The U.S. Fed has recently announced the largest interest rate hike in 20 years. Interest rates are set to rise by 0.5%. Other central banks have followed suit, taking a hawkish position and raising their interest rates to combat inflation. This should not come as a surprise. The Fed has been trying to signal their hawkish policy stance since March 2022, with a few mentions that 2022 will be filled with rate hikes in the remaining FOMC meetings.

Should Singaporeans be worried? What are the things you should look out for?

Whether or not you’re involved in Singapore’s real estate market, you should be prepared for higher prices for borrowing money. In our previous article on interest rates, we talked about the Fed interest rate hikes that are coming for the rest of 2022 and how it will affect mortgage affordability for Singaporeans. The maths from our previous article suggests that this 0.5% rise in interest rates would translate to an additional income of $900 required to afford a loan of $1 million.

In this article, we will focus on interest rate history in the U.S. in relation to inflation numbers and market reactions.

Highest Rate Hike but not Highest Rate Ever

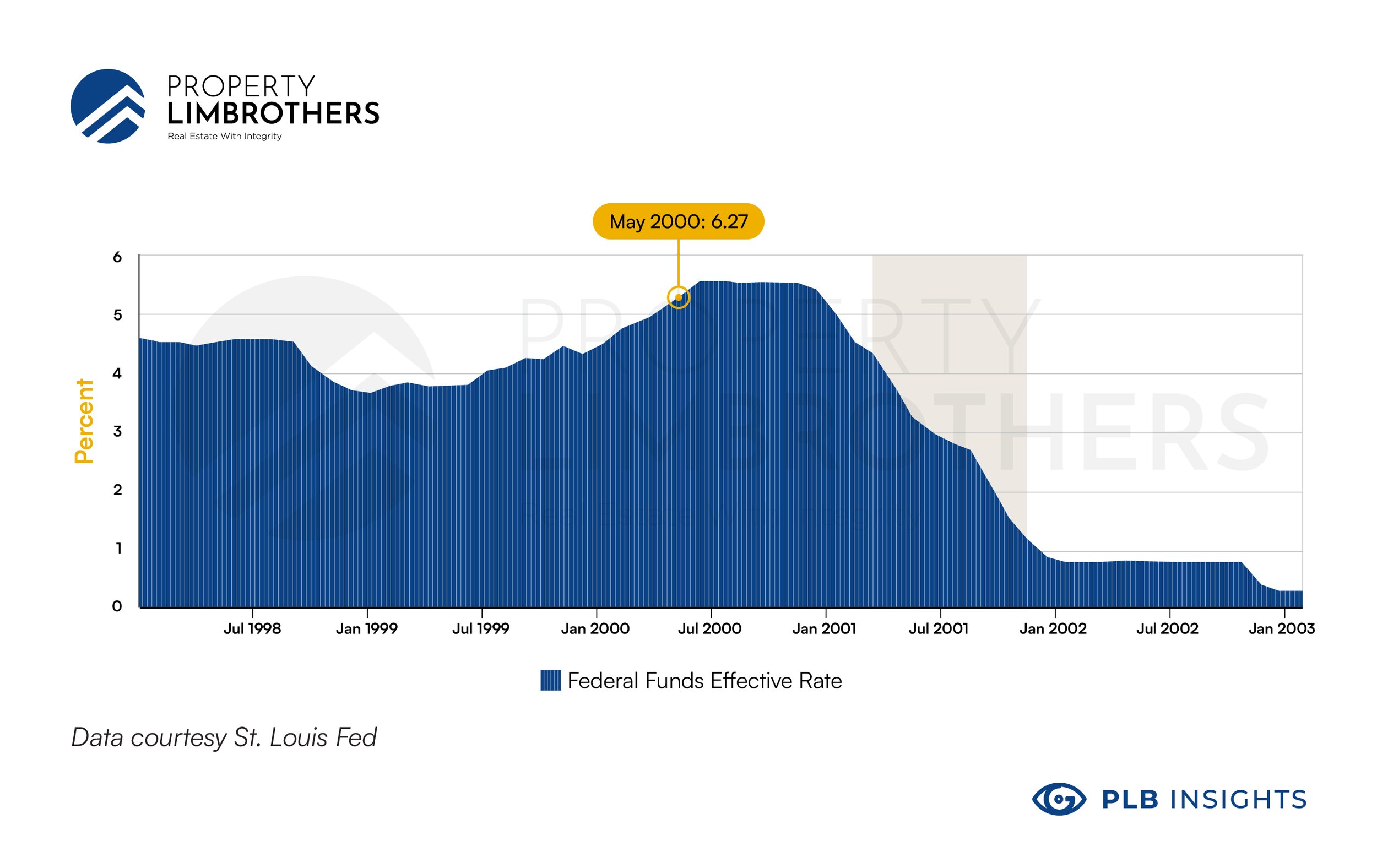

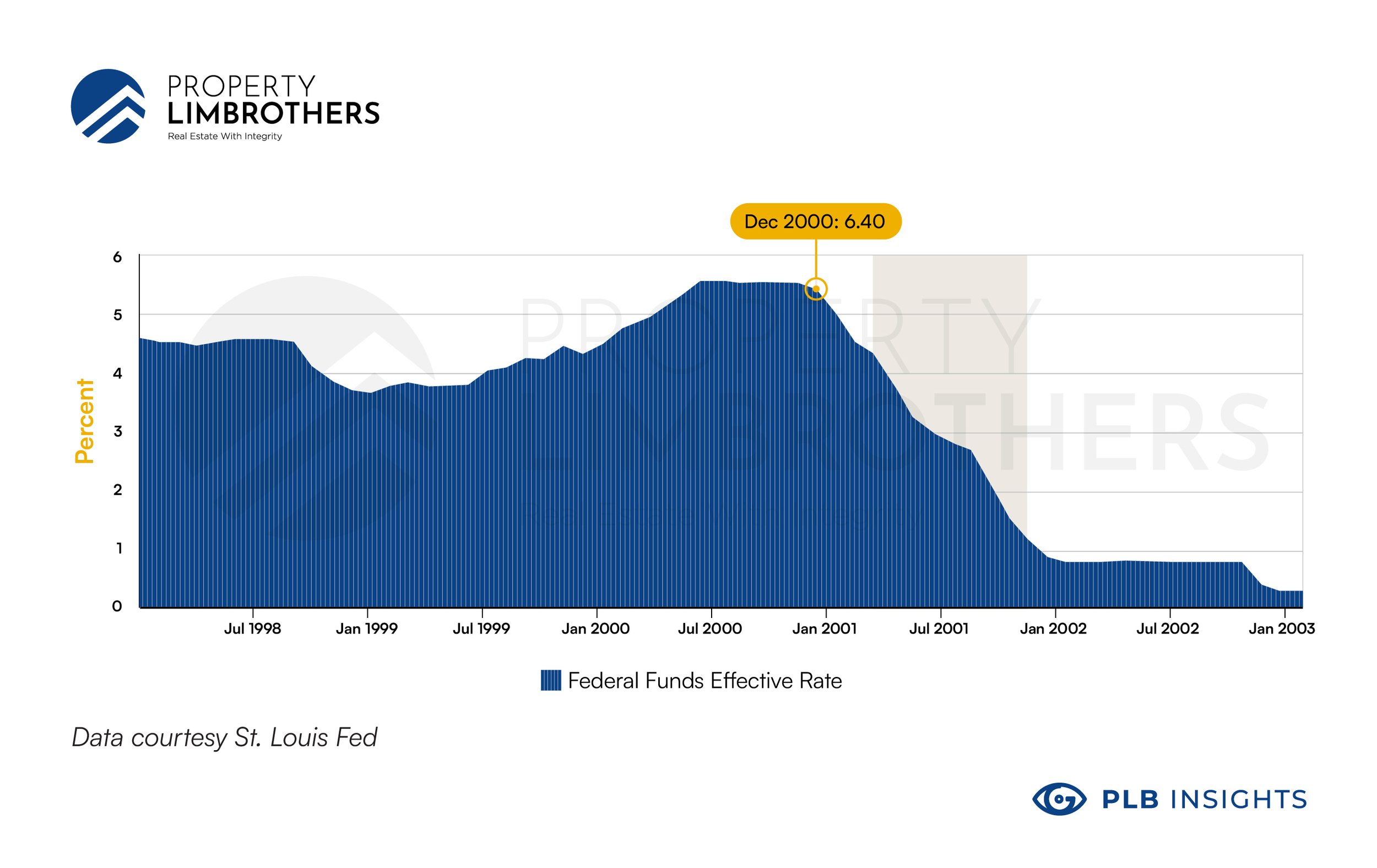

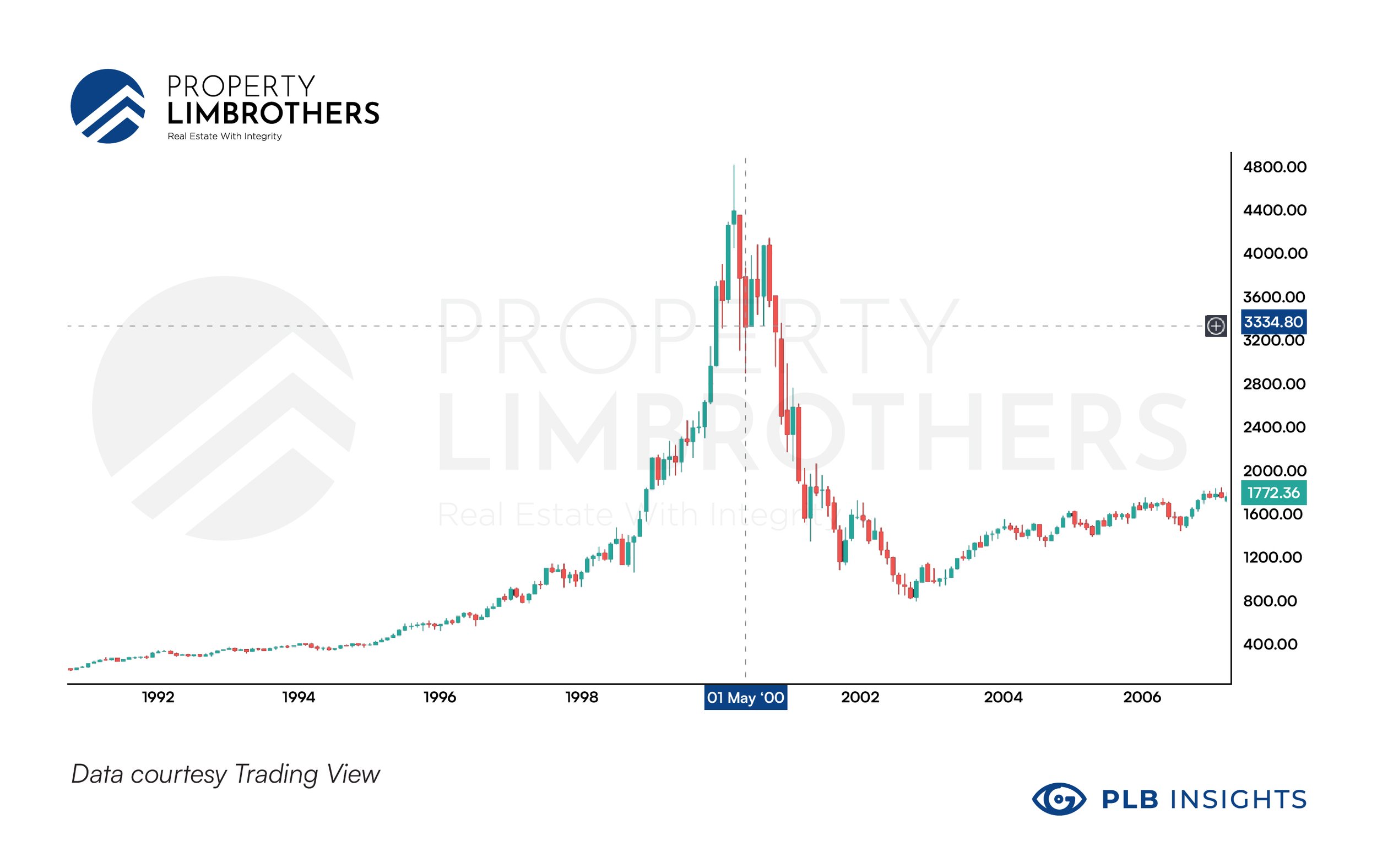

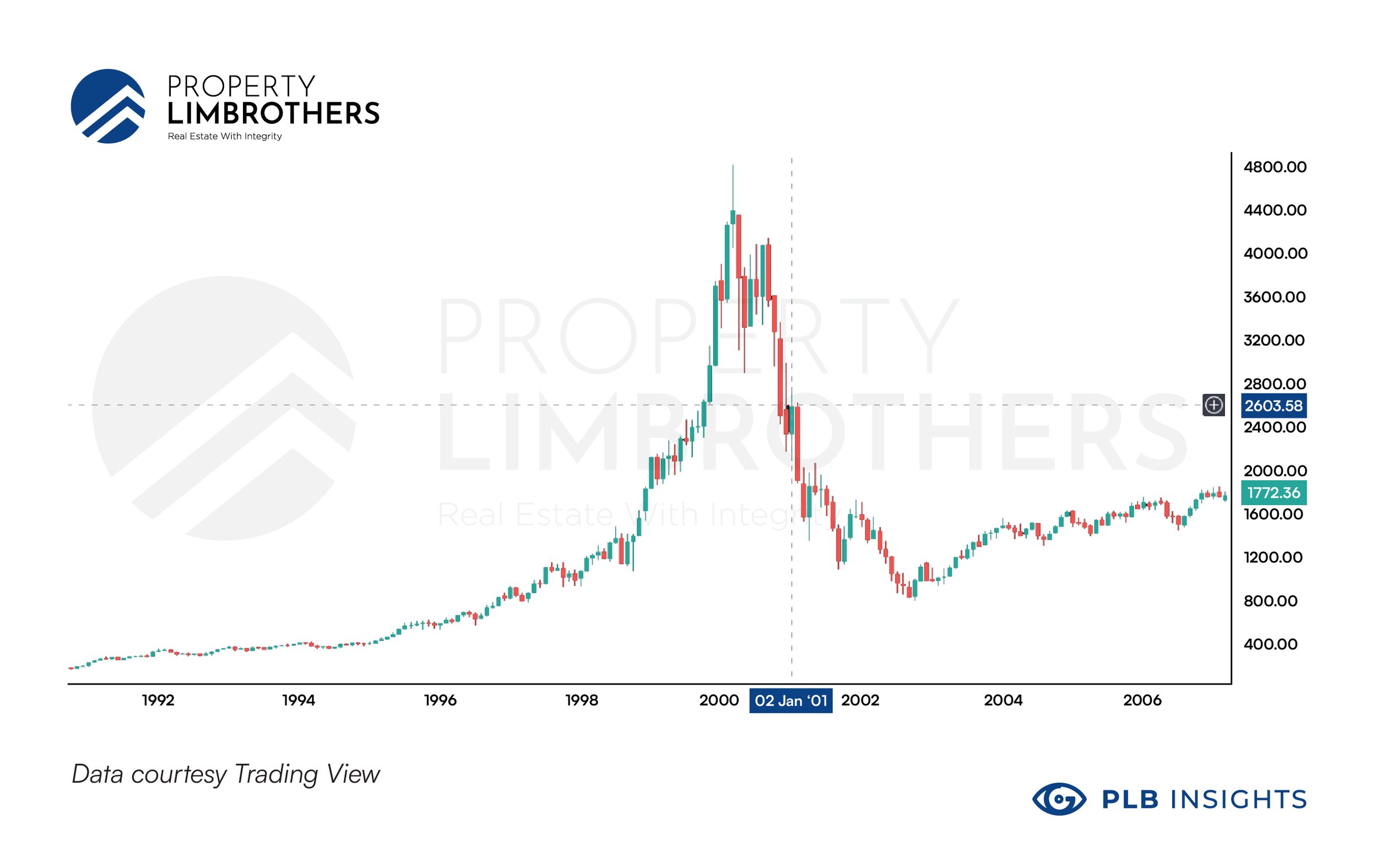

The last time the Fed announced a rate hike of 50 basis points was exactly 22 years ago in May, 2000. This was shortly after the Dot.com bubble reached its peak in March, 2000. The size of the rate hike itself doesn’t tell us enough about how it will affect the markets. What is more important is the persistence of the highest interest rates and its relation to inflation.

In 2000, the interest rate hike did not last long. This might be due to the already low inflation then, around 3.3%. The interest rate hike back then only lasted a short period of time, ending around December of 2000. Thereafter, we see a sharp decline from 6.4% to below 2% by the end of 2021. This steep decline in interest rates was to help encourage companies to invest in technology after the Dot.com bubble crashed investor confidence.

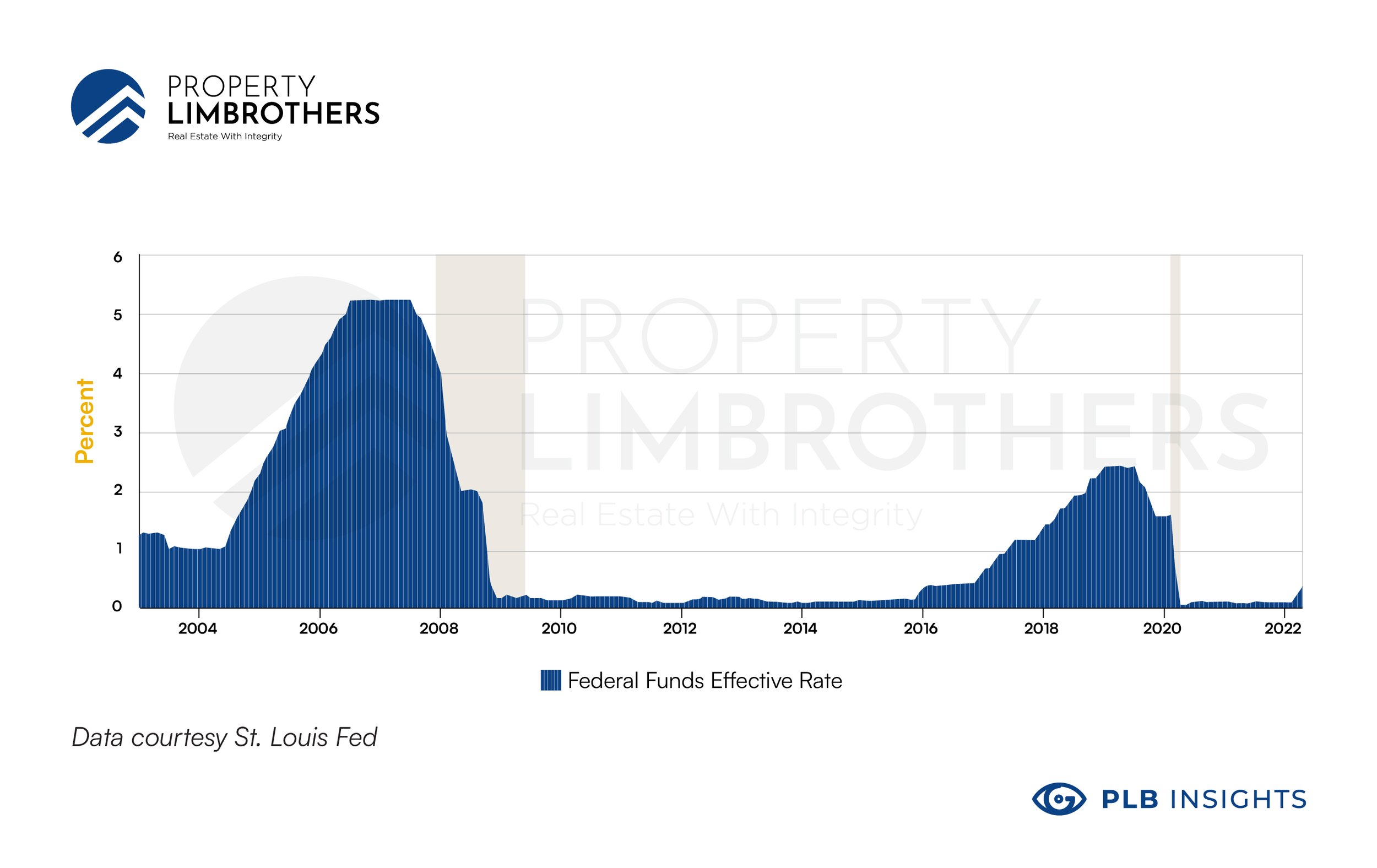

What we call a “high interest rate environment” these days isn’t really high at all. Businesses and institutions are now so used to a low interest rate environment that anything above 1% seems frightening. But we shouldn’t be at all. Looking at 2004 to 2022, notice that the monetary policy goes through a period of tightening (increasing interest rates) and easing (lowering interest rates). This is usually in line with the growth of the economy and inflation (cue macroeconomics 101). Seeing the kink in 2022, we are beginning the start of a new tightening cycle that might last a few years. Interest rates would likely range from 3-4%, which is between the last two tightening cycles in terms of its magnitude.

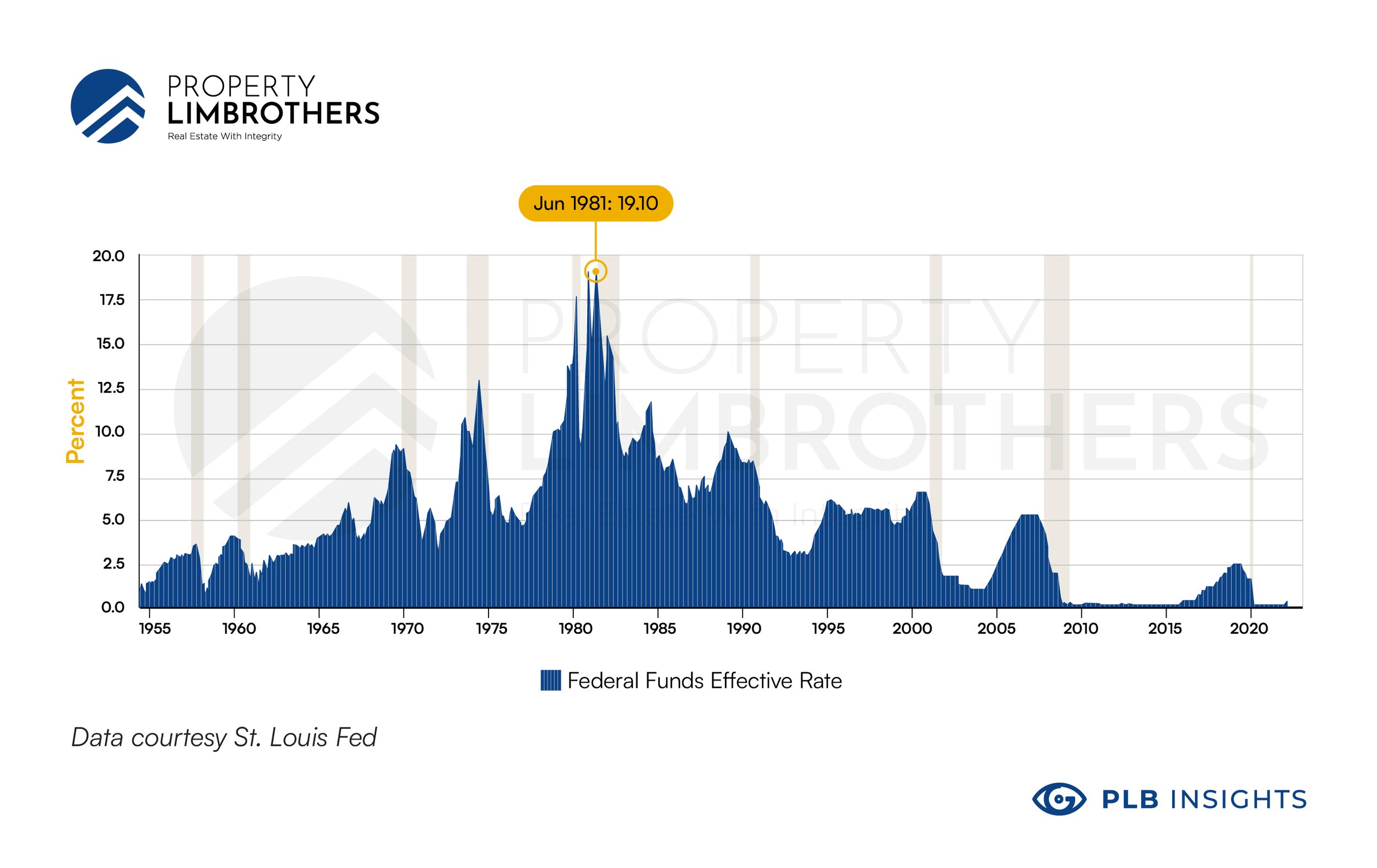

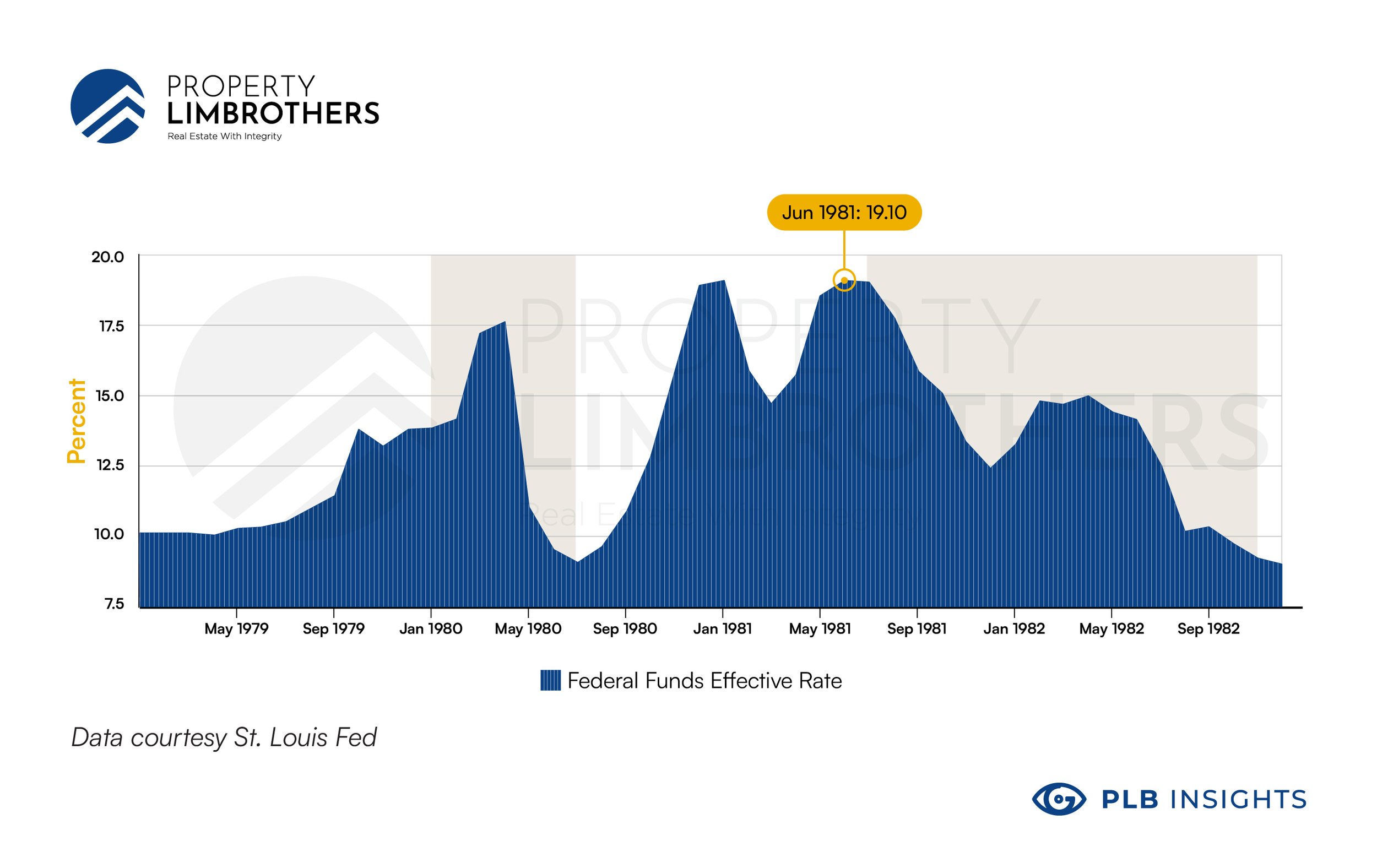

When looking at the recent history of interest rates, 5% may seem really high. Wait till you look at the interest rates in the 1980s, when the U.S. was combating double digit inflation. Compared to 1980 (in the U.S.) which had an annual inflation rate of 13.5%, the current annual inflation rate is at 8.5%. A 5 percentage point difference. The highest interest rate in 1980 reached 19.10% in June, 1981. Compared to today’s 1%, that is a 18 percentage point difference.

In both the 1980s and 2020s, we see a similar trend of market turbulence and recessionary concerns coupled with high inflation. The difference, however, is that interest rates weren’t as high as back in the 1980s. An interest rate of that magnitude in today’s world would probably cause mass panic. The historical chart since the 1960s has shown us how much more relaxed the monetary policy is right now compared to its long history.

While this is the largest rate hike in 2022, it is not the highest interest rate ever. Given the more recent history of U.S. monetary policy, we would probably not see the likes of 19% interest rates in the foreseeable future. However, like the rate hikes during the Dot.com crash, we expect to see markets contract from the lack of access to easy money due to the tightening being done by the Fed. This will be detrimental to market sentiment and investor confidence. Nonetheless, it is a better outcome than hyperinflation.

Carnage in the Financial Markets

The financial markets do not typically respond well to rate hikes. The 50 basis point rate hike back in May 2000 triggered a short term relief rally for 3 months, only to continue free-falling after. From December 2000 interest rates were falling but the technology equity market took more than a year to recover from the Dot.com crash and the high interest rate environment.

Seeing that we are only in the beginning stages of quantitative tightening, there’s bound to be carnage in the financial markets. Currently, major indices in the U.S. are posting losses since the start of the year. Given the current fear in the market along with high interest rates, they are not bound to recover any time soon. What makes it worse is the balance sheet reduction of US$ 95 billion a month. This offloading might upset the bond market, with short-term bond yields rising and potentially flattening or inverting yield curves. This quantitative tightening will strengthen the U.S. dollar against other currencies, as the offloading of debt and equity draws U.S. dollars back to the Fed, reducing the amount of dollars circulating in the economy.

While this macroeconomic policy was intended to stop inflation from spiralling out of control, there is bound to be collateral damage in the economy. Small businesses seeking affordable debt might be priced out and face challenges growing. Equity and Bond markets will face heightened volatility and suppressed prices. The U.S. dollar will continue to gain strength in the short term. It is an extremely challenging time to be an investor. If you are in the midst of restructuring your portfolio, you will face significant reinvestment risks due to the poor timing in turbulent markets.

Where are the Safe Havens?

Is any asset class safe from all the havoc? Typically, traders and investors flee to precious metals and perhaps some commodities. Specific defensive sectors might do well as people restructure their equity portfolios. However, some other typical defensive strategies such as fixed-income investing, have not been doing well in the current market conditions. Precious metals and energy-related commodities have been used as hedges in the current market. However, they will hardly take up a sizable portion of most investment portfolios. When volatility in the market peaks with fear, most investors and money managers will be in cash, which is a difficult spot given the current inflation number of 8.5%.

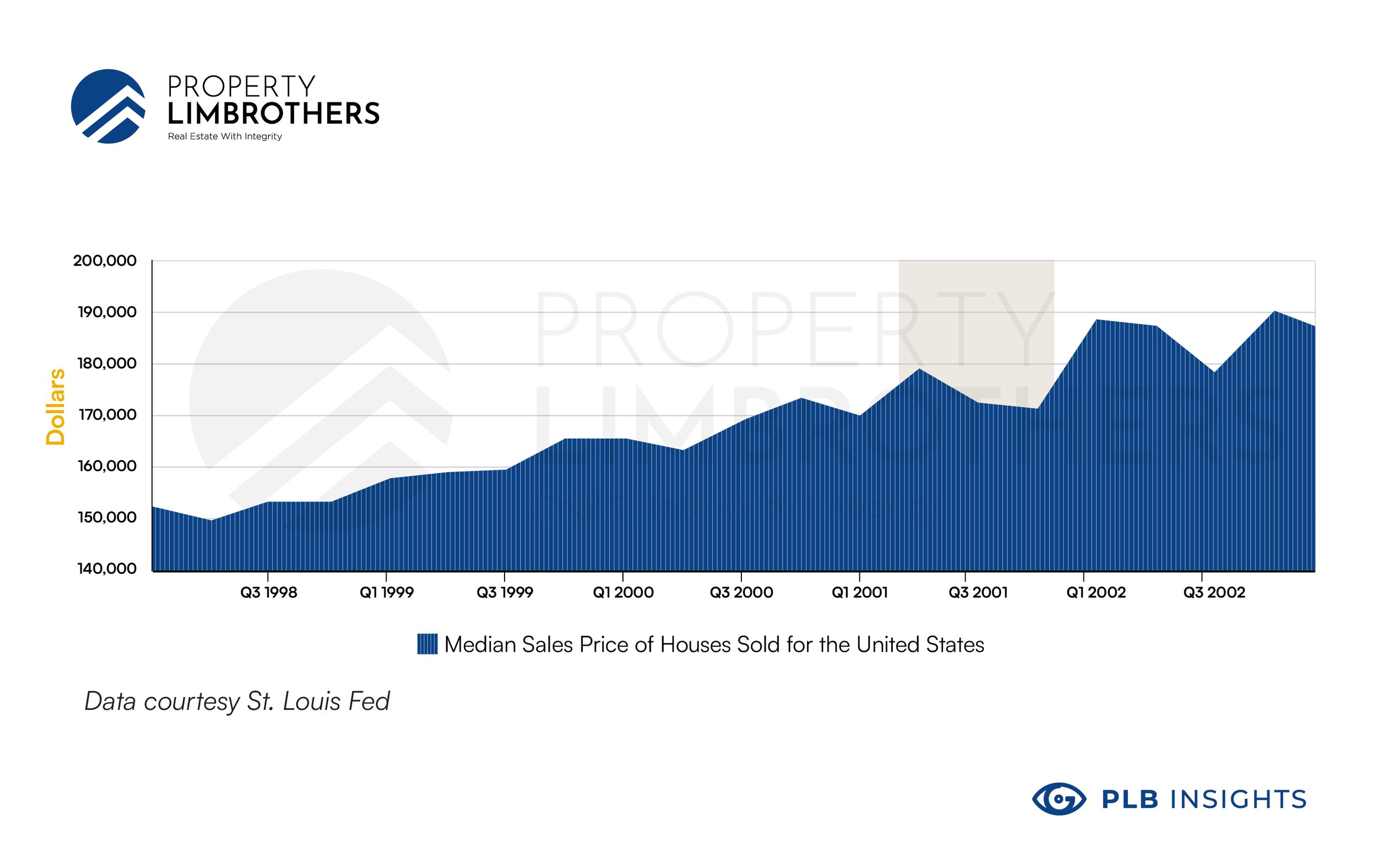

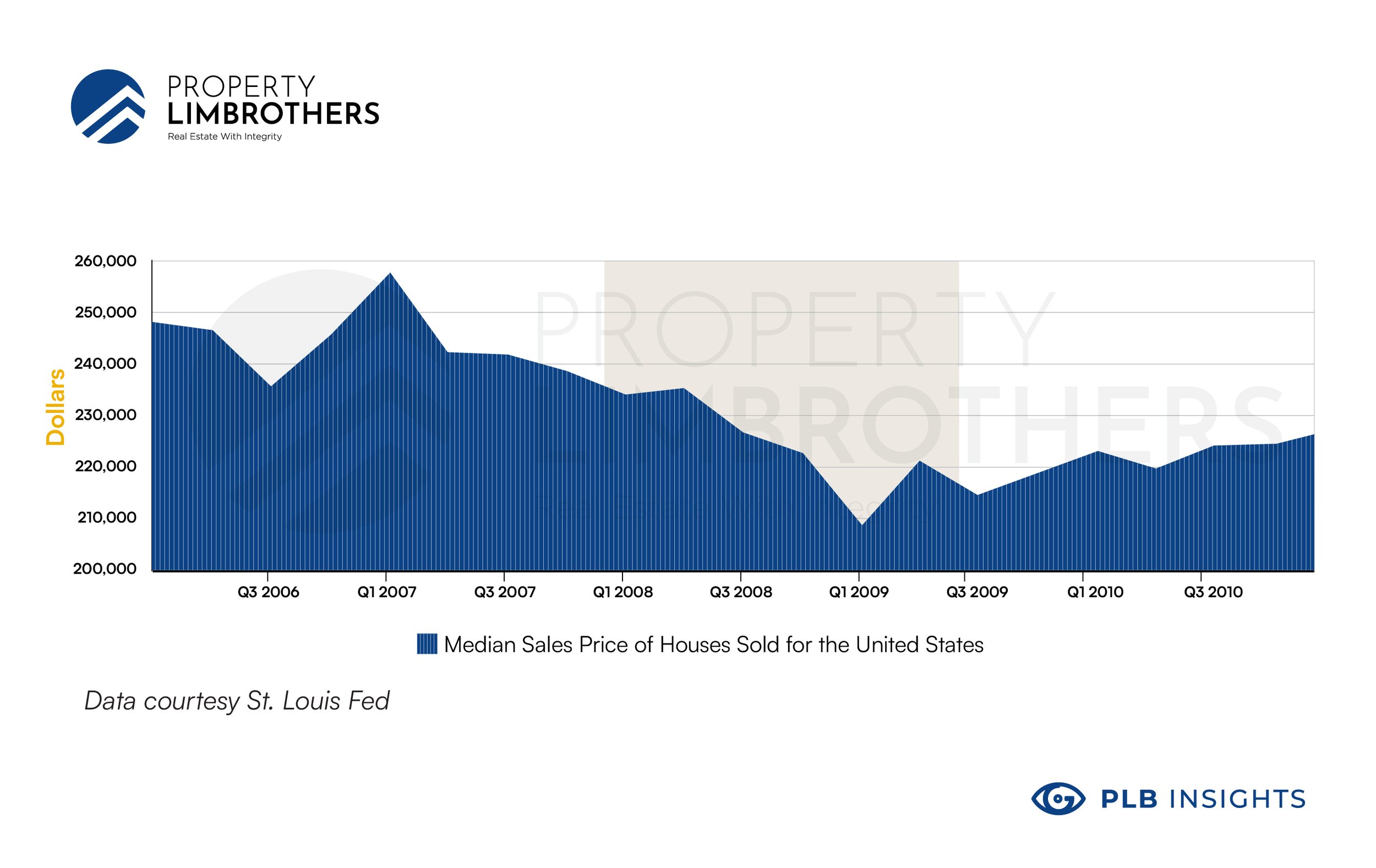

On the other hand, property prices are comparatively less volatile than other asset classes through interest rate changes and market crashes. This might be owed to the nature of the asset as a physical home and also the longer transaction processes. Through the Dot.com crisis of the 2000s, we see property prices remaining strong. Since it was mostly the tech sector and high interest rates that pushed down equity prices, the housing market kept climbing and acted as a safe haven.

In contrast, the market crash during the Global Financial Crisis in 2008 was driven by a subprime mortgage crisis. The housing bubble back then was the cause of financial turmoil and we can see that property prices faced a significant correction in 2008. Inflated prices of properties with many homeowners then not being able to afford the mortgage defaulting on debt, pushed down prices rapidly and banks rushed to make good on their financial accounts. Since then, regulations have been much stricter after seeing many financial institutions go through bankruptcy and a long period of restructuring.

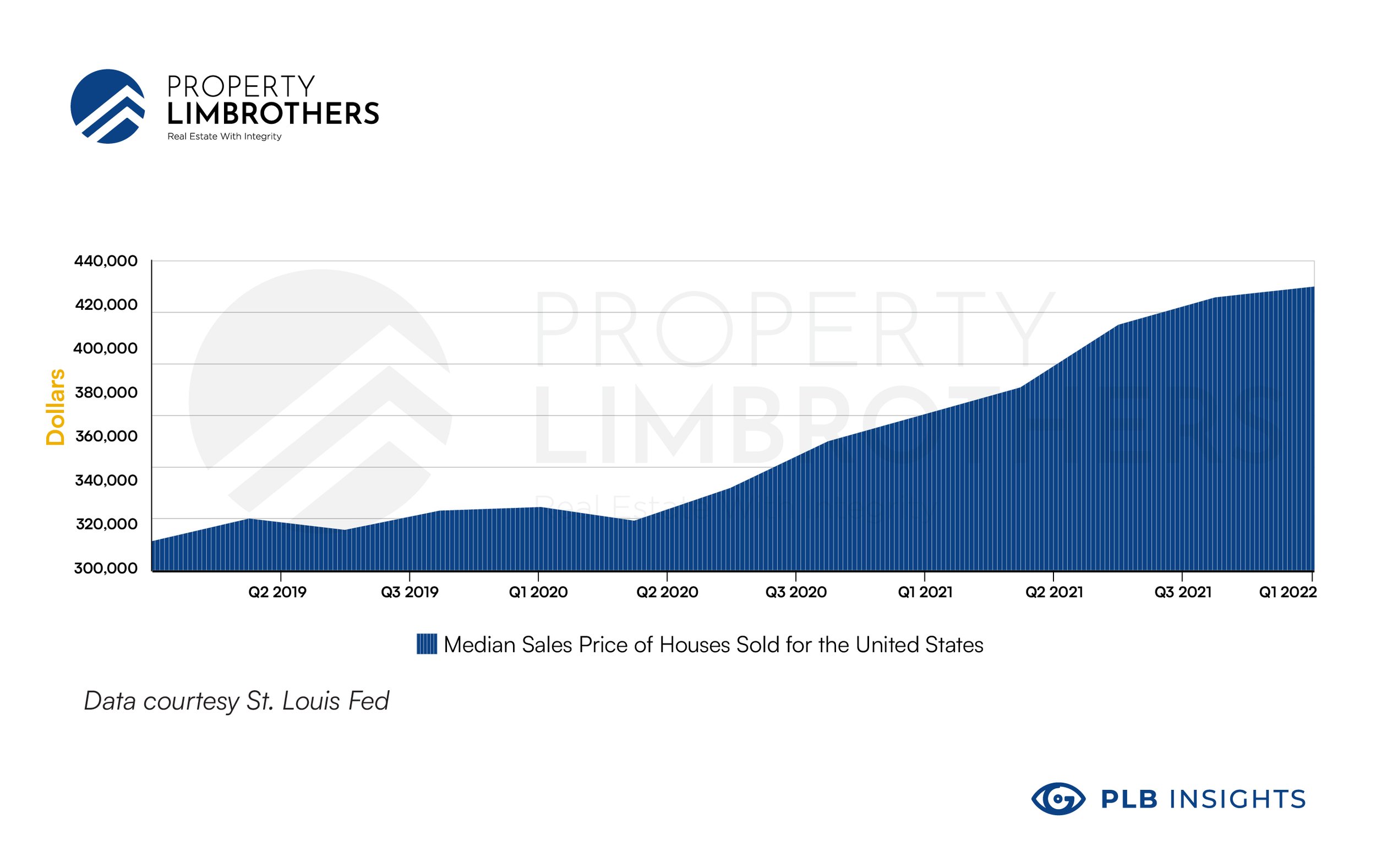

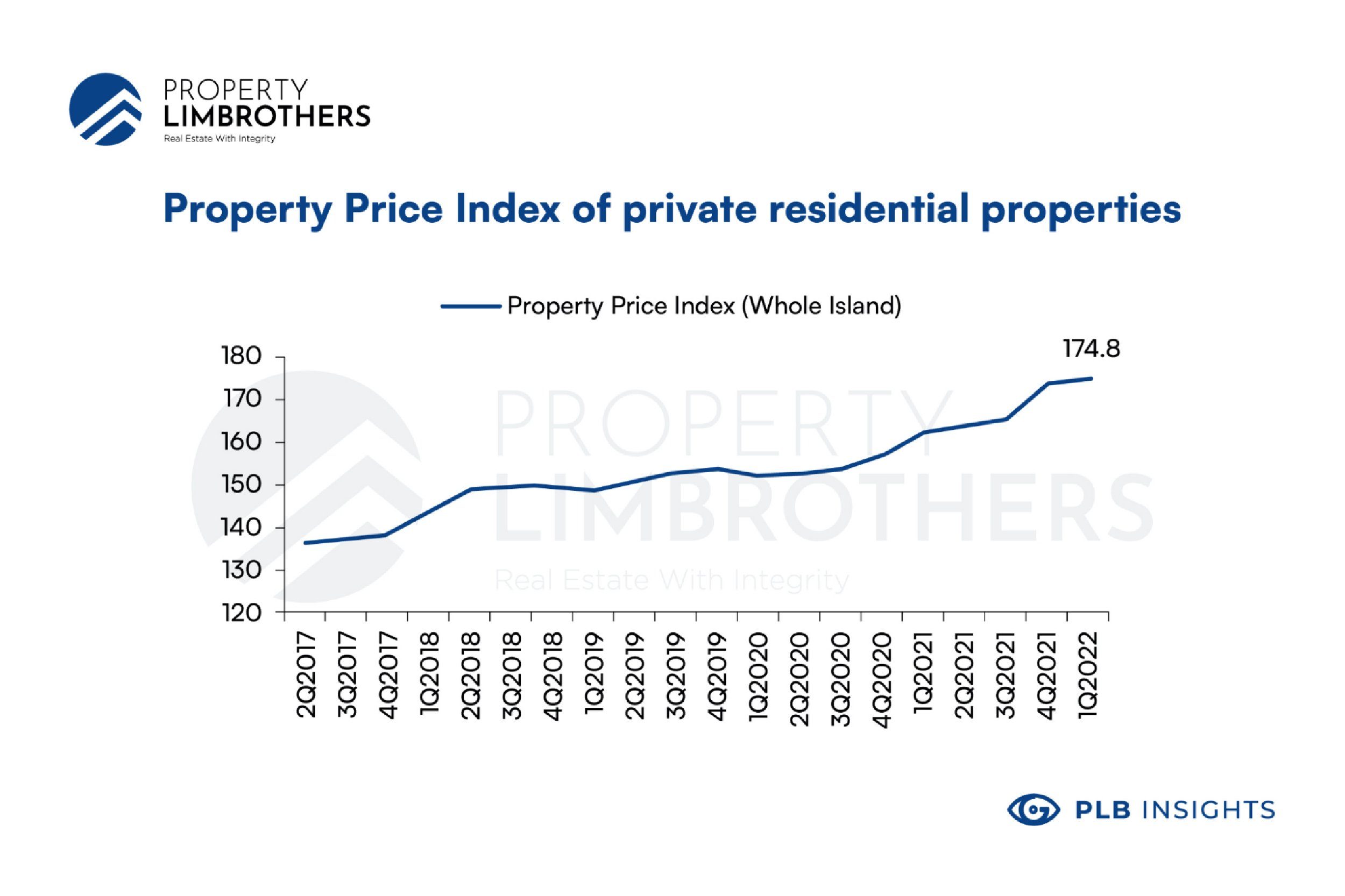

Today’s market is different. The market turbulence we are facing is largely due to a shift in monetary policy owing to a combination of demand-pull and cost-push inflation and geo-political instability due to the Russia-Ukraine Conflict. The underlying cause of market tension is not due to a housing bubble itself. However, you can see that the real estate market has been doing phenomenally since the pandemic. We see a similar pattern in Singapore’s real estate market.

Closing Thoughts

The hike in interest rates might be a shock to many, but fret not. The U.S. Fed gives notice of its intended rate hikes far in advance. At the moment, we are expecting interest rates to sit at around 3-4% by the end of 2022, with regular rate hikes of 0.5% with each Fed meeting. The good news is that if inflation is being kept under control faster than expected, the interest rates might not rise to an exorbitant level.

The real estate market has held strong through inflationary pressures. Due to the nature of the asset, it has been riding up the wave of price hikes throughout the core consumption basket of goods. Property as an inflation hedge is real, and we can see that from the charts. If investors are looking for a safe haven and have a long investment horizon of more than 10 years, real estate might become increasingly attractive despite higher financing costs.

If you wish to know if investing in real estate fits your own individual portfolio, reach out to our experts to find out more!