There is no doubt that positive cash flow is one of the biggest motivating factors why Real Estate remains a mainstay in many investor’s portfolios. It is indeed a joyous occasion when an investment property generates high rental yield and an investor gets to sit back and reap the benefits of positive cash flow. But what happens when that is not the case? In this article, we set out to explore why Real Estate is still a viable investment option even when there is no positive cash flow from rental every month.

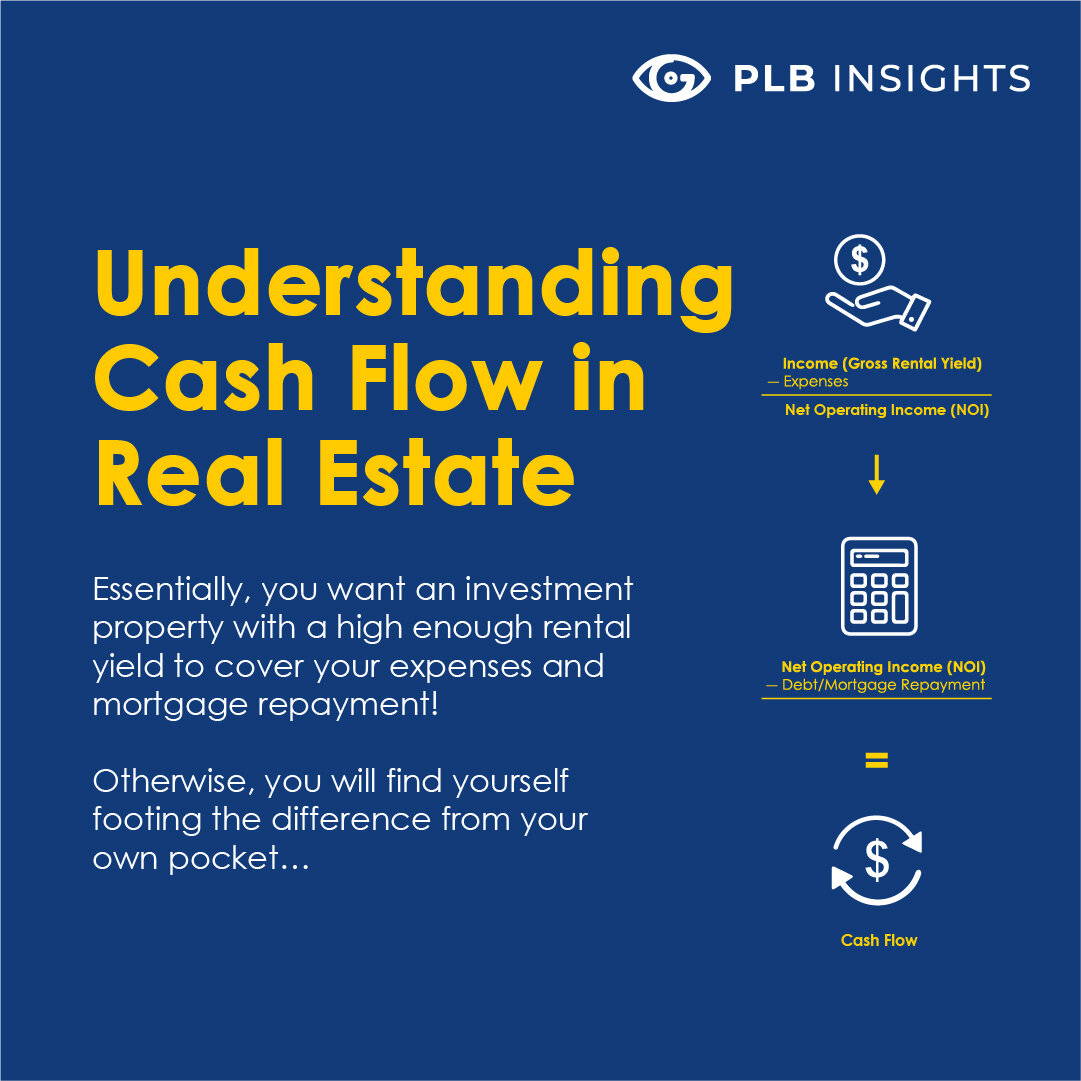

Understanding Cash Flow in Real Estate

It is paramount that we first understand what cashflow in Real Estate really is, its underlying components, and scenarios where negative cash flow could occur. Simply put, cash flow is the total amount of money you have left after deducting expenses and mortgage repayments from your income.

Income

Monthly income can be generated usually from renting out your investment property. The amount of income you can receive varies depending on many factors, such as the prevailing market condition, location, and upkeep and size of your investment property. Negative cash flow usually occurs when income generated is not high enough to cover other costs and expenses incurred on the investment property.

Expenses

Additional expenses will be incurred monthly to ensure the maintenance and upkeep of the investment property. These come in the form of maintenance fees, costs of upgrades and repairs, other miscellaneous costs, and even potential defaults on rents. There is also a need to account for the expense incurred in cases of vacancy in the investment property. A high amount of expense is usually the main culprit for a negative cash flow.

Net Operating Income (NOI)

The net operating income is exactly what it seems. It is the net income left after deducting expenses. The net operating income of the investment property is subjected to income tax at varying rates based on the annual value of the property and also whether you are an owner-occupier or non-owner-occupier.

Debt/Mortgage Repayment

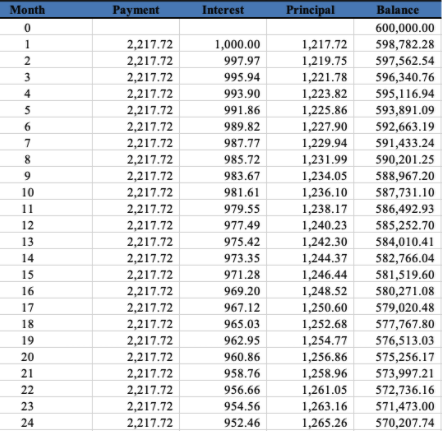

One great advantage of Real Estate investment is that an investor is able to finance the purchase of their property through a mortgage loan. However that also means that a sizeable proportion of the NOI is deducted every month for mortgage repayment. Interestingly enough, especially for Adjustable Rate Mortgages (which is the most common mortgage product in Singapore), even though your mortgage repayment amount is roughly the same every month, mortgage interest will be the highest in the beginning periods of the mortgage loan. On the contrary, principal payment increases as the mortgage matures. Below is an example of the mortgage schedule of a typical $600,000 home loan at 2% amortized over 30 years.

However, sometimes you can also put extra money toward the principal every month if there are no stipulated prepayment penalties in your mortgage arrangement. Therefore it is important to understand what you are getting yourself into when choosing a mortgage product to finance your property purchase! We have collated an updated list of mortgage products offered by various banks here.

So why still invest in Real Estate?

Now that we have established a clear understanding of cash flow in Real Estate and various scenarios where cash flow would be negative, why should we still invest in Real Estate even though there is no positive cash flow from rental every month?

Inflation might your best friend

Contrary to popular belief, inflation can actually be beneficial, especially if you are holding good debts like a mortgage in real estate. However, what is a good debt, and why is it important?

Definition of Good Debt

A good debt is identified as the use of leverage to acquire assets with cash flow generating potential; after all, “It takes money to make money”. Essentially, an investor possessing good debt is basically “using other people’s money” to amass assets that could help to build wealth and increase income in the long term. Examples of good debt include a business loan, mortgage, and even a student loan (very controversial, but this is a topic for another time!)

Inflation eroding Good debt(mortgage), but can this actually happen?

It may come as a surprise to many to find out that inflation actually erodes debt in the long term. But how is this so? The core principle of inflation is that it causes the value of a currency to decline over time. Essentially, the money you have now is worth more than the money you have down the road. In other words, inflation allows debtors to pay lenders back with money that is worth less than it was when they originally borrowed it. This is possible because of the lower purchasing power through time, which explains the difference in nominal versus real value of currency. What this means for Real Estate investors is that over the long term, assuming that the median interest rates averages out through the tenure of their mortgage, their mortgage loan could potentially be eroded by inflation, and they technically pay a lesser amount.

Moreover, when inflation causes prices to hike, the demand for credit increases, which bodes well for lenders, and also investors seeking a mortgage loan. Lenders are more willing to lend money to home buyers because it is less risky, especially with the stabilised property market in Singapore, and also because they are able to use the underlying property as collateral. Higher prices caused by inflation also give owners of investment properties an opportunity to increase their rents. Therefore they could potentially enjoy positive cash flow in the future as things become more expensive over time. This is evident from the fact that the rental market in Singapore remains competitive even in an environment of rapidly increasing inflation rate, which is expected to increase even more throughout the year.

Building equity and Low-Risk Leverage

Leveraging, or popularly coined as “using other people’s money” to invest in Real Estate, is an instrument favoured by investors to generate returns on their Real Estate investments. The robustness of the Real Estate market in Singapore makes properties a low-risk collateral for banks, which allows home loan rates in Singapore to be significantly lower than that in other countries. This further caters to the low risk appetite of Real Estate investors locally.

The mortgage rates in Singapore have an average of slightly more than 1%. With headline inflation standing at 1.3% locally as at April 2021, and expectations for inflation to rise to as high as 2.7%, it works to the advantage of investors seeking a mortgage loan.

Furthermore, every time you pay down your principal, you are building equity (think of equity like money in your “Real Estate piggy bank”) and you are getting a return. The collected rental will pay towards your mortgage loan. After the mortgage loan has been paid off, you own the underlying property free and clear having only paid a down payment, which is only a very small proportion of the total purchase price. Therefore, no positive cash flow from rental is not a bad thing after all because with little to no cash forked out from your own pocket, you’re eventually building towards your investment.

CPF as an added benefit for Mortgage payment

As we know, the CPF is a mandatory comprehensive savings and pension plan for working Singaporeans, and it is funded by employers and employees. Many Singaporeans have a considerably large reservoir of savings in their CPF Ordinary Account. However, other than earning a fixed yearly interest, the only time when the CPF account can be fully utilised is when being used to buy a property, or to service monthly mortgage obligations. Let’s take a look at an example below to see why CPF bodes well for Real Estate investments even when there is no positive cash flow from rental:

Image courtesy Property Science

Let’s say a couple (decoupled to avoid paying ABSD) buys a new launch condo at an asking price of $1.8 mil under the name of the wife. Details of the wife are as such:

Age: 40 Years old

Monthly Salary $12,000

CPF OA account balance: $500,000

Cash Savings: $300,000

Mortgage loan:

-

25 Years

-

1.3% interest rate

-

Monthly payment and fully amortised

To purchase the new-launch investment property, the wife can finance up to 75% of the purchase price through a mortgage loan, and only has to pay a 5% Cash down payment. The remaining 20% of the purchase price can then be financed through her CPF OA account. In doing so, she would have to pay in total $444,600 in CPF monies, $90,000 in cash, and take out a bank loan of $990,000 with monthly mortgage repayment of $3,867 (of which $1,260 is payable via CPF and the remaining $2,607 topped up by cash). Given the current positive market sentiments for private non-landed residential properties, even if appreciation is negligible, and assuming that the investment property yields a negative monthly cash flow of $742.27, she would still be able to generate a 10.9% Cash on Cash return annually when she sells off the property in 5 years’ time. This phenomenon is only possible because the utilization of her CPF helps to reduce her required initial cash outlay, and that the rental income generated could be used to cover her mortgage interests, while building her equity through payment towards the principal.

To put this in simpler terms, sometimes even with a negative monthly cash flow, it could still be much more profitable to utilise your CPF OA account for a residential investment project, as compared to leaving your hard earned money sitting in the CPF OA account accruing only 2.5% return.

However, these are assumptions merely based on current market sentiments and are not fully reflective of the performance of the housing market in the future. Investors need to do the proper due diligence, identify the property that best suits their risk appetite, and ensure that they are not over-leveraging!

Opportunity for Growth

One big advantage of owning Real Estate as an asset is that investors have the ability to influence the performance of their investments. An investment property generating negative cash flow can still be a viable investment if it has the potential for capital growth. Similar to the example above, you can often find negative cash flow properties in areas with high potential for appreciation in the future. Moreover, investors could opt to redecorate and renovate to rejuvenate their investment property, which could in turn increase their rental income in the long run.

Furthermore, an investment property yielding negative cash flow is not a death sentence. There are many things an investor can do to improve their cash flow. For example:

One big advantage of owning Real Estate as an asset is that investors have the ability to influence the performance of their investments. An investment property generating negative cash flow can still be a viable investment if it has the potential for capital growth. Similar to the example above, you can often find negative cash flow properties in areas with high potential for appreciation in the future. Moreover, investors could opt to redecorate and renovate to rejuvenate their investment property, which could in turn increase their rental income in the long run.

Furthermore, an investment property yielding negative cash flow is not a death sentence. There are many things an investor can do to improve their cash flow. For example:

Final Words

As the old adage goes, “Inflation takes from the ignorant, and gives to the well informed.” Saving accumulates wealth, but investments grow it. An investment property is an unique asset class which exemplifies the power of leverage and has many appealing inherent attributes that many other asset classes do not possess. After all, the ultimate goal of an investment property is to build equity by having rental income servicing the interest and principal payments towards the mortgage. There is a reason why the wealthiest in the world amassed their fortune through Real Estate! Therefore, a negative yield in monthly cash flow is merely a short term problem, and could be a sign of a big potential for growth. If investors are savvy enough to tweak their Real Estate investment strategy accordingly, it is only a matter of time before cash flow starts improving.

On that note, we urge potential buyers to not throw caution to the wind and invest in a property hastily without doing the proper due diligence. Investing in the housing market calls for financial prudency because with Real Estate being an illiquid asset class, it is easier to buy than to sell. One wrong purchase decision without a proper exit strategy could prove to be a very costly mistake!

Still mulling over the feasibility of an investment property? Fret not! Feel free to check out our updated and in-depth property investors’ guide here, or contact us for a consultation to go over your next big move!