Besides money, property inheritance is another big asset that could lead to fighting amongst family members – especially if there is no written will in place. A recent article in The Straits Times talks about how many Singaporeans buy properties in trust for their children “to ensure that their children will have a roof over their head and do not have to contend with the increasing prices of properties in future.” In theory, this is very forward-thinking on the part of the parents, but what happens when this backfires in the future?

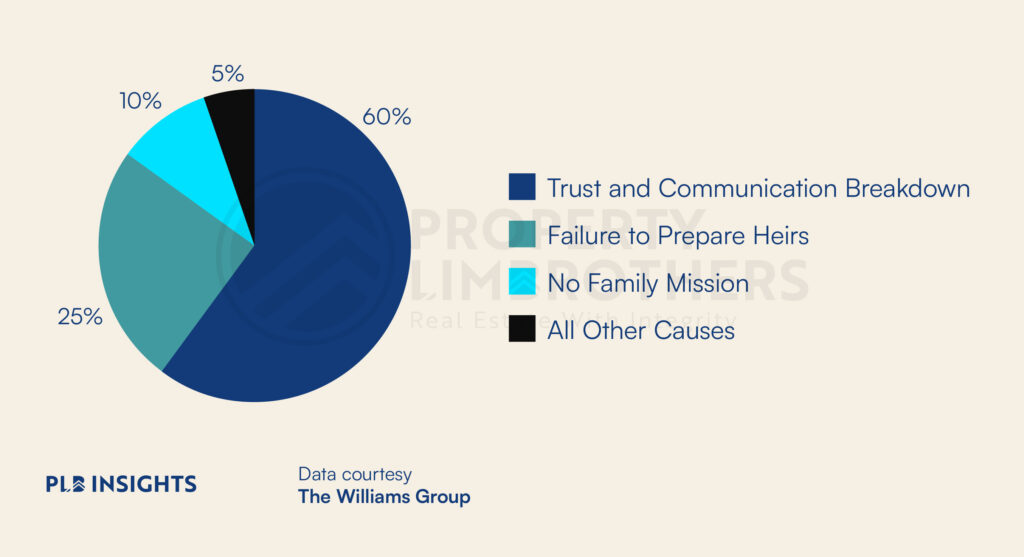

There is a Chinese saying that loosely translates to “Wealth does not last beyond three generations”, and there is even evidence to suggest that this may be factual. In a study conducted by The Williams Group, a family wealth consultancy, they found that seven in 10 families lose their fortune by the second generation. By the third generation, that number increases to 90% of families. What are some things we can consider before writing our wills and passing on properties as inheritance?

What to think about before leaving property as inheritance

Children leading the same lifestyle as their parents

In the 21st century, most affluent households stem from the parents’ wealth due to their own labour and decisions. For example, in the past, cooling measures such as the Additional Buyers’ Stamp Duty (ABSD) did not exist and they were able to accumulate wealth through multiple property investments. With that, they were able to provide for their children what they did not get in their own childhood and pamper them as they should.

However, the problem comes when their children are out of touch with reality and do not understand the work that comes with the money they are given. Seeing their parents spend lavishly on branded goods and services will inadvertently lead them to doing the same as this is all they have ever known. Should the children not hold a stable income of their own, they would be at risk of their property being liquidated. Should the property that is being passed down still have a mortgage to be paid off, will your children be able to afford to pay it? In the unfortunate case whereby they are not able to take on the loan due to their income status, they will have to liquidate the house.

Breakdown in Trust and Communication

In the same study by The William Group as quoted above, they reported that the major factor that causes families to lose their wealth would be Trust and Communication breakdown – accounting for 60% of families who did not retain their wealth by the third generation in the study.

In another Straits Times article, a couple overpaid for a real estate asset to secure a steady cash flow of US$1 million per annum. This would go towards their two children and give them a financial safety net for life. However, both of their children chose to live and work abroad and did not want to oversee this asset in the USA. As a result, the parents sold the house at a loss of more than US$50 million instead. When there is a disconnect between expectations from parents and children, cases like these illustrate the unfortunate outcome which could create rift within the family.

In a Singaporean context, let’s say you have left your HDB flat to your children and they have also bought their own flat. Singapore forbids anyone from owning more than one HDB flat, hence either their flat or the one that they have inherited needs to be sold. While some families want to keep a family house as “tradition”, some children may not subscribe to that thinking and have internal strife with other relatives over managing the flat they are left with.

On the other hand, if you own a HDB flat and inherit a private property, you will have to sell the private property if your HDB has not fulfilled its MOP. If it has, you can keep both properties. However, the catch is that you and your family need to live in the HDB while the private property could be potentially rented out as an alternative. Is the point of leaving a private property to your children for them to live in a condominium and have a better quality of life or for them to capitalise on rental earnings? Without clear expectations set with your children, this could result in a headache for them after inheriting this property.

How to Equip Children to Handle Their Inheritance

Teach them the skills to succeed in life

As the old saying goes, “Give a man a fish and he will eat for a day. Teach a man how to fish and he will eat for life.” Just allotting a sum of money to your children without any context will be a disservice to them. It could potentially distort their perspective in life, just waiting for the inheritance to befall them, and prevent them from creating their own path in life. Therefore, equipping your children with the right values and skills to succeed with their own effort is key to preparing them for life. Inheritance should be viewed as a safety net or boost and not a source of income.

Have transparent discussions about finances

Older generations may find it taboo to talk about sensitive topics, including finances. However, doing so only enforces the idea that money is something to be scared of, leading to failure to properly account for it. Hence, educating your children on the family’s financial situation and how to handle their own money helps them to build a healthy financial intelligence (FQ). In the future, they will be able to manage and sustain their financial wealth by understanding how money works.

Start talking about inheritance early

An example of doing so can be illustrated by this case study. A mother who wanted to ensure her three young children to understand how their inheritance will be used in future. One child mentioned that they read a story on the lack of clean habitats for turtles, this spurred the mother to reach out to turtle rehabilitation centres which can be the philanthropic part of that child’s inheritance. At the end of the session, the child drew pictures of turtles and hung them in the playroom to serve as a reminder of their interests.

Having conversations about money does not need to be a formal session. In this example, the ideas of what the child cares about is factored into their inheritance in an engaging and simple manner which will follow them to adulthood.

Think about what kind of head start your children really need

Warren Buffett once said, “Leave the children enough so that they can do anything, but not enough that they can do nothing” which ties in to the next point. Inheritance can come in many forms and can benefit your heirs differently. It is important to consider their needs or pain points before jumping to write the will. Property can be a great gift for your children to raise their future family, especially with Singapore’s ever increasing housing prices. However, while there is no stamp duty payable for inherited properties, leaving properties to your children will increase their property count. And if they have plans to purchase their own property, they may incur ABSD. To avoid the ABSD and still go ahead with their plans, a possible option would be to sell off the inherited property. But depending on when the inherited property was purchased, they might incur the Seller’s Stamp Duty (SSD) when they sell the property, which will eat into their cash proceeds.

It might still be worth it to bite the bullet and pay the SSD, since monetary funds can help kick start an entrepreneurial child’s business ideas and give them more resources from the get go. After all, inheritance is a gift, and a gift should be crafted personally for the receiver.

Final Words

All in all, inheritance should be a tool for your children to further their growth and ease any financial worries in crucial stages of their life. In Singapore where the cost of owning a property is increasing annually, securing a future home for your children is arguably a wise investment and an effective hedge against economic downturns, as long as your children’s expectations are aligned with yours.

If you need advice on how to purchase an investment property for yourself or your children – reach out to us here and we will be more than happy to assist.