Landed homes have always captured the eyes of Singaporeans and are coveted by foreign investors. These landed homes typically refer to semi-detached, detached, terraces, and good class bungalows. This special segment in Singapore’s property market has taken the headlines over and over again with news on how Good Class Bungalows (GCBs) are transacted among high fliers. The prestige and luxury associated with these properties make them an exciting category to follow and watch.

In this opinion piece, we take a look at how landed properties perform across Singapore. We take a closer look across different districts in Singapore to give insight into which areas might be of interest for landed property investors and new entrants looking to finally buy their first landed home. We will broadly cover 3 categories in this article, the freehold “pure” landed properties, leasehold “pure” landed properties, and strata landed properties. We compare these landed properties with a broad stroke analysis of their performance across different districts. In each category, we cover districts with high volume, appreciation potential, and lowest entry quantum.

Landed homes have always captured the eyes of Singaporeans and are coveted by foreign investors. These landed homes typically refer to semi-detached, detached, terraces, and good class bungalows. This special segment in Singapore’s property market has taken the headlines over and over again with news on how Good Class Bungalows (GCBs) are transacted among high fliers. The prestige and luxury associated with these properties make them an exciting category to follow and watch.

In this opinion piece, we take a look at how landed properties perform across Singapore. We take a closer look across different districts in Singapore to give insight into which areas might be of interest for landed property investors and new entrants looking to finally buy their first landed home. We will broadly cover 3 categories in this article, the freehold “pure” landed properties, leasehold “pure” landed properties, and strata landed properties. We compare these landed properties with a broad stroke analysis of their performance across different districts. In each category, we cover districts with high volume, appreciation potential, and lowest entry quantum.

Freehold Pure Landed Performance

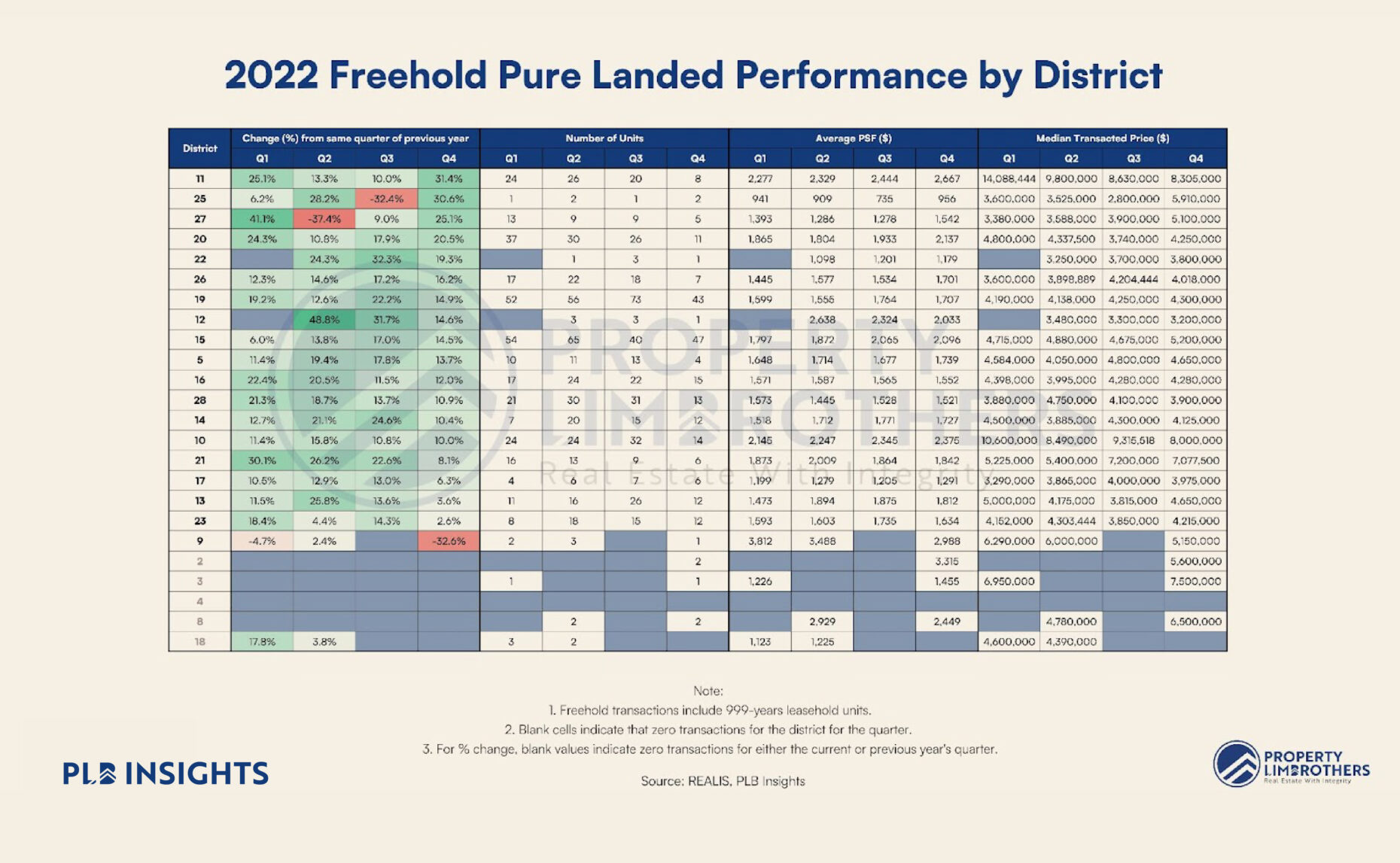

Freehold pure landed properties are a highly sought-after type of real estate in Singapore, known for their exclusivity, privacy, and spacious living. These properties are unique in that they are houses that sit on a piece of land that is solely owned by the homeowner, giving them complete control over their property. Unlike leasehold properties, which are owned by the government and subject to time-based restrictions, freehold properties can be passed down from generation to generation, providing a sense of security and stability for homeowners. Generally, freehold landed properties are a good store of value for two reasons. First, the supply of landed housing is substantially less than other forms of private property (like condos). Second, the freehold nature will help guard the asset value against lease decay. These two core reasons make freehold landed properties a highly desirable type of property. With the limited supply in the freehold landed category, many expect these properties to be a great store of value through rain and shine in the economy. Executing a generalisable analysis of landed properties is tough. Because each landed home is often unique in terms of its condition, location, layout, and more, what is considered “fair” value for the property will vary greatly depending on who is looking at the property. In our analysis, we examine the quarterly performance of landed properties in 2022 against the same quarter of the previous year (2021). We use the quarterly basis as a basis for comparison because landed properties have lower volume of transactions than condos and higher volatility as a result. High volume districts in the freehold pure landed category are District 19 (Serangoon Garden, Hougang, Punggol) and District 15 (Katong, Joo Chiat, Amber Road). These districts are of interest because high volume matters in a property category that is already known for its lower number of transactions. The volume helps prices to move and helps provide more timely updates from the market on the demand for landed properties in the area. District 19 averaged 56 transactions per quarter, while District 15 averaged around 51 transactions per quarter. The high transaction volume is correlated to the higher concentration of landed housing supply. The higher supply in these districts also means that buyers have more unique options to choose from. Despite the high volume of transactions, the median quantum and average PSF are still reasonable.

Prospective landed property owners often wonder about the appreciation potential of their investment. Based on the 2022 Q4 year-on-year return, District 11, which encompasses areas like Watten Estate, Novena, and Thomson, has seen the highest capital appreciation at 31.4%. However, it’s important to note that prices in this district have already risen significantly. Purchasing a landed home with intentions to chase high returns might not be a holistic way to look at the investment decision.

It’s crucial to have a comprehensive understanding of the factors that drive the price of landed properties and to assess whether there is strong potential for continued appreciation in the future. While there is always the possibility that prices will continue to rise, it’s worth considering that the individual characteristics of each landed property can play a significant role in its appreciation potential. By taking a strategic approach and working with knowledgeable real estate professionals, potential buyers can make informed decisions about the value and investment potential of a particular property.

When it comes to the lowest entry quantum for freehold pure landed properties in Singapore, two districts that stand out are District 22 (Jurong) and District 12 (Balestier, Toa Payoh, Serangoon). Both districts have a lower median price as compared to other landed properties in the city-state. District 22 has a median transaction price of $3,800,000 in 2022Q4, while District 12 has a median transaction price of $3,200,000 in the same period. However, it’s worth noting that the transaction volume for these two districts has been relatively low. This raises some concerns about whether the transactions are representative of the wider market for freehold pure landed properties in these areas. It is worth noting that District 22 has a much more palatable average PSF despite the moderately higher median quantum.

Overall, when one is deciding on a landed home, price performance is only one of the many factors to consider. Location, facing, condition, the larger estate, amenities, and more need to fall into perspective before making such a huge decision. That being said, we hope that our insights here will be helpful for people who are new to this market segment. Note that this analysis might not be generalisable at large, especially if the volume of transactions are much lower or if the landed properties in the area are diverse. We do not examine the type of landed property (semi-d, terrace, etc) in this article, but will do so in the future.

High volume districts in the freehold pure landed category are District 19 (Serangoon Garden, Hougang, Punggol) and District 15 (Katong, Joo Chiat, Amber Road). These districts are of interest because high volume matters in a property category that is already known for its lower number of transactions. The volume helps prices to move and helps provide more timely updates from the market on the demand for landed properties in the area. District 19 averaged 56 transactions per quarter, while District 15 averaged around 51 transactions per quarter. The high transaction volume is correlated to the higher concentration of landed housing supply. The higher supply in these districts also means that buyers have more unique options to choose from. Despite the high volume of transactions, the median quantum and average PSF are still reasonable.

Prospective landed property owners often wonder about the appreciation potential of their investment. Based on the 2022 Q4 year-on-year return, District 11, which encompasses areas like Watten Estate, Novena, and Thomson, has seen the highest capital appreciation at 31.4%. However, it’s important to note that prices in this district have already risen significantly. Purchasing a landed home with intentions to chase high returns might not be a holistic way to look at the investment decision.

It’s crucial to have a comprehensive understanding of the factors that drive the price of landed properties and to assess whether there is strong potential for continued appreciation in the future. While there is always the possibility that prices will continue to rise, it’s worth considering that the individual characteristics of each landed property can play a significant role in its appreciation potential. By taking a strategic approach and working with knowledgeable real estate professionals, potential buyers can make informed decisions about the value and investment potential of a particular property.

When it comes to the lowest entry quantum for freehold pure landed properties in Singapore, two districts that stand out are District 22 (Jurong) and District 12 (Balestier, Toa Payoh, Serangoon). Both districts have a lower median price as compared to other landed properties in the city-state. District 22 has a median transaction price of $3,800,000 in 2022Q4, while District 12 has a median transaction price of $3,200,000 in the same period. However, it’s worth noting that the transaction volume for these two districts has been relatively low. This raises some concerns about whether the transactions are representative of the wider market for freehold pure landed properties in these areas. It is worth noting that District 22 has a much more palatable average PSF despite the moderately higher median quantum.

Overall, when one is deciding on a landed home, price performance is only one of the many factors to consider. Location, facing, condition, the larger estate, amenities, and more need to fall into perspective before making such a huge decision. That being said, we hope that our insights here will be helpful for people who are new to this market segment. Note that this analysis might not be generalisable at large, especially if the volume of transactions are much lower or if the landed properties in the area are diverse. We do not examine the type of landed property (semi-d, terrace, etc) in this article, but will do so in the future.

Leasehold Pure Landed Performance

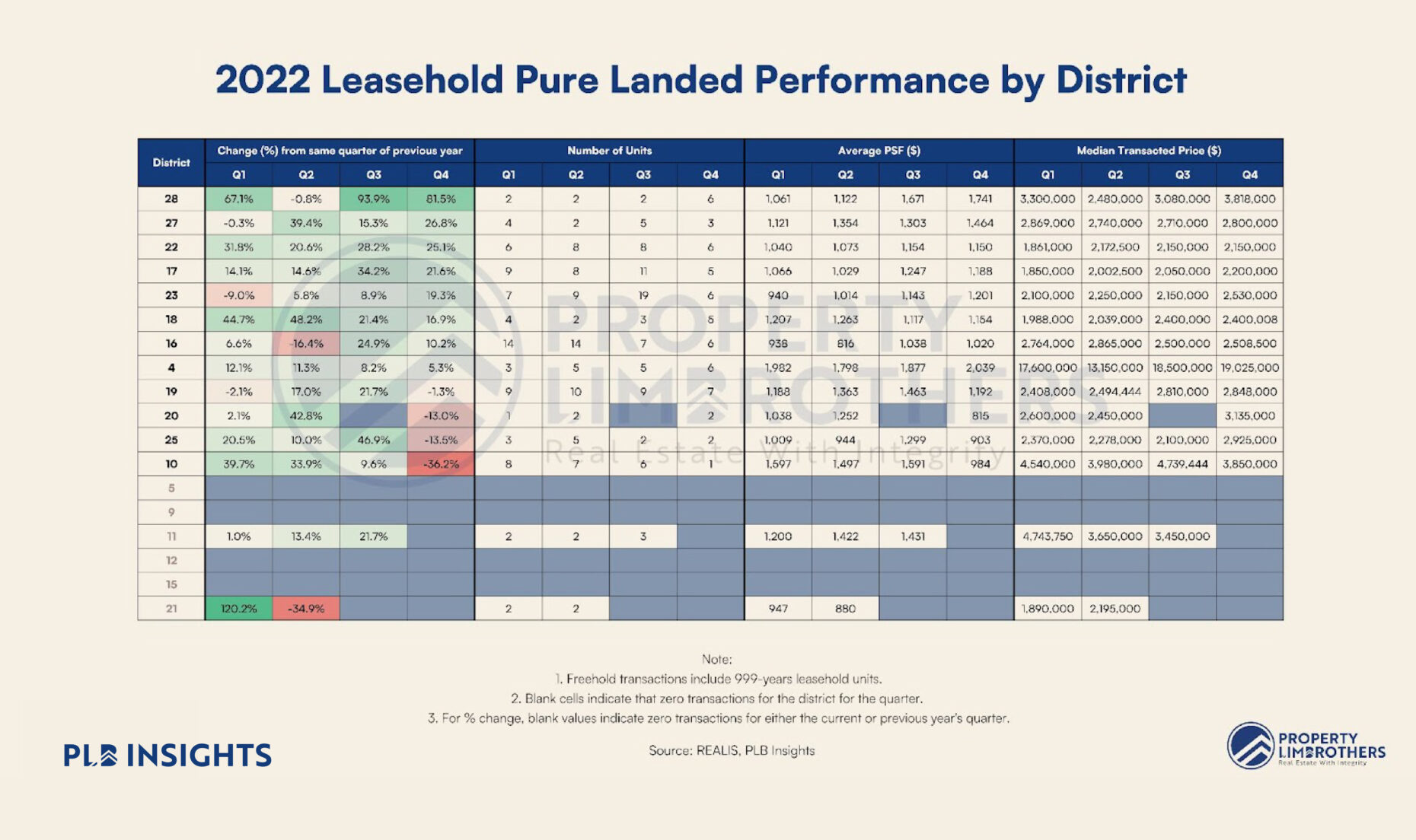

Leasehold pure landed properties are an interesting category. Typically, the market demand is strongest for freehold landed properties found in the Rest of Central Region (RCR). Knowing this, how do leasehold landed properties perform across the island? While some investors might consider the landed property as an asset for legacy, others may simply want to enjoy the asset for what it is and live the landed experience without paying the premium for the freehold status. Compared to freehold pure landed properties, which typically make up approximately 75% of landed homes, leasehold landed properties typically account for an estimated 14% of landed homes. Thus, when we talk about the leasehold pure landed properties in Singapore, we are actually referring to a smaller minority within the landed segment itself. As the supply of leasehold pure landed category is smaller compared to the freehold pure landed category, we also expect volume to be much lower. Two districts are of interest when we are looking at higher relative volume within the same category. District 23 (Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang) and District 16 (Bedok, Upper East Coast, Eastwood, Kew Drive) both have an average of around 10 transactions per quarter each.

While this is much lower compared to the freehold pure landed counterparts, it is considered high for the OCR area. Leasehold pure landed properties in District 23 have a much more palatable median quantum of $2,530,000 and an average PSF of $1,201 in 2022Q4. Likewise, District 16 has a median quantum of $2,508,500 and an average PSF of $1,020 in 2022Q4.

The fastest growing district in 2022 was District 28 (Seletar), with some quarters almost hitting 3 digit year-on-year growth. This district has climbed to a much higher median quantum at $3,818,000 in 2022Q4. While the volume in this district is modest, it has sported the highest growth in 2022Q4 of 81.5%. This unreal difference might be due to differences in the category of landed properties sold in 2022Q4 compared to 2021Q4, so it should be taken with a grain of salt.

District 22 (Jurong) is again of interest to us when it comes to the lowest entry quantum for this category. Interestingly, this district has a much higher volume for the leasehold category when compared with freehold. The median quantum for 2022Q4 sits at $2,150,000 and is accompanied by an average PSF of $1,150. This is approximately a third lower than the median quantum of the lowest priced district of the freehold pure landed category. Thus, from this point of view, we can see how some homebuyers may not choose to go for the freehold option when it may not matter as much to them.

As the supply of leasehold pure landed category is smaller compared to the freehold pure landed category, we also expect volume to be much lower. Two districts are of interest when we are looking at higher relative volume within the same category. District 23 (Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang) and District 16 (Bedok, Upper East Coast, Eastwood, Kew Drive) both have an average of around 10 transactions per quarter each.

While this is much lower compared to the freehold pure landed counterparts, it is considered high for the OCR area. Leasehold pure landed properties in District 23 have a much more palatable median quantum of $2,530,000 and an average PSF of $1,201 in 2022Q4. Likewise, District 16 has a median quantum of $2,508,500 and an average PSF of $1,020 in 2022Q4.

The fastest growing district in 2022 was District 28 (Seletar), with some quarters almost hitting 3 digit year-on-year growth. This district has climbed to a much higher median quantum at $3,818,000 in 2022Q4. While the volume in this district is modest, it has sported the highest growth in 2022Q4 of 81.5%. This unreal difference might be due to differences in the category of landed properties sold in 2022Q4 compared to 2021Q4, so it should be taken with a grain of salt.

District 22 (Jurong) is again of interest to us when it comes to the lowest entry quantum for this category. Interestingly, this district has a much higher volume for the leasehold category when compared with freehold. The median quantum for 2022Q4 sits at $2,150,000 and is accompanied by an average PSF of $1,150. This is approximately a third lower than the median quantum of the lowest priced district of the freehold pure landed category. Thus, from this point of view, we can see how some homebuyers may not choose to go for the freehold option when it may not matter as much to them.

Strata “Landed” Performance

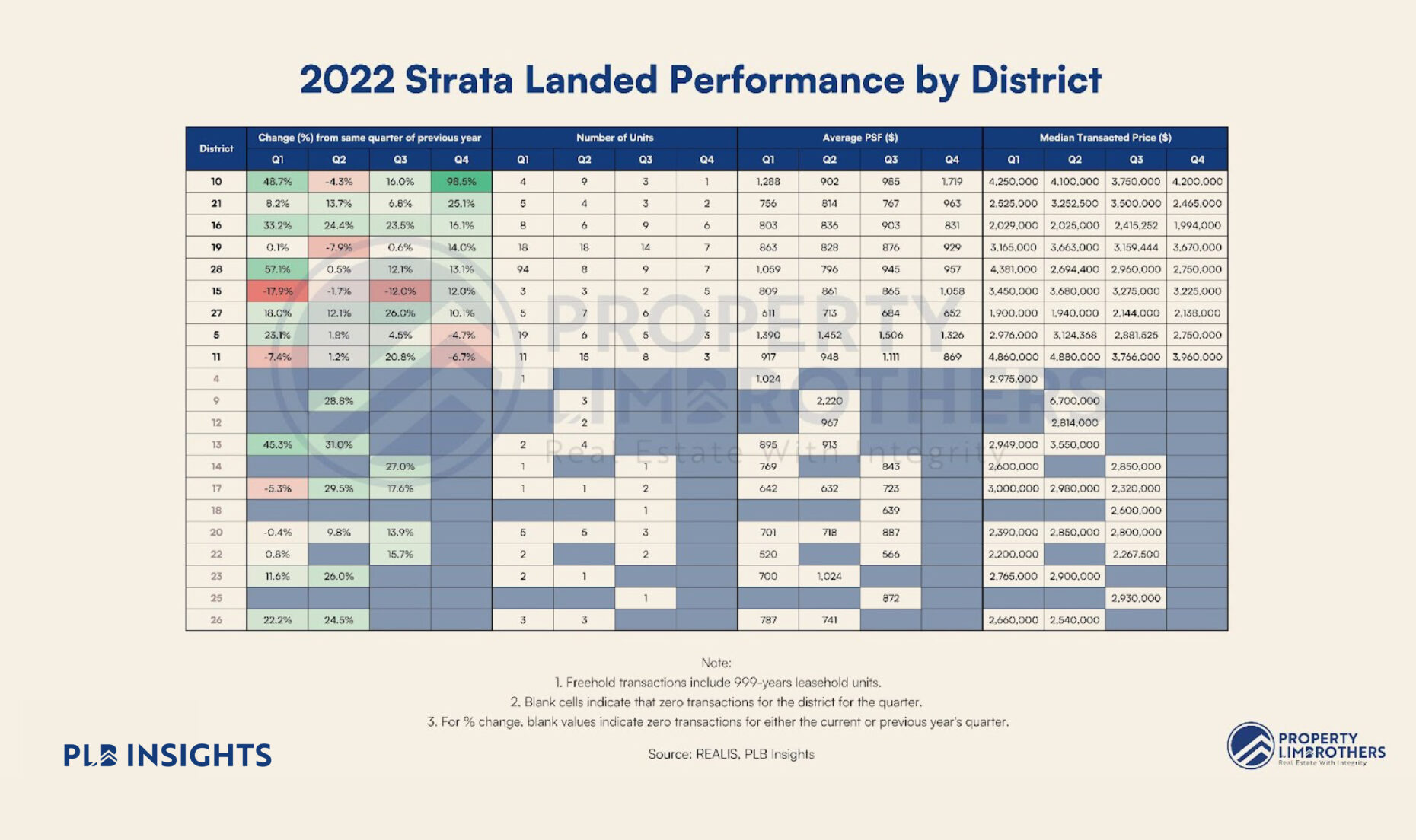

The final category we will explore would be the strata “landed” (also known as cluster homes). These are typically strata terraces, semi-detached and detached homes. Meaning that the owners do not own the land on which the house is built on. Typically, these homes are found in some condo or apartment complexes, offering homeowners a unique experience of having the best of the condo and landed worlds. This category is typically appealing because of the amenities that the condo complex could provide, as well as help with the maintenance. This category accounts for less than 12% of the landed homes. Due to the limited volume and for brevity’s sake, we will examine freehold and leasehold strata “landed” homes in unison. The analysis below lumps both freehold and leasehold strata landed properties together and see how they perform across different districts. The districts of interest when it comes to the volume of transactions are District 28 (Seletar) and District 19 (Serangoon Garden, Hougang, Punggol). We have generally seen these districts perform well in earlier sections. Seeing these districts pop up across the different categories might give investors and prospective homeowners added confidence in these particular districts. District 28 had an average of around 29 transactions per quarter, largely due to a huge sale in 2022Q1. On the other hand, District 19 had around 14 transactions per quarter.

In terms of appreciation potential, we highlight District 27 (Yishun, Sembawang) in this analysis primarily because of its lower average PSF ($652 PSF in 2022Q4) and palatable median quantum ($2,138,000). While this is an OCR heartlands option, the disparity effect might push up the value of the property if the strata landed segment continues to rise as a whole. The disparity effect is also a key concept that investors should use when exploring if their pure landed property has the potential to appreciate further in the future.

When it comes to the lowest entry quantum for the strata landed category, District 16 (Bedok, Upper East Coast, Eastwood, Kew Drive) takes the cake. In 2022Q4, the median quantum was $1,994,000 while the average PSF was $831. Given these attractive levels, some prospective buyers may be tempted by the opportunity to experience a landed home at an entry quantum that they previously would have thought to be much higher. That being said, prospective buyers would need to pay keen attention to the condo development when looking at strata landed homes in Singapore. We use tools such as our MOAT analysis to give us a holistic view of whether these condo developments do well on 10 different dimensions apart from the factor of price.

The districts of interest when it comes to the volume of transactions are District 28 (Seletar) and District 19 (Serangoon Garden, Hougang, Punggol). We have generally seen these districts perform well in earlier sections. Seeing these districts pop up across the different categories might give investors and prospective homeowners added confidence in these particular districts. District 28 had an average of around 29 transactions per quarter, largely due to a huge sale in 2022Q1. On the other hand, District 19 had around 14 transactions per quarter.

In terms of appreciation potential, we highlight District 27 (Yishun, Sembawang) in this analysis primarily because of its lower average PSF ($652 PSF in 2022Q4) and palatable median quantum ($2,138,000). While this is an OCR heartlands option, the disparity effect might push up the value of the property if the strata landed segment continues to rise as a whole. The disparity effect is also a key concept that investors should use when exploring if their pure landed property has the potential to appreciate further in the future.

When it comes to the lowest entry quantum for the strata landed category, District 16 (Bedok, Upper East Coast, Eastwood, Kew Drive) takes the cake. In 2022Q4, the median quantum was $1,994,000 while the average PSF was $831. Given these attractive levels, some prospective buyers may be tempted by the opportunity to experience a landed home at an entry quantum that they previously would have thought to be much higher. That being said, prospective buyers would need to pay keen attention to the condo development when looking at strata landed homes in Singapore. We use tools such as our MOAT analysis to give us a holistic view of whether these condo developments do well on 10 different dimensions apart from the factor of price.