When it comes to property investing, chances are most people would scrutinise every aspect and parameter of their entry strategy – which undeniably is always a good habit to possess to ensure that the property checks all boxes of what they deem as “investment-grade”. However, few would give thought to their rental and exit strategy, or simply put, their property’s future potential tenant and buyer pool.

To a certain extent, that is understandable considering the fact that upon a property purchase, one is technically making an entry into the investment asset, and it is only natural that the mind would fixate itself on all sorts of yardsticks associated with a quality entry. That being said, no matter how attractive of a deal you are able to secure at the point of purchase, rental income can only be earned if there are ready tenant pools for your property, and capital appreciation gains can only be captured if you are able to sell the property. In the same regard, failing to identify your tenant and buyer pool before you sign on the dotted line could potentially present you with a myriad of obstacles to achieving that rental cash flow and resale gains that you have hoped to get out of your property investment.

Thankfully, the silver lining here is that you may be able to overcome these obstacles and mitigate the risks through proper due diligence and knowing who your target audience will be before you make the purchase. In this episode of PropertyLimBrother’s #InvestorsSeries, we have thus put together some factors to aid you in ascertaining whom you can possibly rent and sell your investment property to in the future. Watch our video below to find out more!

In the words of one of the world’s most renowned investors, Warren Buffet – “Risk comes from not knowing what you’re doing”; by understanding your potential target audience for your shortlisted projects, you would be better equipped to make informed decisions such as the types of development and unit configurations to focus on in a particular locale, or whether you should even commit to the investment in the first place.

With that, let us dive right into the first factor that you may look at to identify your target audience!

Region & District that the Project is situated in

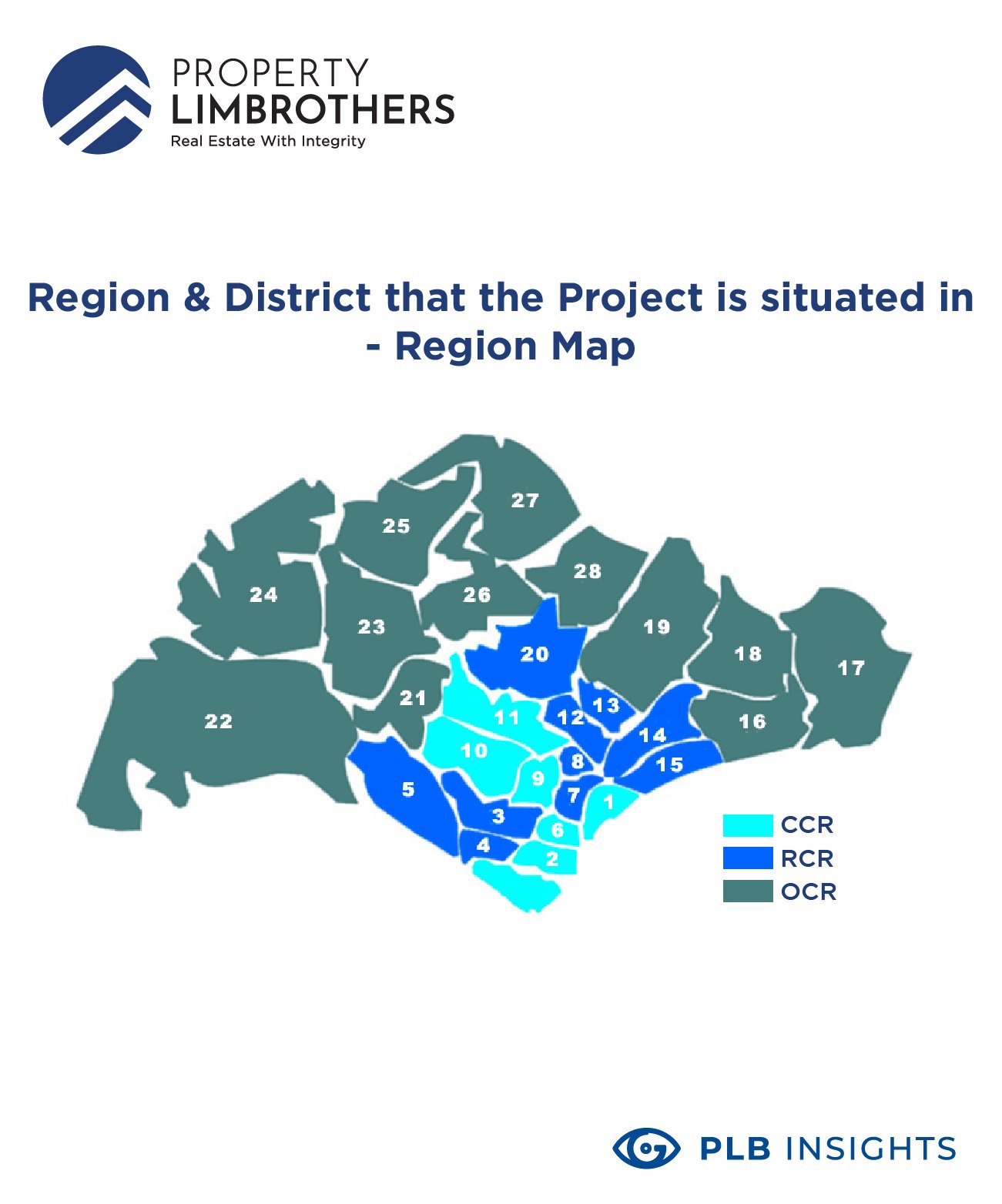

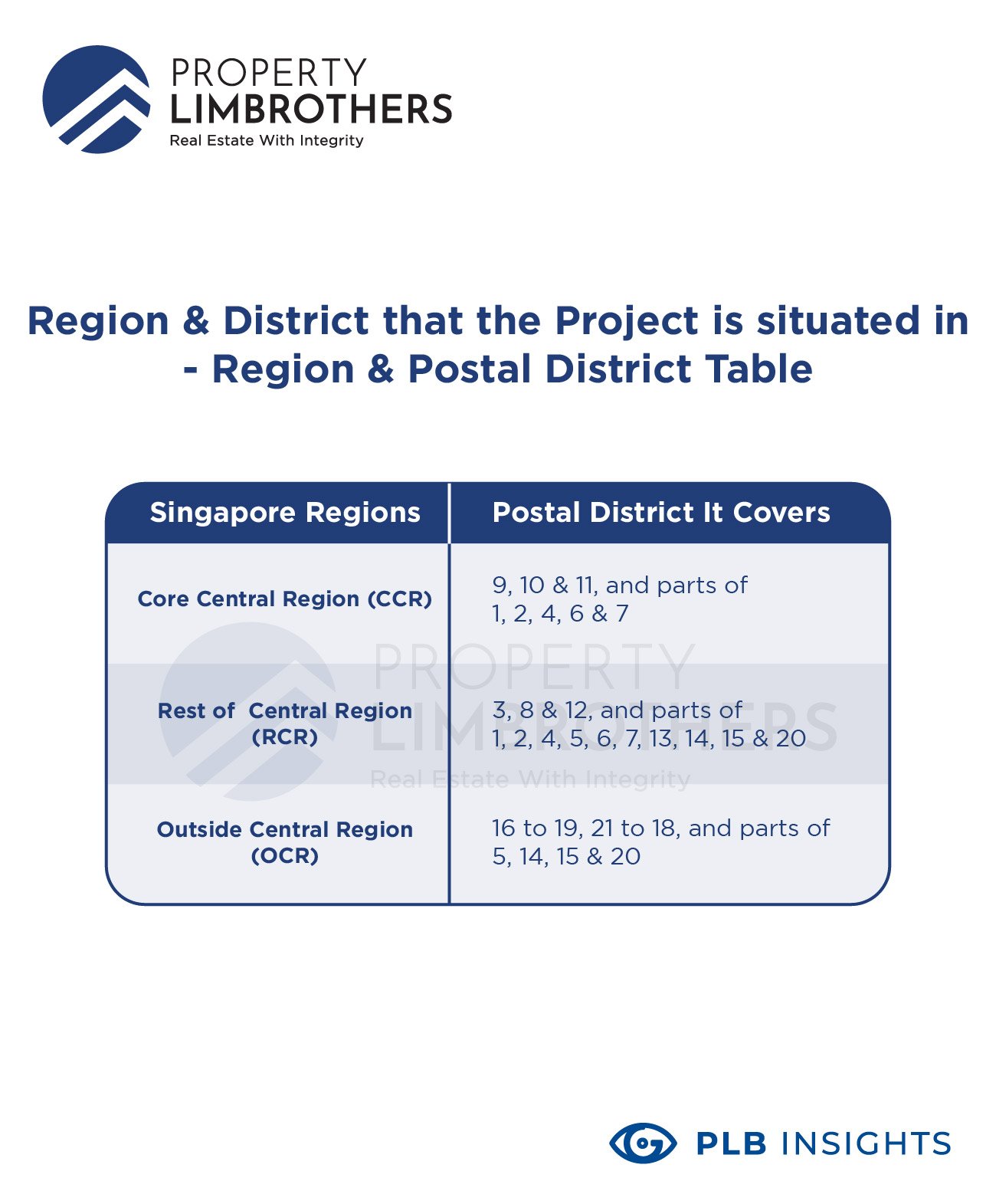

For the uninitiated, Singapore is divided into three main regions namely, the Core Central Region (CCR), Rest of Central Region (RCR) and the Outside Central Region (OCR), with 28 districts nestled within these regions. Different regions and districts tend to cater to different people coming from all walks of life and knowing the area in which your property is located will go a long way in helping you determine the likely tenant and buyer profile for your property.

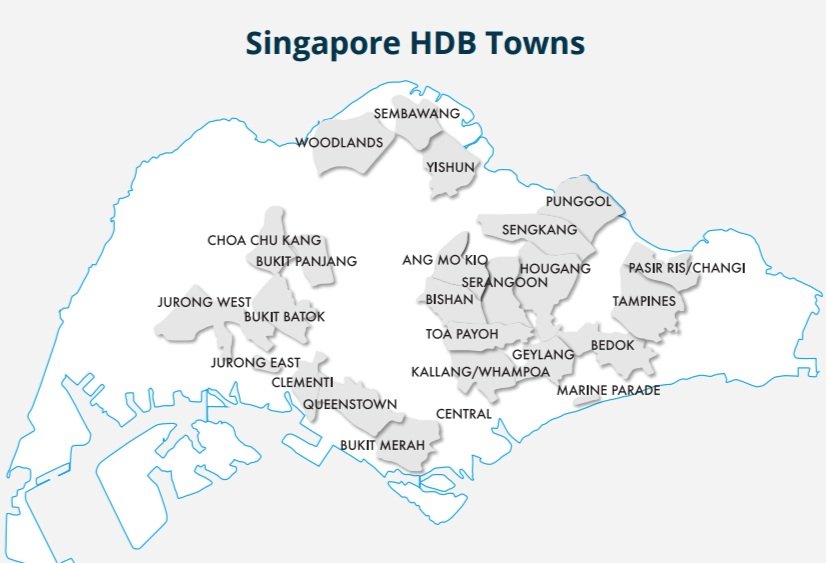

For instance, certain districts such as Districts 04, 09 & 10 have traditionally seen more popularity amongst the expatriates, possibly due to their proximity to Singapore’s city centre and the Central Business District (CBD), where many of them are working at. On the flip side, as you move away from the city centre and towards the suburban areas of RCR and OCR where most of Singapore’s public housing flats (HDB flats) are located at, you might find that there are increasingly more locals instead. This might have also come on the back of the Grapevine effect, a figurative term widely used in the real estate industry to explain the word-of-mouth effect among tenants – where they recommend their neighbourhood to their fellow friends, leading to some towns being highly favoured by certain nationalities or ethnicities.

Singapore HDB Towns courtesy of SRX

Being aware of the region and district’s demographic composition can also help you gain valuable insights into the life stage as well as the needs and wants of your potential tenants and buyers (e.g. are they mostly families looking for larger-sized units? Or are they singles and young couples who are not as bogged down by space constraints?) Consequently, this will serve as a handy guide in helping you narrow down on the ideal sizes and types of property that you should invest in to optimise rental and resale demand down the road.

To facilitate understanding of this point, let us use a simplified example. Based on the most recent data compiled by data.gov.sg, Tampines has one of the highest HDB resident populations, after Jurong West and Woodlands. This means that if you were to invest in the Tampines area, or District 18 in general, it is highly plausible that your future buyer pool could constitute HDB residents who might be looking to upgrade to a private property. More often than not, they would also likely to be at the life stage where they have young children and would appreciate having substantial living spaces and facilities in their next property. With respect to these inferences made, it could then be wise for you to consider investing in a unit with more sqft, say a 3-Bedder and above.

Surrounding Amenities

Educational Institutions

Courtesy of Parenthoodlife.sg

In Singapore, priority admission into a primary school will be given to applicants who live within 1km-2km of the school when it has to boil down to balloting. If you find that your shortlisted property for investment is in the proximity of several primary schools, there may be a good chance your tenants and buyers would be young families looking to secure their children a spot in these schools.

For such profiles, some considerations at the top of their list when looking for a place of residence would likely be the practicality of the unit layout as well as the range of facilities present in the project development. Therefore, it will be to your advantage if you can secure a property in a development with family-friendly facilities such as playgrounds, swimming pools, and 24/7 security, just to name a few. Units with functional configurations that come with good-sized living areas, yard areas for laundry, or even a household shelter for storage needs would also likely be positioned more favourably in the minds of these families.

Besides Primary Schools, you might also want to pay attention to the presence of International Schools and Universities around the property. These establishments could attract international students who are looking to further their studies in Singapore, in which case, smaller-sized units with relatively affordable rent could likely appeal more to this pool of tenants who might have limited disposable income. Those who have travelled to Singapore without their family members would also tend not to be overly concerned about space constraints, adding on to the attractiveness of smaller units in such areas.

Commercial or Industrial Nodes

Changi Business Park courtesy of Wikipedia

Commercial and industrial spaces act as major employment centres for many and being in close proximity of such spaces would provide your property with a major and stable tenant pool with predictable demand coming from those working in the area. Taking this into consideration, you might want to look at units with adequate living and study areas, yet still come at an affordable quantum so as to maximise your rental yield, such as in a 2-bedder. This is especially so if you plan to rely on your property as a means of achieving consistent cash flow and rental income.

Historical Transactions in the Area

Admittedly, past performance is no guarantee of future results. That being said, you may be able to get a rough sensing of the probable tenant and buyer pool for a property by studying the past transaction data. This could be achieved by taking note of the unit size(s) and/or type(s) that have been enjoying high rental and buyer’s demand over the years, in which the trend could very much likely continue into the foreseeable future, ceteris paribus. This gives you a basis upon which you can establish an idea of your potential target audience.

Thanks to property portal platforms and other online real estate tools, you are able to retrieve these data easily, and accordingly, be able to form a well-supported investment thesis on the size and type of units that would likely yield you the best returns, be it in terms of rental income or capital appreciation.

Conclusion

At the risk of sounding like a broken recorder, we would like to emphasise again that ultimately, your returns can only be captured if you are able to rent out or sell your property. As much as entry criteria are important when shortlisting properties to invest in, you should also not overlook the future target audience that is an integral part of your investment strategy.

We hope that this piece has helped you to have an idea of how you can possibly identify your target audience and subsequently, how you can leverage on that knowledge to guide your selection of the ideal developments and units for investment. Should you need further guidance and professional advice for your property investment journey, feel free to get in touch with the PropertyLimBrothers team, and we will get back to you shortly!

P.S. This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we will take you through them all with the PropertyLimBrothers team.