Singapore is affectionately known as “Little Red Dot” by many, and that did not come without basis – we are indeed small by land size and this has resulted in the scarcity and high prices of land here. Thus, we tend to believe that being able to upgrade to a landed home is a dream that is out of reach and some might not even dare think about it. After having worked with numerous clients over the years, we also noticed that large families (especially those who stay together) tend to forsake the idea of upgrading to a traditionally better-performing asset found in private properties for the large spaces that characterised HDB EMs and Executive Apartments (EAs).

Well the truth is, there are ways and means to satisfy both the need for space and the want for capital appreciation. Our client, a loving family of seven, is living proof of that. Let us explore why and how they upgraded to a private property (and a landed one at that!).

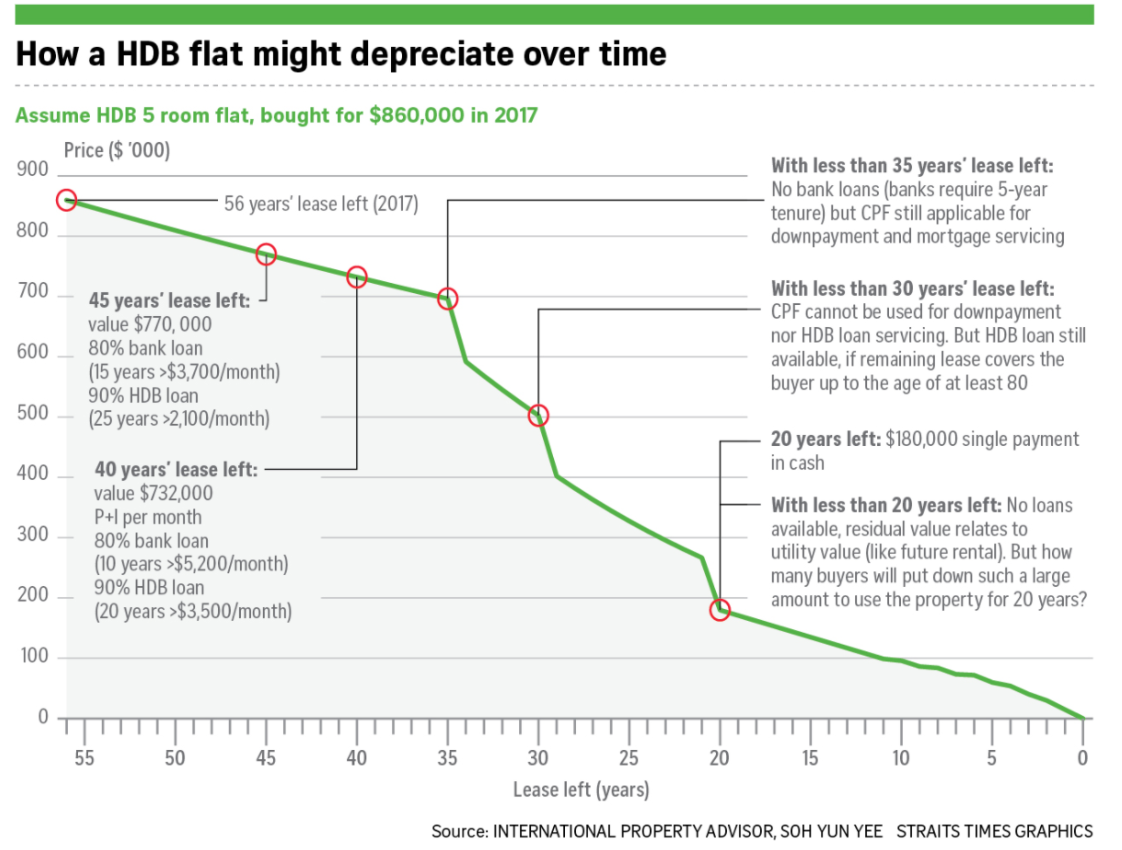

Their EM was being subjected to Lease Decay

Our client initially had three generations living under one roof of an Executive Maisonette (EM) in Pasir Ris. However, it came to their realisation that the price trend of their EM was stagnating due to its old age, and might not be a good store of value in the future. With its lease starting in 1989 – it was about 29 years old when it was marketed and sold by the PropertyLimBrothers (PLB) team back in 2018. With aging flats becoming a prevalent issue – they did not want to be caught in a situation of having their CPF monies becoming trapped in a depreciating asset. They then quickly shifted their priorities towards owning a home that can provide them with both space and capital preservation.

Courtesy of The Straits Times

Awareness Led to Action

This awareness was key in them ultimately coming to the difficult decision to let go of their beautifully-renovated EM. We salute their commitment to move out of their comfort zone and shift the funds locked up in their EM to a better-performing asset class that is less vulnerable to the dangers of Inflation, Depreciation as well as the volatility of Supply and Demand.

Selling their EM, & moving into their new home

PLB was honoured to be able to help them market their property and secure a record price of S$8xxK within just 18 days of our signature marketing efforts. Undoubtedly, the great locational attributes of the EM, quality interior designs and a serious desire by the sellers to move on have all also played a part in the success of the marketing campaign.

The team also went to great lengths in ensuring a smooth Selling & Purchasing timeline for them so that they were able to seamlessly move from the EM to their new home with minimal disruptions in between.

Their EM was sold in Feb’18, and they moved into their new landed home in Jul’18.

Their New Home – Freehold Landed Property!

For this family, we could sense that keeping everyone under the same roof was one of their top priorities. This meant that space was paramount to them. Knowing that a landed property could offer them the spacious comfort and ample spaces that a private condominium might not necessarily be able to offer, we suggested that they consider a landed purchase.

Eventually, they secured themselves a freehold landed property in the D16 area near to Simei MRT Station at the attractive price tag of S$2.5 million. Being of freehold status, they could be assured that its value will hold up for the foreseeable future and depreciation will not be a significant issue in this case. (in fact, landed homes’ prices have already trended higher since the time our client got the property back in Year 2018)

Why A Freehold Landed Property?

Some buyers purchase freehold landed properties as part of legacy planning. The supply of landed homes in Singapore is limited and yet the demand remains strong (evident from the rising PSF prices of landed properties throughout the years). This gives them the confidence that their property will act as a good store of value, or even appreciate in time to come, making it a worthwhile investment to be passed down to the next generation.

Closing Thoughts

PLB’s CEO, Melvin Lim, being someone who also has a large family (with four kids!), highlighted that he can certainly understand his client’s wishes to own a large and comfortable home. It does not always mean that size and space have to be compromised when making an upgrade to a private residence. While there is some truth to that – especially with rising PSF prices, other options are always available if you know where to look. For instance, landed homes can provide you with ample space & double up as a great store of value as well. With the right perspectives, mindset & proper guidance, one can definitely make the shift towards a better asset with minimal disruption to their current lifestyles!

PLB’s extensive experience in marketing and selling units has allowed us to tap into a wide network for good deals for our clients. As long as you are willing and open to options, you can leave the tedious work to us. Rest assured we would do our best to market your property to its fullest potential, while scouting for the next home for you – a property with potential for capital preservation/appreciation, and yet with minimal interruptions to your current lifestyles.

We hope that this piece has given you some brief inspiration and insights into the property progression journey of someone living in Singapore. Should you need further guidance and professional advice, feel free to get in touch with the PropertyLimBrothers team, and we will get back to you shortly! In the meantime, take care and do keep a lookout for our next article!