Recently, the (younger) public’s view on low lease projects have been changing. We see more young couples opting for properties which are older, with more rustic and vintage vibes. These decisions might have met with some “traditional” resistance on buying low lease projects. Are these old-school objections to low lease projects wisdom, or just opinion? Before we move to critique either side of the case, we will break down the process of considering low lease projects as a potential choice.

In this article, we explore the idea of purchasing low lease properties in Singapore, outlining the reasons for both sides of the case. We put out important considerations before you make your big decision.

Does it make sense for whom?

Before we jump in to judge if low lease projects are good buys in their own right, we need to consider who it’s good for. After all, it is people that are the ones buying and enjoying the property. Evaluating the needs of the person who’s buying the property should come first. When we say the needs of the buyer, we are looking at their age, financial situation, number of intended residents, purpose of buying the property (own stay or investment), and whether alternatives are available.

Let’s start with age. The first demographic that comes to mind for low lease projects is the retired population. If you’re in your retirement age (55 to 65 and beyond), you would need the property to at least last you through your retirement years. Even then, you’re looking for a property that has at least 30 to 40 years of lease left. Ironically, what has caught the attention of the media is the presence of young couples choosing such properties rather than retired ones. In this case, older buyers might find themselves being offered a loan with a lower tenure, whereas younger buyers might find themselves with a lower LTV limit. It is between a higher monthly mortgage payment or a higher upfront cash payment, respectively.

This brings us to our point on finance. Typically, you want to be financially sound before buying low lease projects. In terms of financial risk, low lease properties are a lot more riskier than newer properties. So much so that banks are reluctant to give out loans or high valuations on these projects. If you are dealt with a higher mortgage payment or higher cash down payment, you need to make sure that buying the house would not put your daily and future financial needs in jeopardy. Tedious as it may be, you must do the maths to make sure all is well in your accounts.

The number of intended residents should also be considered. If you plan to have a kid in the future or if your parents have a chance of moving in with you, your property plan should be bulletproof and account for as many possibilities as possible. If you lock yourself into a low lease property only to find out later that you need a bigger space, it may be difficult to exit without a loss. To accommodate these possibilities, the buyer should consider if they could afford a larger sized apartment. This can make a huge quality of life difference if such a situation does end up unfolding.

It goes without saying that buying for your own stay or investment is completely different. In the case of low lease projects, it makes more sense for buyers looking for an own stay property. We will cover more of this in the section on pitfalls to be aware of. To put it simply, the benefits that low lease projects offer are very specific. They either suit the needs of the retired population very well, or check the box for what looks & feels like home for younger couples. An important note here is that when you fall in love with a property,

Why consider low lease projects in the first place?

When seriously considering low lease projects, one might go for a low lease HDB flat or a low lease condominium. We will look at how they might or might not be different in the section on performance. The key benefit of low lease projects is the relatively weaker competition for buying. With fewer buyers fighting for the units that you want, lower prices are one of the chief reasons people buy low lease projects.

Low lease projects can also be found in more mature estates, central locations, and quieter areas. There is still variety in choice for people looking to move to this type of property. On this point, it is about location, which like most properties matter for obvious reasons. Some also go for the older, more rustic and vintage properties for the vibe. This is down to personal preference and taste.

Some speculative buyers might look at the possibility of an enbloc. But because this is more of a windfall and almost impossible to predict accurately, we would classify this as more of a pitfall if the timing goes against you.

Pitfalls to be aware of

There are many pitfalls you should be aware of when considering low lease projects. We are not deterring you from looking at them, but there is some wisdom in how the general public has resisted this idea. Here are some of the pitfalls in bullet points:

-

Exit issues with weaker demand and smaller pool of buyers

-

Bank valuation issues due to weaker transaction volume

-

Not getting the full 75% loan because of low remaining lease

-

Need more cash upfront for down payment due to loan issue

-

Lower rental as renters pay a premium for newer units

-

Higher maintenance costs as property ages

-

Building integrity safety concerns if wear and tear is severe

-

Lease expiry — potential for property value to go to zero

-

Poorly timed enbloc, hitting buyers with SSD

-

Prorated CPF usage based on age and remaining lease with calculator here.

Each of these concerns are valid and should be addressed in your buying decision. They are definitely not the kind of concerns you should sweep under the rug, as they can really come back to bite you hard. We have briefly explained some of these pitfalls earlier on in the article. This is not to say that low lease properties are inherently bad. The general idea here is to be extremely cautious in your selection of a low lease property, so that if you really do intend to buy one, you pick the right one that fits your needs and addresses all these pitfalls.

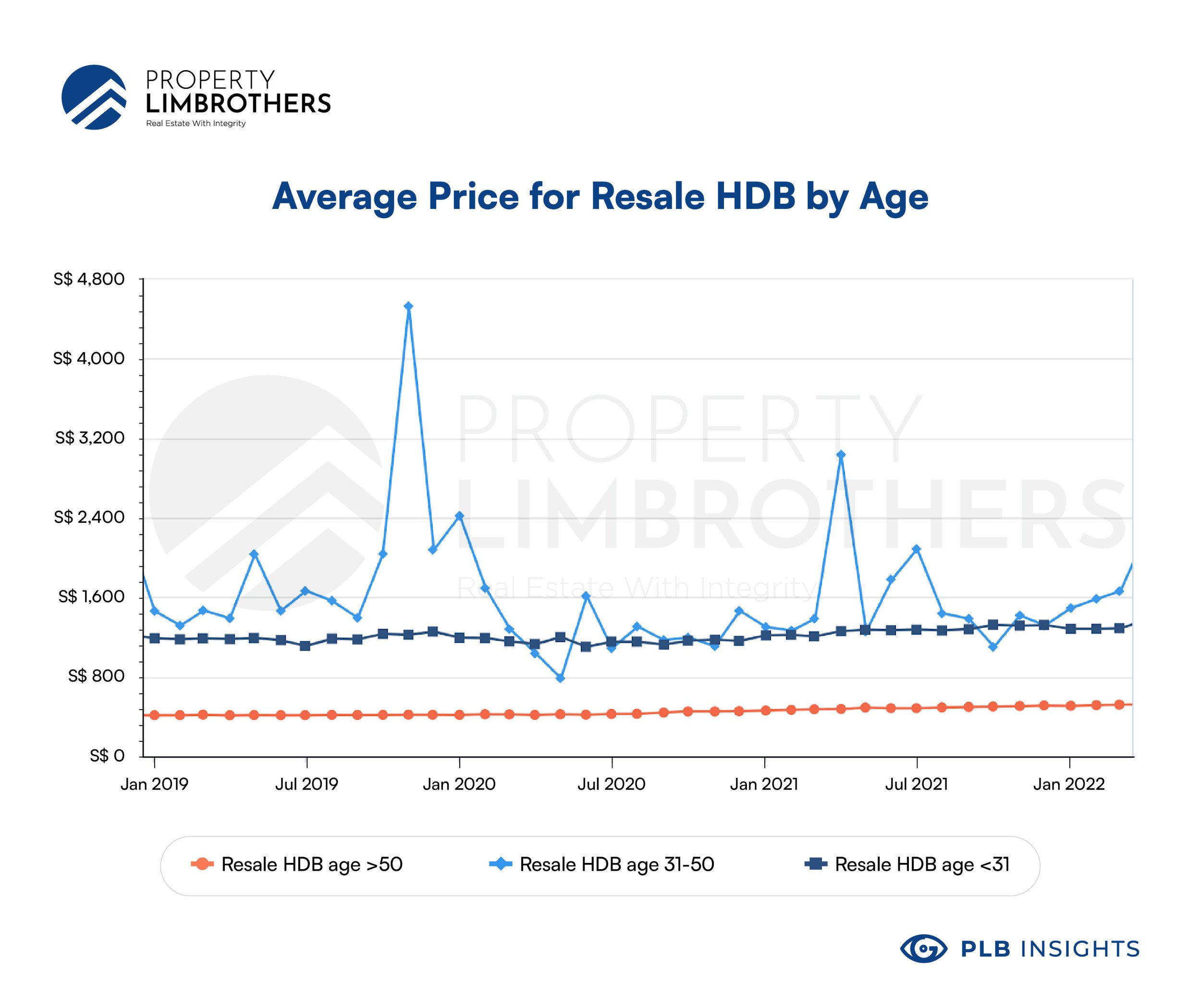

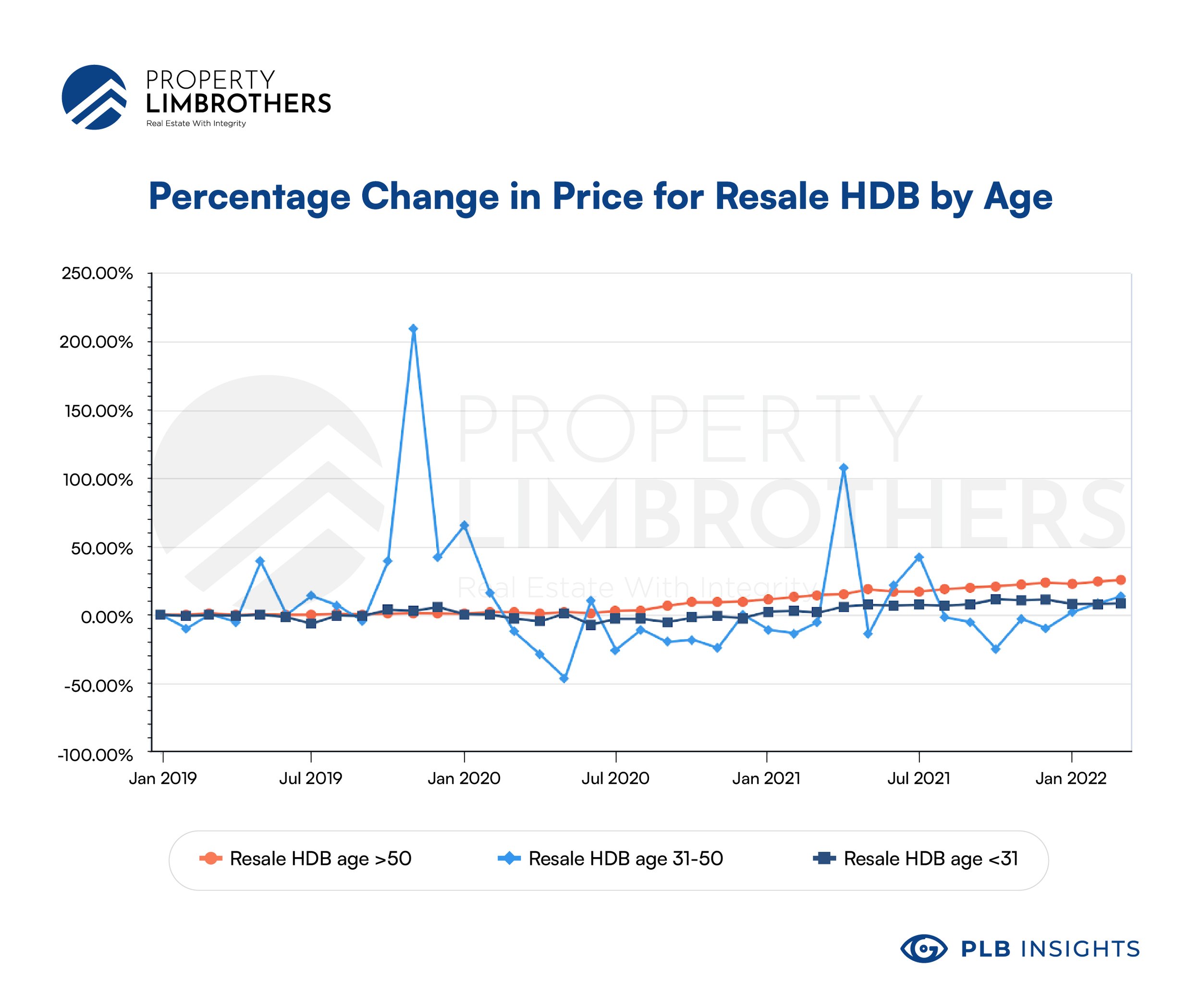

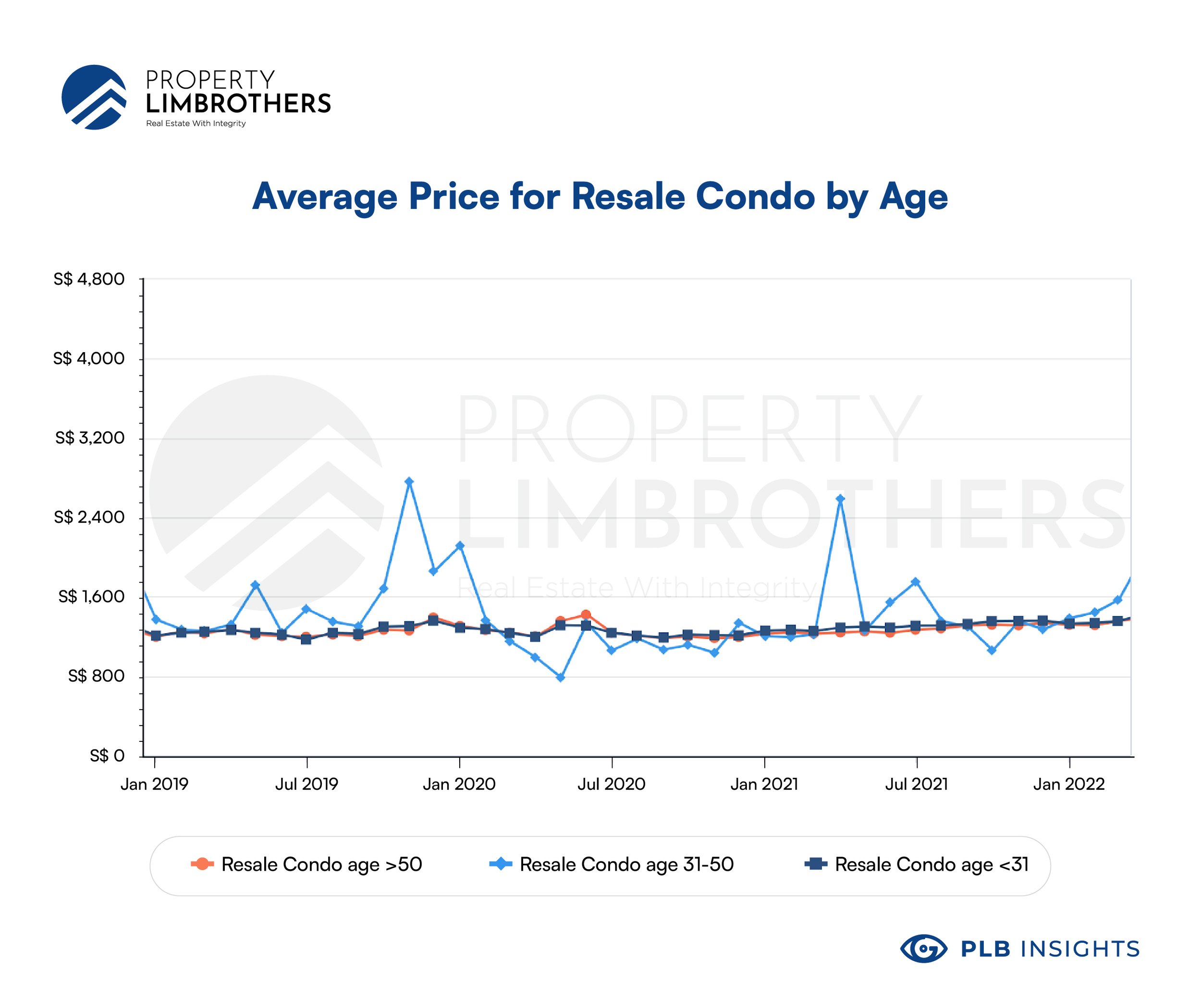

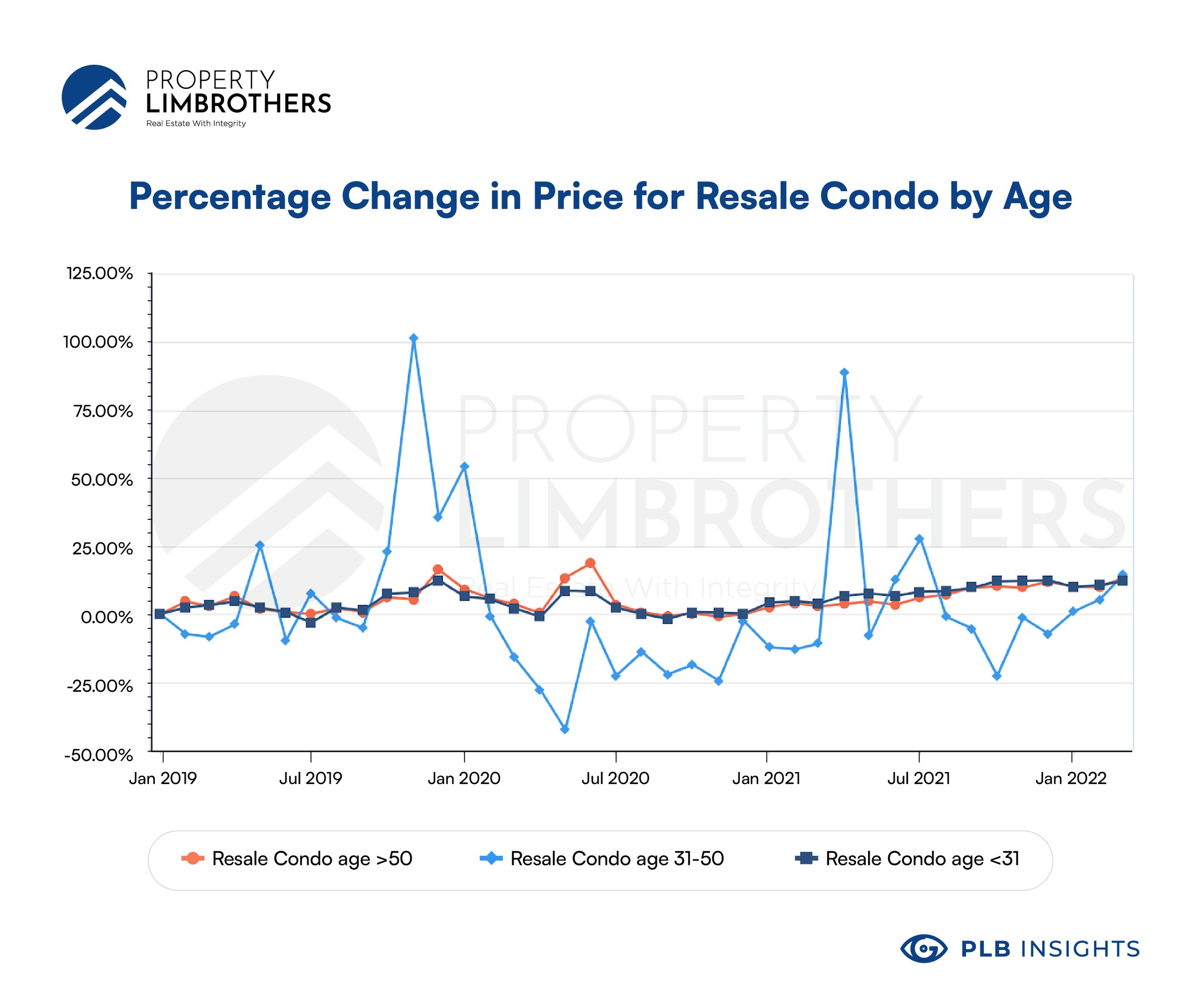

Performance by Remaining Lease

In the following chart analysis, we look at resale HDB, Condo & Apartments (hereon, Condos) with 99 year leasehold and with various amounts of lease remaining. We group them by their age. For the first group (in orange), they are properties which are aged 51 years and above (remaining lease of <49 years). The second group (in light blue) are aged 31 to 50 with a remaining lease of 49 to 68 years. And the third group (in dark blue) are aged 30 years and below, with a remaining lease of at least 69 years. We look at average price performance and percentage change in price over time.

For Resale HDBs, we see the most price volatility for ages 31-50. During this phase, we expect there to be change of hands and transactions from people who are anxious about remaining lease to people who are more optimistic about it. The interesting thing is that the price volatility is mostly in the positive direction, with very few cases of prices going below younger resale HDBs. It is fascinating to note that 31-50 year old resale HDBs are actually priced higher, on average, than resale HDBs aged 30 years and younger. This might be due to the inherent nature of those specific HDB projects (more central/mature estates). While resale HDB aged 51 and above are priced lowest based on psf (around half the price of those aged 31-50), they exhibit the highest growth rate at 26%. The key takeaway here if you’re a buyer is to be careful not to resale HDB prices at its peak when it’s aged 31-50. It would be very difficult to recoup if you plan to exit.

Looking at the month-on-month percentage change for resale HDBs, we see the movement of prices without their baseline psf (such that they all start at 0% on Jan 2019, which is the new baseline). Here is where we see low lease projects shine, with the stable and gradual growth over time. This might be due to resale HDB prices getting exorbitant, pricing out buyers who end up choosing low lease projects which are more affordable.

The story for resale Condos is slightly different. With the base psf for older condos not much different from the younger condos. However, like before, middle aged condos exhibit the most volatility. Arguably, the tighter psf band could be due to open market forces bringing prices closer together, since there are lesser regulations on who can buy and sell private properties. That being said, it seems that market forces also erode the growth rates of older properties. All three groups have grown between 12-14% from Jan 2019 to Mar 2022. The disparity is closed by market forces.

The pattern for volatility for middle aged condos is also different from middle aged resale HDBs. Volatility is more balanced now, going in both directions. The upward movements are a lot less pronounced, and downward movements actually more consistent. This volatility presents dangers as well as opportunities, depending on when you enter the market. If we interpret low and high lease condos as the equilibrium price, buying below this equilibrium can offer returns higher than the benchmark. However, the inverse is also true. Beware of middle aged condos with above-market prices. It seems that the value would be difficult to retain unless it is truly a unique project.

Closing Thoughts

We’ve looked through the reasons for and against low lease properties. The charts from resale HDBs and Condos offer some insight as to what is going on in the market, and the trends that we should be aware of when considering to buy a low lease property. While not a fatal choice, buying a low lease project has non-trivial limitations. What we have not mentioned is that it limits your future property plays due to the difficulty exiting. This opportunity cost is often significant, and would be a lot higher if you’re still young.

Why not consider renting? If you really do love the vintage, you can consider renting while not limiting your property investment journey. You can buy a separate unit for investment purposes while renting a low lease project that you love. This way, you mitigate a lot of the risks and concerns that might come up.

If you wish to have a deeper conversation with us on the topic, reach out to our experts here.