As a homeowner or property owner in Singapore, staying informed about property taxes and the different stamp duties incurred with purchasing any property is crucial for making informed decisions and managing your financial responsibilities.

Navigating the intricacies of taxation can be daunting regardless of whether you are a first-time buyer or an experienced property investor. However, with the right insights and information, you can be equipped with the right tools to confidently move through the stages of purchasing property in Singapore.

In this article, we provide you with a guide to the different taxes and duties that come with property purchases in Singapore and the distinctions between owner-occupied and non-owner-occupied property taxes. We also go over the exemptions, deadlines and procedures for calculating the tax rates and paying them.

Types of Property Taxes & Duties in Singapore

There are several types of property taxes in Singapore that owners and investors must be aware of. This includes the property tax itself, along with a few other duties and types of taxes.

Property Tax

A property tax is a tax that is imposed on residential homes, commercial buildings, and any vacant land. In short, all immovable properties that are owned in Singapore are taxed annually based on the value of the property.

Property taxes across all residential properties such as condominiums, apartments, and landed properties, are similar in that they are progressive. This means that taxpayers with a property that is higher in value are obligated to pay a higher property tax. On the other hand, non-residential properties including industrial, commercial and vacant land have a single flat rate.

Annual property taxes are calculated by taking the Annual Value (AV) of the property and multiplying it with the rates that apply to you.

The AV is considered to be the estimated gross yearly rent of any building, regardless of whether it is rented out or not. This estimated amount excludes maintenance fees and furniture and is determined by comparing similar properties on the market. For land and development sites that are either under construction or vacant, the AV is considered 5% of the estimated freehold market value. Finally, for specialised properties, the AV is 5% of the freehold capital value or it is determined through processes that utilise costs and receipts to determine the estimated rent and AV of the property.

Non-residential properties such as different commercial and industrial properties are taxed at 10% of the Annual Value. Residential properties are taxed at different rates, depending on whether they are owner-occupied or non-owner-occupied. We will discuss this later on in the article.

There are a few types of properties that are exempt from paying property taxes, and these include properties used as a place of worship, properties used for schooling and education, properties used for charitable purposes or those that promote social development in Singapore.

For all other properties that are obligated to pay taxes, there are certain things to take note of. The annual property taxes are due on the 31st of January every year. Any other property tax notices are due 30 days, or one month, from the date of notice. Late payments are charged with a penalty of 5% on unpaid taxes. However, depending on the reasons for the delayed payments, individuals have the right to appeal.

We went over some of the types of duties in the first part of our real estate terms guide. Let’s get a recap and go over some more of these.

Buyer’s Stamp Duty (BSD)

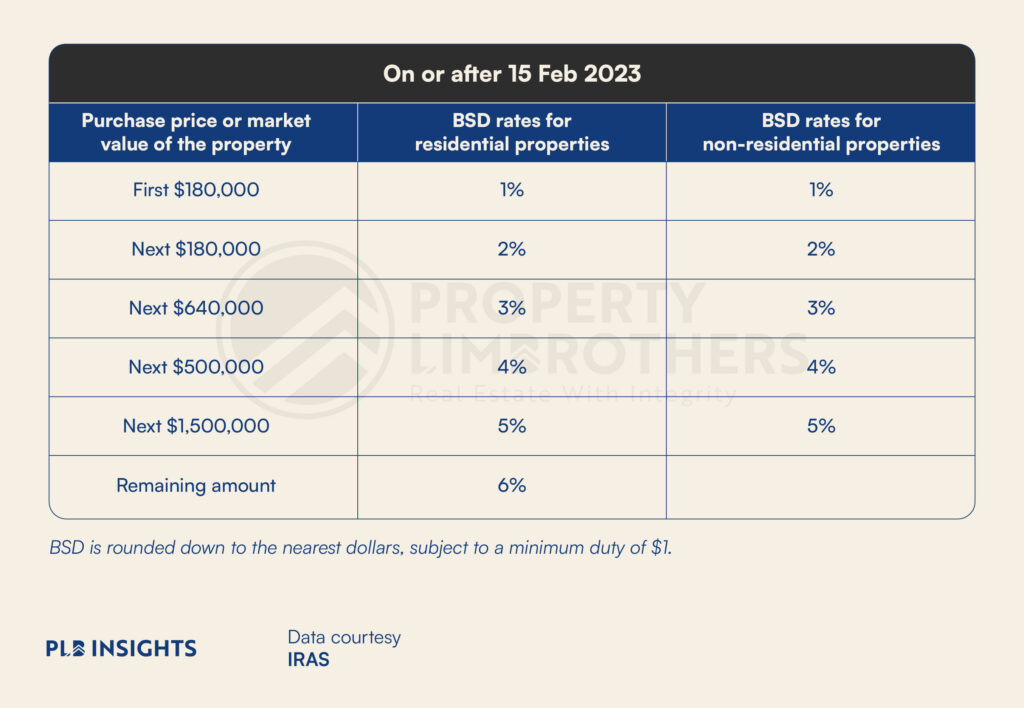

Buyer’s Stamp Duty (BSD) is a type of tax imposed on all residential, commercial and industrial property purchases in Singapore. This tax only applies to buyers, both Singaporeans and foreigners. Buyers of a property must pay the BSD within 2 weeks, or 14 days, of the date of the sale in full.

BSD rates are based on the purchase price or the market value of a property, depending on whichever is higher. So, let’s say you purchase a house that is valued at $4 million, but purchase it for slightly less at $3.5 million, the BSD rate will be calculated at $4 million as it is the higher amount.

Here are the BSD rates as of 15 February 2023:

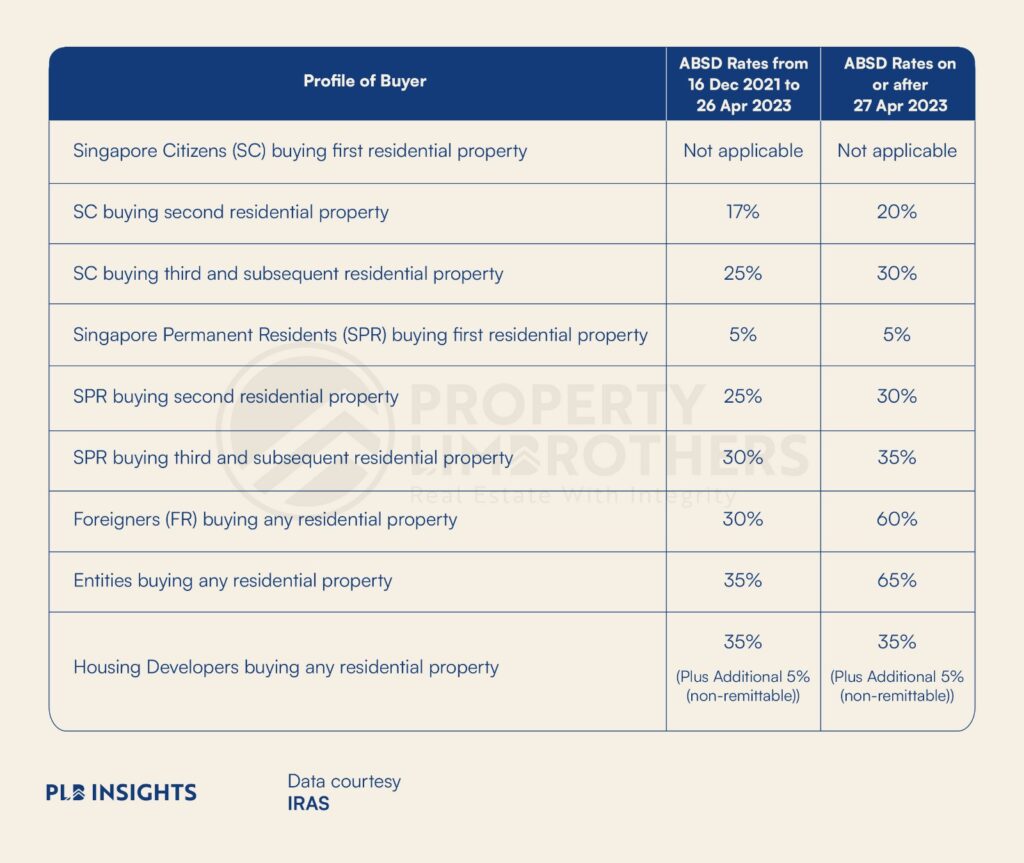

Additional Buyer’s Stamp Duty (ABSD)

Just like the name suggests, an Additional Buyer’s Stamp Duty (ABSD) is a tax that is imposed on top of the BSD on any additional residential properties an individual purchases. This is aimed at cooling the property market to ensure that more Singaporean citizens can have access to affordable housing and the opportunity to own property.

ABSD is applicable to buyers who meet certain criteria when purchasing property. This includes foreigners, being an entity rather than an individual and owning multiple properties.

Here are the current rates for ABSD as of 27 April 2023 in Singapore:

There are specific conditions and exemptions that may apply to certain individuals based on factors such as marriage, inheritance, or property transfers within families. For instance, individuals who have to downgrade from their current private residential property to an HDB resale flat are exempt from paying ABSD. Individuals who are in a contract to sell their current property before signing the Option to Purchase (OTP) for a new property are also exempt from the ABSD.

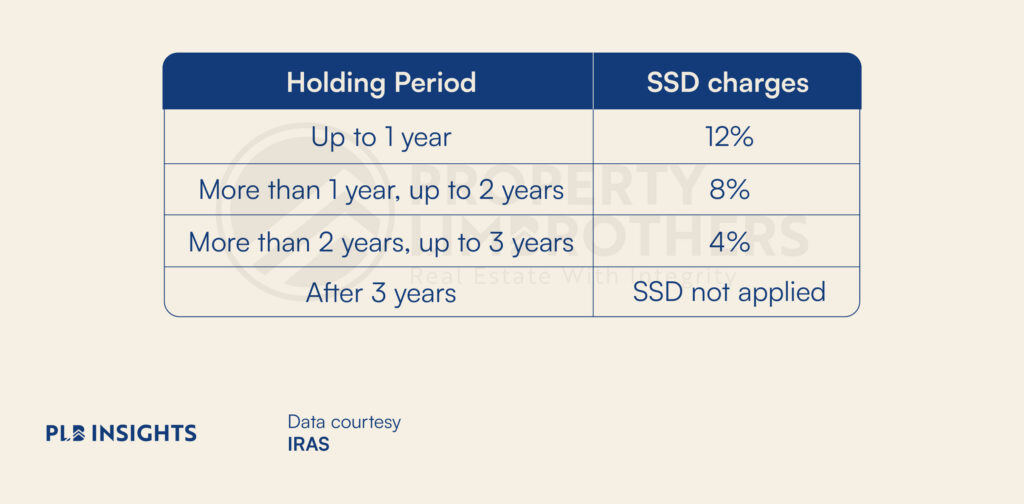

Seller’s Stamp Duty (SSD)

Seller’s Stamp Duty is a tax imposed on residential property that is sold within a three-year holding period. SSD is applicable to all residential properties including buildings, units in a development, and land.

SSD was introduced in Singapore in 2010 with the intention of discouraging citizens from flipping properties for profit and to keep the market stable. Moreover, this duty is applicable even if the property that is being sold was acquired through divorce, inheritance or transfers within the family.

SSD rates are also based on the property’s current market value or its selling price, whichever is higher.

Here are the SSD rates as stated by the IRAS:

There are also exemptions that may apply to certain sellers of property. Here is a list of sellers exempt from paying SSD.

Goods and Services Tax (GST)

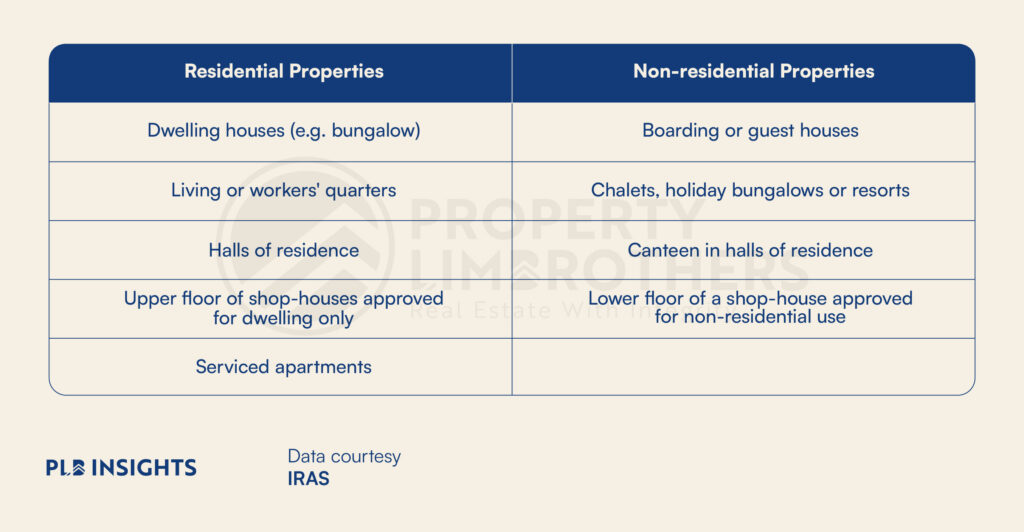

The Goods and Services Tax (GST) is a tax levied on the supply of all goods and services consumed in Singapore. The sale and lease of all non-residential properties in Singapore are subject to GST, which is currently 7%. Residential properties are exempt from GST. However, if the residential properties are furnished, GST must be charged on all the movable furniture and fittings in the house.

Any vacant land, building or flat made for the purpose of building a residential space and is approved for that purpose falls under the category of residential property and is exempt from the GST. Any property that does not fall under this definition is considered a non-residential property and will be subjected to the tax.

Here are some examples of what are considered Residential and Non-residential Properties according to the IRAS:

Land Betterment Charge (LBC)

Put in effect on 1 August 2022, the Land Betterment Charge (LBC) is a type of tax landowners are subject to if they plan to develop or enhance their property in ways that increase its value. Previously, developers had to pay three separate charges: a Development Charge (DC), a Differential Premium (DP), and a Temporary Development Levy (TDL). However, they are now included as one charge under the LBC, which is collected by the Singapore Land Authority (SLA).

LBC rates are calculated by taking the difference between the post-chargeable and pre-chargeable valuation. Moreover, The LBC rates are determined by the location and type of property and are revised every 6 months in consultation with the Inland Revenue Authority of Singapore (IRAS).

What is the Difference Between Owner-Occupied & Non-Owner-Occupied Property Taxes?

As their names suggest, owner-occupied properties and non-owner-occupied properties refer to those that are either occupied or not occupied by owners. Non-owner-occupied properties are typically either rented out or vacant.

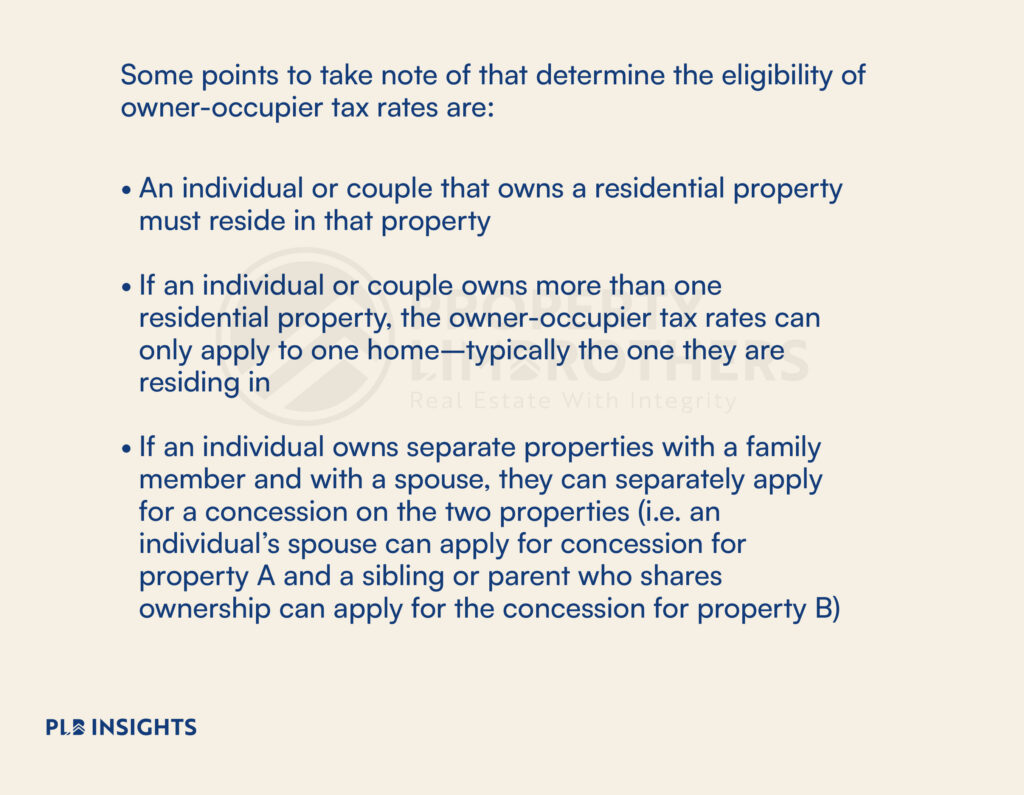

Owner-occupied and non-owner-occupied property taxes are different in terms of how they are calculated and applied when determining rates. In Singapore, owner-occupied residential properties are eligible for concessionary property tax rates known as owner-occupier tax rates. These rates are lower than the property taxes that non-owner-occupied properties are subject to and are implemented to encourage home ownership in Singapore. Additionally, these rates only apply to residential properties.

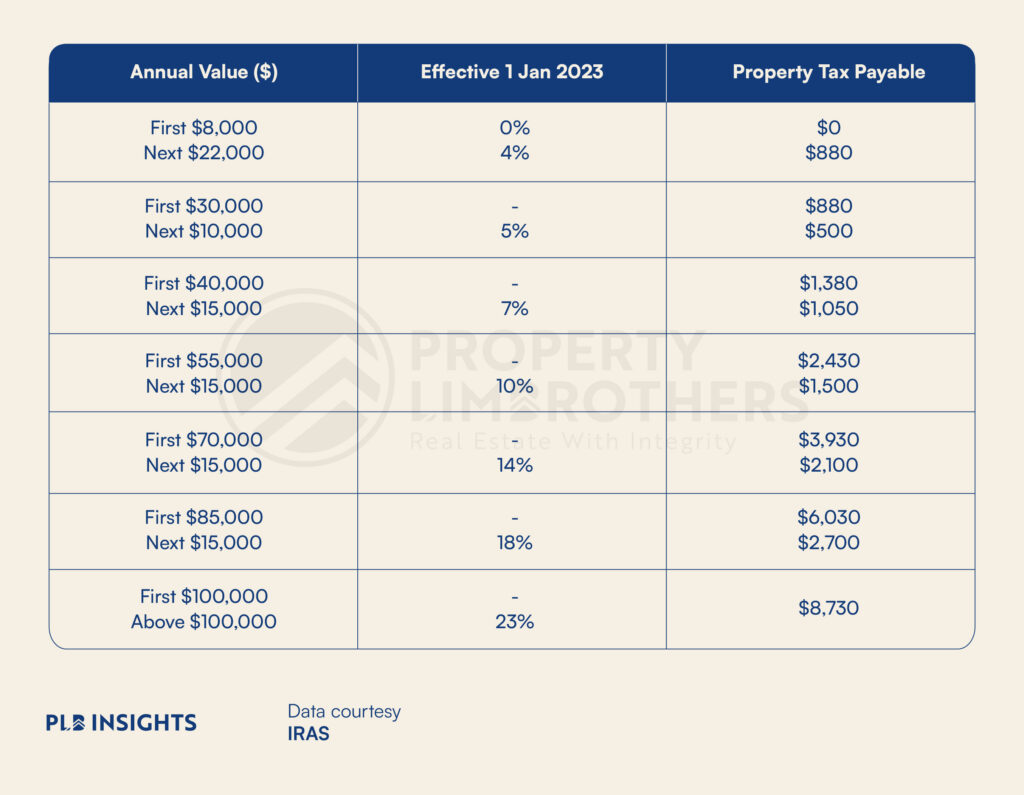

Owner-occupier Tax rates:

Non-owner-occupied tax rates are higher as property owners are not eligible to apply for concessions for their property. These properties are subject to the standard tax rates for residential properties in Singapore. Commercial and industrial properties (buildings and land), regardless of whether they are owner-occupied or non-owner-occupied, are taxed at 10% of the Annual Value.

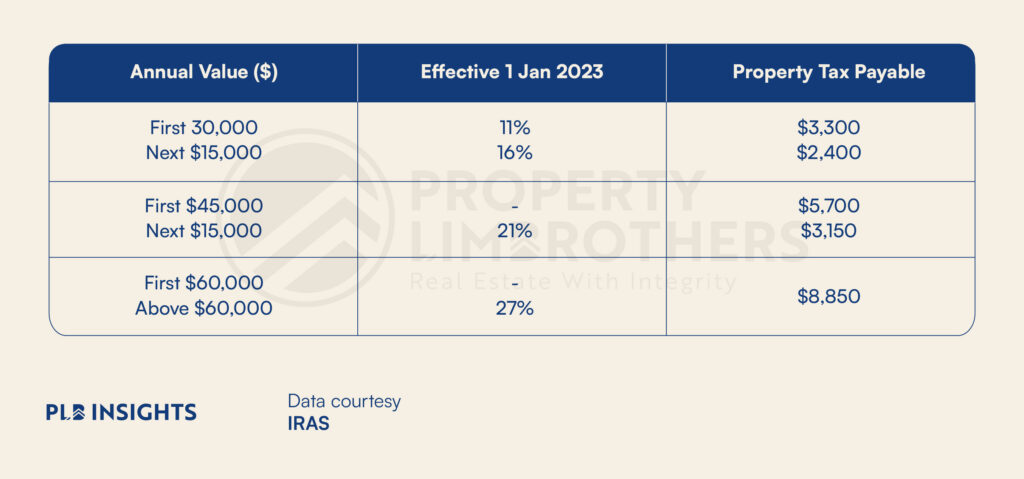

Non-owner-occupied Tax Rates:

Closing Thoughts

We hope this article has been an insightful one.

Property taxes in Singapore form an integral part of the real estate landscape. They are designed to promote affordability for all citizens, regulate the market, and discourage property speculation. As the various property taxes and duties play an essential role in maintaining the market’s stability and sustainability, it is necessary for buyers and sellers to have a thorough understanding of each type of duty and its implications.

Moreover, staying up-to-date with any changes in tax rates and deadlines, and identifying which concessions and exemptions apply to individuals can ensure that the annual process of fulfilling tax obligations can be as smooth and hassle-free as possible for everyone.

If you have any questions or concerns about your property purchases or are looking to work with professionals who can offer you guidance and assistance on every step of your real estate journey, feel free to contact us here.

In the meantime, stay updated on all things real estate here with PLB Insights.

See you in the next one!