The Covid-19 pandemic, or something we can refer to as a ‘Black Swan’ event, has sent shockwaves through the economy, affecting the way we work, live and play. When the government implemented the circuit breaker last April in 2020, physical viewings of properties were prohibited, show flats were shut, and construction works were halted, which led to a delay and uncompleted projects. Market sentiments were negative, and many thought the newly imposed stringent safety management measures and the raging pandemic would pose an unfavourable environment to the domestic housing market. However, the housing market defied odds and proved its resilience by producing a 5.9% YoY increase in May 2021 in the Private Non-Landed segment, all amidst one of the worst recessions in Singapore, where the GDP contracted a markedly 9.19% YoY in 2020. All these signs point towards a signal of a housing bubble, which begs the question: Will there be an impending crash in the property market anytime soon?

As with all things, the performance of any market (the Real Estate market in this context) is very much dependent on demand and supply forces. For example, when the housing supply is unable to catch up with a high demand in the market, such shortage would likely cause housing prices to increase rapidly. Inversely, the reverse can be said for when there is a surplus of housing, where prices would likely drop. Before we arrive at our conclusion of whether the market will crash, let’s first take a closer look at the various supply and demand forces currently in play in the domestic Real Estate market:

US Federal Reserve Quantitative Easing

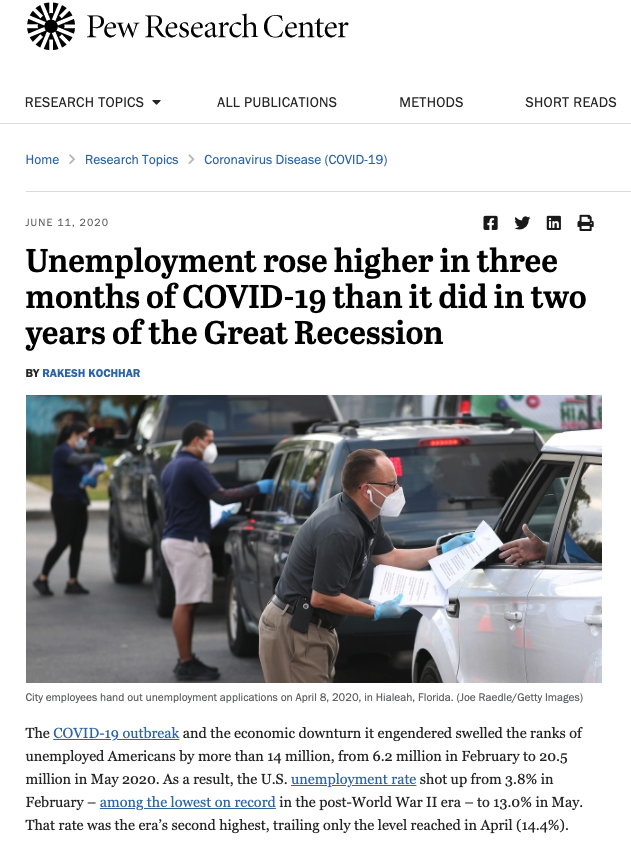

Image courtesy Pew Research Center

The US economy was badly hit by the pandemic, with unemployment rates hitting as high as 14%, causing the economy to fall into a deep recession. Therefore, to rejuvenate the economy, the Federal Reserve decided to roll out Quantitative Easing efforts (also known as open market purchase) by injecting money into the economy.

If this is your first time hearing about Quantitative Easing, fret not! It is basically a monetary policy in which the Central Bank ‘prints money’ and buys government securities from commercial banks and institutions, with the main goal of injecting money into the banking system. This increased money supply would then be loaned out to businesses and individuals, which puts a downward pressure on interest rates, ultimately keeping it low. This boosts the economy because businesses and individuals have more money to spend, which eventually improves the economy and encourages low unemployment. At the time of publication, the US Feds have also announced that it would keep its benchmark interest rate close to zero, meaning cost of borrowing would remain low.

Now you might be wondering: what does the US economy have to do with the property market in Singapore? Unlike other countries where lending rates are typically dictated by the central bank, interest rates in Singapore are determined by the Singapore Interbank Offered Rate (SIBOR), which is largely affected by interest rate movements in the US, which ultimately affects the local mortgage lending rates. With the US Feds announcing interest rates to remain low in the near future, mortgage rates will likely remain at lows too. This means homeowners can reduce the interest payments on their mortgage by refinancing or repricing. Consequently, we could see a trend of potential home buyers capitalising on this by gearing up with a lower cost of borrowing. Foreign investors looking to park their funds elsewhere would also look to invest in Singapore’s Real Estate market. All these would increase the demand for housing locally, while reducing the risk of defaults of homeowners, which bodes well for the already stable housing market in Singapore.

We are now in a low interest rate environment globally, but with the roll out of vaccines and as the global economy slowly recovers, interest rates cannot remain low forever. A further introduction of Quantitative Easing and Expansionary Monetary policy will eventually lead to a high level of inflation and cost of living will be too high. A tapering mechanism will undoubtedly then be put in place, which raises interest rates and causes lesser investments because of a higher cost of financing. As such, mortgage rates in Singapore would increase, and home buyers/investors would be less incentivised to purchase property. This lower demand will cause prices to drop back down.

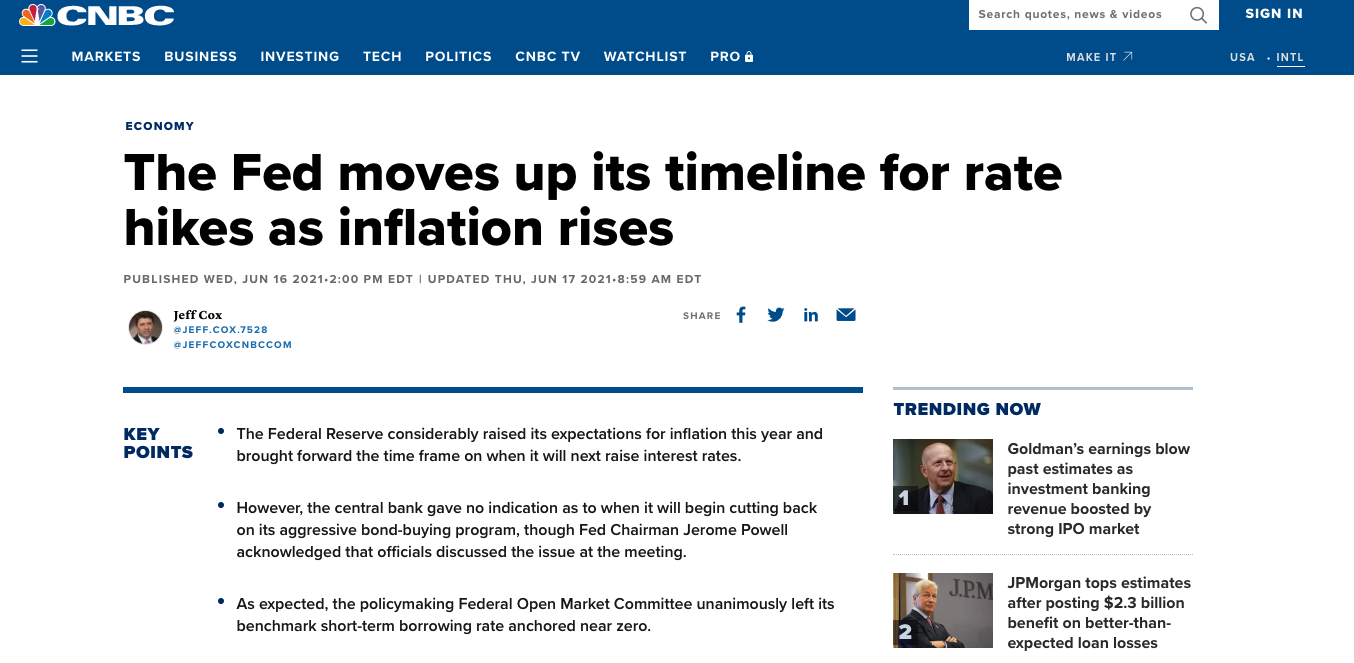

Image courtesy CNBC

This tapering mechanism is already in the works – as at time of publication, the US Federal Reserve Chairman Jerome Powell announced that interest rate hike can be expected as early as 2023.

As such, because of the spillover effect of Quantitative Easing and Monetary Policies in the US, we can expect the housing market locally to trend upwards in the near short term, only for it to increase at a slower rate in the long term as tapering slowly kicks in, causing decreasing money supply and deflation in the economy, and contractionary monetary policy kicking in which increases interest rates, which acts as a deterrence to loan.

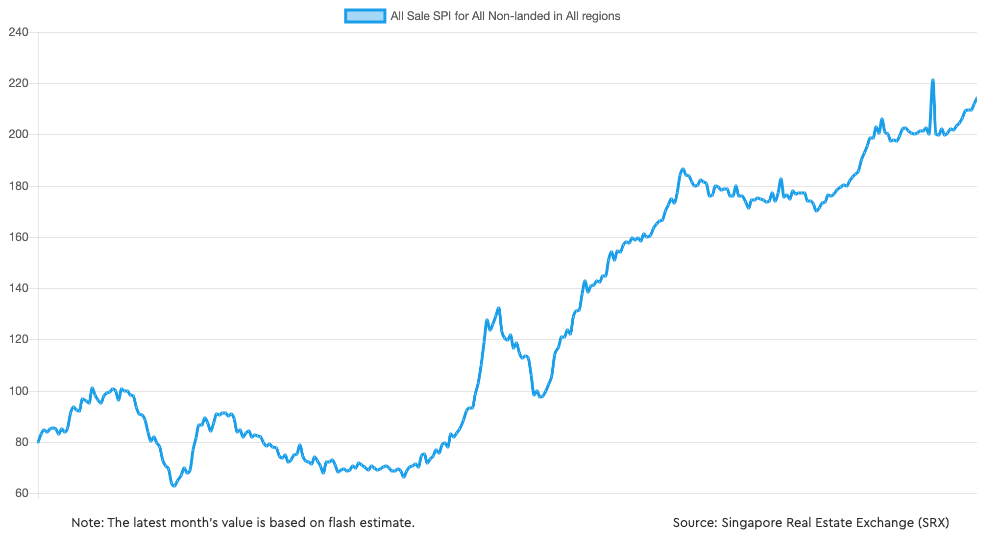

Stability of Singapore’s Housing Market

Singapore has always been known for its stable housing market. In this round of recession caused by the pandemic, the domestic property market proved its resilience, which could be because of the rollout of measures by the government which helped to secure jobs and build market confidence.

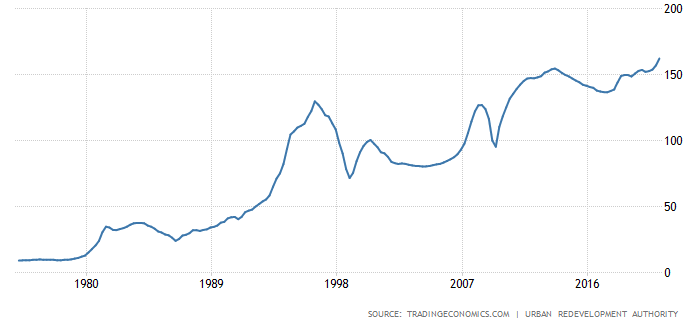

Singapore Property Price Index Courtesy Trading Economics

In the past three recessions, the property price index dipped 11-36%, but in 2020, the government was quick in rolling out a series of supplementary budgets and different measures, which led to the absence of major foreclosures in 2020.

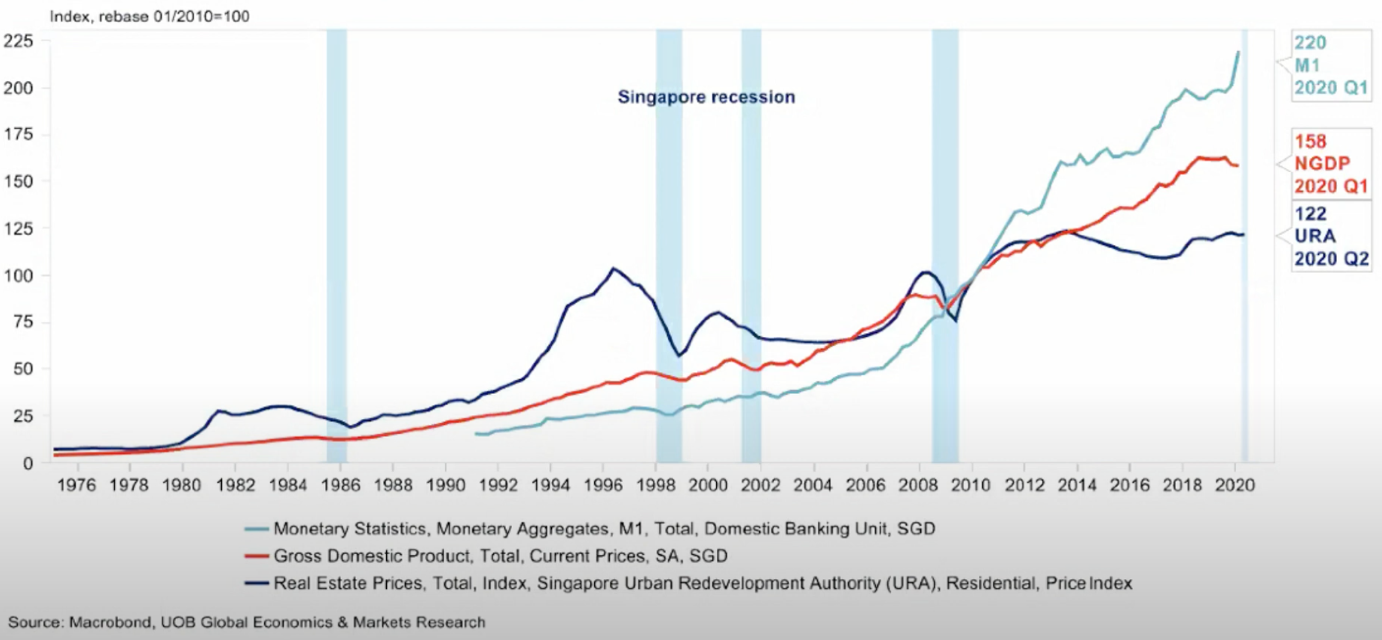

Property Price index vs Nominal GDP vs Liquid Assets chart courtesy Macrobond, UOB Global Economics & Market Research

Based on historical trends, prior to a recession, whenever the property market increases at a faster rate than the GDP, a housing market bubble is created and prices crash/corrects back down close to the Singapore GDP level during a recession. However, prior to the recession caused by the pandemic, the housing market was growing at the same rate as the economy from 2010 to 2014, then stagnated and was even in a short downtrend thereafter as the economy grew. This showed that the housing market technically ‘crashed’ before the current recession, so it is quite unlikely for us to see a crash in the housing market unless the economy declines below the property price index like how it was in the last three recessions.

Moreover, another important factor we have to consider is the ability of property owners to service their mortgage obligations. The liquid assets Singaporeans have on hand (depicted by the light blue line in the graph above) have risen faster than both the GDP and PPI from 2011, which indicates that Singaporeans in general are more financially prepared as compared to the last three recessions. This is one of the primary reasons why the property market in Singapore remains stable because property owners have the means to service their mortgage payments, which decreases the risks of defaults.

Singapore as a safe haven

Singapore is known for its transparency, political stability, and ease of doing business, which are all factors businesses look for in an investment destination. Furthermore, there are various government policies to support the creation and growth of industries and businesses, including the start-up ecosystem. As such, Singapore is often viewed as a top investment destination and is quickly evolving into a critical regional base for foreign businesses because of its developed financial and legal system. It is also well known for being a tax haven, and is home to 46% of Asian regional headquarters. Singapore is also an attractive country to set up shop for tech firms looking for a hub to address the South East Asia market, especially because of its highly educated, tech savvy and multilingual workforce.

The Real Estate market in Singapore is robust, which makes property a low risk collateral for banks to keep interest rates low. Therefore, home buyers both locally and abroad would likely be looking to capitalize on this.

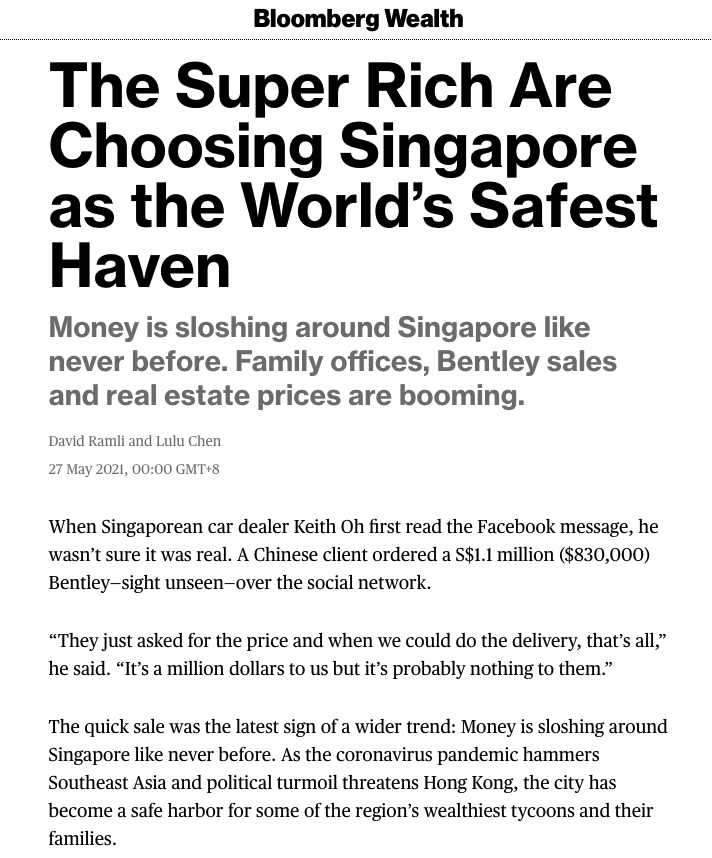

Image courtesy Bloomberg Wealth

Moreover, with the economic instability in their domestic country, foreign investors are also looking into investing in Singapore Real Estate as a safe haven for wealth preservation.

So it comes as no surprise that some of the world’s wealthiest and highly educated would want to live and work in Singapore, thus driving up demand in the housing market.

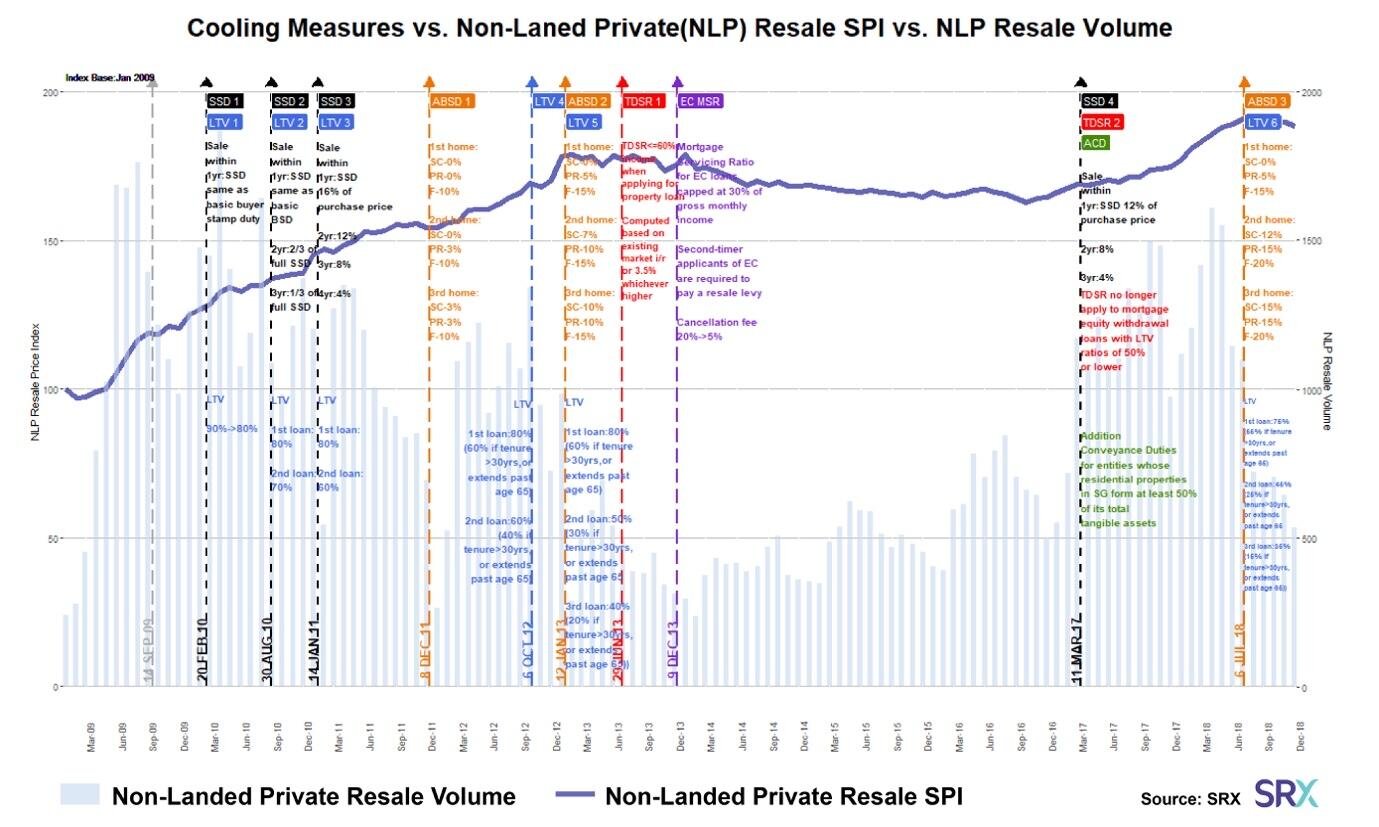

Cooling Measures

As we know, with land being a scarce resource in Singapore, it further highlights the importance of striking a balance between the affordability and competitiveness of the housing market. Case in point: Hong Kong’s expensive housing market. Singapore and Hong Kong are very similar in their dynamics; both are densely populated with high rise public housing being a major component in its housing market. However, the housing market in Hong Kong has reached a point where the highly inflated prices are showing no signs of retracement, even with several attempts of putting cooling measures in place. Even a parking space located in an affluent residential development was sold for a ludicrous HKD$10.2mil . How crazy is that!

The housing market in Singapore has seen steady growth over the past few decades, and the success is largely attributed to the government’s efforts in implementing cooling measures whenever necessary.

The introduction of cooling measures such as Buyer/Seller Stamp Duty (BSD/SSD), Additional Buyer Stamp Duty (ABSD), Total Debt Servicing Ratio (TDSR) and Minimum Occupation Period (MOP) (and many others) not only forces buyers to be more judicious when taking up loans which reduces mortgage default rates, it also plays a big part in deterring property investors from flipping houses for short term gains. Moreover, with the ABSD in effect, property owners looking to upgrade would have to sell off their existing property first to avoid incurring ABSD, which further contributes to the overall transaction of the property market.

Of course, there will always be a few savvy investors who are able to circumvent the system, but ultimately, the cooling measures put in place are pivotal in influencing the housing market in Singapore because it stops profit seekers from jacking prices up, making the property market more stable, which is one of the key appeals to HNWI and UNWI both locally and internationally seeking Real Estate as a good form of wealth preservation.

Calibrated Confirmed Government Land Sales Release

The Government Land Sales (GLS) program is the official alienation of state land to the public for development, which facilitates the implementation of the Concept Plan and Master Plan. Each GLS is carefully calibrated according to the nation’s needs and is announced every six months, and GLS sites are released either through the Confirmed List or Reserve List. The GLS also plays an essential role in determining the price point of property in Singapore.

With the pent-up demand accumulated over the lockdown period, the government has carefully calibrated the supply of private housing in the 2H2021 GLS Program, by moderately increasing the supply of private housing on the confirmed list to 2000 units for the 2H2021 GLS Program, up from 1605 units in the 1H2021 GLS. This is done in response to the declining level of unsold inventory of private housing units over the past year amidst strong demand. These all point towards a strong competition for vacant land by developers, which ultimately drives up tender prices for future GLS releases, as seen from the bidding war for a 99-year leasehold residential site in Ang Mo Kio Avenue 1 which attracted 15 bids. To put this in simpler terms, buyers can expect future new launch developments and possibly resale units to transact at a higher price, because developers have to now charge a premium on their more expensive plot of vacant land.

Possible En Bloc Frenzy

The unsold supply of developers has been falling steadily from its peak of 37,799 units in Q1 2019 to 24,341 units in Q4 2020. A continuation of this rate will see inventory levels fall below 20,000 by the 2nd half of 2021. Developers need land to build more inventory for sale, and the last time inventory levels depleted below 23,300 units marked the start of an en bloc cycle in 2016. These all led to many speculating the rekindling of an en bloc frenzy.

Furthermore, with resale property prices starting to creep up to the price range of new launch condos because of its high transaction volume, buyers might feel more inclined to buy new launch condos, sometimes even the balanced units, because of its inherent value, which increases the confidence of developers of the demand for new development. This would incentivize developers to replenish their depleting land bank. Since the government is moderating the release of state land through the GLS program, developers would start throwing cash at existing condo owners and increase their land bank by way of en bloc.

With prices of Private Non-Landed Residential properties near highs, valuation of land at such places would be high. Moreover, coupled with the rising cost of manpower, material, and construction, developers would have to price their eventual new launch at a higher quantum, and we can thus expect housing prices locally to possibly be on a further uptrend in the near future.

Prevailing Market Sentiment

We have observed various patterns forming in the housing market, particularly caused by the pandemic. For example, amidst the recession caused by the pandemic when everyone is cash strapped, most of the buyers participating in the domestic Real Estate market are those with a longer term view who already have the funds, ready to take advantage of the positive outlook of the market. These are investors looking to capitalise on the low interest rate environment and also to keep Real Estate in Singapore as a good store of value. Therefore, it is unlikely that such buyers are over-leveraging, so there are lesser risks of defaults and a Real Estate bubble forming. Furthermore, with the pandemic exposing the financial readiness of locals, we are seeing families who are better prepared choosing to put their HDB flats up for sale and upgrading to private housing, while families who are badly affected would downgrade from a private property to an HDB resale flat.

The living arrangements of many have also been disrupted because of the pandemic, with the most prominent one being the delay of construction of BTO flats. A BTO flat usually takes around 5-6 years to construct, and with the delay of construction, many newly-wed couples have decided to opt for a resale HDB flat instead because it is too long a waiting period to move into their matrimonial home. Furthermore, with an impending influx of BTO flats reaching its MOP date later this year, we can expect a high transaction volume from these owners looking to profit off their apartment. With these owners having earned their “first pot of gold”, they would likely be seeking to upgrade to a private property, all of which would add to the overall transaction volume, and push prices in the housing market upwards.

Looking Forward

The prevailing market signals mostly point towards a stable housing market in Singapore, and a possible further uptrend in property prices is poised to sustain in the long term outlook. The housing market has also shown historical resilience during economic downturns and during times of financial market depression. However, with many countries still experiencing low vaccination rates and shortages, it is still uncertain what the future holds with the global economy hanging by a thread. Regional uncertainty still stands in the way as the global economy gradually recovers from the pandemic induced economic shockwaves.

Feel free to contact us for a consultation if you are still worried about the future outlook of the housing market, or if you are looking to reconsider the feasibility of your next investment!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.

PLB On Telegram

Home tours and property news — straight to your device.

Insights On Telegram

Fresh articles, market trends and news — right to your device.

Subscribe to our YouTube Channel

PLB Newsletter

Stay up to date with the latest property news and development

The PLB Seller Experience