Cooling measures a few weeks before Christmas, Omicron fears, looming interest hikes in the U.S. – it’s quite an eventful end to 2021 for the average homebuyer and homeowner.

As we begin the new year, so begs the question: will Singapore’s real estate market maintain its resilient bullishness despite COVID-19 and the recent round of cooling measures?

What’s Happening in the Real Estate Market?

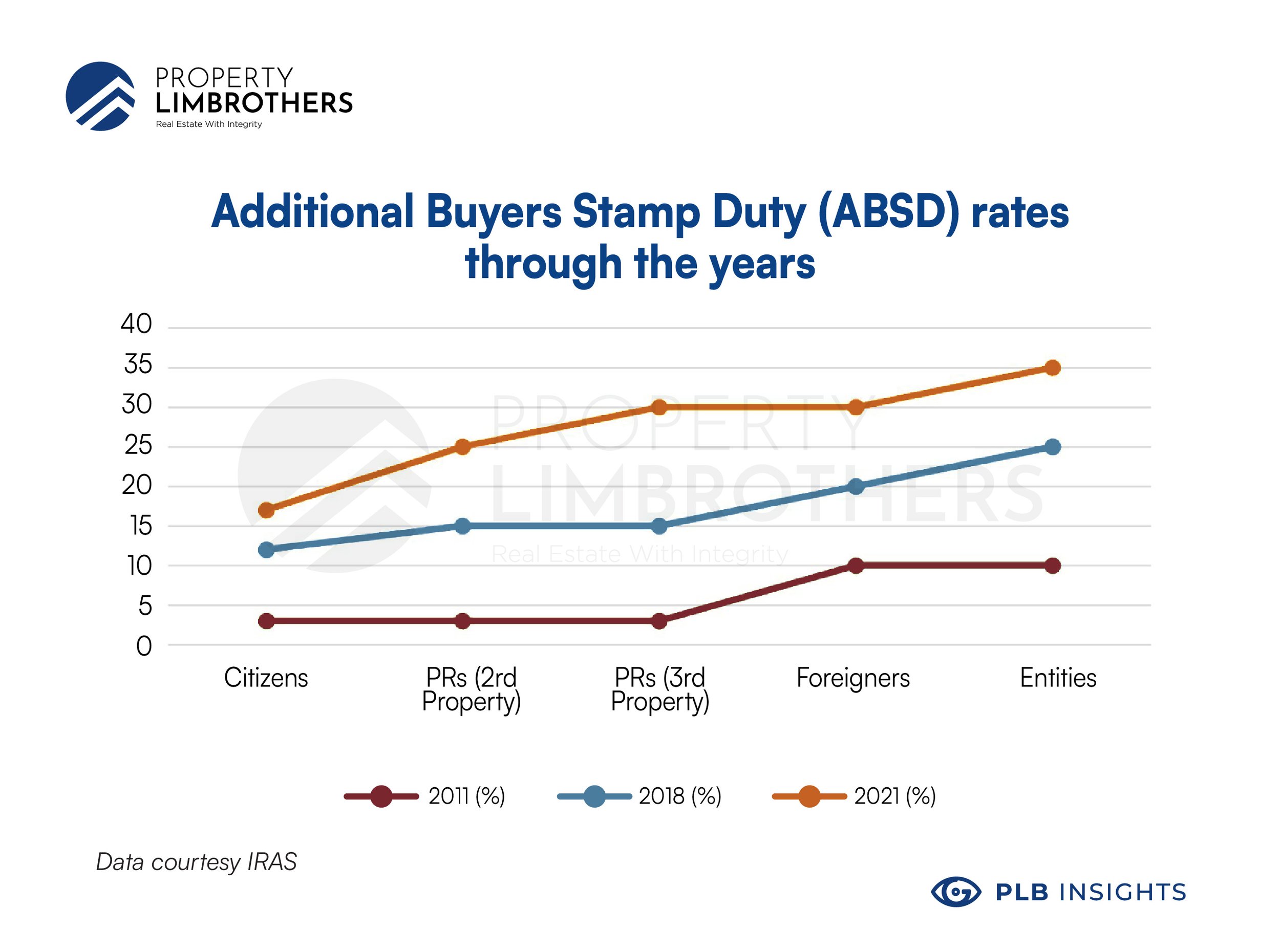

On December 16 2021, new property cooling measures were introduced to the private home, as well as the Housing Development Board (HDB) resale markets. Additional buyer’s stamp duty (ABSD) rates were increased for Singaporean citizens, permanent residents (PRs) and foreigners.

At the time of writing,

What is ABSD?

Additional Buyer’s Stamp Duty (ABSD) is an added payable “taxation” on top of the Buyer’s Stamp Duty (BSD) – an initial property tax – should a homeowner acquire real estate in Singapore. The ABSD artificially marks up the prices of real estate even further and serves two purposes:

-

To manage demand for real estate outpacing limited land supply in Singapore by deterring citizens from acquiring more than one property.

-

To keep housing prices affordable for Singaporeans, as PRs and foreign entities are levied a higher ABSD should they acquire any real estate.

It may sound like a considerable hassle to deal with a higher ABSD – be it a citizen, a PR, or a foreigner. Yet, in the grander scheme of things, these measures are in place to prevent a potential real estate market crash that could be especially devastating for Singapore’s households.

Tighter loans for potential homebuyers

In addition, the total debt servicing ratio (TDSR) for homebuyers has been tightened as well, from 60 per cent to 55 per cent.

In simpler terms, this means that a homebuyer that has taken on a loan to acquire a property may only make use of up to 55 per cent of their gross monthly income to repay monthly debt obligations, provided they have no other debt obligation.

Furthermore, HDB loans will also be lowered from 90% to 85% of a flat’s purchase price – meaning that future homebuyers would have to fork out more money from their own pockets to obtain HDB flats.

The new cooling measure reduces the loan quantum. As such, future homebuyers would now have to incur more immediate costs in obtaining a property, having had to fork out more of their own cash.

This, in turn, might reduce the existing demand for real estate in Singapore. All things remaining constant, might slow property price increases, potentially dampening the real estate market’s bullishness moving forward.

Cooling Measures: are we heading for a new winter?

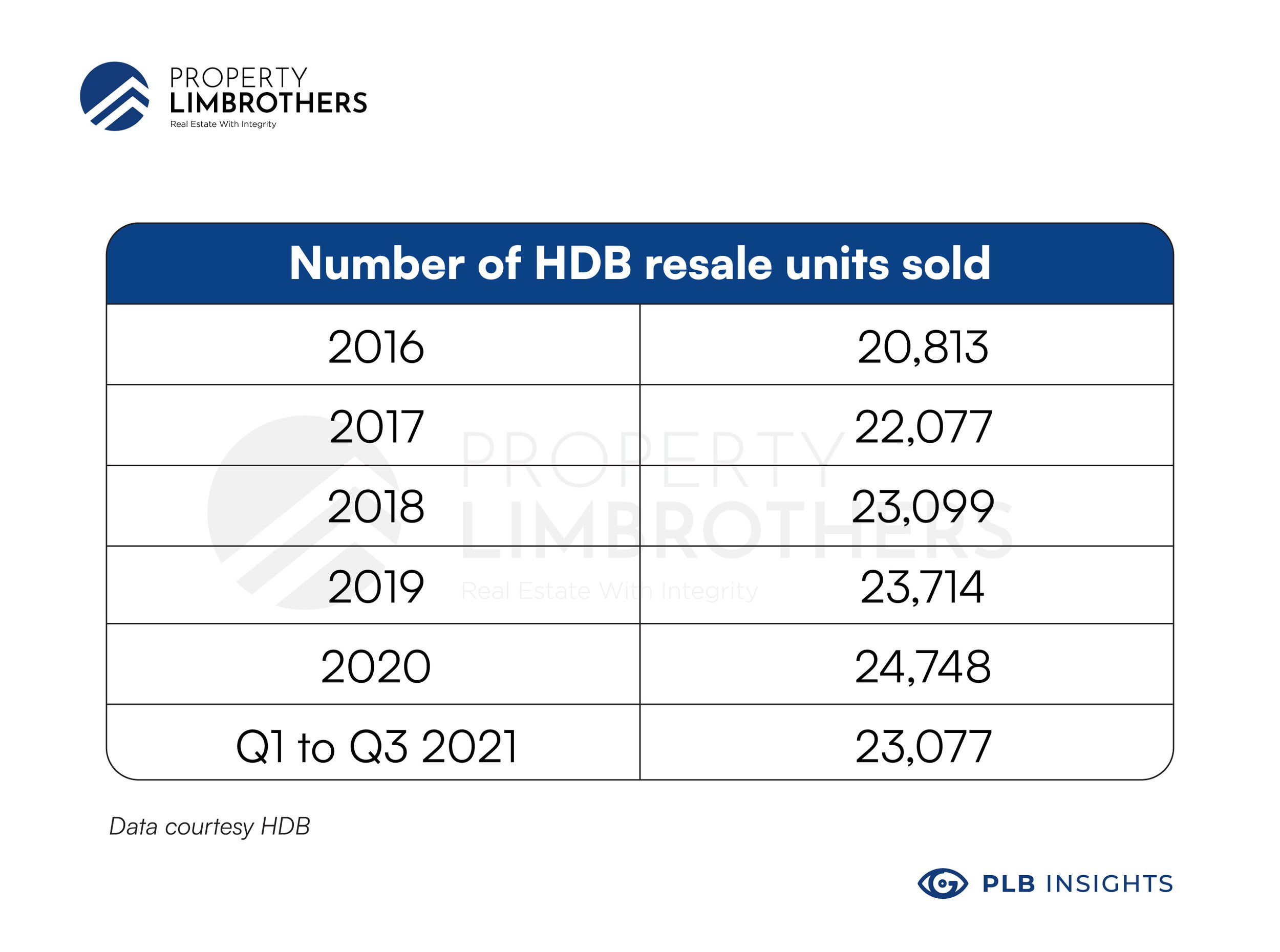

Dr Lee Nai Jia, deputy director of the National University of Singapore (NUS)’s Institute of Real Estate and Urban Studies, has shared similar sentiments. Mentioning that total sales of private homes and HDBs should slow down “significantly” to fewer than 20,000 units each transacted per year in that period.

For comparison, in 2021, 23,077 HDB resale units were sold from Q1 to Q3. And in 2020, 24,748 resale units were sold last year.

You may be asking: so why would this be potentially bearish? Wouldn’t a market with rising demand mean that we could be approaching another bullish year for real estate in 2022?

It’s time to cool down

A market that has remained buoyant in the face of the COVID-19 pandemic – with increasing demand – may be a cause for concern in the longer term; Minister for National Development, Desmond Lee, has mentioned that property prices, when left unchecked, may ‘run ahead of economic fundamentals’. In the shorter term, demand for real estate in Singapore may eventually outpace Singapore’s limited real estate supply, making properties too expensive for households; in the longer term, an eventual correction this year may be potentially devastating for such a market.

Furthermore, Dr Lee has speculated that existing cooling measures put in place by the Government may cause a reduction in real estate prices – be it resale HDB flats or private residential flats – by 10 per cent. He further mentions that it would take ‘two to three years’ for real estate market prices to return to an equilibrium that truly reflects market sentiment.

Interest Rate Hikes in America (and why it could affect our real estate market)

America’s recent inflation woes are no secret: with a triple-effect of supply-chain shortages, labour market woes and rising demand (especially for essentials), the U.S. government, like Singapore, has decided on implementing ‘cooling measures’ to combat such an issue.

One strategy would be to implement an interest rate hike, where the federal funds rate – which determines how much interest banks may charge one another to borrow money overnight – is increased.

As of January 6th, 2022, the Federal Reserve Bank of St. Louis President James Bullard has said that the US Federal Reserve could raise interest rates as early as March this year.

In the article “MAS warns of rising debt among Singapore households” we shared that “The Fed officials are making plans to accelerate the process of ending the pandemic-era stimulus program at their policy meeting on December 14th, taper bond-buying by March instead.

This tapering refers to the gradual slowing down of purchases of securities and bonds — a slowdown that, the Fed says, will begin at some point soon. This, in turn, will increase long-term inflation rates, ultimately affecting mortgage interest rates in Singapore.”

As an open economy and a financial hub, Singapore is easily affected by changes implemented in global markets, especially by a country as influential as America. Should the U.S. Federal Reserve plan to implement an interest rate hike, domestic interest rates (implemented by banks) would be expected to follow suit logically.

How could this affect interest rates in Singapore?

Often, when potential homebuyers intend to acquire properties, they may need to take up a loan – especially for those buying private properties – as they may not be able to fork up enough of their own cash to pay for a portion of the property’s sale price upfront.

These potential homebuyers would then have to choose between two types of bank loans: fixed-rate and floating-rate packages.

How the U.S. Rate Hike May Affect the Real Estate Market

Should the U.S. rate hikes come into play, indices like the Singapore Overnight Rate Average (SORA) would start moving up as capital is borrowed between banks. Especially for floating-rate packages, which have their rates pegged to indices such as SORA, this would mean higher interest rates for said packages.

Even in late 2021, banks in Singapore have already been marking up their fixed-rate interests in anticipation of the U.S. rate hikes. Many have been speculating that the U.S. Federal Reserve may implement these hikes in the second half of 2022.

This may potentially dampen the bullishness of the Singapore real estate market in two ways:

-

Some individuals who may be more attracted to fixed-rate interest loans, such as first-time private home buyers, may be discouraged from taking up such a loan with already-higher debt obligations.

-

Individuals who previously were enticed by floating-rate interest packages may be all the more discouraged to take up such a loan — anticipating higher interest rates in the future that may accord them a more significant financial burden.

Coupled with limits on TDSR – which would lengthen debt obligation timelines even further – this could reduce demand for real estate in Singapore, reducing the strength of the real estate up-cycle.

Why the cooling measures may not be as scary as you think

If Dr Lee’s speculations (of a 10 per cent drop in real estate prices, as mentioned earlier) are correct, we’re looking at a bearish market, for sure. The silver lining here would be that, if valid, we won’t be anticipating a ‘bear market’, where prices typically fall by 20 per cent or more. In addition, these potential price reductions are spread out in the span of two years, reducing the severity of potential losses in property value.

This could mean that we’re not set for a full-fledged bear market in 2022 – rather, a healthy bearish correction that would make prices low enough to be more affordable for households, but not so low as to reduce overall confidence in the Singaporean real estate market.

However, several factors in play could potentially downplay the severity of a real estate market price drop across the board.

You don’t need to pay ABSD – Here’s how to outsmart the system!

To begin with, there are methods that Singaporean homeowners may make use of to avoid ABSD obligations legally.

Firstly, couples may consider holding one home each – rather than to have two homes under one name, which would cause the said person to incur the duty for the additional home.

Secondly, singles may consider obtaining a dual- or triple-key unit, wherein a singular unit is divided into two or three dwellings, with both sharing a front door. Instead of obtaining a separate second or third property for investing, the homeowner may rent out a portion of the unit instead and still generate rental income.

How ‘cooling’ can December’s cooling measures really get?

Understandably, the ABSD – the main highlight of the recent round of cooling measures in 2021 – has been and remains as one of the measures used to ensure more affordable housing for locals.

But in this context, where the COVID-19 pandemic has already reduced foreign participation in the Singapore economy, the third round of ABSD increases may obtain a diminished effect in cooling the real estate market.

The ABSD only applies to citizens or PRs looking to buy additional homes. On top of the grey areas surrounding the ABSD, as mentioned earlier, this means that locals – driving a higher percentage of the demand for real estate in this current economic situation – may not be as discouraged by a higher ABSD from buying properties as predicted.

Millennials May Sustain Rising Private Residential Demand

Baby boomers have definitely been a significant demographic in Singapore. Those who have played a key role in driving the Singaporean housing market in the 1980s are steadily exiting the real estate segment. With a growing ageing population, this may, at surface value, be a bearish sign for the housing market in Singapore. However, this may not necessarily be the case.

In Singapore, Millennials (born between 1981 to 1996) are a larger demographic than Generation X (born between 1965 and 1980), with an annual average number of live births of 46,174 from 1981 to 1996 compared to the average annual number of live births – 45,596 between 1965 and 1980.

Additionally, while we all know full well that the younger generations have fewer children, it may actually be of some benefit in this context! Millennials having smaller family units, with some opting to be single for longer than usual (often for career), would mean that more residential spaces will be needed to house them.

So Bear or Bull?

All in all, we’d say that we’re expecting a slightly bearish real estate market in Singapore as we head in 2022.

While it would be reasonable to expect lower property prices this year, be it in the HDB or private real estate market, don’t be too pessimistic about the real estate market just yet.

We may simply be undergoing a much-needed healthy correction that will keep the rising demand for homes more sustainable, with more affordable prices for households.

Although we cannot say with certainty whether 2022 will end on a bullish or bearish note, we know that the market waits for no one.

For those looking to get their feet wet in Singapore’s Real Estate this exciting year, be it buying, selling or managing your real estate portfolio. Do reach out to us!

When you engage PropertyLimBrothers for your property transactions or investments, be assured that you have an entire team committed to doing its best as our team treats every transaction as if it were our own!

Click here to contact us now!