Singapore, the ideal city for career progression with a fast-paced city lifestyle

Introduction

If you are here reading this article, you are most probably planning to move over to the Asian Dragon of sunny Singapore. In recent months, Singapore has been seeing a decrease in expat population, with the ongoing pandemic that looks like it’s going to be around for a while, many expats are choosing to retreat back to the comfort of their own countries with travel restrictions set in place.

As an expatriate, you are neither born nor raised in the country that you are living in. Most of the time, such individuals come a long way from home into a foreign land with hopes to build up a better life for themselves. Singapore is no stranger to such people who come and go. And no matter how skeptical some of us are towards the idea of a wider foreign talent pool, it is a known fact that they complement the idea of an open economy and most importantly, our growth. We often like to over-generalise and categorise all of them as foreigners. And out of the many that flood into our Little Red Dot, they are more often than not, professionals in their trade and skilled workers dispatched here by their management. As Singapore moves towards becoming a regional technology hub, foreign talent is still vastly required to fill up the job crunch in tech startups and MNCs set up here, especially in the technology field.

Foreigners are defined as non-natives, and this definition technically speaks for itself. The connotations that it takes up are sometimes viewed as partially negative, hence a more inclusive term, expatriates, will be used throughout the rest of this article. (Expatriates to be used as a term defining non-natives from this point onwards)

Why Singapore? In the past decade and even in recent news, Singapore has been experiencing a stable and strong currency, being pegged closely to the USD. Coupled with the fact that our government administration is in good power and stability, Singapore has become a safe haven to be in, particularly during the ongoing pandemic. Factors that contribute to this decision of many rich expats with high net-worth would include – our government’s ability to keep local community cases at a low and its efficiency in curbing the widespread outbreak of the pandemic from infecting the majority of the population. Social security and public health policy during this era was also kept relatively high and effective, and we eventually outperformed neighbouring countries. Because of the safe environment our country provides and also attractive incentives, family offices have thus been set up and rich expats have also arrived on our shores to ride out the storm while there are many also that have left.

Additionally, the standards of living here are great. Balanced infrastructure, clean, safe for families and generally a high standard of living. Singapore has seen a great number of reputable international schools set up around, which encourage expat families to settle in easily.

Apart from our political and social climate during such trying times, speaking more economically, real estate in Singapore is generally a good source of investment and store of value as a whole. There is little to no speculation in real estate in Singapore, as the government exercises careful and timely intervention whenever necessary to cool and regulate the market.

In Singapore, our residential infrastructure also has to abide by stringent construction protocol that is preapproved by the authorities before they are even built. Add that and close monitoring during the construction process, our buildings here have solid infrastructure built by reliable developers to withstand storms and earthquakes (even though we are located along the equator)

So with the context being set, as an individual with neither Singapore citizenship nor permanent residency, what are the types of properties that you can lay your hands on? Read on to find out!

Types of non-restricted properties

Courtesy Unsplash

Firstly, it will be good to understand what type of property you are interested in purchasing. There are both restricted and non-restricted properties that expats are allowed to buy in Singapore. Our Little Red Dot operates on a mindset of a land scarce policy, where every square footage of land counts and matters in urbanisation plans. As our country moves towards greater growth and prosperity with an open economy, so will there also be greater housing demands coming from all over the globe on top of local residents. Because of these different factors, it is important for the government to regulate the housing market very carefully with ever-changing housing economic policies, so as to prevent the shortage from coming sooner than expected, even if housing demand is booming. (and risk having citizens live in bird-cage houses)

Listed below are some of the non-restricted properties that expats can go ahead and purchase without having to gain approval from authorities.

-

Private condominium unit

-

HDB Flat and shophouse (for more information on the eligibility criteria, visit here)

-

Strata landed house, in an approved condominium project

-

A leasehold estate in a landed residential property for a term not exceeding seven years, including any further term which may be granted by way of an option for renewal

-

Shophouses (in land plots that are slated for commercial development)

-

Executive Condominiums that have privatised after 10 years from the date of obtaining the Temporary Occupation Permit (TOP)

Based on statistical reports, 90.4% of Singaporean households own a roof over their heads. This high rate can be attributed to the success of Singapore’s public housing scheme under the Housing Development Board (HDB) for providing affordable housing with numerous subsidies and grants. Singapore has a grand total of 1.08 million flat units under HDB (and counting). HDB flats are thus a commonly seen sight and a more affordable option for expatriates to rent.

Although there is no need to obtain a level of approval to purchase a public housing flat in Singapore, there are certain eligibility requirements that you will have to fulfil. For the full lists of scenarios, do refer here. Let us just list down one example out of the many – to purchase a HDB resale flat as a foreigner, you will need to either 1. Be married to a Singaporean Citizen (SC) or 2. Be married to a Singaporean Permanent Resident (SPR) and be an SPR yourself for at least 3 years. If you are buying it alone, HDBs (BTOs included) are thus not an option. However, you may want to consider the “upgraded” and fancier version of an HDB flat – a condominium unit. Condominiums in Singapore are gated communities with common shared facilities meant only for the use of residents; swimming pools, barbecue pits and gymnasiums. For such developments, they are more commonly referred to as private housing projects.

Types of restricted properties

Courtesy 99.co

Bearing in mind the issue of land scarcity, naturally, the bigger houses will be harder to lay hands on.

Listed below are some of the restricted properties.

-

Vacant residential land

-

Terrace house

-

Semi-detached house

-

Bungalow

-

Detached house

-

Strata landed in developments not approved by authorities

-

Shophouses (in land plots that are slated for non-commercial, residential development)

-

Association premises

-

Places of worship

-

Workers’ dormitory/ serviced apartments/ boarding houses

From the 2 lists listed above, there are 2 special mentions, which are shophouses and strata landed houses (also known as cluster houses).

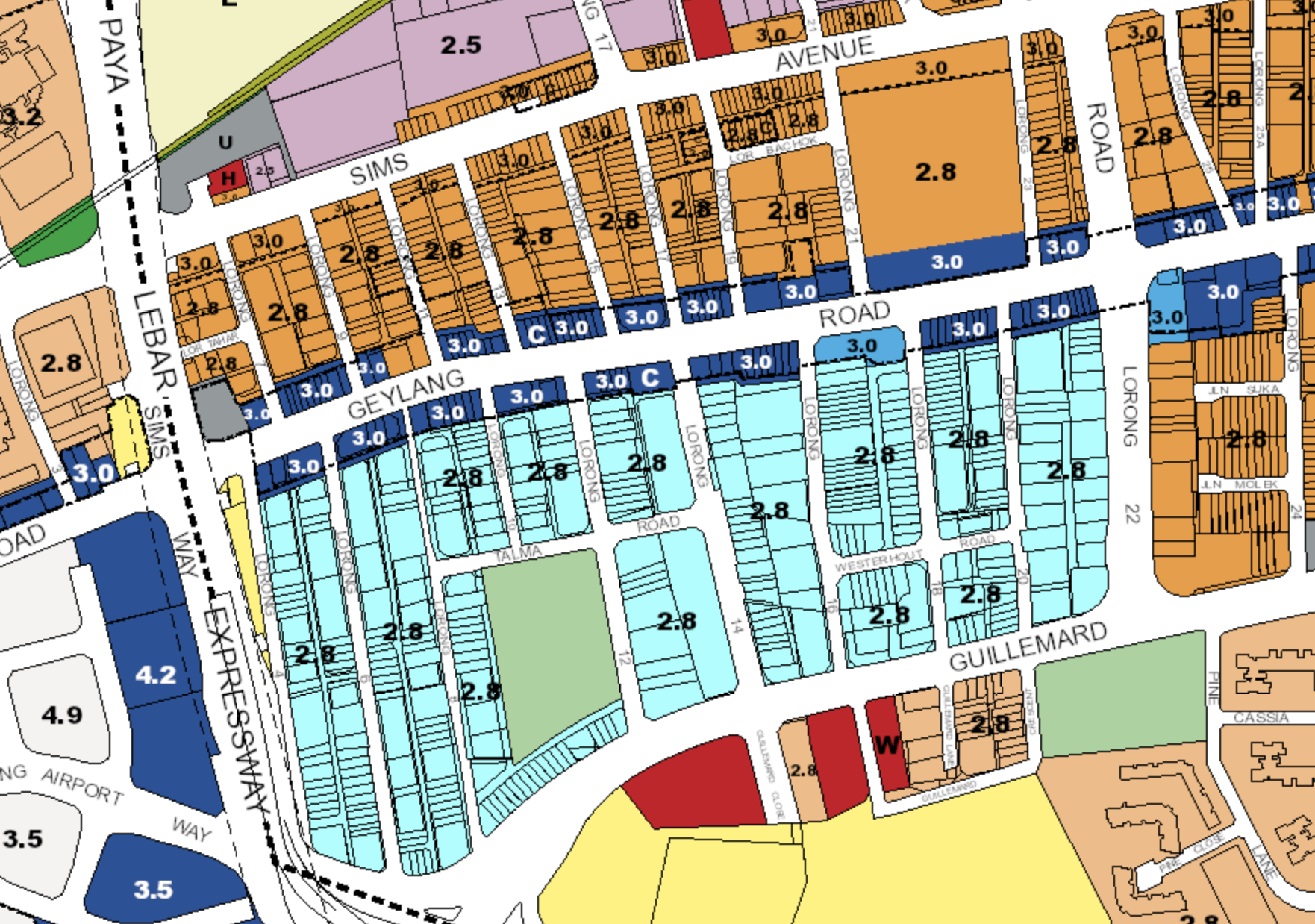

URA SPACE portal

For expatriates who are interested in laying hands on one of our heritage shophouses, be sure to check the URA SPACE portal to check for the land use of the site before deciding! If the shophouse is housed on a plot of land zoned commercial (cyan and dark blue colours), there is no problem purchasing it. However, if it is zoned residential (orange and beige colours), you will definitely need to get approval from the Singapore Land Authority (SLA)’s Land Dealings (Approval) Unit, or LDAU in short. Shophouses in Singapore are commonly seen in big clusters in areas like Geylang and Chinatown. However, you can find them in smaller groups all around other parts of Singapore such as the rainbow-coloured row of conservation shophouses at Koon Seng Road and also at Cairnhill Road, just to name a few.

Strata landed homes courtesy 99.co

As for strata landed houses, they are more commonly found in 2 types of developments. One way to find them is through high-rise condominium projects such as Riverfront Residences that have strata terrace houses in its gated community. There are also other residential projects which have other types of landed homes (semi-detached strata and cluster houses) apart from Riverfront’s strata terrace houses. Other than finding them in private condominium projects, the next alternative where you can find them will be a cluster of houses in a gated community within a landed enclave, such as Watercove. But at the same time, such developments also come with condo-like lifestyle amenities such as a pool and gymnasium.

For such projects, expatriates are only eligible to purchase if the development is approved by the LDAU, so make sure to double check with the developer! Basically, for strata landed houses, you do not have an ownership over the land but own the airspace directly above it. For a more detailed read on strata landed houses and landed homes in general, you can visit here.

In Singapore, there are only around 70,000 landed homes. However, because the government is no longer issuing land parcels to build landed houses, the numbers have plateaued and might even start dwindling as Singapore embraces a growing population, where acquisition of land can even happen to make way for high-rise apartment buildings that can house more households at once. We can also see how the government is regulating the supply of the bigger houses through further analysis on the landed market, where expats are typically granted approval to buy landed properties situated only on 99-year leasehold land titles in a private landed residential enclave. This agreement will only be valid for a maximum term of 7 years, and any extension of sales terms is subjected to approval again. Freehold and 999-year leasehold landed properties are not allowed to be put up for purchase by any expatriates unless special permission is given.

As for Permanent Residents, If you are a single PR or expat entity who wishes to buy any of the abovementioned restricted properties, you will require the consent of Singapore Land Authority (SLA) and may apply for approval with their Land Dealings Approval Unit (LDAU). Essentially, each applicant will be evaluated on a case-by-case basis and typically takes into account the following factors, but not limited to:

-

Being a PR of at least 5 years

-

Provide “exceptional economic contribution” to the country, determined from the amount of taxes you generate

-

Your investments in Singapore, your business activities and the number of workers employed in your company may also be taken into consideration

Life on an island’s island? Sentosa Cove landed enclave

You probably already know of Sentosa Cove, the highly exclusive balinese-like, “made for the rich” island that is situated on the eastern part of Sentosa, Singapore’s island resort that is home to many tourist attractions and landmarks. As mentioned in the list of the restricted properties, landed homes are only put up for purchase by expats on the approval of the LDAU.

But, in the case of Sentosa Cove, expats (non-residents and SPRs) are eligible for purchase of the landed homes in this highly exclusive island (as long as you are able to afford), although it is also recommended to kindly put in a request, just for the sake of formalities. It is said that one usually gets the approval within 48 hours. Sentosa Cove is the only landed enclave intended mostly for the expatriate population, although you can still find a number of “crazy rich” Singaporeans owning a unit there, so there’s definitely some freedom in the market for properties there.

Some good to know facts about this enclave is that all houses on this artificial man-made island are on a 99-year leasehold tenure, and that it is only to be for your own intended stay and not for investment purposes. So don’t be a party pooper and rent your bungalow out, it is not allowed! Also, for mainland landed properties that are typically only sold to SPRs or SCs, a minimum occupation period (MOP) of 5 years is needed, but this rule does not apply for Sentosa Cove properties, though on the flip side, you would not be able to purchase more than 1 property. And lastly, the land area of the property that is intended for purchase on this island must not exceed 1,800 square metres.

Visit here for a read on other reputable places where expats lay hands on in Singapore!

What are some requirements of a foreigner to get approval

What do you need to present to the authorities for approval to buy the restricted properties if you are neither a SC or SPR?

-

Academic background

-

Technical or professional qualifications

-

Career scope

-

History of investments in Singapore (The thicker your portfolio, the better. Housing investments work too!)

Basically you need to be the cream of the crop and have something to present to Singapore’s economy, in terms of what you can contribute to help bring the market to greater heights. Pretty logical right? Nevertheless, let’s just list down a famous example of how Zhang Yong, the CEO of Hai Di Lao and his son Zhang Hanzhi, actually bought a Good Class Bungalow (GCB) each, in different time periods of 2016 and 2021 respectively. This decision came as the two properties are located in a cul de sac which means extra privacy for the billionaire family. Note that because of his explosive contribution to the restaurant chain Hai Di Lao in Singapore, he became a naturalized citizen back in 2018.

How James Dyson also became a PR in Singapore

Singapore is well known to be one of the countries with stringent and rigorous procedures required in order for an entity from abroad to be awarded a PR status. (Honestly, it all depends on what you can contribute) But big names like Jackie Chan, Jet Li have managed to secure this highly regarded status.

Another notable figure who entered the headlines of Singapore with his big business decision (later explained) is Sir James Dyson. Shortly after James Dyson became an SPR, he also purchased a $50 million Good Class Bungalow (GCB) over at Cluny Hill, a highly exclusive landed estate with landed properties going at exorbitant prices. And even though he has since relocated back to the United Kingdom, his residency status remains highly confidential so no one really knows if it has been relinquished or not. What did he have to offer? He made a big decision to move his headquarters of Dyson over to Singapore, housing it at the historic St. John’s Power Station located at Telok Blangah. This move would provide for more employment opportunities for Singaporeans, thus he was granted permanent residency status.

So, at this point, you may be wondering how to go about applying for this status, which can then open up a lot more housing options.

For expats to be put up for PR status consideration, you will need to meet certain fulfilment of requirements which is listed by the Economic Development Board (EDB) below:

-

Under the Global Investor Programme (GIP) administered by the Economic Development Board (EDB), foreigners can be considered for Permanent Resident (PR) status if they invest a certain minimum sum in business set-ups and/or other investment vehicles such as venture capital funds, foundations or trusts that focus on economic development.

-

Private residential properties investment will be considered for application for Permanent Resident application. A foreigner can be considered for PR status if he invests at least S$2 million in business set-ups, other investment vehicles such as venture capital funds, foundations or trusts, and/or private residential properties. Up to 50% of the investment can be in private residential properties, subject to foreign ownership restrictions under the Residential Property Act (RPA). This is to attract and anchor foreign talent in Singapore.

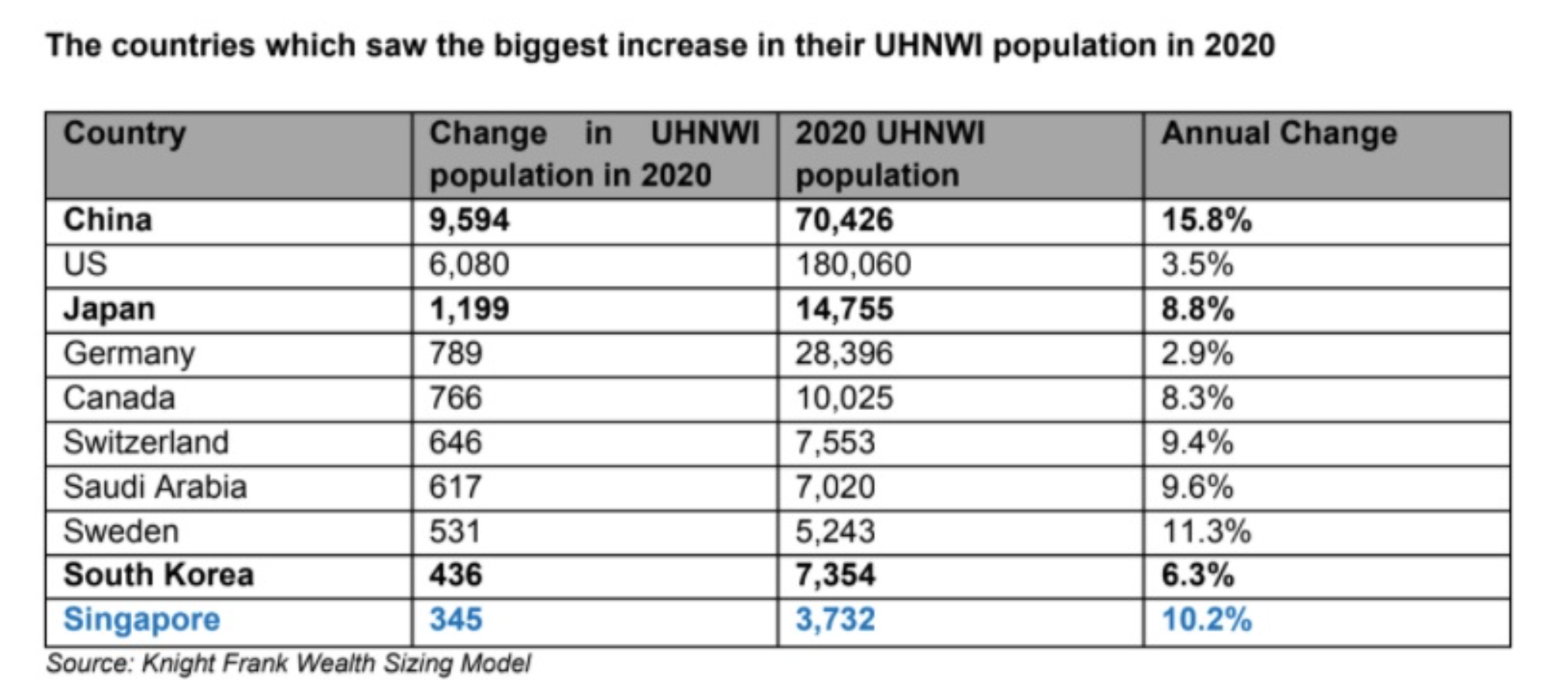

With the increment in ultra-high net worth individuals (UHNWI) setting up shop here in our homeground, we will be seeing an increase in the number of expats that will follow suit. And given the enticing environment and opportunities available in Singapore, many more will want to settle down here. We have also placed in a table to show you the increase in UHNWI for the year 2020 below.

Courtesy Business Times

What are some taxes that expats should be aware of

After stepping out of the airport, nothing is ever tax-free in Singapore. So what are the taxes expats have to pay in Singapore with regards to housing?

-

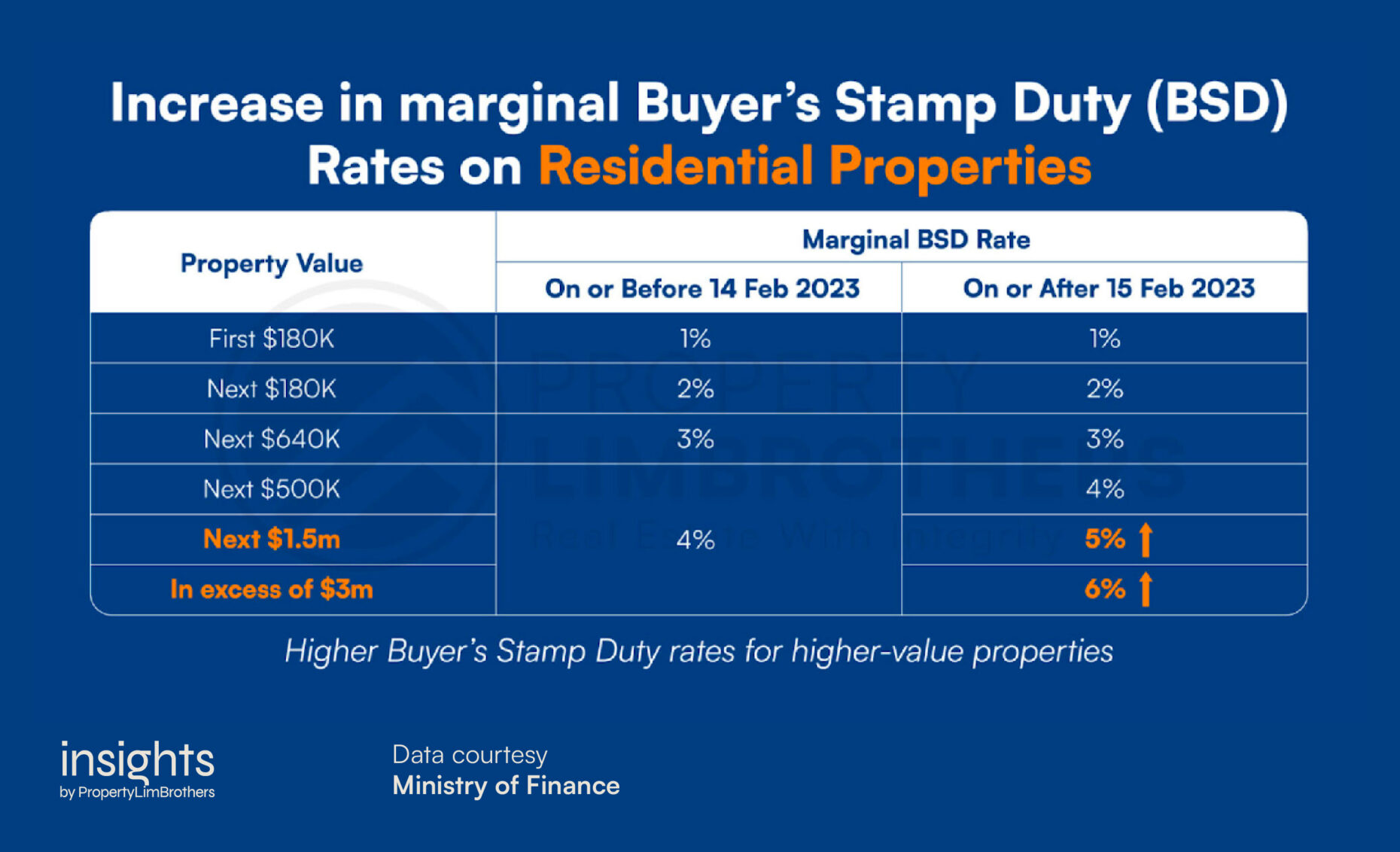

Buyer’s Stamp Duty (BSD)

Everyone (not just in Singapore, by the way) and expats included, are not to be excluded from the Buyer’s Stamp Duty (BSD). The BSD is a tax that you pay when you sign documents during a home sales transaction or acquisition.

Table showing BSD rates

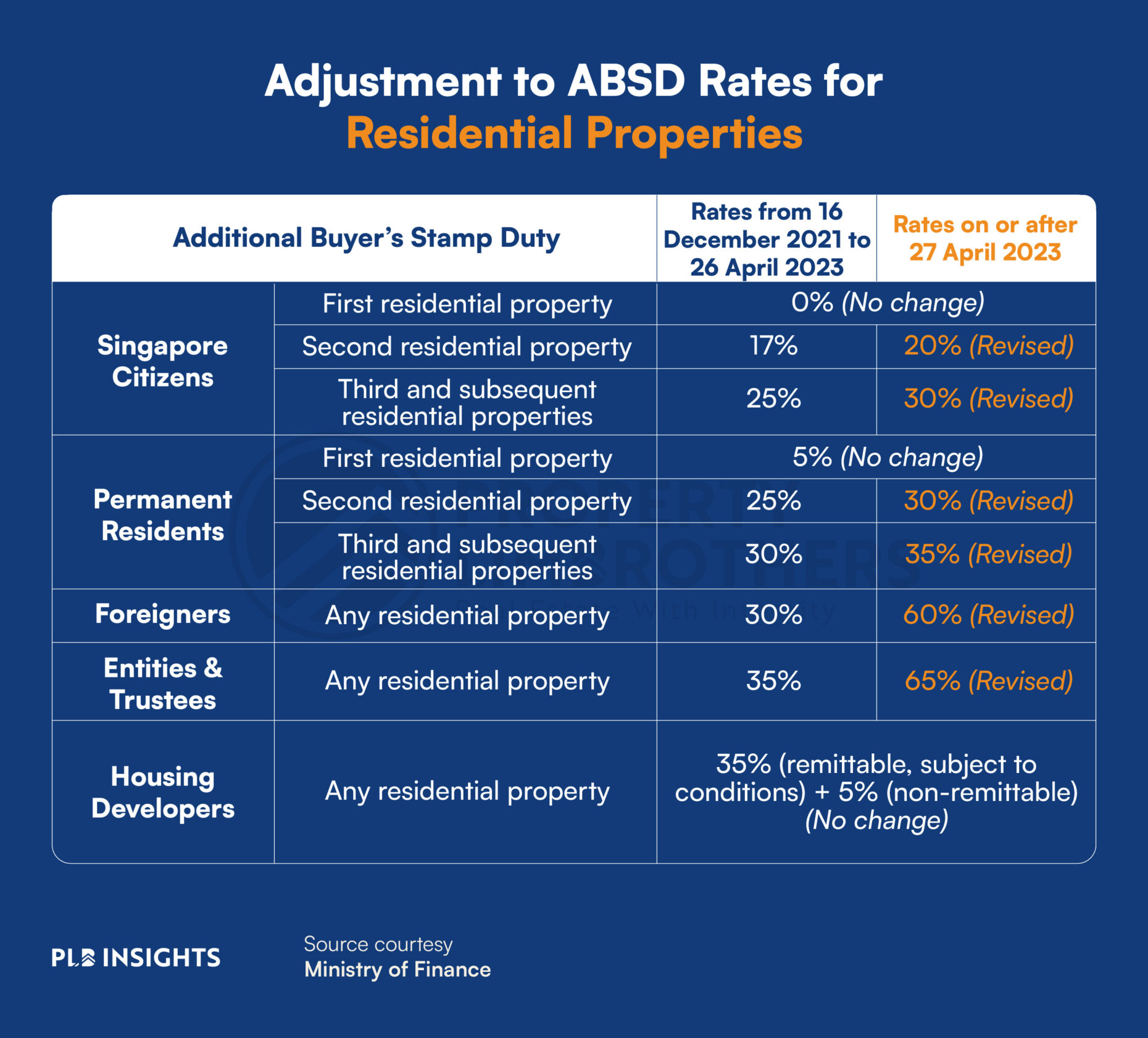

2. Additional Buyer’s Stamp Duty (ABSD)

On top of that, there is also the Additional Buyer’s Stamp Duty (ABSD) that buyers will have to pay if it is their second or any subsequent property.

Table showing ABSD rates

Under this ABSD rule however, there are some exclusions for certain nationalities that fall under the alliances forged in the Free Trade Agreements (FTAs). Expatriates Eligible for ABSD Remission will have to come from certain countries that have FTA ties with Singapore.

Under the respective FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

-

Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

-

Nationals of the United States of America

For a more detailed explanation and analysis of the different property taxes to be paid during or after the transaction process, you can visit here.

Conclusion

Master plan developments are always generated by the urban planning authority in Singapore. Our economy is constantly growing and our landscape is also constantly evolving. In a land size area of 728.3 km², Singapore has managed to fit in 28 different districts, each unique to itself! Before you decide where to set up shop, you might want to learn more about each district and what they have to offer!

For those who would like to enquire about the application of purchase of restricted housing, you can do so by contacting SLA:

You can contact SLA at 6478-3444, or apply online on SLA’s website.

Alternatively, you can also visit them directly for a walk-in appointment at the following address: Land Dealings Approval Unit, Singapore Land Authority, 55 Newton Road, #12-01 Revenue House, Singapore 307987

The most important takeaway from this article is to always send in a request or letter of approval. When in doubt, ask. Even when you are not in doubt, as in the case of Sentosa Cove’s properties, it would be nice to at least let the authorities know that you are not overstepping any boundaries and that you are committed to being a law-abiding resident.

The amount of expatriates that come into our sunny Singapore to engage with our real estate market diversifies our property scene, making Singapore one of the top few countries for investment and even for own-stay purposes! But just like how James Dyson came and went, we should not get too attached to them staying for a long time. Expats sometimes come and go as they please, living lives free as the birds in the skies. As the saying goes, here for a good time, not a long time! We’ll see you in the next PropertyLimBrothers’s Insights post and if you are ready to start planning for your property portfolio in Singapore, you can always reach out to us for a consultation here.

Disclaimer: The information provided in this article is accurate as of the date of publication and is based on the rules and regulations concerning stamp duty rates and taxes in effect at the time. While we strive to update our past articles diligently, please be aware that tax laws and regulations can change frequently, and it is essential to verify the most current rules and guidelines from the relevant government authorities or consult with a qualified professional for the latest updates and accurate advice.