2022 was an interesting year for Singapore’s property market, to say the least. Despite global concerns and several rounds of interest rate hikes, home prices remained resilient and continued to climb to all-time highs, as highlighted in our recent Q3 report.

We also witnessed the rise in million-dollar resale HDB flats, which sparked ongoing debates regarding the affordability of homes under the public housing scheme. Additional cooling measures were timely introduced by the government at the end of September 2022 to address the situation. Although we may see some price corrections in the months following, these cooling measures might allow property prices and rentals to remain elevated while limiting market participation.

As the new year begins, we take this opportunity to look at last year’s star districts that recorded the highest growth. For this article, we will be taking into account all private residential (condo and landed) resale transactions. Let’s dive right into it.

Coming in at Number 5: District 16

District 16 is located on the eastern side of Singapore, mainly made up of the Upper East Coast area and the mature estate of Bedok. As one of the largest residential clusters in eastern Singapore, its proximity to Changi Airport and East Coast Park makes it a highly desirable area to live in for both locals and foreigners.

And among the districts we shortlisted for this article, District 16 had the highest volume of condo and landed transactions in 2022, recording a total of 837 transactions. 82% (693) were condo transactions and 18% (144) were landed transactions.

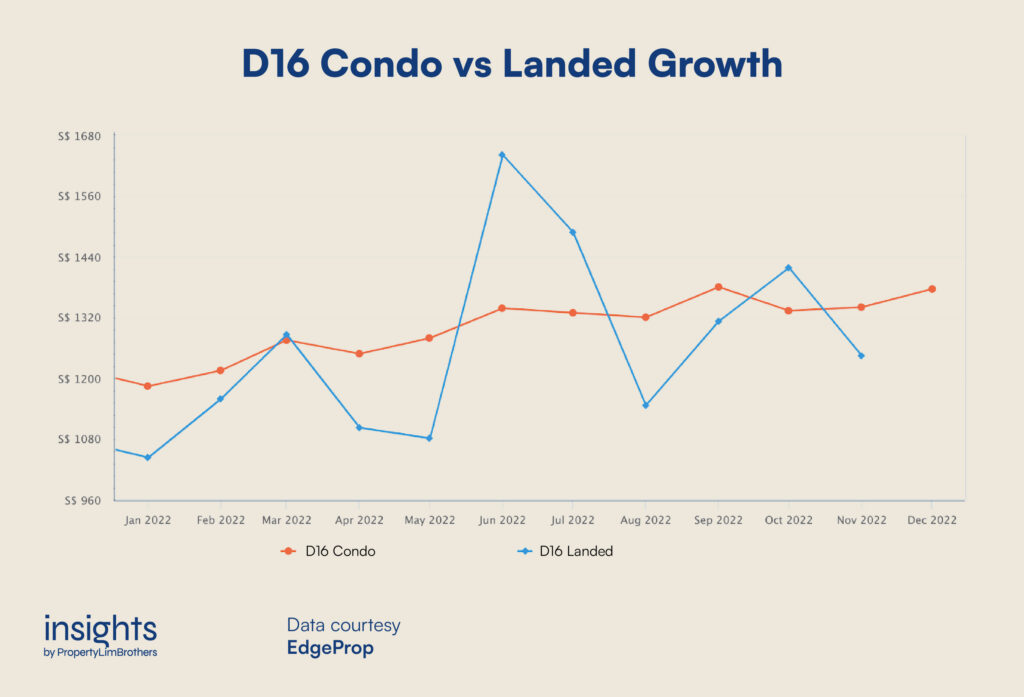

Taking a look at the average prices over the year, condo prices had a steady increase from the start of the year to the end while landed prices fluctuated a lot. As there are significantly fewer landed transactions than condo transactions, this volatility in prices is within expectations. Other factors such as lease decay, condition of the unit, etc may have an impact on the prices as well. Although there was a drastic 30% drop in prices between June and August and no transactions in December, the landed segment still recorded a higher growth rate of 19% compared to the condo segment’s 16%.

Applying the Volume Effect, a higher volume of transactions translates to market confidence that demand is high and this pushes the prices up. The recency of transactions also allows sellers and buyers to evaluate the current value of a property. Despite the transaction volume of District 16 properties fluctuating (and dropping to the lowest for the year in December), average prices remained strong. The low number of transactions could explain the spike in average price between November and December, but overall, the district recorded a respectable growth rate of 18% in 2022 alone.

Fourth Place goes to: District 13

District 13 comprises estates such as Potong Pasir, Bidadari, MacPherson, and Upper Aljunied. It is considered a part of the Rest of Central Region (RCR). As we pointed out previously, RCR properties have been recording solid growth in recent years and the gap between the Central Core Region (CCR) and the RCR has been closing.

The allure of District 13 lies in its city fringe location – located near the city but still having easy access to East Coast Park. Its location marries the best of both worlds, which is attractive to locals and expats who work within the Central Business District (CBD).

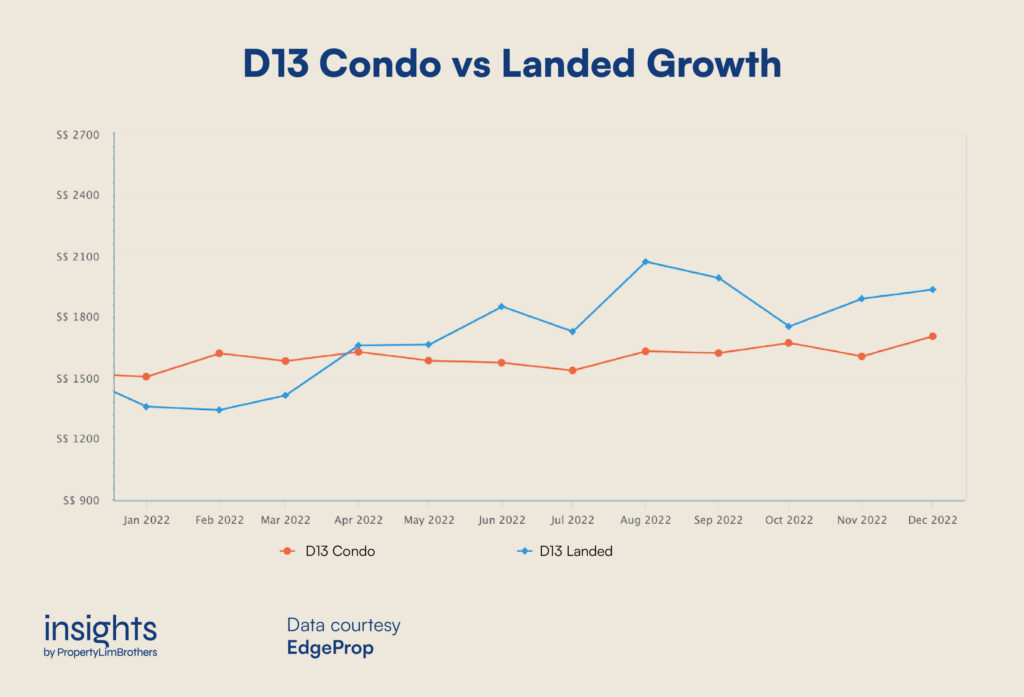

While most districts would be recording a higher growth rate for condos, District 13’s landed segment outperformed the condo segment by 30% and saw an impressive 43% growth this year, with prices peaking at almost S$2,300 psf in August. This could be due to the relatively low number of transactions again, but given the decentralisation of CBD, this growth could also be another signal of the closing disparity gap.

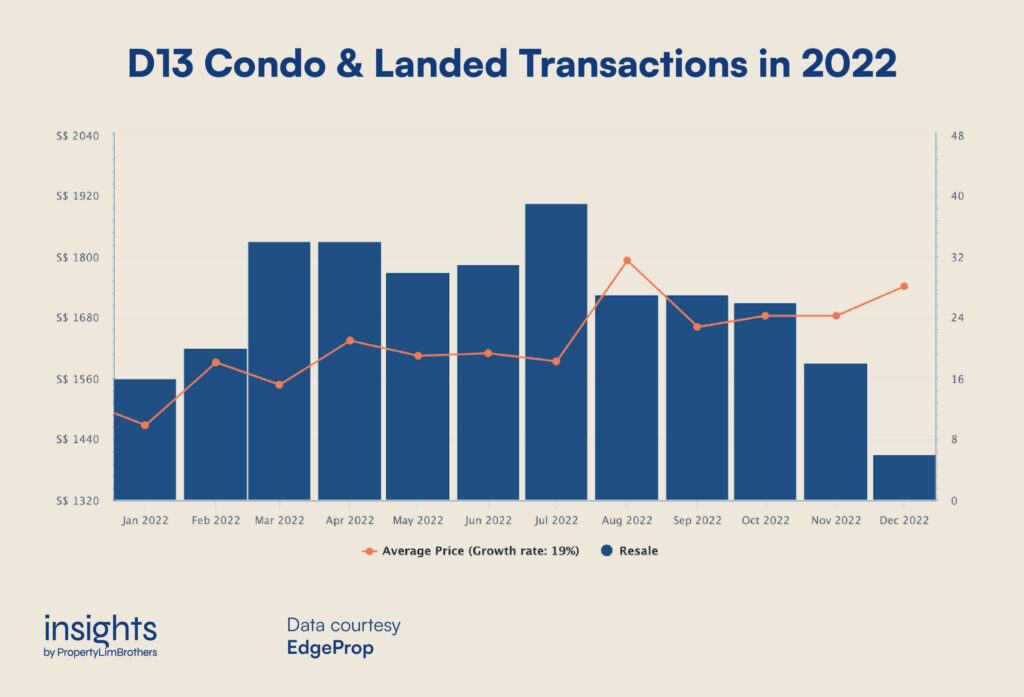

Zooming out to the district as a whole, District 13 recorded a total of 308 condo and landed transactions in 2022. Of the 308, almost 78% (240) are condo transactions and the remaining 22% (68) are landed transactions. Given the fact that the area is still in the midst of a substantial transformation into a key private residential enclave on the city fringe, it is not surprising that District 13 has landed a spot on this list. With an annual growth rate of 19% this year, District 13 would be a district to look out for in 2023 and beyond.

Clinching Third Place: District 4

District 4 is an interesting area because it comprises Sentosa, which houses some of the most luxurious private properties in Singapore and is part of the CCR. It also comprises areas like Harbourfront, Keppel, and Telok Blangah which are part of the RCR. Telok Blangah, especially, has a large HDB cluster that could have contributed to the overall growth of the district as HDB upgraders in the vicinity factor into the exit strategies of private properties.

Aside from its central location, District 4 is also a coveted residential enclave because of the waterfront living that many developments in the area offer. Furthermore, it has major attractions such as Resorts World Sentosa, Keppel Bay, Henderson Waves Trail, and Mount Faber Park.

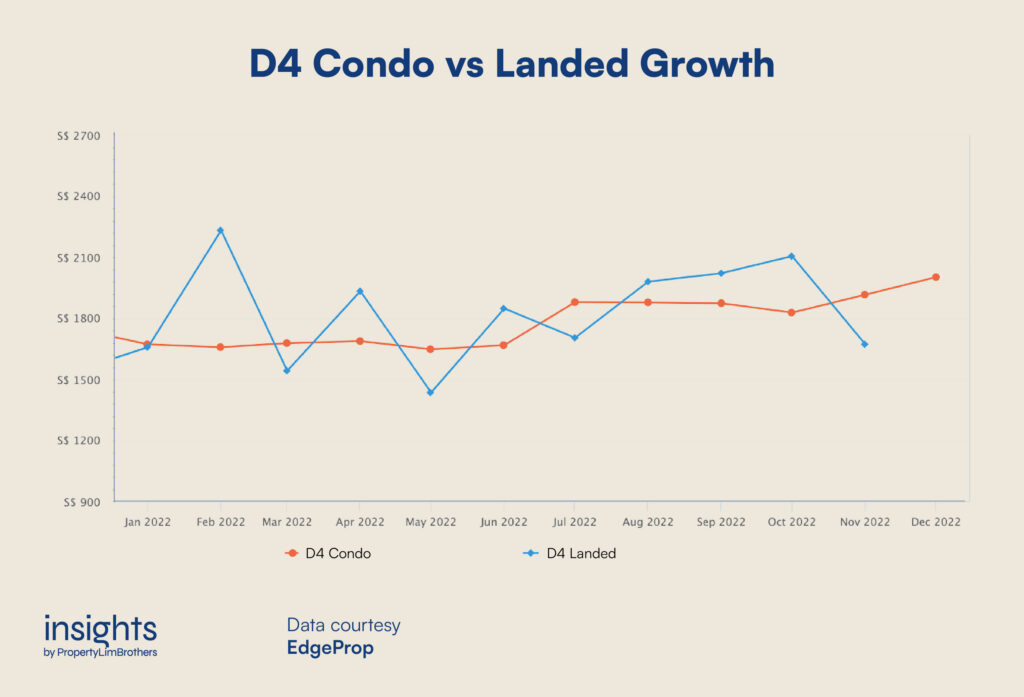

While condo prices in District 4 were on a steady rise and recorded a 20% annual growth rate, landed prices were extremely volatile. Making up only 19 of the 322 total transactions in 2022, the pricing trend of landed properties here is likely a result of the holding power of ultra-high net worth individuals (UHNWIs) and investors who see Singapore as a safe haven to store their wealth. It is also possible that with the rising interest rates, buyers are being priced out of the market, which explains the lower transaction volume throughout the year that is contributing to the volatility of prices here.

In April last year, National Development Minister Desmond Lee announced that HDB would be launching the first Build-to-Order (BTO) project at the current Keppel Club golf site by 2025 as part of the upcoming Greater Southern Waterfront development. Other developments in the area will also be happening in phases over the next 5 to 10 years, making District 4 an area primed for growth and definitely worth keeping a lookout for.

First Runner Up: District 21

District 21 is known for its status as an education hub and is home to renowned institutions such as Singapore Polytechnic, Ngee Ann Polytechnic, and National University of Singapore (NUS). It comprises areas like Clementi, Bukit Timah, Ulu Pandan, Sixth Avenue, and Beauty World.

District 21 is also considered by many as a residential sanctuary, with easy access to the Rail Corridor and nature parks such as Bukit Timah Nature Reserve and Rifle Range Nature Park. And while Clementi is known for its dense HDB population, other areas within District 21 such as Sixth Avenue and Bukit Timah are known for their luxurious condos and landed homes.

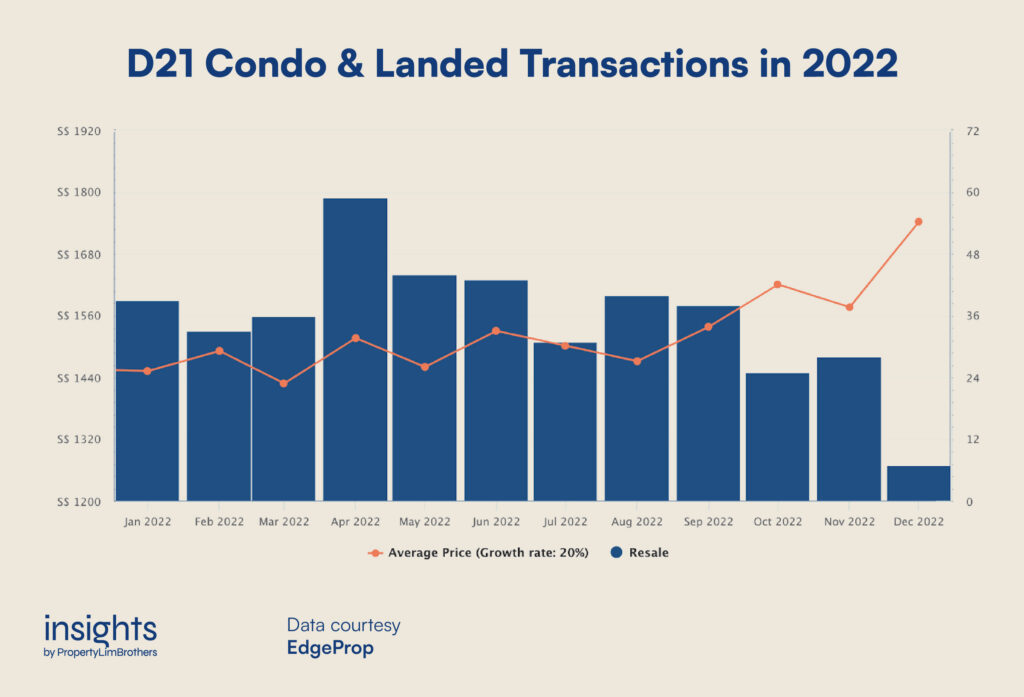

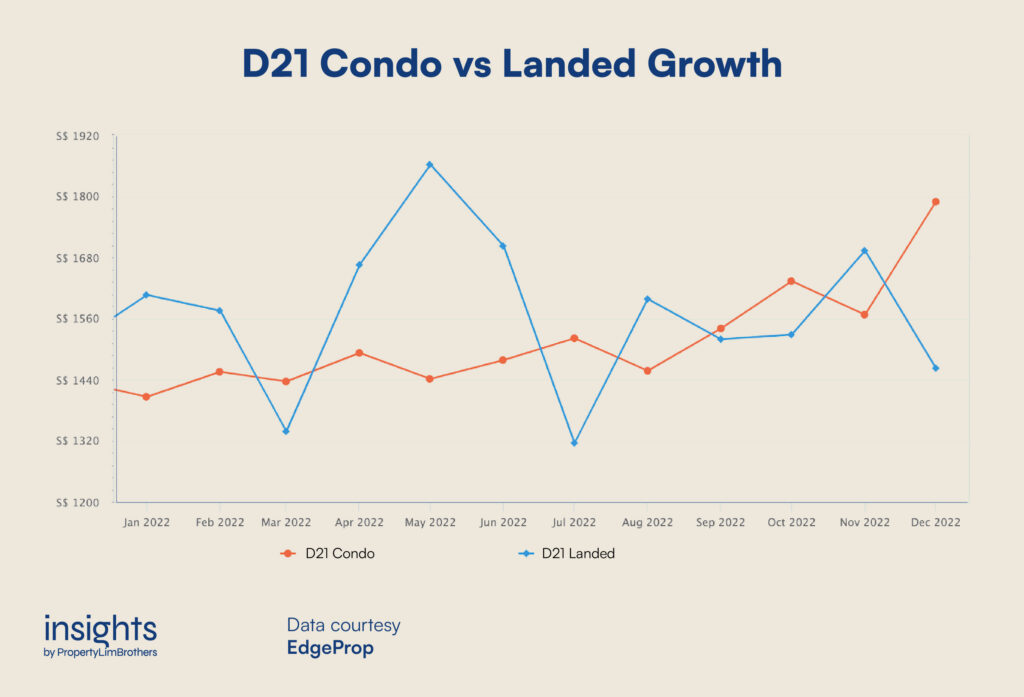

Although it has the same overall growth rate as District 4 in 2022, District 21 placed higher in this list because of its higher volume of transactions. With 423 total transactions in the year, District 21 recorded a 20% annual growth rate. Of the 423 transactions, 364 were condo transactions and 59 were landed transactions.

Landed prices were extremely volatile, with the average psf peaking at S$1,862 in May followed by a sharp drop in June and July. With the relatively low volume of transactions, such volatility in prices is expected, given the nature of landed properties. Different landed property types command different quantum, and this nature is rather difficult to capture when we are looking at the segment as a whole.

For District 21, the overall growth was carried by the performance of the condo segment, which saw a steady increase throughout the year. Clocking an annual growth rate of 27%, the average psf peaked at almost S$1,800 in December. However, the sharp spike in psf between November and December could be attributed to a low volume of transactions in December.

All in all, there are two main reasons District 21 is another district to watch out for:

- Ongoing enhancements to the Rail Corridor

- Upcoming development of a mixed-use commercial and residential site with an integrated transport hub at Jalan Anak Bukit

Both developments are expected to breathe new life into the district, improving accessibility and connectivity.

First Place goes to: District 27

Previously, we covered the Top 5 Condos in District 27 and how it pulled off a strong underdog victory, emerging as the top growth district in the Outside Central Region (OCR). Unsurprisingly, District 27 has made its way to the top of this list as well.

Comprising northern areas such as Yishun and Sembawang, District 27 properties have excelled in the post-pandemic boom. As HDB continues to inject new BTO sites around the Yishun area, condos in the vicinity continue to enjoy a growing pool of exit audiences made up of HDB upgraders.

Despite the disappointing news of ORTO leisure park’s relocation in August last year, the district still has other recreational hotspots to offer – Yishun Dam, Sembawang Hot Spring, and Sembawang Park to name a few.

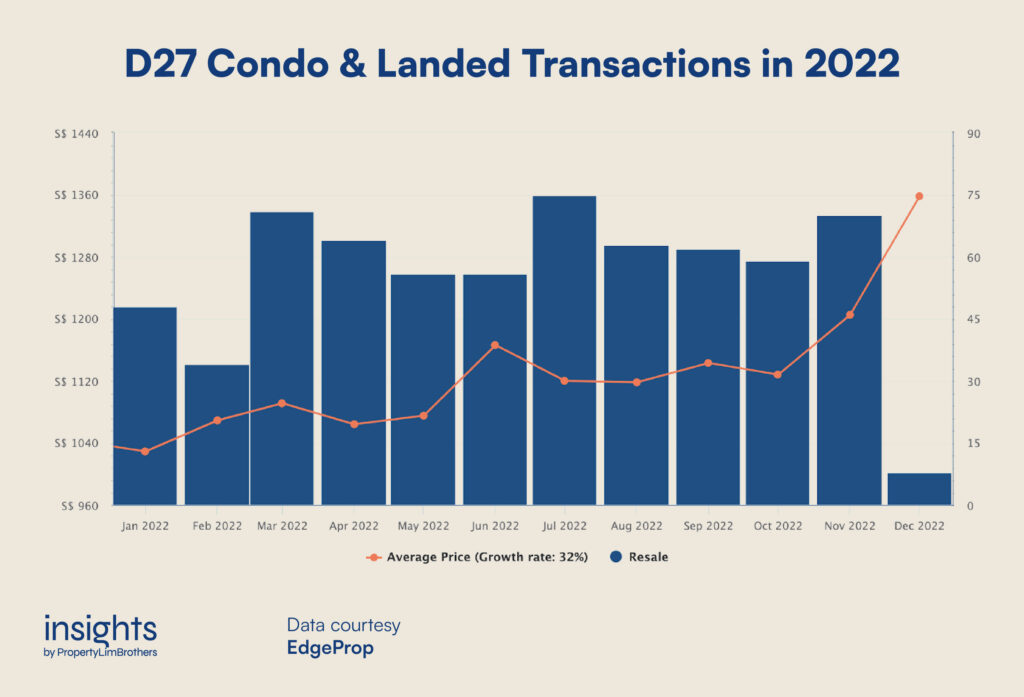

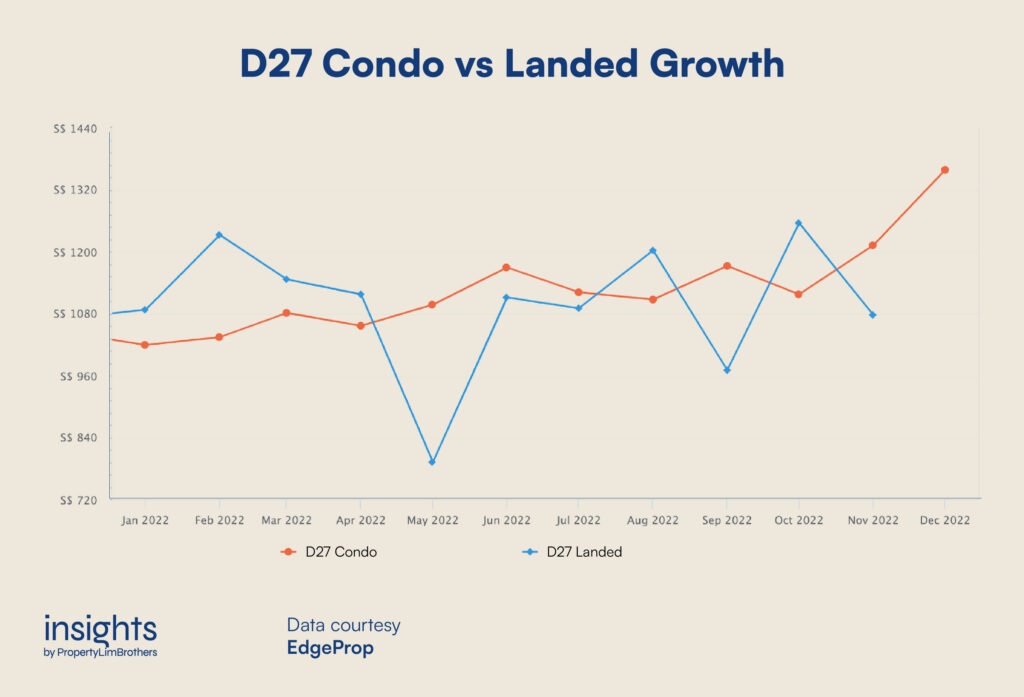

In terms of the volume of transactions, District 27 has the second highest in this list with 666 total transactions in 2022. It has recorded an impressive 32% growth just this year alone. With the high volume of transactions coupled with high growth rate, you can see why it deserves the top spot in thisresa list.

As expected, the primary growth in the region came from the condo segment which made up close to 90% (598) of the total transactions in District 27 last year. Many of the condos here have high MOAT scores of over 75%, signalling high potential for growth.

Like most of the other districts, the landed prices for District 27 were extremely volatile due to the low volume of transactions. Prices dropped significantly between April and May 2022, but that statistic was based on the average psf of only 4 transactions that happened that month. Apart from May and September, the average psf of landed properties in District 27 has been stagnating at around the S$1,000 psf mark.

Closing Thoughts

To conclude, there are a few important caveats to remember. Firstly, this article does not constitute a buy or sell recommendation. Such a decision should only be made after factoring in your goals, finances, needs, and personal circumstances.

Most of the districts that made it onto this list were carried by the strong growth from the condo segment while the price movement of the landed segment was extremely volatile throughout 2022. It is also worth noting that transaction volume slowed across the board towards the end of the year, resulting in a spike in average price.

Lastly, this article only takes into account the performance and growth of districts in 2022. If we were to zoom out to take a more macro look at the performance over the past 3-5 years, the charts might turn out differently.

With that said, if you are looking into any districts for investment or own stay purposes, feel free to reach out to us for a second opinion. Here’s wishing you a good year ahead in 2023!