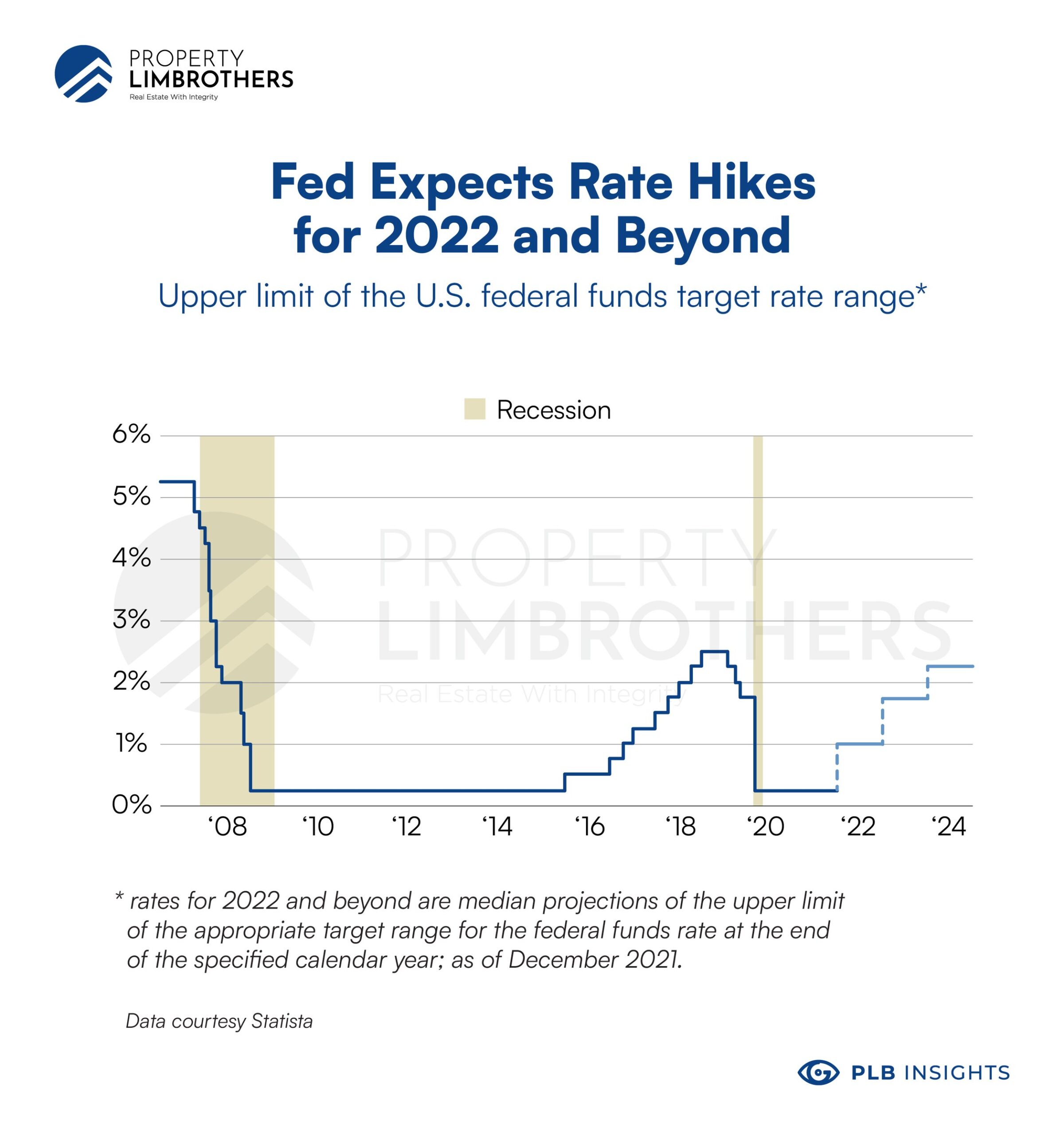

The U.S. Federal Reserve has made an announcement earlier in March that interest rate hikes have been planned going forward. Investors are expecting 7 rounds of rate hikes this year, possibly more going into 2023 and 2024. Each hike would be approximately a 0.25% increase, with the possibility of 0.50% increase if the Fed sees inflation still spiralling up. The Fed funds rate is expected to sit at 1.9% by 2023 (~1.75% increase).

How will this affect mortgage rates in Singapore? In the U.S., mortgage rates are already approaching 5%. The affordability of housing will be affected. Higher interest rates would mean that your monthly repayments will go more to interest rather than principal repayments.

In this article, we look at how Singaporean mortgage rates might be affected by the U.S. Federal Reserve rate hikes. Subsequently, we examine how this will impact the affordability of homes for Singaporeans.

1. Understanding Fed Interest Rates

If you have taken a class in macroeconomic theory, you might have a brief understanding of how monetary policy works. In reality, it is a complex web of transactions between banks and the Fed, and among banks themselves. But don’t be intimidated by the big words. We will explain the essence of it without watering it down.

The recent interest rate changes affect the Fed Funds rate. It is the interest rate banks charge each other for overnight loans to maintain their reserve balance. The reserve balance is basically the minimum amount of cash the bank needs to have (they can’t possibly lend out all their money). The banks who have excess reserves lend to those who do not have sufficient reserves at the Fed Funds interest (though really it is just a guideline).

In order to increase the interest rate, the Fed restricts the supply of money in the system. They do this by selling bonds or securities. Some can think of it as the reverse effect of quantitative easing. By selling bonds or securities, cash from the open market will go to the Fed. With less money circulating in the market, the velocity of money will slow down. This means that the speed of circulation will slow down, and inflation will taper or decrease.

To sum up, monetary policy aims to manipulate economic growth and inflation by controlling the supply of money to the system. More money circulating means higher growth and inflation (as we have seen from the Fed response in early 2020). Conversely, less money circulating means lower growth and inflation.

On the other hand, because the supply of money has decreased and demand remains high, interest rates would increase as suppliers of money would want more bang for their buck. At the end of the day, it boils down to simple demand and supply.

2. Singaporean Mortgage Rates

Now that we have the essence of interest rates, inflation, the demand and supply of money, we will move on to how it affects Singaporean Mortgage Rates here in Singapore.

In the U.S., mortgage rates have seen a rise due to the overwhelming demand for loan money and yet the supply of money is being shrunk. Imagine this on a global scale. Since the global banking system is highly interconnected, many banks hold reserves in USD and borrow from US banks. The spillover of the rate change in the US is a global affair.

Since it is more expensive for banks to borrow from each other, banks abroad (including Singapore) would face a higher interest rate and higher cost of borrowing. This higher cost of borrowing trickles down to customers in the form of higher interest rates for loans and mortgages. While this spillover might take a few weeks or months to become apparent, it is quite likely that Singaporean consumers would soon be faced with higher mortgage rates.

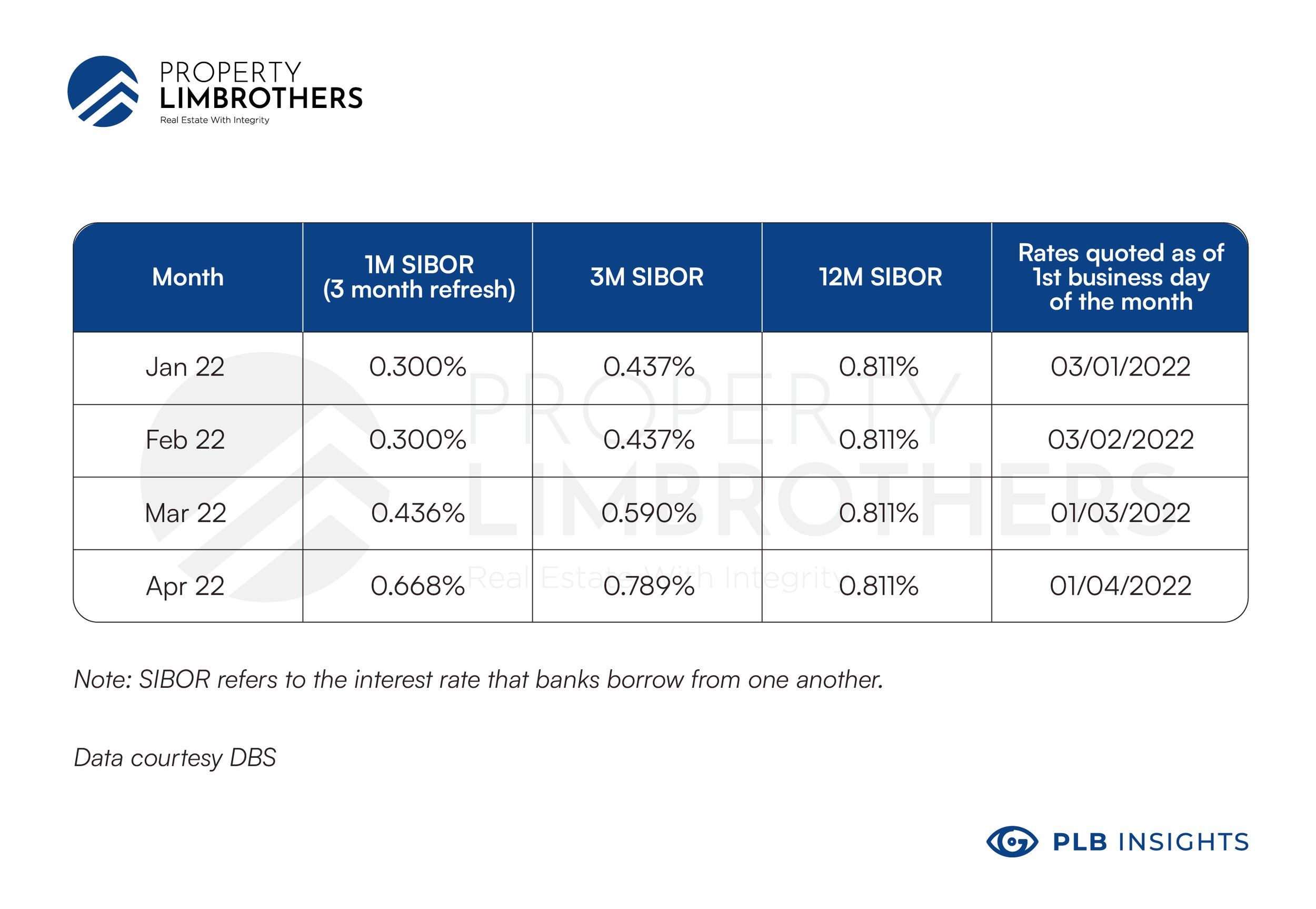

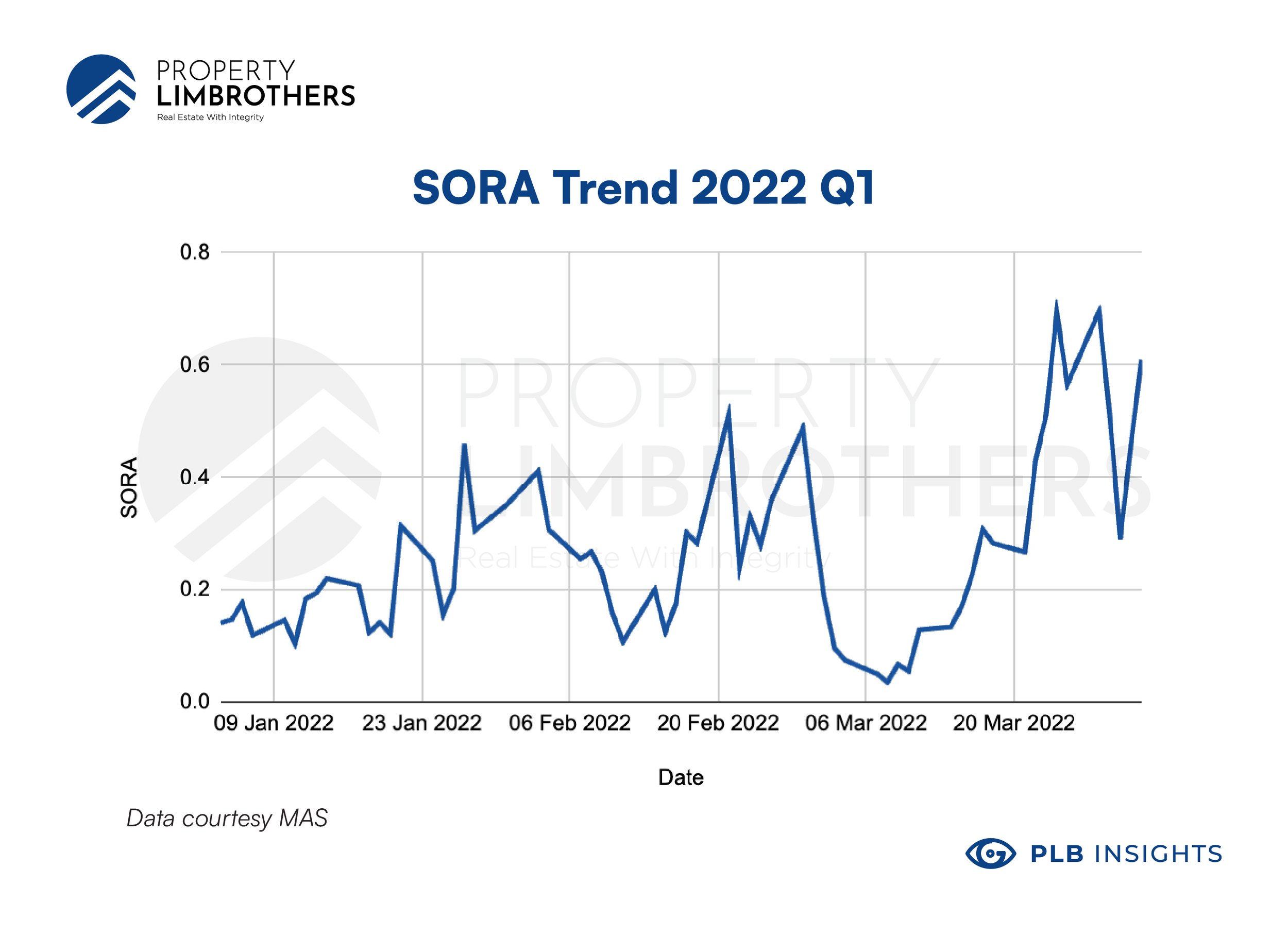

We have seen the 1 month SIBOR (interbank rate) go up by 0.368% from 2022Q1 to 2022Q2. On the other hand, the daily SORA (overnight rate) has increased by 0.467%. Mortgage rates in Singapore are usually pegged to SORA or a bank’s fixed deposit rate. You might want to speak to a banker or real estate agent to have a better understanding of the current interest rate situation. The consensus should be that mortgage rates are expected to rise along with the Fed rates over the coming years. If you have an opportunity to lock-in a fixed rate at a very low interest rate, it might be a good choice. But if you plan on refinancing now, do remember to take into account the legal fees involved.

If you have not yet purchased a property but you intend to do so in the near future, do consider a floating 3 month rate whether it is SORA or SIBOR. The floating rate allows you to to ride out volatility by taking a weighted average of the floating rate. But fixed rates would address this concern better by removing the unpredictability for a marginally higher rate. Do take in mind that the Fed’s decision to raise interest rates are motivated by the inflation situation in the United States. If inflation is under control, the Fed might not continue to be that aggressive with its monetary tightening.

Generally speaking, “lock-ins” help offer a lower mortgage rate in exchange for not being able to refinance the loan. “Fixed rates” offer stability by letting you fix a specific interest rate for a period of time. The stability often comes at the expense of a slightly higher interest rate. These are some terms that you should be aware of.

Given the current pace of monetary tightening in the US, we may see average Singaporean mortgage rates go from 2% now to around 4% in 2023. This is a guesstimate as each loan contract is different due to lock-ins, fixed rates, and special offers that are updated as the year progresses. The aggregate increase in rates we should expect is around 1.5% to 2% by the end of the year.

3. Impact on Home Affordability

How would this affect you if you are planning to buy a new home or refinance your loan?

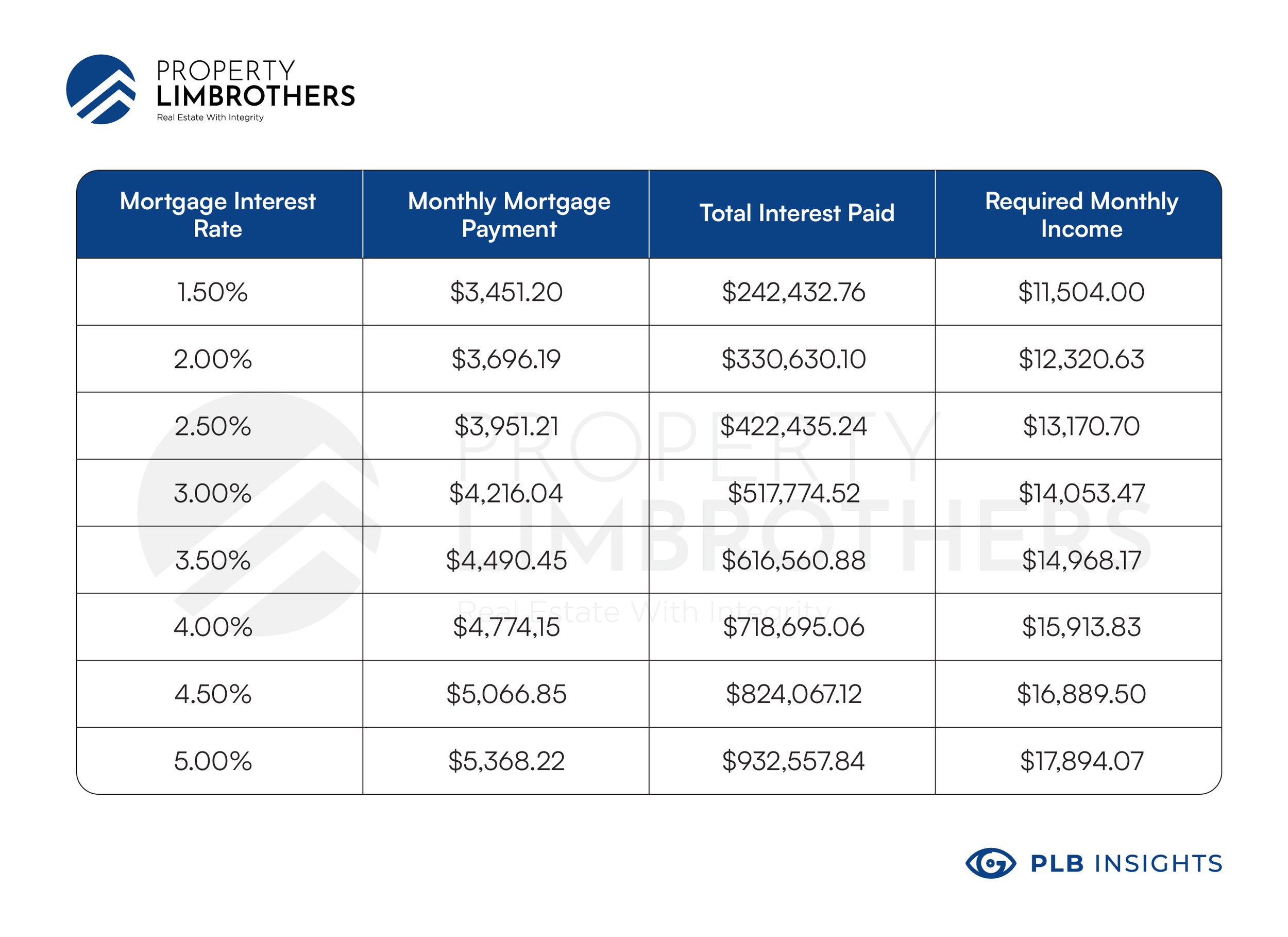

Let’s run a simple simulation to see what the differences are in mortgage payments. We will assume a total loan amount of S$ 1 million and a loan tenure of 30 years on a completed property (loan is disbursed all at once). We will vary the interest rate on 0.5% increments to see how this impacts monthly payments.

We can see from the table that interest rate increases are non-trivial. The total interest you would have to pay would go from S$242,432 when it is 1.5% interest to S$517,774 if mortgage rates rise to 3%. The total interest you would pay is more than doubled. Looking at the table, you can see how quickly the situation could get out of hand if interest rates continue to rise.

In the U.S. mortgage rates would soon approach 5%. If you were to take the same loan in the U.S., you would have paid $932,557 in total interest after 30 years. That is almost the entire quantum of the loan you are taking ($1 million). It might seem ludicrous but that is the reality of the situation in the U.S. right now. With property prices soaring, the loan quantum would also be much higher. The situation is not pretty.

In the column on the right, we calculate the required income you would need to afford this mortgage. While others might use the 55% TDSR ratio, the 30% MSR (mortgage servicing ratio) is a much better number to use. A comfortable income level for a $1 million loan at 1.5% interest would be $11,504. In contrast, at 3% interest for the same loan, a comfortable income level would be $14,053. To make affordability calculations simple for you, for every 0.5% raise in mortgage interest (on a $1 million loan), you would need to make $900 more in order to continue to comfortably afford it.

Closing Thoughts

Interest rates and monetary policy are usually concepts and ideas that the everyday person has only a rough understanding of. We hope that with this article, you have gained a better understanding of the fundamentals behind these concepts. More importantly, you now know how changes in interest rates affect you here, in Singapore.

To sum up the article, we are roughly expecting a 1.5% to 2% raise in mortgage rates by 2023. In terms of affordability in Singapore, this would translate into an additional $2,700 to S3,600 income required per household to afford a loan of $1 million. This is not a trivial matter. A caveat in this article is that the increase in interest rates are a response to inflation in the U.S. If inflation is under control, interest rates might not rise to such a degree. Singapore’s interest rates also respond to our own inflationary pressures and currency movements. Although the situation in the U.S. has the strongest global impact.

If you wish to learn more about how you can make optimised decisions on your property investment journey and the loans you might use to finance your decisions, contact us here for a detailed consultation.