As we approach the last quarter of the year, many look forward to closing the year with a bang. However, the real estate market has shown lacklustre progress for the past few months. Between new hyped launches that have shown a promising November, the statistics do not corroborate the same excitement throughout the country. While a slower market is expected at the end of the year, are these numbers a cause for concern or a positive signal that cooling measures are working?

The lack of major private residential launches for a second consecutive month contributed to a near one-year low in new home sales, with only 203 units sold in October. This is the lowest figure since December 2022, when only 170 units changed hands, as revealed by data released by the Urban Redevelopment Authority (URA) on Wednesday. While the situation has improved in November with the introduction of J’den in Jurong East and Hillock Green in Lentor Central, the overall outlook for 2023 indicates the lowest annual new home sales since 2008, totalling 4,264 units. This decline is attributed to higher interest rates and a slower uptake despite many new launches between July and August 2023.

This year, developers have introduced 19 private non-landed projects comprising 6,815 units, a notable increase from 2022’s 15 projects with 4,528 units. Developers going into 2024 might be backing off from releasing too many launches, as pent-up demand observed during the pandemic seems to have subsided. Possible reasons include people returning to offices more regularly and choosing to stay in their current housing situations amid the effects of inflation.

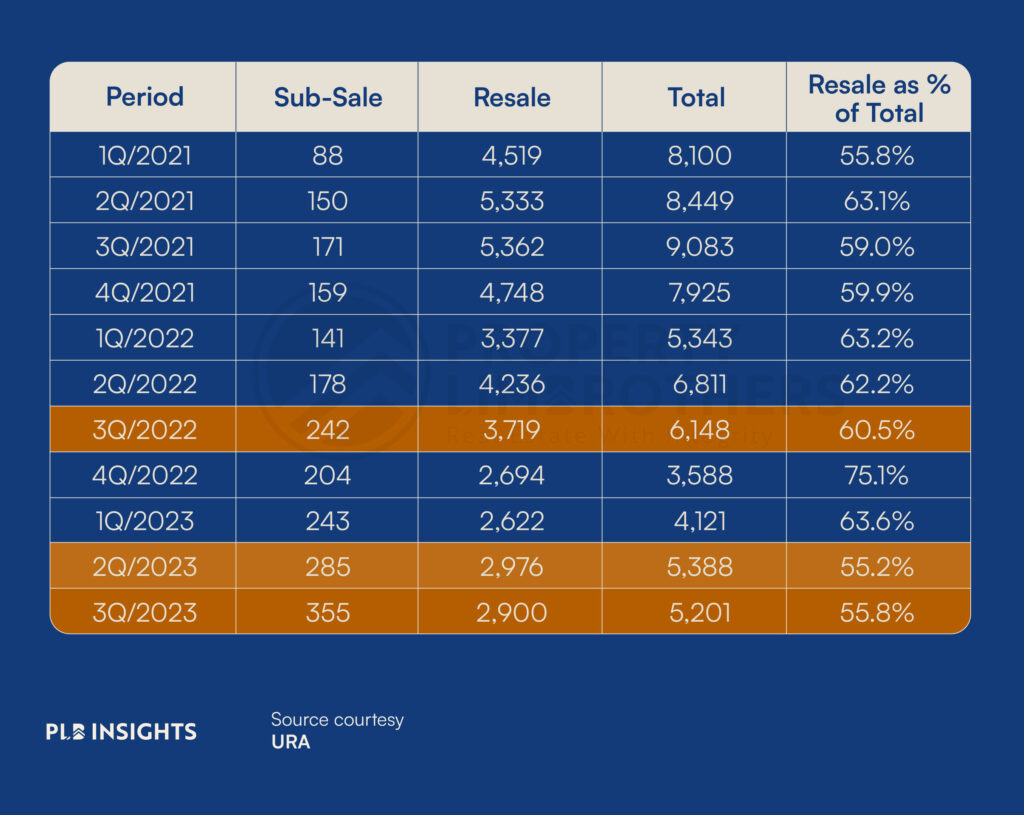

Moreover, recent data from URA indicates that there were 2,900 resale transactions in the third quarter of 2023, accounting for 55.8% of all sale transactions. The total sale transaction volume (up to mid-September) in the third quarter was 4,569, compared to 5,388 in the second quarter and 6,148 in the third quarter of 2022.

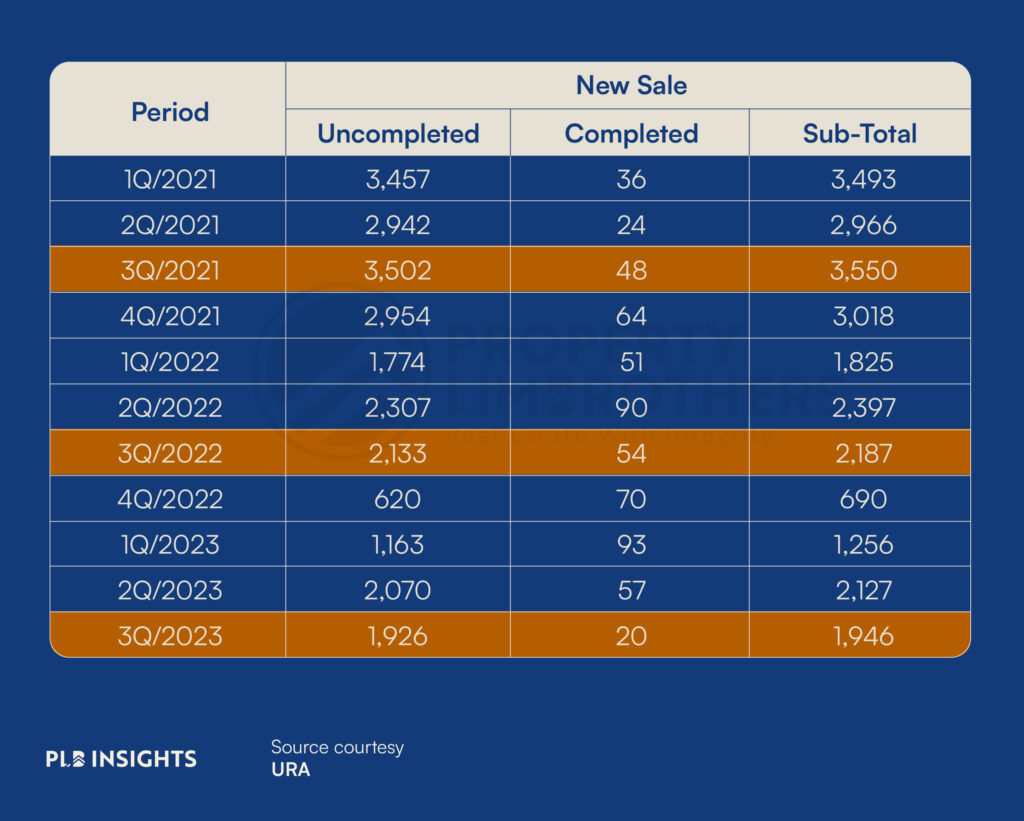

1,946 private residential units (excluding ECs) were sold in the third Quarter of 2023, compared with the 2,127 units sold in the second Quarter. This quarter also records a remarkably lower number than the same period in previous years, with 2,187 in 2022 and 3,550 in 2021.

Year on year, new private home sales (excluding Executive Condominiums) contracted by 35.3%, totalling 314 units compared to October 2022. Including Executive Condominiums, October’s sales fell 33% to 224 units from 335 in September and plummeted 72.4% from 812 a year ago.

Performance of Popular Projects

The robust performance of J’den indicates that there is still an appetite for attractive launches. The development achieved an impressive 88% sales of its 368 residential units over the launch weekend, with an average price of $2,451 per square foot. Notably, all one-bedroom, one-bedroom with study, and two-bedroom units were sold out, showcasing the appeal of the integrated development in Jurong Lake District.

In the luxury market, Watten House at Bukit Timah has defied expectations, with more than half of its 180 units snapped up. This success has alleviated concerns about cooling measures dampening demand for larger luxury homes in prime districts. The take-up rate exceeded expectations, considering the starting price of $3 million for three-bedroom units, a respectable performance given the luxury branding and larger unit types.

What Is To Come In Q4?

As per typical market trends, home sales are anticipated to remain subdued in the year’s final quarter due to the holiday season and increased travel. Some prospective buyers may also be holding off for the 20 new launches expected in the first half of 2024, including developments like Skywaters Residences, directly linked to Tanjong Pagar MRT, and the highly anticipated Lentor Mansion and Lumina Grand EC.

The demand for non-landed homes has been affected by the current high interest rates, the property cooling measures implemented in April 2023, and the uncertain economic outlook. On the other hand, the increased construction costs, higher financing expenses, and elevated prices of landed homes have led buyers to adjust their expectations.

Closing Thoughts

The property market outlook for the last quarter of the year is uncertain due to geopolitical tensions and a persistent high-interest rate environment. We predict that 2023 will end mutedly, and the current challenges will continue into 2024.

Despite the challenges, we anticipate that the market will remain strong. Sellers are unlikely to reduce prices as there is no urgency to do so. Buyers on the other hand, may become more cautious and spend more time searching for their perfect home while adjusting their expectations. If you want someone to guide you along your property journey, contact us and let our friendly consultants help.