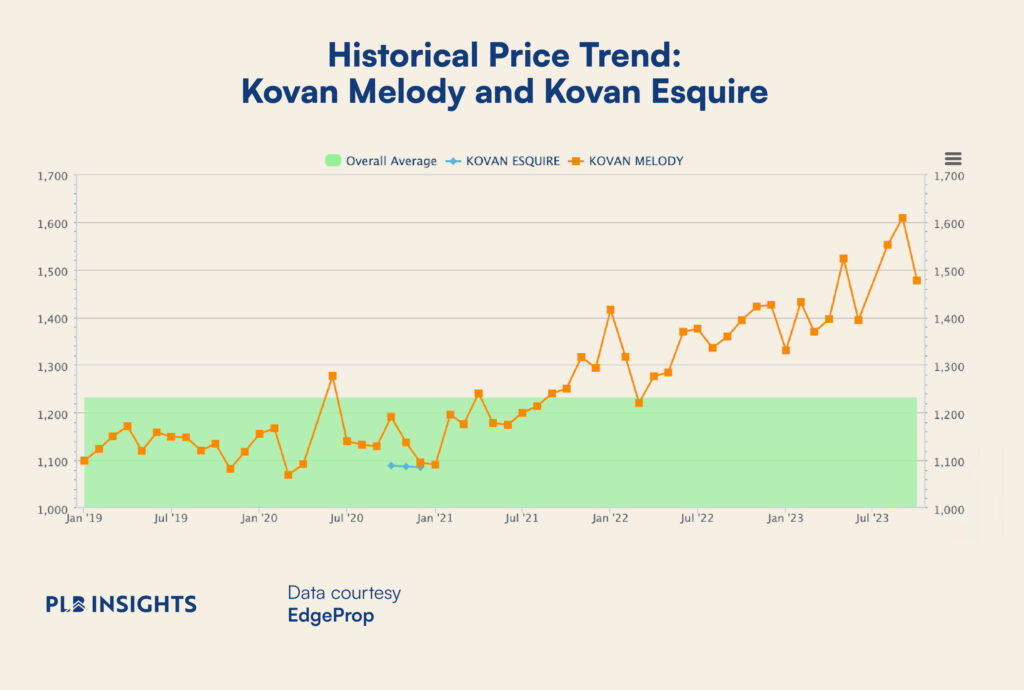

As illustrated in the graph below, we can see that Kovan Melody, in a similar amount of time, has seen a greater price appreciation than Kovan Esquire.

Historical Price Trend: Kovan Melody and Kovan Esquire

The price appreciation witnessed in Kovan Melody’s units can be attributed to several key factors, with volume and popularity standing out prominently.

The volume of transactions can influence the rate of appreciation of the prices of units either positively or negatively. A high sales volume indicates a strong level of interest and demand from homebuyers. Furthermore, this strong demand then creates competition among the buyers. Bidding wars over limited supply can result in prices being driven up, resulting in the overall appreciation of the property.

Additionally, transaction volume also influences market perception. A higher number of transactions tends to create an aura of desirability surrounding the property. Prospective buyers are more likely to perceive the property as popular and hold a positive sentiment toward it, contributing further to price appreciation.

Demand is the most important factor when it comes to price appreciation, without buyers showing an interest in a property, the property cannot be sold. However, it is important to note that without any volume of properties available for sale, there cannot be a high rate of price appreciation.

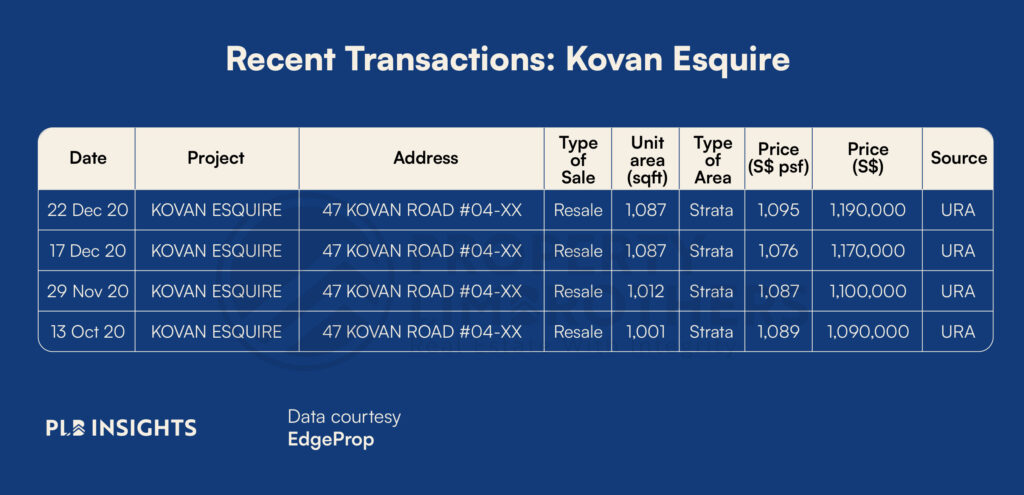

This holds true for Kovan Esquire, as corroborated by the data illustrated in the graph above, as well as in the development’s most recent transaction records.

Closing Thoughts

The preference for 99-year leasehold developments over freehold properties in certain enclaves challenges the conventional idea that freehold properties are always the better option for a long-term home in Singapore’s real estate market.

Factors such as the disparity effect and the rate at which prices of these condos are appreciated, paired with other market dynamics, highlight the desirability of 99-year leasehold projects in the same enclave. With these considerations, some 99-year leasehold properties such as Kovan Melody challenges the notion that freehold condos are the preferred and optimal choice for homebuyers and investors.

We hope you found today’s article insightful. If you want to keep up with all things real estate in Singapore, check out other articles at Insights by PLB, along with the full episode of Cracking the Condo Code.

Feel free to contact us here if you have any questions or are seeking professional guidance on your property journey.

Until the next one, see you!