When was the last time you had to search up the definition of a real estate term or abbreviation that you didn’t understand? Did the search results give you a better understanding, or did they leave you with more questions than answers?

The real estate industry is filled with many jargons, abbreviations, and terminologies that can be rather confusing to those without financial or real estate backgrounds. For licensed real estate salespersons (RES) – there we go, our first abbreviation – part of the job is to break down certain real estate concepts to clients, guide them through the buying or selling process, and of course, to explain any terminologies or jargons that they do not understand.

To that end, we have come up with a master dictionary for local real estate terms to bridge that gap. Be it you’re a buyer, a seller, or a property agent looking to brush up on these terms, we hope that you will find this comprehensive guide useful. Let’s dive right in.

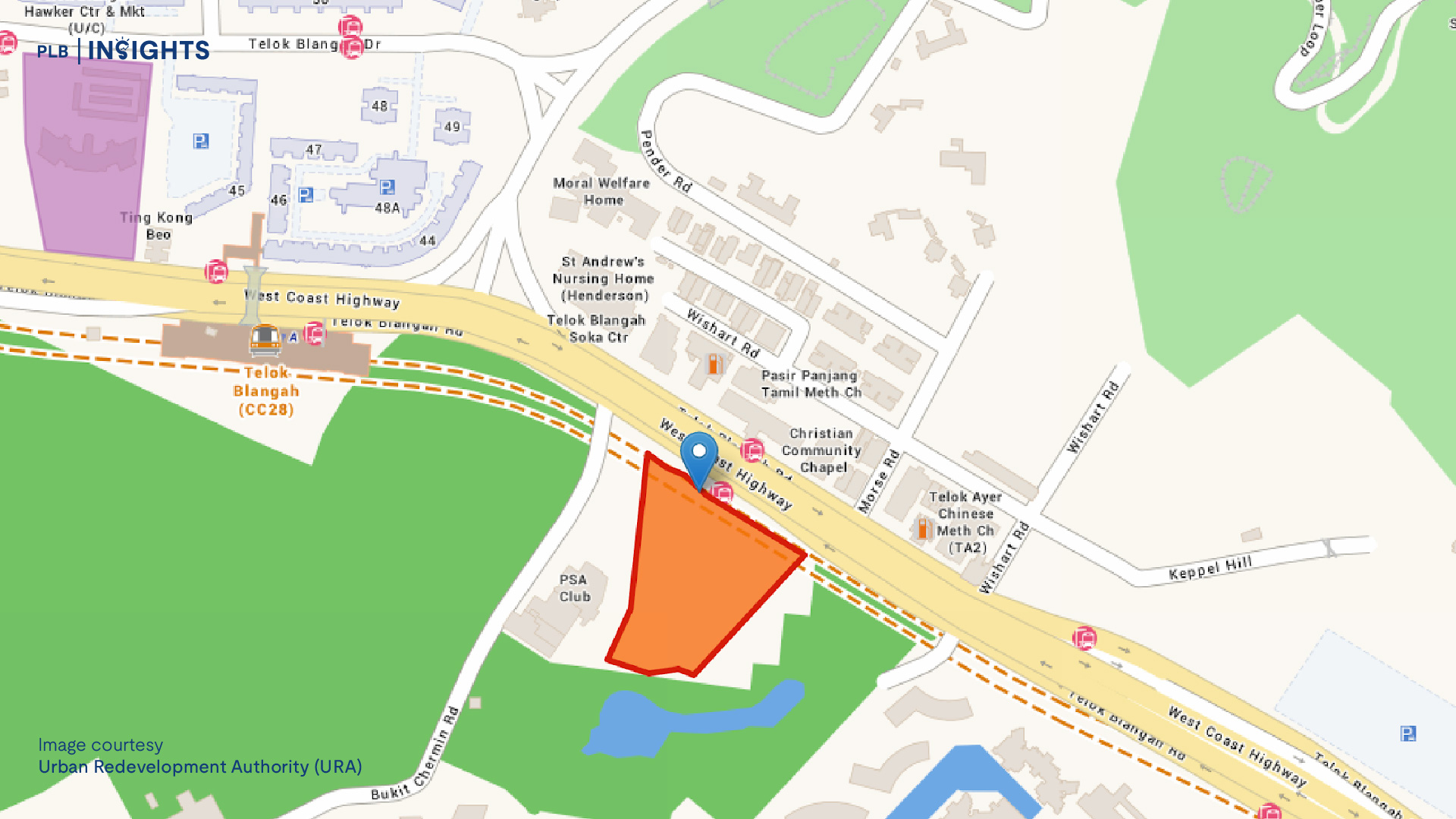

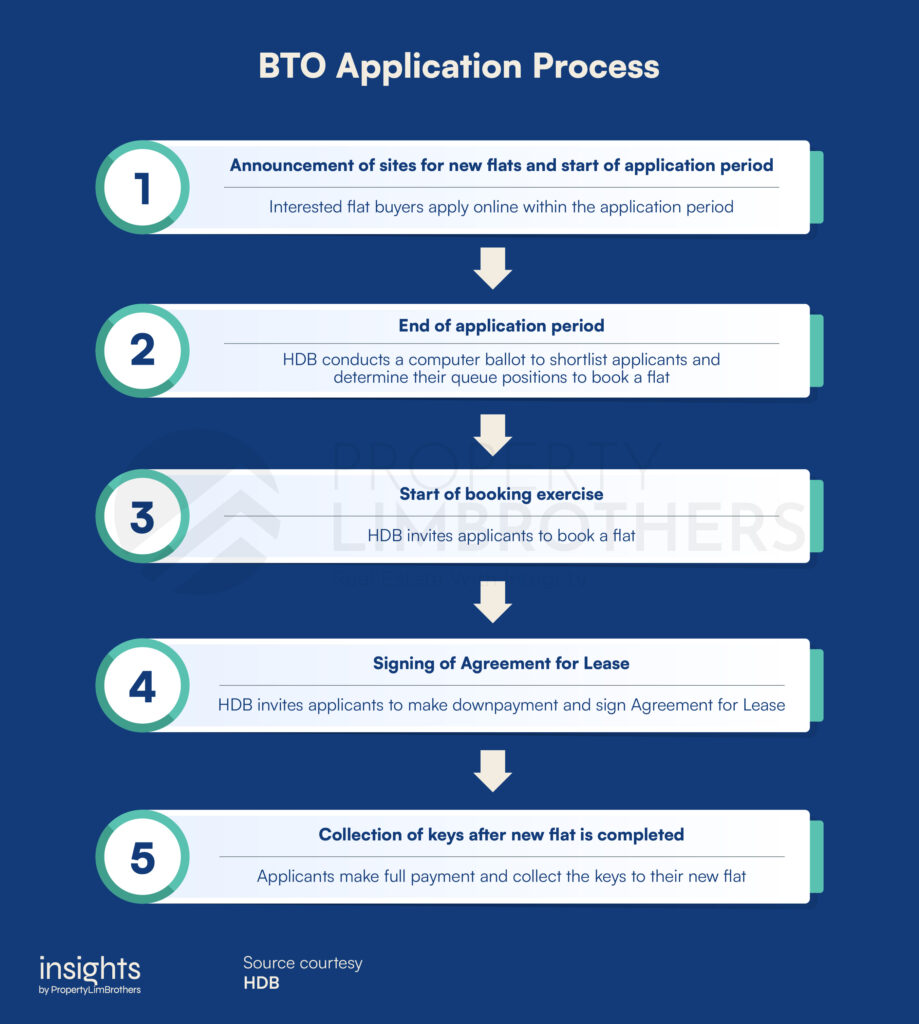

BTO (Build-To-Order)

Most Singaporeans will be familiar with the term BTO, which we often joke about substituting for romantic proposals. BTO or Build-To-Order is a public housing scheme enacted by Singapore’s Housing Development Board (HDB).

Every year, HDB launches four BTO exercises (in February, May, August, and November) with projects all over the country. Applicants will apply for the project and flat type that they desire, and participate in a ballot. Most projects will typically be oversubscribed, especially if the projects are in mature estates, in a central location, or closer to the Central Business District (CBD). During a BTO launch, applicants are able to apply for the project that they are interested in as well as the flat type (e.g., 3-room, 4-room, or 5-room).

As the name suggests, they are build-to-order, which means that once you have successfully applied for and secured a unit, you will have to wait a number of years before the flat is built and ready. It is ideal for couples who can afford to wait a couple of years for the flat to be completed, or can afford to rent while waiting.

SBF (Sale of Balance Flats)

Again, as the name suggests, SBF launches are for the sale of balance flats that were not sold during earlier BTO launches or were repurchased by HDB (due to reasons such as divorce, etc.).

Every year, HDB launches two rounds of SBF exercises, typically in May and November. During an SBF launch, applicants will only be allowed to apply for an estate that they are interested in as well as the flat type. After which, a ballot will be conducted amongst applicants who chose the same estate and flat type. If an applicant is successful in the application and receives an appointment date to go down to HDB for flat selection, they will be able to choose from any project with balance units within the estate that they selected.

For SBF launches, some projects might still be uncompleted, while some might be ready for immediate key collection, so it is usually a shorter waiting time as compared to BTO launches. As such, it is ideal for couples and families who require more urgent housing options.

*It is also important to note that during the May and November launches, you can only choose to apply for either BTO or SBF, not both.

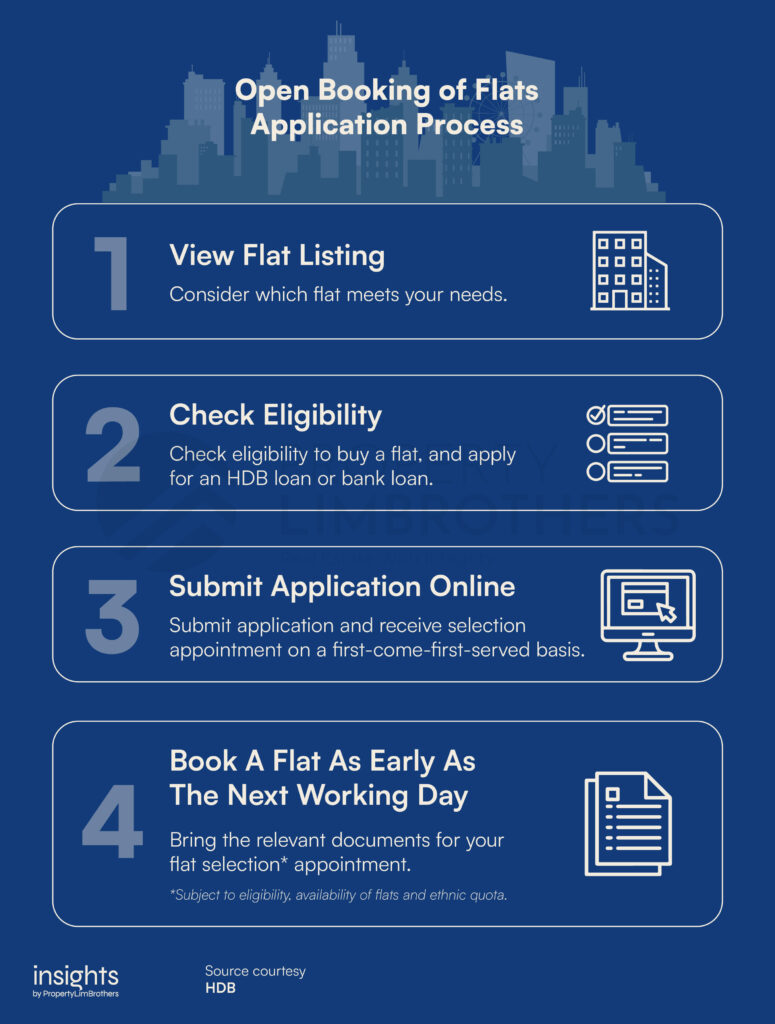

Open Booking of Flats

The open booking of flats is another option for public housing, offering unselected units from past SBF launches. Like the SBF exercise, the open booking of flats is available twice a year. However, some of the listings will come with various degrees of lease decay as they are old flats that were repurchased by HDB.

Before each open booking exercise, HDB will release the listings of units available as well as the application date. This will give applicants time to look through and consider their options.

What makes the open booking different from BTO and SBF launches is that the applicants will receive their queue number on a first-come-first-served basis. Applicants may get an appointment date as soon as the next working day, where they can head down to HDB Hub to book a flat immediately.

*It is important to note that some of the units listed for open booking are only for certain ethnic groups, so be sure the unit you’re going for is available for you.

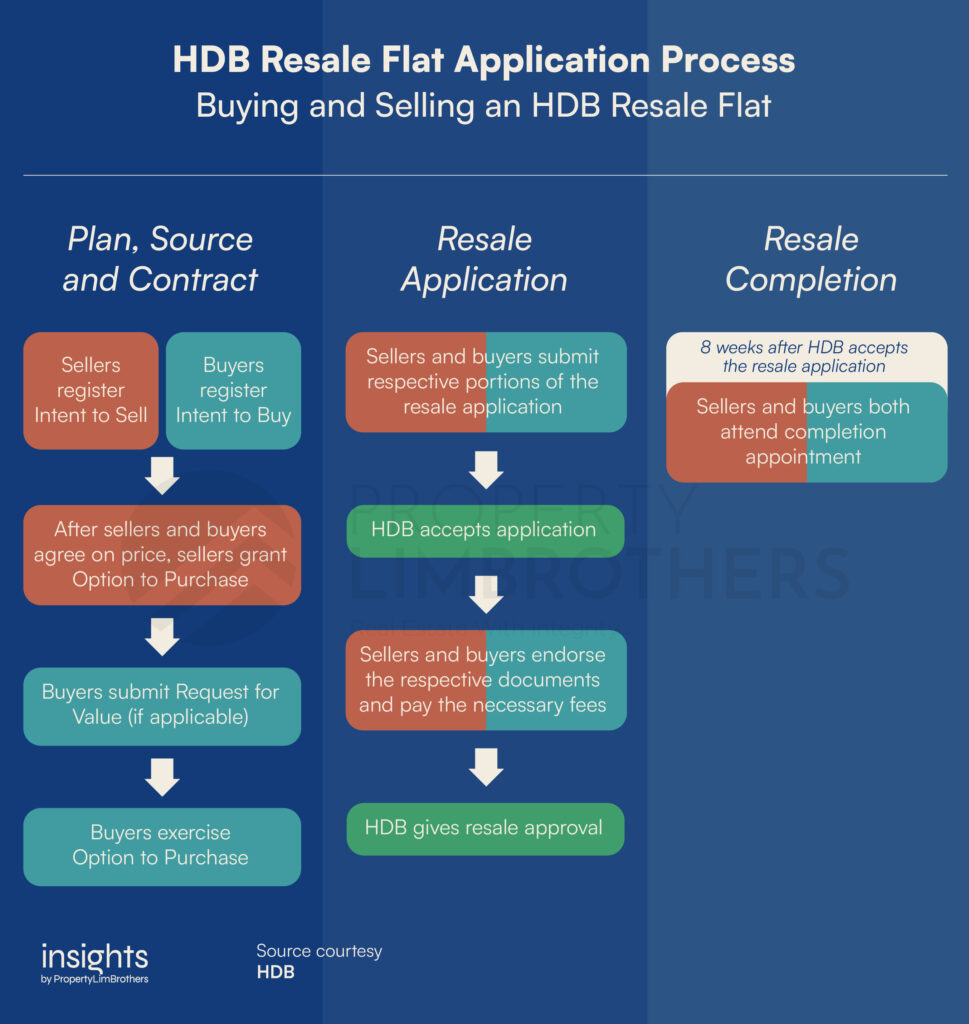

Resale HDB

Resale HDB flats are the last option for public housing, but you will be purchasing them from the open market instead. Because you’re purchasing from the open market, prices are generally higher than if you were to get a flat through the other options we mentioned previously. The process of buying a resale HDB is also very different.

For starters, you will be looking at listings on the open market (property portals, social media, etc.) and arranging your own viewing of the unit. Typically, the listings you find online are listed either by property agents or by the sellers/owners themselves.

Once you find a suitable flat that fits your needs, you will enter into an Option to Purchase (OTP) with the seller, and collect your keys within a few months. This option is ideal for couples who have more urgent housing needs, since it is a much faster process as compared to getting a new flat from a BTO launch.

OTP (Option to Purchase)

Option to Purchase (OTP), or Option for short, is a legally binding real estate contract between the seller and the buyer. It is designed to protect the interests of both parties.

For resale HDBs and private properties, you will enter into an OTP with the seller of the unit that you’re interested in purchasing.

In the agreement, a seller offers an option to the buyer to purchase the property at a fixed price within a limited time frame. Buyers will also be required to pay an option fee which serves as a deposit to “reserve” the property during that time frame, which we refer to as the option period.

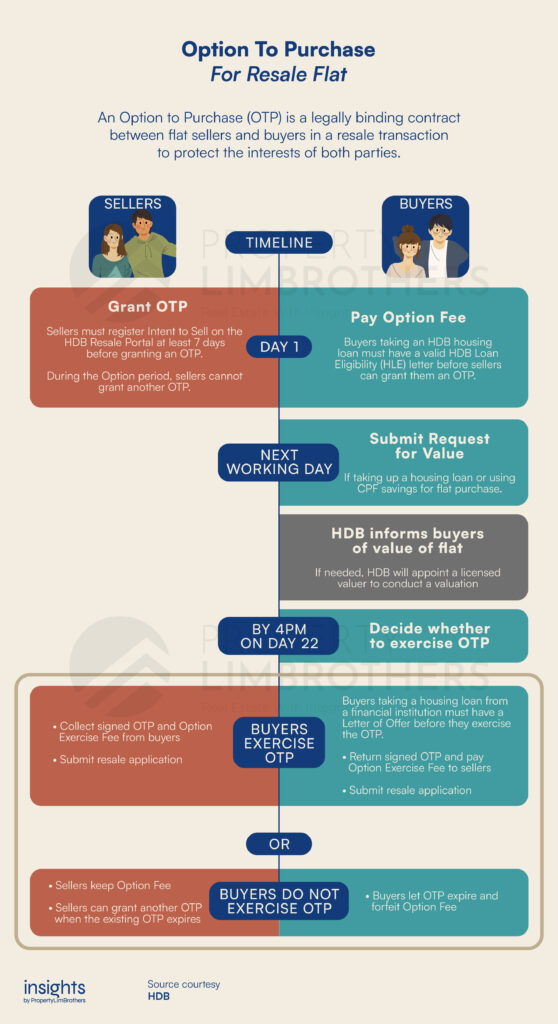

In resale HDB transactions, sellers will have to register their Intent to Sell on the HDB Resale Portal at least 7 days before granting an OTP. After that, the seller and buyer will have to fill up HDB’s OTP form, and buyers will pay an option fee of any amount between $1-$1,000. Once the option fee is paid, both parties will enter into an option period of 21 calendar days. During this option period, sellers are not allowed to grant another OTP while the buyers consider whether to go ahead with the purchase. If they decide not to, they can let the OTP expire and the option fee will be forfeited. If the buyers decide to go ahead with the purchase, they can exercise the OTP and pay an option exercise fee, which can be any amount not exceeding $5,000. Both the option and option exercise fees are negotiable with the seller and will form part of the sale proceeds.

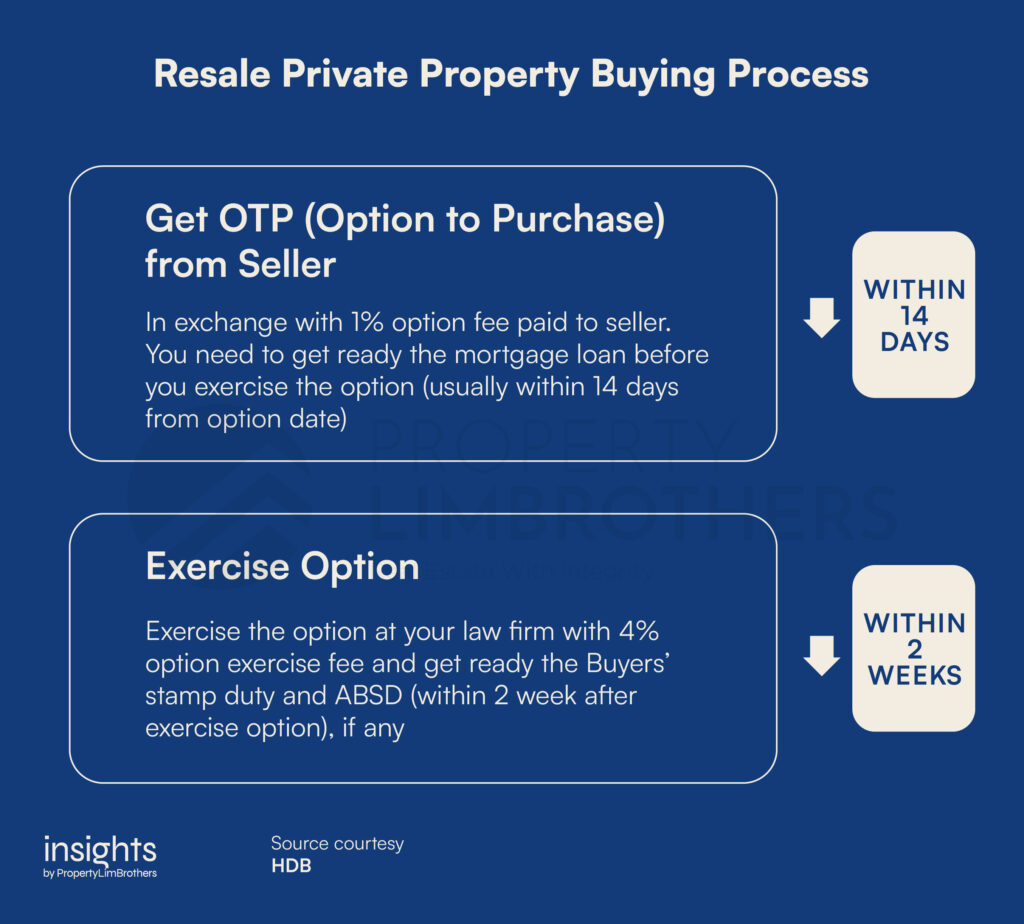

For private properties, the option fee is typically 1% of the purchase price. The option period is a minimum of 14 days, or negotiated for a longer period depending on the involved parties. Once the buyer decides to exercise the OTP, they will make the transfer of the remaining deposit fee which makes up 5% of the purchase price, including the option fee. Again, both the option and deposit fee are negotiable with the seller and will form part of the sale proceeds.

Leasehold, Freehold, and Lease Decay

New HDB flats come with a 99-year lease, while private properties like condos and landed properties can hold varying tenures such as 99-year, 999-year leasehold, or Freehold. Leasehold refers to the right to own a property for a number of years, while Freehold refers to owning land or Strata Unit in perpetuity or without any limit to the duration of ownership.

When we talk about lease decay, it refers to the number of years of lease left on a flat since the completion of the project. When the lease on a property expires, it will be returned to the original owner (HDB, Singapore Land Authority, or other owners).

In Singapore, the greater the lease decay (the lesser the number of years left on the lease), the less value a flat has. But of course, the valuation of a property is not only dependent on lease decay.

For example, a 4-room HDB flat at Ang Mo Kio with 75 years left on the lease might be less valuable than a similar 4-room HDB flat from Ang Mo Kio with 85 years left on the lease, but might be more valuable than say a 3-room HDB flat at Jurong East with 90 years left on the lease.

MOP (Minimum Occupation Period)

MOP is perhaps the most-used term in real estate. It refers to the minimum occupation period, which is the time frame where flat owners cannot sell or rent out their whole property after gaining ownership. However, it is possible to rent out bedrooms as long as you meet the eligibility conditions. MOP only applies to HDB and resale Executive Condo (EC), not private properties.

For HDB and ECs, the MOP is typically 5 years. With the introduction of the Prime Location Public Housing (PLH) model in late 2021, however, selected HDB projects that are built in prime and central locations will have to serve an MOP of 10 years instead.

For flats that fall under the PLH model, resale of flat and investment in private property are allowed after the 10-year MOP, as well as the renting out of spare rooms. However, a huge drawback is that PLH units will not be allowed to be rented out fully even after the MOP has been fulfilled, effectively deterring investors looking to profit from rental.

Temporary Occupation Permit (TOP) & Certificate of Statutory Completion (CSC)

TOP refers to Temporary Occupation Permit. If a project has attained TOP, it means that it is certified as safe to occupy. It is issued by the authorities to allow owners to move into a building while other key requirements are being met, and is one of the two official checkpoints for the completion of a building.

The Certificate of Statutory Completion, or CSC, is the second and final checkpoint for the completion of a building. It is essentially a more permanent version of the TOP, but can take a lot longer for developers to attain. It can only be attained when a project, including all its facilities, is fully completed.

Cooling Measures

Chances are, you would have already seen and read the news of the latest round of cooling measures circulating from every major news platform. In the history of real estate in Singapore, there have been at least 10 rounds of cooling measures, with the latest one targeted mainly at private homeowners planning to downgrade to a resale HDB. So, what exactly are they?

Cooling measures are policies that help to improve affordability for first-time homebuyers, prevent affluent buyers and investors from buying additional properties for investment purposes, and to reduce the risk of a hard landing when interest rates rise in the future.

They are important as they help to encourage financial prudency and deter certain practices such as short-term speculation of the property market.

HFE (HDB Flat Eligibility) Letter

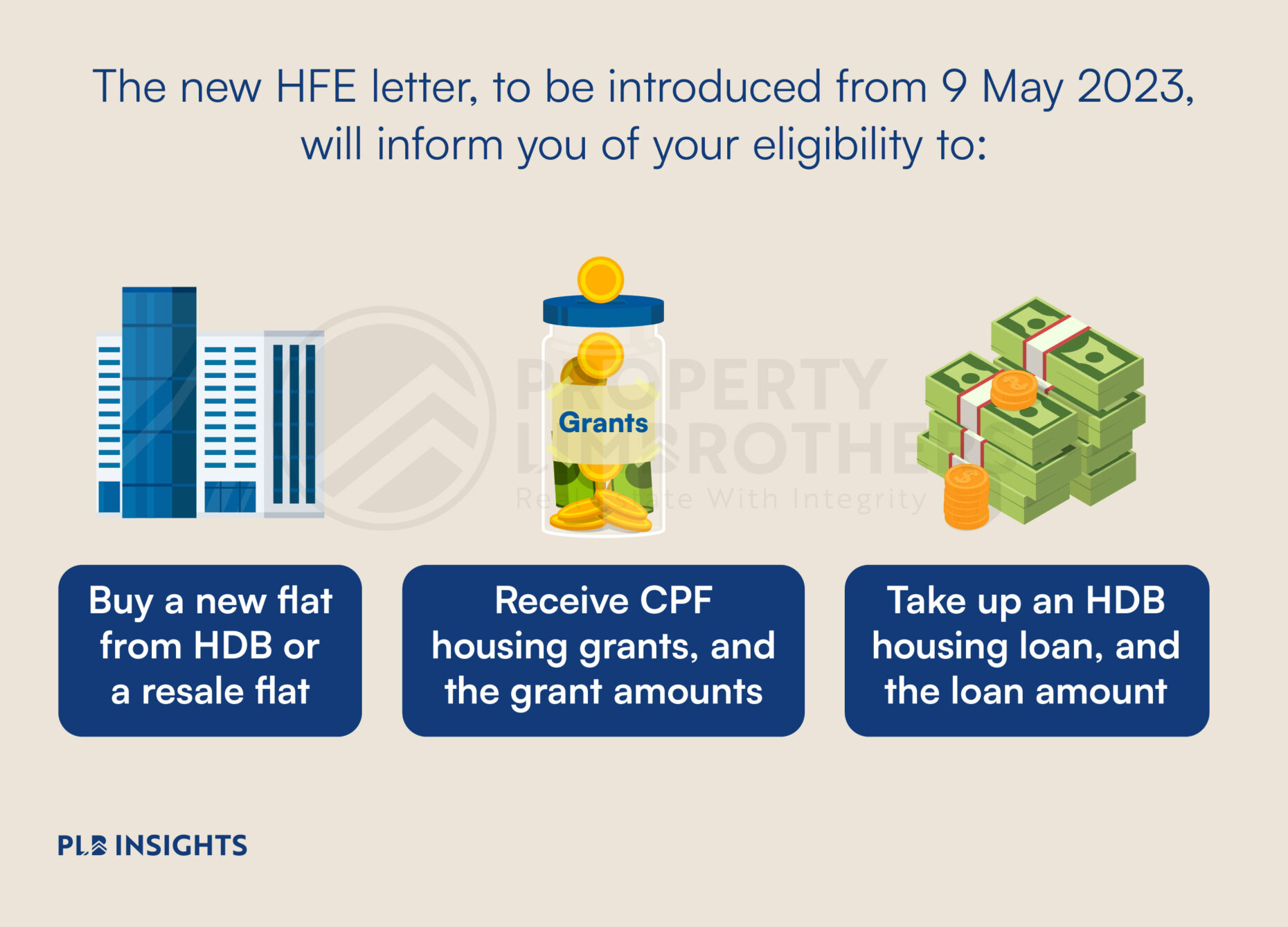

Another frequently used abbreviation is HFE, which stands for HDB Flat Eligibility. As you may already know, the two ways to finance an HDB flat purchase is by taking the HDB loan or a bank loan. There are many differences between the two, such as interest rates and how your eligibility is assessed.

If you are buying an HDB flat, be it from a BTO launch or a resale flat, it is mandatory to have a valid HFE letter from HDB if you are applying for HDB loan. The HFE letter is a confirmation of your housing loan eligibility, as well as the loan quantum and grant amount that you are eligible for. It will also give you important information such as the loan tenure and interest rate. And if you have previously sold a flat, your new HFE will also show you the amount of proceeds from that sale to be used for the new flat purchase so as to minimise the required loan quantum.

You can apply for an HFE letter through the HDB flat portal with all the necessary income documents, and it will be valid for six months from the date of issue. If there are no sudden changes to the applicant(s), occupier(s), or financial situation within this time period, there is no requirement for re-assessment.

*It is important to note that you should be as thorough as possible when applying for the HFE letter as it can significantly affect the loan amount that you can get for your HDB flat purchase.

LTV Ratio (Loan-To-Value Ratio)

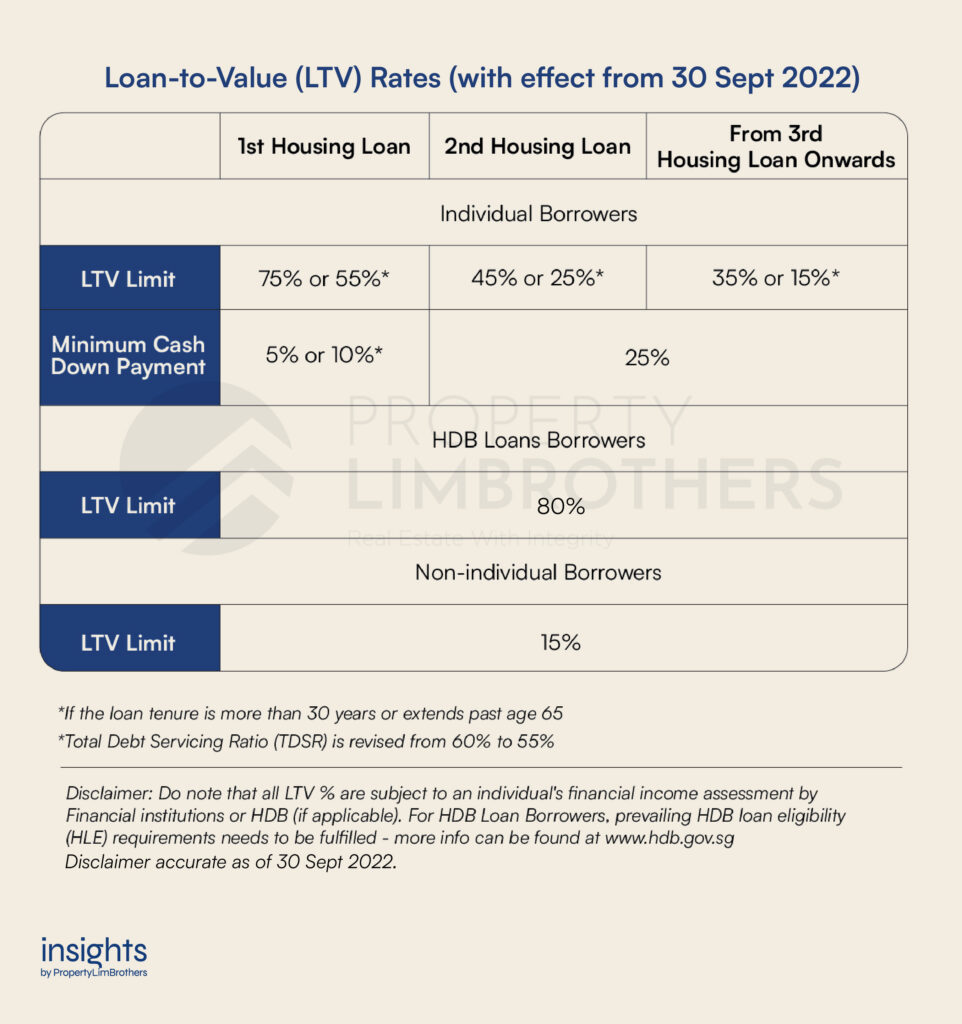

A very important policy in Singapore real estate is loan-to-value (LTV) ratio. The LTV ratio is a restriction placed by the government which determines how much financing buyers can obtain, limiting the maximum amount they can borrow from HDB and banks. It also tells you how much down payment you need to pay upfront in cash and/or CPF Ordinary Account (OA) savings.

Over the years, LTV limits for HDB loans have been revised a few times to encourage more prudent borrowing amid rising debt among Singapore households. At the time of writing, after the latest round of cooling measures, the LTV for HDB loans is at 80%. This means that the maximum loan amount you can borrow from HDB is 80% of the property’s price, with the remaining 20% being the down payment.

On the other hand, the LTV for bank loans is 75%, with the remaining 25% being the down payment.

*It is important to note that you may not always qualify for the maximum loan amount. Some factors that can affect your loan amount include your combined income, remaining lease of the property you are buying, credit score, age, and loan tenure.

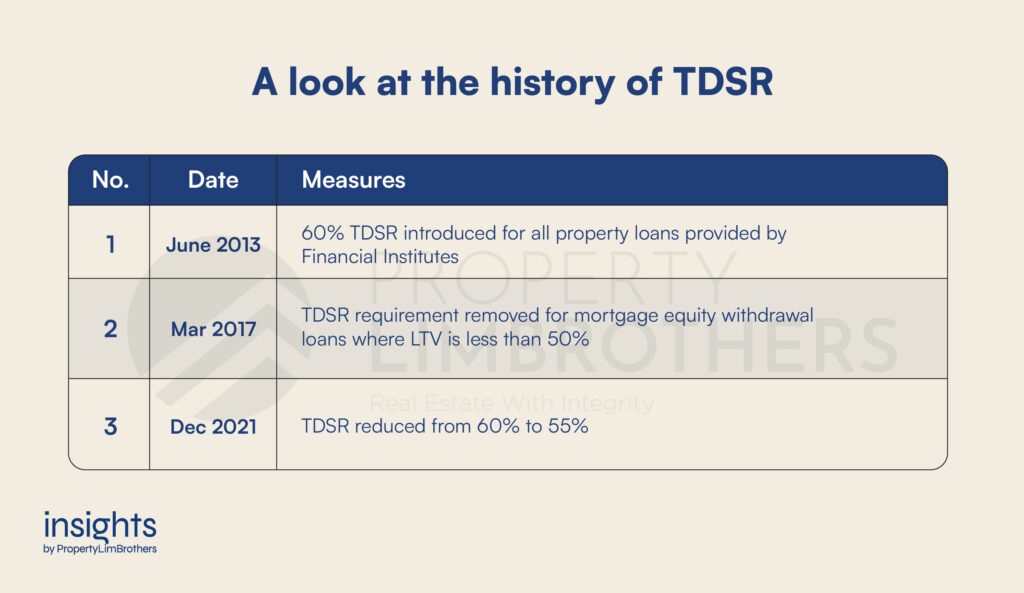

TDSR (Total Debt Servicing Ratio)

Another important policy to limit borrowing is the total debt servicing ratio (TDSR). It refers to the maximum percentage of a borrower’s gross monthly income that can go towards repaying their total monthly debt obligations. This applies to property loans offered by financial institutions, for all types of properties. HDB loans are not subjected to TDSR rules.

The TDSR was introduced by the government in 2013 to ensure that buyers do not overleverage on bank loans and end up drowning in debt. The TDSR also serves to control real estate speculation in Singapore as many individuals used to take out large loans in the past to buy houses that they would later sell for a profit. Lastly, it prevents the issuance of high-risk loans and standardizes the framework that banks use to assess a borrower’s ability to repay their loans.

At the time of writing, a buyer’s TDSR is capped at a maximum of 55% of their monthly income. This means that your total monthly debt obligations should not be more than 55% of your total monthly income. Housing loans, credit card loans, student loans, car loans, renovation loans, and other secured or unsecured loans are all included in the total monthly debt obligations.

With the adjustment of the stress-test interest rate in the latest round of cooling measures, borrowers must still be able to maintain a TDSR of 55% or below even if interest rates increase to 4%.

To work out your TDSR, you can check out our TDSR calculator here.

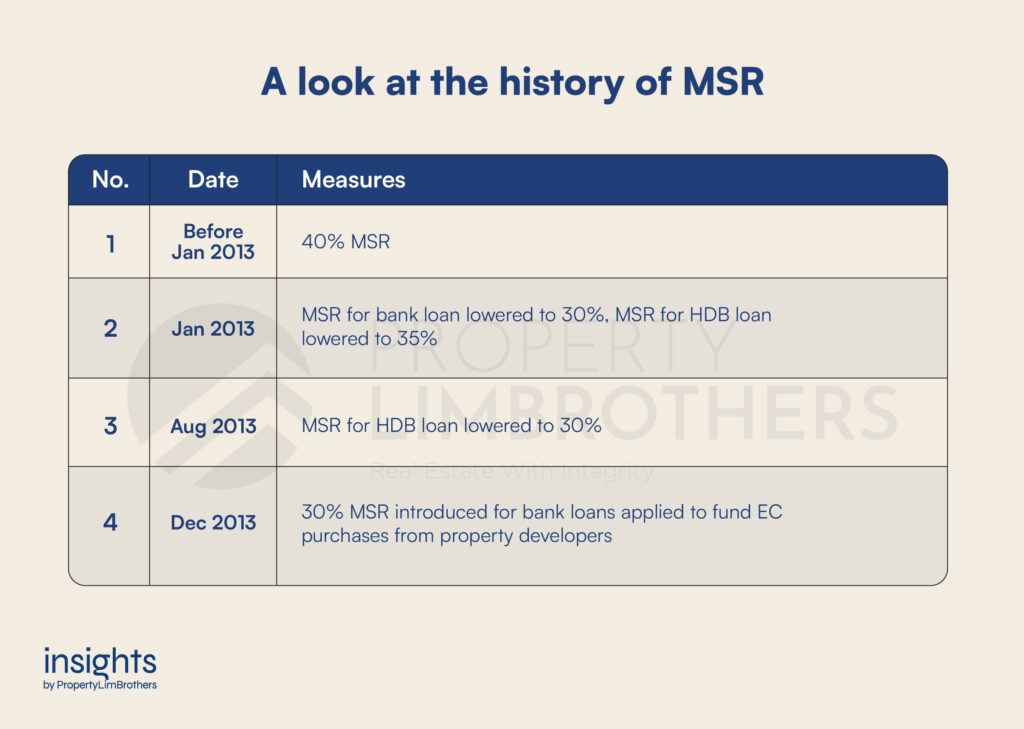

MSR (Mortgage Servicing Ratio)

To ensure that borrowers do not take up too much debt, the government also introduced the mortgage servicing ratio (MSR). It refers to the percentage of a borrower’s gross monthly income that goes towards repaying all housing loans, including the loan being applied for. With this rule, buyers can use a maximum of 30% of their gross monthly income for their monthly loan repayment.

Unlike the TDSR, which only applies to loans granted by financial institutions for all property types, the MSR is applicable to both HDB and bank loans but only for HDB flats and Executive Condominiums (ECs) where the MOP of the EC has not expired.

For buyers who are taking a bank loan to purchase an HDB flat or EC, both the MSR and TDSR will be taken into account.

To work out your MSR, you can check out our MSR calculator here.

COV (Cash Over Valuation)

COV, or Cash-Over-Valuation, is the amount a buyer must pay in cash when the purchase price of the property they are buying is higher than its market value. COV applies to both HDB resale flats and private properties.

When it comes to private properties, COV seldom has an impact on the transaction as both the buyers and sellers can seek and acquire a valuation of the unit before making an offer or listing for sale, respectively. As a result, both parties will be aware of the COV amount before the transaction takes place.

On the other hand, for HDB resale flats, the valuation from HDB can only be obtained after both parties have agreed on a price and signed the Option to Purchase (OTP). In other words, buyers will not know how much COV they have to pay until after the OTP has been signed and the option fee has been paid. However, HDB’s valuation of a property is often based on the recent transactions around the estate so it is possible to estimate the valuation by comparing it with similar properties.

It is also important to note that the Loan-to-Value ratio (LTV) will be calculated based on the valuation of the flat excluding the COV. This means that if you have agreed on a price of $600,000 for a property that is valued at $550,000, the LTV will be calculated based on the $550,000 and not the full $600,000.

Additionally, COV can only be paid in cash. Grants, CPF, HDB or bank loans cannot be used to cover the cost.

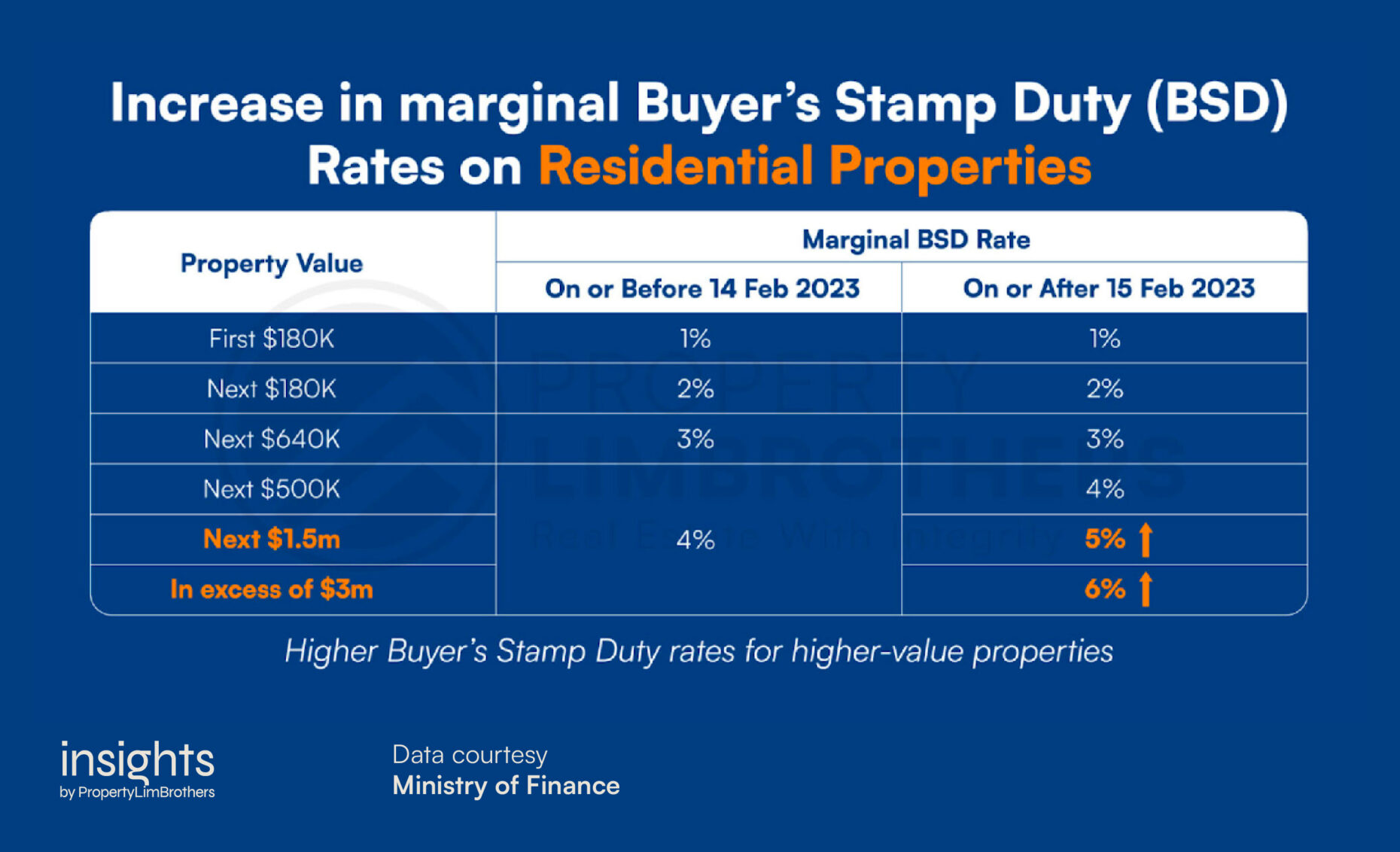

BSD (Buyer’s Stamp Duty)

Buyer’s stamp duty, or BSD, is a tax levied on all property purchases in Singapore, be it BTO flat, resale flat, EC, condominium, landed property, or commercial property. As the name suggests, this tax only applies to the buyers.

Buyers have to pay BSD within 14 days from the date of purchase/acquisition with cash and/or CPF.

BSD is calculated based on the purchase price (the amount signed in the agreement) or market value (based on the valuation report) of the property, whichever is higher. This means that even if you manage to negotiate a lower purchase price than the valuation, the BSD rate will still be calculated based on the higher amount.

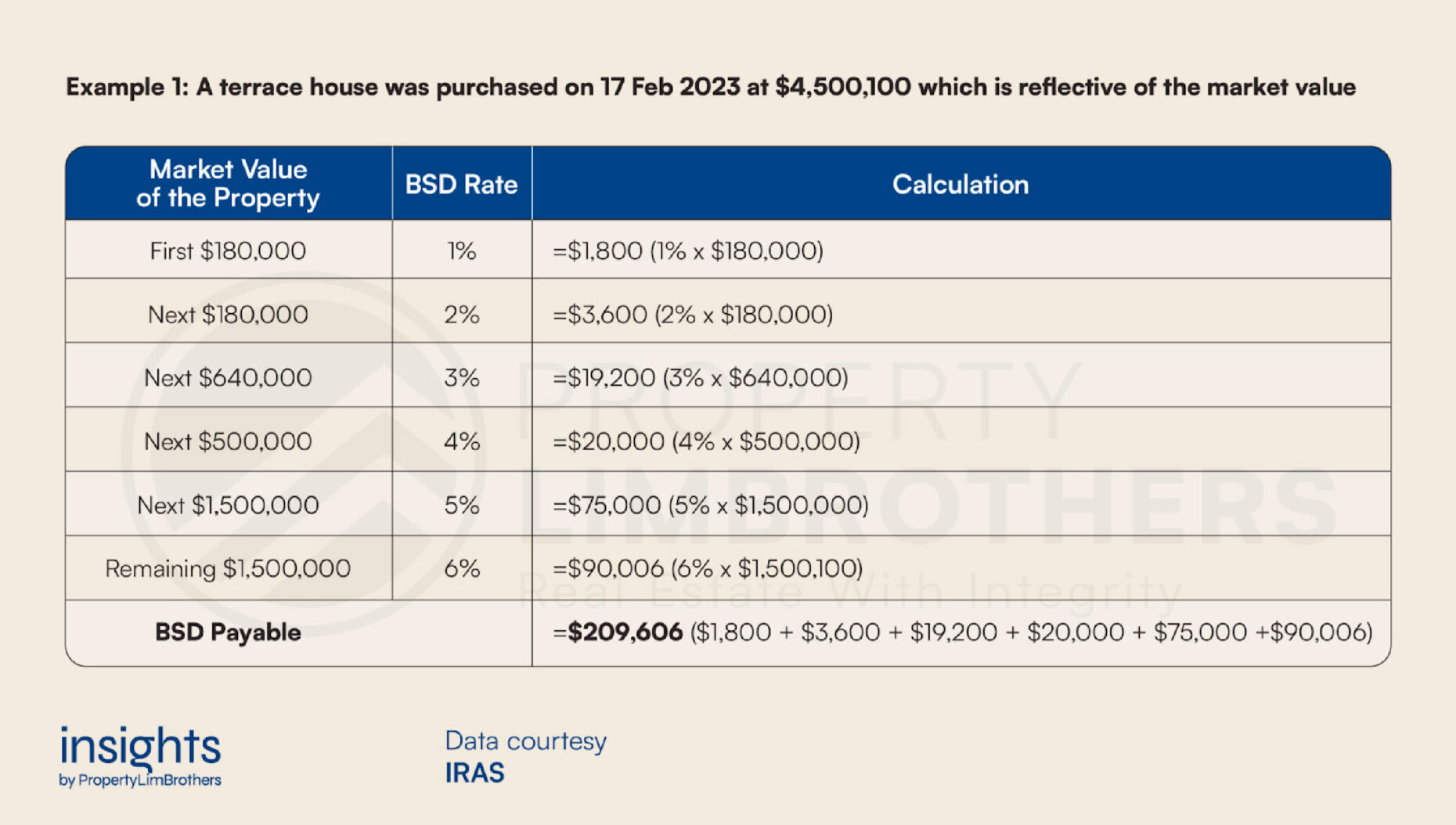

BSD was last revised in 2023 during the Budget 2023 speech, with BSD rates for higher-value properties seeing an increase. The current BSD rates are as follows:

It is important to understand that the BSD is a progressive tax. This means that the percentage rates will be applied to different market value brackets of the property being acquired, tabulated up to the full purchase or valuation price. Below is an example of how it is calculated:

In some cases where the property is a mix of residential and commercial, such as shophouses, the BSD will be calculated accordingly based on the residential and non-residential percentages.

For more information on BSD, you can check out this guide by IRAS here.

SSD (Seller’s Stamp Duty)

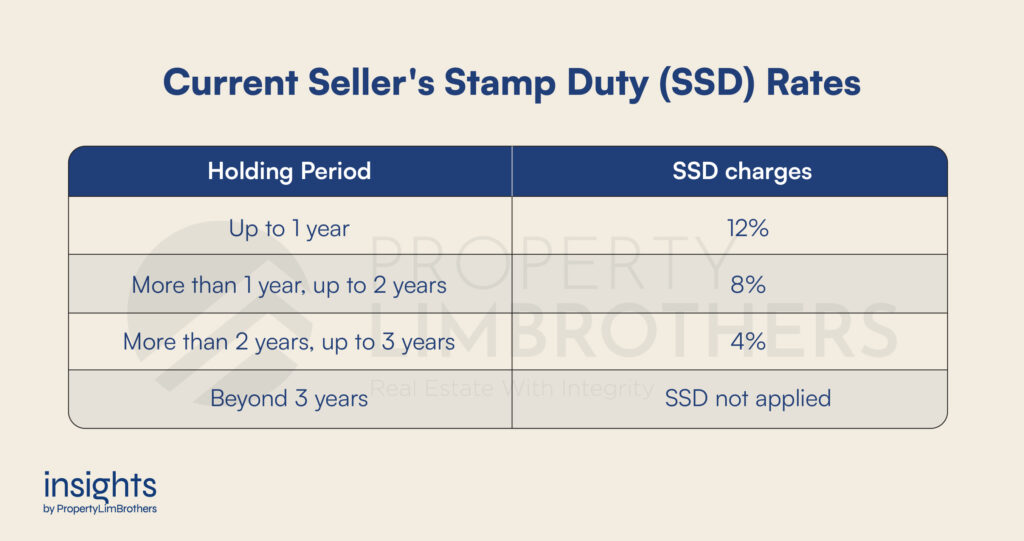

If there is a buyer’s stamp duty, it shouldn’t surprise you to find out that there’s also a seller’s stamp duty. In order to combat property flipping, SSD is levied on residential properties that are sold within the 3-year holding period.

Similar to the BSD, SSD rates are based on the selling price or current market value of the property, whichever is higher. It must also be paid within 14 days (in cash or CPF) from the date of contract signing, and failure to do so will result in a hefty 5% per annum daily penalty.

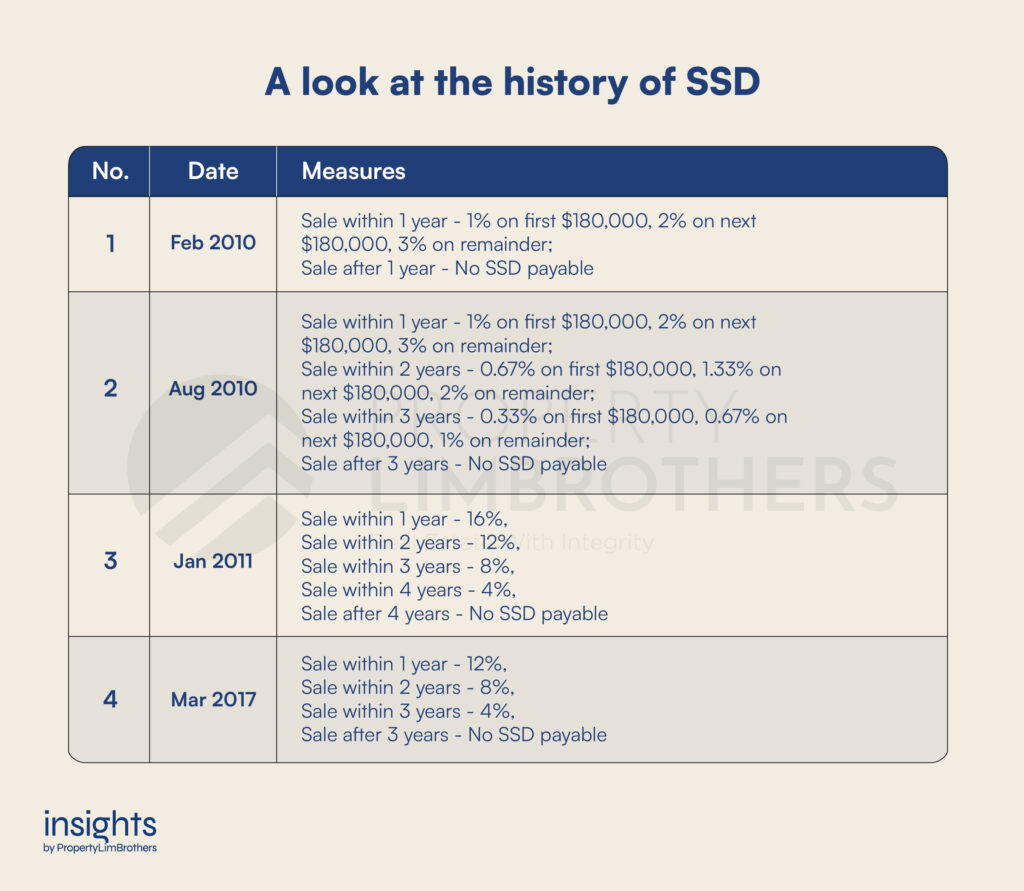

Last revised in 2017, the current SSD rates are as follows:

*It is important to note that SSD still applies if the property is acquired through divorce, inheritance, or transfers within the family.

There are exemptions from SSD under the Stamp Duties Act, under certain scenarios. You can check out the full list of exemptions here.

ABSD (Additional Buyer’s Stamp Duty)

Additional Buyer’s Stamp Duty, or ABSD for short, is a tax levied on top of the Buyer’s Stamp Duty (BSD) on any additional properties that you purchase. ABSD is applied across all private residential properties such as condos or landed property. It does not apply to HDB flats as you cannot purchase HDB as an additional property. If you buy an HDB flat while owning a private property, you must dispose of your private property within 6 months.

Residential property also includes shophouses with living quarters and HDB void deck stores with an upper-level set aside for residential use. Overseas properties will not be included in ABSD calculation.

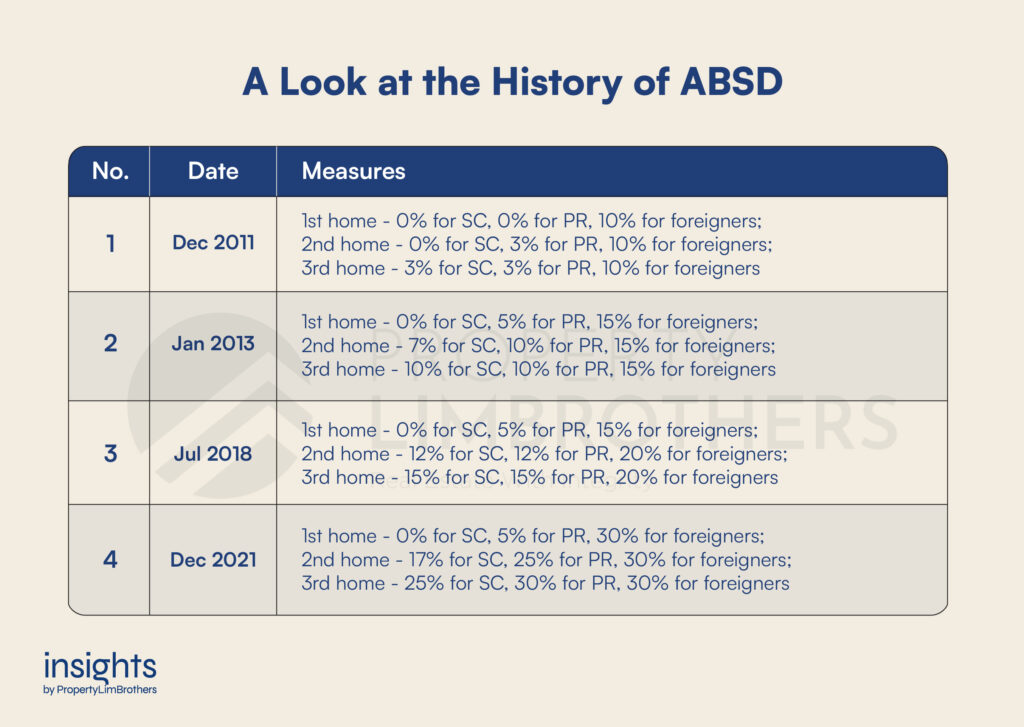

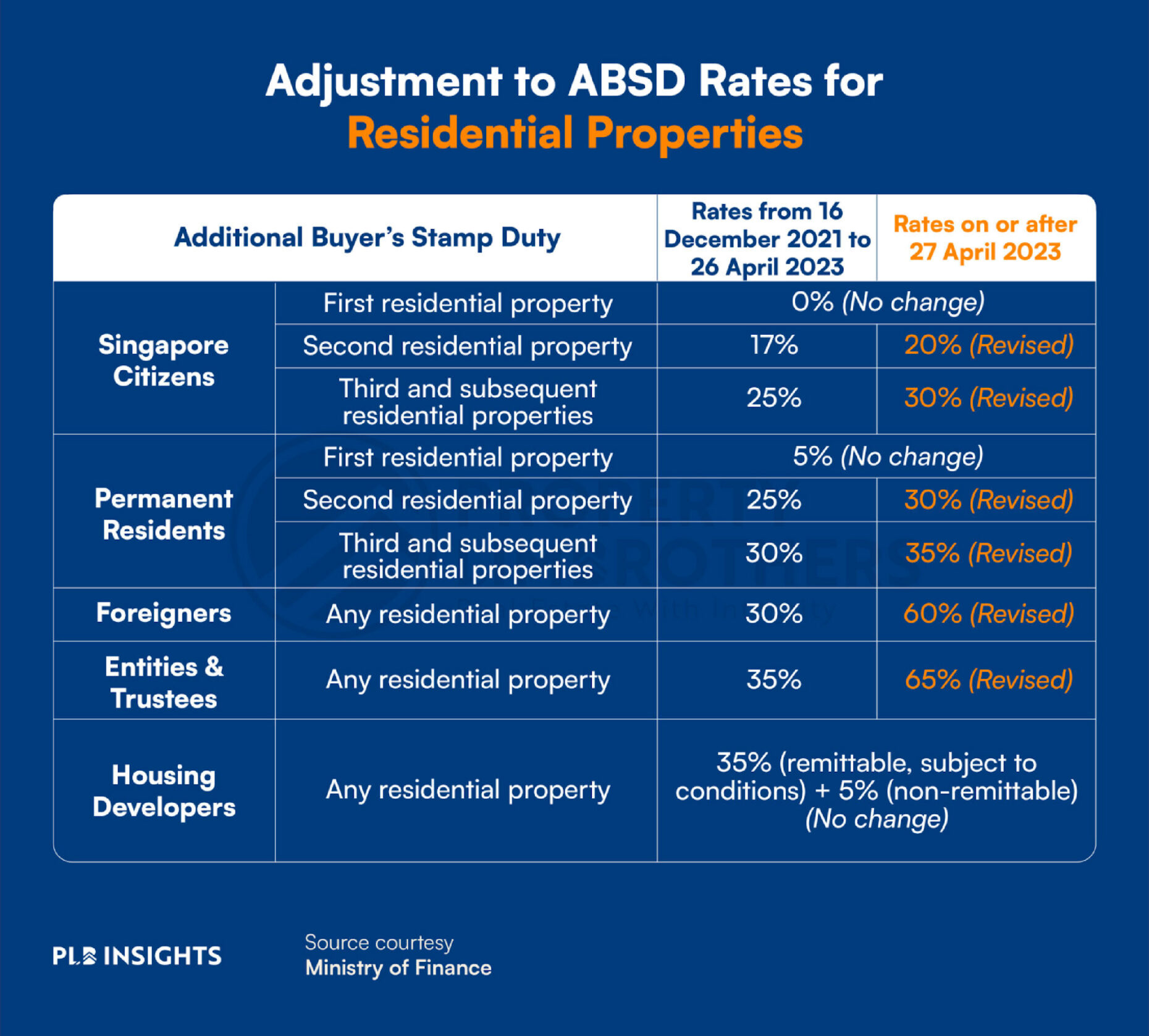

The ABSD was introduced in 2011 to manage the surge in demand for property. Since then, the government raised the ABSD rates in four different rounds of cooling measures (2013, 2018, 2021, 2023) to deter property investors, foreigners, and private entities from purchasing multiple residential properties.

ABSD rates levied depend on your residency status as well as the number of properties you own. It will apply to either the property’s purchase price or its market value, whichever is higher.

Last revised in the April 2023 cooling measures, the current ABSD rates are as follows:

Additionally, any transfer of residential property into a living trust (i.e., any trustee buying a residential property) will be subjected to an ABSD rate of 35%.

ABSD exemptions may be granted for certain cases, like when you’ve already contracted to sell your current residential property before signing the OTP for a new one. A married couple may also be eligible for ABSD remission on the purchase of a residential property if they meet certain conditions. For the full terms and conditions on ABSD remission and joint purchases, do check out IRAS’s guide.

PSF (Per Square Foot)

In Singapore, the real estate industry uses Per Square Foot (PSF) as a metric to evaluate the value of a property. It refers to the rough amount you pay per square foot of the property.

PSF is typically used to analyze the performance of both existing and new launch projects. By comparing the PSF of properties and projects, you can observe various patterns in consumer behaviour and make more informed decisions in your property journey.

However, while PSF does provide some indication of how well a property or project is performing, it does not always paint the full picture. A lot of other factors such as location, upcoming developments in the estate, age and remaining lease, amount of renovations done, etc. can play a part in the valuation of a property as well.

We have previously covered the Land Cost PSF Method, which can be used to determine whether it is more cost-effective to purchase a new launch or a resale property.

Decoupling

Decoupling is a concept in real estate that refers to the act of transferring one’s share of the property to their spouse so that one can buy another property without having an existing property count.

It is a popular investment strategy that allows co-owners (typically married Singaporean couples) to buy extra properties without incurring the hefty Additional Buyer’s Stamp Duty (ABSD) rates.

We have previously covered the topic of decoupling and whether it still makes sense in today’s property market.

Final Words

We hope that this article has provided you with a deeper understanding of some of the most commonly used jargon and abbreviations in the Singapore real estate industry. If there are still certain concepts that you don’t understand and are looking for some help, feel free to reach out to us here. See you in the next one.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.