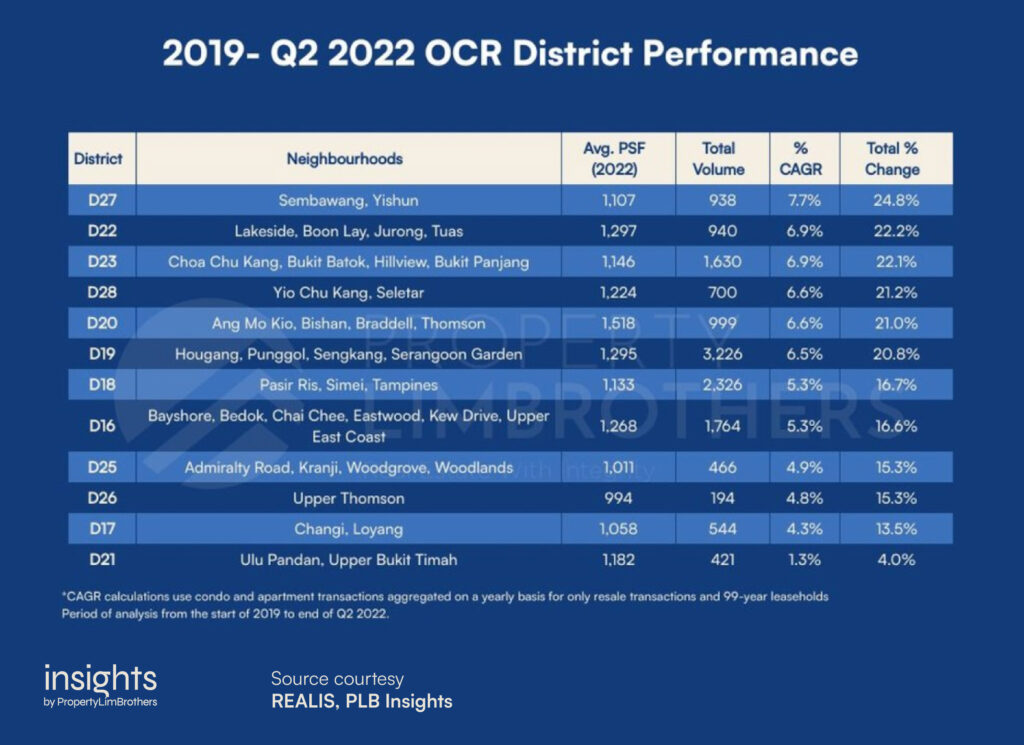

District 23 is located in the Northwest portion of Singapore. It is a large residential cluster that has been tucked away into a quieter part of our bustling city. Choa Chu Kang, Bukit Batok, Hillview, and Bukit Panjang are examples of some of the neighbourhoods found in the area.

Most residents in Singapore might not have visited this part of our island. Other than occasionally passing by on the way to the causeway towards Malaysia. Yet, it was placed as the third highest growth district in the OCR based on our 2022 Q2 report. District 23 has grown by a substantial amount, around a 22.1% increase from 2019 to the end of Q2 2022. This puts it at a Compound Annual Growth Rate (CAGR) of 6.9%, close to tying with the second place, District 22.

Impressive as it may be, do note that past performance is not indicative of future performance. The property prices might have grown substantially, but it is not a surefire way to continuous growth. This is not a buy or sell recommendation.

In this article, we will explore the Top 5 Resale Leasehold Condos in District 23. Where are these fast growing condos located? District 23 spans a large geographic area. Stay tuned to find out where you can find the condos which appreciated the most since 2019.

Fifth Place: Guilin View

In fifth place, we have Guilin View. It is a 99-year leasehold condominium with its lease starting in 1996. It has a total of 655 units which are sized comfortably above 850 sqft, with around half of the units sized between 1,201 and 1,400 sqft.

From 2019 to the end of 2022 Q2, Guilin View transacted at an average of $973 psf and had a total volume of 74 transactions. It achieved a CAGR of 5.4% and 16.5% of absolute growth in the same period.

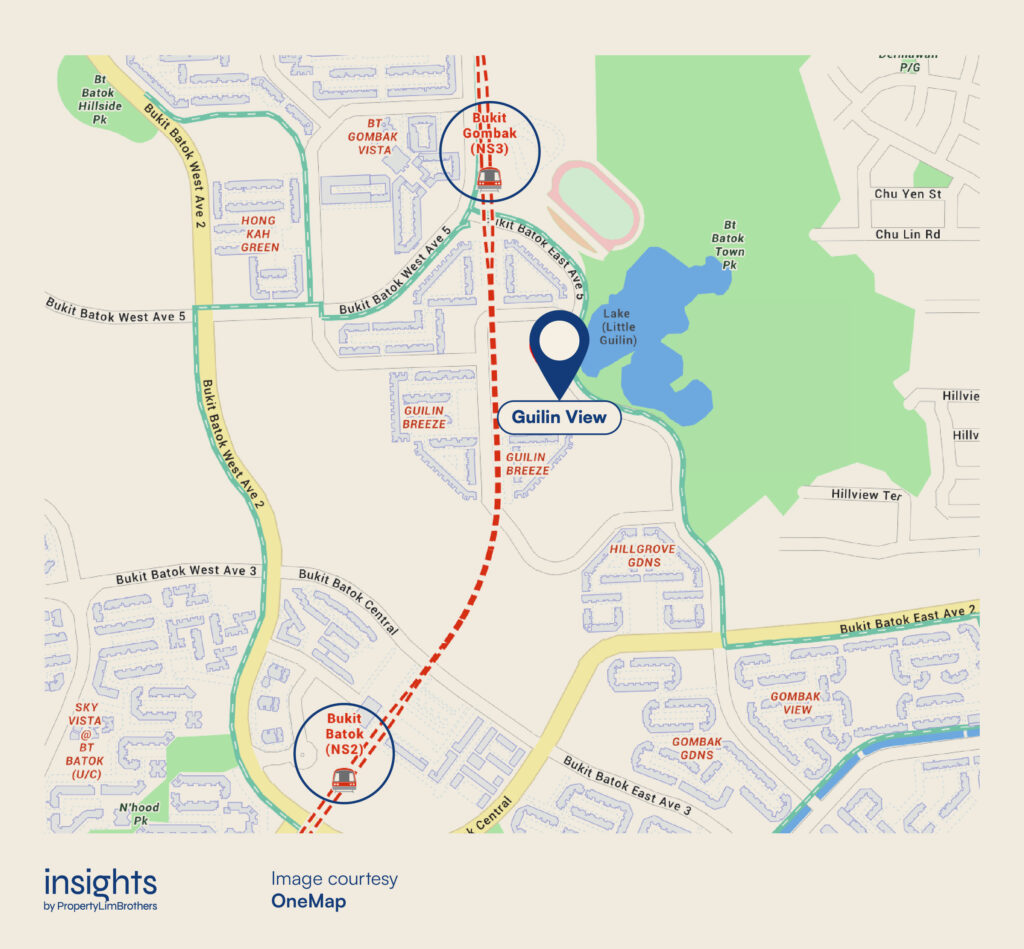

Guilin View is located less than 400m south of Bukit Gombak MRT, and less than 800m northeast of Bukit Batok MRT. It has a great facing towards Little Guilin Lake which is the namesake of this condo. There is a good mix of public and private residences in the immediate vicinity of Bukit Gombak MRT.

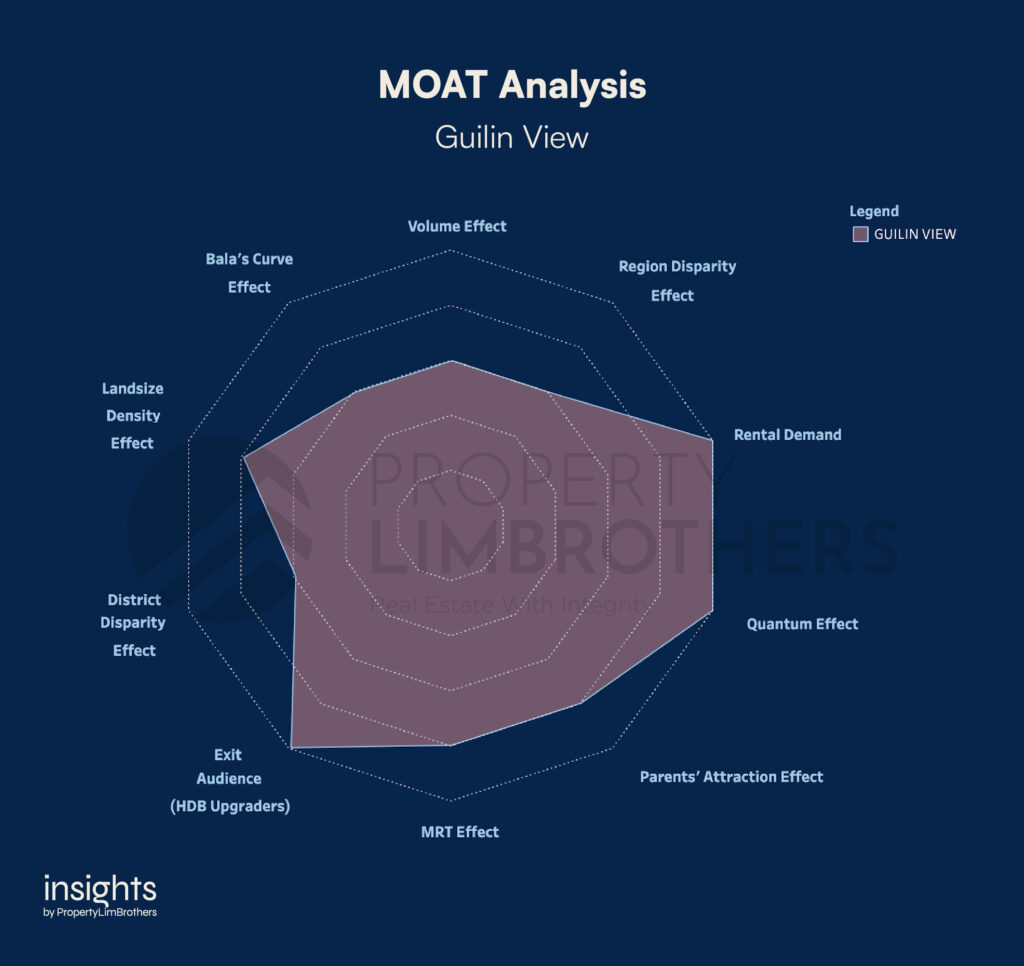

Apart from boasting a great view of the mini lake and its astounding rock formations, Guilin View has a very strong MOAT profile. The general well-rounded performance of Guilin View is accompanied by a high score of 5 on Rental Demand, Quantum Effect, Exit Audience.

Guilin View scores a total of 78% on the MOAT Analysis. This is a very high score despite the marginally lower remaining lease on this condo (approx. 73 years). Nonetheless, this condo has achieved good price growth in the past few years and remains at an affordable quantum while being located close to the MRT.

Fourth Place: Regent Grove

Regent Grove comes in at fourth place. Between 2019 and 2022 Q2, it transacted at an average of $808 psf with a total volume of 65 transactions. It achieved 5.6% on CAGR, and 17.7% in Absolute Growth in the same period.

Regent Grove is a 99-year leasehold condominium with its lease starting in 1997. It was completed in 2000 with a total of 553 units. Like Guilin View, most of the units are very comfortably sized. For Regent Grove, around two thirds of the units are sized between 1,101 and 1,200 sqft.

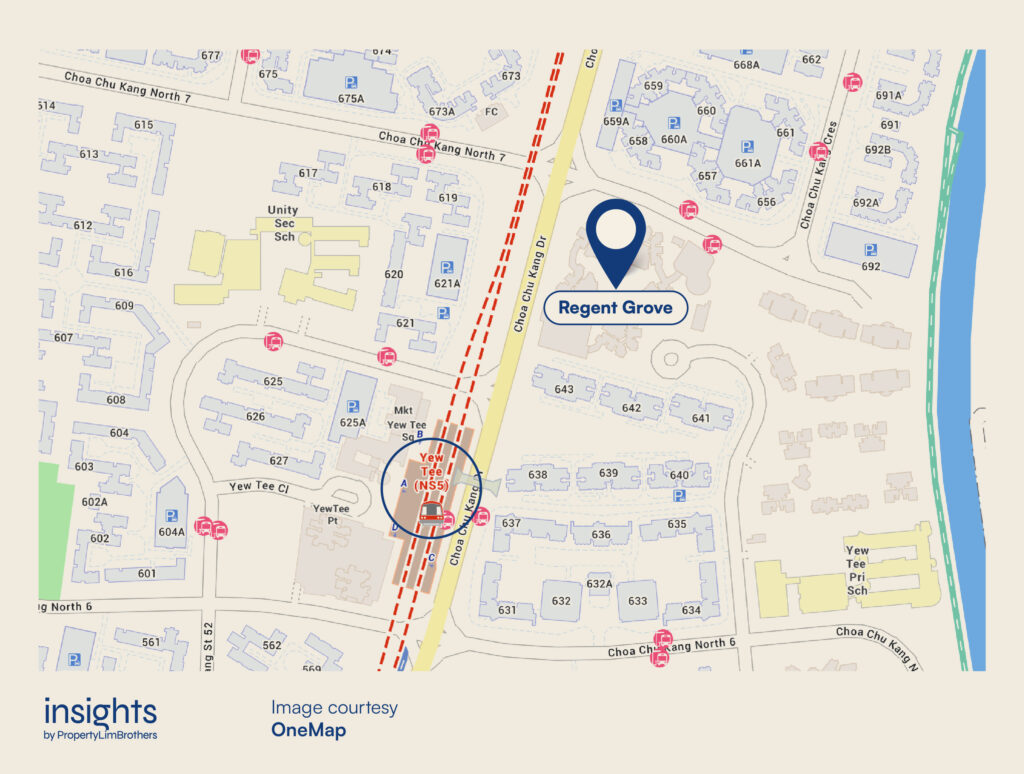

Regent Grove is located around 300m from Yew Tee MRT station. It is located in a diverse residential area with a good mix of public housing. Within the immediate vicinity, we also find Unity Secondary School and Yew Tee Primary School.

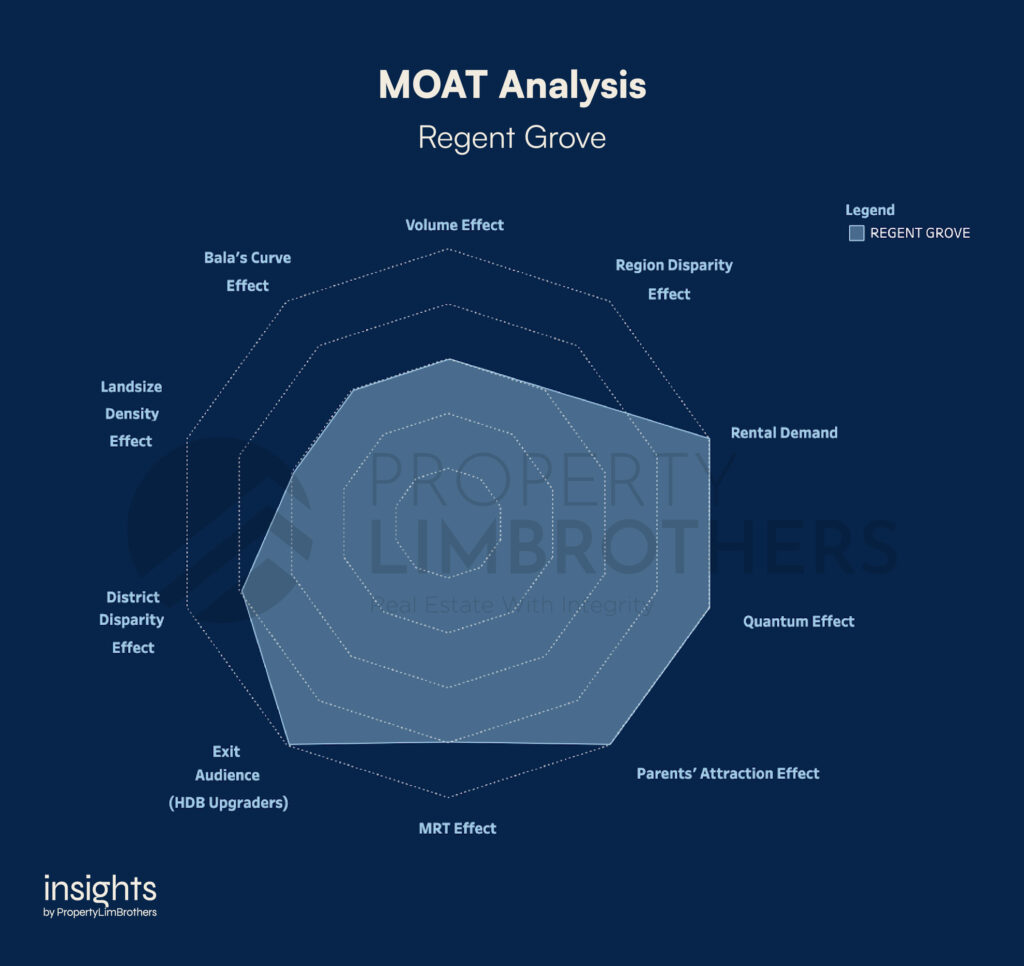

Regent Grove scores a total of 82% on MOAT Analysis. It has strong performance in Rental Demand, Quantum Effect, and Exit Audience like Guilin View. But in addition, it also scores a 5 in Parents’ Attraction Effect and a marginally better score of 4 on District Disparity Effect.

While the MOAT performance and price growth have done exceptionally well for Regent Grove, the declining lease may grow to be a concern after another decade or two. Apart from that concern, the more affordable price range may grow to be more attractive as market conditions get tougher and purchasing power of buyers continues to dip due to cooling measures and the economic slowdown.

Third Place: Palm Gardens

In third place, we have Palm Gardens. It is a 99-year leasehold condominium with its lease starting in 1996. It was completed in 2000 with a total of 694 units, and to some surprise, it has a similar unit size distribution as compared to the two condos we have shared in this article. Almost two thirds of the condominium units are sized between 1,201 to 1,300 sqft, a very comfortable range for families.

From 2019 to 2022 Q2, Palm Gardens transacted at an average of $869 psf with a total volume of 105 transactions . In the same period, Palm Gardens achieved a 5.7% CAGR, and 18% on Absolute Growth.

Palm Gardens is located less than 300m from South View LRT, Keat Hong LRT and is within 1km of Choa Chu Kang MRT. It is found on Hong San Walk, which is between Choa Chu Kang Way and Choa Chu Kang Ave 1.

The area surrounding Palm Gardens is mostly filled with a mix of private and public housing. Choa Chu Kang is one of the larger residential clusters and the district transacts at a relatively higher volume compared to other districts in the OCR. This is what we observe of the top 5 growth condos in District 23 thus far.

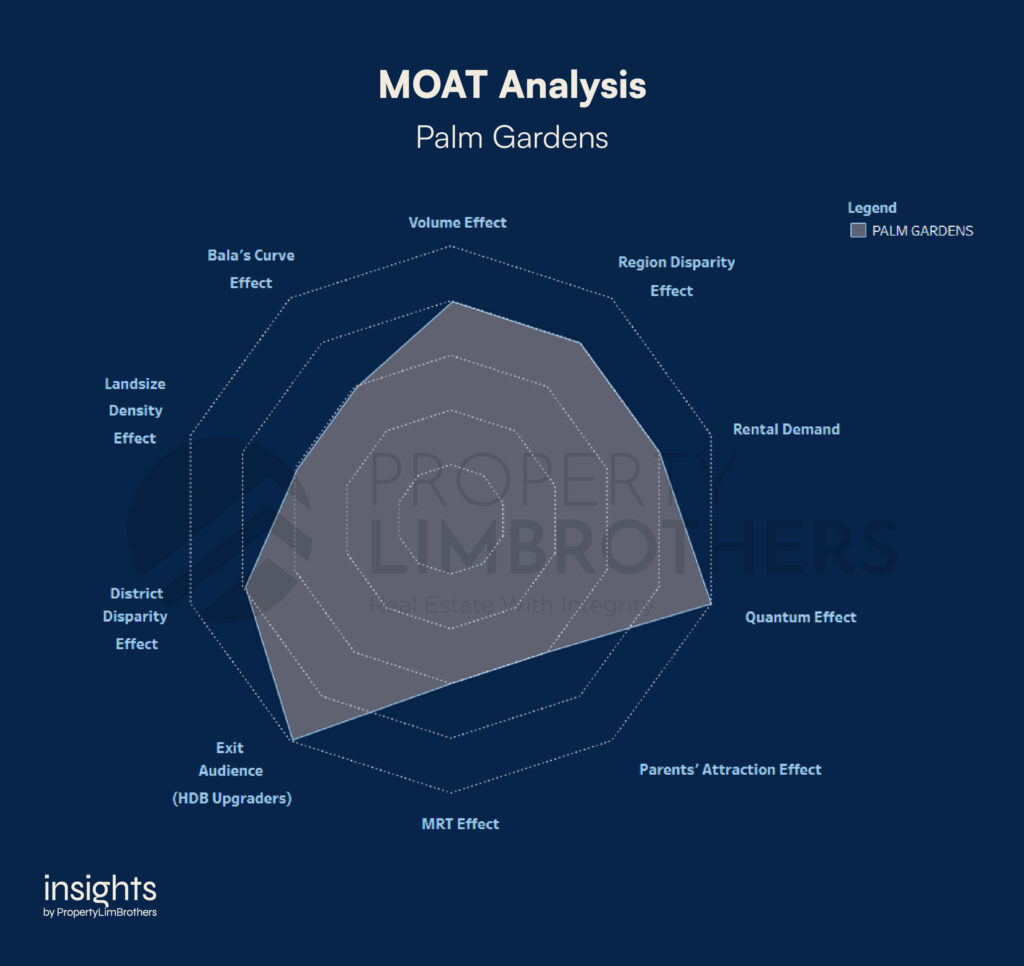

Comparing Palm Gardens to the prior 2 condominiums, Palm Gardens has marginally higher growth but has a marginally lower MOAT score of 76%. Nonetheless, this is still an exceptionally high MOAT score when we compare this to the entire condo population. Palm Gardens scores a 5 on Quantum Effect and Exit Audience. And is well-rounded in the other aspects of the MOAT Analysis.

The strong performance of these large residential clusters across District 23 goes to show that you do not necessarily need to be located close to the city centre, a shopping mall, or an integrated transport interchange to be able to grow. As long as the demand and supply conditions are right for the district, properties across Singapore are able to appreciate decently.

Second Place: The Madeira

The Madeira is placed second among the Top 5 Growth Condos in District 23. It is a 99-year leasehold condo located in Bukit Batok. Its lease started in 2000, and the condo was completed in 2003 with a total of 456 units. Almost half of the units are sized between 1,301 to 1,400 sqft.

From 2019 to 2022 Q2, the average transacted price of units in The Madeira was around $995 psf. It had a total volume of 52 transactions, achieving a CAGR of 5.8% and Absolute Growth of 18.3% over the course of the same period.

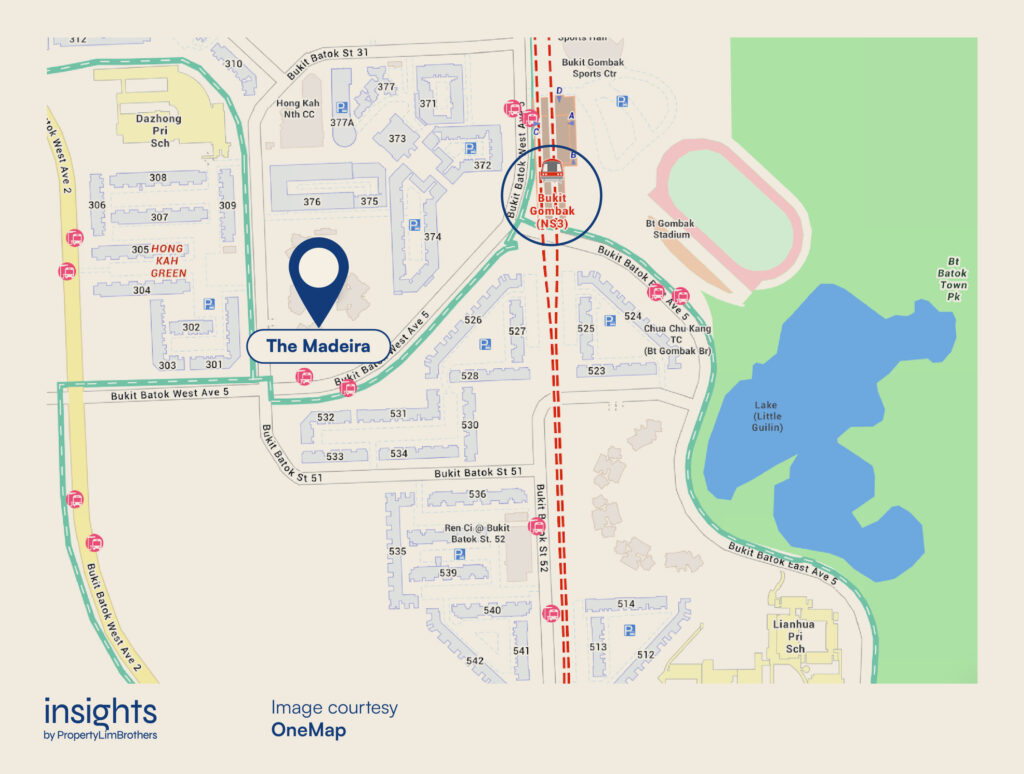

The Madeira is located close to Guilin View (our number 5 entry). The Madeira is also less than 300m from Bukit Gombak MRT, and is one of the few private properties located close to the MRT in this area.

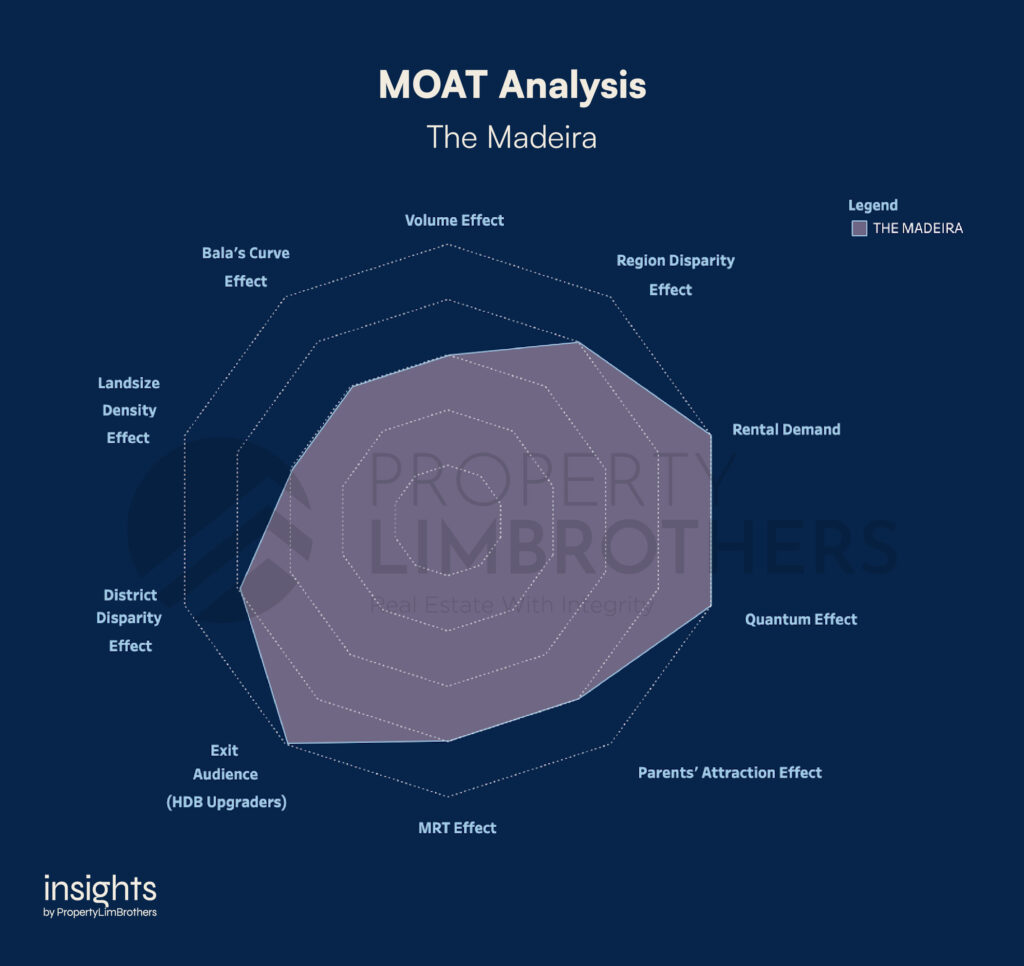

The Madeira performs exceptionally well on the MOAT Analysis with a total score of 80%. Again, it exhibits a strong all-rounder performance when it comes to the MOAT. It scores a 5 on Rental Demand, Quantum Effect, and Exit Audience. And has marginally more lease (3-4 years) than the other projects we have mentioned.

Overall, The Madeira’s location is great. And with a strong MOAT, future upside would not come as a surprise as it still scores quite high (4 points) on District and Region Disparity.

First Place: Hilltop Grove

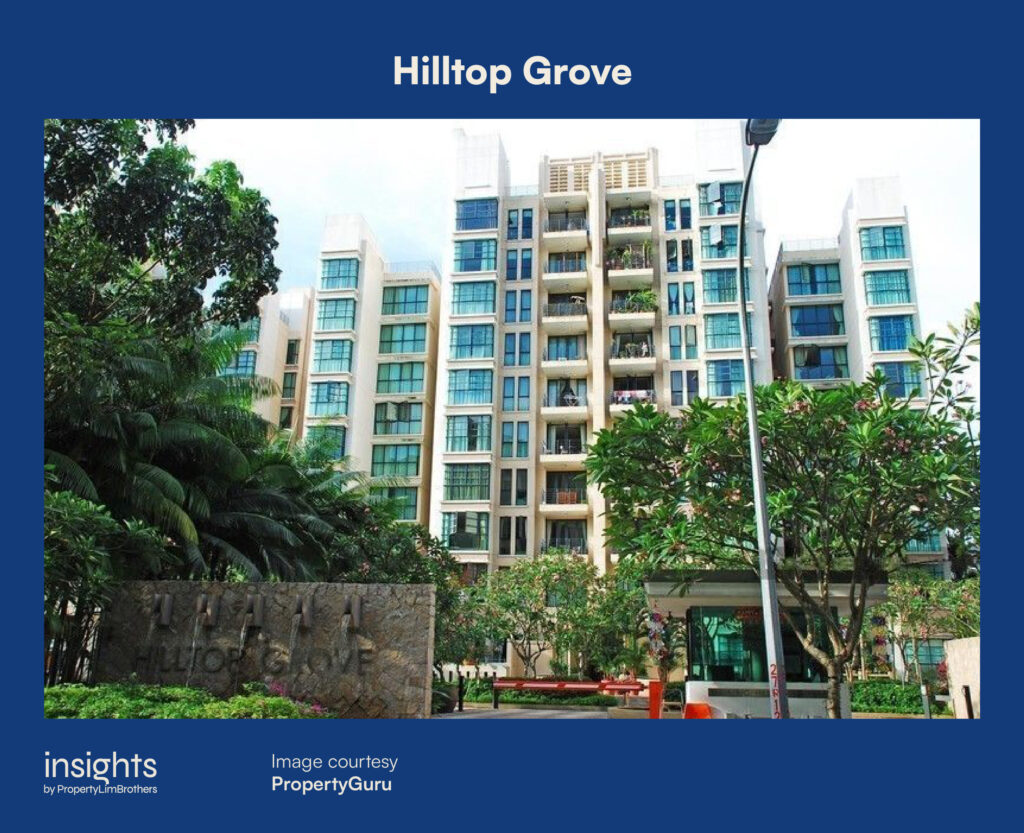

Finally, coming in at First Place, we have Hilltop Grove. It is a 99-year leasehold condo with its lease starting in 1996. It was completed in 2001 with a total of 192 units, more than half of which are sized between 1,201 and 1,400 sqft. Hilltop Groves is the smallest of all the Top 5 Growth condos and one of the furthest away from MRT stations.

Yet, it has grown the most within the short time span of three and a half years. From 2019 to 2022 Q2, it was transacting at an average price of $948 psf with a small volume of 26 transactions. Nonetheless, it has a CAGR of 7%, and an Absolute Growth of 22.6%.

Compared to the rest of the Top 5 Growth Condos, Hilltop Grove is located in a cluster of private housing. It is located at the end of Hillview Avenue, quietly tucked into a more private area of District 23. Perhaps this is one of the reasons for the growth performance of Hilltop Grove.

Hilltop Grove looks deceptively close to Bukit Gombak MRT but it is not accessible through Bukit Batok Town Park. From walking to public transport, the closest way is probably through Bukit Batok East Ave 2.

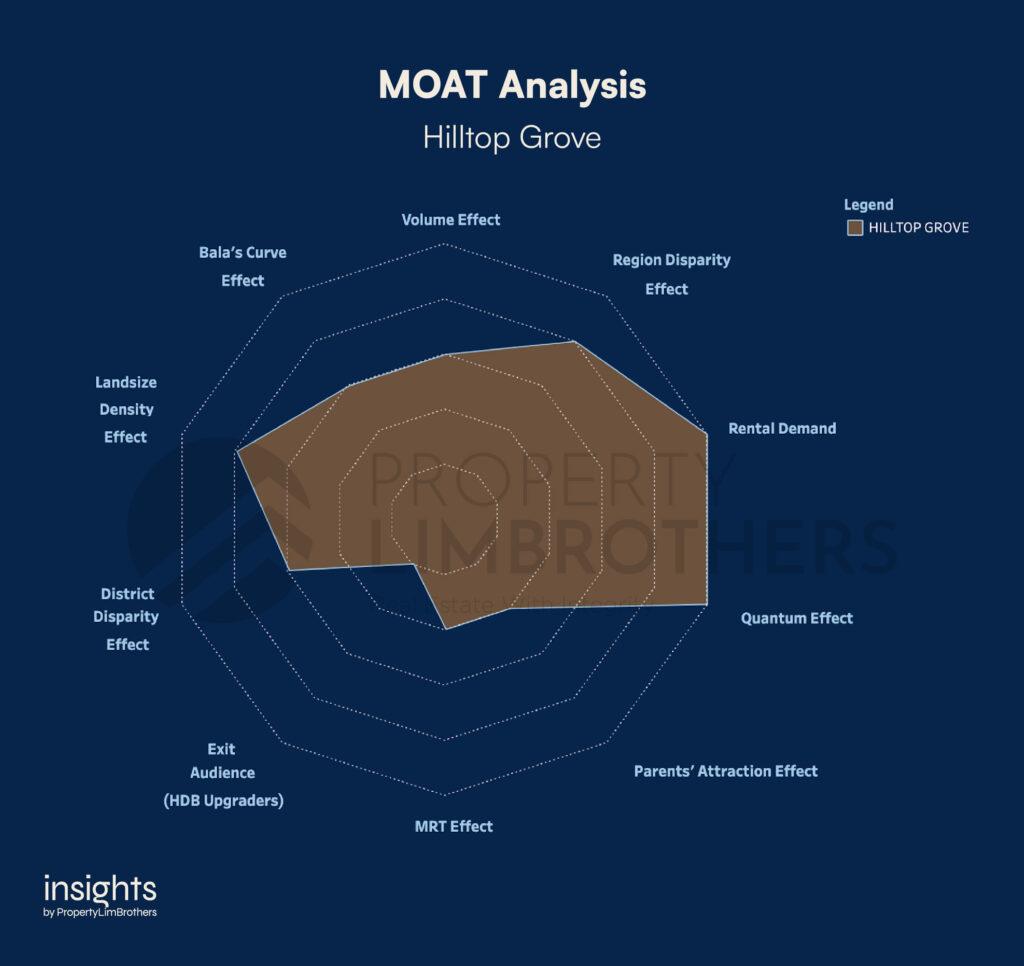

Hilltop Grove scores 64% in total on the MOAT Analysis. This is similar to District 27, where we see the top growth condo being a small development located in a quieter corner of the district. The high growth number may be due to strong sales performance from recent transactions in the post-pandemic property price boom.

Part of the reason for the strong growth number despite the lower MOAT score might be that the relatively low average price of $948 psf still gives it room to grow to the upside when compared to other private housing estates. With the appropriate buyers, prices can appreciate decently within a short period of time for smaller developments. Thus, lower MOAT scores are more of an exception rather than a rule when it comes to the growth potential of Condos.

Closing Thoughts

There are some interesting features the Top 5 Growth Condos in District 23 have in common. First, most of the condos were completed around 2000. This indicates that there is decent room for appreciation for 99-year leasehold condominiums even into the third decade of ownership.

Another interesting feature is that 3 out of the top 5 condos are located around the Bukit Gombak area. Despite it being a relatively more mature estate as compared to Canberra in our District 27 article, more mature residential estates in the OCR can also provide decent growth conditions for Condos.

Finally, 4 out of 5 of the Top Growth Condos in District 23 have a very high MOAT score above 75%. This high MOAT score may be indicative (but not necessarily deterministic) of the strong growth potential for Condos. As we have seen, some outliers with a lower MOAT score might still be able to top the charts when it comes to the growth.