Divorce is a complicated process that can be mentally, emotionally, and financially draining to navigate. On top of ending a marriage and relationship, you have to decide on custody and dividing of assets. And the largest asset to be divided between the two of you will likely be your property.

Who gets to keep the flat? If you sell it, how will the sale proceeds be split? Or do you have to surrender your flat to HDB?

In this article, we will explain the consequences of a divorce with regard to what happens to your HDB flat. Please keep in mind that this article is not a replacement for professional legal advice and is not intended to serve as such. To fully understand the specific steps and potential outcomes of your individual case, it is recommended that you consult with an experienced family lawyer.

How is the fate of the HDB flat decided?

The first question is whether the divorce is amicable or contested. This sets the tone for how the property settlement will be done. And of course, all these can only be set in motion after the divorce is finalised. Your decision regarding the HDB flat will be recorded in a court judgement during an ancillary matter hearing, so everything will be in black and white in case of disputes in the future.

Scenario 1: Both parties mutually agree on what happens to the HDB flat after divorce

For the first scenario, it is an amicable divorce settlement. Both of you are still open to negotiation and mediation, and are free to mutually agree on what to do with the flat. The next question to ask is whether the HDB flat has cleared its TOP and MOP.

If it has not cleared TOP, the flat will have to be surrendered to HDB together with any grants received, which also means you will be forfeiting any downpayment paid. If it has not cleared MOP, HDB will purchase the flat back from you at the prevailing compensation price, subject to their approval and valuation. And from there, you can mutually agree on how to split the compensation between the two of you.

If your flat has fulfilled both TOP and MOP, you have two options here.

(a) Transfer interest in flat

This allows one party to transfer their interest in the flat to the other party, allowing them to keep the flat. To be eligible to apply for a transfer, you need to pay back any loans and return any grants received from the government, such as HDB housing grants.

You also have to meet HDB’s eligibility conditions. To retain the HDB flat, you have to either: (i) have care and control of your children and the financial ability to take over the loan for the flat, or (ii) qualify for the Single Singapore Citizen Scheme (Singapore Citizen above the age of 35) if you have no children.

Once that is done, you can submit your application and necessary paperwork through My HDBpage. Your ex-spouse also needs to give their consent to the transfer through the same portal. For more details on the process, visit the HDB website.

(b) Selling the flat and splitting sale proceeds

The other alternative is to sell the flat and split the sale proceeds. The proportion of the split can be mutually agreed upon as well. This would be the more straightforward way to proceed with the splitting of assets.

Scenario 2: Contested divorce – Court decides what happens to the HDB flat after divorce

In the event of a contested divorce and you cannot agree on what should happen to the HDB flat, the court will step in to decide this on your behalf when dividing your matrimonial assets.

Your HDB flat is likely to be considered a matrimonial asset in the event of a divorce. According to the Women’s Charter, an asset is considered a matrimonial asset if it was acquired during the marriage by one or both parties, and is used for shelter, transportation, household purposes, education, recreation, or aesthetic purposes. Additionally, the asset must have been substantially improved during the marriage by one or both parties.

However, if the flat was acquired before the marriage through a gift or inheritance and was not substantially improved during the marriage, it will not be considered a matrimonial asset. Do note that there are some cases where it may be considered a matrimonial asset if your children or ex-spouse has stayed in the flat.

It’s also important to note that being married does not grant a spouse an interest in an HDB flat owned by the other spouse, unless it is considered a matrimonial asset under the Women’s Charter.

How will the court divide the HDB flat?

The court may order one spouse to transfer their interest in the flat to the other spouse, or order the flat to be sold with the proceeds divided between the parties in a certain proportion.

Division of matrimonial assets does not have to be equal. For instance, in cases where the marriage was short-lived, courts may choose to divide assets based on each party’s financial contributions towards the acquisition of the assets.

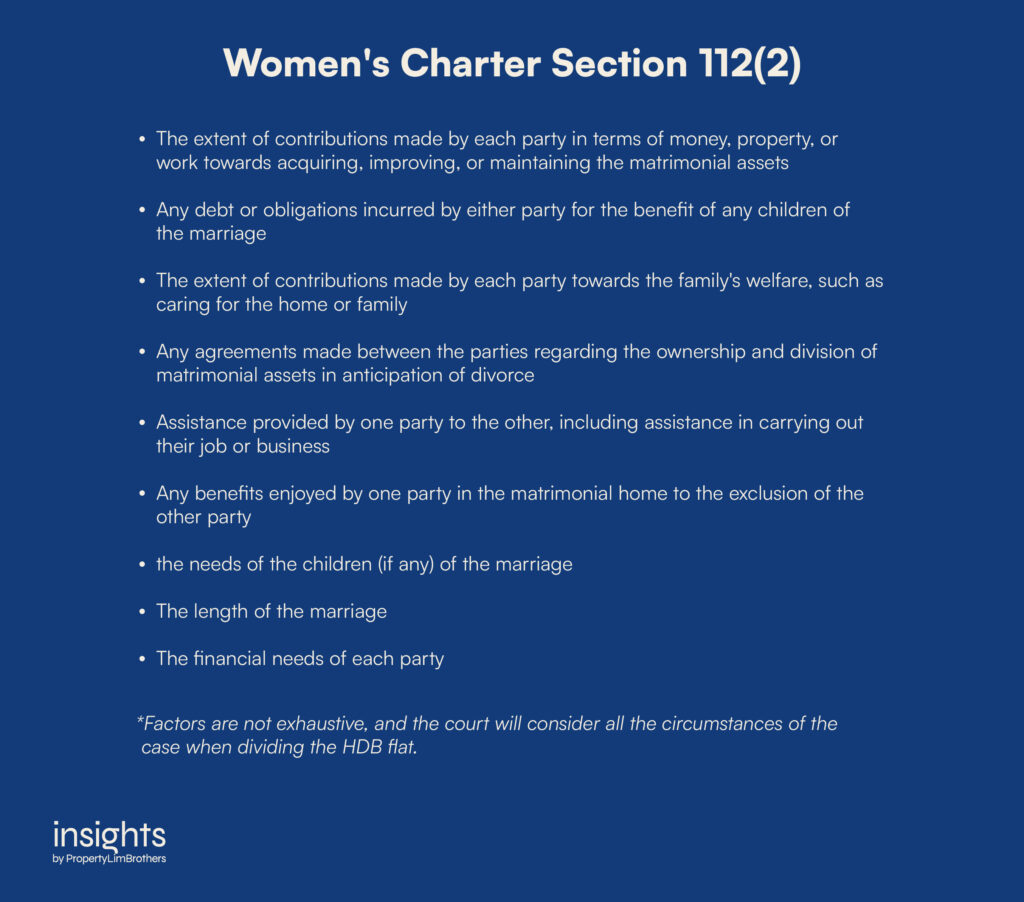

The court’s decision on the division of matrimonial assets is based on various factors as outlined in Section 112(2) of the Women’s Charter. These factors include:

It’s important to note that these factors are not exhaustive, and the court will consider all the circumstances of the case when dividing the HDB flat.

Can you buy a new HDB flat after divorce?

It depends. The most important factor is whether you had already enjoyed HDB housing subsidies when you bought your first home. If you did not take the grants when you bought your first home, you will retain your first-timer applicant status and will be eligible for CPF housing grants. Conversely, if you have gotten the grants before and plan to get subsidised housing again, you will be considered a second-timer in HDB’s eyes.

In the event that your matrimonial home is sold in the divorce, and you have custody of your children and need to buy or rent a new flat to live in, there are priority schemes and housing measures to assist divorcees with children.

Divorced parents can buy a new flat from HDB with their children and can qualify for the Assistance Scheme for Second-Timers (Divorced/Widowed Parents) (ASSIST) if they meet eligibility criteria such as citizenship and income ceiling. Under the scheme, 5% of 2-room Flexi and 3-room BTO flats in non-mature estates is set aside for this group of people. However, do take note that you can only qualify for the Enhanced CPF Housing Grant (EHG) if you are a first-timer. This means that if you have previously gotten grants and used them on your first home, you will likely not get any subsidies when buying a new flat, unless you have found new love and applied together with a first-timer. If you apply with a first-timer as a couple, your combined income will be assessed and the EHG (Singles) will be paid out to the first-timer.

Once you have successfully balloted for a new flat, if you have to rent while waiting for it to be completed, you can also apply for a temporary rental flat under the Parenthood Provisional Housing Scheme (PPHS).

Unfortunately, you will not be eligible to buy a new HDB flat if you have no children under your custody from the marriage, have previously received housing subsidies, and are applying alone as a single. You will only be able to buy from the resale market under the Single Scheme.

What happens to your home loan after divorce if you’re retaining the flat?

In the event that you have mutually agreed to retain the house or are granted a transfer of interest by the court, you will be required to get a new home loan since the flat is under single ownership now, unless the flat is already fully paid for.

If you opt for an HDB loan, you will have to enter into a new loan agreement with HDB after an assessment of your HDB Loan Eligibility (HLE). If you opt for a bank loan, you have to obtain an Approval-in-Principle (AIP) with a bank.

However, there are eligibility criteria to be met, such as the 30% Mortgage Servicing Ratio (MSR) and the 55% Total Debt Servicing Ratio (TDSR).

If you are unable to secure the full loan amount, you will have to take a smaller loan and make up the remaining balance with cash or funds from your CPF, which will be included in the downpayment.

Below is a scenario of what happens during a transfer of ownership after a divorce:

Do note that every case and situation is different, and HDB will assess the circumstances on a case by case basis. The above scenario might not accurately reflect the actual fees involved. For a clearer understanding, do seek professional advice and clarification from HDB and your lawyer directly.

Knowing the extent of your loan obligations before the finalisation of your divorce can assist you in making an informed decision on whether you are able to afford taking over the flat.

Closing Thoughts

Divorce is not easy to go through, and there is no good timing for it. Sometimes a marriage or relationship ends, and even though the legal proceedings and property settlement may seem cold, they are necessary steps to take before the healing begins.

If you’re a divorcee seeking property options, we understand that this can be a difficult and sensitive time for you. We want to assure you that you are not alone and that there are resources available to help you navigate this process. We encourage you to take the time to explore your options and seek the guidance of a professional who can help you make informed decisions about your future. Remember that you deserve to live in a home that brings you comfort and security, and we are here to help you make that a reality.