In today’s bullish and rosy market environment where property prices seem to be breaking new highs every other day, how can you determine whether you are indeed paying a fair price for a property?

Property prices in Singapore are not exactly the cheapest, and the last thing you would want is for you to pay the price (pun intended) of over-paying for your purchase – such as by having to fork out higher Cash over Valuation (COV), restricting your lifestyle choices just so to sustain the higher mortgage payments, or even having to offload your property at an undesirable price in the future. Sure, you may finally get to own your dream property, but are the trade-offs worth it?

In this episode of PropertyLimBrother’s #InvestorsSeries, we have thus put together five parameters that you may look into to help you determine the right price for your property purchase. Watch the video below to learn more!

#1 Current Asking Prices of Similar Units

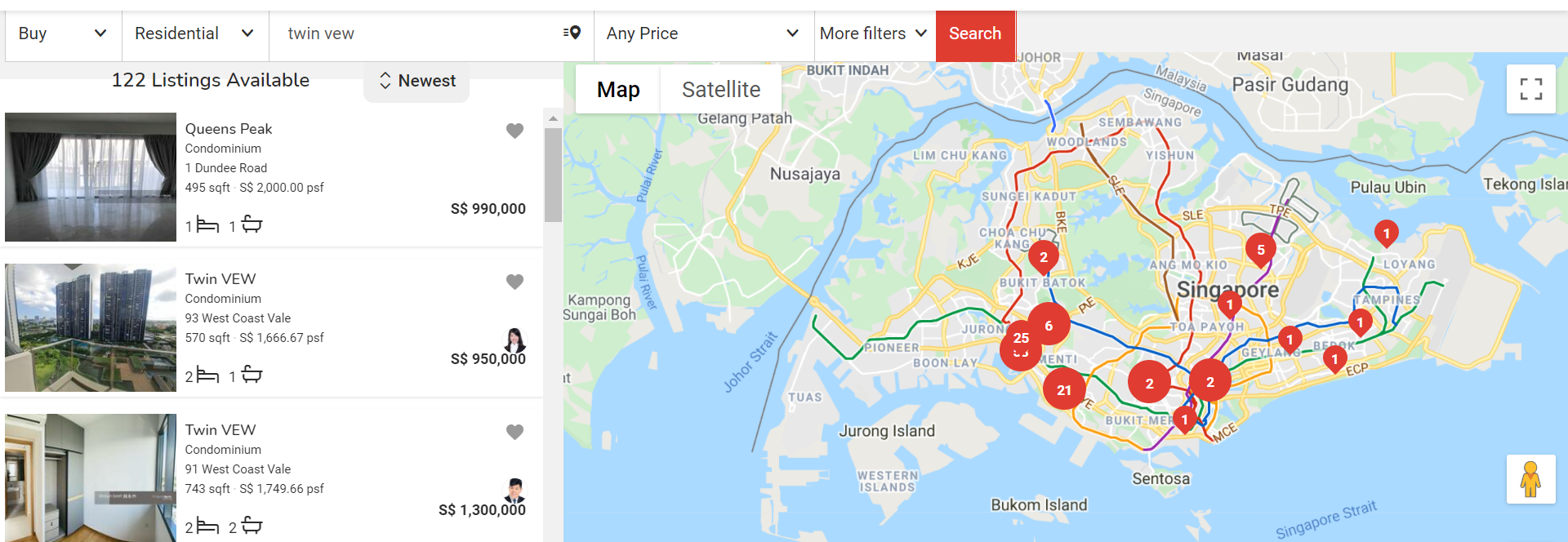

While the final transacted price often turns out to be different from the asking price (due to the tendency of sellers pricing their property higher to buffer for negotiations), having an idea of the current asking prices of similar units in the development could give you a good sense of the price range that most sellers are expecting for their units. Correspondingly, you will then be able to determine if the other party is pricing their property at an exorbitant price, outside of the norm or average.

Just a caveat though, it is not uncommon to find select units in the same development and stack being priced differently or at a premium to the others – and that also does not necessarily mean that the property is being priced inaccurately. It could be by virtue of intrinsic factors unique only to these units that justify them commanding a higher market price. Some examples of such factors are beautiful interior renovation, being situated on higher floor levels, or the ability to offer desirable views and facings. To be certain that this price premium is well-founded, you could fall back on photos and videos of the unit as a guide, although we would very much suggest heading down for a physical viewing as well to really get a feel of its attributes.

There are multiple online property research tools for you to obtain data on asking prices. Just a tip: to better match the results to your shortlisted unit, you can also apply additional search filters such as number of bedrooms, floor size, and floor level amongst many other characteristics.

Courtesy of PropertyGuru

#2 Recently Transacted Prices

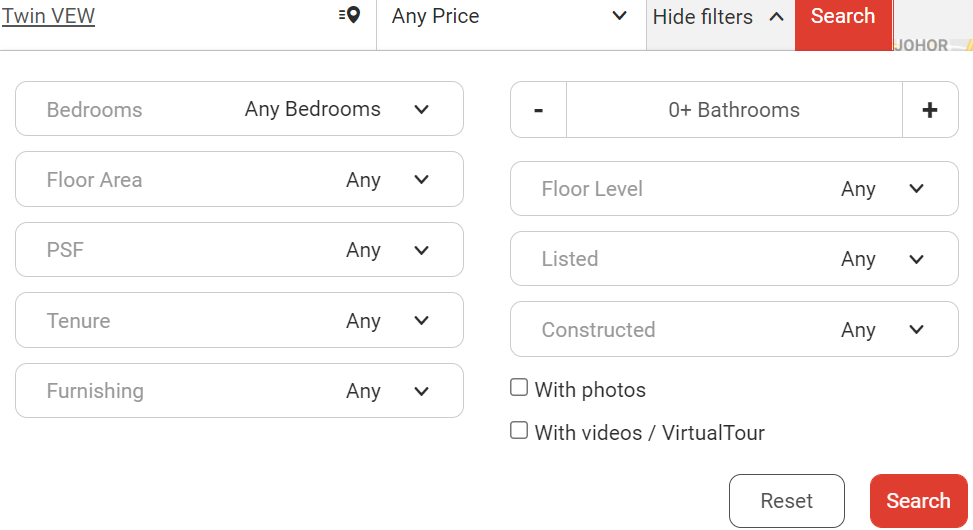

Contrary to asking prices where they primarily reflect the sellers’ wishes, transacted prices are a relatively more objective measure of what a property is worth in the eyes of the broader market. Being equipped with knowledge of recently transacted prices in a development can help you form a factual basis of a reasonable amount to shell out for a property.

To account for market trends and changes, especially in a fast-moving market like the one we are in right now, it would be best to look at transactions up till the last 6 to 12 months – any transactions older than that might risk being irrelevant and of an inaccurate representation of the current pricing trends.

Some online tools that you can use for your research are:

-

URA’s Private Residential Property Transactions e-service – This tool enables you to search for private property transactions up to the past 5 years. You can filter your search by ‘Project’ or by ‘Property Type and Postal District’

Courtesy of URA

-

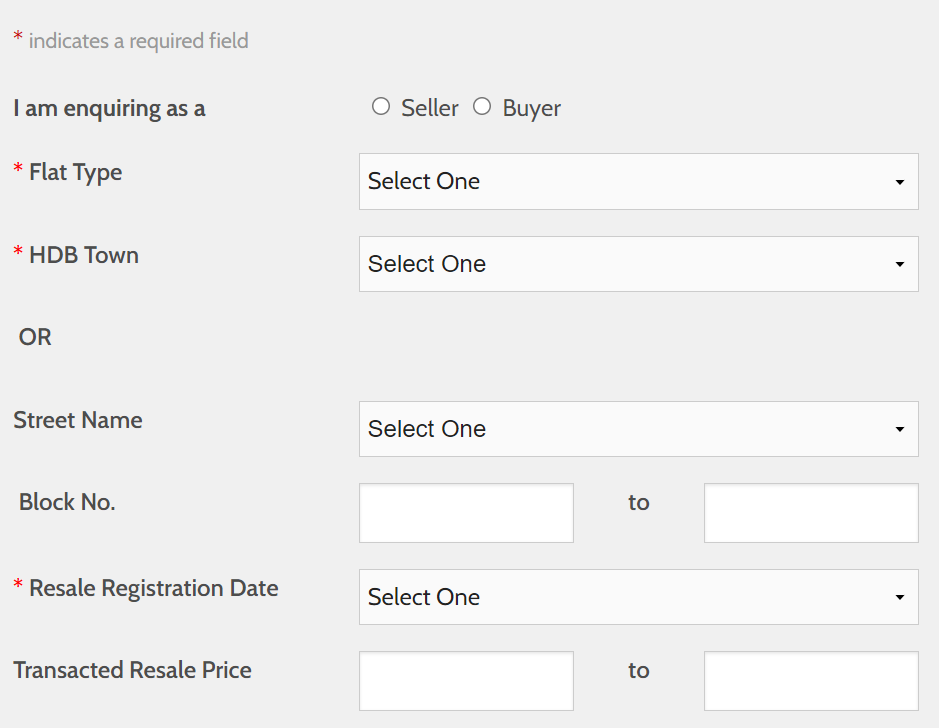

HDB’s Resale Flat Prices e-service – For public resale flats, you may use this tool to check for transactions up to the past 12 months. You will be able to search by ‘Flat Type’, ‘HDB Town’ or even down to the ‘Block No.’ if you would like

Courtesy of HDB

Perhaps it will be worthwhile to also note that on top of providing you with an indication of a property’s value, recently transacted prices might also have a bearing on your loan financing journey later on. Some banks will conduct property valuation to decide on the amount of financing to offer to you. Banks may obtain this valuation based on the development’s recent transactions, and should the unit’s purchase price deviate too much from the recent transactions, they might not be willing to match it with the valuation. This will in turn reduce the amount of loan you can obtain.

#3 Recent Highest Transacted Price

Following the point on transacted prices, you might also want to know the highest transacted price for the development. This is particularly worthy of attention if you are purchasing the property with the intention to exit with a profit 3 to 5 years down the road.

The idea here is that the highest transacted price could act as a ceiling to the pricing you can possibly fetch for the property in the near future (assuming there are no more record prices). Depending on your investment goals and targeted returns on investment, and keeping in mind this upper limit of your property’s potential value, you can then decide if the asking price is one that you are comfortable to accept.

Using online property portals, you are able to have a quick glance at the development’s price trends together with its highest transacted price. On top of those, you can also garner deeper insights by filtering based on unit size (no. of bedrooms).

Courtesy of 99.co

#4 Peak Price of the Development

Although fairly similar to the previous point, we think a notable difference in the two concepts warrants us mentioning this as a separate point on its own.

Peak price here differs slightly from the recent highest transacted price in the sense that greater emphasis is placed on the all-time record price that was set throughout the entirety of the property’s lifespan, rather than the recency of the transaction.

Think of it this way: If you are purchasing the property at a price that is already close to the historical high that was ever achieved by the development, this means that in order to turn a profit from your property, you will have to defy history (quite literally) and set a new record price for the development. This will not come easy considering potential buyers’ anchoring bias to the historical peak price, influencing their willingness to pay prices higher than that.

#5 Valuation Price

With knowledge on how much a property is valued, you can have the assurance that you are paying a fair market value for it. In the best case scenario, you might even find yourself a deal in an undervalued property!

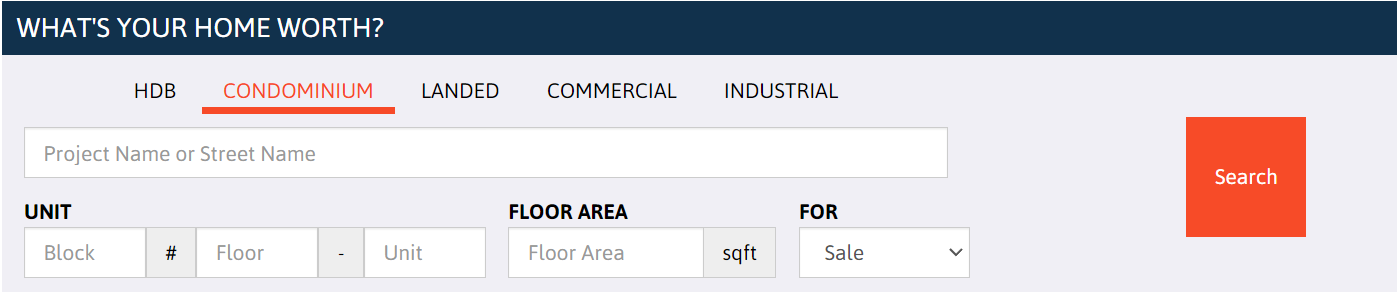

D.I.Y with Online Evaluation Tools

Unless you are an agent, online evaluation tools might be your best bet to ascertain the valuation of a property. Thanks to the advancement of technology, these tools can be found easily at no cost. Based on information that you have keyed in, they will be able to provide you with an estimated value of the property in question.

Courtesy of EdgeProp

Using a combination of such online tools coupled with the relevant websites mentioned earlier for past transactions, you should be able to deduce a pretty good estimate of the property’s worth to compare against the asking price.

Professional Help

If you prefer to have professionals conduct in-depth valuation and analysis for you instead, here are three great options:

-

Valuation Firm

For a detailed valuation, you can opt to engage a valuation firm at a cost. These firms have all the data and formulas necessary to factor in the property’s intrinsic attributes such as renovation and its overall maintenance – something that might not be accounted for in online tools.

-

Bank Indicative Valuations

To get an indicative valuation, you can reach out to your respective banker(s) for assistance as each bank usually has a panel of valuation companies that can help with the valuation. This also translates to the overall valuation that will be taken into account when you are eventually applying for a mortgage loan for your property purchase, which will affect Loan-to-Value (LTV) ratio.

-

Property Agents

Alternatively, you may also seek advice from credible agents who will be able to provide you with an accurate estimated valuation of the property. Being able to help you negotiate for a better deal will also be the icing on the cake for engaging their services. Should you require help in this aspect, feel free to contact the PropertyLimBrothers team. We have helped many with their property investment journey and we will be happy to guide you along as well!

Final Words

As an investor, it is crucial to understand the valuation of a property and the right price to pay to boost your odds of success in your property investment journey. Putting emotions aside, do not hesitate to walk away from a deal if the price does not make sense to you. The property market is vast and there will always be another property that fits your budget and needs.

We hope that this has helped you understand how you may determine the right buying price for your property. Once again, should you need further guidance and professional advice, feel free to get in touch with the team, and we will always be happy to help!

Also, if you have read till here, thank you for staying with us on our PLB Insights page. It has been an amazing year sharing key real estate analysis and insights with you, and we wish you a very happy new year. See you next year and have a restful season!

P.S. This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we will take you through them all with the PropertyLimBrothers team.