At PropertyLimBrothers, our style is to share the actual performance of the market. To clearly observe which segments have grown, and use performance data to identify the next upcoming growth segments. Our thesis on property investment is to find Disparity Gaps in the market during any particular season and go for a value play by targeting undervalued properties.

We do not have biases against or for any particular property class. Obsessing with a property-pushing strategy would hurt big picture property investment performance. Like how a technical analyst observes price action and volume, we observe which property product type will accelerate in price growth or are consolidating before moving the next leg up. Because of the cyclical nature of Singapore’s property market by segment rotation due to the upgrading demographics, every different season will see different property types behave differently in terms of demand and price action.

Our main strategy is to pick products which have a shorter and faster ROI season. We do this while taking into consideration whether it is our client’s first primary residence to balance family needs.

But if it is an investment property, then it is clear cut on studying the Disparity Gap and historical price action.

In this article, we present the following opportunity spaces: D9/10 Private Condominiums and Landed Properties with a size of greater than 3,000 sqft & Commercial Shophouses.

D9/10 Condominiums, Apartments & Landed Properties

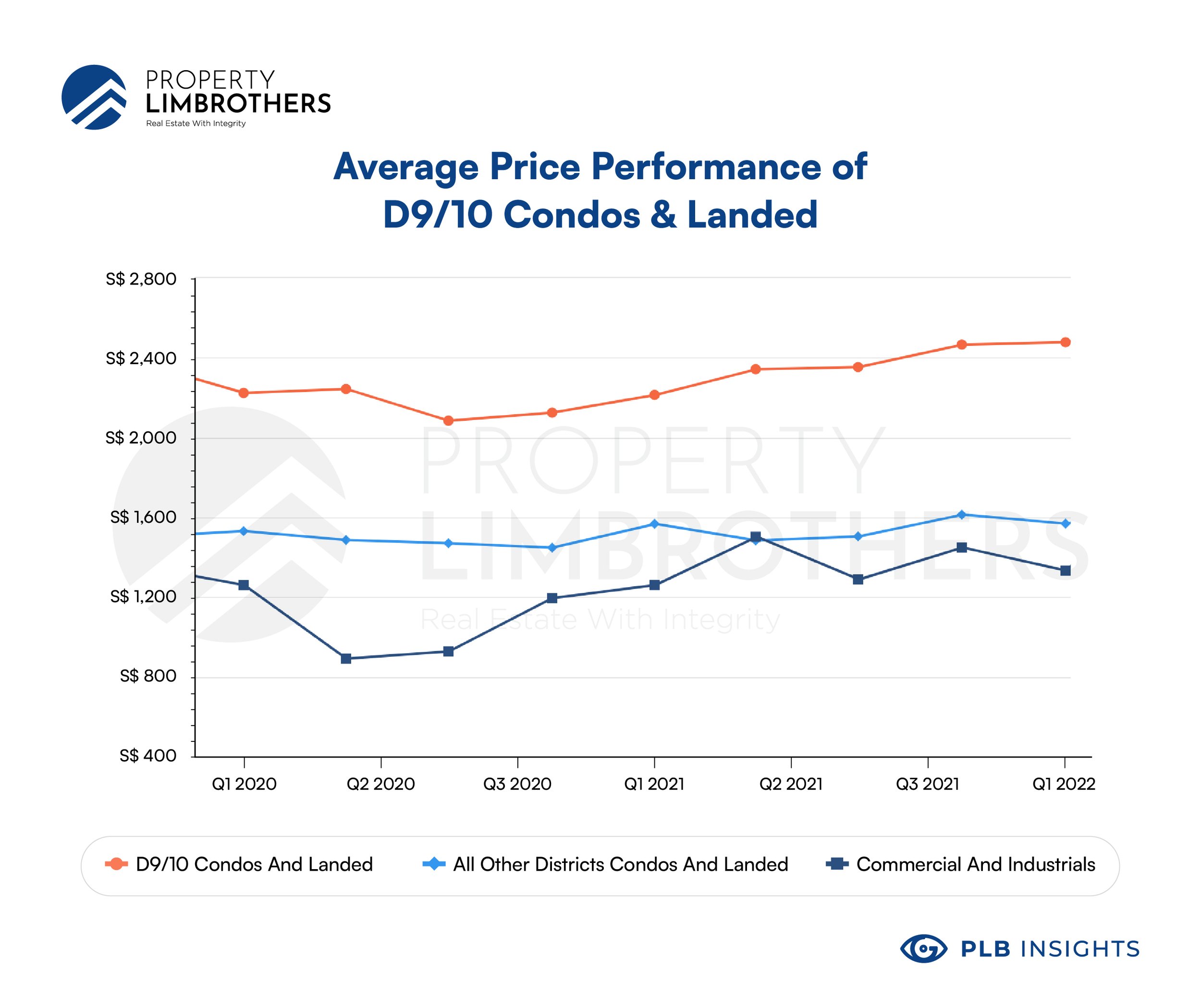

General condos and landed properties in D9/10 have outperformed their comparables in other districts by a margin of 5-9%. Commercial and industrial properties are recovering with a growth rate of 6% since the start of 2020. In this section, we cover the luxury segment specific to district 9 and 10. This includes (D9) Orchard Road, River Valley, Cairnhill, and (D10) Tanglin Road, Farrer, Holland, Bukit Timah, Ardmore areas.

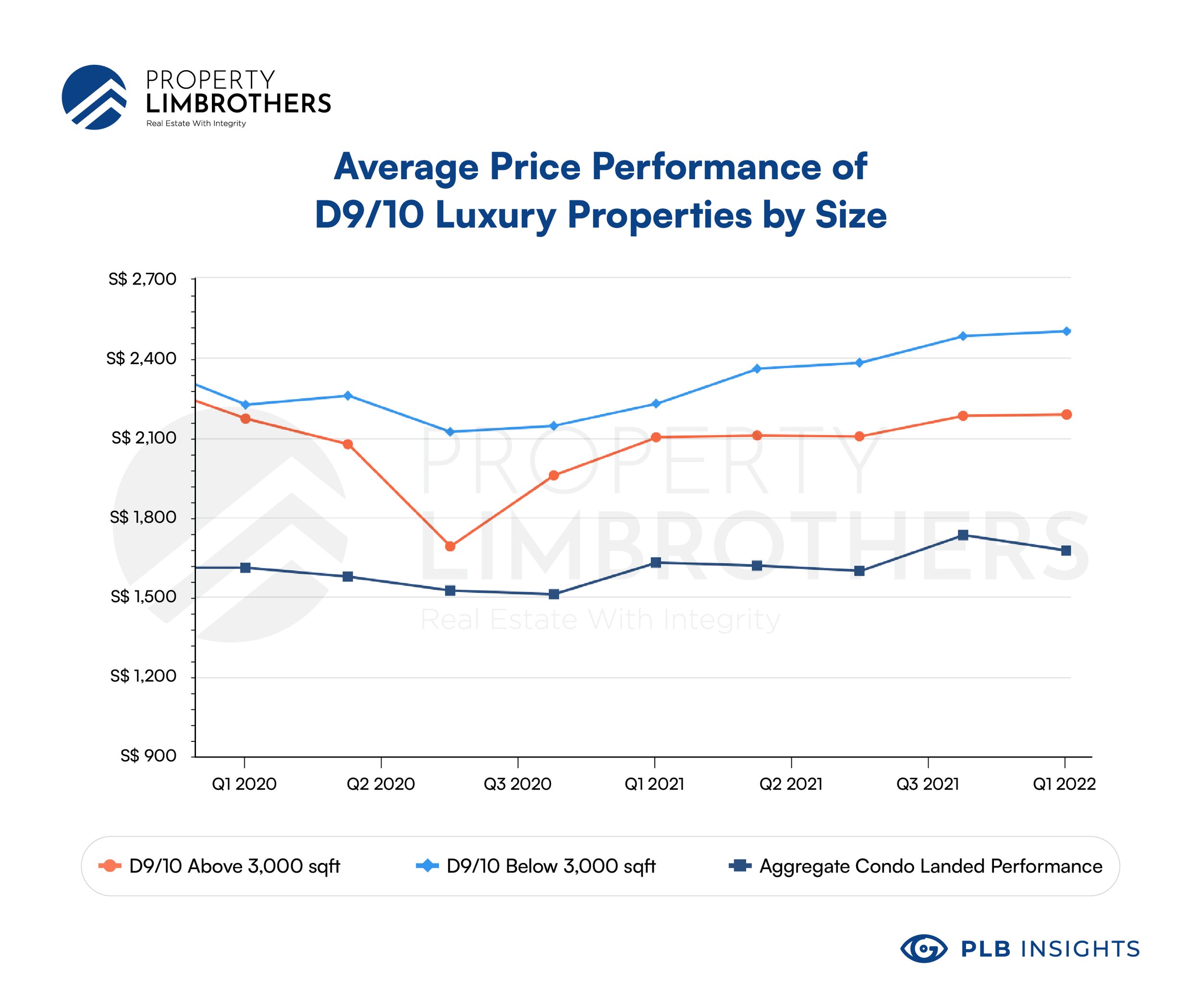

Compared to the aggregate performance for condos and landed properties, the smaller luxury properties have outperformed the baseline by 8%. On the other hand, larger properties have underperformed the baseline by 3%. Looking closer at the growth trends by percentage, we see that D9/10 luxury properties are quickly catching up to match the aggressive growth of private condos and landed properties and offer a good undervalued investment.

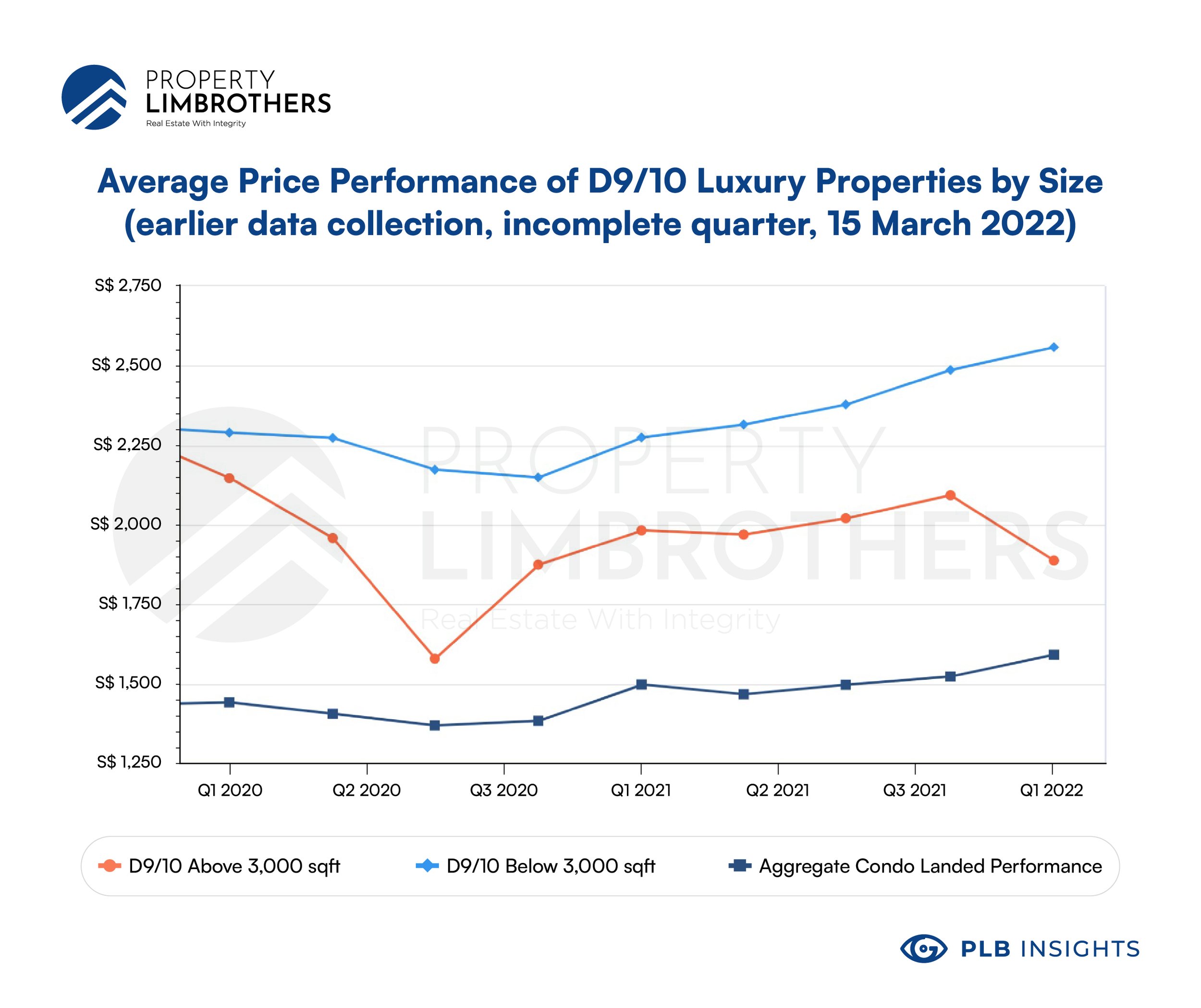

When we compare this to earlier data collection of the same comparisons, we actually noticed a much larger difference of 22% deviation from the baseline performance. Of course, a caveat here is that the transactions are live and being continuously added as the quarter goes on. To clear the analysis of noise, we still refer to the growth trend by percentage above. That being said, this chart shows that it is very possible to get even more undervalued investments in this space that can be at a potentially larger discount, signalling high price variance in this space.

The Landed segment is of key interest to us. We will have a follow-up article on this in the coming weeks as we take you through a deeper analysis of that part of the luxury segment.

Commercial Shophouses as an Opportunity

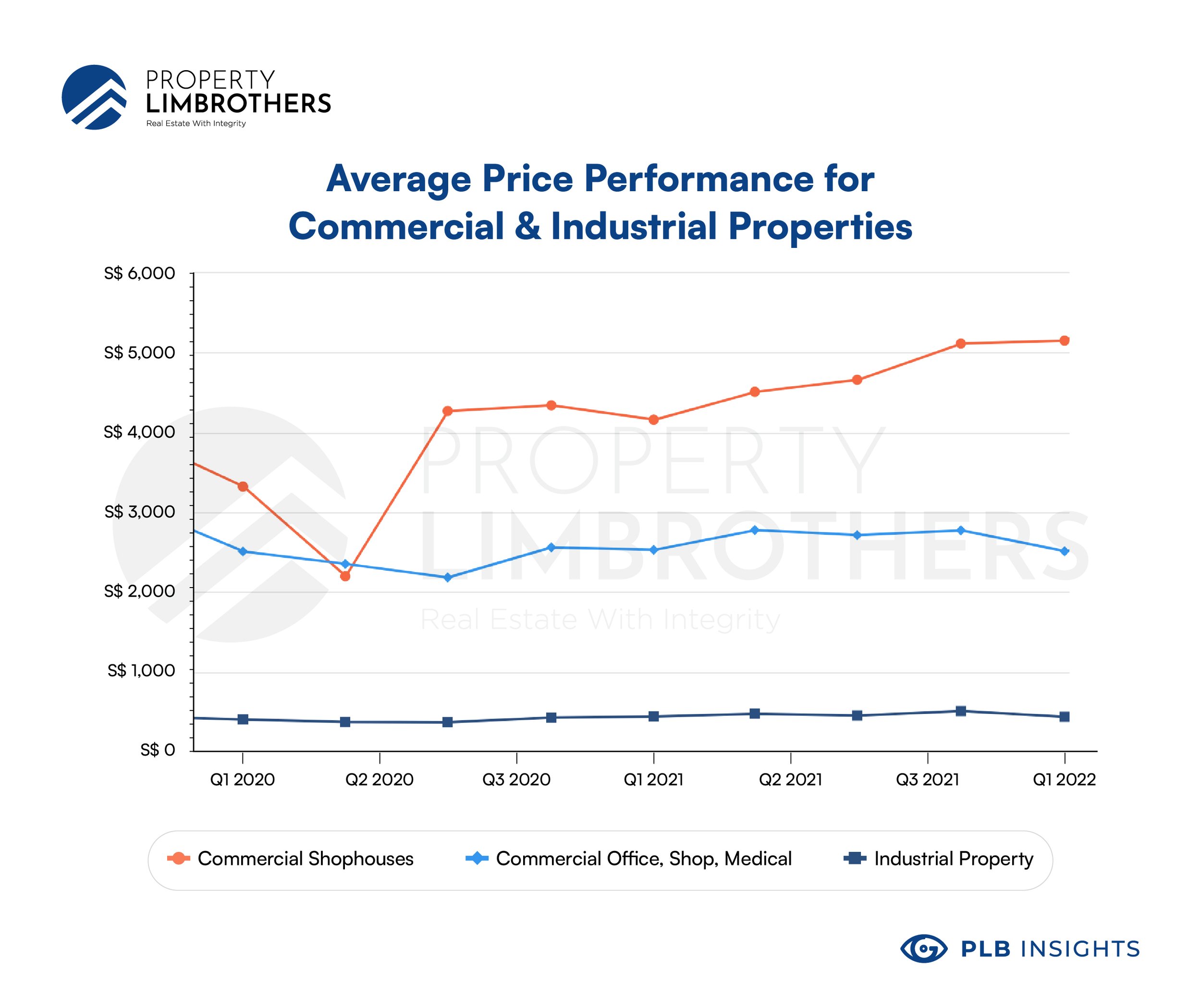

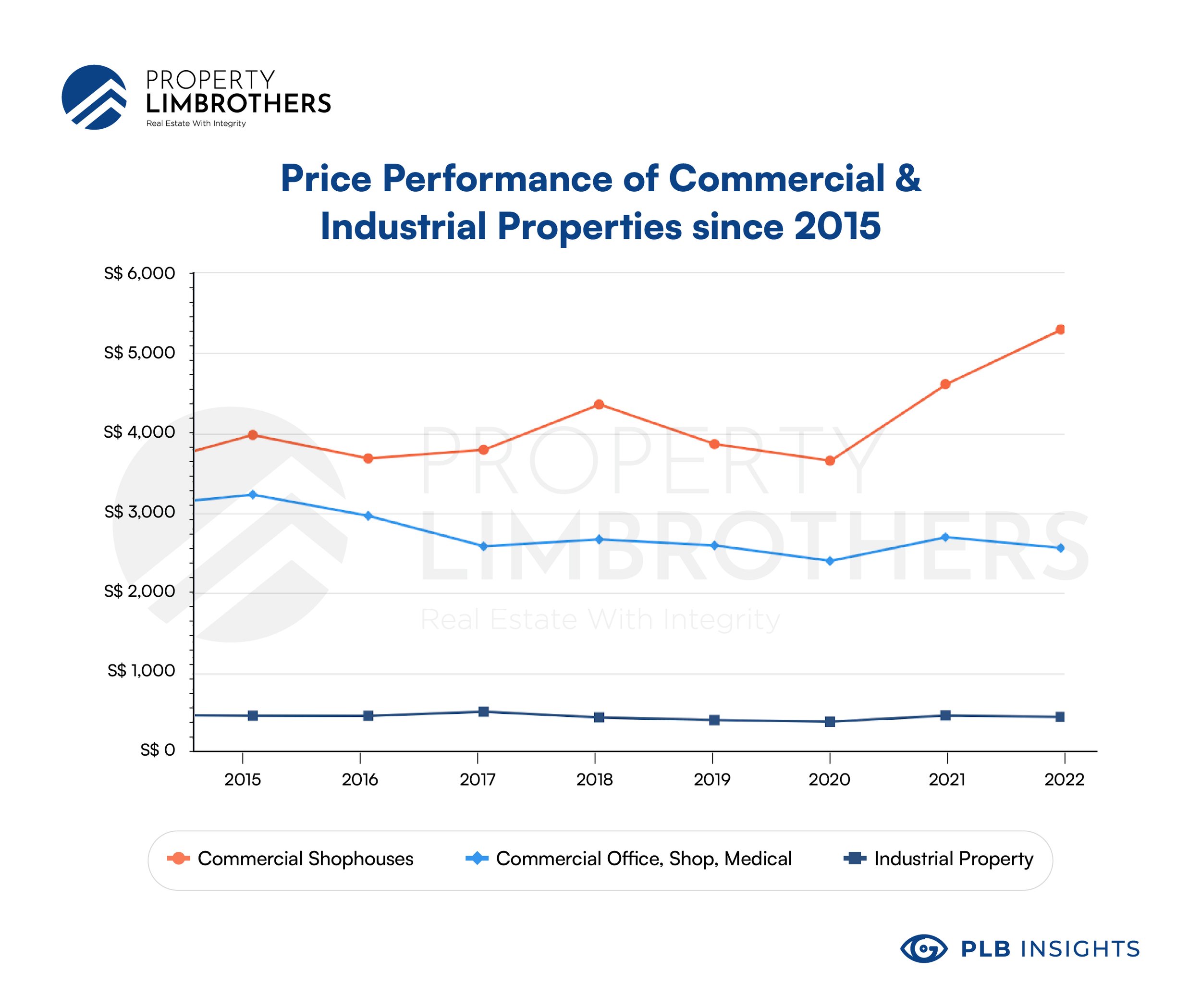

The second opportunity space we would like to present is the space of commercial shophouses in the backdrop of tremendous price performance of the commercial and industrial property space. Commercial shophouses have performed exceptionally well at 55% price growth since the start of the pandemic. Other commercial properties are still consolidating. Industrial real estate is recovering at a modest 8% since 2020.

This is a great example to clarify our Disparity Gap thesis. Investments made based on Disparity Gaps should have strong fundamentals and a positive long term trend. This is so that the difference in price would narrow, and the price will catch up to the true value of undervalued properties.

Buying into office, shop, medical commercial real estate is not a Disparity Gap play due to their poor long term performance. Instead of closing the price gap, macro trends indicate that this gap would widen instead. This dispersion effect will be worsened by work-from-home trends that appear to be a semi-permanent fixture in the current economy. Thus, in the commercial real estate space, we advocate for a longer term momentum play using commercial shophouses.

An important caveat here is that a small number of transactions may have skewed the observed result. Some commercial properties offer exceptional Rental Yield and growth opportunities. The cautionary word here would be to be more selective and sensitive to your choice of commercial property investment to make sure that you pick the right one.

Looking at the chart below for a broader picture of the performance of commercial and industrial real estate since 2015, we see that industrial properties have been largely stagnant and commercial properties ex shophouses have a long term downtrend. Commercial Shophouses have been the anomaly and main beneficiary of the K-shaped recovery following the pandemic (2020 onwards). You can see from the chart a sharp kink upwards for Commercial Shophouses. Again, this is more of a momentum play rather than a Disparity Gap play.

As mentioned in the previous section, the commercial space might be more attractive to foreign HNW investors due to the ABSD exemption, which can create a huge boost to capital gains. The recent ABSD increase from 20% to 30% for foreign investors of residential properties would hurt the capital gains and deter short-run speculative investment. Commercial shophouses here provide a flexible entry into the Singaporean property market. When entering, ABSD does not apply and banks are able to give 80% LTV, giving you slightly higher leverage. Furthermore, some shophouses provide flexibility to investors and are able to partially convert for residential purposes. ABSD would then be pro-rated on the residential portion and applied upon the change of use.

We believe that this class of commercial property will continue to shine through the future of work as companies downsize their usage of commercial space. The ongoing promotion of heritage preservation also plays a key role in giving some shophouses its unique selling point as a piece of history, and not just another storefront.

We have dedicated a few articles on Shophouses. Our Editorial Team has covered Shophouses as an investment property, how to select Shophouses and the transaction process, the architectural features and styles of Shophouses. We have also started a series that will cover Shophouses in specific districts in Singapore like this article.

Closing Thoughts

In this short feature article, we cover the D9/10 Luxury Segment (consisting of Condos, Apartments, Landed properties) and Commercial Shophouses as part of our journey in Editorial to explore the ideas brought up in our Quarter 1 Report. In the coming weeks, look forward to our articles as we continue to look through opportunities and ideas together.

If you have any ideas or questions that you would like answered, drop us an email or contact us here. You may also want to consider setting up a face to face meeting with our experts if you want to know how all these trends may impact your property journey.