In the earlier article relating to the Population Census 2020, we spoke of the effects on different aspects of the Population Census relating to the Property Market. The general trend across Public and Private Housing, the underlying driver of the Property Market with increased earning power, how ageing affects buying power and implications of a well-connected city. In this article, we will further expand on the specific trends of each Micro-Segment.

Where are some of the considerations for the next 10 Years?

After interpreting the JUICY statistics in our first article, let us share our JUICY Insights for the future.

2021

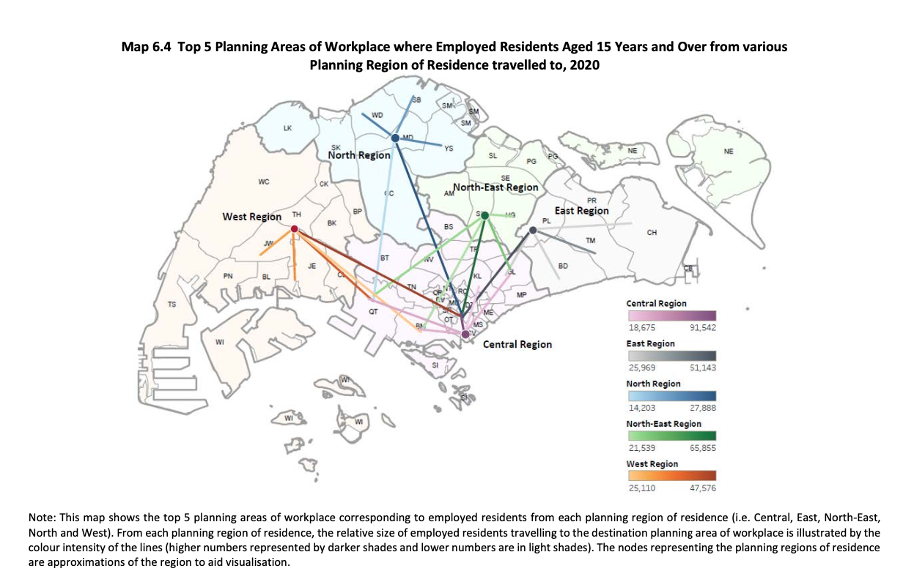

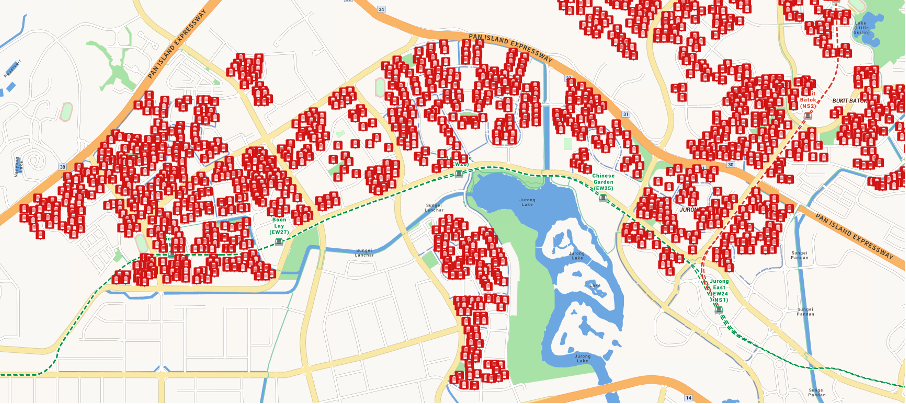

According to the Census, the Top 3 areas where residents work are the Downtown Core, Queenstown, followed by Geylang. From the map above, the darkest shaded lines from each region skew towards the Downtown Core; considering it is THE Central Business District (CBD), most businesses are still housed within the already dense concrete jungle. However, with the decentralisation of the CBD, we expect a different climate in the coming years.

Queenstown is the next on the list, housing the next most prominent business district, one-North, which started development in 2001. Queenstown is a testament to the possibility of decentralising the CBD with its current standing of the 2nd Top area where residents work. Since its inauguration in 2001, when it was designed as a business park and high-tech R&D hub, many notable companies and developments are housed in the 200ha space. It now houses Shopee, A*STAR, P&G, The Walt Disney Company (Southeast Asia), Canon, Garena, Ubisoft, our largest media broadcaster (MediaCorp Campus) and recently Razer. Although one-North is fundamentally different from the Downtown Core in terms of the businesses it seeks to house, it just goes to show the ability to move the CBD out of the Central area with purposeful development.

The bronze medal in the list is Geylang, without surprise, where commercial and industrial developments are abundant, from office spaces to factories & warehouses. The planning area of Geylang includes Aljunied, Kallang Way, MacPherson, Geylang East (Paya Lebar to Eunos Station), Kampong Ubi. The business district of Paya Lebar essentially offers a glimpse into the crystal ball of what the Jurong Lake District will likely be. Consolidation of commercial and industrial facilities on one side, while an abundance of housing surrounding the area. Having a mix of administrative offices to production capabilities in factories and the ability for logistical operations, all working hand in hand to complement each sector of operation.

However, we have noticed a significant lack of public housing in the Geylang Planning Area. Albeit there is a good number of private residential developments, from boutique apartments to Condominium compounds. In contrast, with an abundance of public housing on one side and the consolidation of commercial & industrial spaces on the other, will Jurong Lake District be a preference for companies to start shifting to the west? Considering that there is more affordable housing, it will be easier to attract workers in that area with shorter travelling times. At the same time, being nearer to the Second-Link Causeway and the future consolidation of PSA ports means more effortless logistical movements for companies. Although it is unlikely that ALL businesses will move towards the west, we believe there will definitely be an increased demand for houses in the west area for residents who are looking to reduce the time spent on their daily commute.

Crystal Ball

The problem with statistics is that they are always historical, but what we like to concern ourselves with are forward-looking matters. The Singapore Government plans for more MRT stations within 10 minutes of walking distance and to reduce the time spent commuting each day and ease congestion in each transport system. 2 MRT lines and the expansion of the existing East-West line to reach Tuas have been completed since 2010, which has caused the increase in public transport usage/preferences. With the completion of another 3 MRT lines, this preference will continue to expand, as increased accessibility will no longer justify the convenience of a private vehicle in commuting to the office.

The increased connectivity will prove to be a dilemma for investors looking to buy into popular 99-year leaseholds developments that offer tenants excellent connectivity. When everywhere is “near MRT”, where should you look to invest your money to be of top consideration in a competitive rental market? Investors should look for areas where the developments have a niche offering of amenities or even spacious units that could be “extra value” for tenants in order to improve rental yield. For those looking for Capital Gain in their own-stay unit, while similar factors should be considered, more should be regarded when finally committing to the down-payment. Proximity to integrated hubs and better-connected stations would definitely out-shine stand-alone stations. Areas where there are plenty of options for lifestyle activities would be on the rise with the emphasis that the COVID-19 Pandemic has brought about.

The Perfect Example

From the recent sales of The Reef at King’s Dock, which sold over 90% of 300 units offered over its launch weekend, the preference for these factors is well highlighted. While waterfront living is no longer a novelty, the project jointly developed by Mapletree and Keppel Land has many “Checkboxes” of a good development. Excellent connectivity with 3 MRT lines, the future completion of the “Circle” Line, a bus terminal which has the possibility of transformation into an integrated hub, an abundance of amenities with 2 malls, niche offering of facilities (First Underwater Sanctuary in Singapore) and a good spread of unit variation. All these factors combined will help entice buyers to pay a premium to achieve their lifestyle and Property goals.

While the Reef at King’s Dock is a luxury consideration, and it may seem like there is a sea of factors for Property decisions, the Key fundamental is deciding the purpose of the Property. The purpose behind the Property will help ease the number of considerations needed, help with budget planning and suitability of each lifestyle. In the following segments, we will look at the specifics of each micro-segment that can help you navigate your property decision, be it Public Housing, upgrading to the Private Property Market or even future-proofing/estate planning with Landed Housing.

Public Housing Market — HDB

In our previous article, we spoke a little about the increase of 1- & 2- Room flats and 4-Room flats households. While we understand the primary shift to 1- & 2- Room flats, the increase in 4-Room flats and decrease in 5-Room flats may leave some wondering, why is there a shift in these categories? The older generation probably always held the concept that 5-Rooms are “better” than 4-Rooms in a certain sense, because of its size and during our parent’s era, the 5-Room flats are seen as more of a premium option.

The shift in these numbers has been a deliberate effort by the Government. Attributing it to space constraints, HDB launched 9,273 4-Room BTO flats in central mature estates since 2015 and only 642 5-Room flats were offered up in the same timeframe. In the exact words of HDB and from an article by The Straits Times in September 2020, “Land for new housing in these areas is limited. Hence, more four-room and smaller BTO flats are provided to allow more families to live closer to the city.”

Our local property portal 99.co also wrote a follow-up article on The REAL reasons why HDB doesn’t build new five-room BTO flats in central areas. While we see merit in the two different outlets, we at PLB would like to concern ourselves more with the hands we can play with the cards we have been dealt rather than faulting the dealer. Before we conclude, let’s take a look at a more recent piece of news.

Limiting Paper Gains

The Minister of National Development, Desmond Lee, recently talked about the obstacles and the possible implications surrounding Prime Flats (public housing in prime locations) in a virtual public engagement session. The areas mentioned were the level of affordability, the eligibility criteria, the balloting process, and these flats’ profitability. Amongst the suggestions, there were mentions of a more extended minimum occupation period than the current five years and a tiered system for the Government to recover the additional subsidies when the flats are sold (Perhaps to moderate the profits from the sale of these flats). However, he also mentioned that the revised Public Housing model would not be retroactively applied to existing flat owners but applicable to future public housing in prime locations.

This dialogue was held amidst the current climate of Million-Dollar Resale HDBs, which is seen as a contradiction to the current Public Housing policy and the rising Resale Price Index (RPI) at the point of peaking. It seems almost inevitable that the Government will release a new framework to “cool” the current HDB market and to continue the principle of ensuring affordability in Public Housing. Whatever it entails, be it additional subsidies or longer MOPs, we will not be able to deduce the effects until such measures are released.

HDB Trend

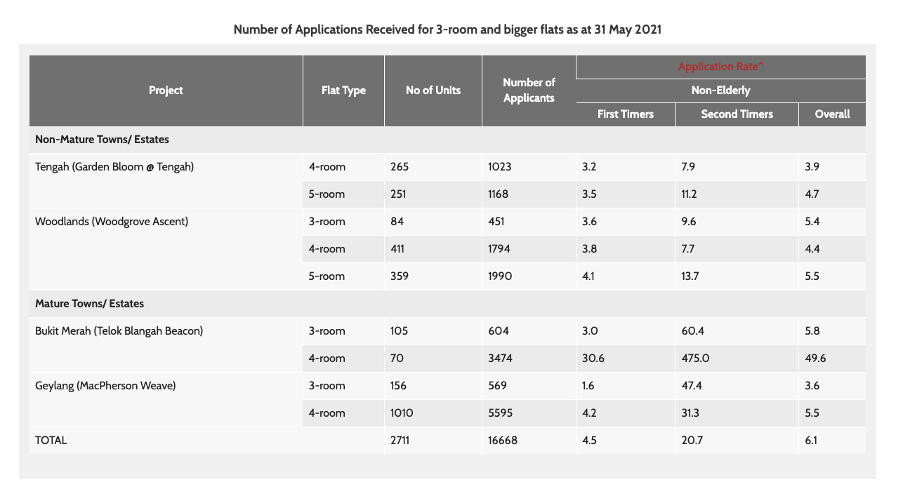

From the May 2021 BTO exercise, we can easily observe the updated shift in our Public Housing Market. The supply of 4-room flats easily dwarfs the supply of 5-room flats by almost 3 times, 1,756 4-Room flats and 610 5-Room flats. At the same time, the number of applicants to the central region Mature Towns is at a whopping 10,242, almost twice that of 6,426 in towns outside the central region.

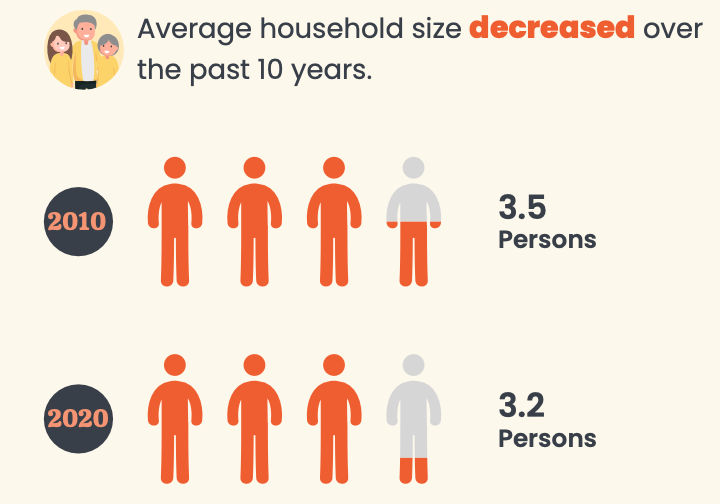

With the decreased household sizes, an influx of 4-Room flats and a lower supply of 5-Room flats, we foresee that 4-Room flats will likely be the most transacted type of property in the Public Housing Market. At the same time, the decreased supply of 5-Room flats could cause prices to spike if demand in these flats surge. However, with our declined household sizes, you technically would have sufficient space/rooms in 4-Room flats for whatever property needs/wants you may have. Households with larger family sizes would possibly turn to older 5-Room flats or even upgrade to the Private Property Market to suit their family needs.

Another phenomenon might occur. Just like the days when the government announced that Executive Masionettes (EMs) will no longer be in production as BTOs. The only way to buy one is to go to the resale market. Thus, in years to come when the supply of newer 5 room models dwindles from the BTO market, will we start viewing 5 rooms as a rarity just like how we view the EMs?

One other thing to note is also, if this trend were to continue, with only 3-Room or 4-Room flats offered through BTO and subsequently coming onstream to the resale market after they hit their 5 years MOP mark. The largest unit configuration will be 4-Room flats in the next 10/15/120 years. Buyers and/or families will still prefer larger units which will cause the 4-Room flats of 90+ years of lease balance surge in transaction volume. With the surge in transaction, naturally prices will rise in tandem due to demand. Will we then face another future problem when the prices start to tip closer to “unaffordable housing” which many of us do not want to happen? We shall leave that debate to the future. But for now, let’s take a look at the other segments.

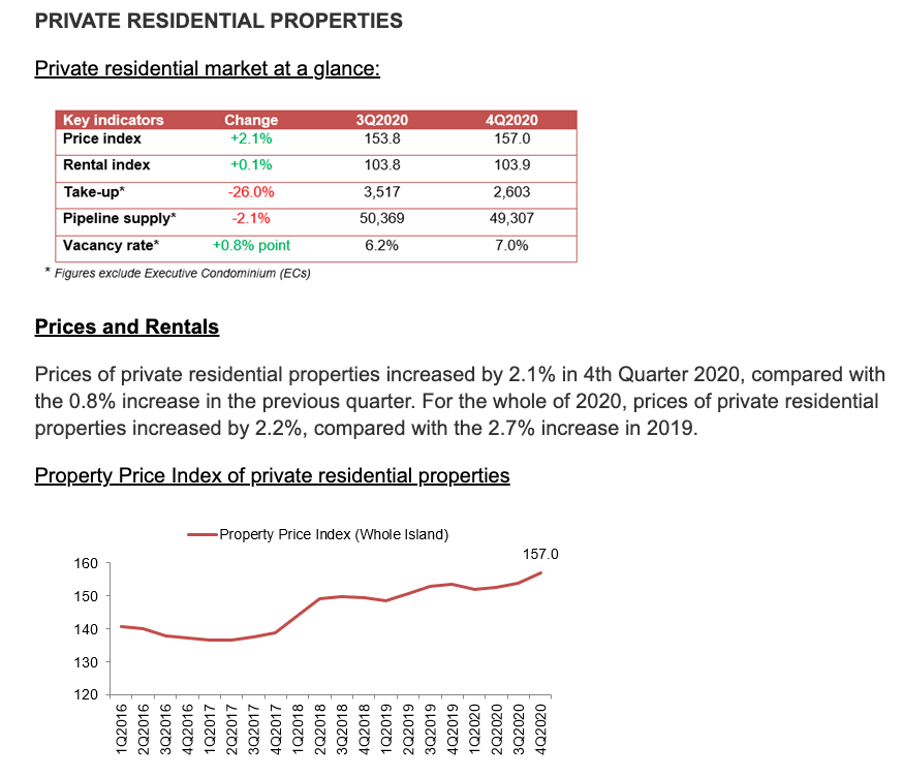

Private Housing Market — Condominiums & Apartments

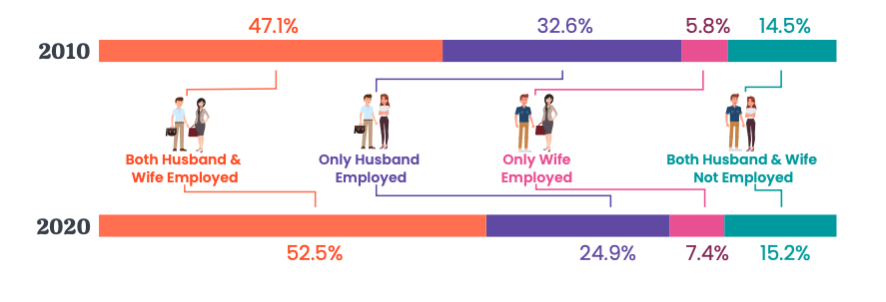

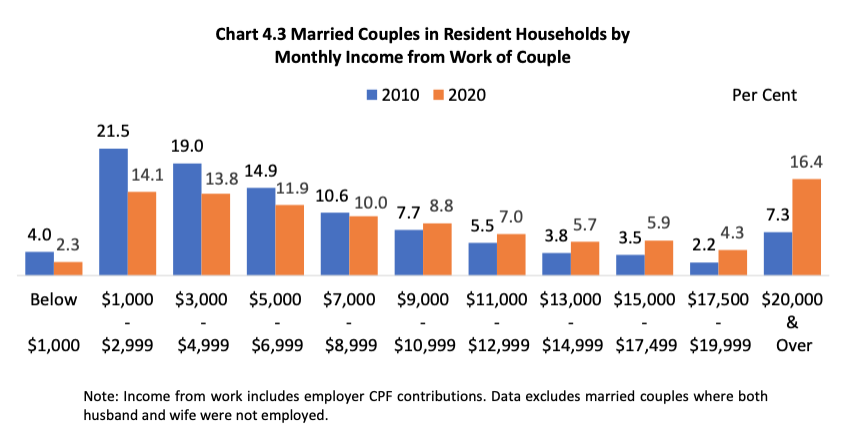

The median and average income of households saw a significant increase over the last 10 years. However, the household income takes into account the headcount and contribution of the children, siblings &/or parents living with the couple/owners of the house. At the same time, the household income is tabulated across the whole population and households. Ultimately banks will only consider the 2 individuals purchasing the flat together and assess the income between those 2 individuals. As such, we would like to highlight the statistics concerning married couples.

In the last 10 years, the percentage of dual-career couples increased from 47.1% to 52.5%. This means that there is more earning power between couples which translates to buying power. Along with this change, we also noticed a significant increase in Non-Landed Residential households (Condominiums & Apartments). The metrics on dual-career couples and increase in Non-Landed Residential households rose in tandem, which is a given. With a higher buying power, couples are now able to afford a more exclusive lifestyle. Purchasing a private property is one way to invest your hard-earned money and enjoy a certain lifestyle.

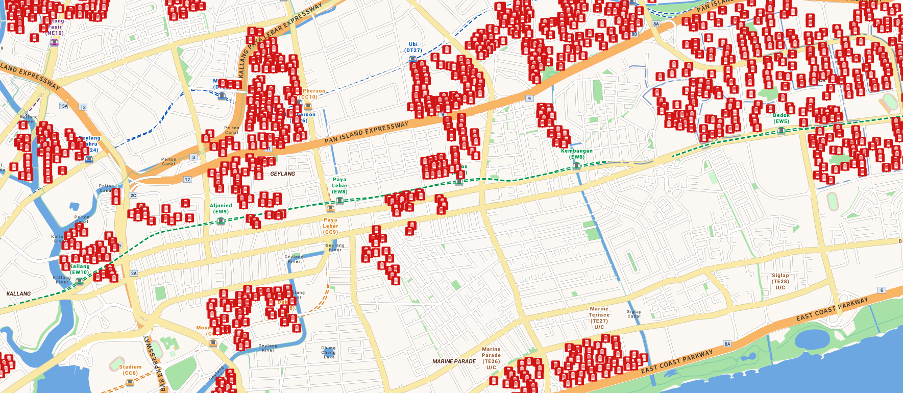

Of course, a dual income model will also mean that there are increased possibilities of the married couple investing in 1 property each under one’s name. Thereby increasing the count of multiple properties under each household as the dual career couple’s income increases. This trend is important because in tandem to the transaction volume having maintained at a certain level even when we have had a reduction in foreign buyers buying private properties since the ABSD inception, the main bulk of buyers in the past couple of years has been Singaporeans ourselves. Singapore essentially has grown to sort of a self-supporting market with its own set of “real estate fans” rather than depending on foreign buyers investing in our properties. The Straits Times reported that 80% of the buyers for Irwell Hill Residences are Singaporeans. The statistics are encouraging in relation to the buying power of Singaporean residents.

So how much has this “Power” actually grown?

More Money

From the table of Monthly Income from Work of Couples (Married Couples, girlfriend-boyfriend not included), the percentage of couples earning more than $13,000 is one-third of all couples at 32.3%. Why $13,000 and above? The income ceiling for HDB loans and Family Grant (For Resale flats) is at $14,000. Anything above $14,000 you will only be entitled to Proximity Housing Grant and will have to take a bank loan for your HDB purchase. As such, couples at this earning bracket often choose to purchase a Private Property because they are able to leverage on a larger loan quantum from banks, compared to a HDB Housing Loan. To illustrate the difference, let’s take a look at the calculations below:

HDB Housing Loan

Gross Monthly Household Income: $14,000

Max Threshold set by Monetary Authority of Singapore: MSR 30%

Interest Rate: 2.6% (CPF + 0.1%)

Repayment Period: 25 Years (Maximum for HDB purchase)

Estimated Loan Amount: $925,700 (Assuming you have the 10% in Cash/CPF)

This amount is the maximum amount HDB will and can loan to you.

Bank Loan

Gross Monthly Household Income: $14,000

Max Threshold set by Monetary Authority of Singapore: TDSR 60%

Interest Rate: 1.5% – 2% (Based on indicative prevailing interest rates)

Repayment Period: 30 Years (Maximum for Private Property)

Estimated Loan Amount: $1,870,637 (Assuming you have the 25% in Cash/CPF)

Based on the Loan Amount you may be eligible for, we can already see a stark difference of almost twice the quantum. Coupled with the increased income capabilities, servicing the higher mortgage and having the excess Cash/CPF for the downpayment is unlikely an obstacle for earners at this bracket. The highlight is also the increase in earners of $20,000 and above category. Easily spread between hubby and wife, if each earns average at $10,000. it will mean that each of them can purchase a property at up to $1.78M with a maximum loan of $1.33M (TDSR 60%) if they are aged 35 years old with no other debt obligation.

With one-third of couples earning enough to purchase a unit of their choice from a spread of Private Properties, the next consideration would be what type of units would be of preference.

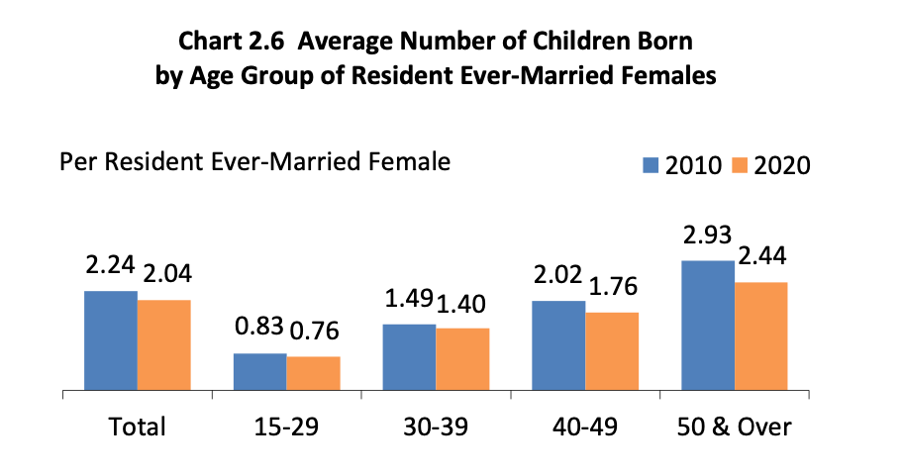

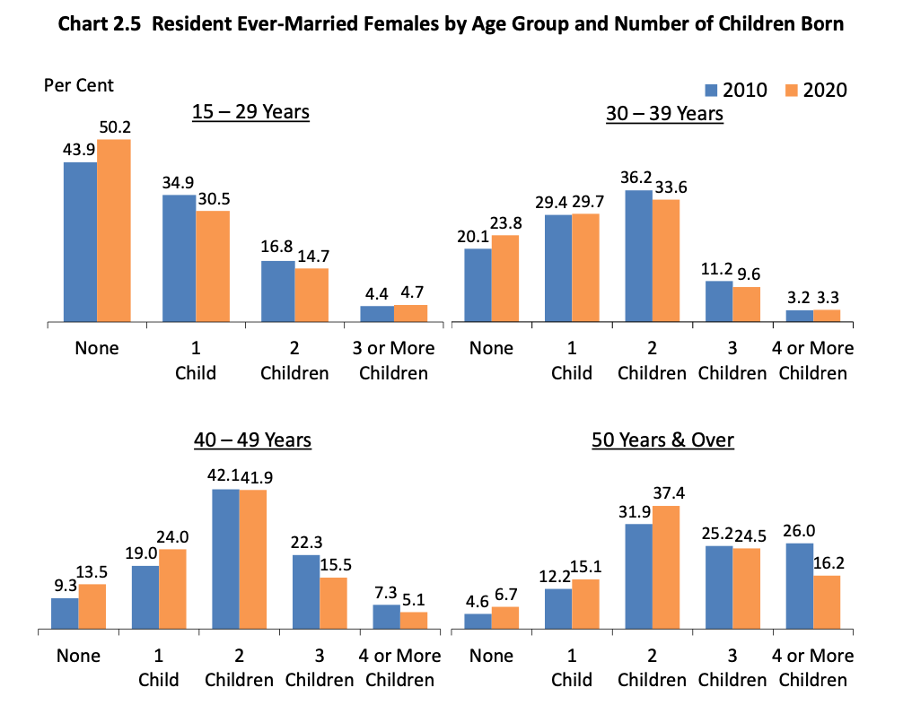

Less Children

Our continuously declining birth rate is a little worrying. In order to supplement our population and workforce, we will have to invite more foreigners to take up residency in our country. If we do have more foreigners in the future, we believe our housing policy will need an overhaul to sustain the population. But that’s a debate for a different platform. What we are more concerned with is how it affects the property decisions of this generation. As more families have dual-income couples, there are increasing restrictions on starting families. This has indirectly resulted in a reduction of household sizes.

Lesser children mean fewer people in a household, and with fewer people in a household means you need less space. Couples now have fewer commitments and higher-earning powers. Allowing them to have their pick at most of the properties they set their eyes on. Often, we have heard that newer developments are smaller in size and are incomparable to older developments. However, these comments do not take into consideration that there is a shift in this generation. Households have fewer people.

New launches usually have more updated facilities and amenities. Take the NEWEST Launch in 2021, for example, Pasir Ris 8. Pasir Ris 8 has an abundance of facilities that many Singaporeans will take an interest in, Song rooms, Gourmet Kitchen space and Coworking lounges. These are facilities that will further entice buyers to buy into the development because they are offerings that buyers need and want in the current climate. At the same time, although smaller than relatively older developments, the layouts of Pasir Ris 8 are well utilised and more efficient. Do you really need the extra long corridor space to perk up the overall size of your unit?

Lifestyle factors seem to be the priority of many, especially so when after a hard day’s work, you will want to return to a space you can fully enjoy and recharge. There is also an underlying trend where buyers spend a good amount on renovation because they want to achieve a certain lifestyle goal in their houses, as depicted in the article above. In order to achieve that, these buyers will often look for units with specific layouts that have well-utilised and efficient spaces, so they do not have to pour in more cost to change the layout.

Developers are also aware of the population trends that have shifted. Most of the newer developments have started to offer 2-Bedders as the majority of units. Similarly, in the resale market, when the difference between a 2-Bedder and a 3-Bedder sometimes stretch to over $700,000, it just doesn’t make sense to pay that amount if you do not need the extra space. Especially when some 2-Bedders are nearer to the $1,000,000 mark, which is more palatable to young couples just starting out their property journey. Even if they did have the $700K excess to pay for the unit, they might consider saving it for renovation costs. In the future, when these young couples would want to start a family, the additional benefit of 2-Bedder units is the rental versatility to rent out the whole unit or to two separate tenants.

For couples who have a child or are looking to expand their family size, 3-Bedders will still be of prime choice. With the reduction in household sizes, the 3-Bedder layouts will be sufficient to serve many families and their needs. Couples who are in a later stage of life who may have exited from their HDBs with some paper gains will likely look towards 3-Bedders to be a store of their money and at the same time hunt for Capital Appreciation. However, the potential for Capital Appreciation will be tougher in the future with the various developments. Unique products from new launches with niche offerings will be a good consideration if looking to sell at a profit, and larger units in the resale market will be seen as a greater value to command a premium over smaller units.

On Covid

On the other side of the picture, what is happening in the resale market in the last 12 months ever since the inception of the Circuit breaker due to the pandemic has also altered another trend. Because of the circuit breaker, with most activities happening at home since then. Where work from home is a norm now by default for most companies, study at home, exercise at home sometimes, travel being affected, eating is usually at home as well during the circuit breaker period.

We can easily see how our lives usually revolve around these 5 primary needs/concerns; Home, Transport, Travelling overseas, Kids school Needs, Work. The main concerns will be Home and Transport which we can induce improvements on. Thus, contributing to the reason on homes getting hot in demand recently, with Private Vehicles also experiencing an uptrend in prices during this period.

In a separate article, we spoke a little about the increase in demand for larger units. You have probably either heard a friend upgrading from a 3-bedder to 4-bedder, or a friend from a 2-bedder condo to 3-bedder. Or even someone from a condo to a Landed property. Everyone seems to be moving bigger for more space or that extra bedroom. You may also have heard someone doing renovations to their existing home for “improvements”. Thus, the trend for bigger apartments is one of the hot favourites for this season from families. Will this then even out the scales of demand from what we see above due to smaller households?

Landed Housing Market — The Apex

Although we have a declining birth rate, there is also a significant preference in people who choose to have children. Many of which have 2 or more children across 3 out of 4 of the age groups. Unfortunately, the shrinking sizes of units is not good news for these groups of people. It will be likely that these groups will start to consider landed housing or even larger but older resale units.

However, the dilemma over older and larger resale units is that they often either have a declining lease (99-Year Leaseholds) or they do not appreciate much in value (Freehold) unless they have very significant developments surrounding them. Causing most buyers to consider landed housing for their great store of value and ability to appreciate over the years given the limited supply. The biggest question is, how much income do you need to earn before you can consider landed housing?

The Answer: At least $17,000

A Gross Monthly Household Income of $17,000 will allow you a maximum loan of about $2.2 Million, taking into consideration that this is 75% of what the banks can loan to you. That brings your Max Property Price to be slightly above $3 Million. In today’s climate, $3 Million is the entry to an inter-terrace of a relatively acceptable location. According to the Census, about one-fifth of married couples are able to achieve this loan quantum of $3 Million, with 20.7% earning $17,500 and above.

Space & Privacy

Other than being an asset tool that is considered by many established individuals, landed housing is much sought after for the space that you simply are not able to get in a condominium or even a HDB flat. Unless the HDB flat you buy is 1 of the 285 landed terraced houses that HDB had built back in the 1970s. This particular unit was sold by our team at PropertyLimBrothers. Many questioned the feasibility of buying these houses due to the lower number of years left in the lease. However, there are factors that many neglected to consider.

Space & Privacy. Living in a landed home means not needing to share the space within your compound with anybody else. Having the premium of space and privacy is a commodity further highlighted by the COVID-19 Pandemic. Owners are more willing to pay for these factors because they simply require them. Looking past the fact that this is a HDB flat, this is actually the cheapest landed housing that you will be able to get in today’s climate. And, if owners are willing to pay a premium over owning this type of public landed housing, just imagine the demand of a private landed house by those able to afford them.

Moreover, this is a City fringe landed property at the brim of the Novena/Newton area at the Whampoa estate. Looking at different angles, to rent a similar sized landed property around the area will easily cost a family $7,000 a month at the median rent psf. Buying this property with 49 years lease left if the current family is renting or intending to rent will be more wise from a rental comparison perspective because the monthly depreciation per say is at $2,xxx per month compared to paying your landlord $7,000. Especially if you are a retiree who has been already living in a landed property they purchased 20 – 30 years ago. This group of people who likely want to exit the market given the capital gain over the years. Utilising some of the sale proceeds to fully pay for this unit allows them to continue living in a landed property (at a very good location) plus have extra funds of $2 – $5 million cash for retirement spending. These types of properties require a distinct group of buyers in order to fully utilise the value and appreciate the uniqueness.

The Value in Landed Housing

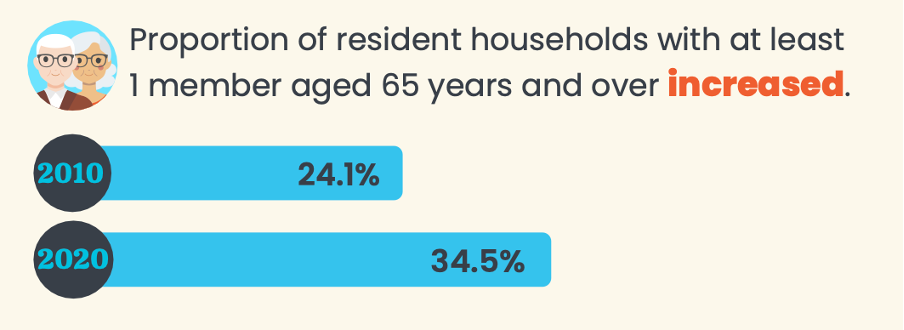

Real Estate is an asset class that is never left out in the portfolios of well-established individuals/investors. Simply because of its store of value, the ability to appreciate and at the same time the ability to leverage on the value of the property to unlock liquidity from the asset. Highlights of the landed market are often covered by The Straits Times on noteworthy purchases. Such as the recent GCB purchase at Bin Tong Park by Grab CEO and the GCB in Caldecott Hill by Secret Lab CEO. In the last 5 years, we’ve seen the average PSF of landed properties rise about $200 to $1,400 across all types and districts in Singapore. Typically, the value of the land of a country will rise in tandem with the performance of the economy as the country becomes more valuable. Many consider landed housing for their asset progression portfolios and when Estate Planning. As our population ages, we have seen a rise in demand for landed housing over the last few years. Estate Planning is amongst the reasons that fuel the landed housing market. Some might consider Freehold condominiums over landed housing because they may want to enjoy the facilities in the development. Ultimately, a freehold Strata-Subdivided unit is still a little inferior compared to owning a plot of land.

Other than portfolio considerations, senior individuals often look to landed housing as they like the serenity and the inclusivity that some enclaves offer. Bonus offerings such as large celebrations within the enclaves and getting a lift out from your neighbour to the main road are some engagements that bring back the Kampong Spirit some senior residents appreciate. In some enclaves, the landed housing community is more tight-knit than a densely packed high-rise development.

Whether it is for extra space or asset progression, we believe the landed housing market will continue to be on the rise. Demand for larger units will definitely be in the spotlight as condominium developments get smaller for those looking to upsize their family. A minimum offering of at least 4 – 5 Bedrooms will likely see the highest popularity. Anything less, buyers may consider luxury condominiums. Anything more, buyers may deem them unnecessary and hunt for units that are more suitable to their needs. However, we foresee a very competitive landed housing market as Singapore progresses, and more are looking to move into our country.

Our Take

We recently spoke a little more on the Population Census on our Podcast, Nuggets On The Go, reviewing the coverage by The Straits Times with relation to the property market. If you are more of a reader, then you may prefer our previous article, Population Census 2020 — How will Singapore’s Property Climate change in 10 charts.

The trend in public housing will likely skew towards 4-Room flats due to deliberate intervention by the Government of limiting the supply of larger flats. For larger families they may have to search for flats outside the Central Region or consider Private Housing. Most 3-Room Premium units these days will offer a good amount of space for families and still have provision for a helper’s room. Those in the later stages of their lives will face tough competition in the landed market as demand continues to grow from locals and foreigners (if they manage to get LDAU approval) looking to move into Singapore.

We are very excited for the next Population Census in 10 years to see how much further we will and have changed. If you would like to find out more or just need some general advice on your property portfolio and potential purchases, you may wish to speak to our consultants. Or leave a comment in the section below to let us know your thoughts and observations on our article. And as usual, we’ll catch you on our next Signature Home Tours.