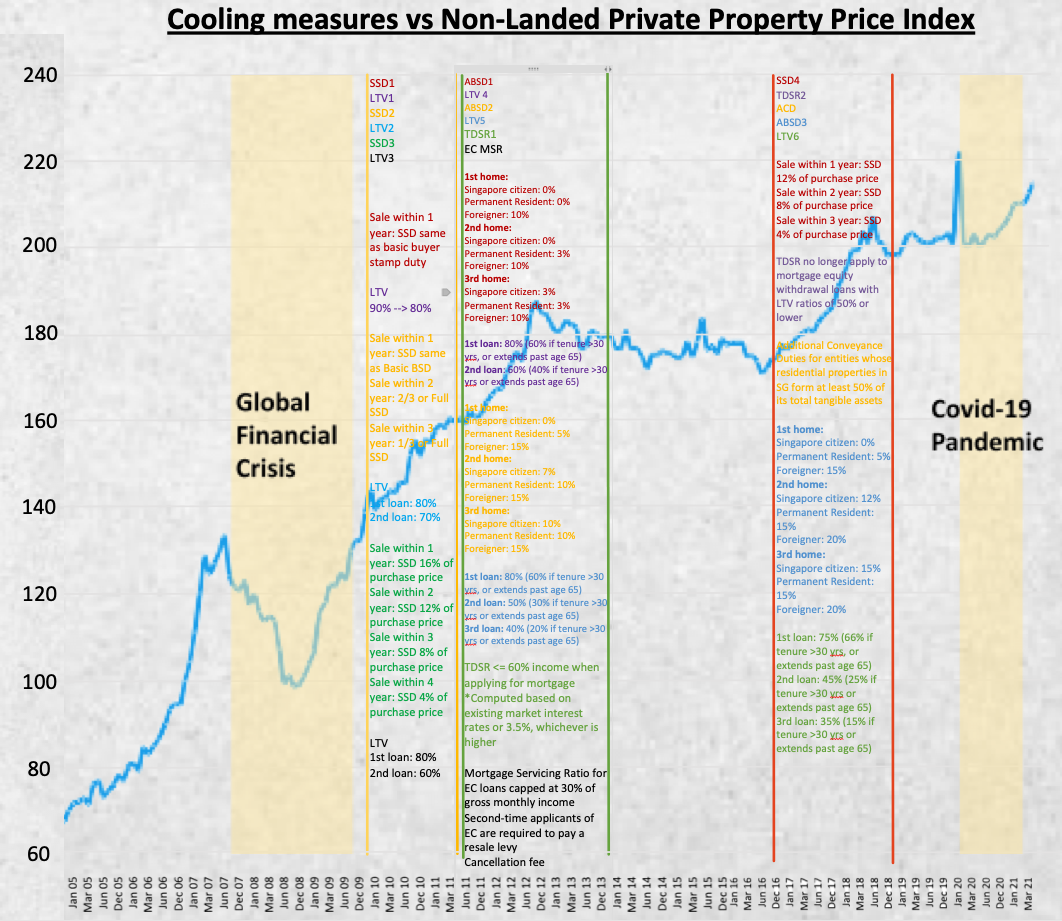

Amongst other cooling measures that have been implemented by the Government, the Additional Buyer Stamp Duty has probably been the one that has had the most impact towards property investors who have multiple properties.. However, we have to agree that these implementations have helped the market stabilise during certain highs.

With the unprecedented run of the housing market amidst one of the worst recession caused by the pandemic, it is no longer a question of whether there will be another round of cooling measures, but perhaps when. This has intensified the rumour mills of another possible round of cooling measures later in the year.

As such, a common topic has been circulating among many property investors and first time home buyers: What if cooling measures come again, and should they wait for the dip after the next cooling measure to enter the market? To answer these, we first have to take a look at the history of cooling measures in Singapore and its effect, current market sentiments, and the various ways in which the government usually intervenes in the housing market.

History of Cooling Measures in Singapore and its effect

Singapore’s housing market has been widely known to be a safe haven as compared to its counterparts abroad, as evident from its consistent growth and low interest rates. This is largely attributed to the fact that the government has been able to successfully intervene with appropriate cooling measures whenever necessary to prevent the market from straying too far from its economic fundamentals.

Data courtesy SRX

Looking at the historical performance of the non-landed private property with respect to the various cooling measures, we can see a big shift in the dynamics of the housing market from a speculative one to a more stable and sustainable vehicle. Prior to the influx of implementation of cooling measures in 2010-2013, the housing market in Singapore was pretty much ‘unregulated’; mortgage loans were easily obtainable and the absence of concrete restrictive policies like the ABSD and Seller Stamp Duty (SSD) meant that there was a rampant speculation and flipping of houses, which caused the housing market to be more volatile and sensitive to changes in market sentiments.

Following the Global Financial Crisis, we can see that the housing market rebounded rapidly, which is largely attributed to the spillover effect from the massive Quantitative Easing efforts from the US Feds.

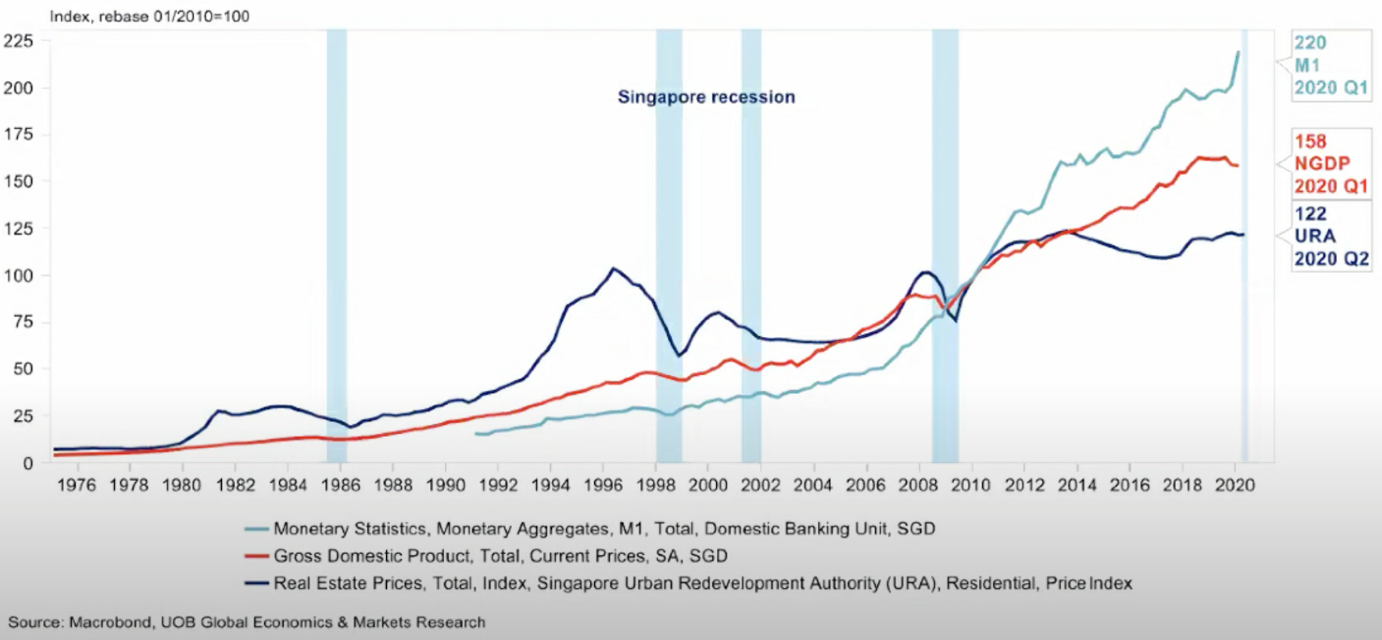

Property Price index vs Nominal GDP vs Liquid Assets chart courtesy Macrobond, UOB Global Economics & Market Research

As a result, we see an increasing trend of Singaporeans holding more liquid assets from 2010, which means that homeowners have a higher capacity to service their mortgage obligations and also have a stronger holding power. Moreover, coupled with the fact that the housing market was on a big discount following the massive dip caused by the Global Financial Crisis, it incentivised investors to take advantage of such a favourable environment to invest in the housing market in Singapore. Consequently, the government got creative and intervened by implementing a series of cooling measures to prevent an imminent housing bubble from forming.

These cooling measures proved to be effective because the introduction of measures like Total Debt Servicing Ratio (TDSR) and stricter Loan-To-Value limit (LTV) meant that home buyers had to be more judicious when taking out a mortgage to finance their property, and ensured that they were not over leveraging. The dreaded introduction of the ABSD also meant the restriction of property speculator’s ability to pocket short term gains off flipping houses.

The market was stabilised for another few years before the start of the En Bloc frenzy in 2016 which caused prices to spike again. The influx of FOMO buyers rushing to enter the market before the new and tighter ABSD and LTV limits coming into effect also likely contributed to the spike in prices. Nevertheless, the pre-pandemic cooling measures implemented were still effective in keeping the housing market’s economic fundamentals in check.

So what do these mean for property investors, and even first time homebuyers pondering on their purchase? Based on historical trends, it all point towards 3 things:

-

Cooling measures serve to stabilise the housing market. Major dip in prices rarely happens/are minimal after the implementation of multiple rounds of cooling measures.

-

Whenever there is a major dip in the housing market, the recovery is likely to be much more prominent.

-

The robust nature of the housing market in Singapore indicates its ability to perform even in times of economic depression, and have shown its resilience even after several rounds of cooling measures in place.

If we were to zoom out and look at the bigger picture, we can observe that the housing market is constantly on an uptrend and purely based on this macro perspective, and judging from the higher illiquidity of Real Estate as an asset class, we believe that it might be rather unwise for any home buyers to attempt timing their entry into the market. On that note, with a proper selection criteria and a comprehensive “MOAT” analysis – yes, exactly like a castle’s moat that helps prevent potential attacks from invaders, property investors might likely be better off having skin in the game early to improve their chances of capital appreciation.

So what happens if cooling measures really come again?

Let’s say the best case scenario happens and a major dip looms over the housing market. Let’s do a buy-now-or-wait analysis against the probable cooling measures commonly taken by the government:

1. Lower Loan-To-Value Limit:

An influx of buyers rushed to show flats in an attempt to secure their new home before the implementation of a tighter LTV limit. Amidst the current run in the housing market, the government could possibly attempt the same by lowering the LTV ratio from the current 75% to 70%. The 5% reduction might seem menial, but if we were to factor in the opportunity cost of the additional capital outlay and the overall quantum of say a new launch condo, this small reduction in LTV limit would eat into the potential capital appreciation of the property should the buyer purchase during the ‘major dip’ and sell after the SSD period.

Let’s use a real life scenario to better illustrate this point:

A couple bought a new launch condo at a big discount during the ‘major dip’ at around $1.5 mil. With the new LTV in effect, the couple can only finance up to 70% of the purchase price and must service the remaining $450,000 with CPF and Cash Down Payment (previously it would have only been $375,000). Let’s say the property appreciates by a generous 20% in 3 years and the couple decides to put their property up for sale, their cash on cash return would be reduced because of the extra $75,000 in initial capital outlay, and we have not even taken into account repayment of CPF Accrued Interest, Buyer’s Stamp Duty (BSD), potential ABSD for owning an extra property and legal fees, etc.

The opportunity cost of the extra $75,000 initial capital outlay is potentially high because it could have been better utilised in some other form of higher yielding assets. Moreover, with an ever increasing cost of living in Singapore, the extra capital outlay could have also been better used to service the living arrangement and necessities of the couple.

To analyse the disadvantage of a lower LTV limit in another way, it greatly reduces the budget of the couple to purchase a property. For example, the initial $375,000 capital outlay at 75% LTV could have bought the couple a new launch condo at around $1.5mil. However, with the reduced LTV of 70%, the $375,000 capital outlay can now only afford the couple a development worth $1.25 mil. After taking into account the additional costs such as BSD and legal fees etc, the couple is realistically only looking at buying a development worth a little more than $1.1mil. That is merely a 2 bedroom apartment near an MRT station in the RCR.

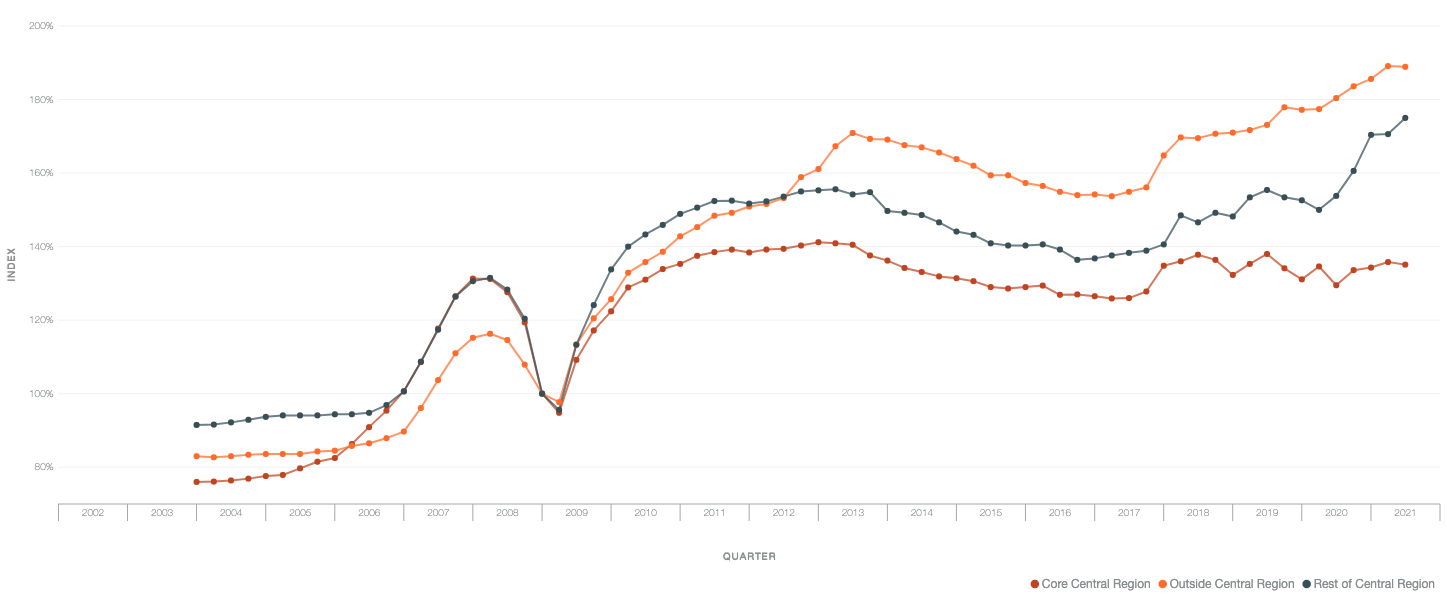

Private Non-Landed Residential Property Price Index, data courtesy Data.gov

Furthermore, let’s observe the impact of a stricter LTV limit. Looking at the private non-landed residential property price index, we can see that the tightening of LTV limit to 75% in July 2018 helped to stabilize prices in the Core Central Region (CCR), while prices in the Outside Central Region (OCR) and Rest of Central Region (RCR) increased steadily in the next few quarters. This further reinforces the fact that cooling measures such as the LTV limit only serves to stabilise the housing market, and major dip in prices rarely happens/are minimal after the implementation of multiple rounds of cooling measures. Assuming the government imposes a more stringent LTV limit of 70%, this likely means that future home buyers would have lower leverage power in an environment where property prices are steadily appreciating. This serves as a huge disadvantage especially for first time home buyers because they are now being burdened with the obligation to put down a larger down payment quantum.

2. Lower TDSR:

The TDSR is a framework to ensure borrowers are not overleveraging to buy their property. It limits the percentage of a homebuyer’s income that is permitted to be used to service their loans. The TDSR is currently sitting at 60%, which means a home buyer’s total loan obligations (everything including car loans, personal loans, credit card debts etc) cannot exceed 60% of their total gross income.

In an effort to cool down the property market, the government could impose a lower TDSR framework. What this means for home buyers is that their ability to purchase a new property is greatly reduced. Home buyers have to be more prudent in their expenditure (aka quickly pay off their student/car loan, and reduce credit card debt) to get sufficient mortgage loans. Therefore, even with a ‘dip’ in the housing market, if home buyers are unable to service the initial capital outlay requirements of their property because of a lower obtainable mortgage loan quantum, they would not be able to complete the purchase of their new property. This lower TDSR framework would certainly act as a barrier of entry for many home buyers, especially first time home buyers with limited budgets.

3. More Stringent ABSD Rates:

The main goal of the ABSD is to reduce the affordability of the purchase of subsequent properties in Singapore to deter buyers from entering the market, which lowers transaction volume. This restriction of transaction volume prevents prices from increasing further and allows the property market to cool down. The government increased the ABSD rate from 7% to 12% in 2018 for Singapore Citizens, much to the dismay of many home buyers looking to enter the market.

Nevertheless, the government could possibly be looking at further increasing the ABSD rate in the next round of cooling measures.

If you think about it, the ABSD requires buyers to first pay an additional 12% on the price tag. However, with the higher cost of ownership caused by the ABSD surcharge, it has proven to be very effective and essential for a nation like Singapore with a scarcity of land as it discourages home buyers from over leveraging and emphasises the importance of being prudent in their investments.

The decoupling strategy is becoming increasingly common these days as couples look to restructure their property ownership responsibilities to not have to incur the ABSD levy when purchasing their 2nd property. How it works is that the husband or wife would transfer full ownership of their property over to the other, leaving the other half the ability to purchase an additional property unencumbered by ABSD. However, this decoupling strategy was made impermissible by the government in 2016 for the HDB market to curb speculation and to keep public housing prices affordable.

Should I wait till the next cooling measures?

It might be rather unwise to time the market especially if you are looking for your primary residence in the Singapore market. This is because Singapore’s Property market has matured and there is a strong economic moat around it. Cooling measures add on to that moat of protection because we have been so used to the nearly 10 rounds of cooling measures since the last 10 years.

Nevertheless, a purchase decision should ultimately be made only after studying the purchase and working out the numbers and analysis for it to make sense.

Let’s take a look at a few more factors to consider:

URA Flash Estimates:

One way many investors use to discern the condition of the housing market is by monitoring the flash estimates released by URA every quarter. Although these flash estimates are somewhat accurate in reflecting the prevailing condition of the housing market, it is likely a lagging indicator and is not a full representation of the dynamic nature of the housing market. As such, it might not be the best method for investors to time their entry into the housing market. Furthermore, instead of depending on past transacted prices, we could get a better sense of the current fast paced market by observing the existing inventory in the resale and new launch market, which could help us get a better understanding of the current asking prices in the market.

En Bloc Frenzy:

The latest talk in town is that a possible en bloc frenzy is around the corner yet again.

Image courtesy Channel News Asia

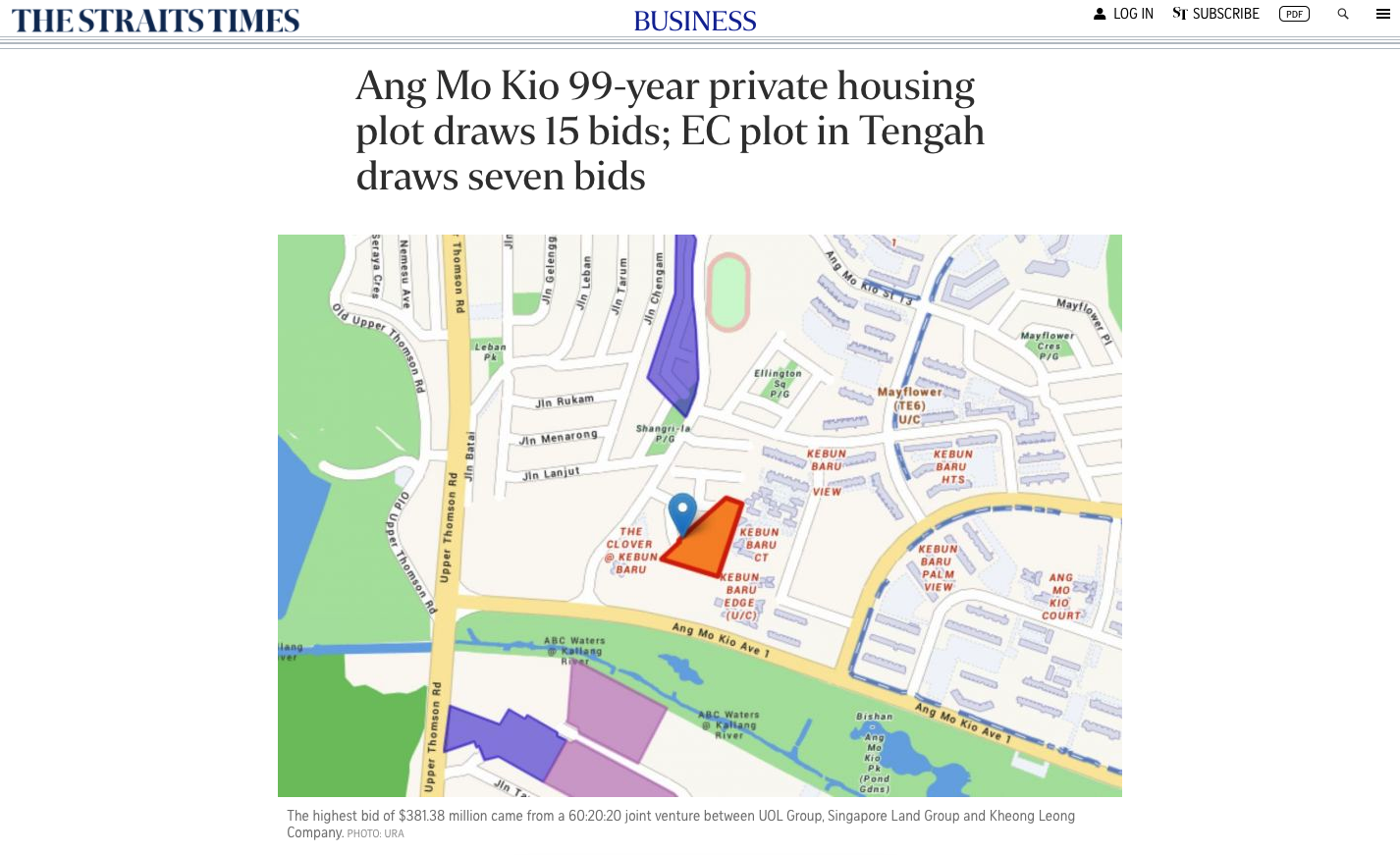

As mentioned in multiple reports and press releases, developer’s land banks are depleting quickly and there will be a high demand for vacant land by developers to replenish their land bank for development. As such, there is a high possibility of an en bloc happening again. Furthermore, it could also lead to a fierce bidding war for GLS sites, which is already taking shape right now.

Image courtesy The Straits Times

With such a high demand for land, the successful tender price for these vacant sites would certainly be on the higher side, and developers would be obligated to sell at a higher premium for it to make business sense.

Therefore, even if the government were to implement cooling measures, it would probably only slow down the market for a period of time as we have seen in the cooling measures implemented in July 2018, but not completely bring it to a halt. After waiting on the side lines and monitoring the market, buyers would start to re-enter the market once again when the situation normalises. It is about the supply and demand forces in play, and the prevailing conditions mostly point towards the fact that chances for a dip in the housing market post cooling measures are slim.

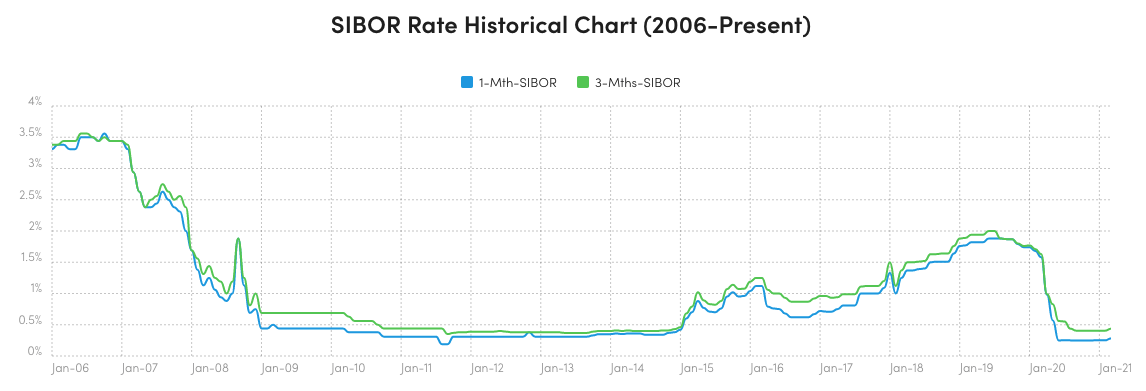

Interest Rate:

We are currently in a period where homebuyers are able to enjoy low interest rates on their mortgage. For the past year, the 3-Month SIBOR has been consistently putting up rates near all-time lows at around 0.4%, which has allowed mortgage rates in Singapore to remain one of the lowest internationally.

Historical SIBOR Rates, data courtesy moneysmart.sg

However, with talks of tapering by the US Feds shaping up, interest rates are slated to increase in tandem. Property investors might want to consider taking advantage of the low interest rate environment now because even a small percentage increase in mortgage interest rate could impact the buying appetite because buying power is different compared to when rates are lower. For example, a mere 0.5% increase in the interest rate of a typical $800,000 mortgage loan fully amortised over 30 years would cause a homebuyer to incur an extra $68,800 in interest payment. What this means for said property investor is lower profitability because the cash received upon reversion would be used to service an inflated outstanding loan balance because of a higher interest payment.

Final Words

Love it or hate it, we live in a nation where a lot of eyes are on our limited land because of the SAFE HAVEN status that Singapore has achieved over the years with our strong governance and stable economy. What’s more, real estate is one of Singaporean’s first loves.

Therefore, when planning for your primary property. Our advice is not to time the market. The old strategy of Selling, Renting and Timing the market for reentry is a thing of the past. If it’s your investment property, then it is ok to wait for an opportune moment.

But in every market and every season, there are disparities that happen and we believe that if we know how to hunt for those disparities, you can find properties that suit.

If you would like some professional guidance on property investment, we have a team of dedicated and experienced professionals who can help you here at PropertyLimBrothers. We hope this article has been insightful and stay tuned for our next one!