It is a commonplace for Singaporeans to own or at least desire to have more than one property as part of their investment portfolio, either to collect rent or to accumulate wealth and hedge against inflation through capital appreciation.

Having an additional property is akin to having a side hustle or additional part-time business. As the landlord, not only do you need to manage the purchase, but also the lease and rental. During the ownership of the property, things under your purview would include annual property tax, MCST, repairs, and rental income tax!

However, other than taking care of these occasional obligations, owning multiple properties can be seen as a self-sustaining business. One can also engage property agents (like us!) to help with managing your rental properties.

What are the Benefits of Owning Multiple Properties in Singapore

1. Rental income

Having additional properties would mean you could lease it out to gain an income through rent paid by tenants. However, most Singaporeans have a valid concern about whether the rental received would cover the capital sunken in to purchase the property.

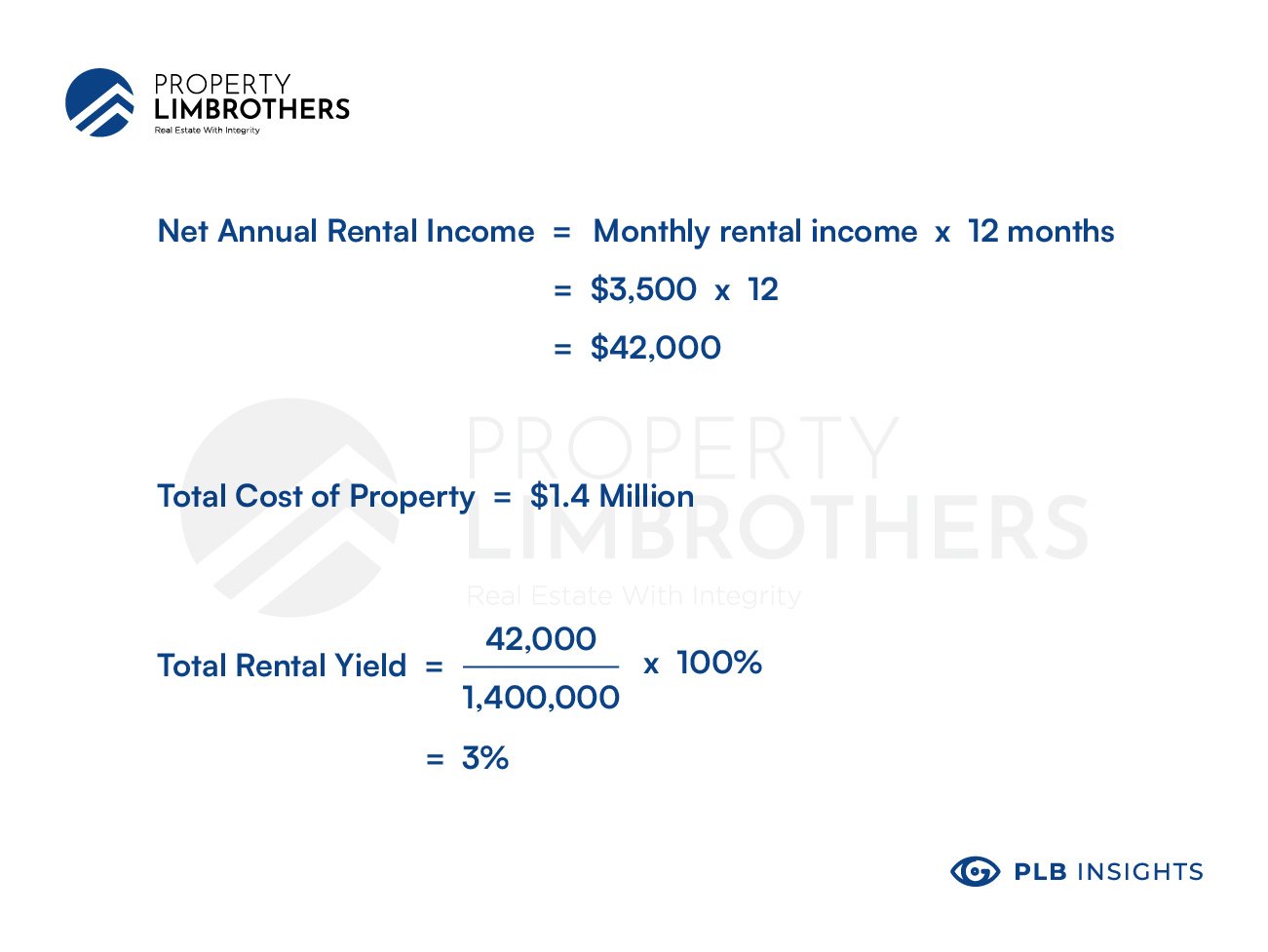

We need to figure out the Net Annual Rental income to decide whether renting out a particular property is profitable.

Total Rental Yield = (Net Annual Rental Income / Total Cost of Property) x 100% :

Net Annual Rental income is the total amount of rent collected in a year after paying property taxes, MCST fees, property agent commissions and other miscellaneous costs.

Potential investors should also note that the “Price tag” of a property is often less than the total capital sunken into purchasing a property.

The Total Cost of Property includes stamp duties, conveyancing fees, renovation costs, among many other things.

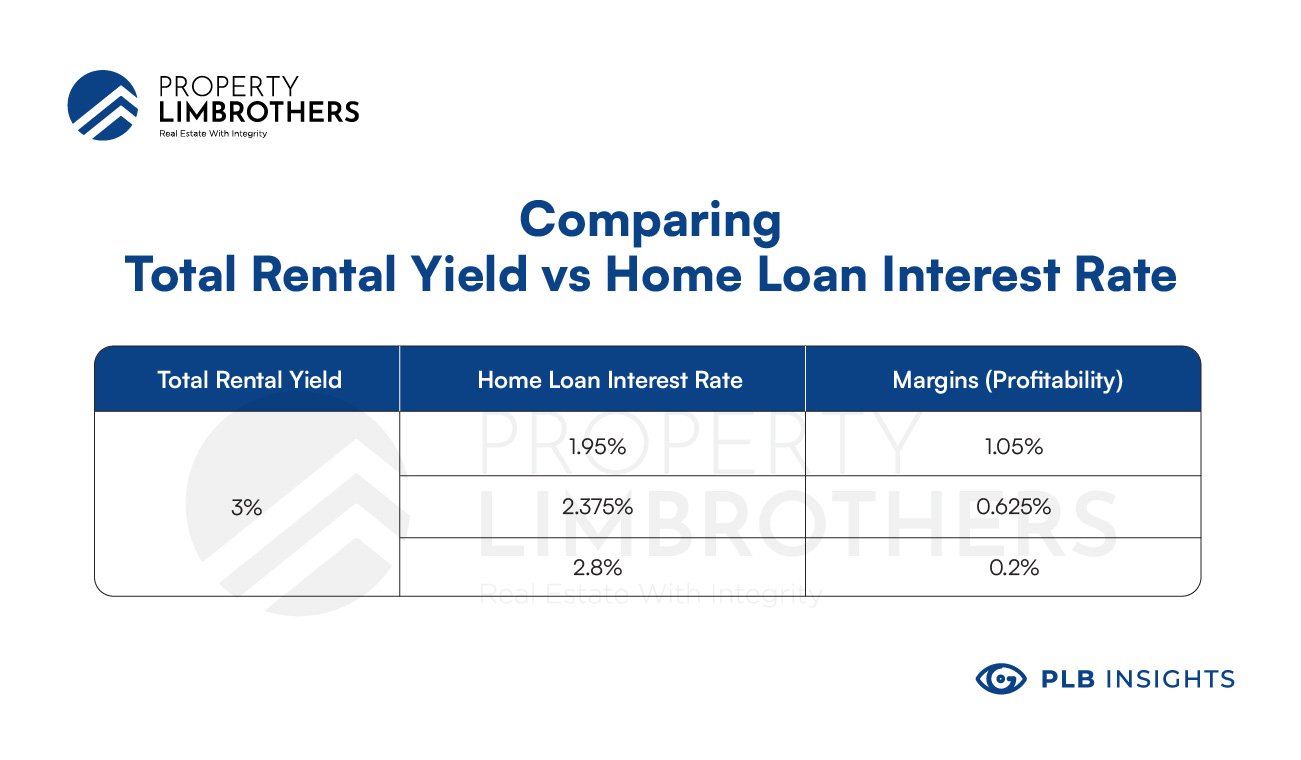

We can compare the Total Rental Yield against the Home Loan Interest Rate to give an idea on the profitability of rentals as an investment.

Assuming some basic parameters for an example to illustrate the concept:

-

Eligible for 30-year tenure loan

-

Purchased a new launch condo, with a total cost of property at $1.4 Million

-

Property is rented out immediately after TOP

-

Monthly rental of $3,500 (RCR Region, close proximity to MRT, existing tenant pool, full facilities)

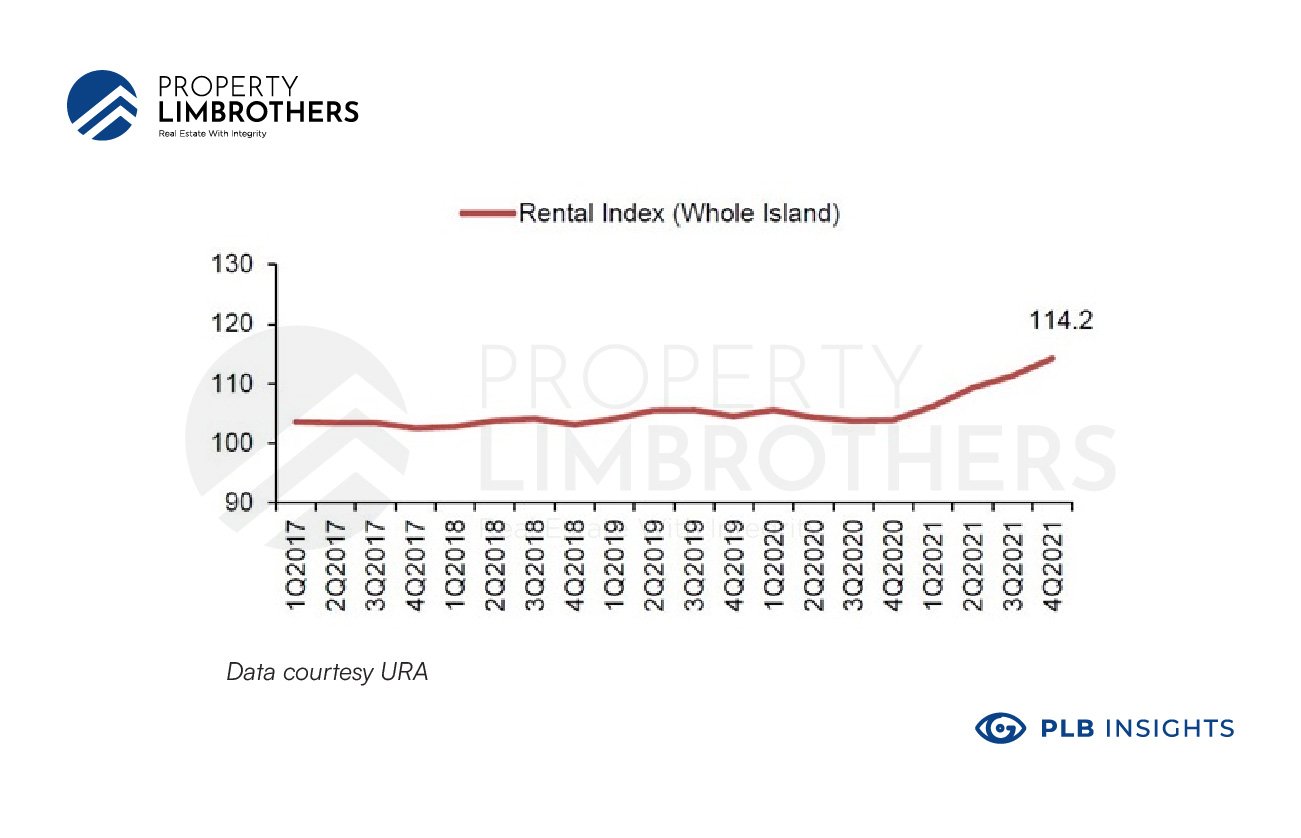

It can also be said that there is a growing rental market— the government’s recent round of additional cooling measures targeted only buyers rather than renters. Millennials and Gen Z are also looking for rental homes for their taste of independence and a space to call their own. Due to pandemic restrictions, Malaysians working in Singapore can no longer commute easily between the countries, adding to the rental market demand.

Thus it will not be surprising to see that rental rate increase, which will likely persist into 2022. As JLL’s Ong puts it, “This is likely to boost leasing demand, and we could see rents rising by 5% to 7% this year”.

Recent Singapore’s rising Rental Price Index gives evidence that there is an increasing demand thus growing profitability of Rentals.

2. The Power of Leveraging

Although property is a big-ticket item, one does not necessarily need a wad of cash in hand in order to acquire a property. CPF and home mortgage loans can be utilised as a way to offset the initial financial obligation of purchasing a property.

Home mortgage loans from banks range from 1.95% to 2.8%, which happens to be one of the cheapest loans available from banks. On top of that, there are ways to further reduce costs through refinancing by opting for different interest rate packages to suit the market environment, reducing the amount paid in interest.

In a way, purchasing property offers one of the cheapest ways of borrowing money to invest, earning “interest” in the form of rental yield through money that you don’t even own!

3. Capital Appreciation (Profit from resale)

Capital appreciation is when the property’s value increases above its purchase price over time.

With Singapore being a land-scarce nation, real estate often commands a premium and ever-increasing price. Property prices are also more resilient to black swan events considering that they are.

COVID-19 is exemplary of this phenomenon – During the years of the pandemic, private residential property prices continued to soar with disregard for the situation that we are in. This characteristic would be favourable for investors looking to diversify their investment portfolios and harden their portfolios against risky situations.

Is owning multiple properties still the Singaporean Dream?

Real estate remains to be a multi-faceted tool, where one is not only able to leverage, earn rental income but also appreciate the capital sunken in with the right market conditions.

Need more guidance on property investing? Feel free to reach out to our team. Click here to contact us now!

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.

Interested in The Basics of Buying Real Estate in Singapore as a Foreigner. How Do I fund my purchase? We delve into that in our insights article here!

Curious to find out more about The Metaverse, NFTs, Crypto and Its Role in the Future of Real Estate? We delve into that in our insights article here!

To check out our Investors Series Season 1, click here! And for Investors Series Season 2, click here!