Leasehold vs. freehold properties – the perennial question of homebuyers buying private property. When we hear the term leasehold, there seem to be two camps of buyers: those who are relatively un-opinionated about it, and those who take personal offence when being asked if they would consider buying a leasehold condo, for instance.

While there are several factors to consider when buying one’s property, the topic of tenure is one that repeatedly surfaces time and again – especially given how emotional buying a forever home can be.

Then again, there are some homebuyers who don’t exactly see the point of freehold. These buyers find themselves deterred by the added premium, or concerned instead about other factors such as location or amenities.

Regardless of which camp you land yourself in, it’s important to have an objective, reasoned view of the pros and cons of both leasehold and freehold properties. This article might help!

A brief background on property tenure in Singapore

Before we jump right into our key benefits and disadvantages, let’s first establish understandings of the terms leasehold and freehold land.

In terms of condominium tenures in Singapore, we have the freehold, 99-year leasehold, as well as the 999-year leasehold. Buyers largely consider 999-year leasehold properties as freehold properties and the similarity in value of freehold and 999-year leasehold land reflects that.

Issued in the pre-independence era, freehold properties are buildings indefinitely owned by the owner – until he decides to sell it. In this instance, owners are considered proprietors: they own and are responsible for, both the land as well as the building itself.

However, one should be careful to note the Land Acquisition Act (1966) in Singapore, which mandates and allows for even freehold properties to be recalled by the state in the event of extraordinary circumstances. These circumstances are rare, but not impossible, when your property is sitting on land embarked for future development, such as transport works. (When land is acquired by the government, proprietors will be paid the market rate for his/her property.)

On the other hand, all Government Land Sales (GLS) sites are 99-year leasehold. In this instance, building interest and ownership reverts back to the state once the tenure expires. Owners of such properties are called subsidiary proprietors – you have a share in the land, not the land in its entirety.

Across the 2 years of 2016 and 2017, a total of 41 projects were sold en bloc. Of these, 76% were freehold while 24% were leasehold, testament to the en bloc potential of freehold properties.

What are the districts with the most freehold properties and why?

Unsurprisingly, estates that lie closer to the heart of Singapore have more freehold properties compared to those in the periphery. As explained earlier, most freehold properties in Singapore are holdover buildings from Singapore’s colonial era. With the introduction of Government Land Sales where the title of freehold land was no longer distributed, most buildings since have only been given leasehold status.

So, central Singapore, where the current prime districts are located naturally houses most of Singapore’s freehold properties.

99-year leasehold property pros and cons:

Pros:

1. Significantly cheaper

As might be expected, leasehold properties are generally sold at 10-15% cheaper than freehold properties of similar location, age and amenities. Simply put, freehold properties land themselves a premium on its price tag despite all else being held constant.

2. Higher rental yield

Along the same tune, leasehold properties also generate higher rental yield. Broken down, the formula we use for rental yield is the annual rental income divided by the total cost of the property. As tenants are, safe to say, generally unbothered by the tenure of the property, the annual rental income remains the same for both, while the price for purchase differs. This point is especially important to note for buyers who are purchasing for investment and not for personal stay.

3. Appreciating investment

Leasehold properties have at many times, proven themselves as worthy investments, appreciating beyond or selling for a higher price than freehold properties of similar standing. In a 2019 CNA report, we find leasehold condominiums appreciating by 86.7 per cent over the past decade while, freehold condominiums lag behind, at around 60.8 per cent.

Cons

1. Finite ownership

The golden years of a leasehold condo are its initial 20 years. During this period, the owner may find the price of his/her property appreciating steadily. Beyond that, as the lease starts to shorten, owners may find difficulty maintaining the high selling price. Eventually, when the 99-year lease is up – as was the case with the HDB flats at Geylang Lorong 3, the land that the property sits on eventually reverts back to the state, meaning that the value effectively goes to zero.

However, there remains a possibility of an en bloc sale for leasehold properties, which allow homeowners to cash out their properties. Developers who redevelop the land may also apply to URA to top-up the lease to a full 99 years, negating the above mentioned disadvantage. During the 2017 en bloc fever, Business Times reported that the trend has shifted and leaseholds were more popular than freeholds, even though in theory freeholds should be more desirable and were favoured in the past.

2. Loan restrictions

Aside from a finite duration of owning the land, leasehold properties may face restrictions regarding loan and CPF usage. With new laws introduced in 2019 to govern housing loans for leasehold properties, owners may find difficulty tapping into their loans and CPF funds, particularly for buildings whose remaining lease will not cover them till 95 years of age.

3. Concentrated in particular locations

As mentioned earlier, freehold properties tend to find themselves concentrated in particular locations in Singapore. If one is simply considering buying a property in a location with a lack of freehold properties (e.g. Punggol), they may find the argument of leasehold vs. freehold made redundant anyway.

4. Lease Decay

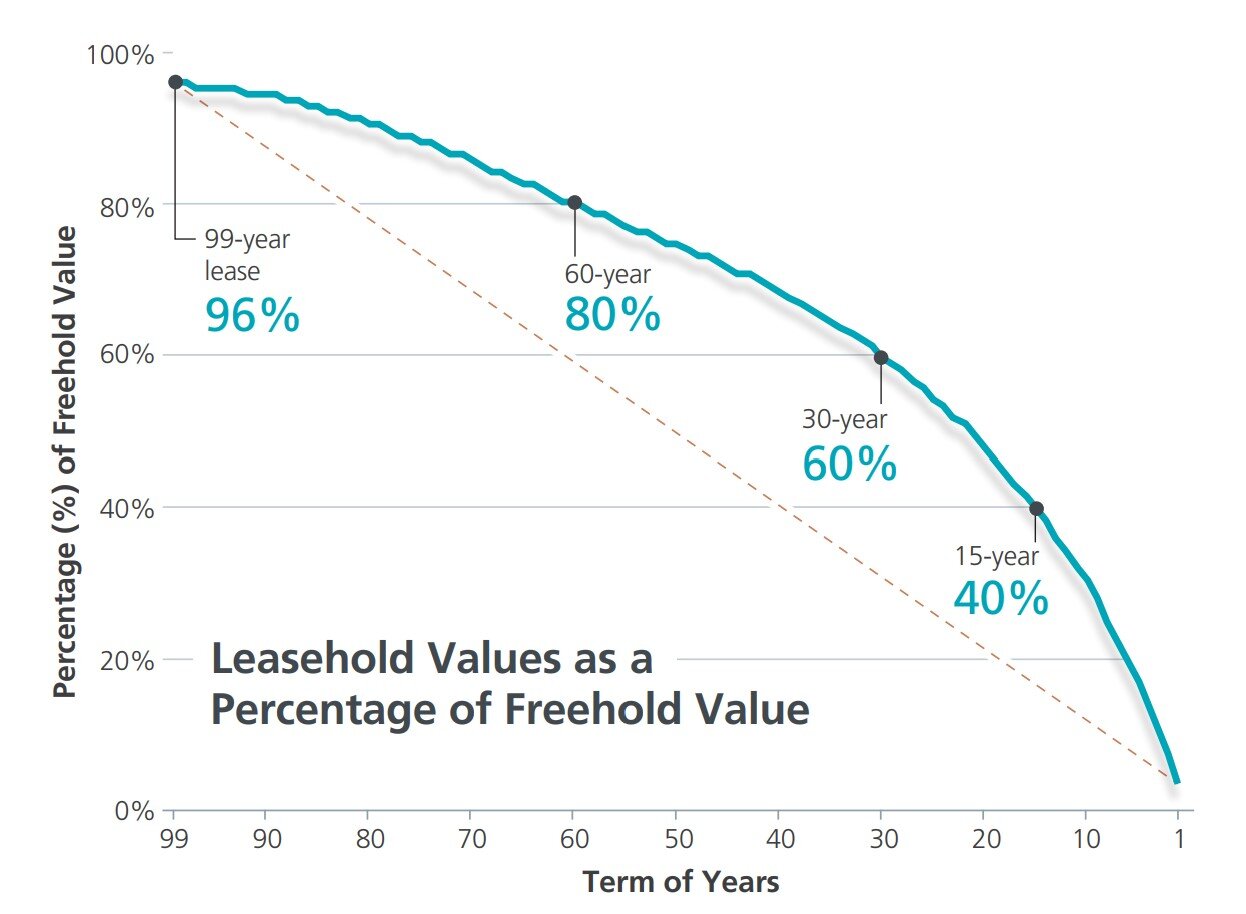

This is a major concern for projects that are nearing the end of their lease as the property value tends to depreciate more drastically over the years according to the Bala curve.

While the majority of the 99 years follow this trend, do note that there are some interesting outliers that defy this trend such as Mandarin Gardens, Neptune Court, Pine Grove, Arcadia, Hillcrest Arcadia which we will cover in a future topic.

Freehold/999-year leasehold property pros and cons:

Pros

1. The Legacy

The biggest appeal of freehold properties may very well lie in its ability to serve as a generational asset, and leave it behind for the next generation. Knowing that land values in space-scarce Singapore tend to hold their values well and appreciate over time, buyers who buy into this ideology see freehold property investments as a bequest to their lineage and pathways to true financial freedom and asset building.

2. Higher en bloc prices

Freehold properties see themselves fetching better prices during en bloc sales, which is a given since owners are after all “giving up more” than their leasehold counterparts. Furthermore, freehold properties may find themselves immune to the depreciation that comes from a shortening lease tenure, although the material value of the property itself might decline based on age and wear-and-tear of the building.

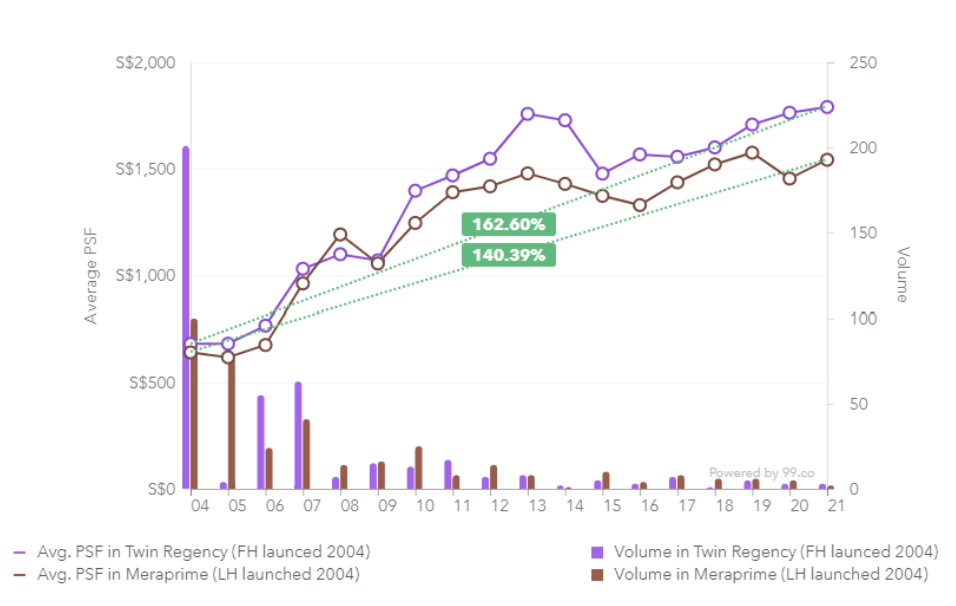

3. Scarcity value

Because freehold land is no longer released, there is scarcity value to freehold properties. Hence, freehold property owners have greater bargaining power when they resell their units in the open market, resulting in more robust and resilient prices compared to resale condos. In the below comparison between the freehold Twin Regency and the leasehold Meraprime, two condos with similar locational attributes and facilities, we discovered that the price growth of the freehold condo has outperformed its leasehold counterpart since 2004.

Source: 99.co research

Cons

1. Emotional buying

Where ownership and lineage is concerned, many of our parents’ generations and before find an allure in being able to call a property truly theirs – one that may eventually be passed down for generations to come. Yet, with rapidly changing social structures, living patterns as well as the age of globalisation, permanent ownership may, at last, be made superfluous. Here, we caution buyers of emotional buying, where they buy a freehold property with the sole intent of passing down to the next generation. While that may be a romantic idea, reality may prove otherwise, as it has for many families in the past.

2. En bloc is not a given

Although freehold condos are “easier” to en bloc, the appeal of a particular development to developers are affected by myriad factors, such as zoning laws that govern the future use of the land and state of the economy at the time. For instance, freehold properties in low-density zoned landed areas may not have as good an en bloc prospect compared to a leasehold property near a transport node. Developers may also find it more economical to bid for leasehold property and pay to top up the lease, as we saw many such instances during the last en bloc fever in 2017 and 2018. Furthermore, if you’re hoping for en bloc in a freehold development, be prepared to encounter much more resistance from your fellow residents when a motion for collective sale is held. This is simply because, for many owners, there’s no urgency to part with a freehold asset, especially if the premises are well-maintained.

3. Unforeseeable future

While one may plan for a forever home, it may not be forever when the surroundings around a property is finite. For example, a freehold property within the River Valley area boasted as unparalleled in the past, faces much larger competition today as competitors sited closer to Great World MRTs and Great World City like Riviere have appeared. In addition, newer condos also have the latest tech which a previously built freehold might not have. New launches can therefore offer an edge that an older freehold condo does not.

4. Maintenance over an ageing condo

Additionally, buyers should keep in mind that repairs cost by the Management Corporation Strata Title (MCST) are borne by occupants. With older condominiums, one can expect to face additional costs in maintenance, repair and possible upgrading. These fees are borne and split among homeowners.

Consider buying 99-year leasehold property when …

In general, one can consider buying a leasehold property if they enjoy flexibility and can appreciate market volatility. While many of the previous generations were looking to buy a forever home, many buyers on the market today are looking for greater flexibility in terms of homeownership, and may not hold a property for more than a fraction of the leasehold tenure anyway.

Because of a lower outlay leading to a higher rental yield, leasehold properties also sit well with buyers who see the property as investment, and are intending to lease it out for rental income, or sell whenever the market appreciates. Such buyers may find there are several other factors that lend themselves salient, and take precedence over tenure.

Last but not least, when the price disparity widens between your shortlisted leasehold vs that of a freehold, it might seem to be wise to buy into the leasehold given that it will be the cheaper option.

Consider buying freehold property when:

One the other hand, you can consider buying a freehold property when you want a generational asset, a forever home to be passed down as a legacy for decades to come. Homeowners who can afford the extra premium for the peace of mind, will find the freehold property largely attractive compared to the leasehold property with limited tenure.

Owners who appreciate the flexibility in terms of house structure, rental process as well as loan applications will also find freehold properties enabling these processes. Furthermore, owning a piece of land in a city with such scarce resources can feel extremely rewarding for the one looking for a home to retire in. Of course, when it comes down to pricing and the gap to a leasehold is considerably small, generally around $100,000 to $200,000, then freehold will be the obvious choice.

Not all 99-year leasehold properties are equal

At this point, it may be useful to also note that not all leasehold properties are equal. Where many leasehold properties are issued by the state, some are instead issued by certain developers. Properties such as Greenwood Mews, The Alana, The Shore Residences, universally owned by Far East Organisation, will find themselves reverted to FEO instead of the state. For such properties, the 99 year leasehold given to owners are simply carved out of the freehold/ 999 year tenure by the developer who wants to retain an interest in the land.

In this instance, buyers should beware of very limited en bloc potential of these buildings. Given that the developers will eventually regain interest of the land, buyers may never see the day where huge returns on their property arise from the windfall that is en bloc.

There may also be bigger considerations than tenure

Having extensively considered the pros and cons of each kind of tenure, it may be worthwhile now to put things into perspective. In fact, we see that some of these other factors may even take precedence and weightage in your consideration of properties.

1. Location and accessibility

“Location is king”: an adage that never goes out of style. Whether you are looking for a property to stay or invest, the location of a property forever remains the most important factor in real estate. Here, properties in prime districts, or highly accessible locations (e.g. near to an MRT station) will always attract buyers.

2. Amenities within the neighbourhood

Schools, supermarkets, gyms, parks and the like enhance our quality of life. Buyers will pay a premium to live nearer to these amenities and are always willing to pay a premium for them. Amenities

within the condo itself is also a factor that can make or break a property deal.

3. Master Plans and future developments

Equipped with knowledge from the latest URA Master Plan and upcoming developments, we can better plan for a property purchase. Future developments can have a huge implication on the resale value of a property, be it freehold or leasehold, so it’s important to know how empty plots of land is zoned in the vicinity of a prospective home. Also take note of the plot ratio, which determines the height and density of future developments.

4. Purpose of purchase

As elaborated previously, buying a property to stay and buying it as investment can entail a different set of concerns. While a freehold property may be more attractive to the buyer looking for a generational asset, the leasehold property can be cheaper, giving more flexibility to the investor or someone looking for a more short term asset.

5. Reputation of developer

Other than the general factors, you would be surprised that even the factor of developer reputation can be decisive in the purchase of a condominium, because buyers feel it determines the quality of workmanship and finishings of the completed development. A developer with the better track record might convince a buyer to choose a leasehold project over a freehold one. A developer with a track record of defects might even struggle to sell units in a subsequent development, even if it is freehold.

6. Overall real estate market

The overall economic market as well as broader factors such as cooling measures affect prices in the real estate market. While we always aim to buy low and sell high, market prices vary on the daily and statistics may not always be reliable. Although the buyer may feel inclined to price watch, we suggest general awareness and prudence in making these big decisions.

Understanding these factors help us to appreciate the heterogeneity of the real estate market – that each development is unique and different. While the statistics are revealing of general market trends and buyer motivations, they might not accurately capture the key attributes of an individual development that drive its intrinsic value up. Decisions on leasehold vs. freehold properties hence warrants a deeper study of individual properties.

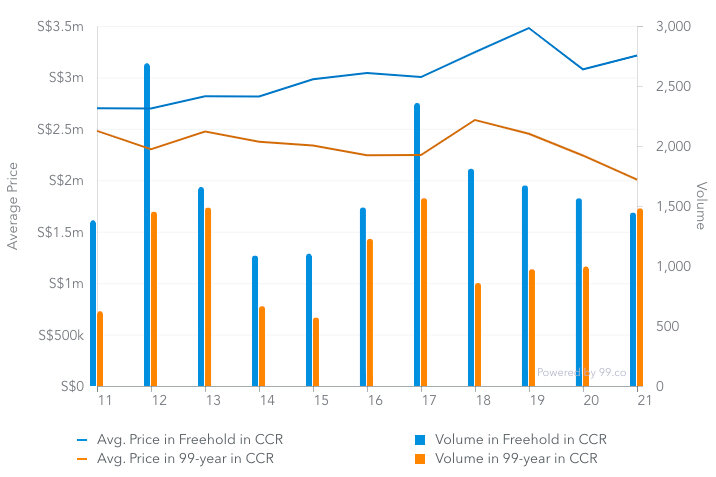

7. Volume of transactions

Ultimately, regardless if the property is a freehold or leasehold, what determines the pricing behaviour lies in the transaction volume.

Source: 99.co research

Conclusion

While tenure is an important consideration, we would be cautious to place an overly heavy weightage on any one factor when buying a property. Buying a property is a huge decision in one’s life and a fully-informed decision based on different viewpoints and considerations is merited.