Market trends are ever changing, and prices across different segments in the market reflect consumer demands against our existing supply of properties. In this article, we take a look at what we term as the Chasm gap – the divergence between price movements for landed and non-landed properties – and examine the implications of such a pricing trend on the Landed market in Singapore. We also evaluate why landed properties will become a class of their own, with its own market behaviour and provide a checklist on the traits of a strong, future-proof property, in the event that you are searching for your next landed home.

What is the chasm gap?

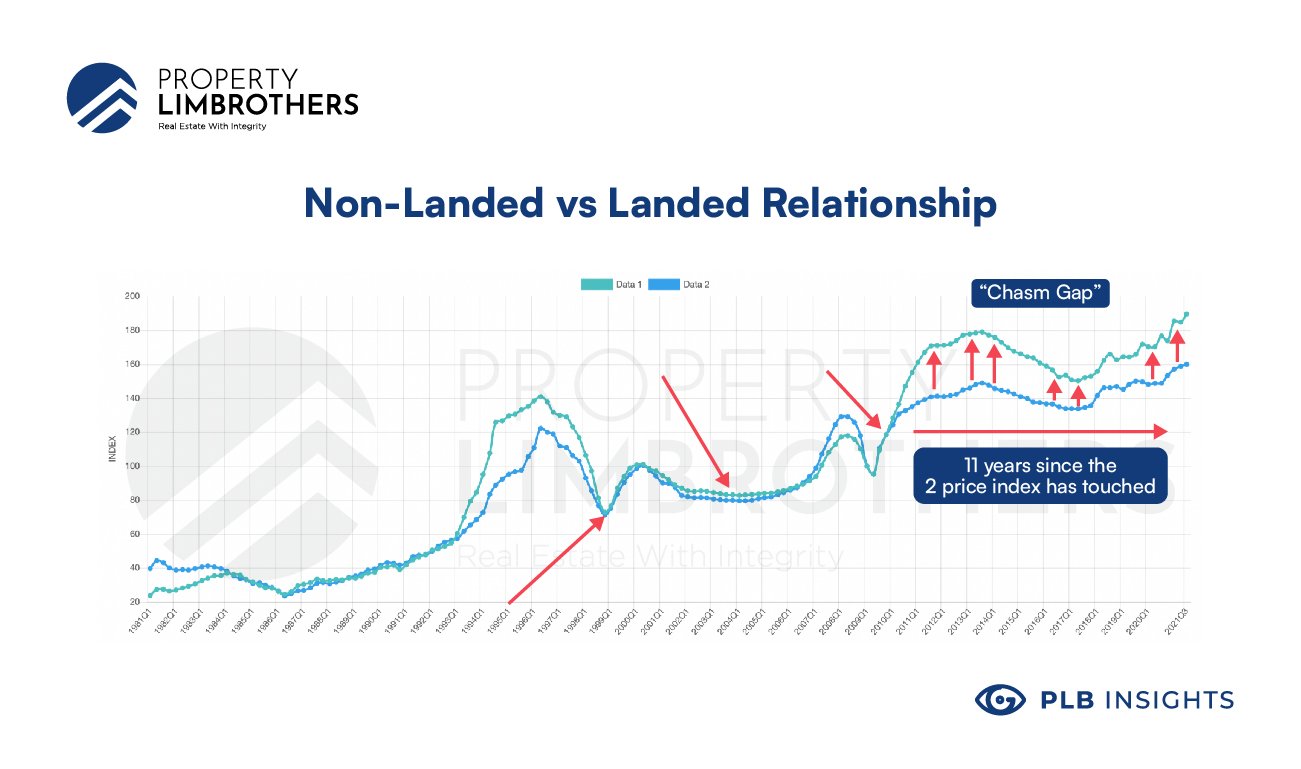

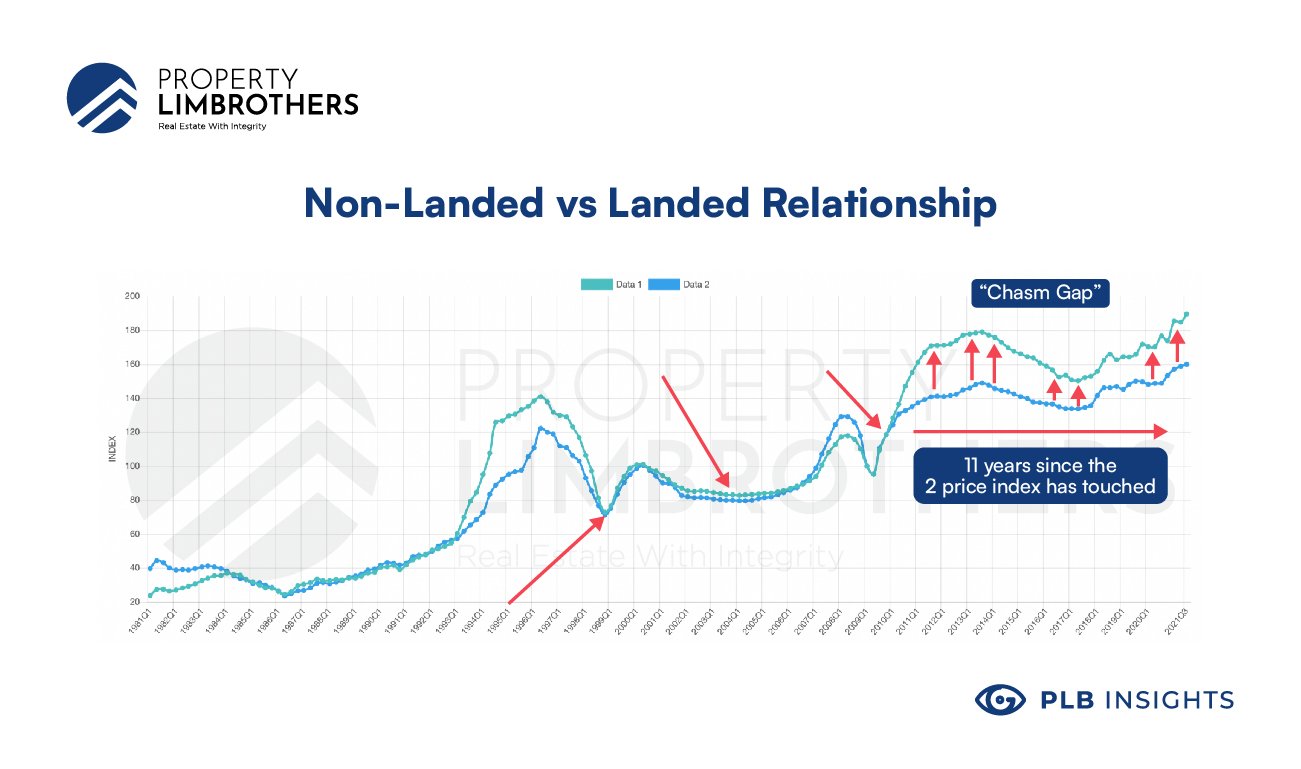

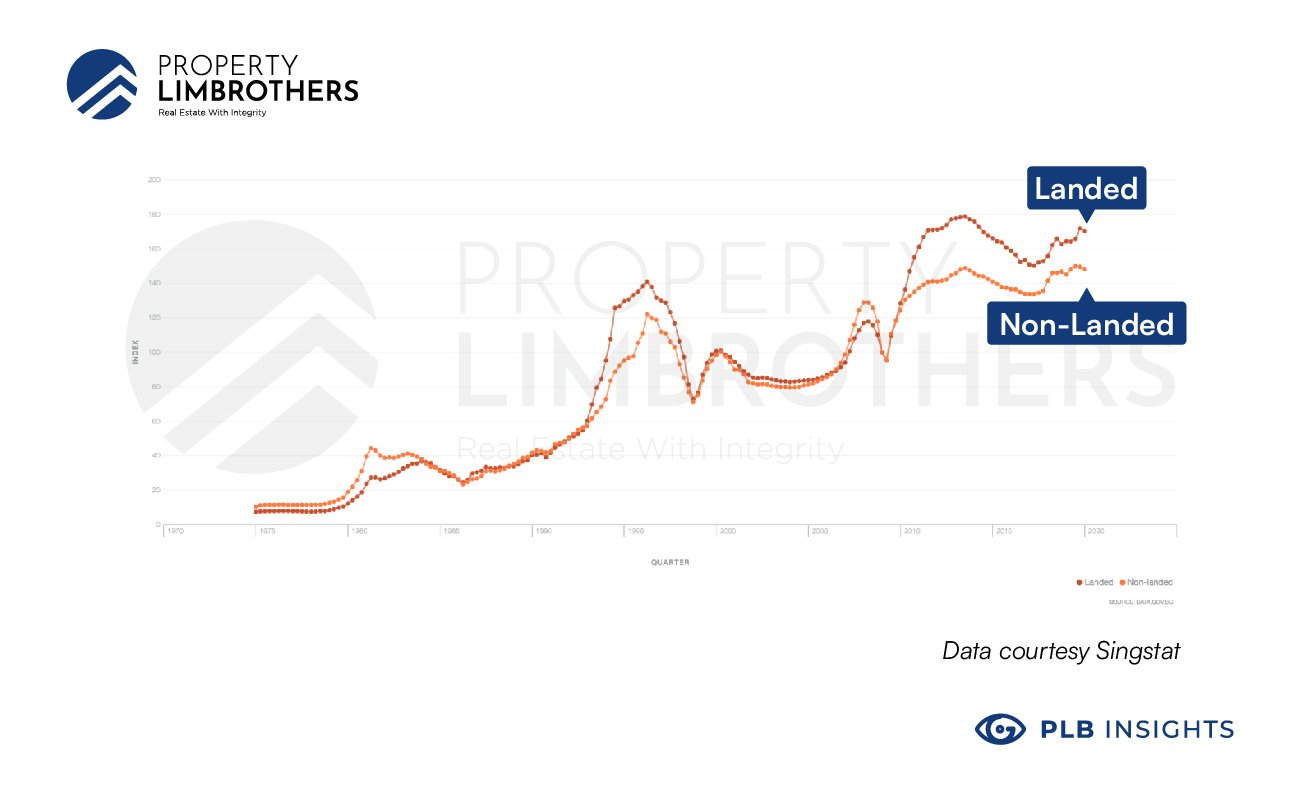

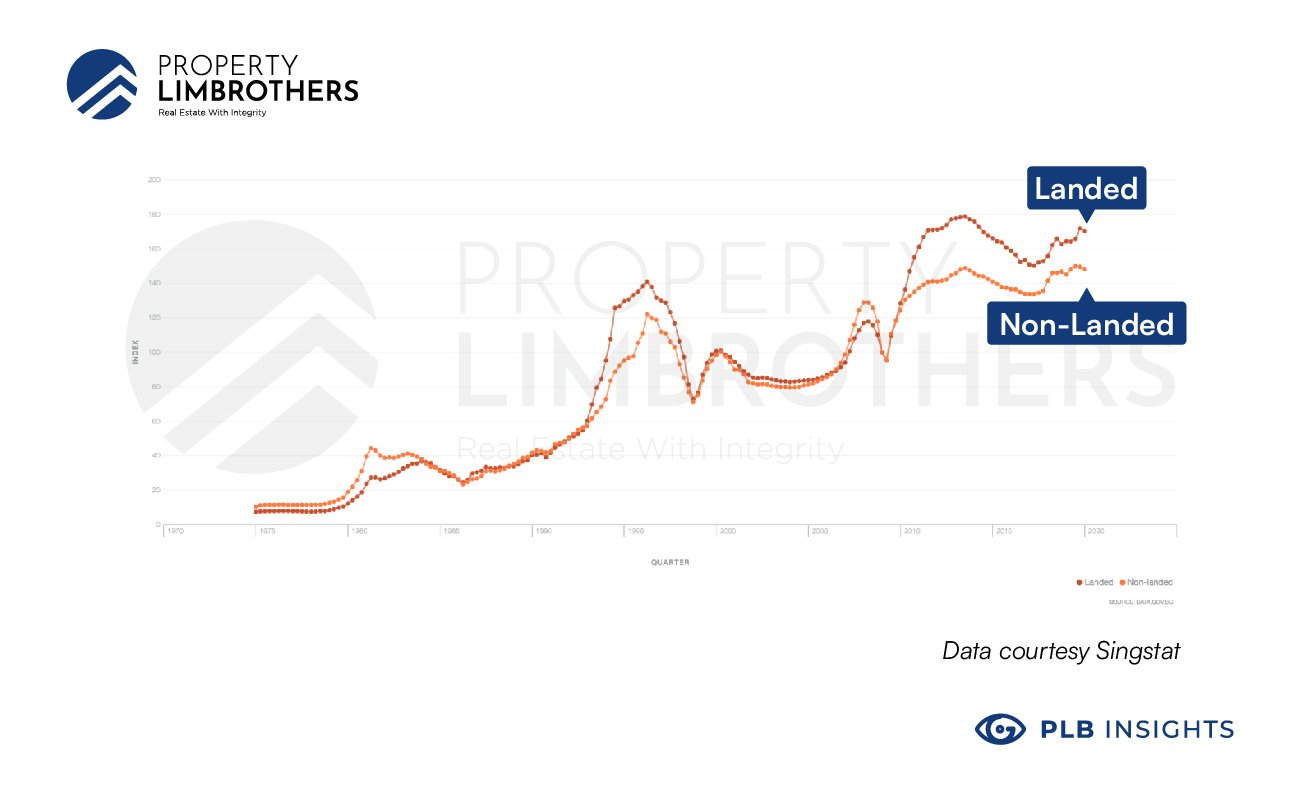

Simply put, the Chasm Gap is the divergence between price movements for landed and non-landed properties in Singapore. Before the various cooling measures, prices for landed and non-landed properties moved in tandem with each other. However, in 2011, we see that landed property prices diverged from non-landed and has maintained a higher relative price index for more than 11 years. The strength of this trend is evident from how this difference has been kept consistent over the years, and is in fact widening.

From here, two possible scenarios may occur. First, the non-landed price forms a support such that landed price does not fall below the non-landed trend. Second, the gap between landed and non-landed may widen even further, securing landed property as a class of its own.

We expect the Chasm gap to continue to persist due to a variety of traits relating to the demand and supply of landed property compared to non-landed property.

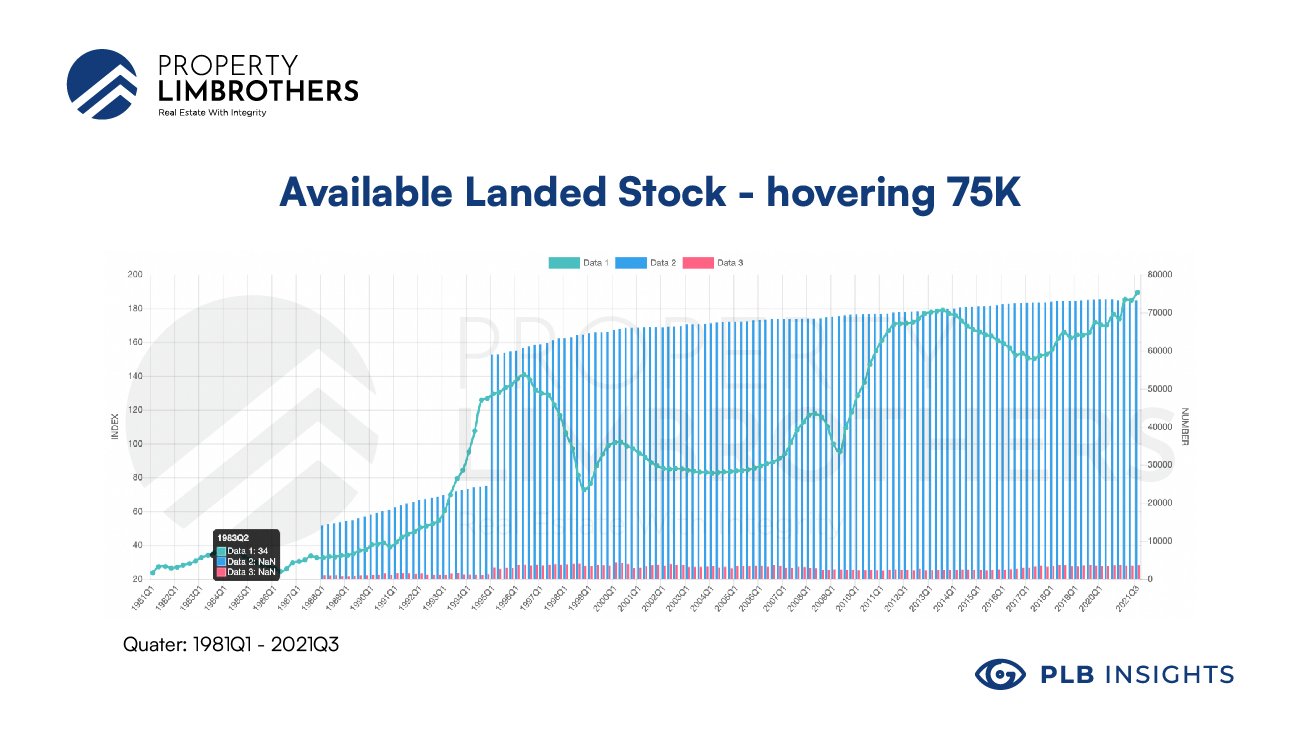

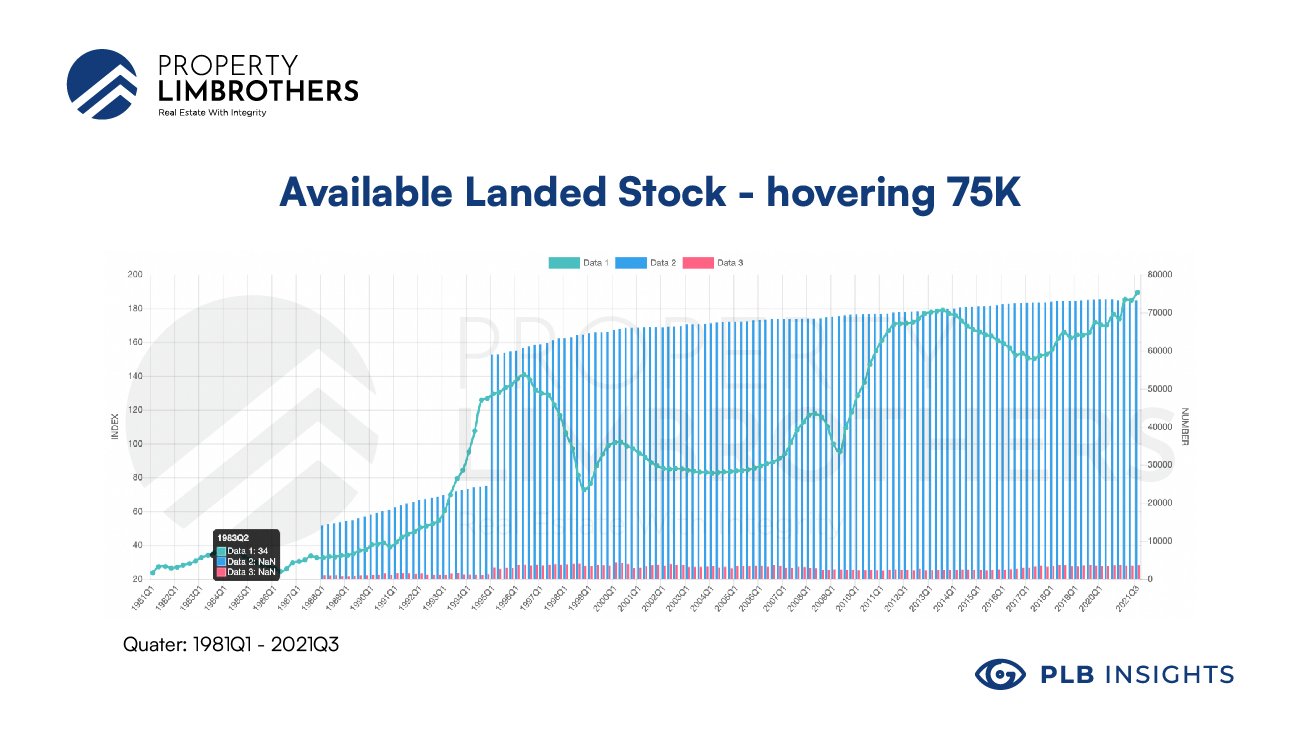

Limited availability of landed stock

Singapore is widely known for its limited land area, almost all of which has already been used for development by the government. Land reserved for landed property is also particularly rare. Since 26 years ago, the available landed stock has been hovering at 75,000, and increasing at an extremely slow rate. Even if landed developments should be torn down and rebuilt for resale, the total space available for landed property remains consistent and is simply subdivided into smaller plots. This limited availability of landed stock in our real estate market hence restricts new supply of landed property, increasing demand for a low supply commodity.

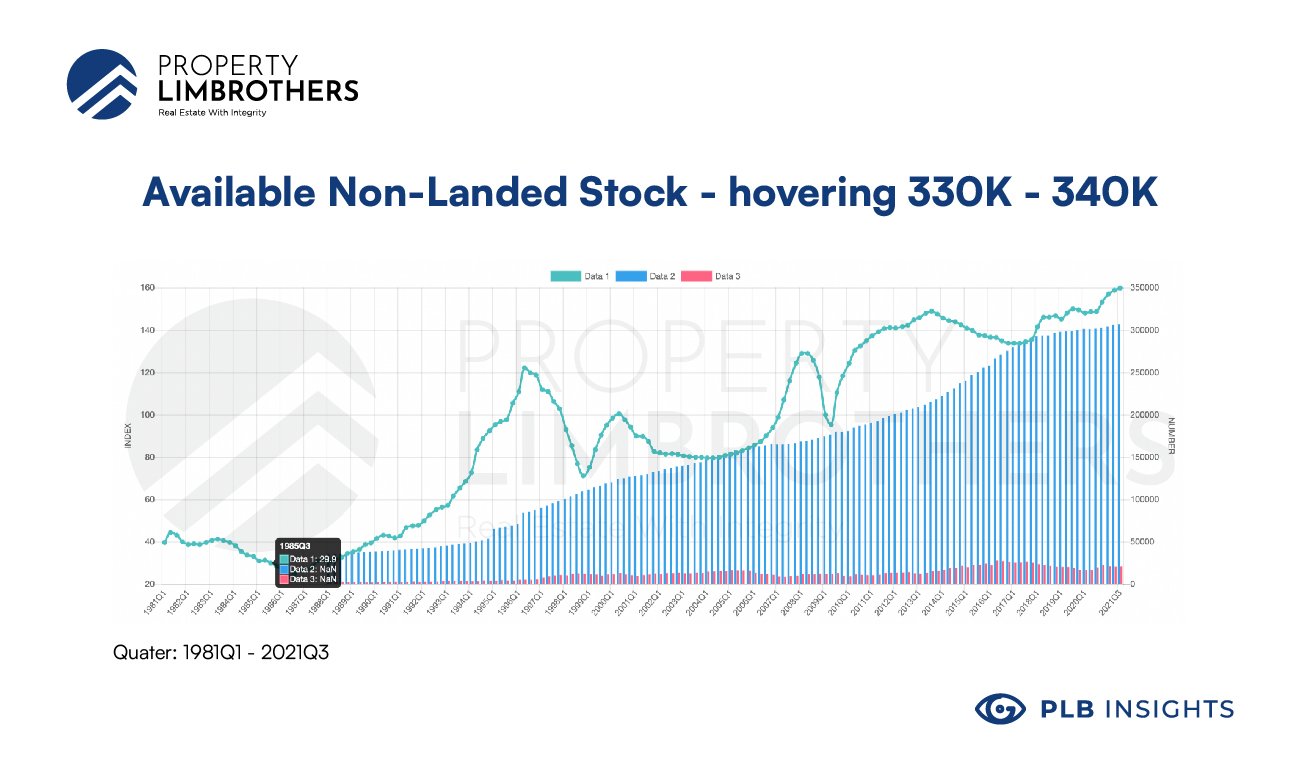

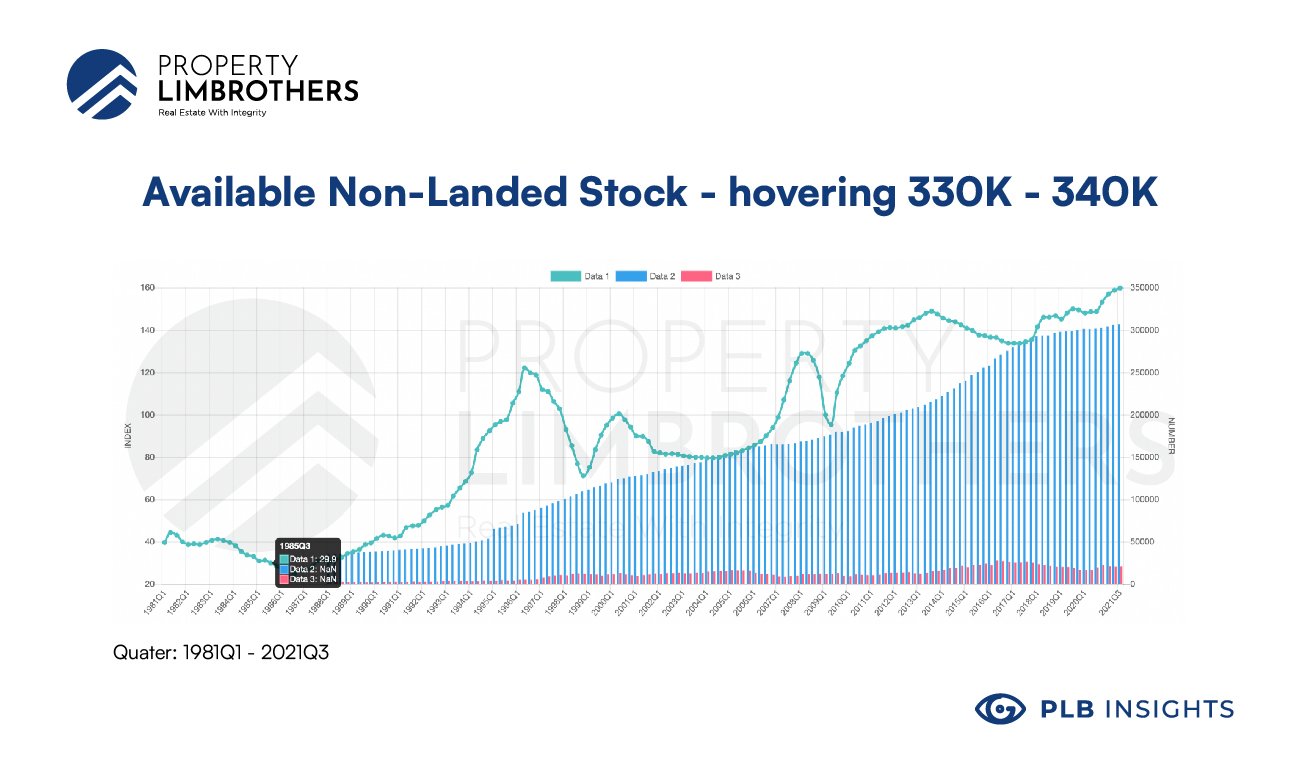

By contrast, non-landed stock exists at 330,000 and continues to increase at a much faster rate, with new developer launches almost every quarter of the year. This difference in supply is a key factor that leads to the contrast in price gap between the landed and non-landed market.

Changing market conditions further reducing the landed stock

In addition to the already limited stock, changing market conditions further reduce the amount of available landed properties in the market, making this asset particularly rare and desirable.

First, supply for landed properties is drying up as owners expect prices to rise and choose not to sell. With high holding power, the asking prices of landed properties are less likely to be negotiated since sellers know that they can profit more from the current (and not yet finished) surge in demand.

Second, construction of landed properties is becoming more prohibitive as COVID-19 continues to cause delays in the supply chain. The disruption to global businesses means that construction salaries, material costs, shipping costs, and levies are all increasing in tandem in an already sluggish construction market.

Motivated demand due to market conditions

Driven by a change in consumer behaviour in combating COVID-19 fatigue, market trends indicate an increased appetite for more spacious homes, including landed properties. Due to fatigue from WFH measures, travel restrictions, and a general sense of being cooped up for so long, many are now considering upgrading to landed property where there are open gardens, rooftop terraces, and larger rooms.

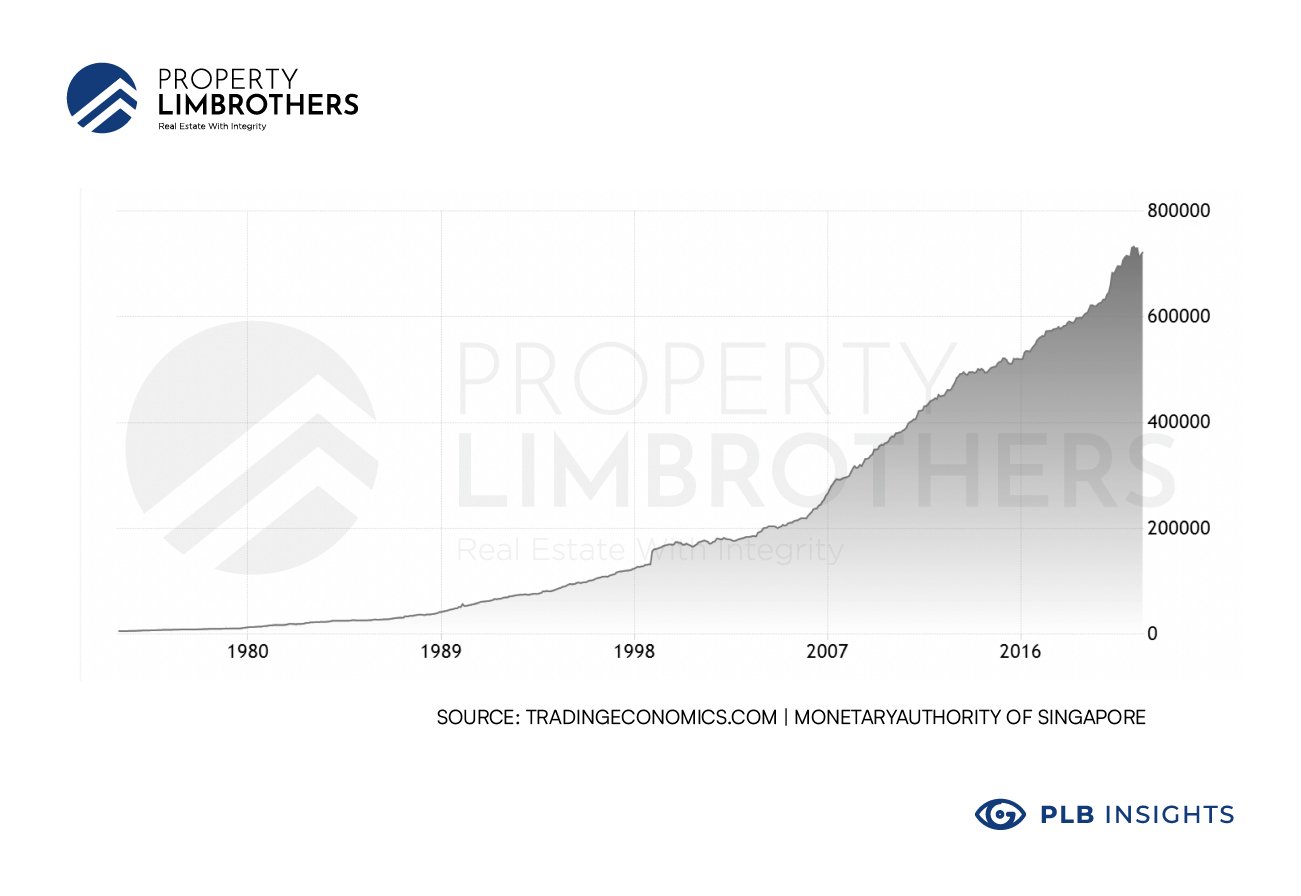

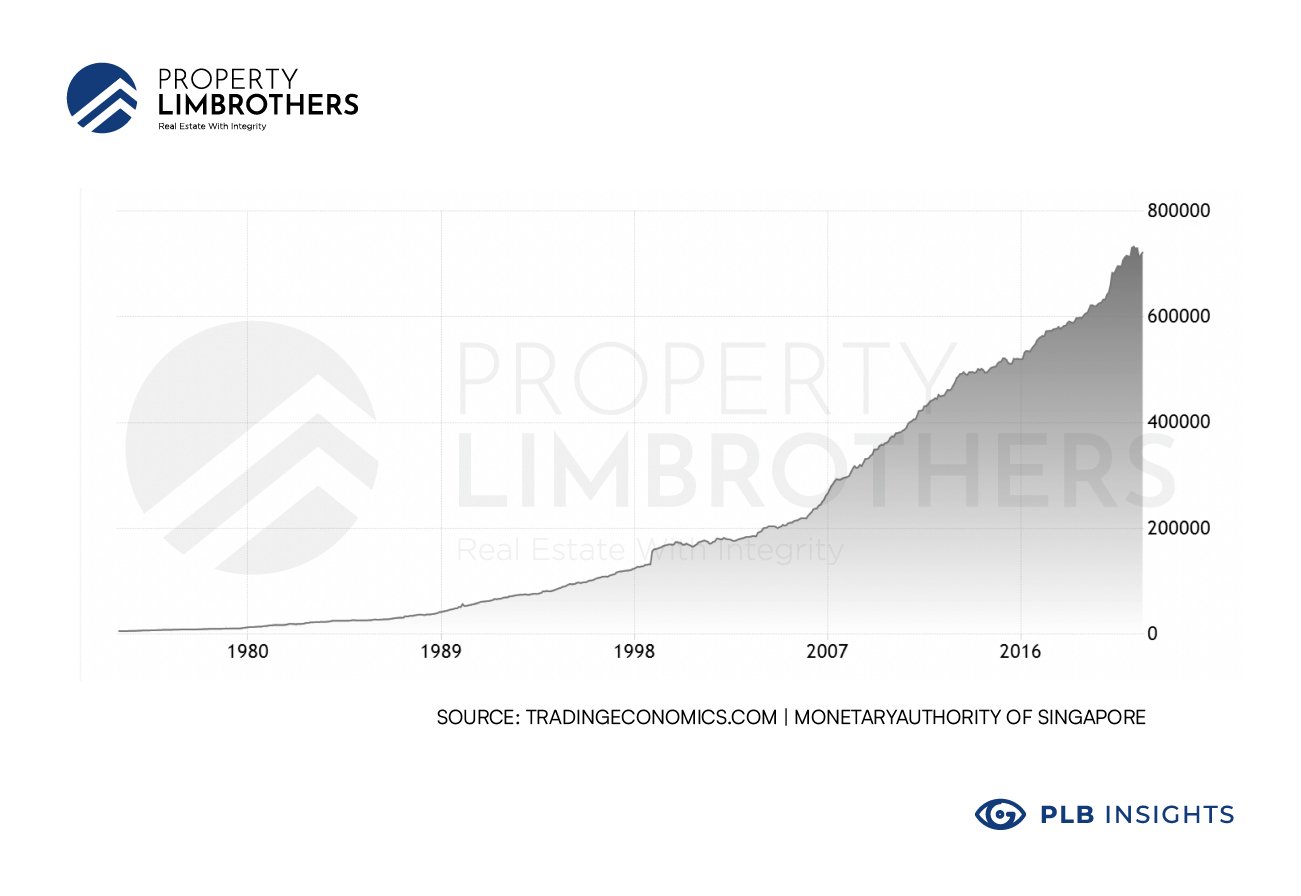

This behaviour change is further enabled by the vast supply of money that has flooded the market due to quantitative easing in the US. We see this in the M2 money supply chart and also in our local money supply. In a low interest environment, buyers are taking advantage to secure higher value properties at lower interest.

What does the chasm gap mean for me?

Because the Chasm gap is likely to continue, it is our prediction here at PropertyLimBrothers that prices for landed and non-landed will diverge until landed properties become a class of their own, with its own market behaviour.

This Chasm gap provides a prime opportunity for buyers to benefit from the current landed property market. As such, those who can afford to buy landed properties will likely benefit from its strong store of value, and continued price appreciation.

However, buyers must come prepared with their own research on the traits of the landed area and an exit plan that is future-proof. This means knowing your target buyer audience 5 – 10 years down the road, and the strengths of your target property.

For example, we recommend that buyers go through a checklist when viewing properties to cover all bases for a strong, future-proof property.

For landed properties, we typically look at these aspects (non-exhaustive):

-

Facilities that will not lose attractiveness

-

Minimum 5 bed-rooms

-

Large parking spaces (for multi-generational families)

-

Attractive interior design and architecture

To be even more well-prepared, buyers should also survey their target district and thoroughly compare the costs (both direct and indirect) of purchasing or rebuilding an entire property.

Checklist of considerations if you are getting a landed property

Get a price sample of the properties in the district

For example, a dedicated buyer looking for landed property will go down to the district and note down the types of landed properties that are available and their asking prices.

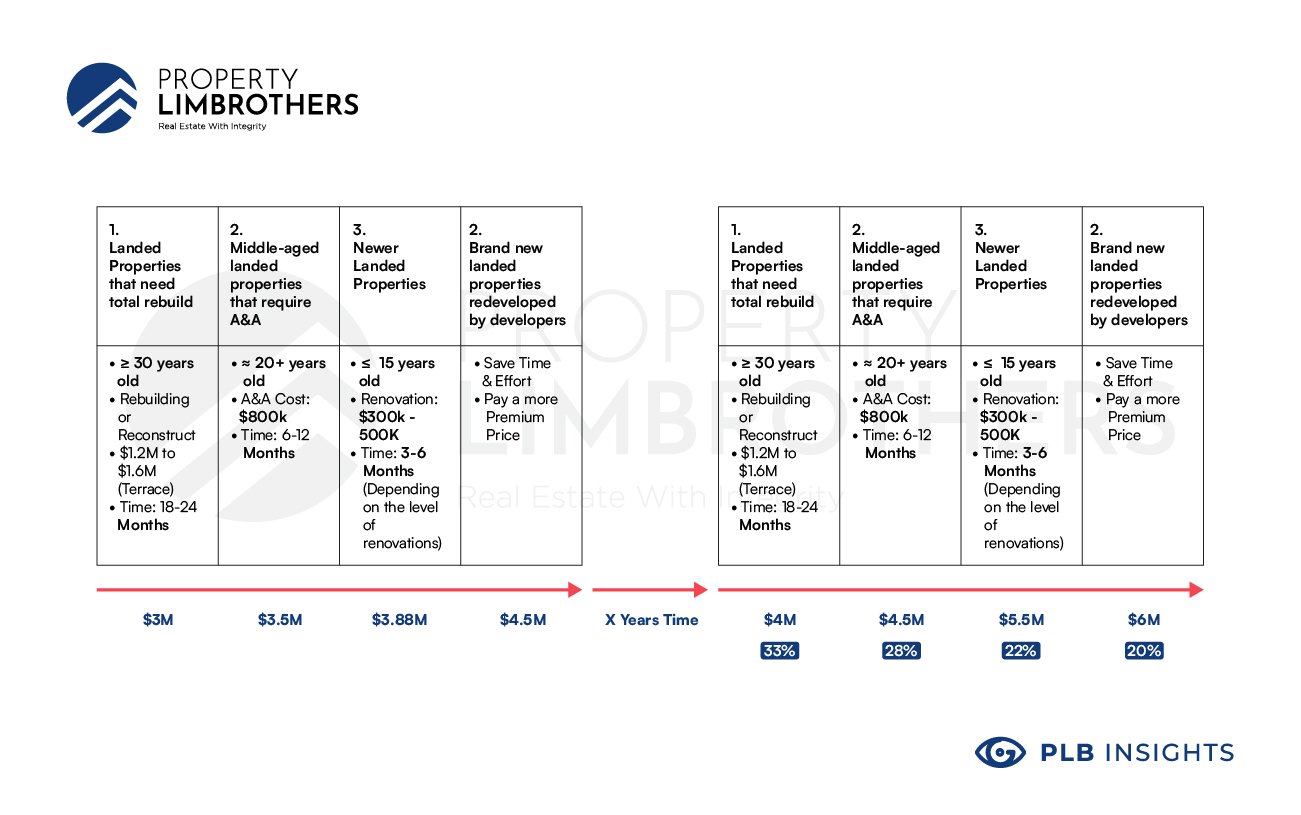

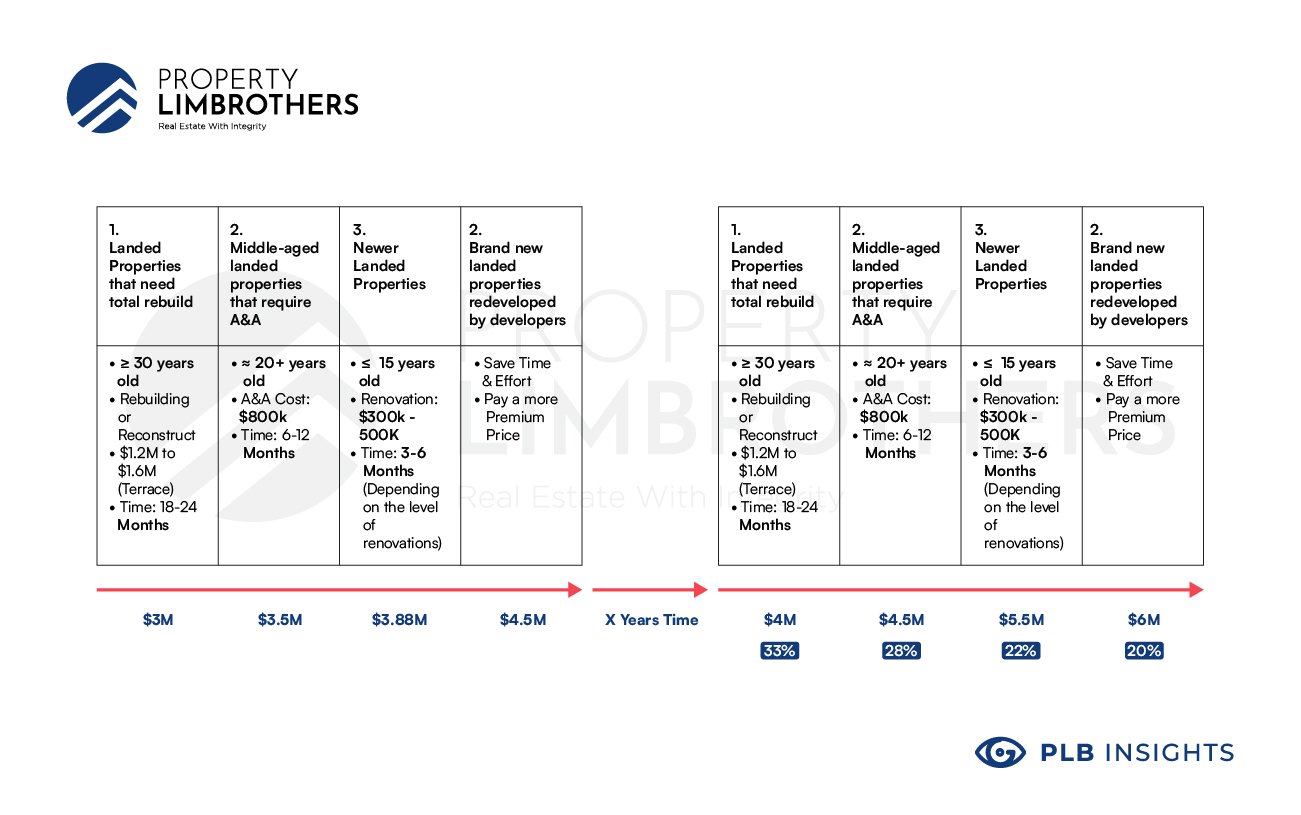

The 4 categories of landed property are:

-

Properties that need total rebuilding (> 30 years)

-

Middle-aged properties that need A&A (> 20 years)

-

Newer properties (< 15 years)

-

Brand new properties (redeveloped by developers)

Consider if their percentage premiums are worth paying

We then look at the asking price of these same 4 categories 12 months ago and compare their percentage increase to understand how much their prices have already appreciated. Usually, more expensive properties experience lower percentages increase. This means that those buying lower priced properties in a rising market are paying a greater percentage premium over a year ago (even though the absolute premium may be lower).

For example, an older Category 1 property has appreciated 33% from $3M to $4M while a brand new Category 4 property has appreciated 20% from $5M to $6M. For the same absolute premium of $1M, less of the total price is paid as price appreciation for the Category 4 property.

From the standpoint of an investor, perhaps buying a Category 1 rebuild would be the most logical choice that provides the investor with the lower cost of entry and highest potential for percentage gain.

However, for buyers looking to purchase a home for their own stay, the slight premium for a higher category property would still make sense as waiting to search for the ‘best’ property risks quick property price movements that may potentially price these buyers out of the market.

Consider the additional costs of buying an old property

Buying an older, cheaper home might actually be more expensive in the long-run. Older properties require intensive renovations which take months to years, during which you will have to rent. Add to that the logistics, time, and effort that is needed to arrange renovations and you have an equivalent of a full-time job.

Using the same example comparing a Category 1 and 4 property:

A $4M Category 1 property would involve an average of $1.5M in renovation costs over 2 years. Additional rent over 2 years adds up to anywhere between $50,000 – 100,000. The disruption to daily life as you move between properties also cannot be understated, especially with younger children and elderly family members. This adds up to almost $6M, which is what you would pay for a Category 4 home yet with none of the hassle.

Consider your priorities

We recommend buyers to reflect on their priorities for a landed property.

Are you someone who values architecture and design very much? Or do you value the convenience of newer developments?

In some cases, buyers may be highly motivated to purchase an older property because of unique architectural traits which cannot be found in newer homes. Alternatively, they may enjoy the freedom of redesigning the property to suit their vision. For these buyers, it makes sense to buy older properties and rebuild them despite the additional effort and costs. For other buyers, it may ultimately make more sense to choose newer, more expensive homes if they can afford it, for the calculations may balance out in the long run after factoring in time and redesigning costs.

Conclusion

Regardless of which types of landed property you eventually decide to buy, the advice is always the same: Do your research and future-proof your exit. Having a systematic approach to ticking off the things that would make your landed property stand out 5 – 10 years from now is key to investing in the landed property market.

The Chasm gap offers a great reason to jump into the landed property market. With proper planning, buyers can look forward to a positive real estate investment journey. If you are interested in buying a landed property, or need any other real estate advice, feel free to reach out to us here at PropertyLimBrothers, always happy to show you the place.