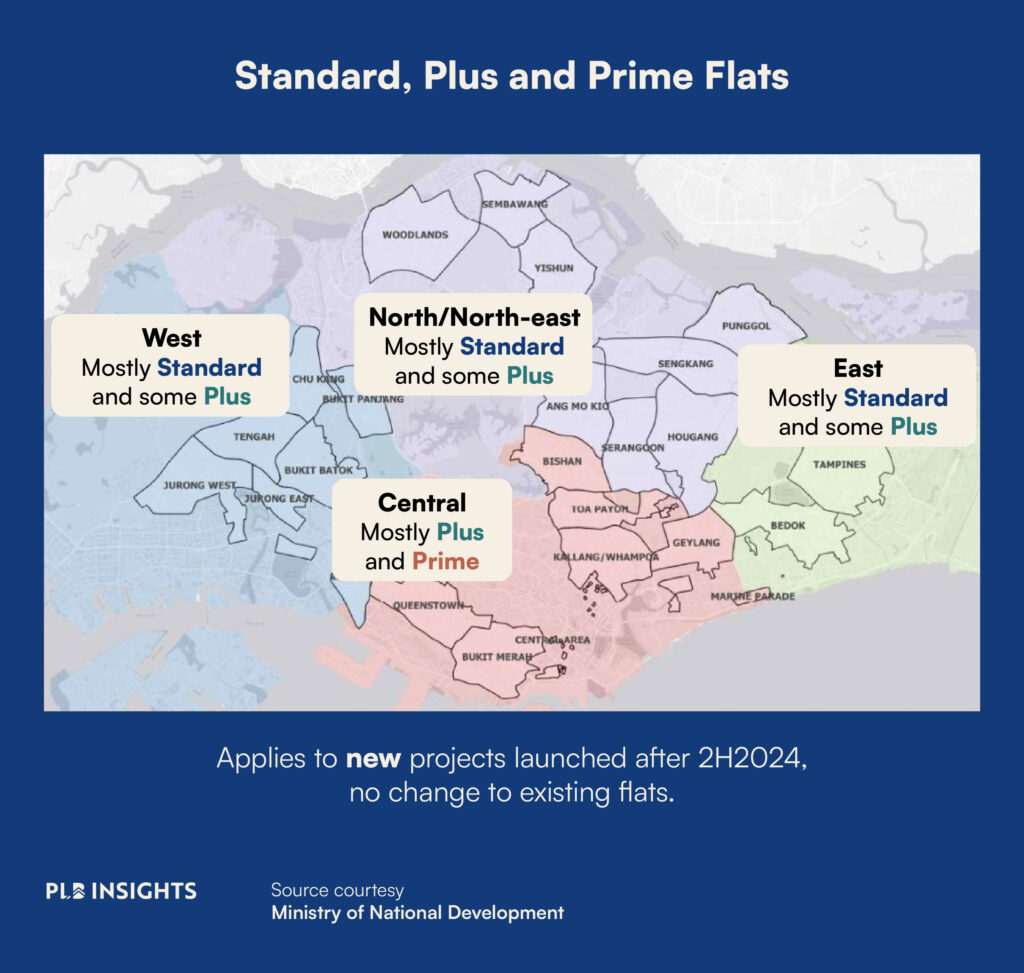

At this year’s National Day Rally speech, Prime Minister Lee Hsien Loong announced that HDB will soon do away with its “mature” and “non-mature” classification of BTO projects. In its place, a new classification framework of “Standard”, “Plus”, and “Prime” projects will be rolled out from the second half of 2024.

This change was not unprecedented or surprising, since the government had previously announced that the HDB classification framework was under review. As Singapore forges ahead with its decentralisation efforts such as the Punggol Digital District, Jurong Lake District, and Woodlands Regional Centre, the existing labels no longer accurately reflect the realities of today’s estates. Towns like Sengkang, Hougang, and Bukit Panjang that fall under non-mature estates are also much more developed than they were 10 to 20 years ago and can’t exactly be called non-mature.

With the new framework, future BTO projects will be classified based on its locational attributes, changing the way HDB prices and sells its flats. This is expected to send ripples across Singapore’s public housing market. In this article, we examine the potential impact of the new classification framework as well as reactions and market sentiments from the ground.

Plus Flats: More Subsidies, Stricter Restrictions on Choicer Locations

Under the new framework, Standard flats are regular flats with the least amount of subsidies and restrictions. These flats will have the standard 5-year Minimum Occupation Period (MOP), no income ceiling for resale buyers, and owners are able to rent out the unit fully upon fulfilling the MOP. Standard flats will make up the majority of flat supply.

Prime flats are those under the Prime Location Public Housing (PLH) model, typically located at the choicest location near the city centre. These flats come with the most subsidies and the strictest restrictions. Restrictions include a 10-year MOP, subsidy recovery for the first owner upon resale, and full BTO eligibility conditions such as an income ceiling of $14,000.

Plus flats, a new category of flats introduced at this year’s NDR, will be those located at choicer locations near MRT stations or town centres. They will come with more subsidies and stricter restrictions. A day after the NDR, Minister for National Development Desmond Lee announced the resale restrictions for Plus flats. These include a 10 -year MOP, a 30-month wait-out period for private property owners, and a $14,000 income ceiling for resale buyers (both families and singles). Only Singaporeans will be able to buy Plus flats on the resale market. Additionally, owners will not be able to rent out the entire flat (even after MOP) and the first owner will be subject to a subsidy recovery upon resale.

Under this new framework, singles will also be allowed to purchase a new 2-room Flexi flat across all categories. For resale flats, singles will be able to buy any size Standard and Plus flats (except 3Gen flats) in any location, as well as 2-room Prime Flexi flats. The eligible age and the income ceiling remains unchanged at 35 years old and $7,000.

With this new framework to classify future BTO projects, what could be some of the potential implications on the public housing market?

1. Reframe BTO flats as homes instead of investments

The introduction of the PLH model in 2021 was part of the government’s efforts to reduce the “lottery effect” in the BTO system, mitigating potential windfall gains in projects with strong locational attributes. It worked to taper demand for BTO projects in prime locations such as Queenstown, Bukit Merah, and Kallang/Whampoa, ensuring that those who apply for these flats are purchasing for their own long-term stay rather than to flip it for profits.

In fact, in the past few launches, more aspiring homeowners have gone for projects with extremely strong locational attributes but did not fall under the PLH model. One example is Central Weave at Ang Mo Kio, which saw 17 applicants vying for each available unit. Such projects that are located near the town centre often outperform those in the outskirts of the same town, in terms of application rates at the BTO application phase.

As such, the government introduced Plus flats, a new category for these projects in order to further taper the demand and reposition HDB flats as homes instead of investments. This solves HDB’s dilemma between having to mitigate the lottery effect and ensuring a good social mix, while keeping the system fair for Singaporeans of all income groups.

Many attribute the current high resale prices of newly-MOP flats to owner-investors who buy a BTO flat with the intent to upgrade after five years. With the new Plus and Prime flats, house-flipping will be further discouraged as upgraders will not risk the long waiting time of 14 years (4 years for the construction on top of the 10-year MOP).

Once the framework is rolled out in the second half of 2024, we might be able to observe a shift in application pattern, perhaps favouring the Standard flats which do not come with tight restrictions. On a more macro level, it may even signal the end of an era as we depart from the traditional Singaporean route of asset progression from BTO to private property.

2. Buyers likely to turn to resale market, driving prices up

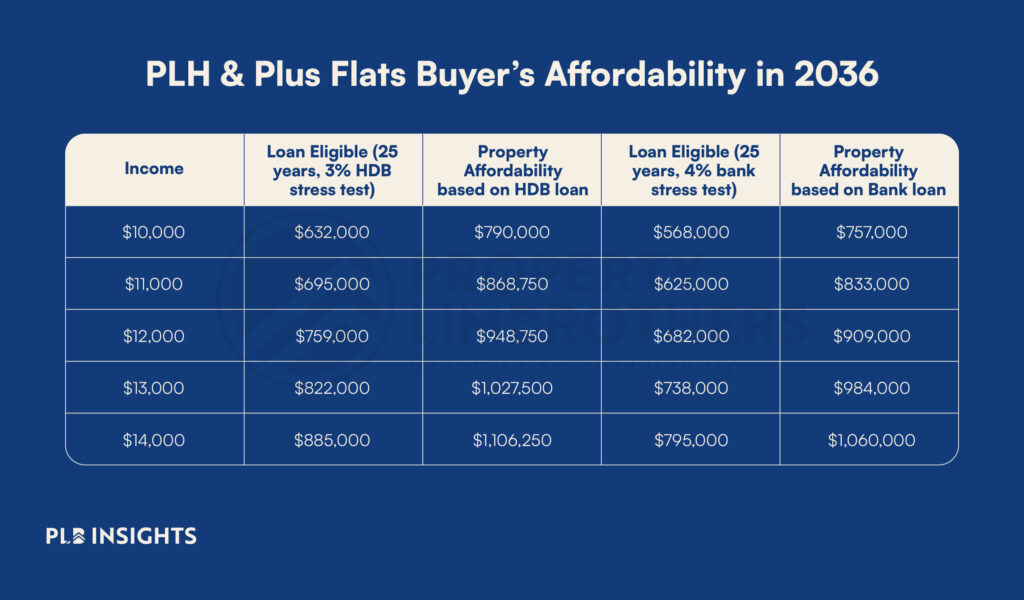

As mentioned earlier, the timeline for the resale of Plus and Prime flats will be around 14 years later. If we were to calculate using the income ceiling for Plus and Prime flats in the future, you will realise that based on the current Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR), buyers can qualify for flats with a quantum of around $1.1M if they take an HDB loan and around $1M if they opt for a bank loan. After taking into account inflation over the years, the pool of buyers for these flats will be limited. Not to mention that there will be a subsidy clawback upon resale. This means that the cash proceeds will likely be around the same as Standard flats – the only difference being the resale timeline, meaning how soon you can resell the flat.

The new framework sends a very clear signal for homeowners to only pick Plus and Prime flats if they have no plans to sell immediately and plan to stay long-term. Those who aspire to sell their flat upon MOP and upgrade to a bigger flat or private property should either go for Standard flats or the resale market.

Given that the reclassification is retrospective, meaning that it will only affect projects that will be launching after 2H 2024, projects that should have fallen under the new Plus model (such as Central Weave at Ang Mo Kio that PM Lee cited as an example) will not be slapped with the tight restrictions. This will likely increase the demand for the existing stock of flats in such projects with strong locational attributes. Since the government has also increased the amount of grants recently for resale buyers, resale flats will become an even more attractive option. In the near-term, prices may rise in tandem with the surge in demand for resale flats near MRT stations and town centres.

3. Main woes of singles remain unaddressed

Singles will have a wider range of housing options after the new framework rolls out. Although this is a step in the right direction for singles who want their own space, many that we have spoken to say that the reclassification barely moves the needle and lament the limited benefits of this new framework.

Currently, singles are only eligible to buy a new or resale flat if they are 35 years of age or older. Because of the nature of BTOs, a 35-year-old single that successfully applies for a flat (assuming it takes a couple of tries) will likely only collect their keys when they are in their 40s. That is a long time to wait for singles who have already been trying to get their own place and move out since their late 20s.

We could also argue that they can go for private property to avoid the long waiting time. But that’s an oxymoron, because if they could afford private property, they would not even need to wait until they are 35 years old.

But what about resale flats?

The plight of some singles is the fact that they exceed the $7,000 income ceiling but are priced out of the resale market (in central locations and for larger unit types) since they get lower subsidies. If they are not able to apply for a BTO and are unable to afford a resale flat, it leaves them with no other choice than to rent for an extended period of time – which is extremely costly with a hot rental market and increasing rents.

While there might be an uptick in application of 2-room Plus and Prime flats once the new framework is implemented as singles switch from resale options to BTO, the numbers will not be significant enough to have any adverse effect on the resale market.

Many continue to petition for further relaxing of the policy to allow singles to purchase bigger unit types like 3-room BTO flats in any location as well as to lower the age eligibility. As the number of singles is expected to grow, a larger supply of 2-room flats or other forms of housing may also be needed to meet the demand. However, this might not be an easy task for policymakers as couples and families remain the priority for public housing, and they have to strike a balance between addressing demand and the supply limitations driven by land scarcity.

Closing Thoughts

Overall, the new classification framework helps HDB distinguish homebuyers purchasing a flat for own-stay purposes and those who are focusing on asset progression. We think that this is a smart move by the government to distribute the focus of first-time homebuyers and strike a healthy balance between mitigating the lottery effect, achieving good social mix, and keeping the system fair while meeting the demand and needs of homebuyers.

However, the ripple effect of the new framework remains to be seen. How exactly is HDB going to define Plus flats? What will the situation be like when the first batch of PLH flats reaches MOP? Should you go for a BTO or resale now? If you have more burning questions like these, join us at our upcoming webinar, where we will be discussing the new framework and its potential implications in the future.

Do also reach out to us here if you would like a personalised consultation to get a second opinion on your current options and how it will impact your property journey. See you in the next one.