Real estate statistics provide critical insights into the ever-changing market. Not only for professionals but also for budding real estate gurus like you and me. Staying on top of real estate statistics can help enhance your property strategy and plans. With unlimited data on the internet, information overload is inevitable. Where to start and what to look out for?

In this article, we will break down five exciting charts about the residential scene in Singapore.

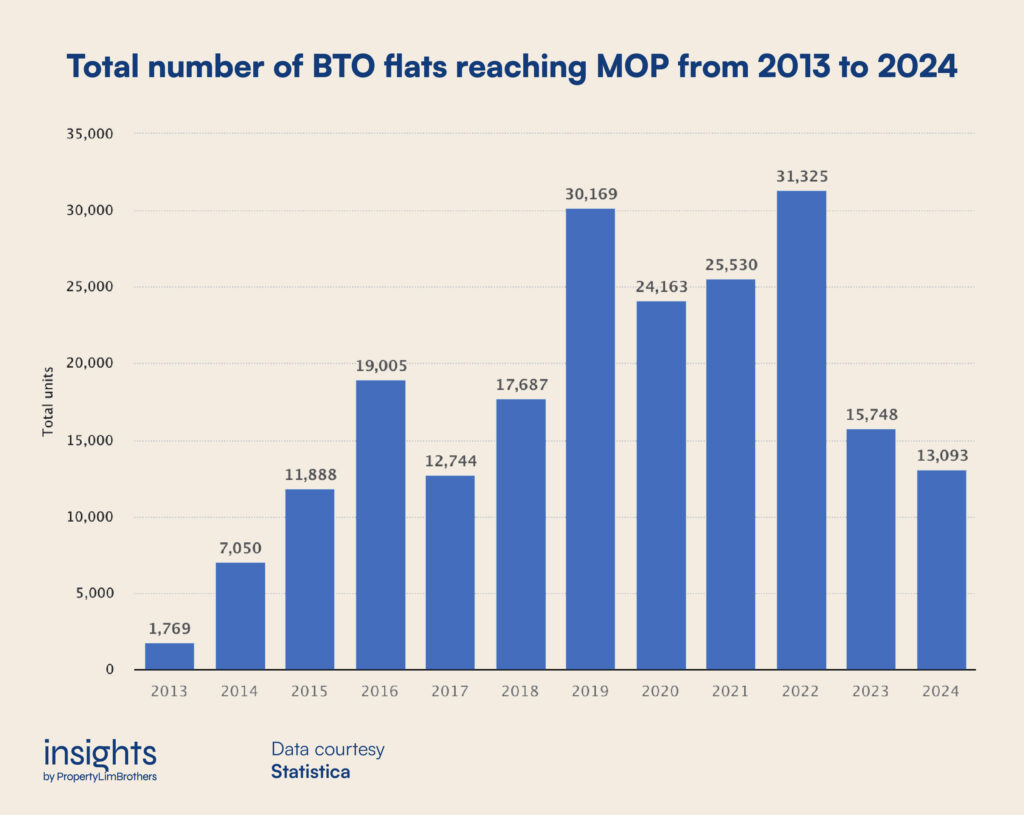

#1 Number of Built-To-Order (BTO) flats reaching MOP

MOP, also known as the Minimum Occupation Period, is a time when owners have to physically occupy their flat before releasing the property to the open market. For most BTO flats, their MOP is five years unless;

- the property is under the Prime Location Public Housing (PLH) scheme or

- buyers purchase under the Fresh Start Housing Scheme

This year marks the peak for the number of flats reaching MOP. In the next two years, the amount of flats available is expected to drop by over half. What does this mean for the residential market?

Amongst HDB owners, BTO owners have the highest motivation to exit from their BTO flats that hit the five years mark. Most BTO flats will see a healthy paper gain after staying there for five years. This will mean that these families with the most locked-up profit are sitting under their HDB properties. Although not all owners might sell their properties at the five-year mark, this group likely can upgrade to private properties.

There is no data to track how many people exited from their BTO properties. However, if thousands of families hit their MOP status year-on-year, the chances of kinetic energy are high. After all, buyers have a steady demand for flats that have just completed their MOP. These properties are the next best thing to a brand new HDB flat.

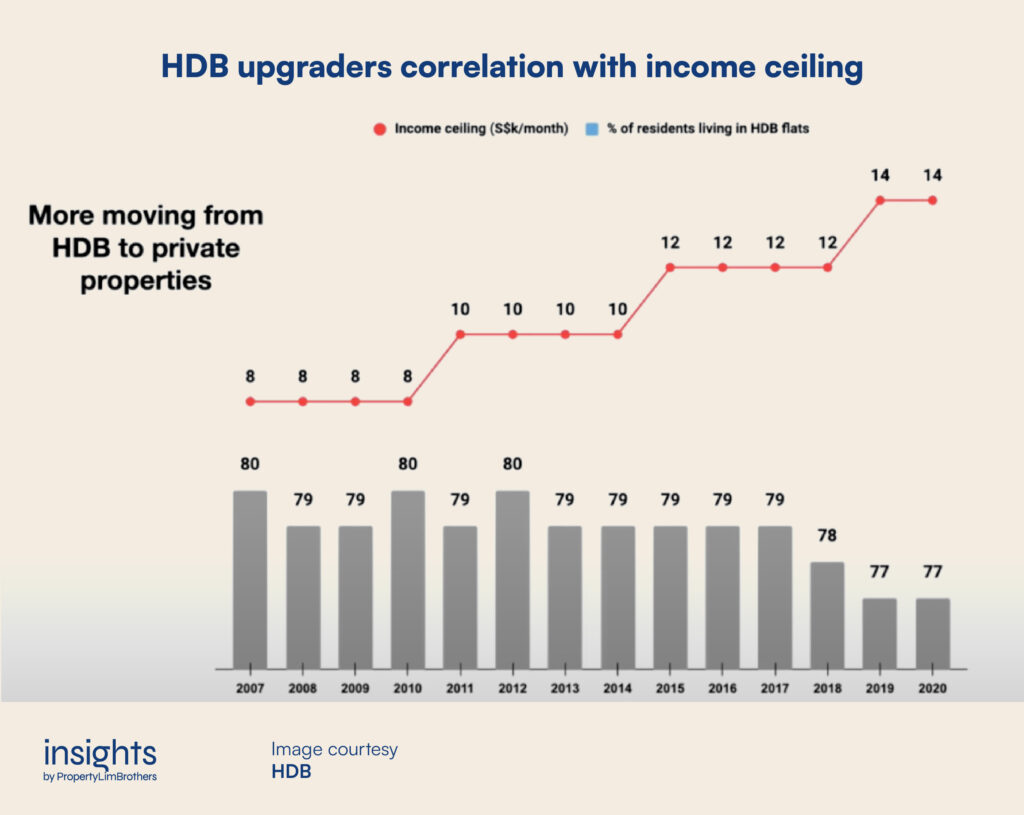

#2 HDB upgraders’ correlation with their income ceiling

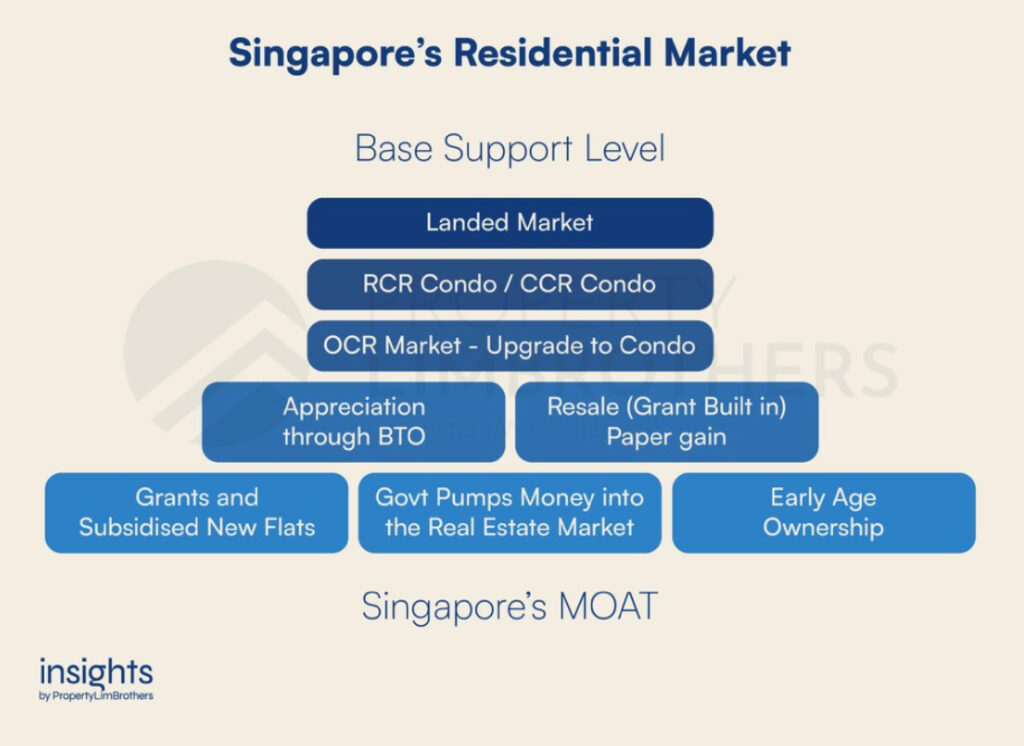

Previously, we explored the base support level of Singapore’s MOAT through resale grants and subsidised new flats. Now, we will explore HDB upgraders’ correlation with their income ceiling.

Based on the income ceiling per month against the percentage of residents living in HDB flats, we notice that as the income increases, the lower the proportion of HDB residents.

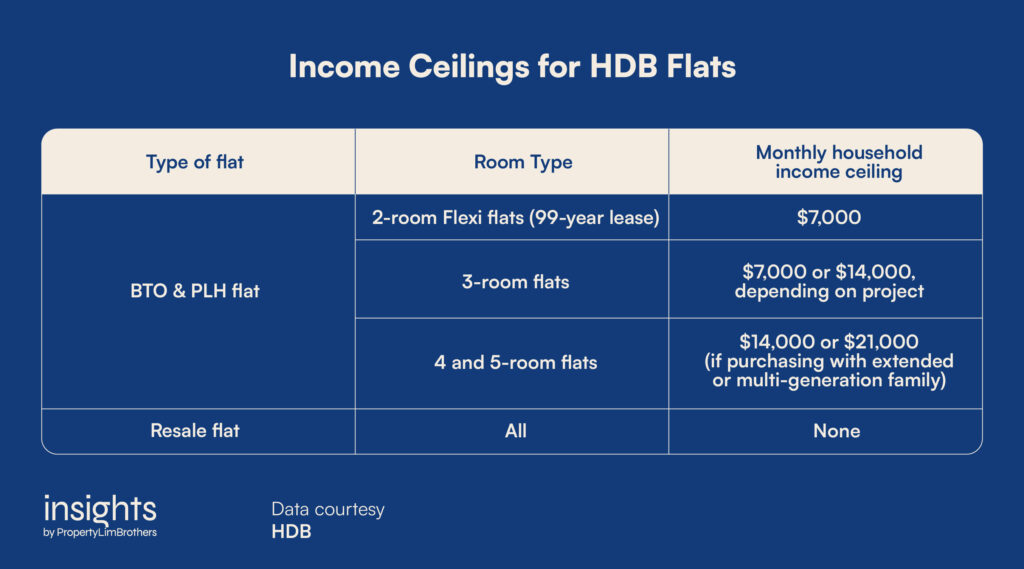

One of the requirements to purchase HDB flats is a monthly household income ceiling. This income ceiling helps ensure priority goes to the people who need it the most.

As income categories of families grow closer to the monthly household ceiling, more are moving away from their existing HDB properties. Although resale flats have no income ceiling involved in the purchase, families’ income has to be below $14,000 if these purchasers want to utilise CPF Housing Grants.

Aside from having more financial means, the deterrence from the income ceiling may fuel more motivation for higher-income families to sell their properties to move up to private properties.

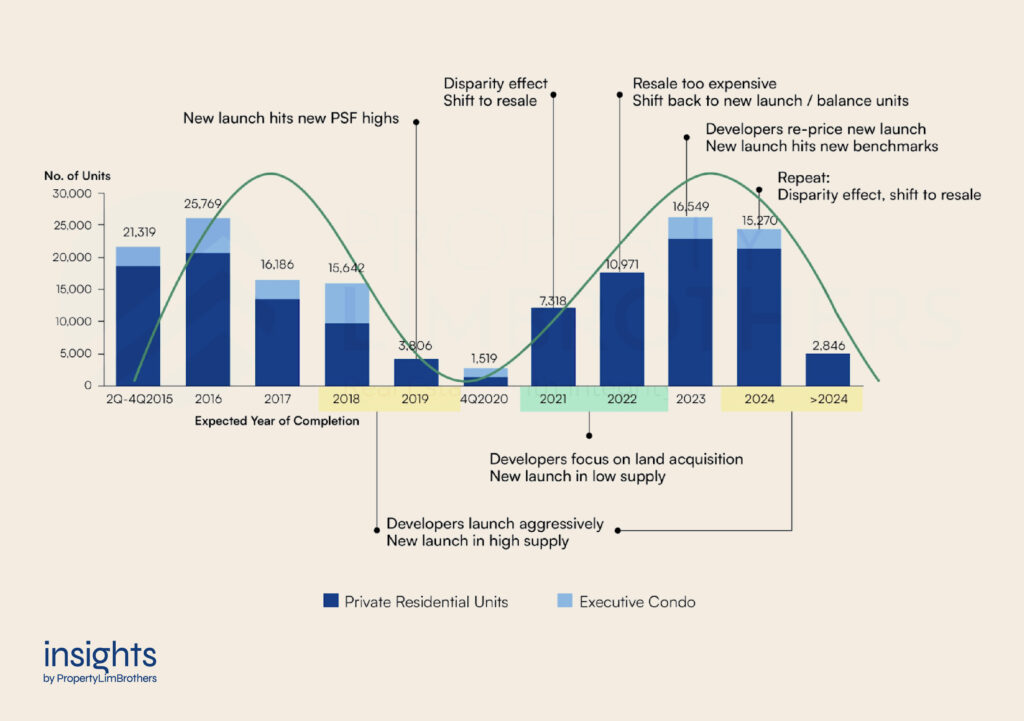

#3 New Residential Launch Supply

Euro-Asia Park, Oxley Gardens, and Kensington Park Condo. These are just some of the many en bloc attempts made this year. This year, the government unveiled multiple new sites under the Government Land Sales (GLS) Programme. What does this mean for everybody? It is a sign that developers’ land banks may be drying up.

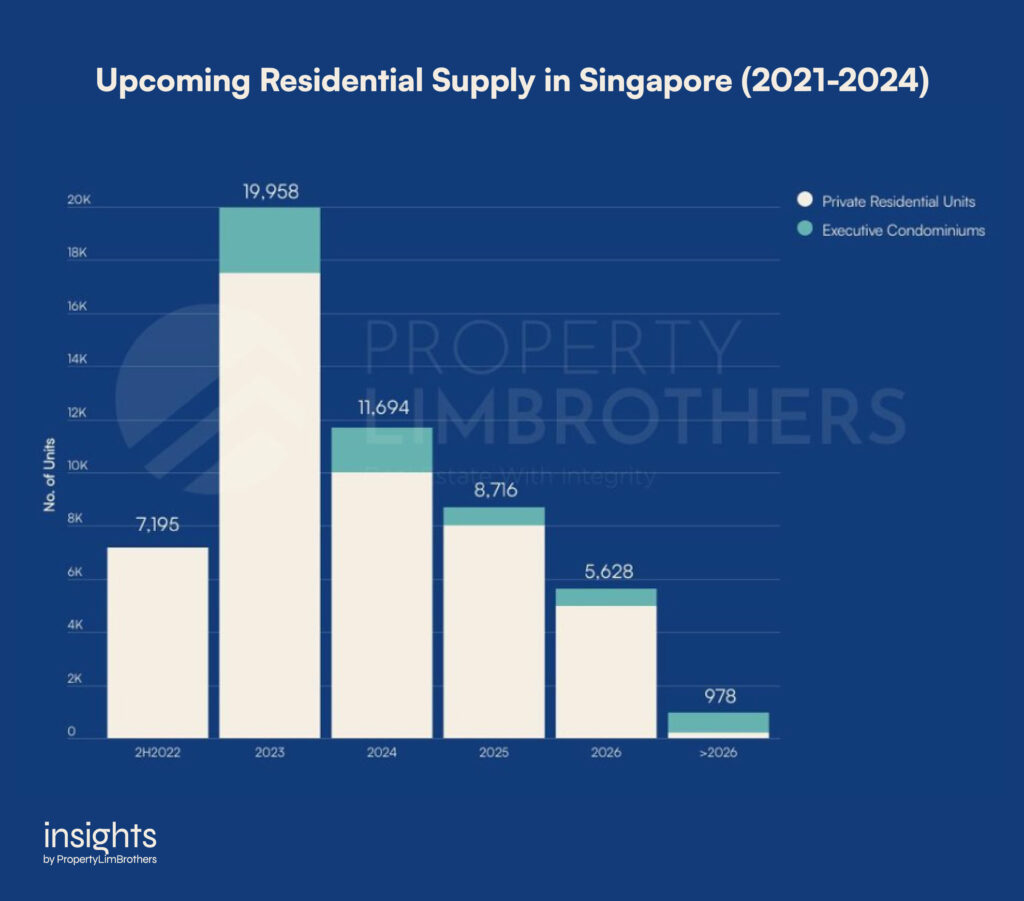

According to the Urban Redevelopment Authority’s latest update on the Q2 performance, 2023 will see a significant spike in the stock of completed private properties. Afterwards, Singaporeans and developers can expect a lowered supply of new launches.

As discussed earlier in the year, the focus on construction and land acquisition typically alternate every two years. As evident by en bloc attempts and GLS releases, the theory stands that real estate is cyclical. Resale prices getting too expensive coincides with reality as we see the government implementing new cooling measures. In 2023, we may expect resale properties to continue moving as new launch prices grow and buyers look to fall back onto resale properties.

#4 The Average Net Cash versus the Debt per Household

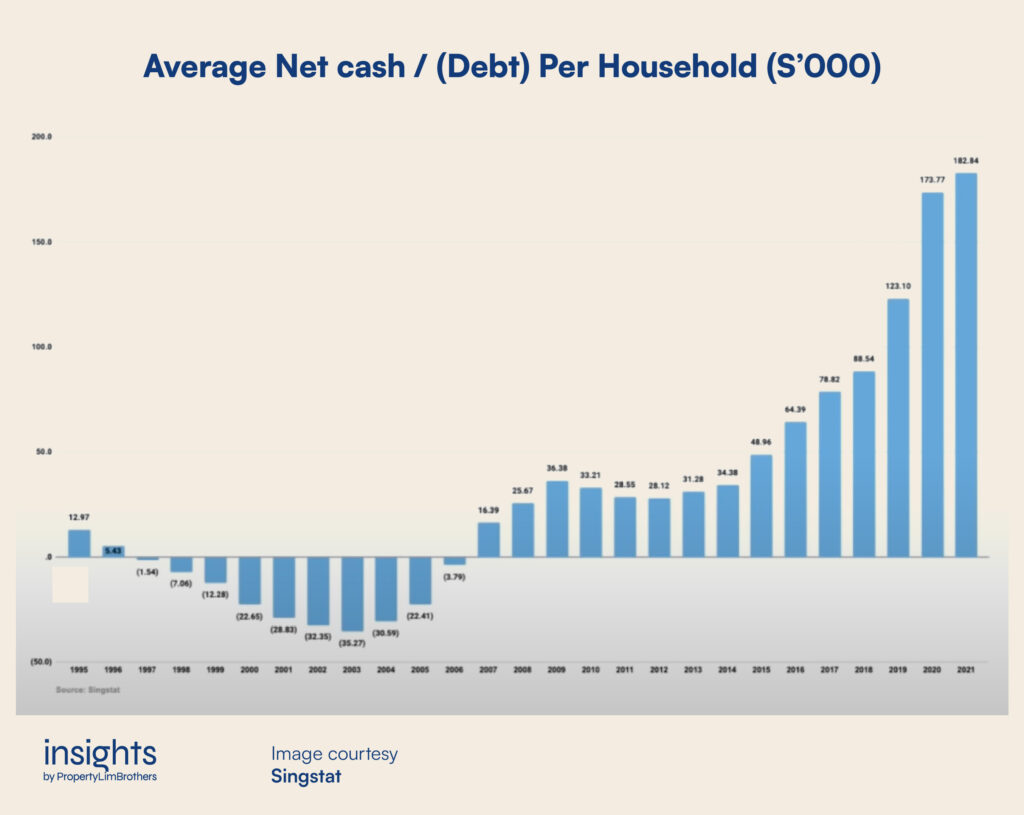

A curious question that some may have is when the interest rate rises, will a lot of people dump their properties? The Average Net Cash versus the Debt per Household helps to determine the spending power of families through the calculation of household liabilities such as loans and credit fees.

While it is unrealistic to spend the entirety of income servicing debt, this average will provide a general look into a household’s financial health. Generally, the higher the average, the better the household’s financial health and the higher the household spending power.

We note that the average net cash versus the debt per household has increased over the past two years. There was a sharp rise from 2017 till today. The sharpest rise was between 2019 and 2020 from 123 index points to 173 index points.

The rise in terms of net cash per household versus their debt level means that households have higher holding power over their existing property. Despite the high-interest rates that may be at play, Households will be able to tide through inflation. There is no reason why existing families with properties will fire sell them into the resale market.

#5 Mortgage

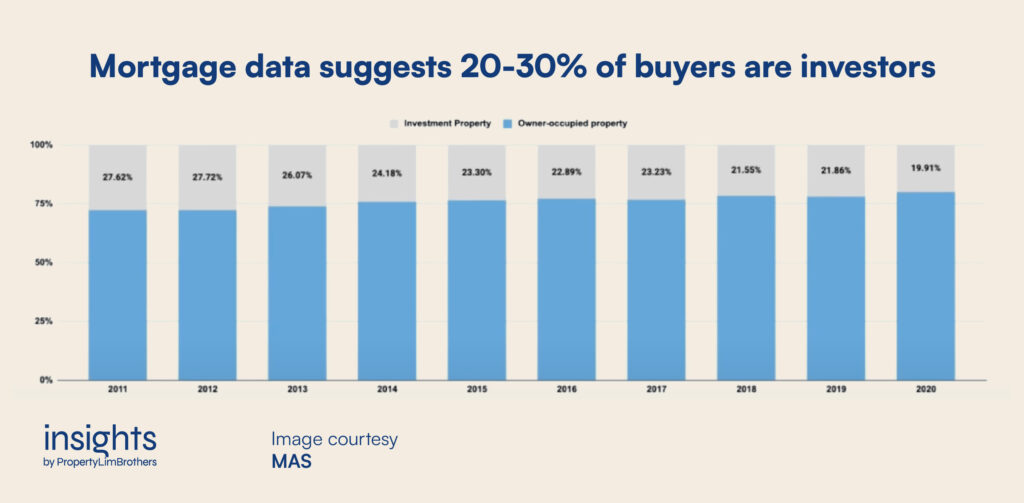

Mortgage data also suggests that there are few motivations for households to fire-sell their properties in the resale market. According to MAS, more people are buying their properties for their own stay.

The grey bar shows a drop in people buying properties for investment. The decline is very minute from 2019 to 2020, with a 2% drop in investment and a 2% rise in the number of people buying their property for their own stay reasons. The minute change in mortgage take-up shows that the more people buy properties for their own stay reasons, the less motivation and the less likely they have to dump their properties in the market through a recession.

Especially considering other factors such as proximity to children’s school and possibly having secured fixed mortgage rates, the motivation to hold the property through high-interest rates is even stronger.

Final Thoughts

In this article we have touched bases on BTOs reaching MOP, HDB upgraders’ relationship with their income ceiling, the potential fire selling of properties in a high-interest climate, and more!

Our top three biggest takeaways are

- Owners whose flat is reaching MOP and those with higher income ceilings have more motivation than others to upgrade to private properties.

- Real estate is cyclical and we can expect a shift of focus to construction in the next few years.

- There are a few reasons for households to fire-sell their properties in this high-interest period.

What are your biggest takeaways from this article?

We hope that you have understood a little more about Singapore’s residential market and that this article sparked more curiosity within yourself to explore Singapore’s real estate scene. If these statistics pique your interest, be sure to check out our Insights Q2 report. If not, check out our other insights to stay updated on the latest happenings. Till next time!