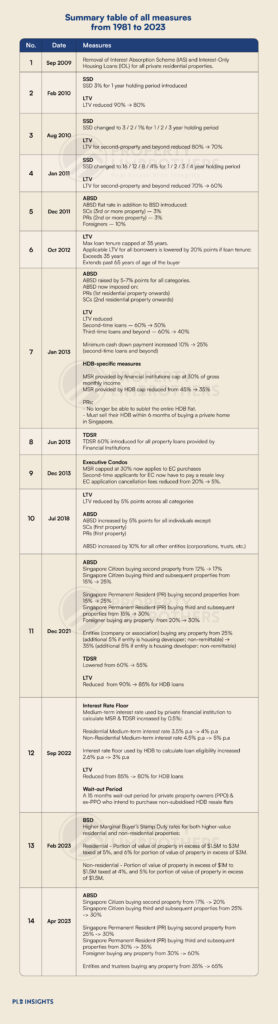

The landscape of property ownership has dramatically evolved from the time when affordability allowed investors to effortlessly acquire multiple private residences. As we navigate the current real estate landscape, it becomes increasingly evident that cooling measures stand as a formidable force driving the relentless surge in housing prices.

In an era where you can no longer find a 40-cent cup of kopi (coffee), a pressing question looms over prospective homebuyers: Will the dream of owning a private property in Singapore remain within reach?

Looking at Past vs Current Property Trends

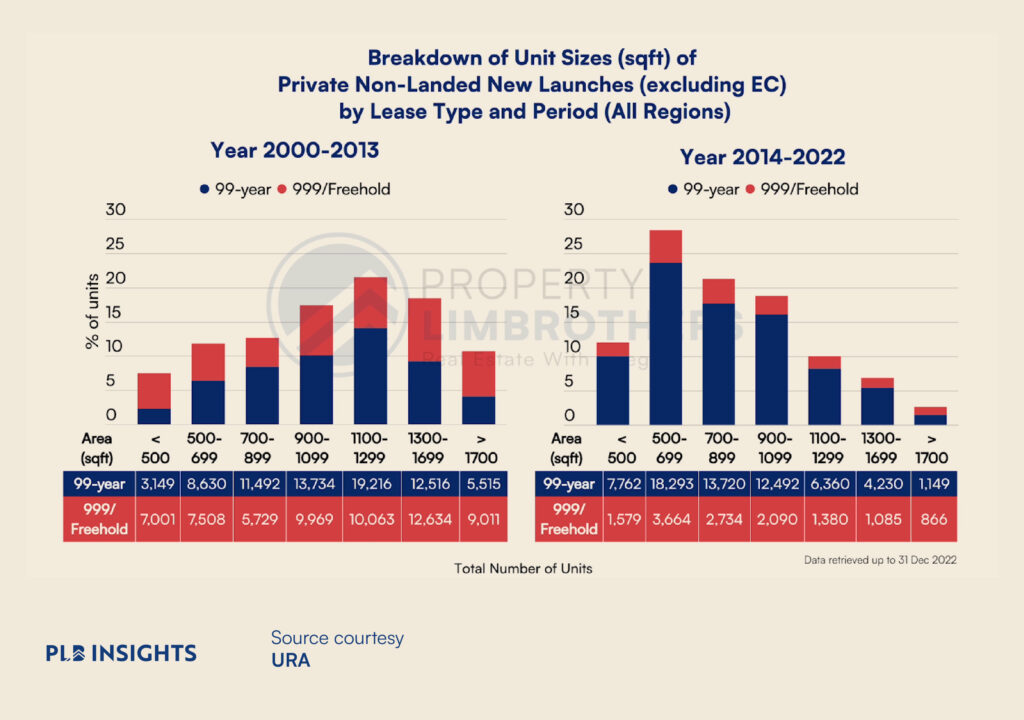

You might have heard that housing prices have been on the rise while unit sizes are shrinking – and it’s true.

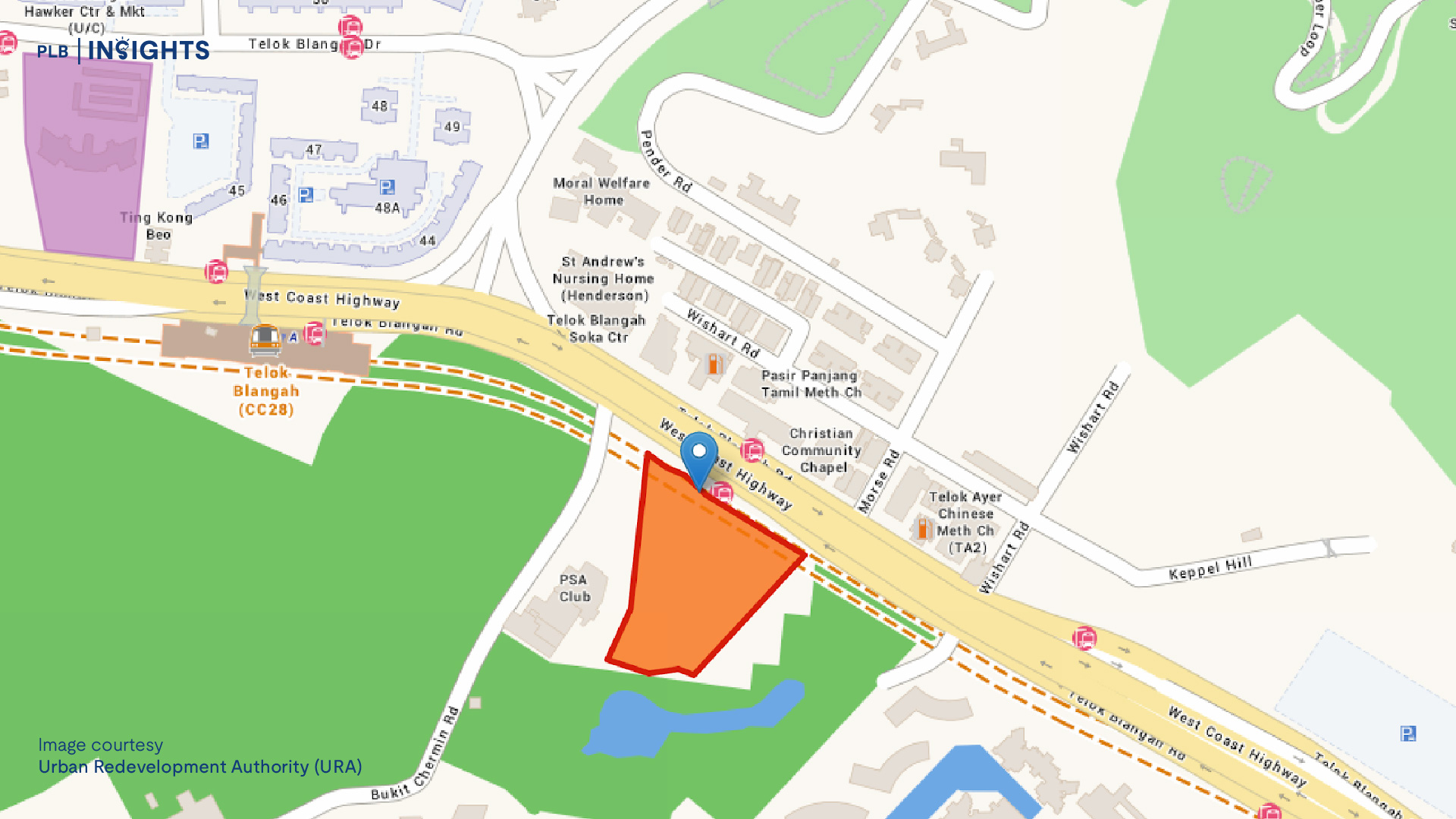

Based on the data we have gathered, developers have been putting out smaller units post-2013. 2013 marks the year when Total Debt Serving Ratio (TDSR) was first implemented. It dramatically affected the affordability of individuals since the amount they could loan from the banks got restricted. Since affordability was restricted, developers started building smaller homes in order to keep the price quantum palatable for the market. This is seen through the higher supply of smaller units from 2014 onwards and the more efficient layouts such as the removal of bay windows in most projects. Note that although the sizes are adjusted, the price PSF remains similar.

There has also been a shift towards more 99-year leasehold units compared to freehold projects. This is likely because freehold launches usually come from en bloc sales, leading to fewer units. Conversely, 99-year leaseholds new launches frequently come from Government Land Sales (GLS) – a regularly released resource, leading to a higher availability of leasehold units.

Calculating Affordability

The majority, if not all, property buyers opt for loans when acquiring new properties. However, the extent of your loan eligibility isn’t solely determined by the previously mentioned TDSR. Additional factors that come into play include the Mortgage Servicing Ratio (MSR) and Loan-to-Value (LTV) ratio. It’s important to note that MSR primarily impacts loans for Housing and Development Board (HDB) flats and Executive Condominiums (ECs).

Consider reading this article to learn about factors to consider when estimating your realistic monthly instalment. At the time of writing, MSR is capped at 30% and TDSR at 55%. A useful tool to aid your financial calculations will definitely be online MSR/TDSR calculators.

A Summary of Cooling Measures

Acquiring multiple properties in the past was unquestionably a more viable practice. Here is a summary of the various cooling measures implemented over the years.

For more information about the latest cooling measures, do check out our previous articles on the Budget 2023 housing measures and the April 2023 ABSD hike.

Are Landed Properties inferior to Condominiums?

Have you come across the concept of the ‘Five Cs of Singapore’? This somewhat outdated ideal encapsulates the Singaporean Dream of possessing cash, a car, credit card, a condominium, and a country club membership.

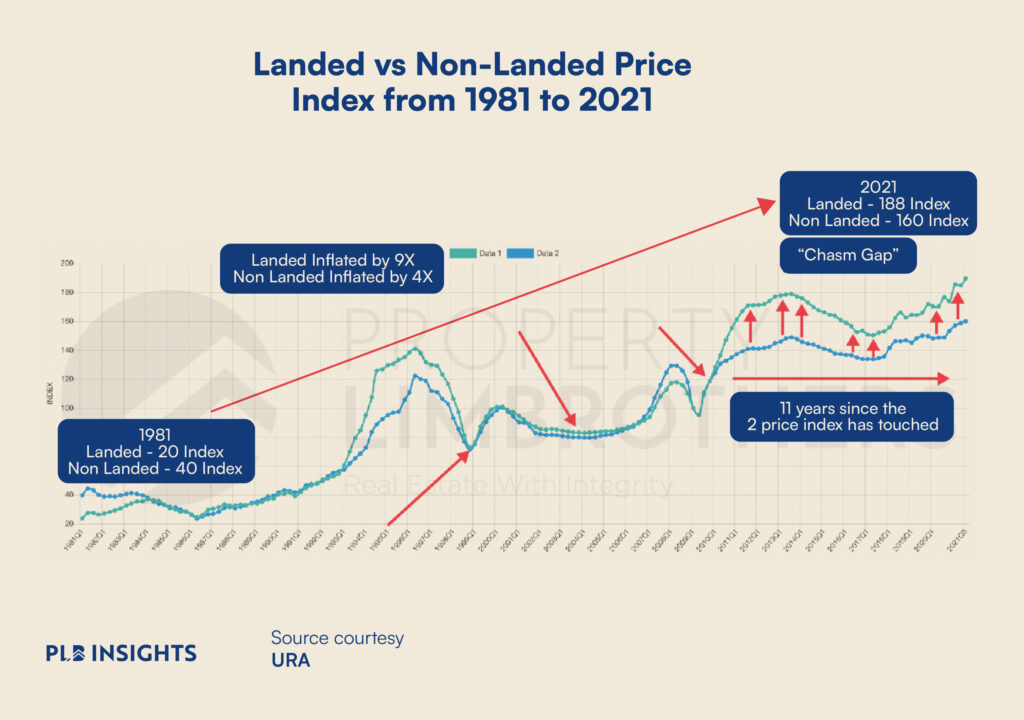

The pivotal year of 2010 stands out as a landmark occurrence, wherein the landed price index surpassed that of condominiums. This event marked a significant shift in perception, igniting thought-provoking questions into the hierarchy of desirability within the real estate landscape.

At the core of the escalating affluence surrounding landed properties lies the key factor of restricted supply. The inherent scarcity of available land for landed housing fueled a substantial surge in their market value, rendering them an increasingly sought-after asset. In contrast, the abundance of condominium units introduces a distinctly different dynamic, shaping the ebb and flow of supply and demand, thereby influencing their relative allure.

Moving beyond considerations of supply, the contrasting nature of buyer demographics further amplifies the contrast between landed properties and condominiums. The exclusive nature of landed properties inherently limits their accessibility, catering to a select demographic with the financial capacity to navigate this premium market segment. In contrast, condominiums embrace a wider spectrum of potential buyers, capturing a broader market due to their varying price points and diversified amenities.

This juxtaposition reveals a distinct chasm gap that separates these two property types – a gap characterised not only by physical attributes but also by intricate economic and cultural influences.

This begs the question…

Will we be able to afford a Private Property in Singapore Anymore?

Let’s take a $2 million property as our benchmark and proceed to determine the requisite minimum household income/cash +CPF for a couple assuming:

- Both Singapore Citizens

- Both 35 years old

- First property purchase

- Both $800 monthly credit card debt each

- $900 monthly car loan repayments for one vehicle

- 30 year loan tenure

Given this context, the prospect of achieving the financial threshold required for this property becomes less promising, especially when considering the prevailing median gross individual income of $6.8k per month for the 35-44 age bracket, as reported by the Ministry of Manpower (MOM).

This notable income discrepancy of $7,000 underscores the considerable challenge of not only attaining the necessary loan capacity but also amassing the essential $575,000 in cash.

As prices continue their relentless climb, the prospects of future private property ownership seem increasingly intertwined with those who currently possess private properties. This ownership status positions them advantageously, as they sit atop assets that facilitate the accumulation of equity. This equity growth, in tandem with rising incomes, lays the foundation for potential upgrades to more valued properties within the real estate landscape.

Demographics also play a role in shaping this landscape. With nearly 1 in 5 Singaporeans aged 65 and older as of 2022, a scenario unfolds wherein a substantial number of current citizens or their heirs will inherit parental properties, potentially leading to subsequent sales. This anticipated phenomenon could introduce a new class of property buyers fueled by this “inheritance” capital, thereby influencing price dynamics, perhaps even prompting temporary fluctuations in HDB prices.

The intricacies of inheritance and property choices introduce a layer of complexity. When children inherit HDB properties while already owning one, a deliberation arises: they must decide between retaining their existing HDB unit or assuming their parents’ HDB property. Typically, the inclination leans towards selling the inherited HDB, especially if it has lesser tenure remaining. However, an exception emerges when the heir possesses a private property acquired before August 30th, 2010. In such cases, the heir can retain the inherited HDB, contingent on fulfilling the occupancy requirement.

Final Thoughts

In conclusion, the impending era of mass inheritance of HDBs promises to add a captivating dimension to the property landscape. Curiosity lingers about the government’s forthcoming policies to safeguard property prices and address leases nearing expiration. Undoubtedly, inheritance will grant a significant advantage to future property owners compared to those who begin anew.

While the allure of owning private properties carries prestige, it’s crucial to acknowledge Singapore’s thoughtfully planned public housing and infrastructure. Notably, HDB consistently enhances their new developments with upgraded designs and layouts.

Whether you are considering whether you should move to a private property or purchase one for investment purposes, feel free to contact our experienced consultants who can guide you through the process. Till next time!