Singapore is heralded as one of the “free-est” markets in the world, yet on the other hand others may not feel the same about its real estate market.

With the number of extra costs and limitations that real estate investors may need to work with even to buy a piece of Singaporean property, you may think that Singaporean real estate may not be a top pick for investors.

While conventionally, lower taxes have been attracting much-needed foreign direct investment in Singapore’s other sectors. It is the presence of these regulations — and its net-positive effects on Singaporean real estate – that have ultimately built up and maintained the Singapore property market’s reputation of stability.

Moreover, we know that the Singaporean property market isn’t solely about attracting investor dollars. The government has proactively enacted real estate regulations not only to protect investors’ interests but also to ensure that its residents can afford a new home. The last thing Singapore wants is a duplicate of Vancouver’s issue where foreign money was dominating the real estate market.

These regulations, in turn, strike an equitable balance between public welfare and market development.

A quick history on Singaporean real estate regulation

1960: The Housing and Development Board (HDB) was established in order to manage public housing for Singaporeans amid several housing issues (including but not limited to overcrowding, homelessness and lack of hygiene).

1961: The Bukit Ho Swee fire erupts, prompting the HDB to take action to build low-cost flats swiftly. As mentioned in our article on “The History of Growth in Singapore’s Real Estate Market” – The Bukit Ho Swee Fire was a major fire in what now is the Tiong Bahru housing estate that left as many as 2,833 families homeless.

1968: Singaporeans were allowed a part to play in the public housing market as HDB flats were made more affordable, and allowed to be bought by one’s Central Provident Fund (CPF), a social security savings scheme funded by both individuals and their employers.

1970: Over this decade, a third of Singaporeans lived in HDB flats. This meant that succeeding laws and statutes over the public market have been a critical part of real estate regulation as early as 10 years after independence.

HDB blocks along Bukit Ho Swee in the early 1960s. These flats often consisted of cheaper one-room flats.

1971: A public housing resale market would be allowed to function, but resellers were required to finish a Minimum Occupation Period (MOP) of 5 years at the time before being able to sell their HDB units.

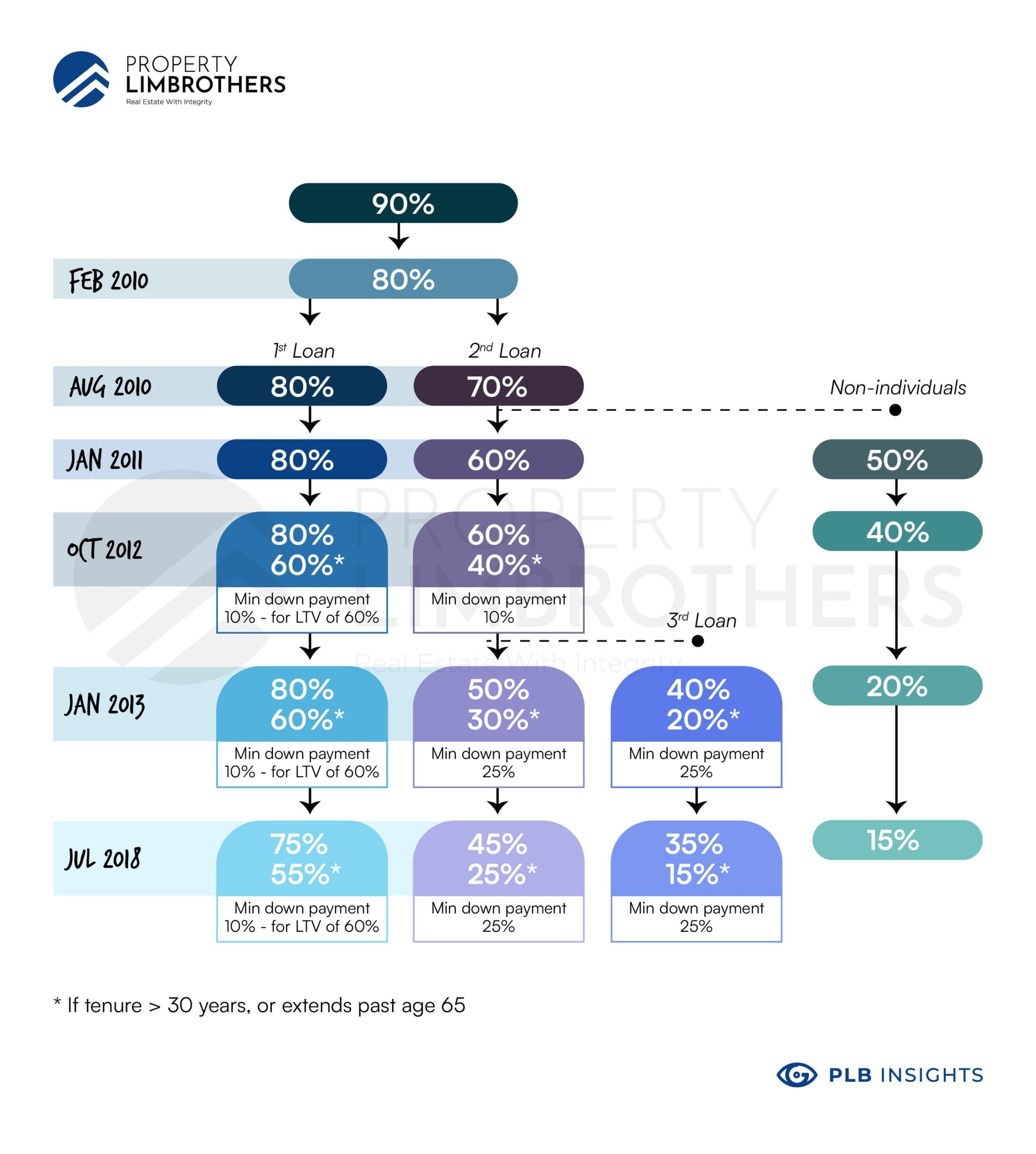

1996: The first Loan-to-Value (LTV) limits would be introduced. While not a cooling measure per se, these regulations were put in place primarily to ensure sound banking practices within the property market.

2005: LTV limits would be increased from 80% to 90%. Giving banks more room to assess risk, hence offer up to their discretion, the consumers a wider range of financing options when purchasing real estate.

2010: In February 2010, the government introduced the Sellers’ Stamp Duty. These regulations aim to reduce overheating through short-term speculation within the property market in Singapore.

2011: The Additional Buyers’ Stamp Duty (ABSD) would be introduced on 8th December 2011 as an additional cooling measure to manage rising demand within the property market.

Initially, Singaporean Citizens would only pay 3% in ABSD on their 3rd property. In comparison, Permanent Residents (PRs) were required to pay their 3 percent ABSD on their 2nd property, and foreigners and entities were entitled to pay only 10% ABSD on any property. Feeling nostalgic yet?

2013: The ABSD would be revised and increased yet again:

Singaporean Citizens: 7% on 2nd property, 10 on 3rd and additional properties

PRs: 5% on 1st property, 10% on subsequent properties

Foreigners and Entities: 15% on any property obtained

2017: The ABSD would be increased once again to combat inflationary risks within the Singaporean property market.

2021: A third round of cooling measures would be introduced to the property market, as ABSD rates would be increased across the board by 5 to 10%. LTV limits would be reduced from 90 to 85% for HDB loans and 75% for bank loans.

2023: Another round of cooling measures saw ABSD rates increase by 3 to 5% for Singaporeans and PRs buying their second and subsequent residential properties. ABSD rates for foreigners buying any residential property doubled to 60%, and 65% for entities and trustees.

What makes Singaporean real estate regulation unique?

Let’s be clear. Singapore is incredibly small. And we mean incredibly small. We are, after all, a tiny red dot within the little red dots printers use to indicate our locations on the world map. So when we say that land is scarce in Singapore, it would be an understatement.

As such, building Singapore’s real estate market into the haven of stability is a continuously arduous task. To do so, most of Singapore’s real estate regulations have been proactive rather than reactive.

Because of such regulations, the impact of possible issues including but not limited to property speculation and profiteering have been largely mitigated.

Not only does the government maintain a good standard of welfare for its residents (with 9 out of 10 resident households being owner-occupied in 2020), but it also has maintained the Singaporean real estate market’s reputation as a haven of stable growth for foreign investment.

Let’s assess two regulations made by the Singapore government and their impact on the nation’s real estate market: the ABSD and LTV limits.

Benefits of Additional Buyers’ Stamp Duties (ABSD)

As mentioned earlier, the ABSD was introduced first in 2011 as a cooling measure to manage possible overheating during a bullish recovery from the 2009 Global Financial Crisis. Similar measures were implemented in 2018, and, more recently, 2021 for the same purposes – to manage a market at risk of turning euphoric.

Yet when we look at the ABSD rates themselves, we notice that these rates aren’t flat. They differ in terms of a) residency status and b) the number of homes bought. Why may this be so?

Foreign investment is pouring into Singapore and no doubt that the real estate market has shared a piece of this growing pie. However, learning from past blunders made during the financial crisis of 2007-2008, the dangers of property speculation are all the more glaring to a market as small as Singapore’s.

This particular cooling measure insulates Singapore’s property market from international competition and/or demand (shielding from global speculation), maintaining our property price index at a sustainable level. It could also be seen as an effort of protectionism, helping Singapore to build capital in the form of physical real estate.

What happened with the first two rounds of ABSD?

As we examine the effects of the ABSD in both its introduction in 2011 and its first revisions in 2018, take note of two phrases: ‘economic fundamentals’, and ‘financial prudence’. In other words, a) is growth, especially in the Singaporean real estate market, sustainable, and b) whether homebuyers are taking on the risk they are willing to stomach.

The first two rounds of ABSD: what were its effects?

A quick recovery from the Global Financial Crisis meant more potential homebuyers: in fact, Singapore’s residential property price index rose 38.2% between Q2 2009 and Q2 2010.

On the Non-Landed Resale Market

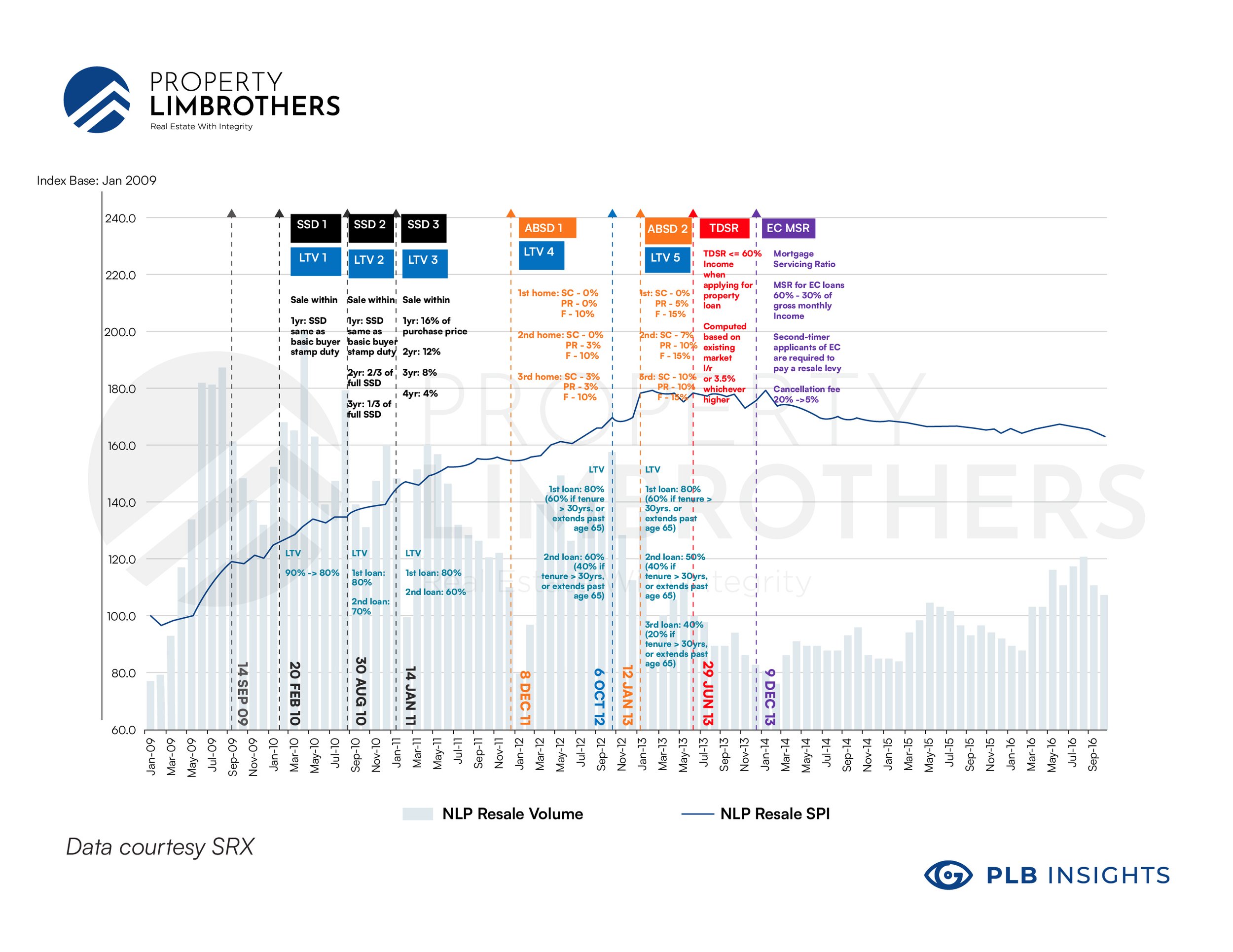

Let’s look at the Non-Landed Resale market, for instance. Take the Singapore Real Estate Exchange Property Index (SPI) for reference, represented in a line.

Did the market cool down when ABSD was introduced in 2011? It did for a while – more specifically, between December of 2011 and January of 2012. Yet, in March of 2012, prices picked up speed once again.

After a revision in 2013, the ABSD’s intended cooling of the Singapore real estate market truly started to kick in. From 2009 to 2013, the SPI experienced an upward trend. Yet, after January 2013, the SPI went sideways, even experiencing a gradual correction (from near-180 to about 160) that lasted until Q3 2016 – nothing too alarming to scare investors away.

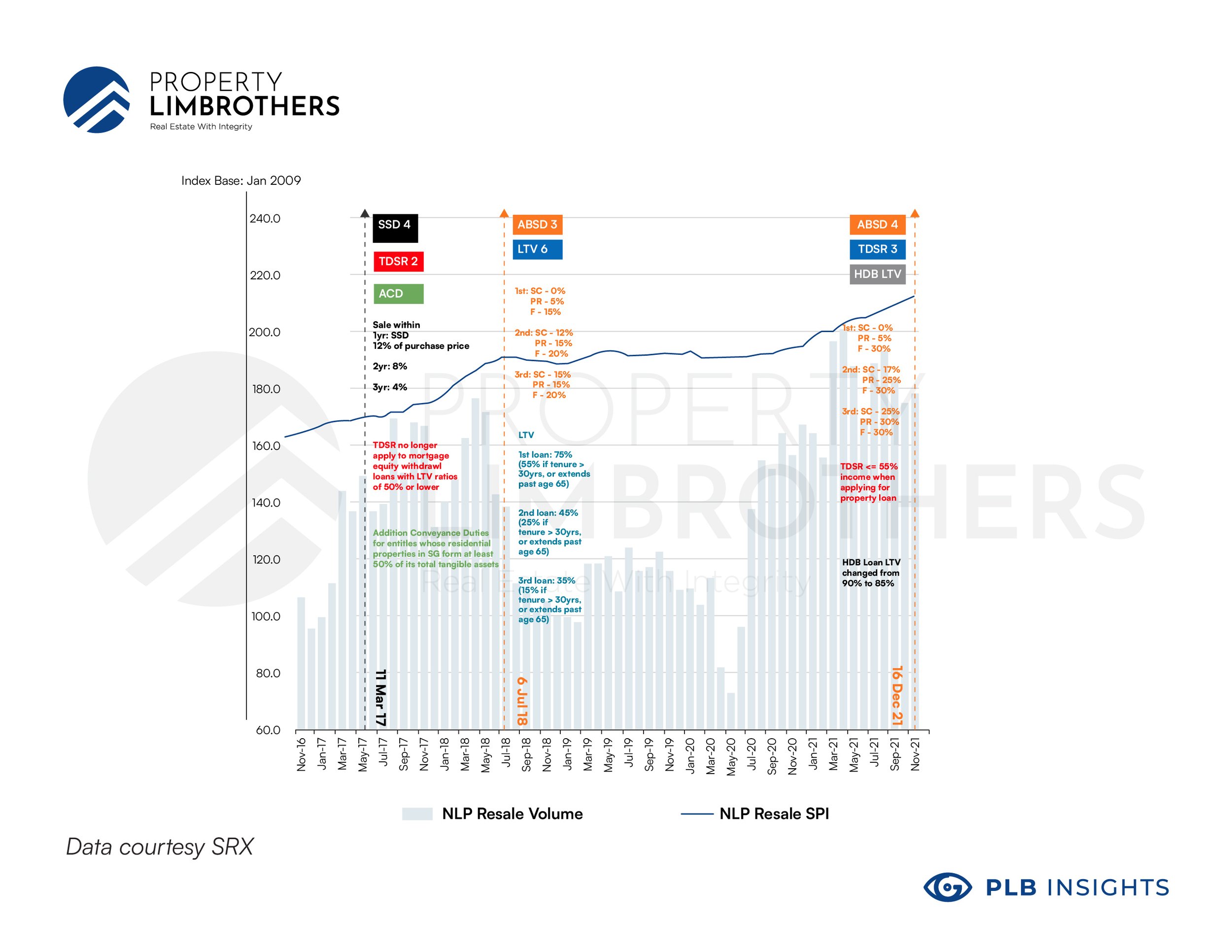

On the 2018 ABSD rounds

We know full well that no correction cycle lasts forever. From September 2016 to July 2018, the SPI experienced its next bullish cycle, rising from 164.4 points to 190.9.

While not as alarming as the 2009-2010 cycle, the government was prudent to introduce a third round of ABSD cooling measures.

Yet, the market correction was not as significant as the first two ABSD rounds.

Our theory? It wouldn’t be because the third ABSD round was “not painful enough”. Perhaps the market did not correct as much back then as the government was more proactive in ending a potential overheating issue before it even began. Such proactiveness would be evident as growth in the SPI from the 2018 rounds till 2020 were slower and more manageable.

If the government had not regulated the Singaporean real estate market as much in 2018, we would be in a situation where more drastic measures would have to be implemented to cool down the market. The fact is, buyers should expect regular cooling measures, as it is in every interest of the governing bodies to never allow a property bubble such as the one US witness in 2007-2008 financial crisis.

Learning points from the three ABSD measures

1) That the ABSD did cool property prices down to better represent the real estate market’s economic fundamentals, especially in reference to the 2013 and 2018 rounds;

2) Surely, we may objectively conclude that no cooling measure is perfect. Still, as shown between the 2011, 2013 and 2018 rounds, the Singaporean government has grown to be more proactive in managing the real estate market.

Financial regulation (it plays a part too)

And when we’re talking about regulations, we’re not just talking about real estate regulations. Rules on financial governance have also played a part in keeping our real estate market robust and healthy.

Singapore’s Loan-to-Value (LTV) limits: a contemporary history (2010 – 2021)

As a recap, LTV limits are maximum restrictions placed on the LTV ratios of mortgage loans. For example, if the LTV limit for mortgages is 40 %, you are expected to pay upfront for 60 % of the property’s value.

Data courtesy SRX

LTV limits: What does this have to do with Singaporean real estate?

Similar to cars, you will need to present a lot of capital to obtain properties in Singapore. As such, mortgages for properties are commonplace. Here, the Singaporean government acknowledges the role of what is known as macroprudential policies in the real estate market.

Macroprudential policies are also known as policies that aim to avert ‘systemic risks’, or risks of damage to the country’s financial market as a whole, similar to the American Subprime Mortgage Crisis of 2008.

So what may be considered as a potential ‘systemic risk’ to Singapore? Currently, household debt as a percentage of GDP has increased from 67.1% in 2020 to 70% in Q3 2021. In layman’s terms, imagine if 70% of a country’s growth is driven by debt. It would be great if these households may pay off such debt, but what if too many families fail to service their obligations?

According to a study made by the Monetary Authority of Singapore (MAS), (LTV) limits aim to “address the top-down systemic risks associated with rapid increases in property prices and housing loans [as well as] support micro-prudential supervision by mitigating credit risk at the level of individual financial institutions.”

Big words, huh?

Essentially, the tighter the LTV limits, the less likely that potential homeowners may take on undue risk buying up properties, especially any additional homes.

In turn, these limits help to cover for banks by reducing the risk of a debtor not being able to pay up on their mortgage loans in the first place.

Hence, fewer families default on mortgage loans, and it would be unlikely for such a debt crisis to reach a degree so severe it would topple Singapore’s banks.

Learning points: Loan-to-Value Limits

As mortgage loans continue to be a more integral part of Singapore’s real estate market, proactive reforms have to be implemented to mitigate potential systemic risks. LTV limits do precisely that, promoting a healthy credit system within banks for mortgage loans that continue to give value to our property market.

Conclusion

The Singaporean real estate market is, no doubt, highly regulated. Many would, as a result, feel a bit disincentivized to participate in such a market.

However, one look at its market trends and we can conclude that such regulation is a pragmatic must-have that, instead of hindering the Singaporean real estate market, it actually contributes to its economic health and robust growth.

While the public focus remains heavily on the growth of the real estate market, our real estate governing bodies remain steadfast in their interest in the sustainability of the growth as well. This is what makes Singapore’s economy healthy and robust.

If you’re looking to invest in Singapore’s Real Estate whether you’re a Singaporean or a Foreign Investor do feel free to contact us! Clickhere to contact us now!

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.