Hip. Enchanted. Charming. These are the words that come to mind when one thinks of Singapore’s Shophouses. A time capsule containing the memories of Singapore’s colonial past and heritage. Spread out all over Singapore, shophouses serve as both residential and commercial properties. Whether in the CBD or in the outskirts of town, we can somehow catch a glimpse of these sweethearts as we traverse from city to heartland.

In our previous articles, we have covered why Shophouses are a great option for property investment. We have also covered the architectural features of Shophouses and how they are varied and unique. Without a doubt, the performance of Shophouses as a commercial property investment has outclassed other traditional means.

In this article, we give a step-by-step guide to explain the purchasing process for a Shophouse in Singapore. This will help shed some light on the administrative details of the property purchase. It will be an interesting read if you want to learn more about how commercial shophouse investments can be purchased.

1. Set up an Investment Holding Company to Buy the Shophouse

When buying a Shophouse in Singapore, consider setting up an investment holding company to hold it. Using this method to hold the Shophouse has many benefits. An investment holding company has flexibility in its ownership structure (decided by shares) and may hold on to multiple investment instruments (other businesses or properties). This means that you may get multiple investors on board as shareholders of the company. A key reason for this vehicle is because of limited liability. Your personal assets will not be liable as the company is a separate legal entity.

This mode of entry into Singaporean real estate and investment is foreigner-friendly. It is considered a separate tax entity (in case you have concerns as a HNW individual). Corporate tax in Singapore stands at a competitive 17%. You can use the holding company in Singapore as a way to consolidate and optimise your tax obligations. This is possible even if you have subsidiary businesses or assets overseas. One perk is that ABSD doesn’t apply for commercial Shophouses, do note that Shophouses with residential components will have an ABSD on the value of the Residential component.

Image courtesy hcamag.com

Here is a simple checklist for the requirements of opening and running a holding company in Singapore. For more information you should consult an accountant or ACRA for advice.

-

Your company name needs to be approved by ACRA

-

Personal identification documents and residential address of the Directors, Shareholders and Company Secretary is required

-

You will need to obtain the signed consent of the nominated Directors and Secretary.

-

One of your directors should be local resident

-

A physical office address in Singapore is required for the company

-

You will need a Constitution for your company

-

If you are a foreigner without a SingPass account, you will need a registered filing agent to submit the application for you

-

You will need to keep of proper accounts and records up to the standard of accounting in Singapore

-

Annual returns with ACRA would need to be filed

-

Pay your yearly corporate tax on time

-

Hold Annual General Meetings (AGM)

Do note that this is not an exhaustive list. You will need to do your due diligence in opening and maintaining your company up to the standard of Singapore’s regulators.

2. Register for GST?

Image courtesy Vulcan Post

The next consideration is whether you should set up a GST or Non-GST registered company? In Singapore, companies with turnover of greater than $1 million dollars are required to register for GST. Smaller companies are not required to but can voluntarily do so. Why is this important? While commercial or industrial properties are not subject to ABSD, it might be subjected to GST depending on if the seller is a GST registered company.

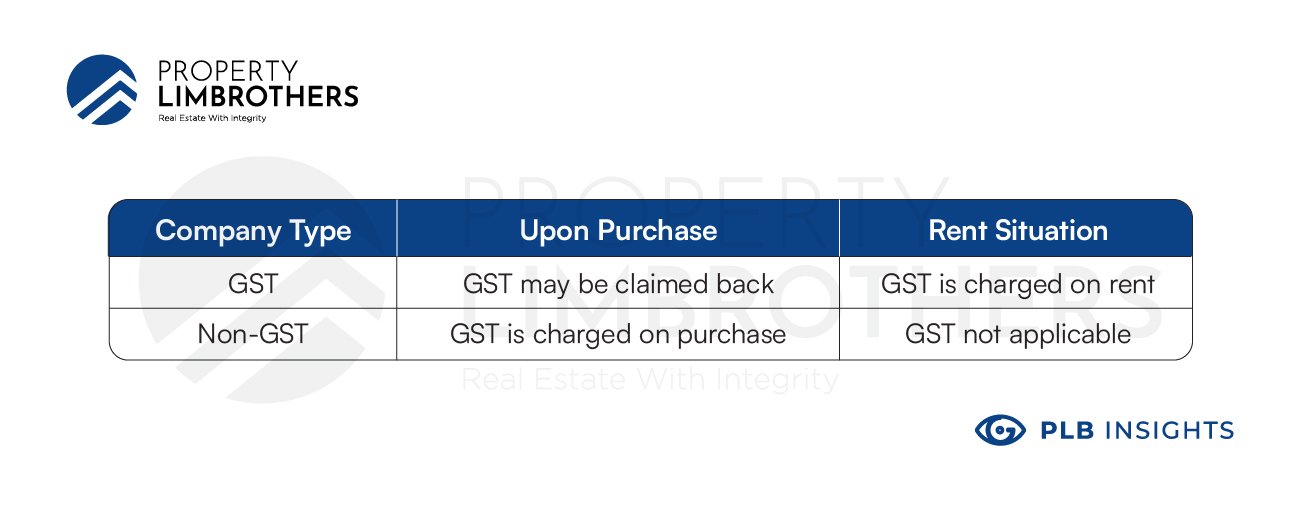

If you are buying commercial property from a GST registered company, you will need to pay GST on your purchase price. However, if you are buying using a GST registered company as well, you may claim back that amount. Instead, if it were a non-GST company buying it, you would have to pay this amount. What’s the catch then? As it turns out, the main trade-off is whether or not GST will apply to the rent you collect from that property. Here is a table to clear up any potential confusion you might have.

Please note that if you are a Non-GST registered company, it is illegal to collect GST as you are not an approved agent of the government to do so. Doing so could land you in jail.

This is a big decision. Especially if you are planning to use this company to hold other subsidiaries as well. It will also be important to know that this will apply to subsequent commercial or industrial property moves you intend to make. It would be wise to take a long-term stance in making this decision. One way to look at this is to see it as a form of cash flow management. By reducing the GST payable upon purchase, and instead “amortising” it over rent. Of course, this might be a form of mental accounting to convince yourself. But the rising GST rates over the course of the next two years is not a joke.

Singapore will raise GST by 1% twice from the start of 2023 and 2024 respectively. If the 2% hike over the next two years is enough to recoil consumers, you should definitely consider how it will impact your commercial shophouse investments. If you were to purchase a S$10 million commercial shophouse in 2024, the GST payable would be S$900K. That’s almost a million. Each percentage increase in GST for a S$10 million property would translate to S$100K in GST paid.

3. Work with a Trusted Banker

Image courtesy Nikkei Asia

The next step in the puzzle is securing a loan for your holding company to buy the Shophouse. This is ideal as it helps you make use of leverage in the investment. It could also help with affording higher quantum investments which you might be interested in. The process for securing a loan for an individual investor is different from that for a corporate entity.

First, Total Debt Servicing Ratio (TDSR) does not apply to companies. You will have to manage your debt and cash flow to make sure that your company does not end up becoming insolvent. Having a trusted banker helps because they would understand your situation better and hopefully present more favourable loan terms. They might also be able to help with the variables that work in ranges.

Here is a list you need to consider before applying for a commercial loan:

-

At least 1 to 2 years of credit history if you are a young company

-

Interest rates for commercial loans are usually in the range of 2-3%. It might be going up these 2-3 years by 0.5 to 1.5% due to U.S. Fed rate hikes

-

Get advice on which interest rates to use, SORA, SIBOR etc.

-

Legal and valuation fees need to be factored in

-

Refinancing options and their legal fees

-

LTV requirements are usually between 60% (investment purposes) & 80% (own use).

-

Banks would need to see a local ownership of 30% in the company before offering you the loan

The difficulty lies in local ownership and credit history, especially for young companies. The good news is that due to the nature of the holding company, you just need to look for a Singaporean investor willing to buy 30% of the shares of your holding company. This helps especially if you plan on going for higher quantum investments. Having more investors with the same goal and game-plan on board really helps to pool together funds for such a commercial investment.

For the concern on credit history of young companies, some business owners might park their existing businesses under the holding company to help with income flows. Do note that your holding company is not allowed to directly operate its own business; it may only hold shares of businesses that run those direct operations. If your company is completely new and you still wish to obtain a commercial loan, you may need an in-depth discussion with your banker on whether taking the loan is possible given that you have sufficient collateral to present to the bank. You might need to show funds to obtain the loan. The key concern banks have is the origin of the funds as Singapore takes a strong stance against money laundering and terrorist financing.

4. Set up Rental Management

The next important step is to make sure you have a proper rental management system in place. This is a key part of your investment strategy, since you will be using the rent to offset the mortgage on the commercial shophouse. If you are not able to find a tenant or your rental income is suspended (like during the start of the pandemic), you still need to pay the mortgage. Thus, make sure you have sufficient cash flow to backup your commercial shophouse investment in the event you are not able to generate rent.

When finding tenants for your commercial shophouse, you would need to know what kind of tenants you prefer. Would these tenants be interested in your property? Are you planning to lease it to a law firm? A cafe? A start-up or SME? A boutique restaurant? The list can go on. Think about the cluster in which your shophouse investment is located. What other businesses are already in the area? This can help give you a rough idea of the tenancy situation.

Another option is to take up the previous tenant of the shophouse, if it was sold to you with a tenant already occupying the property. Just make sure that the terms and conditions are to your satisfaction for all intents and purposes. The situation of the pandemic has given landlords a little more paranoia in crafting contracts. You might want to be very clear and explicit on the terms for payment of rent arrears if your tenant misses a payment date. You might also want to consider force majeure clauses or frustration clauses in the event that another unpredictable event happens and disrupts rental income. If this portion of rent management seems confusing to you, it is because rental management is in the domain of commercial real estate brokers. Few companies arrange this on their own.

Closing Thoughts

To conclude, we have covered four big administrative matters in a commercial shophouse investment. This technically applies to commercial real estate in general too.

-

Set up a holding company

-

Consider registering for GST

-

Work with a trusted banker

-

Set up rental management

As at the time of the writing of this article, the announced increase in GST in 2023 and 2024 is a key aspect for shophouse investors to pay attention to. While it may not be a good idea to base your decision solely on the GST rise, it is an important cost consideration when you do decide to invest. In addition, the interest rates are set to rise based on the U.S. Fed announcements. Mortgage rates will soon reach 5% in the United States. With this news in sight, commercial real estate loans hitting 3-5% in 2024 is not unimaginable.

If you are still unsure about how to start the process of investing in shophouses, contact our experts here to find out more if it’s the right path for you.