A common question among young couples looking to purchase their first home is whether they should use CPF or cash for their first property down payment

In this episode of our investors series, we dive into figuring out whether using CPF or Cash would be better for making your first property down payment according to your financial situation.

The debate about using CPF or cash arises due to the fact that there is an accrued interest with the use of CPF money from your Ordinary Account for the down payment of a property.

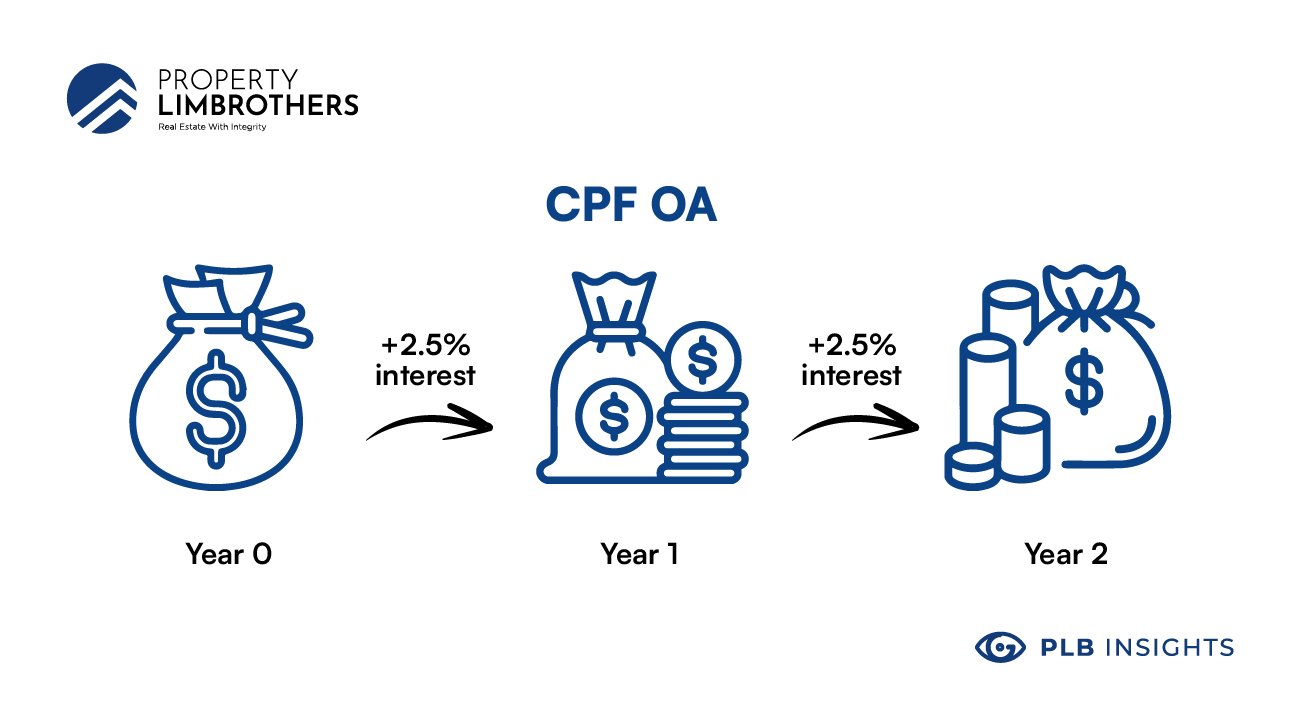

Accrued Interest on CPF monies in Ordinary Account

According to the CPF website, Cash saved in the Ordinary Account earns an interest rate that is reviewed quarterly based on the 3-month average of major local banks interest rates (subjected to the legislated minimum interest of 2.5% per annum).

At the current time of writing the Interest rate from 1 October 2021 to 31 December 2021 is 2.5% per annum.

In other words, money in your CPF Ordinary Account will earn a interest of 2.5% per annum, this means that by using the money from CPF Ordinary Account in order to make the down payment of your property, the CPF board will stop paying interest on the portion of money you have taken out.

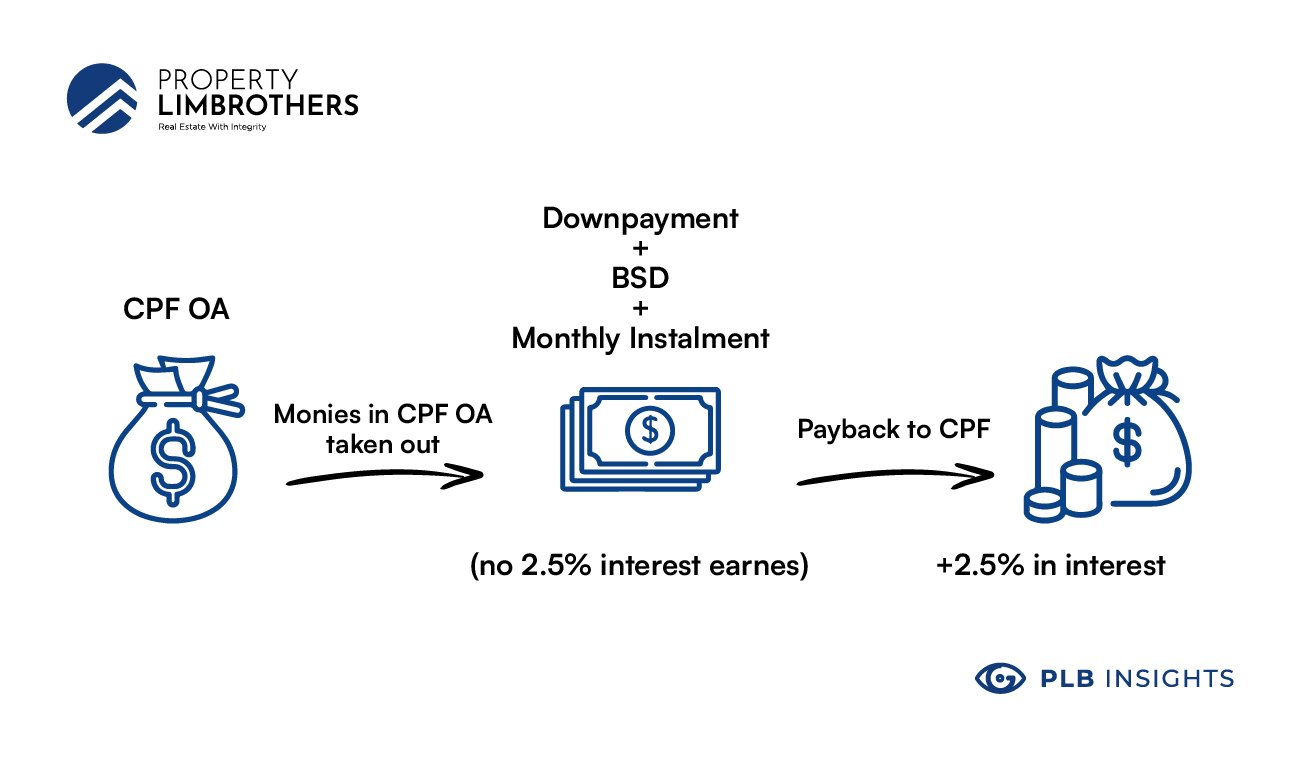

Paying back the Accrued Interest

The portion of money you have taken out to make the down payment on your property will then have to be paid back to CPF board along with the accrued interest — the 2.5% interest that you could have earned should you not have used your CPF.

Down payment

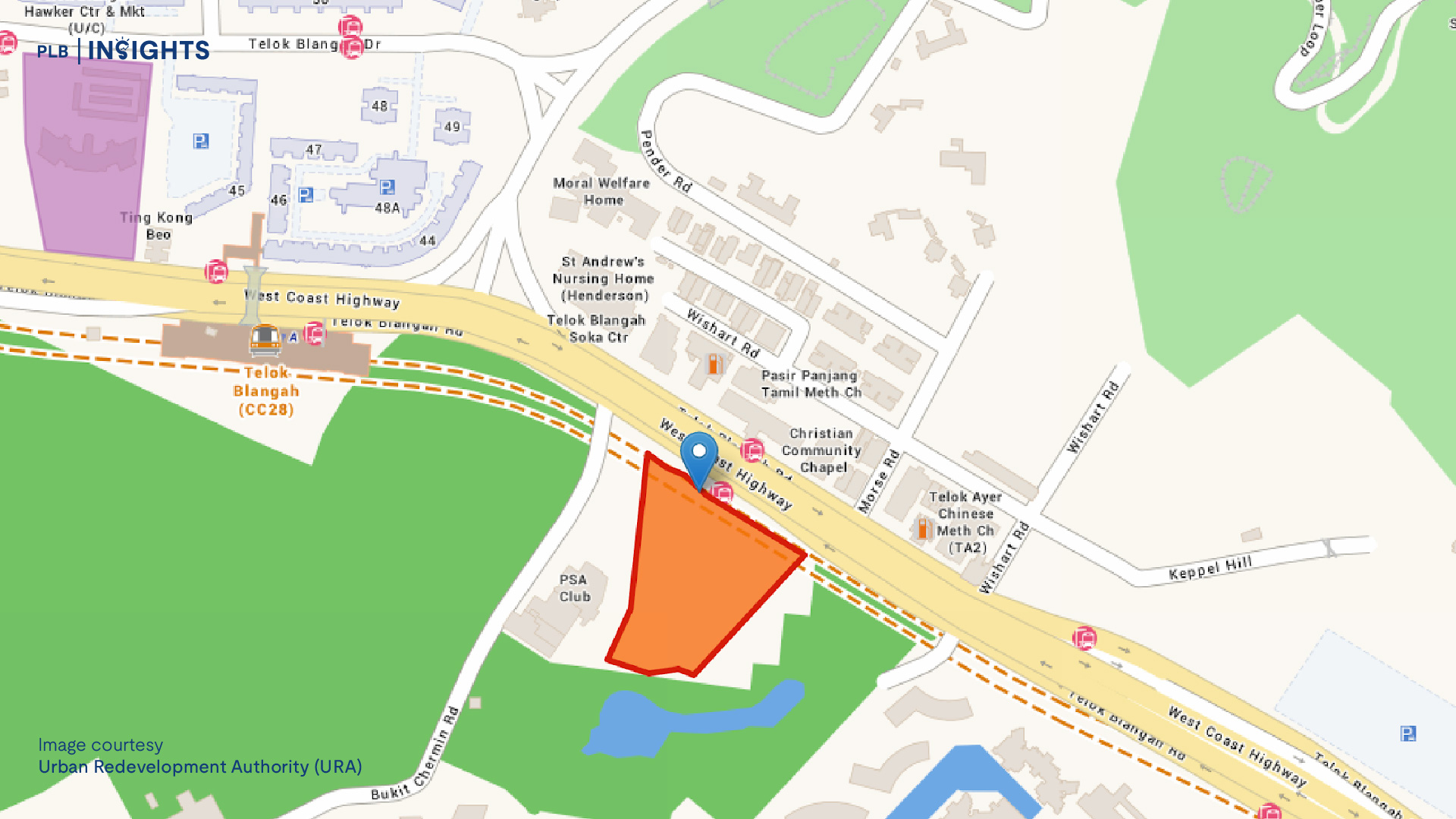

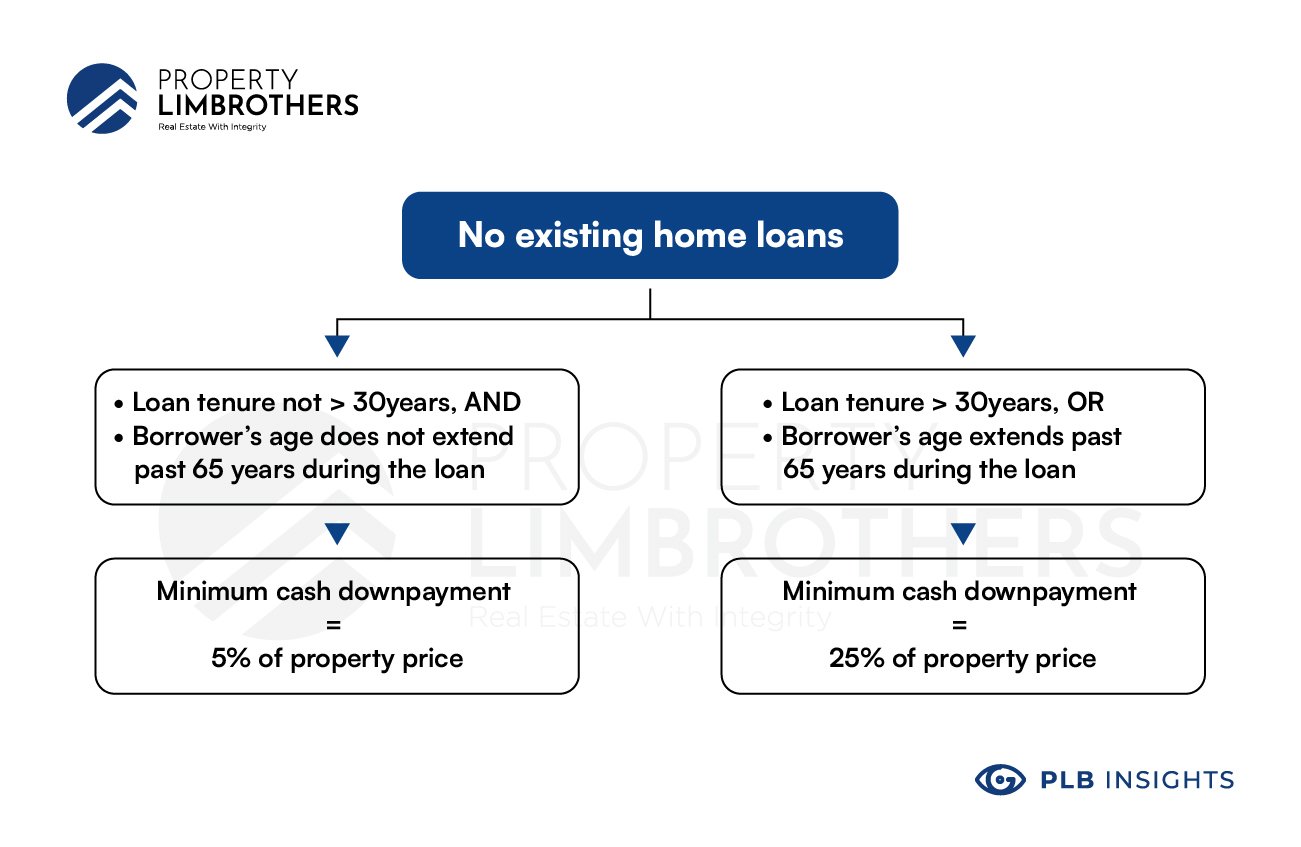

Following the flowchart below, we can get a rough understanding of the minimum cash down payment one has to make when purchasing a condo.

Do take note that:

-

For the purpose of this article, the mentioned points are in the context of a Bank Loan and not a HDB Housing Loan

-

The first 5% has to be paid fully in cash when you exercise your option to purchase.

-

The other 20% can be paid using cash and/or CPF during the completion date. However, CPF Funds have to be ready by 2-4 weeks before the actual completion date.

Example

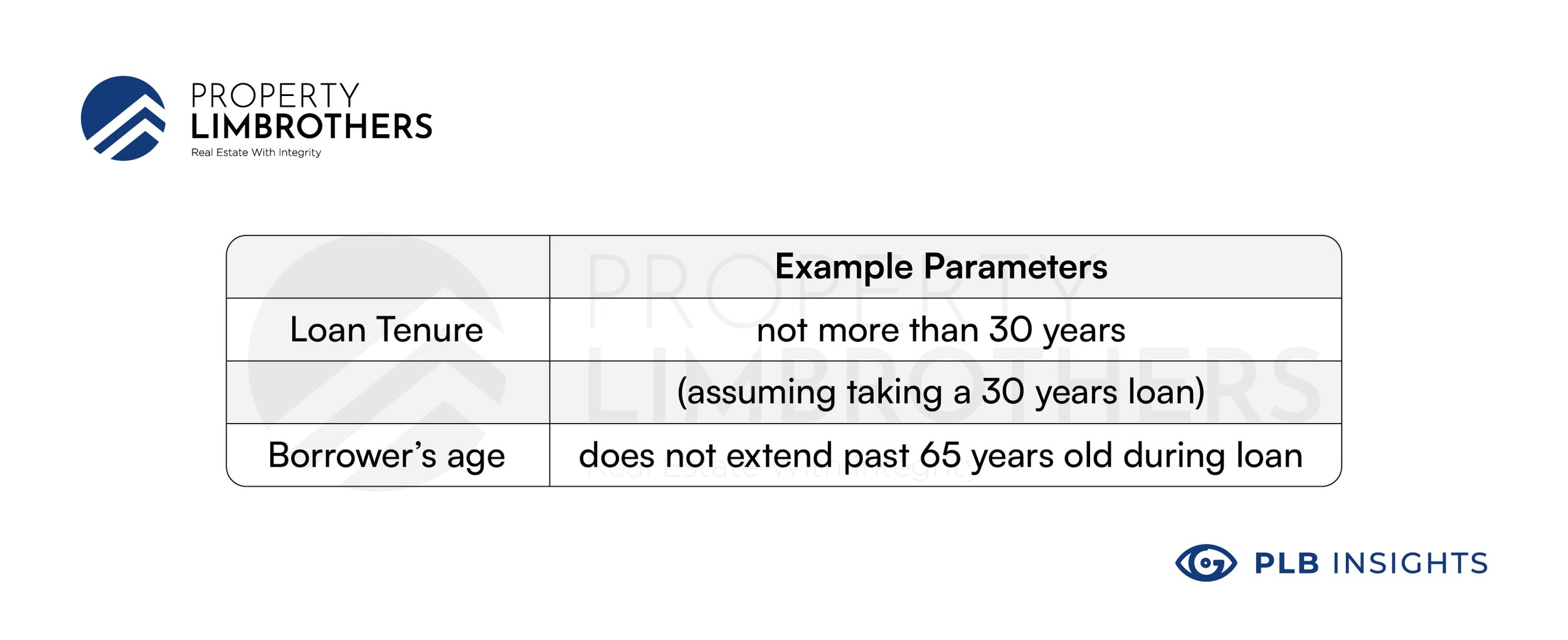

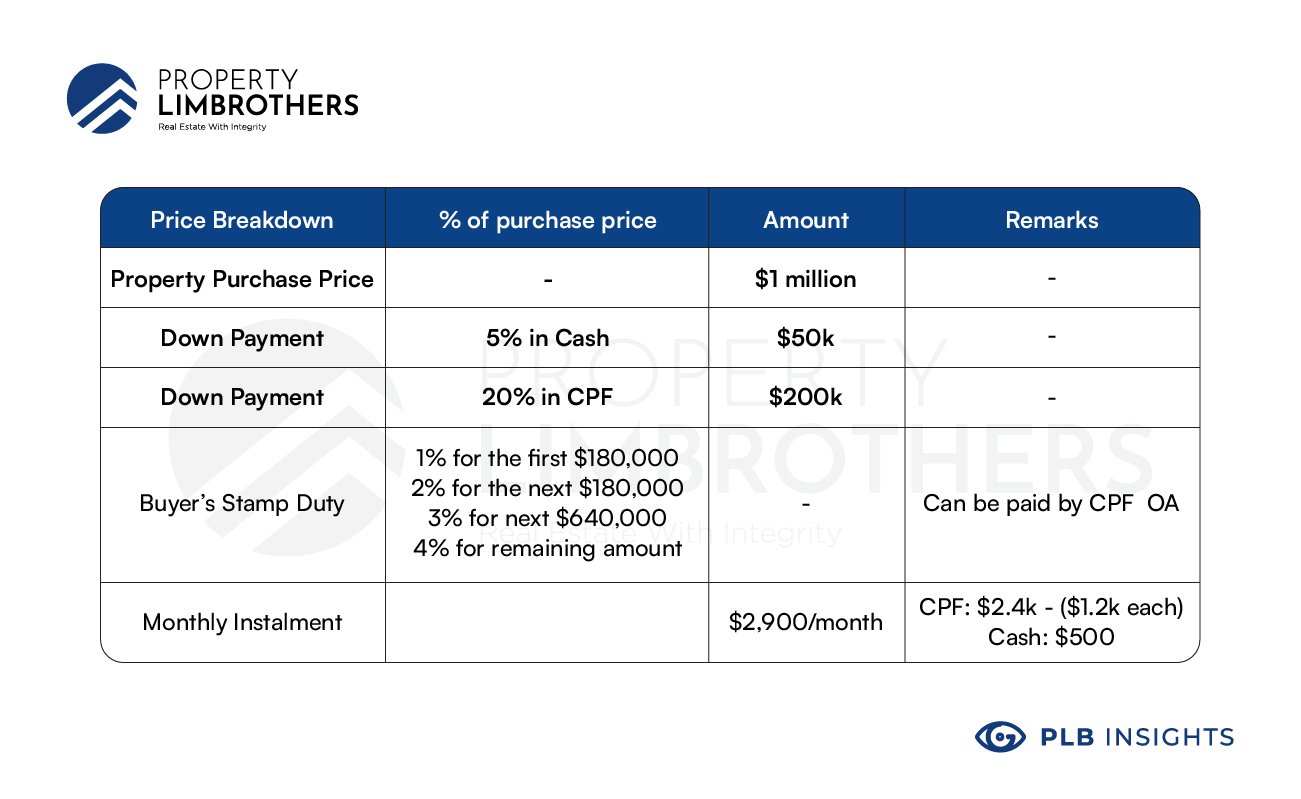

Let us use an example to illustrate this hypothetical situation where a couple is buying their first property and a bank loan is taken.

The above follows an assumption that the buyers are age 45 or younger and earn minimally $6k monthly. Hence there will be an CPF OA allocation of about 21% of their monthly salary – which will be sufficient to cover the monthly instalment to be paid in CPF.

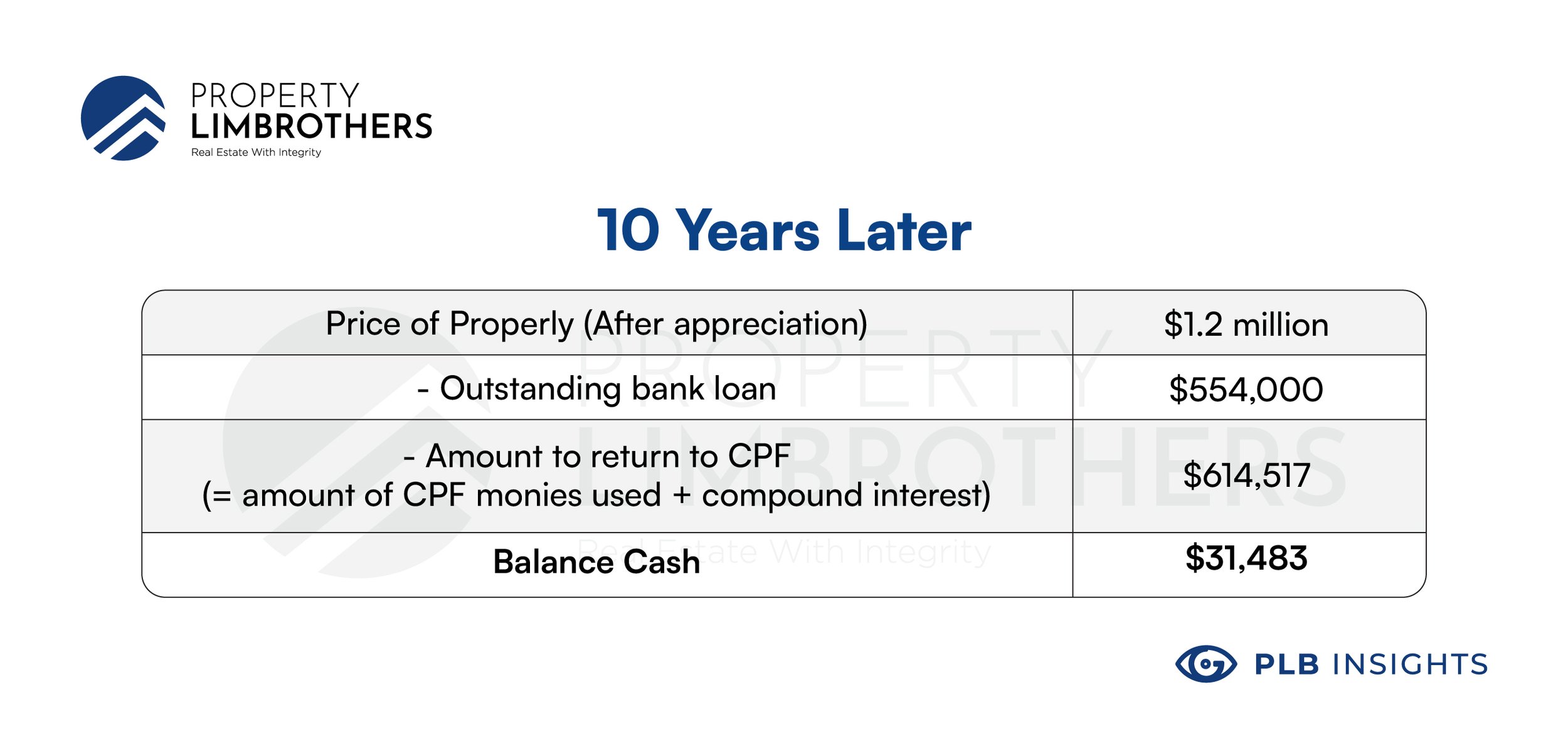

In the event that the couple wishes to sell the property 10 years later, we assume that the couple is able to sell the property at an appreciated value of $1.2 million.

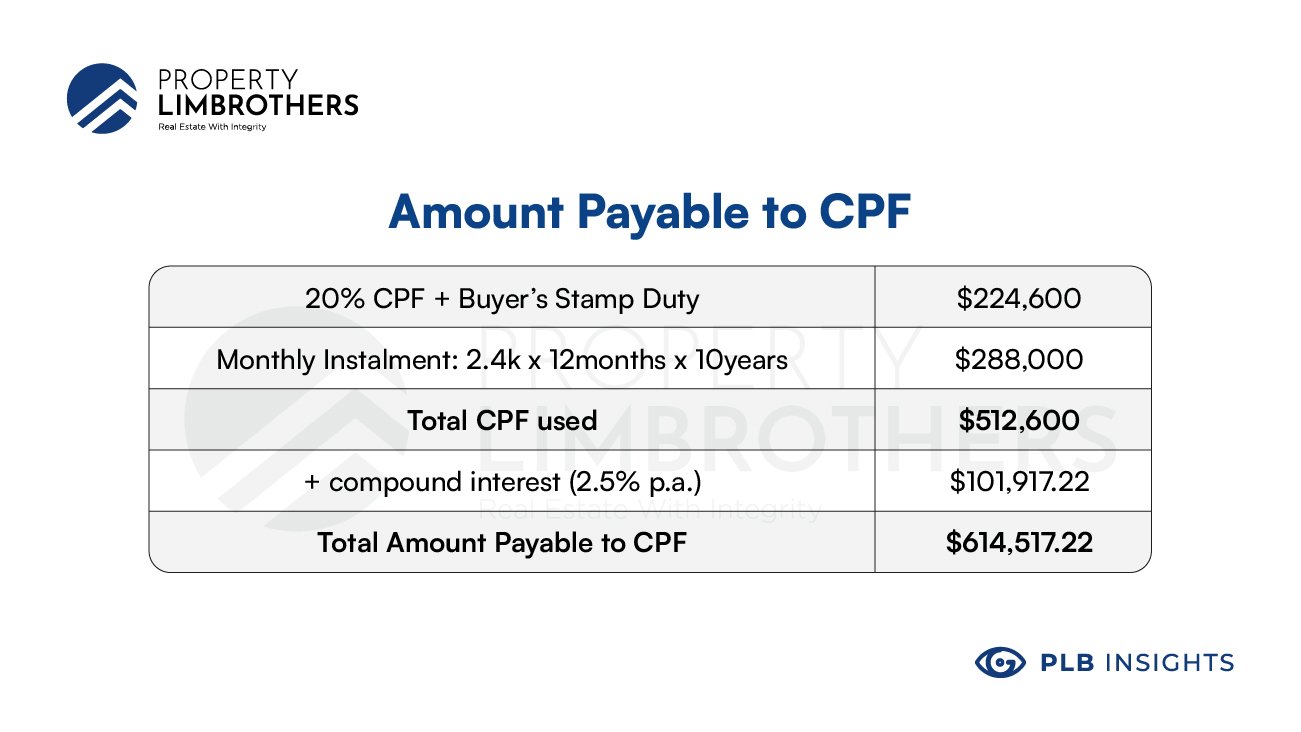

Since the couple has used their CPF OA for the payment of 20% down payment and Buyer’s Stamp Duty.

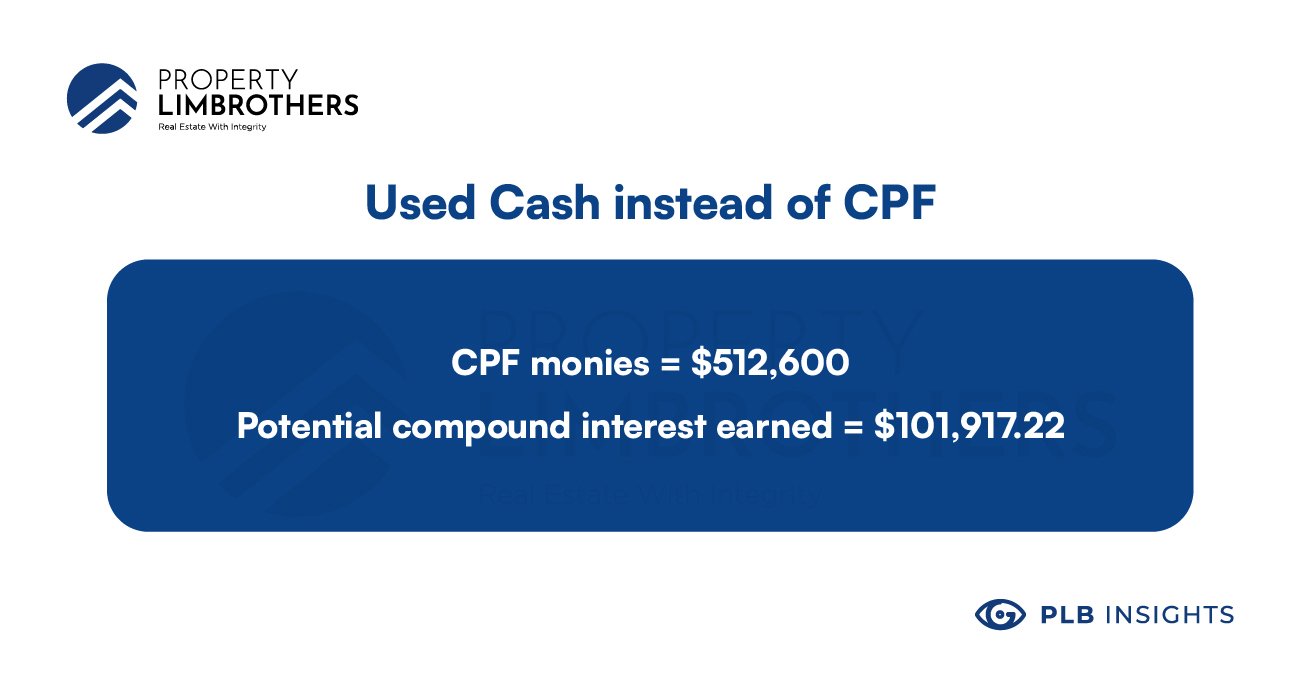

The potential interest that you would have earned if you used cash instead of CPF would have to be paid back to the CPF board into your ordinary account, on top of the total CPF funds used, as part of the amount to return to your CPF account.

When does it make sense to use your CPF Ordinary Account

1. No choice (Insufficient Cash to make 25% down payment)

It is pretty self-explanatory that if one does not have enough cash reserve to pay the 25% down payment fully in cash, they would have to then utilise the CPF Ordinary Account to pay for 20% of the down payment (provided they meet the requirements)

2. Cash able to earn better returns (>2.5% per annum)

Another scenario where it makes more economical sense to use your CPF Ordinary Account is if your cash is able to earn a better rate of return compared to the 2.5% you would earn on cash in your CPF Ordinary Account.

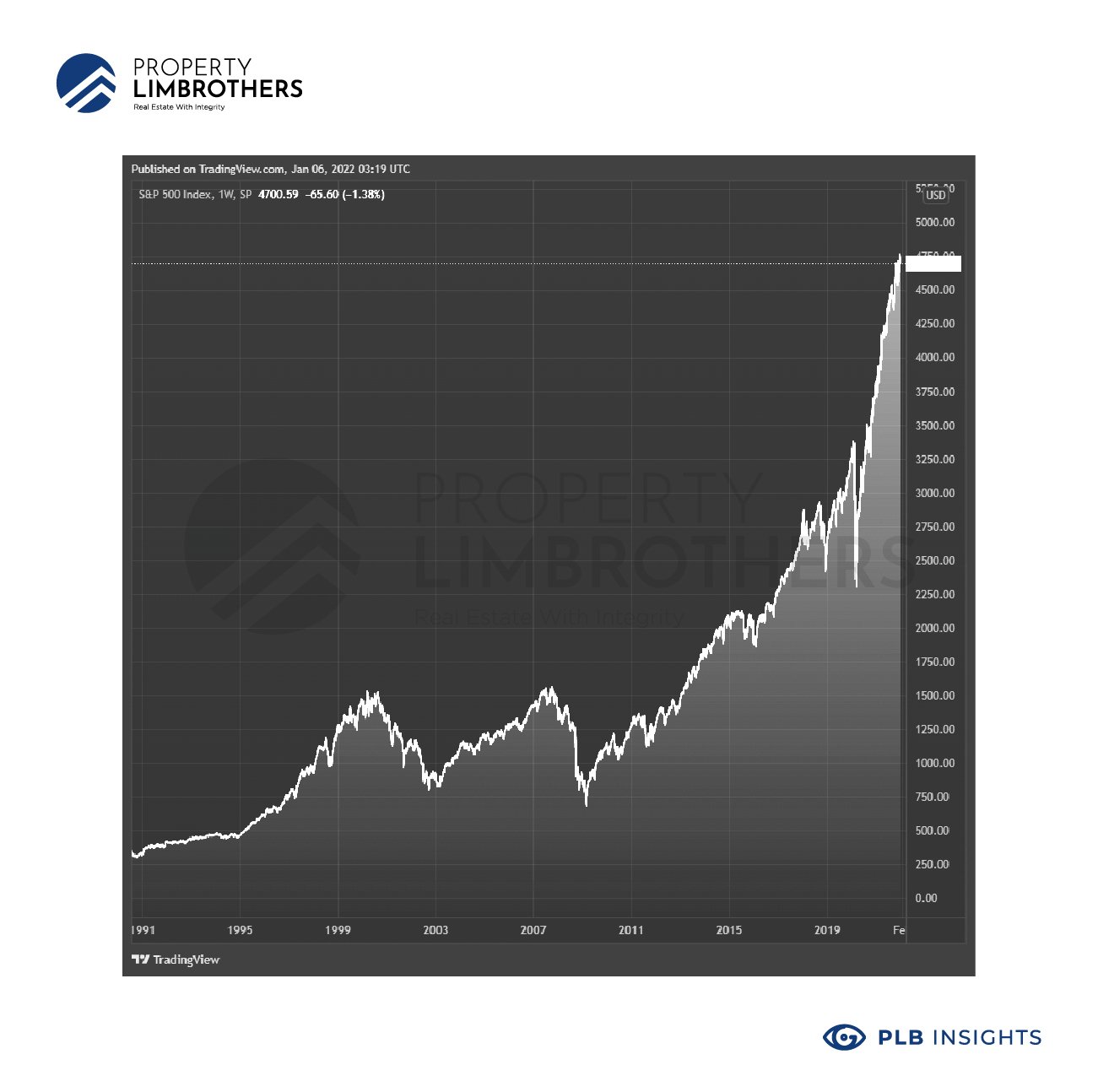

If you were to use your CPF OA to make the down payment, you will free up cash on hand to invest in the stock market which could potentially return far more than the annual interest of 2.5% per annum that is given by your CPF OA.

Expanding on the earlier example, if the couple makes a lump sum cash investment into the S&P 500 of $224,000 (equals to 20% Down payment + BSD), and continues to make a monthly cash investment of $2,400 (equals to monthly instalment).

Assuming that the S&P 500 grows at 6% per annum (historical growth rates are 8% per annum, but past performance is not indicative of future results, hence the usage of a conservative 6% per annum). The simple monthly growth = 0.5%.

The couple in 10 years time would have made the following:

The couple would have made $186,937.78 more in by investing their cash in the stock market as compared to using the cash, and leaving their CPF OA account untouched which would only have made a measly $101,972.22 in interest. Which pales in comparison to the $288,855 interest accrued by investing in the stock market.

In essence, in this given scenario, the total Capital Gains would be equivalent to the CPF OA accrued Interest amount of $101,972.22 plus the growth from stock investment of $288,855. Although it may boil down to a matter of financial preference, in this given scenario, you will be, metaphorically, making your money work harder.

That being said, investing your money in the stock market comes with its risk and one should only do so after having done their due diligence.

Conclusion

Ultimately, if one is unable to make the down payment fully in cash, they would have no choice but to utilise the CPF Ordinary Account to make 20% of the cash down payment if eligible.

However, as discussed earlier, it is possible that using your CPF Ordinary Account to make 20% of your down payment might be more economical than making a full cash down payment.

Should you be able to invest your cash and gain a return on investments greater than 2.5% per annum, your investment would have outperformed the returns on monies in the CPF Ordinary Account thus in this scenario you would have earned more in interest.

Hopefully, this article has been informative and helps you to gauge whether you would be better off using your CPF or to pay in cash for your first property down payment. Need more guidance? Feel free to reach out to our PropertyLimBrothers Buyers’ Consult team. Click here to contact us now!

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.

Ps: Place this hashtag #InvestorsSeries in front of any questions you might have for us in our comments section below, or feel free to email us at [email protected]. We would love to answer your queries surrounding property investing in Singapore!

Interested in finding out what is the break even price of your property, and what are the costs of owning a property that is not typically considered? Click here!

If you want to know what we think you should consider when setting an appropriate monthly mortgage payment, click here!

To check out our Investors Series Season 1 click here! And for Investors Series Season 2 click here!