The property market today and twenty years ago is different. The very fundamentals of the housing game have changed. Primarily driven by regulatory forces in the form of Cooling Measures, the market cycle of Singapore’s property market is a lot flatter. Boom and bust cycles in the property market are becoming less volatile thanks to Cooling Measures. Is such strong government intervention necessary on this Little Red Dot?

Well, it is partially because we are a small island city that such interventions work (on an implementation and enforcement basis). More importantly, it is vital that we do not let our markets be swept up in the chaos when global markets exhibit sickness. Cooling Measures protect the interests of Singapore’s housing market by keeping price growth sustainable and relatively stable. This is a simple yet difficult to appreciate position. Property owners want their assets to appreciate like a rocket to the moon. Aspiring home buyers want property to remain affordable so that they can get their first home. Cooling measures help to balance these desires.

In this article, we discuss the fundamentals of Singapore’s housing market and how the Cooling Measures have changed the way our market operates (for the better). A lesson from history tells us how different types of property indexes behave when crises and cooling measures hit. Will history also tell us what kinds of cooling measures will come in the near future? Continue reading to find out!

The Fundamentals of Singapore’s Housing Market

The strength of Singapore’s housing market is not unique. Many investors compare Singapore to other first world cities and island economies. Singapore is typically compared with Hong Kong. A housing market with limited land and a market status as a regional hub. Another important fundamental that sets Singapore apart from its neighbours is geopolitical stability. The west often looks to Singapore as a political oxymoron. Single-party democratic rule. Yet, government policy has been more than sound, setting a world-class example in housing, transport, and development policies.

While there is always debate about public policy and its hypothetical alternatives, it is impossible to please everyone. Importantly, the current Singapore is far from its worst-case scenario. And that is more than enough to be thankful for. A small island economy needs strong economic and regulatory fundamentals if it wishes to remain as a fixture in an ever-changing world. Focusing on these three fundamentals of limited land, regional hub status, and geopolitical stability, we elaborate on how they set the tone for the housing market in Singapore.

First, Singapore has limited land. Land scarcity is both a boon and a bane. Land scarcity pushes up its value. Having limited land to develop helps to assure the retention of value for already developed land areas. Alternatively, if land is too scarce, there would be insufficient space for living and work. This would stunt economic growth and create a high-density living environment. The development of land needs to have a sustainable pace such that these factors are all balanced. Land reclamation helps increase the potential of waterfront developments. Although, there is a limit to how much land you can reclaim.

Next, scarce land alone does not give the land and its property value. You could be the only 100 sqm villa in the middle of the ocean, but you still might not be worth much. Economic activities, amenities and mobility options give land its value. Scarcity amplifies this value created from human presence and activities. As a regional hub for business, finance, transport, and trade, Singapore is an important checkpoint for economic activities across Southeast Asia, and arguably the Pacific. Many businesses choose to locate their headquarters in Singapore. This brings with it job opportunities and foreign talents.

Finally, the geopolitical stability and strong regulatory bodies here in Singapore helps ensure a stable and business-friendly environment to operate. Respected and effective rule of law helps maintain civility in the business landscape. The geographical location is also protected from natural disasters. On top of that, Singapore has a developed educational system with strong institutions to back it. These factors make it favourable for people to live, work, and settle down in Singapore.

While these factors in general seem just like a general advertisement for Singapore, it is equally crucial to the housing market. After all, behind each property purchase is a family or individual whose lives are embedded into Singaporean society. An appealing city to live and work in will have a robust demand for its real estate. The fundamentals of strong housing stem from Singapore’s strength in its economy, overall infrastructure, and sound governance.

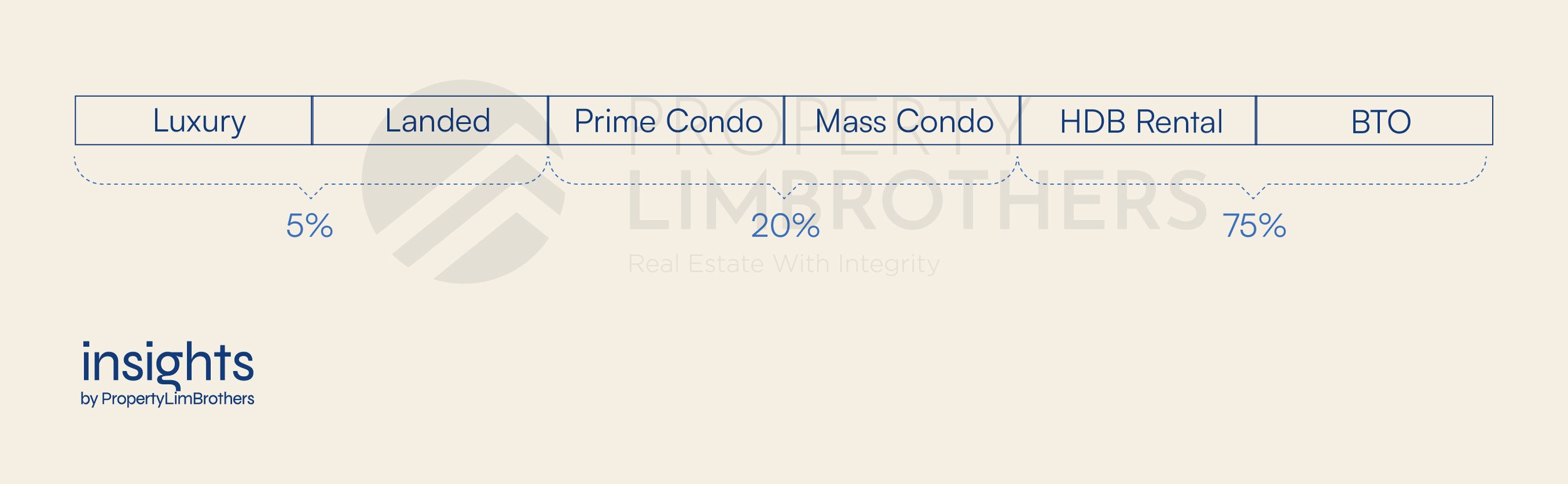

Within the housing market itself, the value of properties are also relatively stable and maintain a healthy level of growth. This strong growth stems from a large and healthy base of Singaporean consumers. A huge credit for this should go to the public housing system which serves as the base group of housing consumers. BTO, HDB Resale, and HDB rentals approximately account for 75% of the Singaporean housing market. Condominium and apartments for the mass and premium segments further account for another 20%. The final 5% of the market is accounted for by the Luxury and Landed segment.

How the housing market is stratified is important. Having a large base of HDB upgraders forms the basis of demand and price growth for the condominium segments. Likewise, luxury and landed property growth is led by the demand from consumers upgrading from condos. The growth of housing markets is only as sustainable as people progress up the socio-economic ladder. If these segments outpace or undercut each other in terms of price, it signals an underlying problem in the fundamentals of the housing market. It is akin to playing a game of Jenga. If too many bricks are missing from the base or the middle of the tower, the whole thing will come crashing down (the government will probably hold it in place before everything actually crashes).

For Singapore to continue to grow its housing market in the future, we have to keep a close eye on how the HDB and Condo segments are performing. Are they affordable? Are prices climbing too fast? These are important questions to ask if we are planning to make a move to participate in the housing market.

Cooling Measures & Housing Fundamentals

Free markets are the dream of classical economists—efficient markets which can self-regulate. By now, even the everyday person would know this is some sort of pipe dream. Just as how humans are not perfect, neither are how markets behave. Economic decisions such as buying and selling, are in part related to human emotions and behaviour and not pure rationality. One of the reasons why markets get overheated and crash afterwards (boom and bust cycle) is because of euphoric buying and chasing higher prices, and panic selling when prices start to go south.

Simply put, Cooling Measures help to temper market euphoria. When things get too overheated, cooling measures (aptly named) help to pull people out of that euphoric state (hopefully, the housing market never gets so bad as to need a Heating Measure to push up prices). There are a few specific mechanisms that Cooling Measures change in order to influence price movement in the market.

Primarily, Cooling Measures increase transaction costs and holding periods for property purchases. It also puts into place some rules to reduce the ease of obtaining credit through Loan-To-Valuation (LTV), Debt and Mortgage Servicing Ratio (TDSR, MSR) reductions in order to maintain a sustainable level of buying. We call this the Affordability Paradox; reduce affordability now to improve affordability in the long run.

Transaction Costs are increased through the introduction of more stamp duties. Seller’s Stamp Duties (SSD) and Additional Buyer’s Stamp Duties (ABSD) were introduced in 2010 and 2011, respectively. ABSD increases the cost of transacting residential properties beyond the ownership of one property. At first, foreign investors were the target of ABSD. Subsequently, this expanded to include Permanent Residents and Singaporeans who own more than one property in Singapore. By increasing the costs of transacting multiple properties, ABSD aims to curb speculative buying by taxing away the potential gains from additional properties (10-30%). Thus, reducing the incentives to buy multiple properties for short-term investment purposes. It also curbs foreign speculation in local property markets as foreigners have to pay a higher ABSD.

On the other hand, SSD prolongs the Holding Period for residential properties. SSD is payable if the homeowner sells the property within the span of 3-4 years from purchase. This increases the time people hold on to the property and reduces the incentive to buy and flip properties within a short period of time. In combination, SSD and ABSD increase transaction friction through the increase of transaction costs on multiple properties and prolong the time people hold onto the properties that they buy. This results in a huge reduction in speculative transactions. Volume contracts and price becomes less volatile in both directions. By slowing down the cycle of buying and selling, the housing market is made more stable.

The Affordability Paradox is another interesting way to stabilise prices in the housing market. Make housing less affordable now to make it more affordable in the future. That is the basic gist of it. By reducing the LTV from 90% to 75% for private property and 85% for HDBs, it is much more difficult to foot the down payment for additional properties. The lower TDSR and MSR ratios mean that buyers have to be of a higher income level in order to afford multiple properties and loans. This hurts the affordability of buying multiple properties and reduces speculative transactions in the market. In other words, it hurts people more (greater cash and income requirement) as they buy more and more properties.

By slowing down the property transaction cycle and implementing the Affordability Paradox, the housing market flushes out speculative participants and retains the persistent players. Long-term participants who use the property for their own stay or retirement/legacy needs would not hastily sell or buy properties. They would do so under much greater consideration and planning. The changes in these market fundamentals are how Cooling Measures work to make property growth sustainable.

A History of Cooling Measures

Crazed investors with cheque books in hand ready to buy at launch. Highly anticipated Condominium launches sell out like hot cakes from the first day. This imagery we introduced at the beginning of the article is no longer commonplace. The 2008 Global Financial Crisis (GFC) was a huge wake-up call for everyone. Consumers, financial institutions, and regulators. All were in shock at the collapse of AAA-rated banks. Because of reckless borrowing and lending, the subprime mortgage crisis in the US was a gory example of how a housing bust can go really, really wrong.

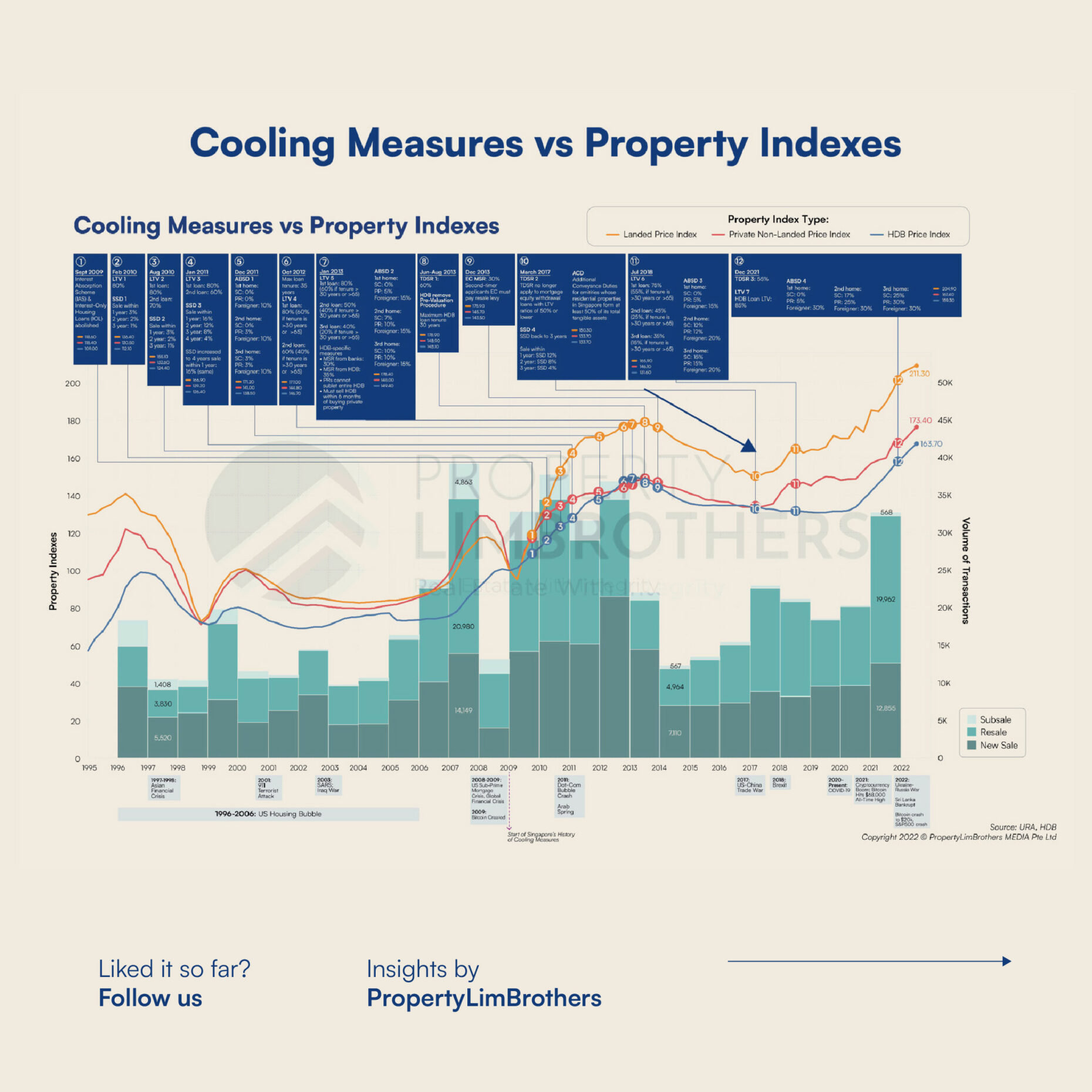

The first few rounds of Cooling Measures in Singapore were introduced Post-GFC, from 2009 to 2014. Property Lim Brothers has put together a graphic to show you how the property indexes have responded to both Cooling Measures and market crises. We have identified 12 different moments when Cooling Measures were introduced and modified from 2009 to present.

As explained earlier in the article, each form of cooling measure alters a fundamental aspect of the transactions in the housing market. With prices continuing its upward trend, the trajectory suggests potentially introducing new Cooling Measures if property prices continue to rise unabated. Round 6 to 9 of Cooling Measures greatly affected affordability by implementing HDB and EC specific cooling measures involving the introduction and reduction of MSR and TDSR. LTV is also lowered based on the tenure of the loan.

These specific Cooling Measures that targeted the base of the property market (HDB & EC segments) severely dampened the property indexes for the next four years (2014-2017). However, post-pandemic Singapore has seen the property indexes climbing up again. Despite the recent introduction of the December 2021 Cooling Measures involving a lower TDSR (55%), lower HDB LTV (85%) and higher ABSD, prices are still climbing steadily in 2022. Will the rest of 2022 and 2023 be beset with a new wave of Cooling Measures?

Speculating what Future Cooling Measures might look like

If prices continue to spiral upwards, more Cooling Measures will likely come. To keep the property prices in check with real income growth, we are speculating that there will be more targeted Cooling Measures to make sure that first time buyers are still able to afford property in Singapore. This might mean more Cooling Measures for people who buy multiple properties or are not first time buyers, in order to reduce transactions that are speculative in nature. Arguably, this might reduce the property ownership disparity among different demographics.

One possibility is further differentiation of LTVs based on the number of properties owned. First time buyers or upgraders who have sold their homes may be able to obtain higher quantum loans for their properties. On the other hand, investors with multiple properties would have a lower LTV for the second property and beyond, which would increase the down payment requirement and put off speculative property buying. It might be a good way to keep housing affordable to the groups of people that need it the most.

Another idea is differentiated loan tenures. Loan tenures for the investors who own multiple properties would have shortened loan tenures. This would increase the mortgage payable on the second property and beyond. On the other hand, first time property buyers could benefit from longer loan tenures and more affordable mortgage payments. These two ideas are just speculation on what future cooling measures may look like. And how they could have a more customised and sensitive approach using the Affordability Paradox.

It could also be possible that the rising interest rate environment might be enough to put speculative investors off. The higher interest payments, cost of capital, and recession worries might be enough to cool off demand for the property market. While prices may stay elevated or continue increasing, the volume of speculative buying that chases higher prices would probably taper off.

Closing Thoughts

Cooling Measures has been a crucial way for the government to keep the property market sustainable. Love it or hate it, they are probably here to stay. We hope this article has helped you better understand the fundamentals of Singapore’s housing market and how Cooling Measures work on a fundamental level. Looking at the history of Cooling Measures in Singapore, more might be on their way if property prices continue to climb further into the rest of 2022 and 2023.

If you would like to know more about how the latest Cooling Measures might affect your property journey, contact us here for a session with our experts to find out more.