Over the years, especially for newly minted college grads stepping into the workforce, or even newly-weds buying their first homes, we often hear news of rising inflation rate, Quantitative Easing, and the importance of acquiring good debt being thrown around in the media. We sometimes even hear savvy investors advocating how “the rich acquire good debt, while the poor get into debt to acquire liabilities”, which begs the question: What is inflation, and how does it actually affect us? In this article, we set out to explain the significance of inflation, its underlying principles, and how it is able to erode good debts like mortgages in the long term.

What is inflation?

The basis of inflation is very important, yet simple. Basically, it causes the value of a currency to decline over time. Essentially, the money you have now is worth more than the money you have down the road. Inflation rate risk simply refers to the risk of reduction of purchasing power of your wealth as a result of rising cost of goods. Think of your favourite plate of Chicken Rice. Back in the 90s, you could probably buy a plate of Chicken Rice for a little more than a dollar. Today, that same plate of chicken rice would set you back at least $3.50! This is a classic example of inflation working its magic. There are many ways to measure the rate of inflation, but the most common one would be the Consumer Price Index (CPI), which measures the rising costs of a given basket of goods.

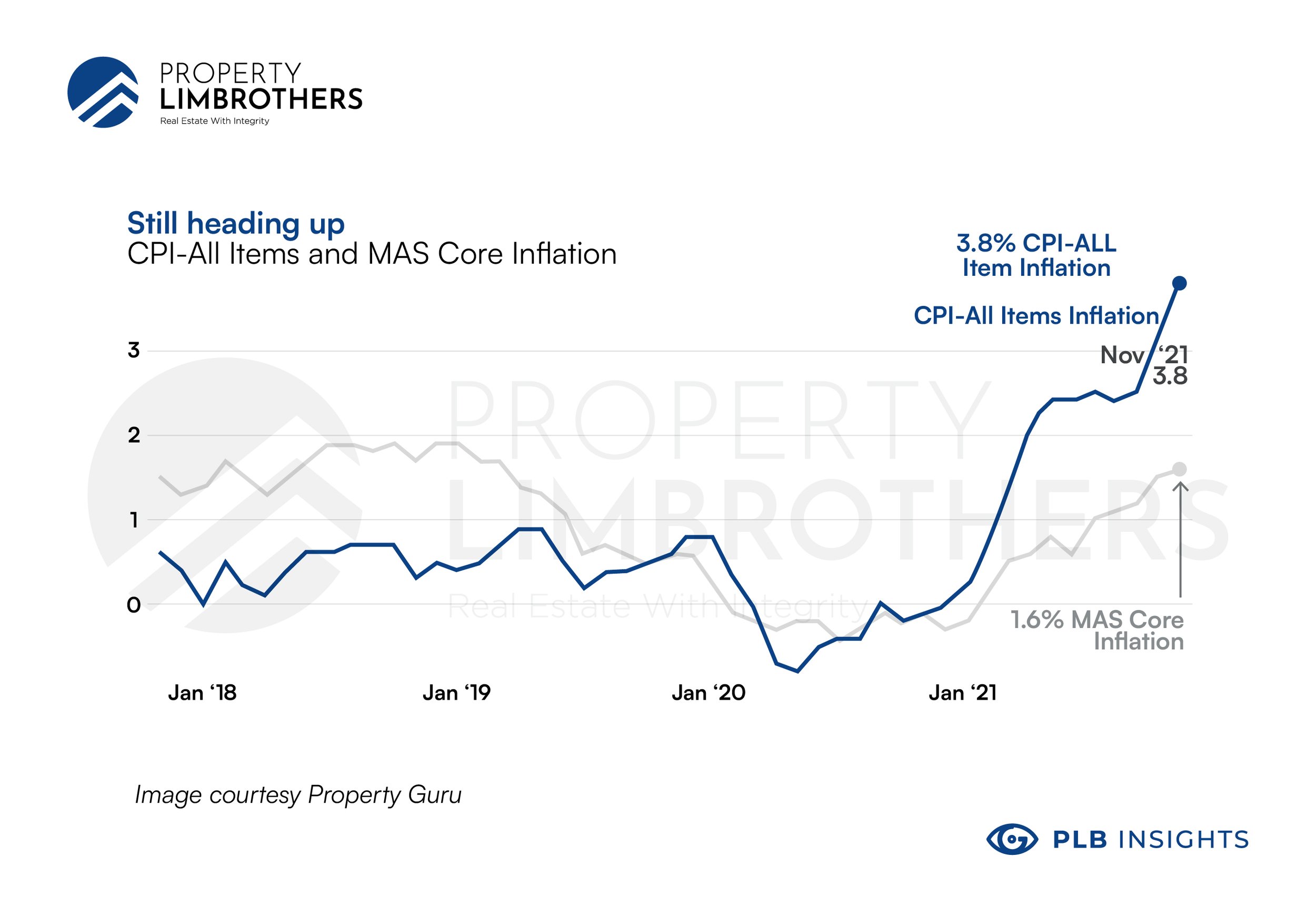

On a side note, the local media outlets usually report inflation figures in 2 formats: Headline Inflation and Core Inflation. The Headline inflation rate refers to the change in value of all goods in a basket, while the Core Inflation figure includes every component of the Headline Inflation except fuel and food items. We will mainly be referring to the headline inflation figure in this article. The headline inflation rate in Singapore stands at around 3.8% as of November 2021.

Biggest culprit of inflation: Quantitative Easing

There are many factors contributing to inflation, but the increase in monetary supply in the economy is the main cause of the phenomenon. The increase in monetary supply can be carried out through a variety of mechanisms in the economy, with the latest and most common practice being the Quantitative Easing efforts by the US Federal Reserve to rejuvenate the economy following the recession caused by the pandemic. But what is Quantitative Easing, and how does it actually work?

The US Federal Reserve, or commonly known as The US Feds, have the ability to influence the economy through Open Market Operations like Quantitative Easing. This is basically a monetary policy in which the Central Bank engage in the creation of new currencies, or in layman terms “print money” to buy securities such as Treasury Bonds and Mortgage-Backed Securities from commercial banks and institutions (This is what it means when the media reports about the feds “increasing assets in their balance sheet”).

Doing so injects a huge volume of money supply into the banking system, which increases the liquidity and availability of banks to loan out to businesses and individuals, and also puts a downwards pressure on interest rates. This ultimately boosts the economy because individuals and businesses can borrow at a lower cost, and have more money to spend, which increases the overall market confidence, eventually improving the economy. To give some real world context, up until recently, the US Feds have been increasing its balance sheet at a rate of approximately US$120B per month, with Treasury Securities making up US$80B and Mortgage-Backed Securities making up the remaining US$40B.

However, this comes at a cost because when there is an abundance of money in the economy, it further dilutes the value of the existing currency. The continual printing of monetary supplies can eventually lead to high levels of inflation, causing cost of living to be too high. This phenomenon is colloquially known as hyperinflation. Sounds familiar? That is because it actually happened to Germany in 1923 where prices ran out of control. Fun fact, the price of a loaf of bread actually ran from 250 marks in January 1923 to 200,000 million marks in November 1923!

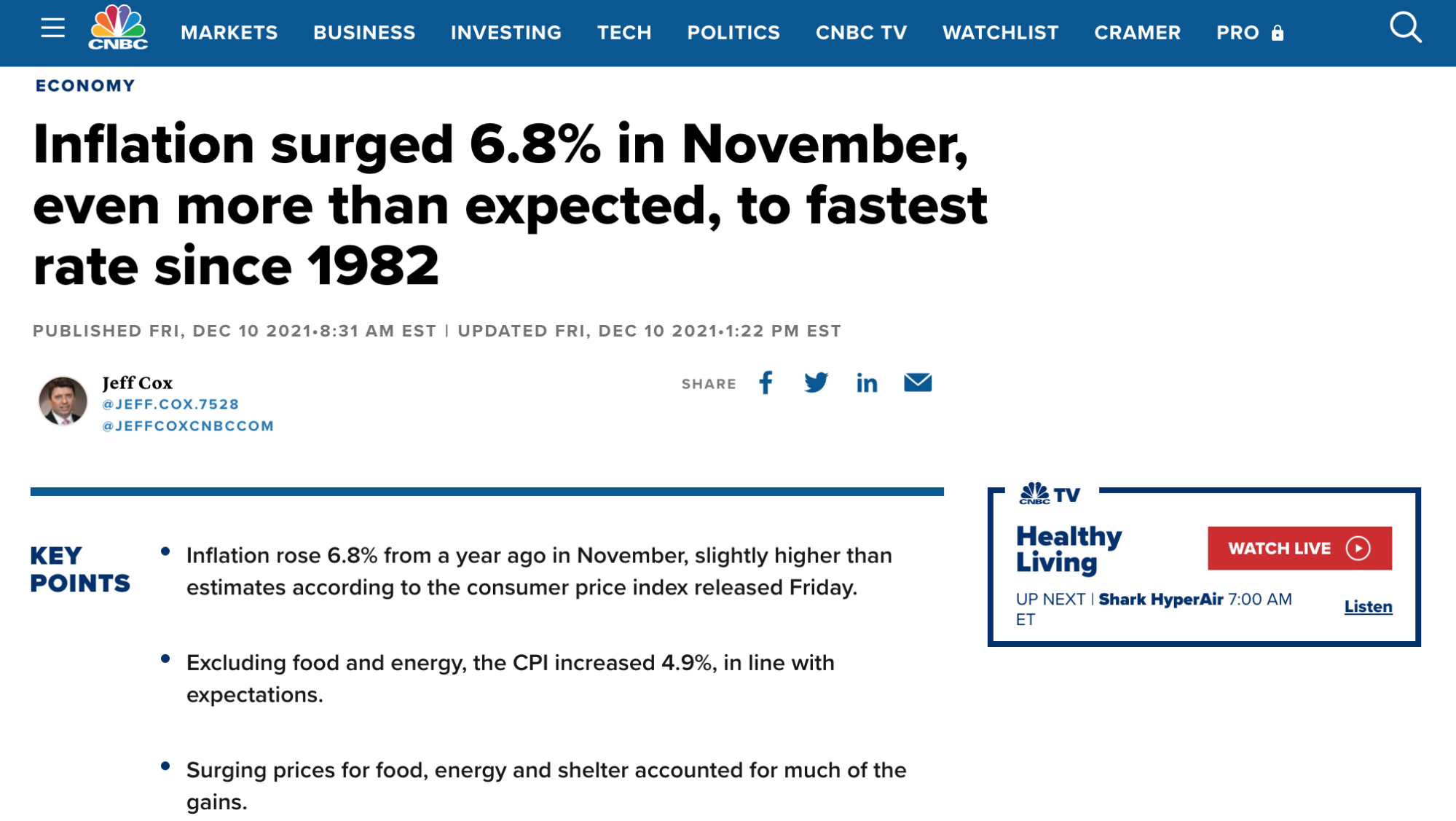

In total, the US Feds have increased the asset column of their balance sheet to a little over US$20 Trillion, which means almost 80% of all currency in circulation in the United States of America have been printed since the onset of the pandemic. As such, inflation figures were reported at an alarming rate of 6.8% in November 2021.

Courtesy CNBC

Cautious of the adverse effects of hyperinflation, the US Feds have begun tapering its purchase of assets in November 2021 by scaling back its rate of purchase by US$15 Billion a month. On 15 December 2021, the US Feds ramped up its tapering process by doubling the decrease in rate of purchase to US$30 Billion a month. At such a trajectory, the US Feds are projected to stop purchasing assets as early as 2022.

What are good debts?

The difference between a good debt and a bad debt is that it is used as a form of leverage to acquire assets with cash flow generating capabilities; after all, “It takes money to make money”. Essentially, an investor possessing good debt is basically “using other people’s money” to amass assets that could help them build wealth and increase income in the long term. Examples of good debt include a business loan, mortgage, and even a student loan (very controversial, but this is a topic for another time!)

Why inflation can be a good thing for property investors

It may come as a surprise to many that inflation, albeit its notorious capability of diminishing consumer’s purchasing power, can actually erode good debts like Mortgages in the long term. But how is this so? As mentioned, the core principle of inflation is that it causes the value of a currency to decline over time, which essentially means that the money you have now is worth more than the money you have down the road.

1. Erosion of good debts

Simply put, based on the basic principle of inflation, it actually allows debtors or mortgagors to pay back lenders in the future with money that is devalued, as compared to when they initially borrowed it. This is possible because of the lower purchasing power through time, which explains the difference in the nominal and real value of currency. What this means for Real Estate investors is that over the tenure of their mortgage loan, assuming that the median interest rate averages out over its maturity period, their mortgage loan could potentially be eroded by inflation, and they technically pay a lesser amount.

2. Reduces cost of borrowing

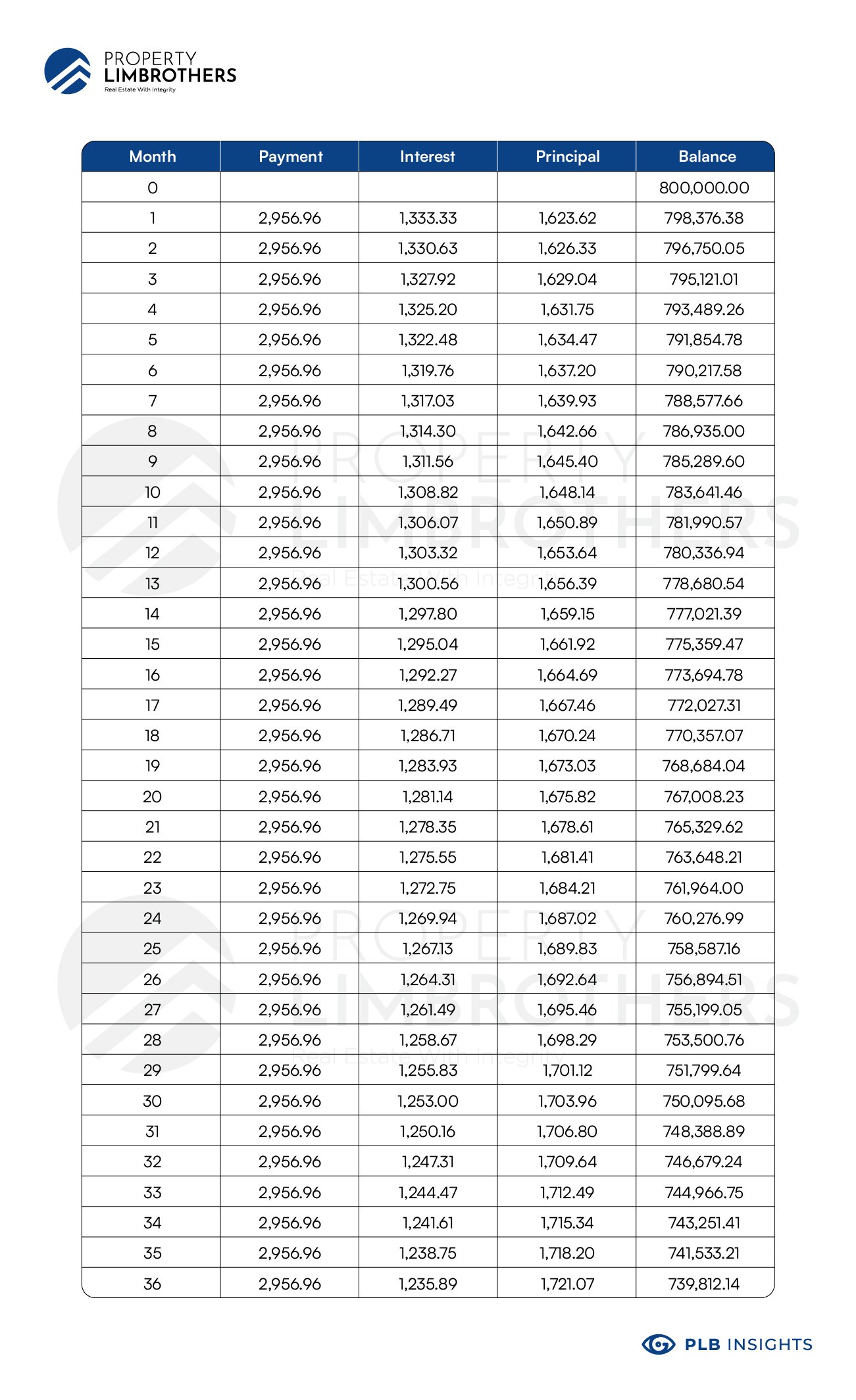

Furthermore, a high inflationary environment bodes well for borrowers in terms of cost of borrowing. As we know, a mortgage consists of 2 portions – the Principal and Interest payment. Below is an example of the monthly debt servicing for the first 3 years of a typical $800,000 mortgage loan at 2% amortised over 30 years:

Say the current inflation rate is 2%, it practically means that the 2% interest payment yearly has been eroded, and the cost of borrowing is minimal. This potentially also means that most of the mortgage payment would be used to service the principal payments, which is beneficial to the investor.

3. Favourable environment for borrowers

Moreover, more often than not, when inflation causes prices to hike, the demand for credit increases, which is advantageous for both lenders and also investors seeking a mortgage loan. This is because lenders are more willing to lend money to home buyers because of the lower risk, especially since the underlying property can be used as collateral, coupled with the stability of the housing market in Singapore. This makes it easier for borrowers to obtain a mortgage loan to acquire their Real Estate asset. However, buyers should note the detrimental effects of over-leveraging, and practise financial prudency.

4. Inflation leads to appreciation of assets

Inflation not only helps to erode good debts, it also inflates the value of an asset overtime. Let’s take a look at the prices of some of the properties in Singapore over the years:

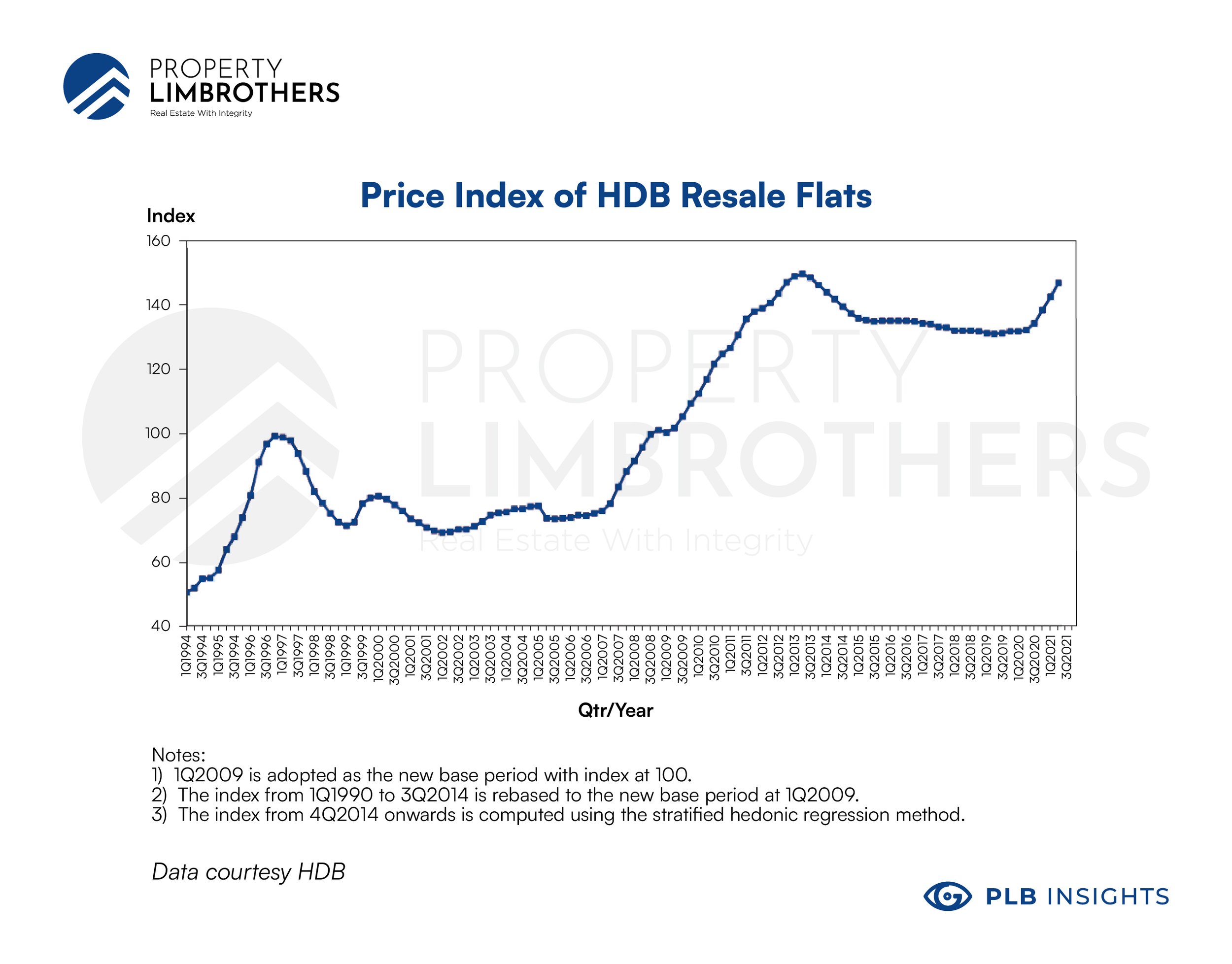

In 2006, a 4-room HDB apartment in Bishan held an indicative quantum price of approximately $321,000. Today, a similar 4-room HDB apartment in Bishan would transact at approximately $640,000. The historical price index of HDB resale flats clearly shows the overall increase in value of HDB apartments over the years.

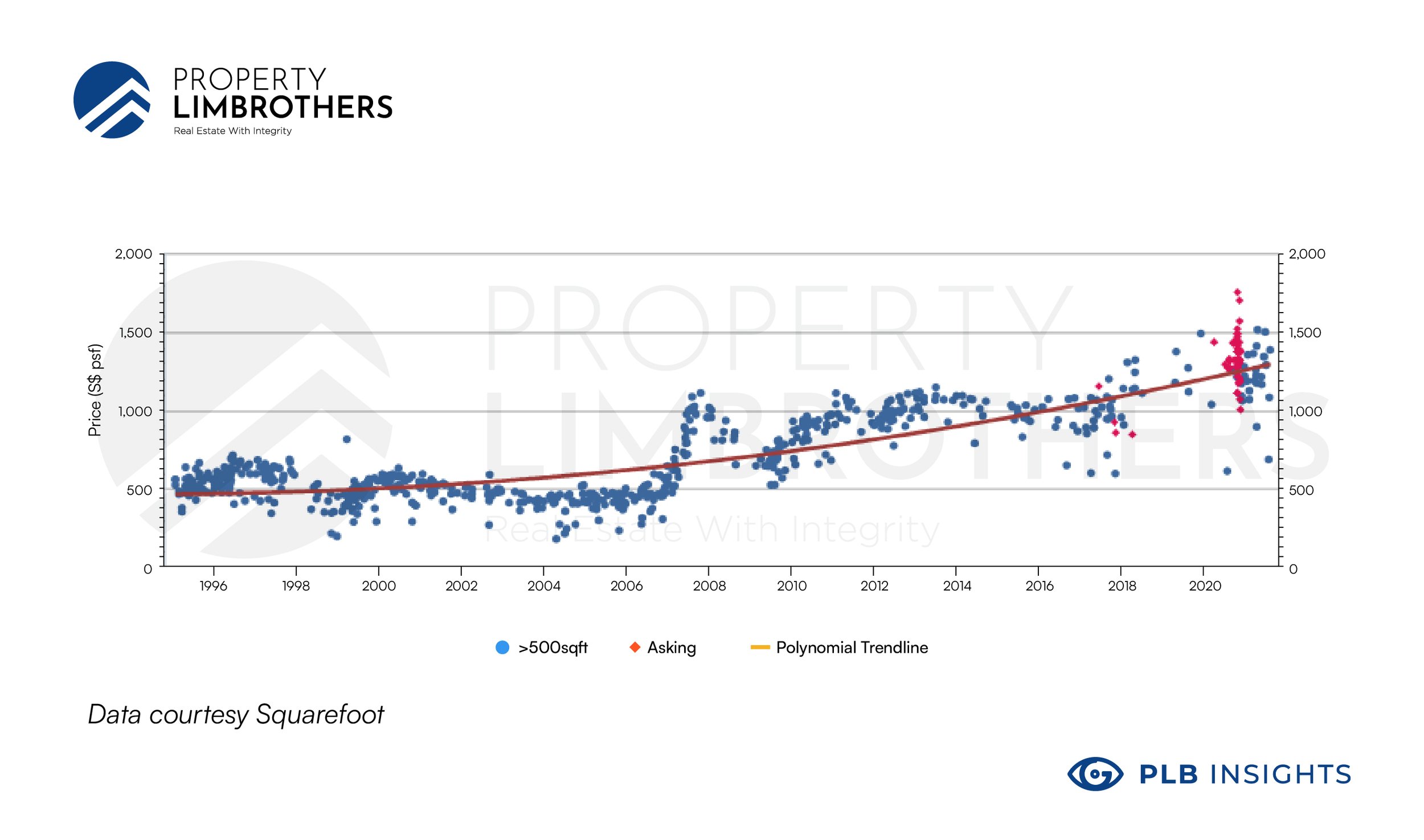

In the Private Non-Landed Residential sector, prices have also seen an upward trend due to the effects of inflation. For example, Pandan Valley, a Freehold Condominium Development in District 21 saw an appreciation from approximately $500 PSF in 1996 to upwards of $1000 PSF in 2021.

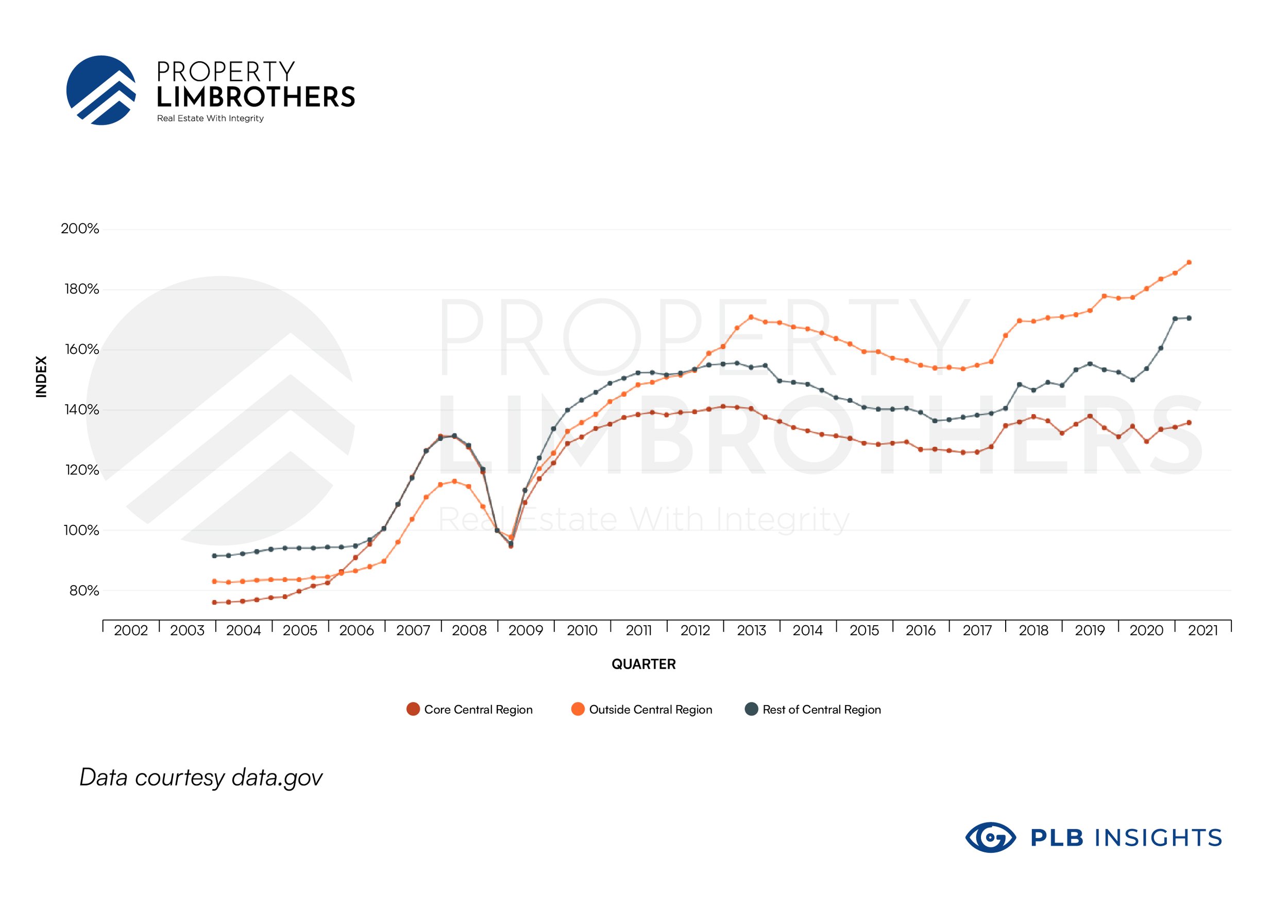

Looking at the overall price trend of the Private Non-Landed Residential properties locally, it has also seen an appreciation in price even with the introduction of many rounds of cooling measures.

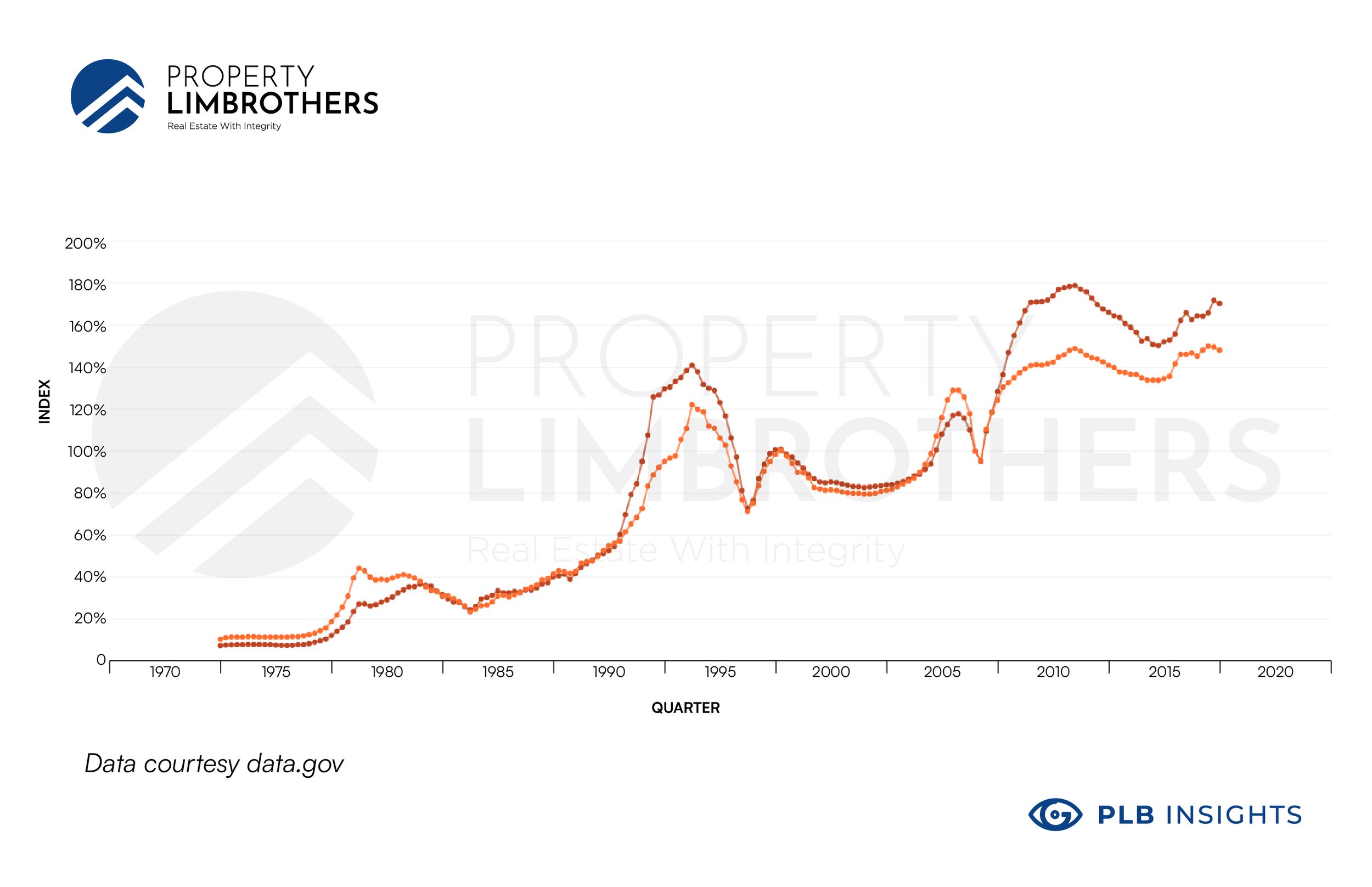

The Private Landed Residential sector in Singapore saw the most drastic change in quantum price over the years.

The overall price trend increased in tandem with the private non-landed residential properties, but at a more distinct and faster rate especially in recent years. For example, historical prices of Terrace houses in the Jalan Bunga Rampai vicinity ranged anywhere from $400,000 to $550,000 in the 1980s. Today, the value of private Terrace houses in Jalan Bunga Rampai have almost quadrupled since, putting up resale asking prices of around $2.87m to $3.5m. We have done a video home tour of a Freehold Inter Terrace unit at Jalan Bunga Rampai, do check it out here! Alternatively, we have previously also written an article on the story and historical prices of landed homes in Singapore, do check it out here!

Now back to the main narrative, why is it that inflation leads to an appreciation in the value of assets? We believe that it is because savvy investors, both locally and internationally, are looking to park their wealth in better forms of investment vehicles which have the capability of generating consistent cash flow while having an inherent good store of value.

Courtesy The Straits Times

This is part of the reason why we saw a recent influx of foreign investors, High Net Worth Individuals and even businesses participating in our domestic Real Estate market, with more well-known examples being the purchase of a Good Class Bungalow at Nassim Road for $128.8m by Ms Jin Xiao Qun, wife of Nanofilm Technologies International founder Dr Shi Xu; and even ByteDance moving its Headquarters to Singapore (although there might be other political and economic reasoning behind it as well but we are not going into that today)

Courtesy The Business Times

Final Words

Real Estate is often touted to be the ‘best hedge against inflation’, and we have seen enough transactions and success stories to back up that claim, but we have also seen a fair share of negative sales in property transactions. We have also observed investors tapping into the power of leverage during a high inflationary environment, and also investors suffering from the detrimental effects of overleveraging. However, one thing is for sure: inflation is here to stay, and putting your hard earned money into a cash flow generating asset like Real Estate with the power of leverage would make more financial sense, as you are limiting the risk of your wealth being eroded by inflation.

If you are still keen on researching more about the effects of inflation on your next property purchase decision, or are looking to enter at an opportune time, stay on our Insights page to find out more, or contact us for more questions here!